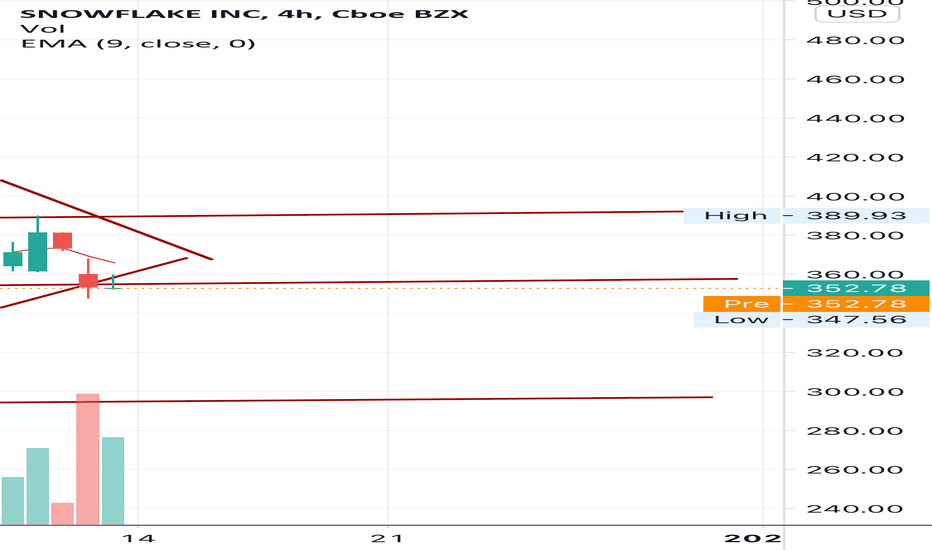

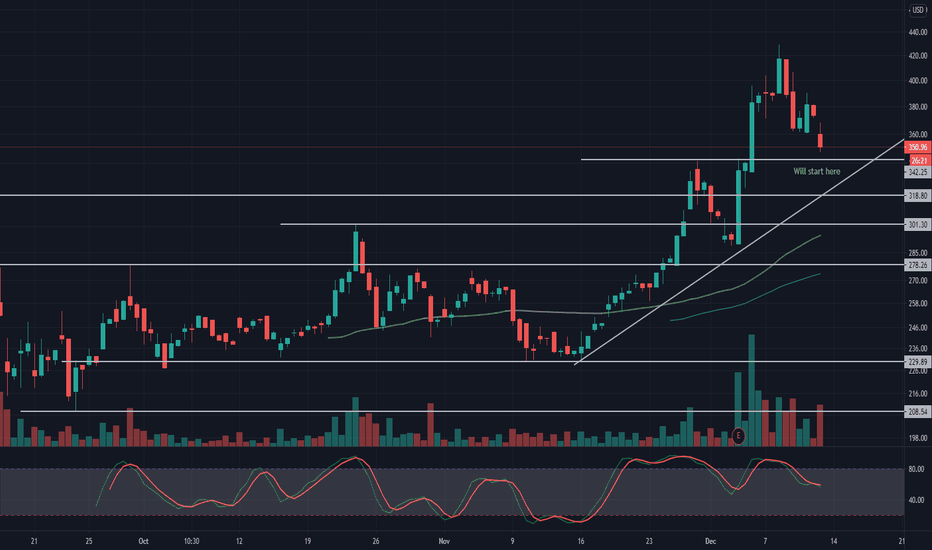

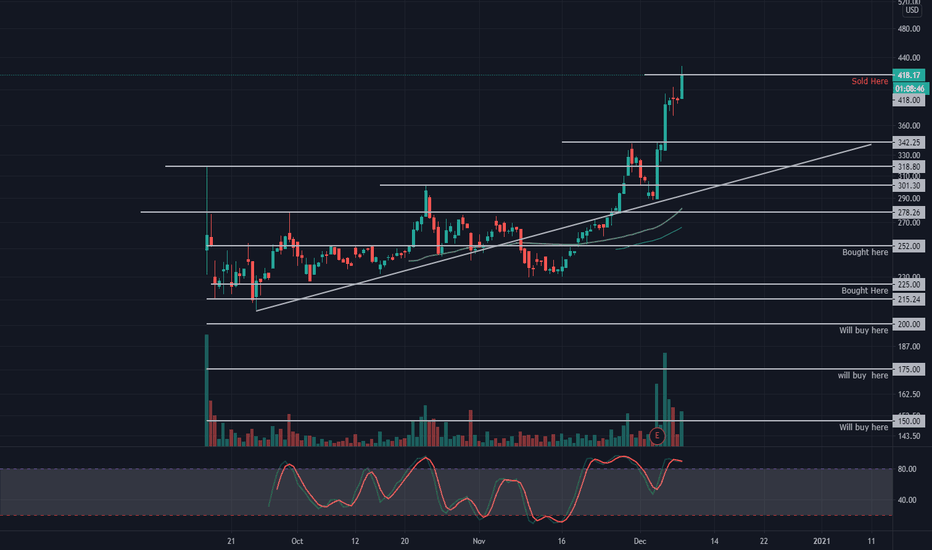

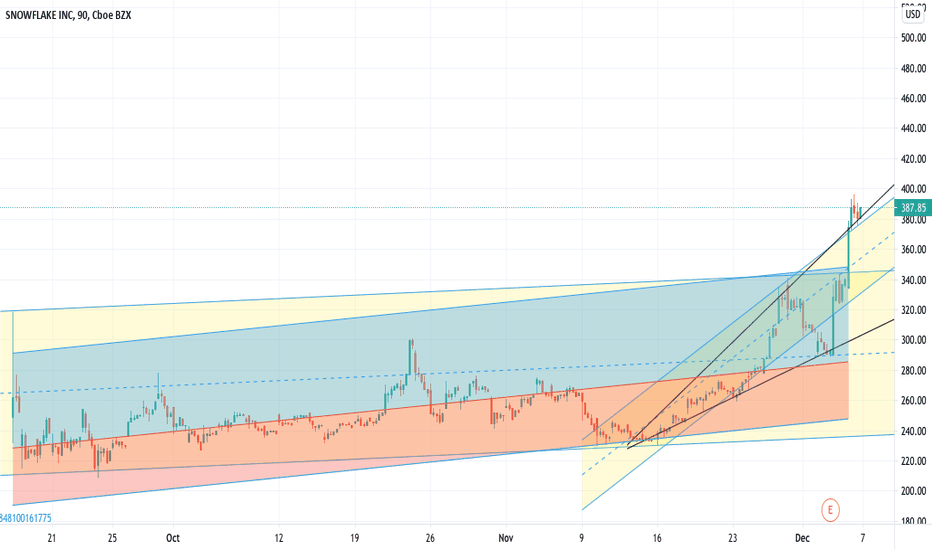

SnowFlake to 500 Still in play, calls not changed from last weekBuy the Dip until proven otherwise in Bull trends!

Correction probably due to profit taking/ selling in anticipation of Dec 14 Snow Lock up Expiry

