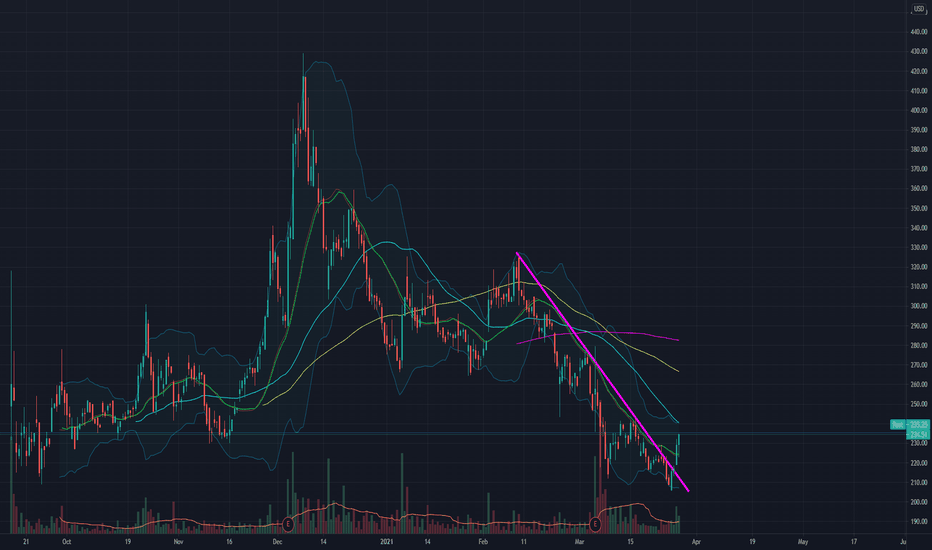

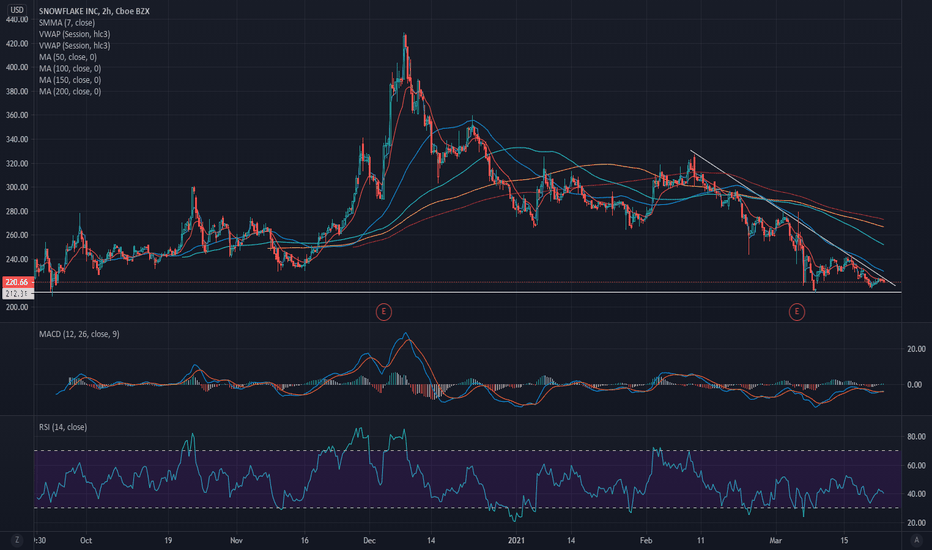

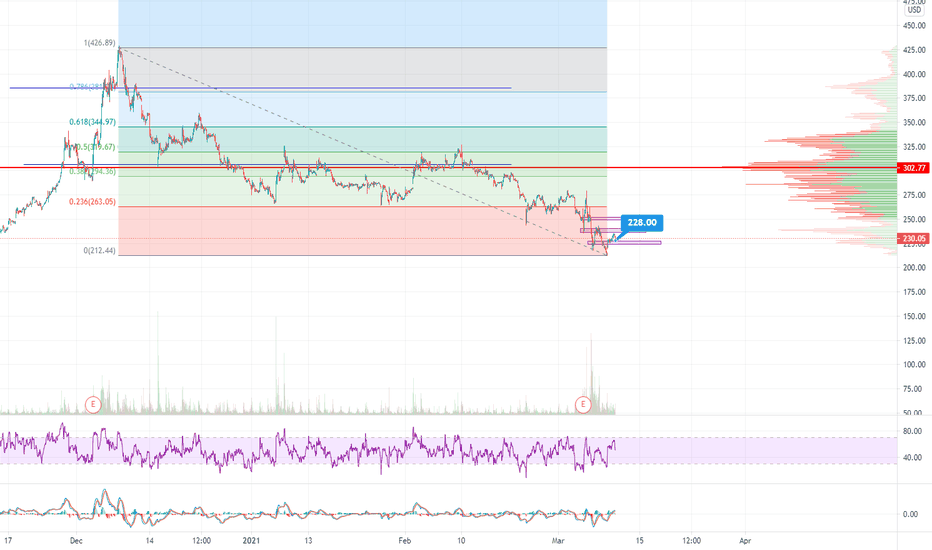

$SNOW Potential Bottom PickingNow that the trading week is over, we can take a closer look at how the broader markets have performed. For the most part of the week, the markets appeared to be quite choppy but now looking like we can potentially start moving higher.

If that is the case, then I think there is a potential here to bottom pick a high flying enterprise software company called Snowflake. At one point this stock was trading over 150x price to sales. It might sound ridiculous but in a controlled market where you have massive money printing, I don't think the majority of market participants are buying for fundamental cash flow. Instead, the markets appear to be competing for market share as there are only 100% possible owners of a company. :)

All in all, I categorized this technical setup as a reversal play and if the broader markets can rally then I think $SNOW can run up quite substantially for the short to mid term trader.

