Rigetti Computing Is +1,700% in a Year. What Does Its Chart Say?Is quantum computing the next big thing after artificial intelligence? We might know more soon after Rigetti Computing NASDAQ:RGTI reports quarterly results on Tuesday.

Let's check out RGTI's fundamental and technical picture:

Rigetti Computing's Fundamental Analysis

Quantum-computing companies are developing super-powerful computers using the physics system known as "quantum mechanics."

Quantum stocks like RGTI, D-Wave Quantum NYSE:QBTS , IonQ NYSE:IONQ and Quantum Computing NASDAQ:QUBT have all swung wildly in recent months as investors try to get into the sector early on.

For instance, RGTI has risen more than 1,700% over the past 12 months, but only about 1.2% year to date.

This is not yet a profitable sector, so it's so hard to know where things are heading.

Will these companies survive as stand-alone businesses that eventually become independently viable? Or are they simply competing to be the one or two that make it to a point where they catch Big Tech's eye and become acquisition targets?

There are far more questions than answers right now regarding this high-tech industry. So, readers should understand that any investment at this early point is probably speculative in nature.

As for Rigetti, the firm operates quantum computers over the cloud, serving global enterprise, governmental and academic clients through its platform.

RGTI has developed a multi-chip quantum processor for scalable computing. The company can integrate this platform into any public or private cloud or hybrid thereof to suit a client's needs.

Rigetti will report Q2 results after the bell on Tuesday (Aug. 12). I could only find two sell-side analysts who cover the stock, and both have lowered their estimates for the company's results since quarter began.

Their consensus calls for an adjusted $0.04 loss per share on just $1.87 million of revenue. (Yes, that's million, not billion.)

Such results would compare to year-ago figures of a $0.09 adjusted loss per share on $3.09 million of revenues. That might not look so hot, but the industry isn't so hot yet.