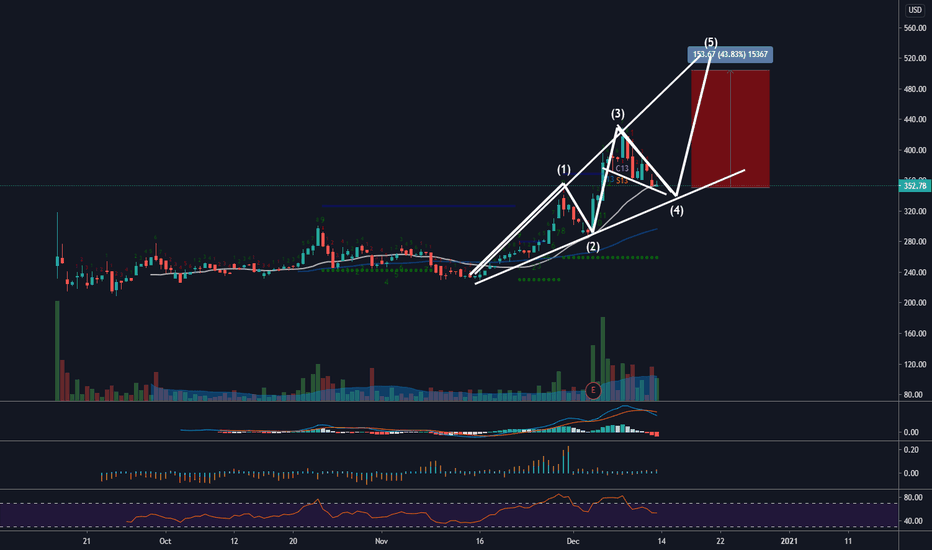

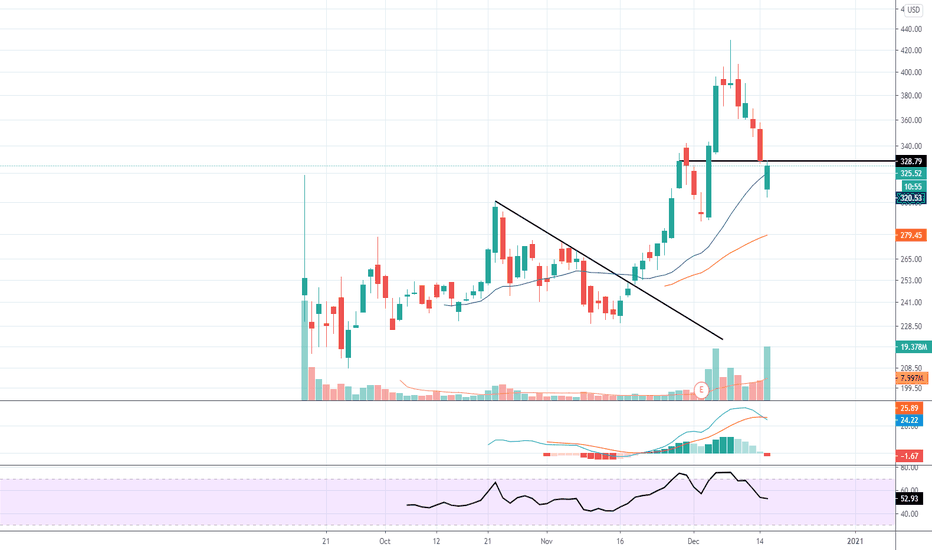

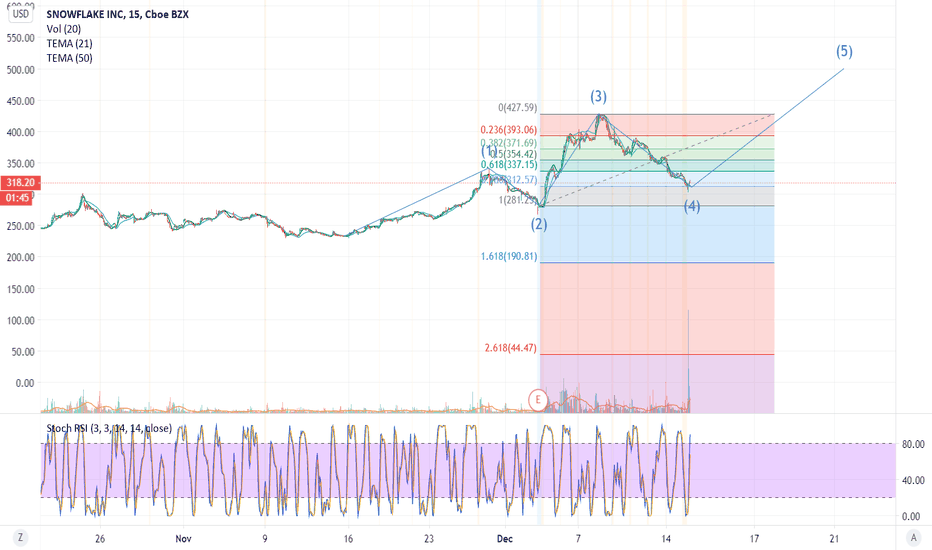

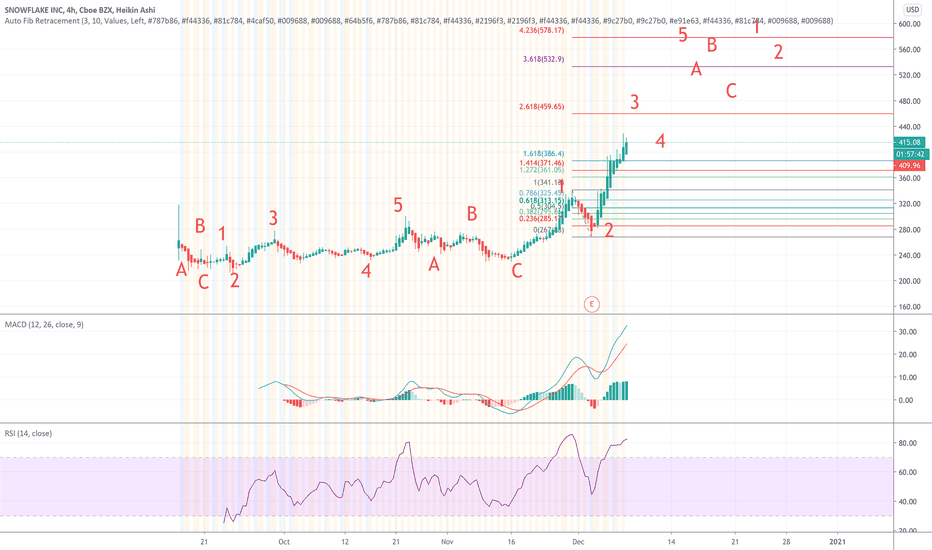

Elliot wave theory suggests another wave 5 to come, with wave 4 correction.