- EnterpriseGuy

SNOW trade ideas

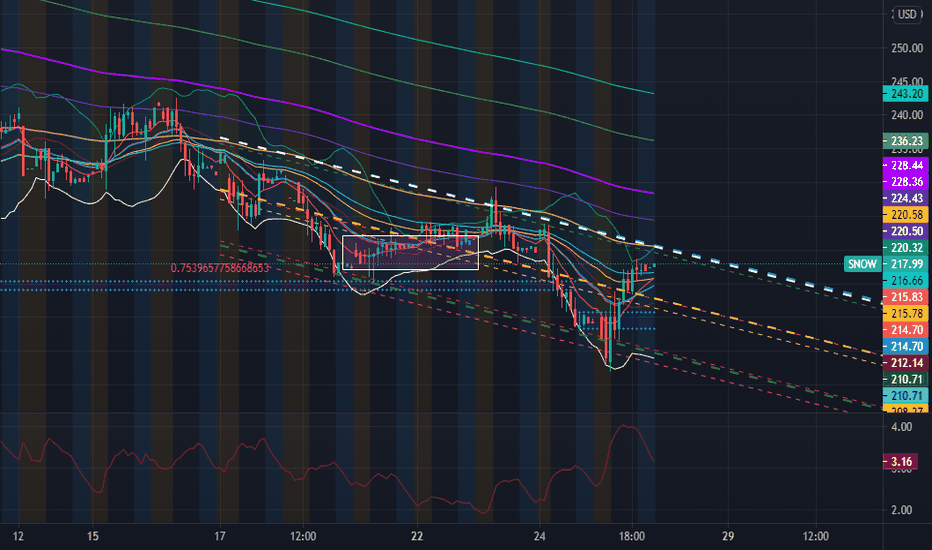

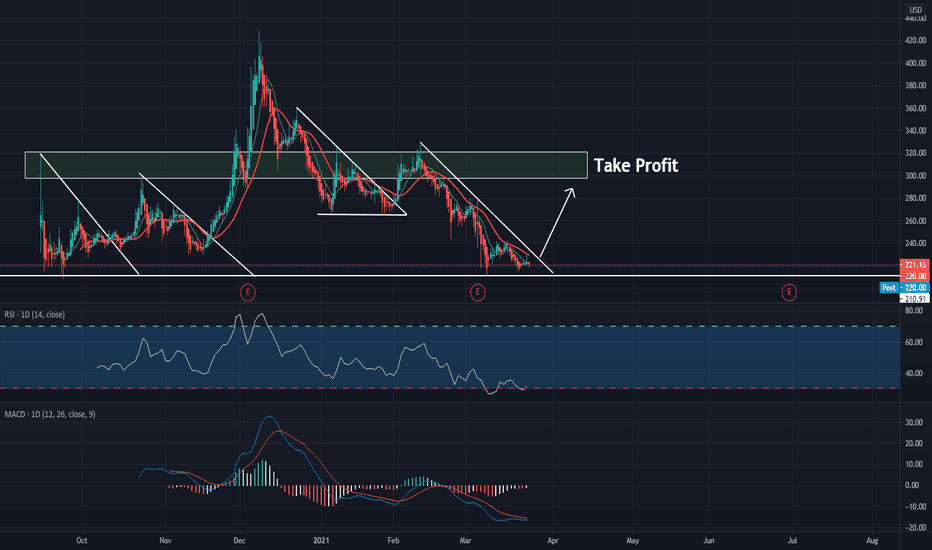

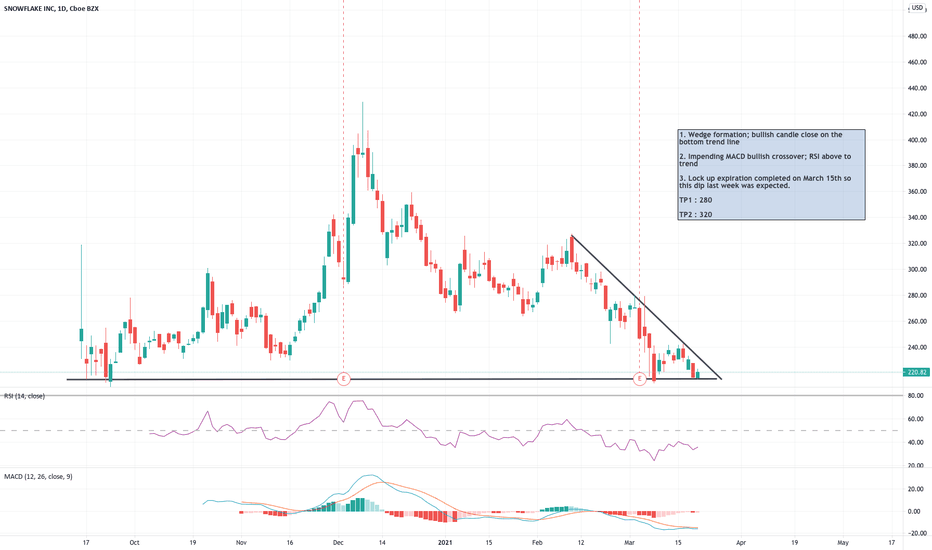

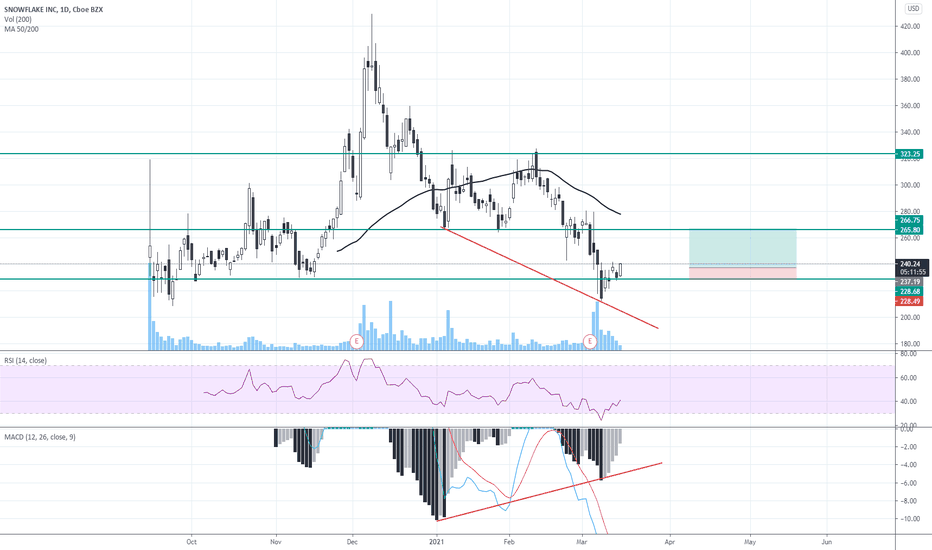

SNOW, WILL IT HAPPEN AGAIN?Hello fellow traders and investors, here's another trade idea.

SNOW has recently been pulling back and previously makes a breakout above the trendlines, if PTON makes a recovery to the take profit area it offers around a 40% ROI.