Rigetti Computing's Technical Analysis

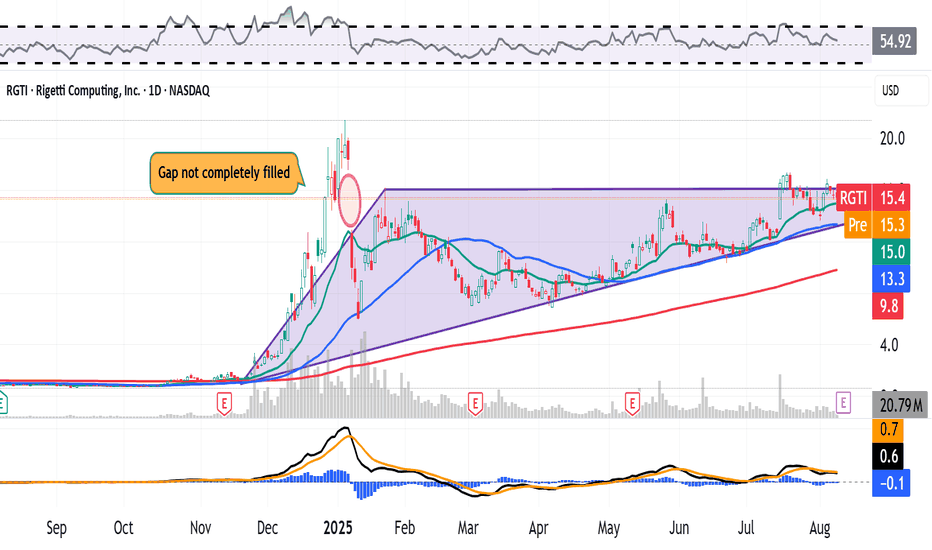

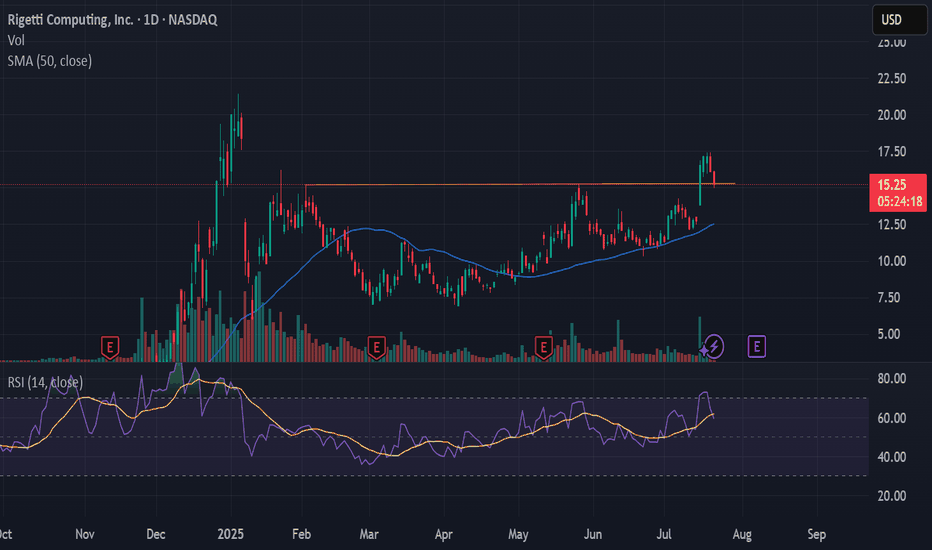

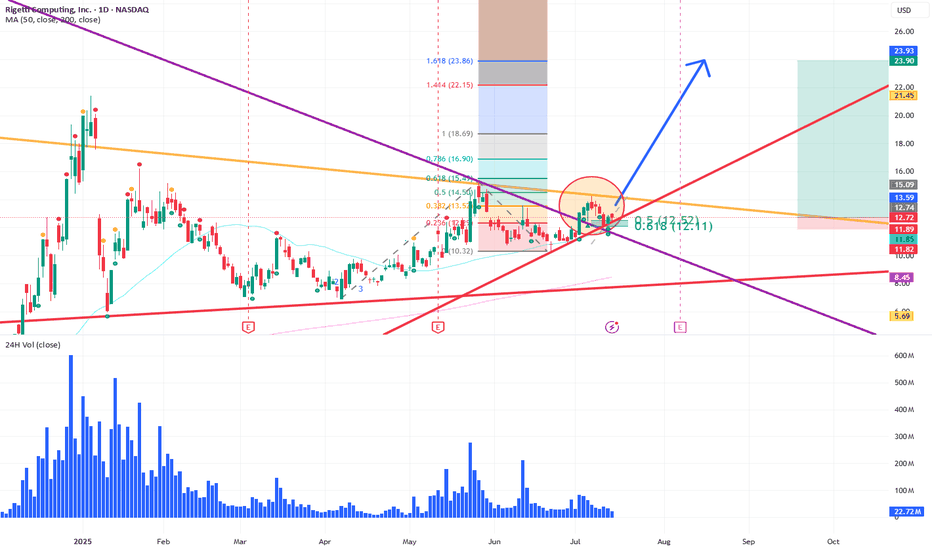

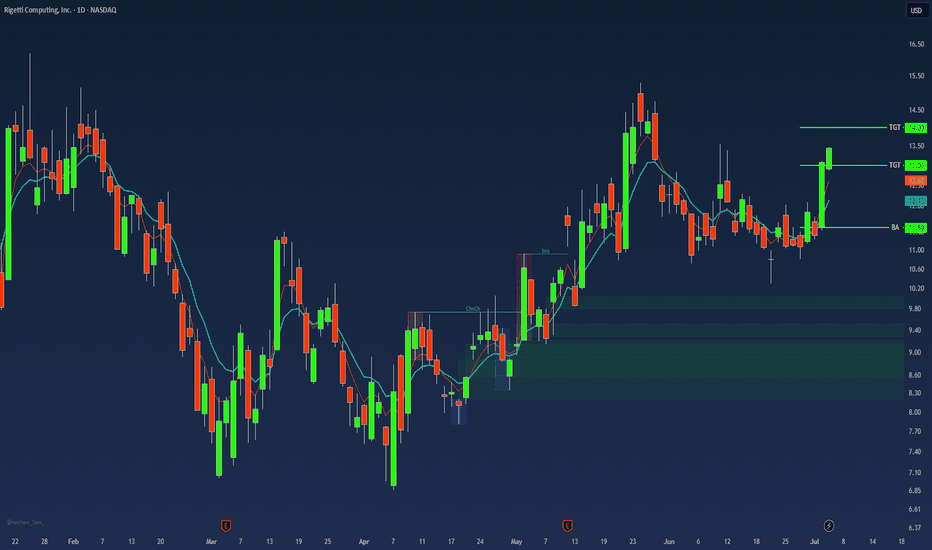

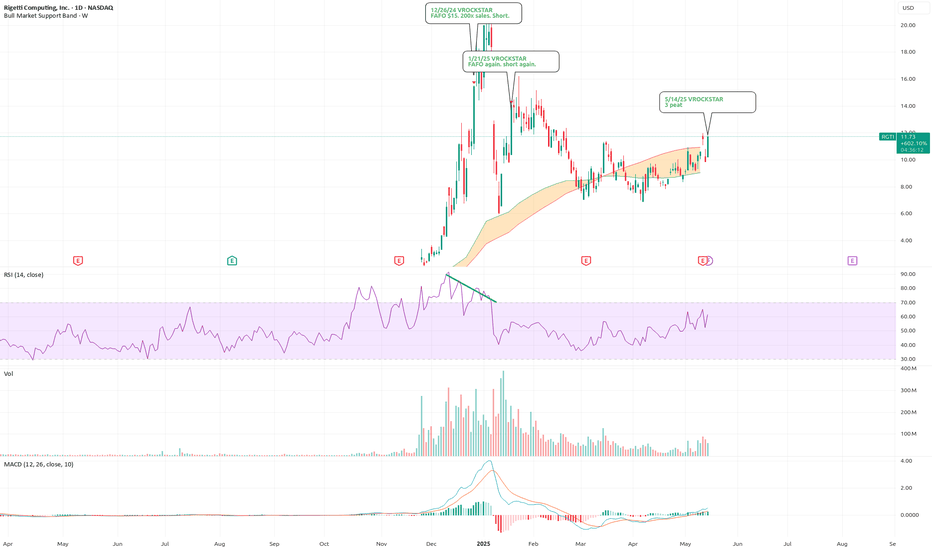

Now let's look at RGTI's chart going back 12 months:

Readers will note that after coming out of a late 2024 price spike, Rigetti gapped lower in early January, as denoted with a red oval in the chart's center.

This gap has not yet completely filled, even with the stock's recent rally in July.

Now, unfilled gaps don't always fill -- but eventually, most usually do.

What I see developing from the short consolidation period that came after that gap and into the present is what's known as an "ascending triangle" pattern (the purple field in the chart above).

This is historically a bullish pattern, where a stock generally hits resistance at or close to the same level over a period of time while continuously making higher lows. This forms the shape of a triangle, where the flat top line of resistance is the pivot.

Meanwhile, Rigetti's Relative Strength Index (the gray line at the chart's top) is better than neutral, but nowhere near being technically overbought so far.

And the stock's daily Moving Average Convergence Divergence indicator (or "MACD," marked with black and gold lines and blue bars at the chart's bottom) is not yet bullishly postured, but is close to being so.

If Rigetti breaks out from its ascending-triangle pattern, the stock's 12-day Exponential Moving Average (or "EMA," marked with a black line) could cross above its 26-day EMA (the gold line). The histogram of the 9-day EMA (the blue bars) could also go positive. All of that could be taken as technically bullish.

(Moomoo Technologies Inc. Markets Commentator Stephen “Sarge” Guilfoyle had no position in RGTI at the time of writing this column, but was long QUBT and QBTS.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

RGTI trade ideas

My Bookie Doesn’t Offer Qubit Parlays My Bookie Doesn’t Offer Qubit Parlays. So I went to my interactive broker.

Rigetti Computing (RGTI) reports earnings today after market close. While fundamentals may be stretched, quantum computing remains one of the hottest tech narratives right now.

Trade Setup:

Option Type: Call

Strike Price: $16

Expiry: Aug 15, 2025

Reasoning: If earnings come in at least neutral, momentum + sector hype could push the stock to $18+ within 3 days, delivering ~100 USD profit per option.

Catalyst: Earnings report + strong sentiment in quantum computing space.

Risk:

If earnings disappoint or sentiment fades, price could drop quickly; options are highly leveraged and expire soon.