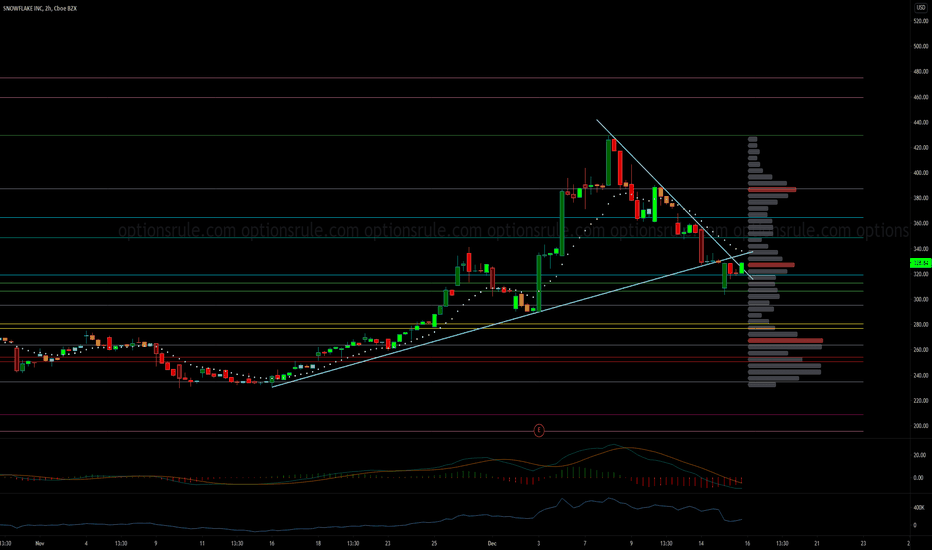

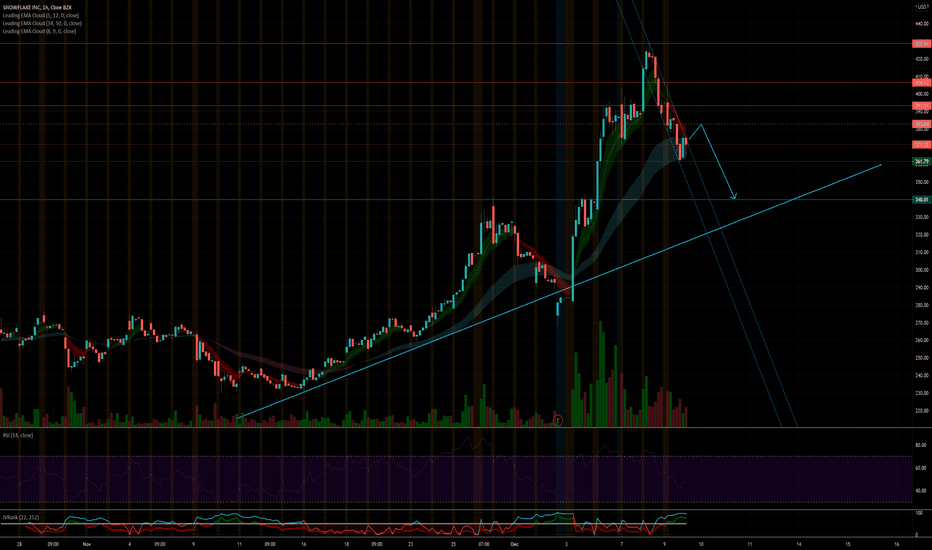

Descending wedge on correction - higher probability of upside move

I have bought early at 377, a bit early in hind sight, But If you see my previous posts I sold the local top area on 8 Dec so I am actually re buying more shares by selling high and buying more lower.

Buying more at current levels on Monday open.

These are opportunities to make money.

Buy during fear and the rewards are greater than buying in areas without fear.

SNOW TO 500!!