Technicals:

The Macd indicates that it's oversold

The EMA's are in a downtrend

The RSI is oversold

When To Buy:

When the Macd crosses its EMA

When the EMA's crossover

When To Sell:

I recommend selling at its previous high offering around a 40% ROI.

Fundamentals: SNOW provides a cloud-based data storing software that provides data warehouse modernization, accelerating analytics and overall productivity. They have a P/S of 103 which is a lot, sales growth Q/Q of 118.60% which is amazing however their earnings per share growth Q/Q of -218% isn't good at all however with their amazing return on investment of 66% they should be able to fix this is in a few years and finally, a short float of 17% which could easily cause a short squeeze if it breaks out over the trendline and investors and traders start buying they will have to cover their positions.

Rating: 50/100 since their technicals look okay and their EPS and P/S isn't looking too strong their rating will have to be 40/100 however if this meets your criteria feel free to add it to your watchlist.

I hope you enjoyed this quick analysis and many more to come.

If you enjoyed leave a like, follow, comment your thoughts and share this trade idea.

Thanks.

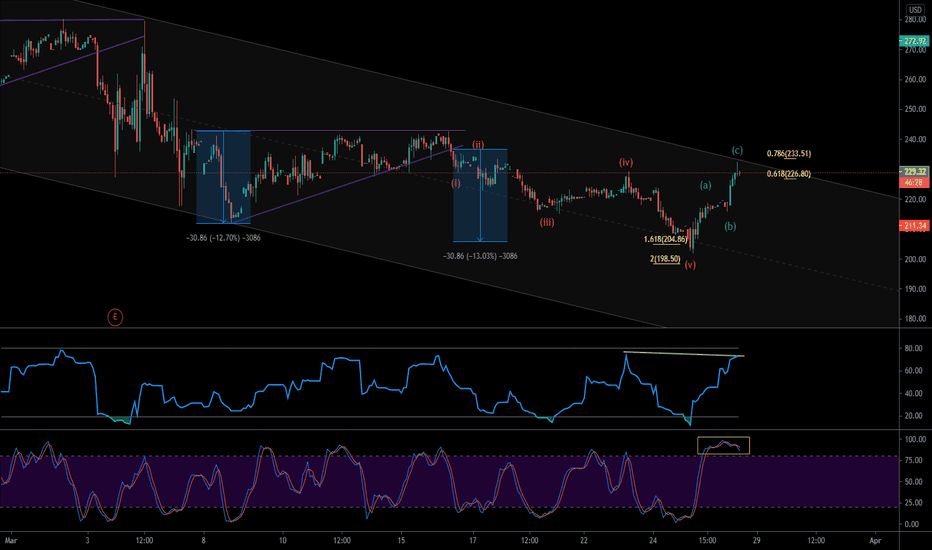

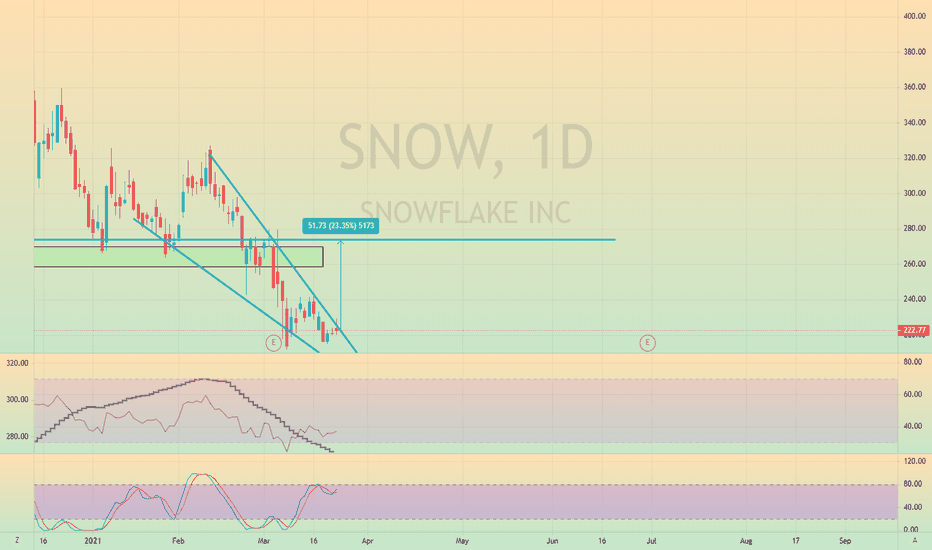

LONG SNOWClassic bullish divergence on the daily. This is probably kind of late to publish the idea. The perfect entry was around 230. However, it still has run to go. I bought a few shares, and already sold half of the position to book profits and will let this run. This is a technical, but also a fundamental play, and I love to hold stocks like this on my long term portfolio.