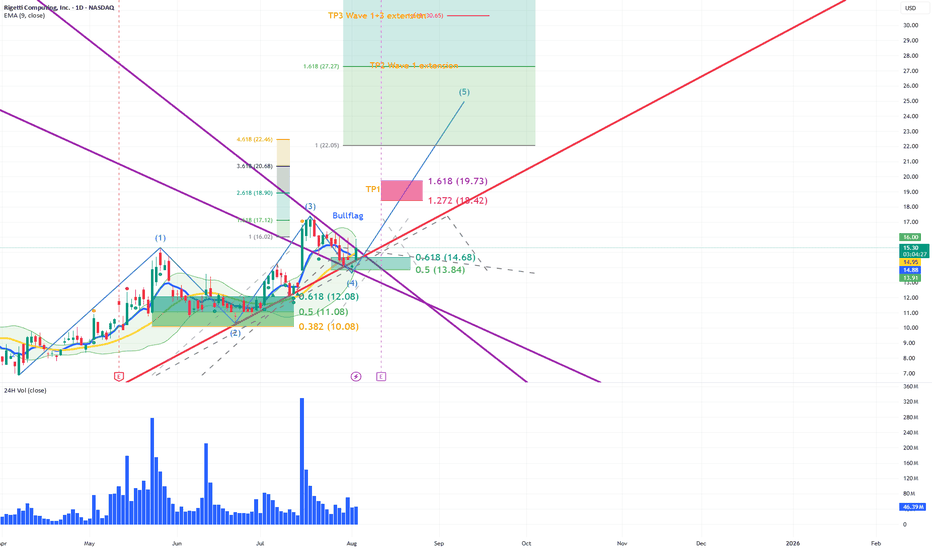

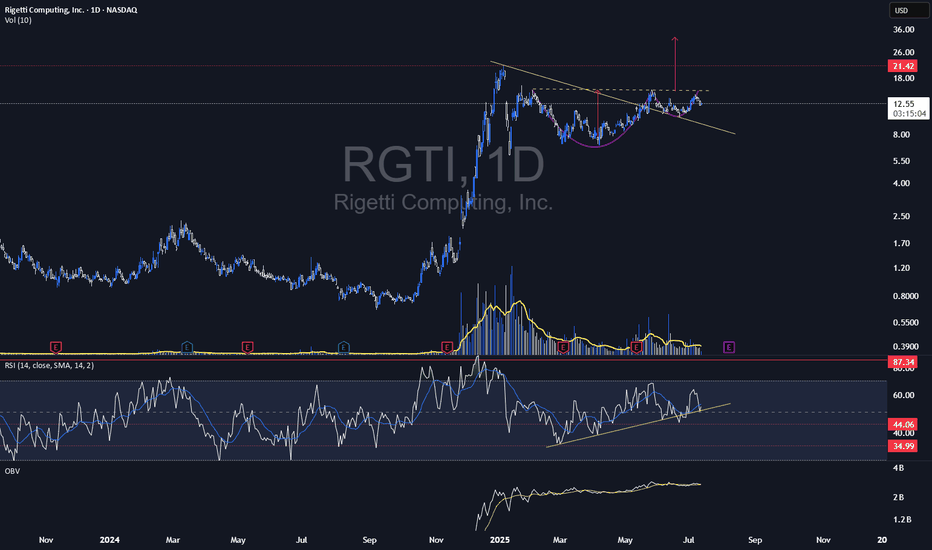

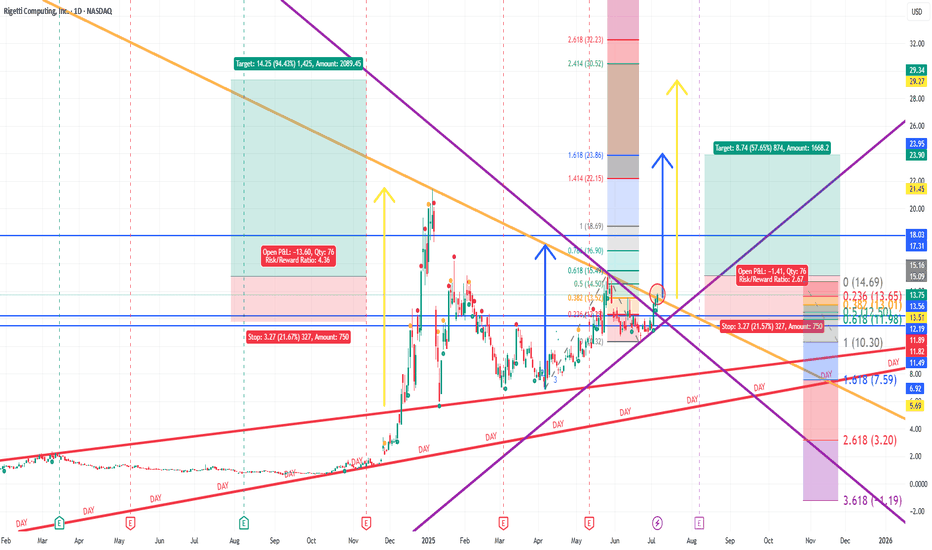

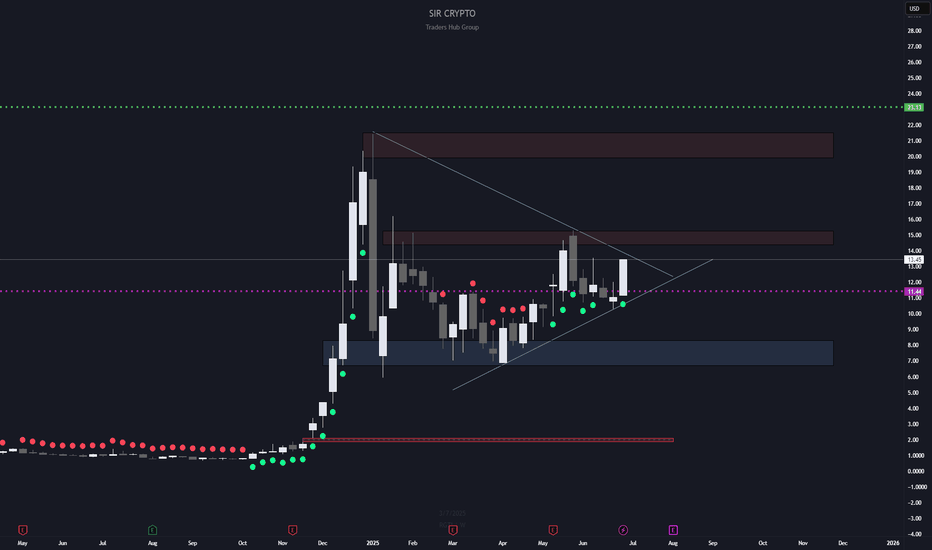

Wave 5 Break-OutLooks like Rigetti completed the wave 4 correction to the 0,5 fib zone (green box).