SNOW trade ideas

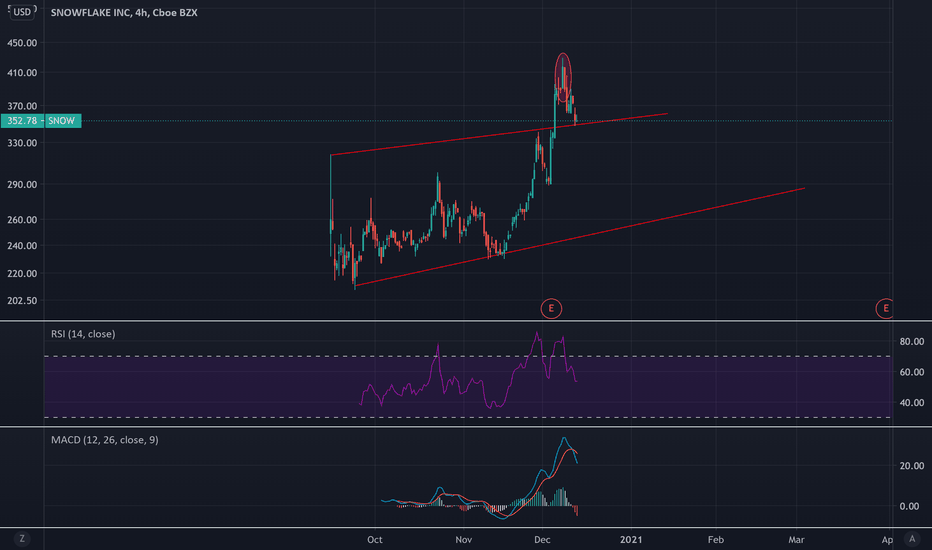

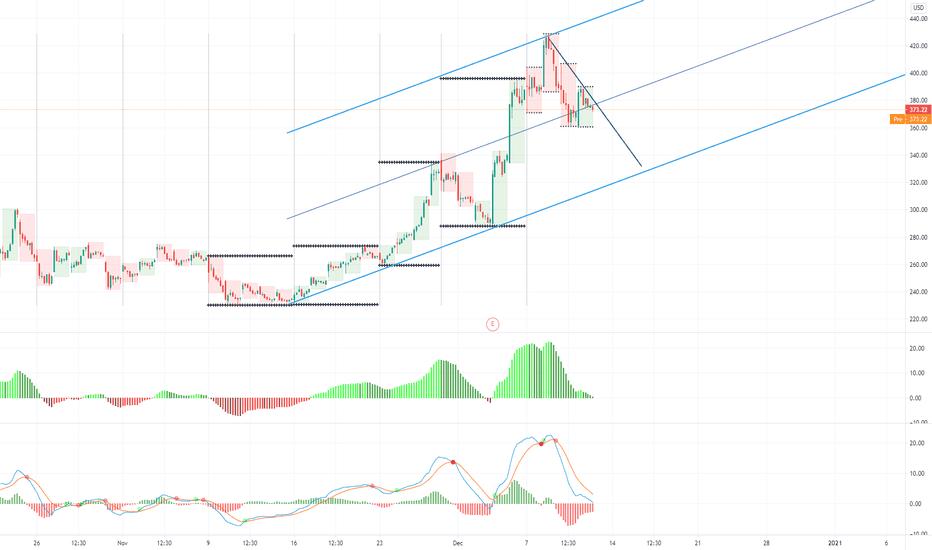

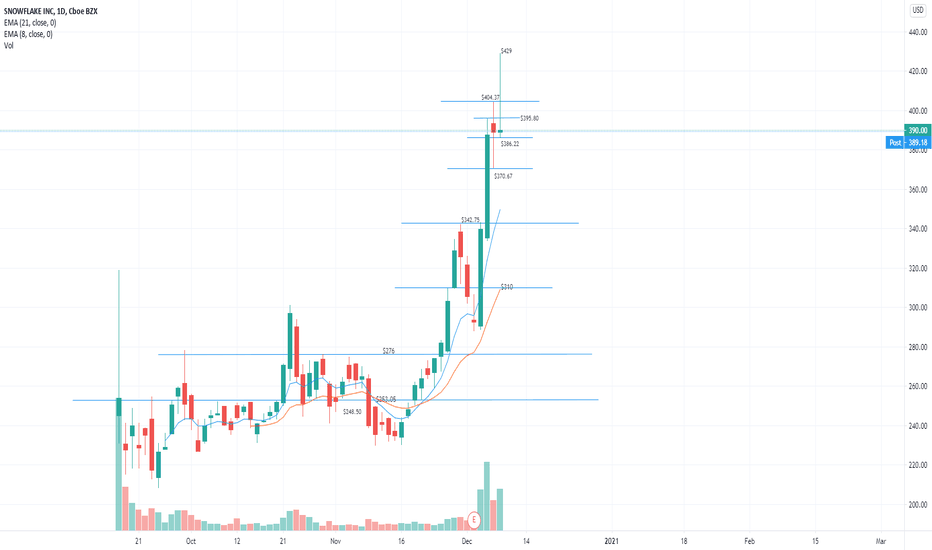

SNOW - money flowing out of this name to new IPOsSNOW was the new shiny thing - up over 75% of the IPO price in just over 50 some trading days.

Now the new kids are in town. $DASH $ABNB