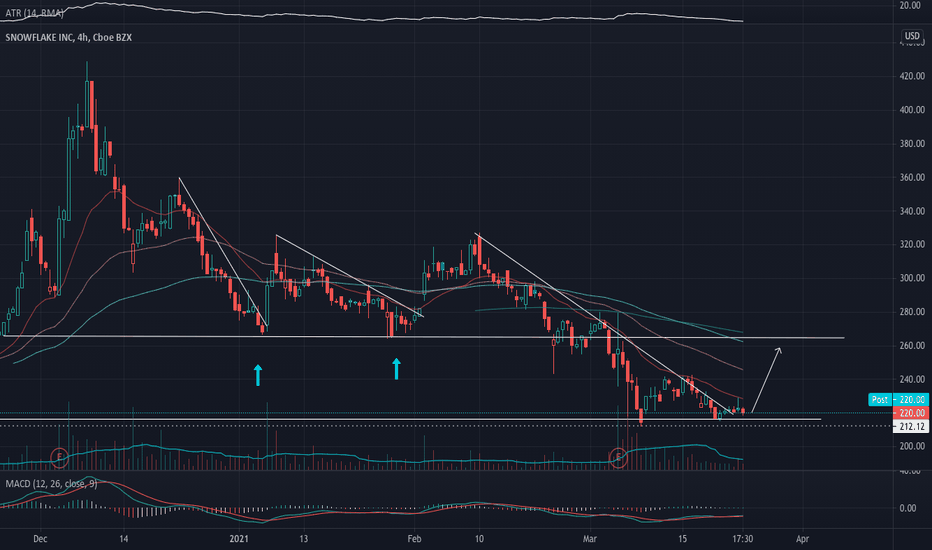

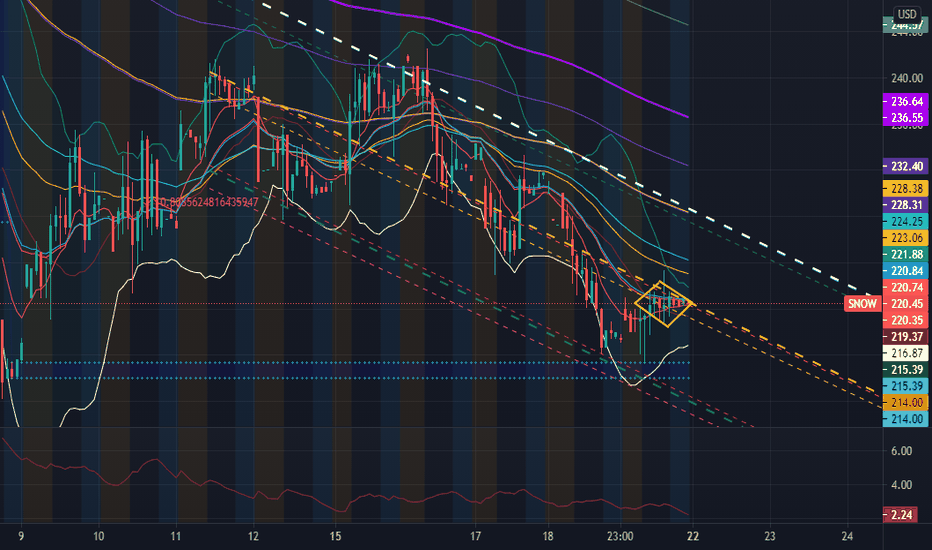

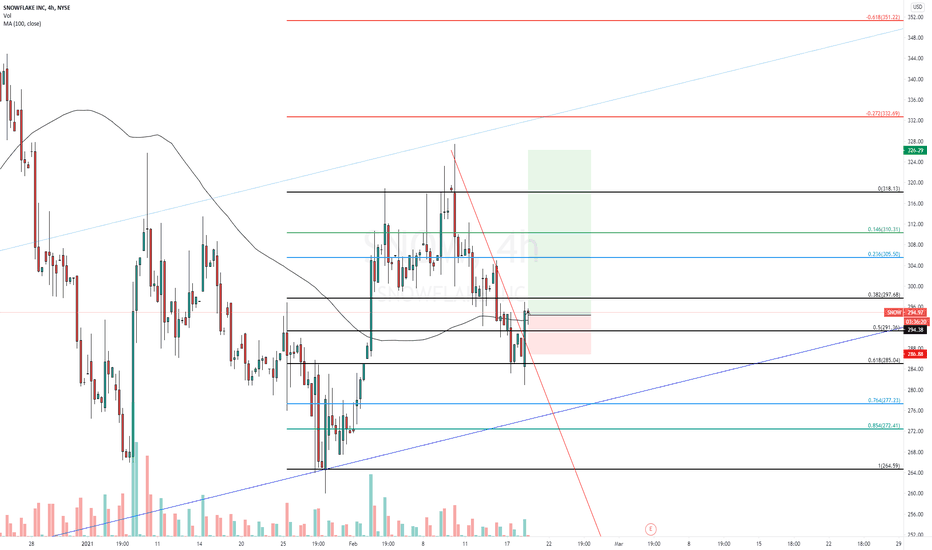

Snow 18-02-2021 LongAsset and Time frame -SNOW,4H

Entry Price -294.98

Exit(Stop Loss) -287.67

Exit(Take Profit) -317.05

Technical Analysis -Price broke a confirmed LTF trend line with an engulfing bullish candle, and above the 4H MA, Price jumped because of the new 100 MA on the daily chart and reacted strongly,price also reacted to the 0.618 Fibonacci level.

I entered the trade with a smaller position(0.50%) because the market sentiment is currently bearish and because their earning report is soon.