Today it broke out of the purple bullflag and reentered the red support.

Saw a retest of the bullflag support earlier today.

If we start wave 5 we might see:

TP1: 18,42 tp 19,73

TP2 27,27 TP1 extension

TP3: 30,65 Wave1+3 extension

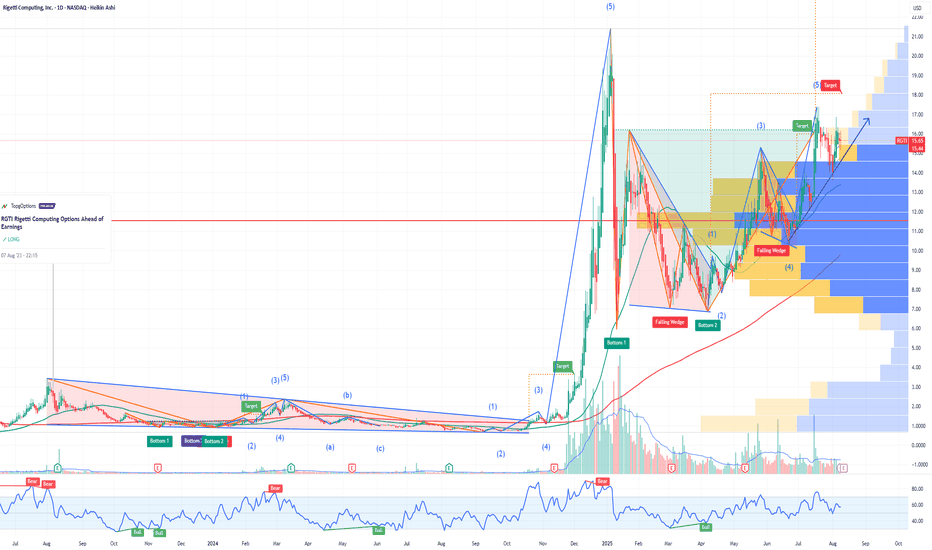

RGTI Rigetti Computing Options Ahead of EarningsIf you haven`t bought RGTI before the rally:

Now analyzing the options chain and the chart patterns of RGTI Rigetti Computing prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2027-1-15,

for a premium of approximately $6.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Chapter 3: The Big Gap Fill (RGTI) Chapter 3: The Big Gap Fill

After the luminous victory of the Alienoid Bulls in Chapter 1, the quantum lattice began to warp. Unbeknownst to them, the Mech Bears had not been defeated—only waiting, recalibrating, and evolving.

Hidden in the deep recesses of the 7D stackspace, a new war protocol had been activated: Project GAP-FILL.

Forged from the remnants of collapsed timelines and corrupted trading algorithms, the Mech Bears returned with upgraded plasma scythes, vortex cannons, and distortion shields—engineered specifically to slice through fractal bullish momentum.

Their mission: rupture the vertical trajectory of the Bulls by targeting the exposed gap at $14.87 .

And they struck with precision.

The plasma walls cracked. Alienoid defenders were torn apart, pixel by pixel. Charts trembled. RSI indicators bled below the midline. Volume spikes echoed like sirens through algorithmic space.

The Bulls fought valiantly, but their entangled rally code had become predictable. Their once-pristine yellow pathways had begun to fade under the purple-fanged teeth of the Bears' synthetic sell walls.

$14.87 was now no longer just a price—it was a battlefield scar.

It pulsed in red, flickering like a dying star, as algorithms calculated:

→ Bounce? An emergency quantum surge from sector Theta-12 might catch the fall.

→ Or further dip? Toward the gravitational pull at $13.80... or even deeper, toward the haunted zone beneath $12.60.

Whispers from the quantum feed rippled across timelines:

“If the Bulls can't re-stabilize above $14.87, the mech horde will breach the next support sector.”

The volume candles crackled, RSI skidded down through 30, and the future became uncertain.

The Alienoid Bulls retreated to regroup, wounded but not broken, preparing for what many called…

The Great Reversal War. NASDAQ:RGTI

Rigetti: Quantum Mirage or Computing's Next Frontier?Rigetti Computing, a pioneer in quantum computing, recently commanded market attention with a significant 41% surge in its stock. This jump followed a critical technological breakthrough: achieving 99.5% median 2-qubit gate fidelity on its modular 36-qubit system. This represents a twofold reduction in error rates from previous benchmarks, a vital step toward practical quantum applications. Rigetti's superconducting qubits offer gate speeds over 1,000 times faster than competing modalities like ion traps, leveraging semiconductor industry techniques for scalability. The company plans to launch its 36-qubit system by mid-2025 and aims for a 100+ qubit system by year-end, underscoring its rapid technological roadmap.

Beyond technical achievements, strategic partnerships and government contracts bolster Rigetti's position. A substantial $100 million manufacturing deal and a $35 million equity investment from server giant Quanta validate Rigetti's modular architecture. Government backing also provides a stable revenue stream, including a $1 million DARPA award for developing "utility-scale quantum computing" and a $5.48 million Air Force consortium award for advanced chip fabrication. The company further secured three UK Innovate awards for quantum error correction. These collaborations signal confidence from both private industry and national defense initiatives, crucial for a sector still in its nascent stages of commercialization.

Despite these positives, Rigetti's financial metrics reflect the high-risk, high-reward nature of quantum investment. While its market capitalization stands at a robust $5.5 billion, Q1 2025 revenue declined over 50% year-over-year to $1.5 million. Operating expenses remain substantial, with the company operating at a loss. Rigetti's valuation hinges on future potential rather than current profitability, trading at a high price-to-sales ratio. This places immense pressure on the company to meet ambitious technological milestones and rapidly scale revenue in the coming years, transforming speculative bets into tangible commercial success.