I would like to hear your opinions and what can I do to improve, many thanks

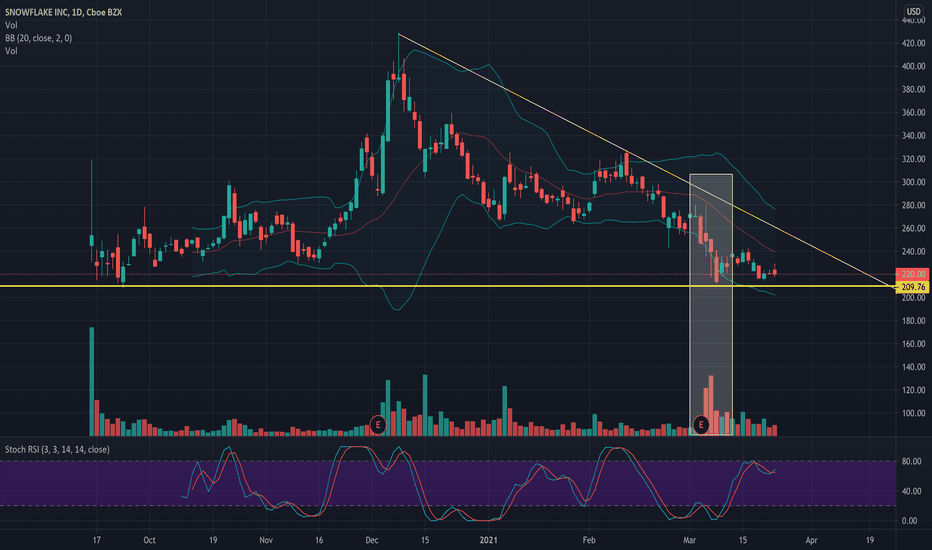

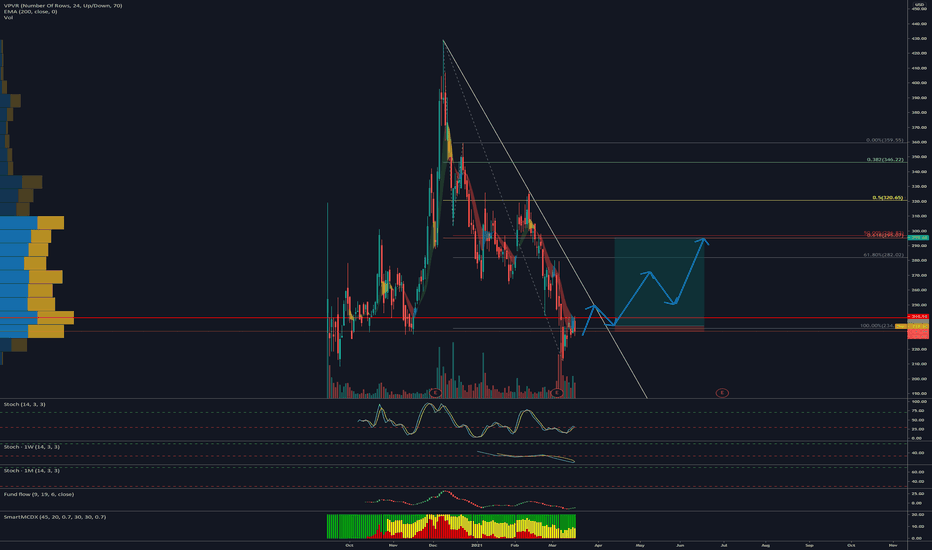

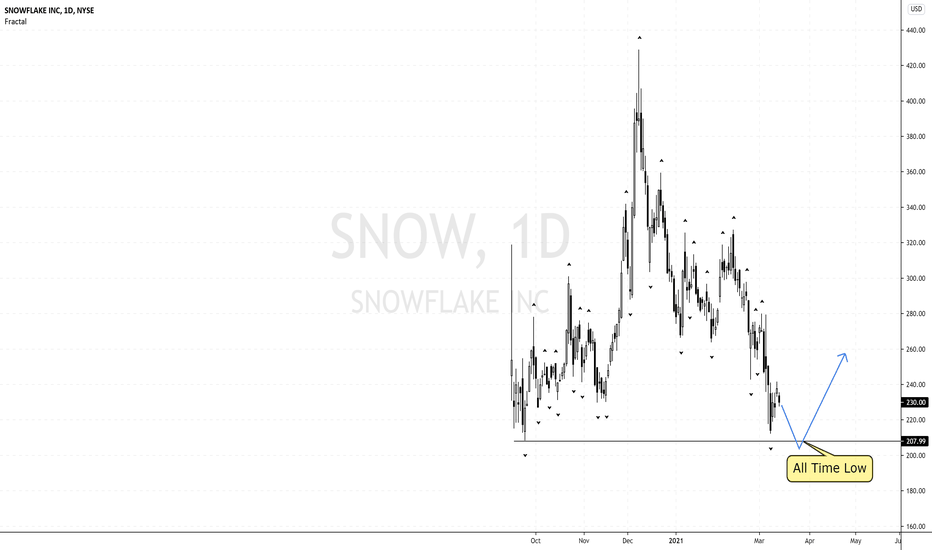

SNOWFLAKE Stock Should Be On Your WatchlistSince the stock was listed on NYSE, it has rallied to a high @ 429, and now the stock price is near its