The broader quantum computing landscape is marked by intense competition and geopolitical implications. Giants like IBM and Google, also leveraging superconducting qubits, race alongside Rigetti. The sector's projected market size varies wildly, reflecting ongoing uncertainty about widespread commercial adoption. From a geostrategic perspective, quantum computing poses both a national security threat to current encryption and an opportunity for military advancement, driving a global race in post-quantum cryptography. Rigetti's extensive patent portfolio, comprising 37 quantum computing patents, underscores its intellectual property differentiation. However, macroeconomic factors, including rising interest rates, could tighten venture capital funding for speculative high-tech ventures, adding another layer of complexity to Rigetti's path forward.

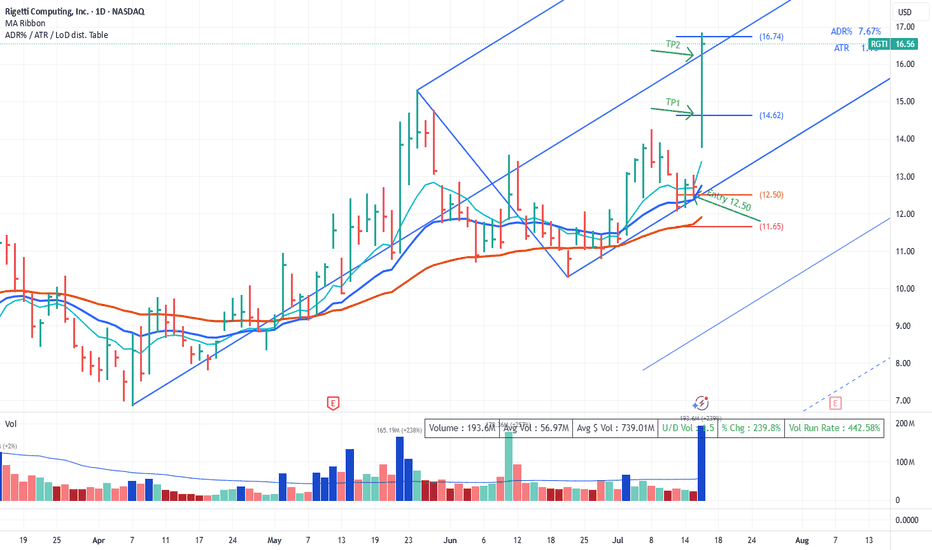

Median Line Trade RGTIPrice tests the LMH and rejects it. Look for a long at the retest. We get set at 12.50.

TP1 is logical at 2.5R and just before the prior top in case we fail to follow through

TP2 is at the median line. As Dr Andrews says "Price makes it to the Median Line 80% of the time".

Ok 'we got lucky' on some news for such a quick set of T/P's. Price definitely moved quicker than expected. However it wasn't luck that put us in the position.

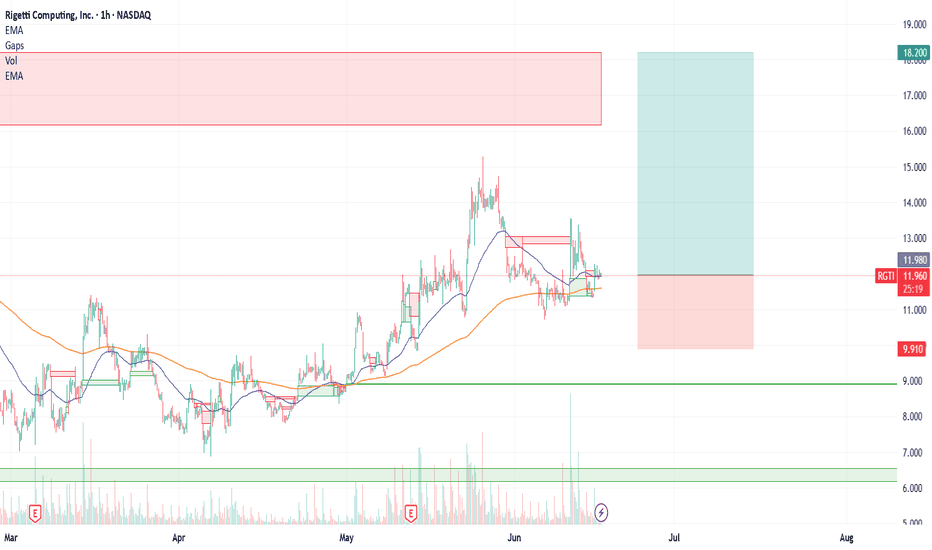

RGTI Heading to $17+ Good evening trading family

So currently due to price action it appears we are on our way to 17 dollar target however we expect a little bit of a correction at the 15 range.

However worst scenario if we go below 11 dollars be prepared for a sinker down to 8.

Trade Smarter Live Better

Kris/ Mindbloome Exchange

RGTI - Another Quatum Stock . Should i buy?Hello Everyone,

So last Quantum stock that i try to analyse today is RGTI - Rigetti Computing

First of all some figures for RGTI:

Revenue: $1.47 M — down 52% YoY and 36% QoQ

Operating Expenses: $22.1 M — up 22% YoY

Operating Loss: $21.6 M .

Net Income: +$42.6 M (+$0.15 eps) — driven by ~$62 M one-time non-cash gains .

Cash & Equivalents: ~$209 M as of Mar 31; ~$238 M by Apr 30 after $35 M investment from Quanta Government

Contracts:

DARPA Quantum Benchmarking Initiative Stage A, up to $1 M.

$5.5 M AFOSR award.

£3.5 M Innovate UK grants, including expansion of NQCC QPU from 24→36 qubits

Partnerships & Investments: $35 M strategic collaboration with Quanta Computer at ~$11.59/share

It's a high-risk, high-reward quantum play—valuable for those bullish on long-term quantum commercialization, but likely volatile near-term.