all-time-low. If there is a break below this low with rejection (on high volume), that could be the reversal indication. This is a stock to be on your watchlist!!!

N.B

- Let emotions and sentiments work for you

-ALWAYS Use Proper Risk Management In Your Trades

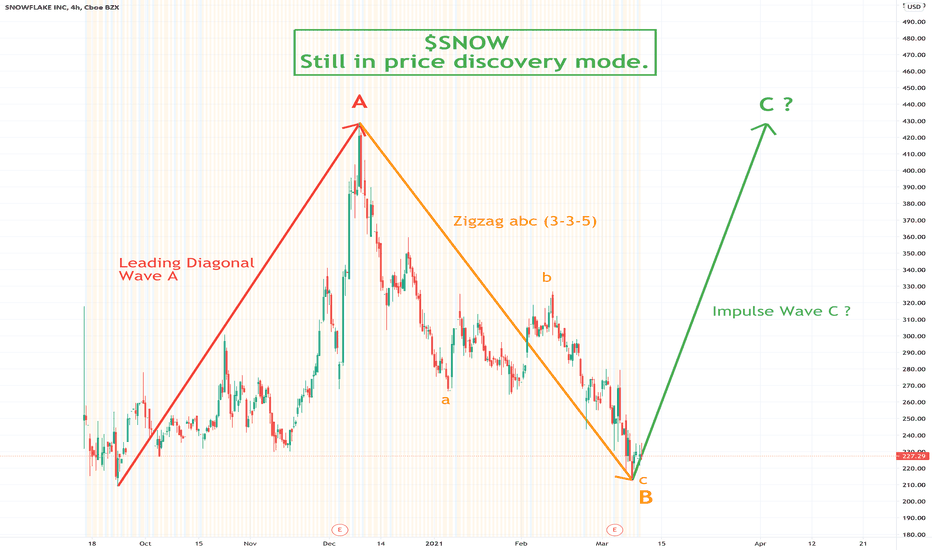

$SNOW still in price discovery mode.Charting for a friend.