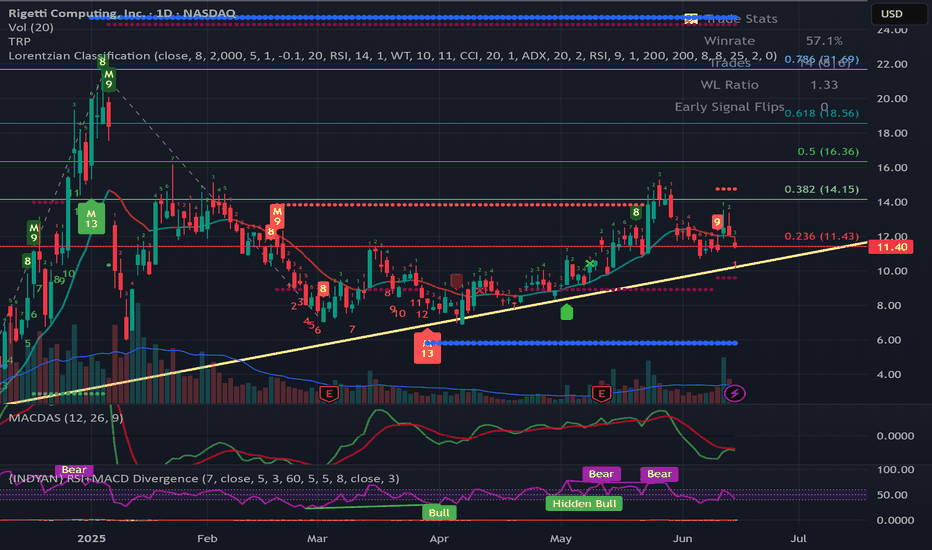

Chart Analysis:

For the time being it is stucked between 14.50 - 11.00 .

If it goes down to 9.00 $ level for me it could be the good opportunity to increase my positions.

14.15 - 14-30 is the resistance level and if this level are broken then it can quickly reach to 16.30 - 16.50 Levels.

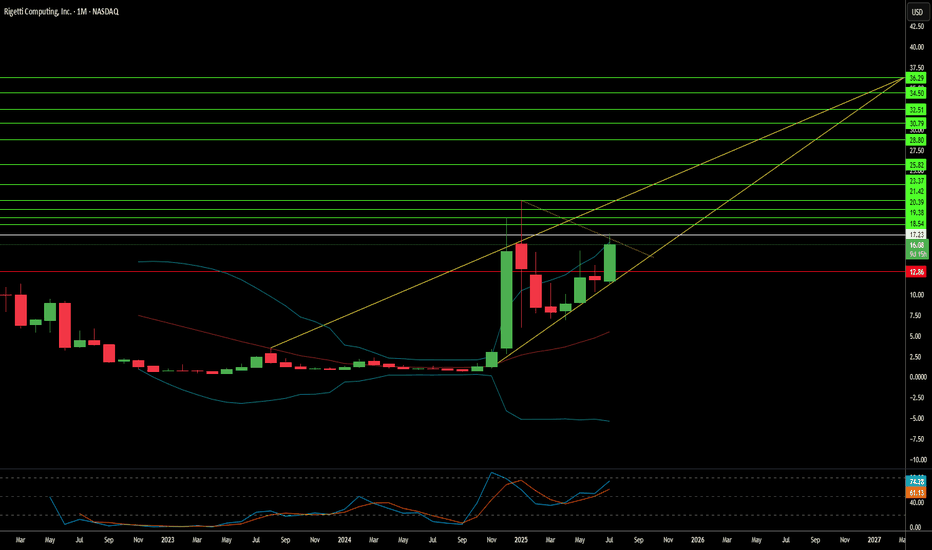

Biggest resistance level is in 21.50 and if this level is broken then we can see 25.00 - 26.00 level very quickly.

My long term expectetion in One year maybe less it can be reach the 25.00 - 26.00 Level.

So Same as i mentioned for IONQ and QBTS , i would like to be a early investor and beginning of this year i started increase my positions some Quatum computing stocks and RGTI is one of them.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a lovely Sunday to all.

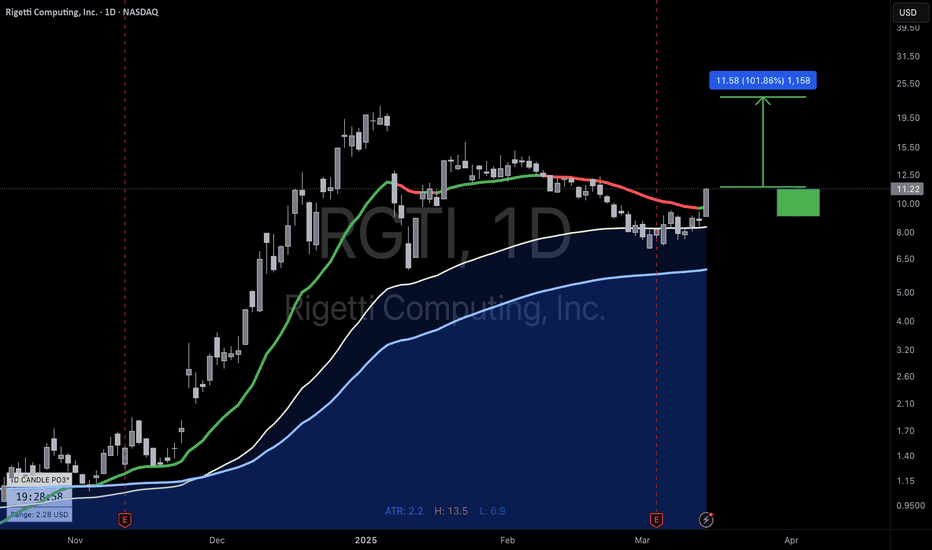

RGTI : First Long Position AreaNASDAQ listed Rigetti Computing Inc. stock is currently trading above the 50 and 200 period moving averages.

Once it gained momentum, it later lost it but its outlook is not weak at the moment.

Right now, if the Iran-Israel war uncertainty is overcome and if there is no bad news affecting the index, the gap may close.

Risk/Reward ratio of 3.00 is a very valuable ratio to try with small position amounts.

Risk/Reward Ratio : 3.00

Stop-Loss : 9.91

Take-Profit : 18.2

Regards.

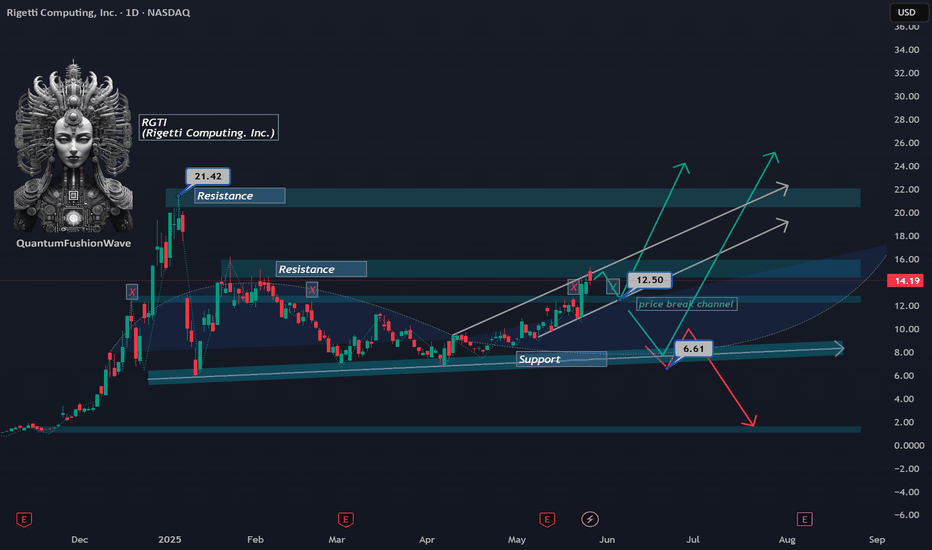

Rigetti's Quantum Leap: Can RGTI Ride the Hype to $100?Rigetti Computing Inc. (RGTI) is a notable company in the quantum computing space, focused on developing superconducting qubit systems. As of late May 2025, the stock is trading around $14.19, marking a sharp rise from its earlier levels this year.

The stock has rallied more than 1,200% over the past six months, pushing RGTI toward the upper boundary of its current ascending channel. The $15.00–$15.50 range is acting as a psychological resistance area. After such a strong move, a technical pullback toward the $12.50 zone would be considered healthy, potentially allowing the stock to reset while remaining within its bullish structure. If $12.50 fails to hold, the next notable support sits near $7.59, a previous area of accumulation.

Rigetti’s growth outlook is supported by several key drivers:

Technological Innovation: The company is on track to roll out more advanced quantum systems, including a 36-qubit system by mid-2025 and a 100+ qubit system by year-end. These advances are built on its modular chip architecture, aimed at scaling performance.

Strategic Collaborations: Rigetti has been expanding its reach by partnering with leading cloud platforms, making its quantum systems more widely accessible and integrated with broader tech ecosystems.

Government Support: The company is also involved in government-backed quantum initiatives, strengthening its credibility and positioning in the national quantum strategy.

As the global quantum computing market continues to gain momentum, Rigetti is well-positioned to benefit. If the bullish trend persists, some forecasts suggest the stock could potentially reach the $100 level by the end of 2026.

Traders and investors should watch key levels: $12.50 and $7.59 on the downside as support, and $15.50 as the immediate resistance to confirm momentum or identify pullback opportunities.

100% move potential Quantum Computing RGTIRegetti Computing Inc. (RGTI) - Quantum Computing is on the move - Breaking above the 25 day EMA to continue the uptrend. RGTI has the potential to move 100% of the current price. With that potential, when would you sell at 25% , 50%, 75% or 100%? Otherwise, would you hold longterm?