Will try to work with what I have, but with what I have here, there's really not enough data or price confirmation to pinpoint any other than that we are in a price discovery territory.

As such, Wave B might not even have ended its run and may dip even lower.

An assumption that Wave B has completed is generous indeed, and in such circumstances, a Wave C climb will set a TP of $428.

However, it will be wise to stay on the sidelines for this one, for now.

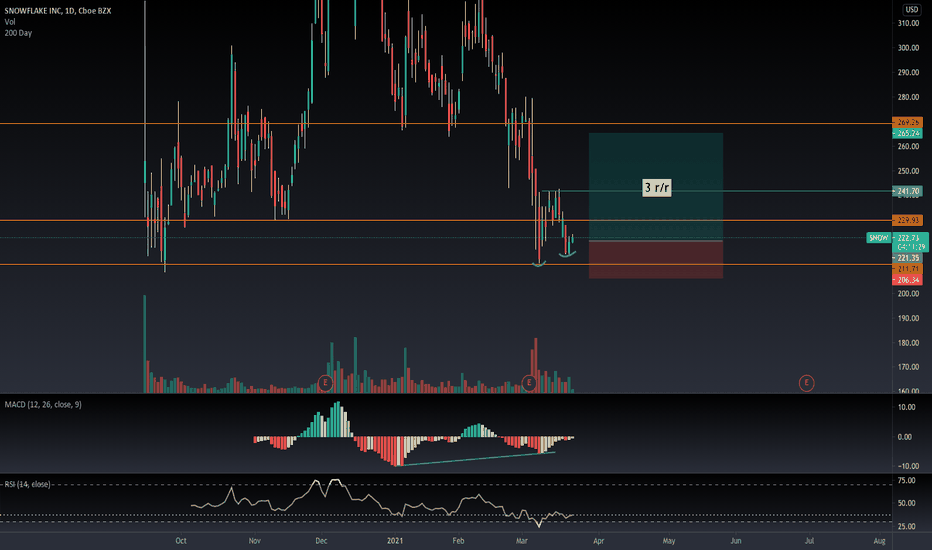

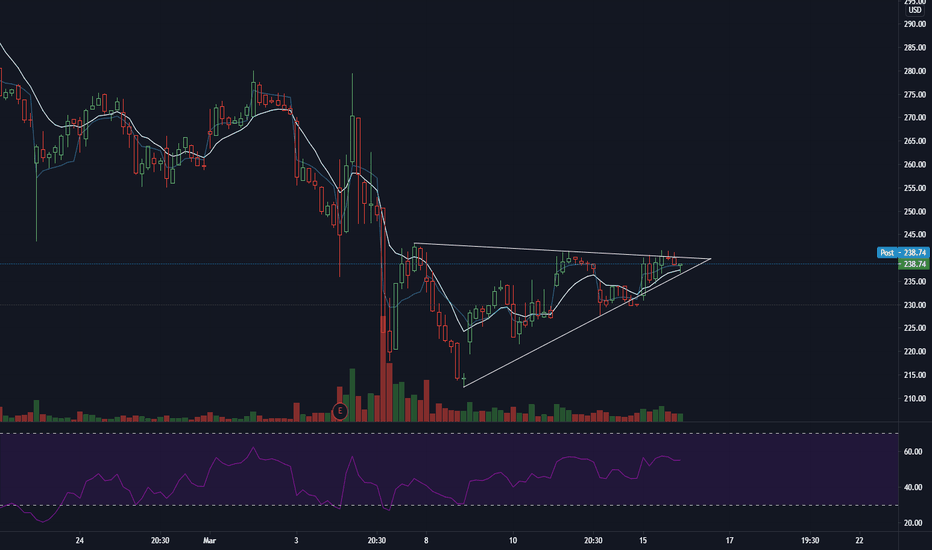

$SNOW LONG$SNOW has been beaten down to IPO price during this rotation out of tech due to rising interest rates.

Lockup Expired on 3/5/2021, which added to sell pressure.

It's currently sitting at bottom of channel and major support.

With any NASDAQ strength and renewed confidence in growth names, we can see this bounce BIGLY.