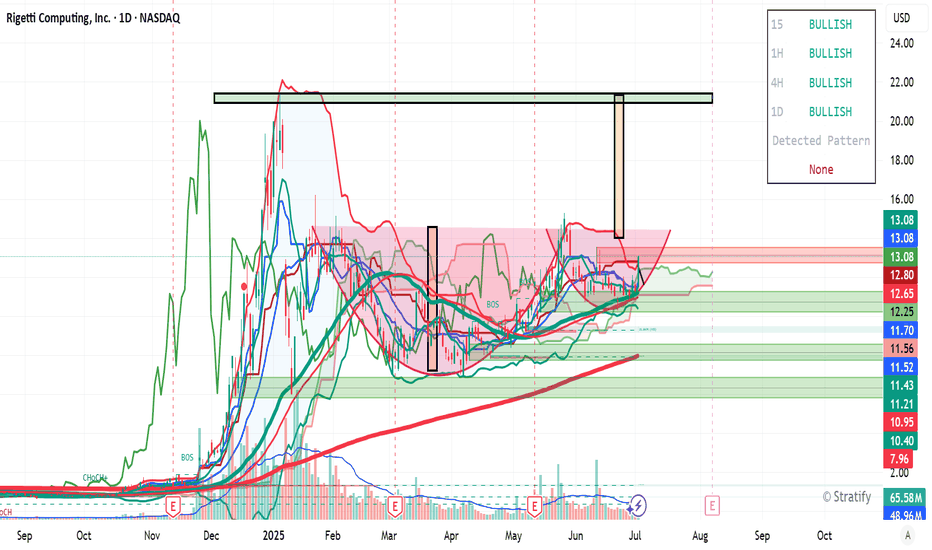

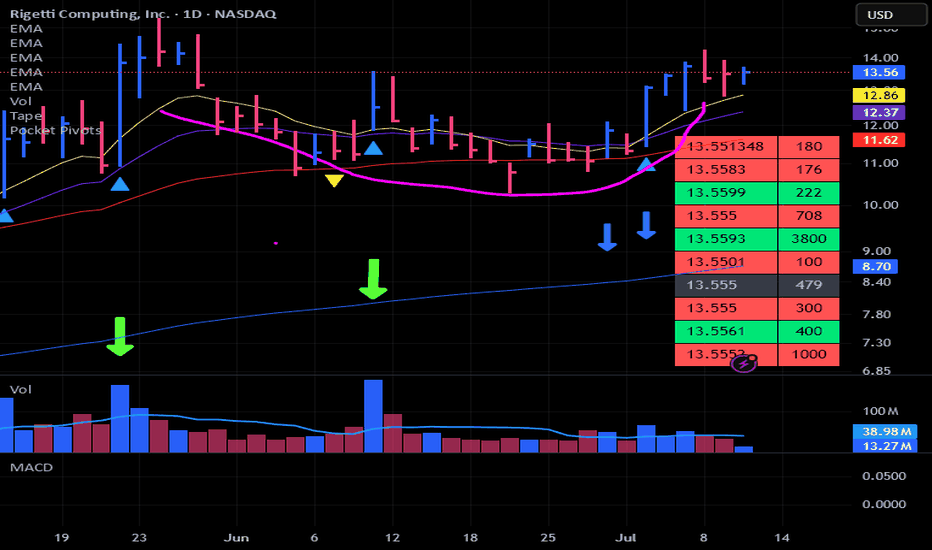

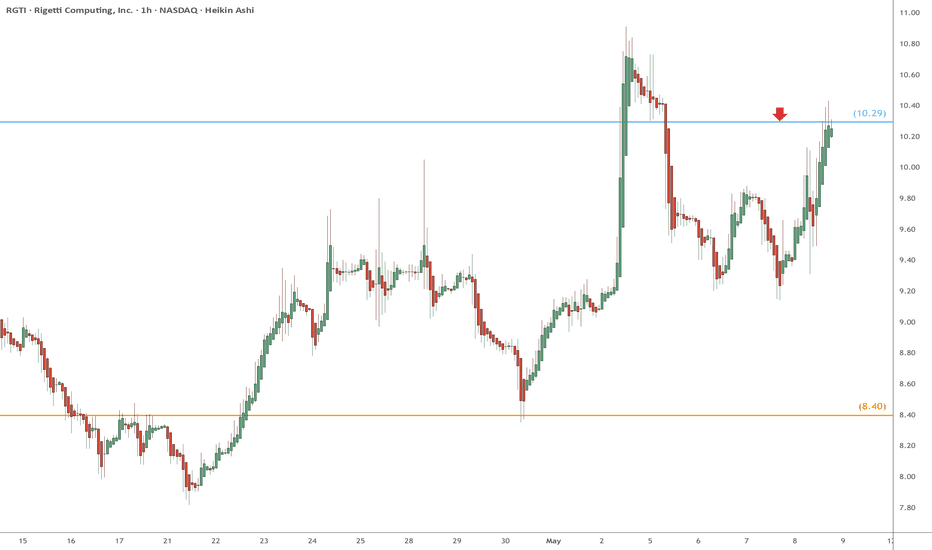

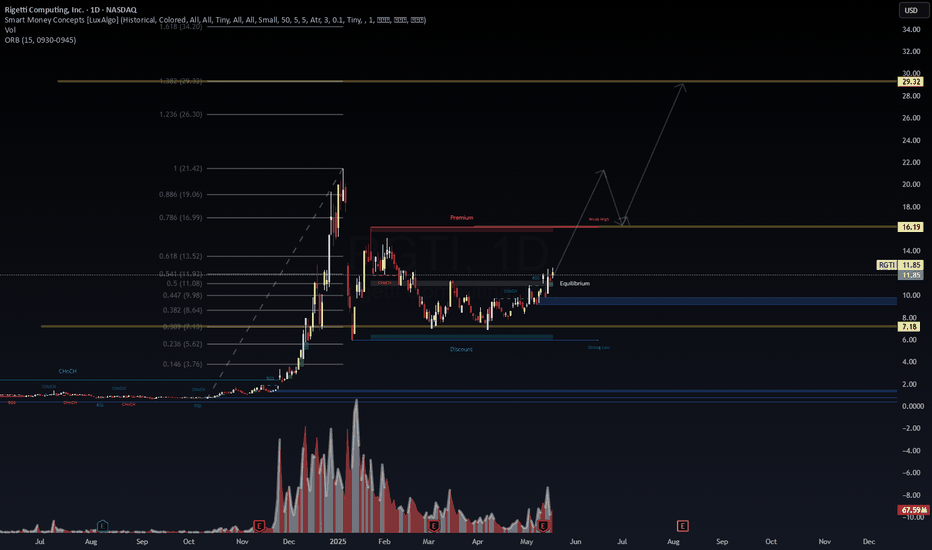

RGTI | Smart Money Positioning Underway – Reaccumulation BeforePublished by: Wavervanir_International_LLC

Timeframe: 1D | Bias: Bullish Accumulation | Strategy: Smart Money Concepts (SMC) + Fib + Volume Structure

🔍 Technical Thesis

Rigetti Computing ( NASDAQ:RGTI ) is showing signs of a textbook smart money reaccumulation phase following a parabolic expansion and a subsequent controlled pullback. Volume confirms interest remains intact, with volatility compression and CHoCH signals aligning into a bullish continuation setup.

The chart structure suggests the asset has cleared the discount accumulation range (~$7.18) and is currently balancing near equilibrium (~$11.85). A move through this zone would shift market structure decisively toward premium pricing, unlocking upside targets.

📌 Key Structural Levels

Zone Price Notes

Discount Demand Zone $6.00–$7.18 Accumulation confirmed by CHoCH & BOS

Equilibrium Level ~$11.85 Current rebalancing area

Premium Target 1 $16.19 Weak High & Liquidity Magnet

Fibonacci Extension Zone $26.30–$34.20 Long-term expansion potential

Volume Spike 67.59M Institutional accumulation signal (early April–May)

📈 Scenarios

Bullish Path (Primary):

Break and retest of $13.52 (0.618 fib) leads to push toward $16.19.

Mid-term continuation to $26–$30+ zone on quantum hype or government contract announcements.

Bearish Rejection (Alternative):

Temporary fade to $9.50–$10.50 support, then reattempt equilibrium reclaim.

Invalidated if weekly closes below $7.18 demand zone.

🧠 Institutional Narrative Control:

With the quantum computing sector gaining momentum in the AI arms race, RGTI offers asymmetric upside potential. Government contracts, unique IP, and low float dynamics make this a name worth leading before the herd arrives.

📊 SMC confluence, fib retracement alignment, and psychological liquidity levels make NASDAQ:RGTI a high-conviction mid-cap growth narrative.

Expect volatility, but opportunities are rare at these structural locations.

📣 Follow for real-time updates and data-backed SMC plays.

— Wavervanir_International_LLC

#RGTI #QuantumComputing #SmartMoney #LiquidityMap #TradingView #VolumeAnalysis #InstitutionalAccumulation #FibLevels #AIInfrastructure