$DASH IPO coincided with QQQ sell off.

$ABNB is coming Thursday.

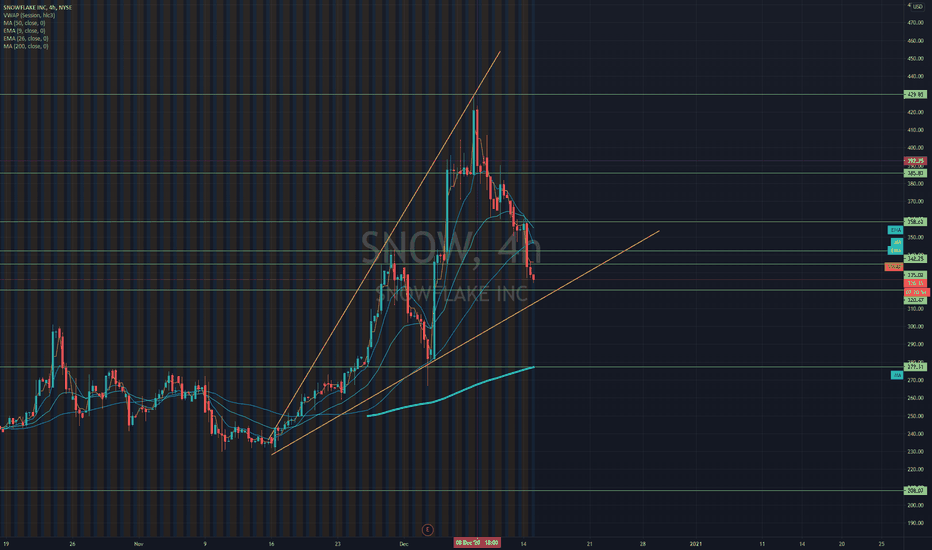

SNOW is selling and more down trend in QQQ to be expected. Profit taking time?

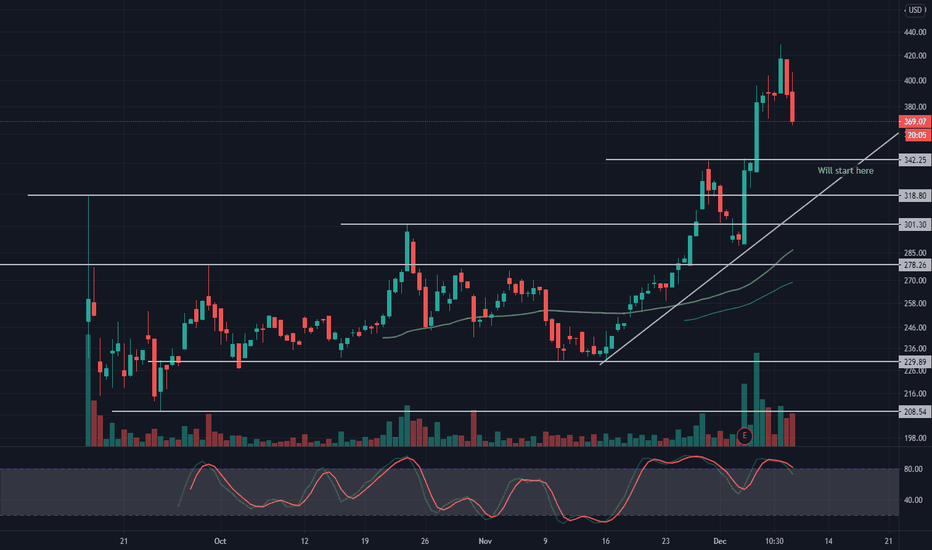

Playing PUTs when the price hits as high as $383 on the bounce.

Price Target $340

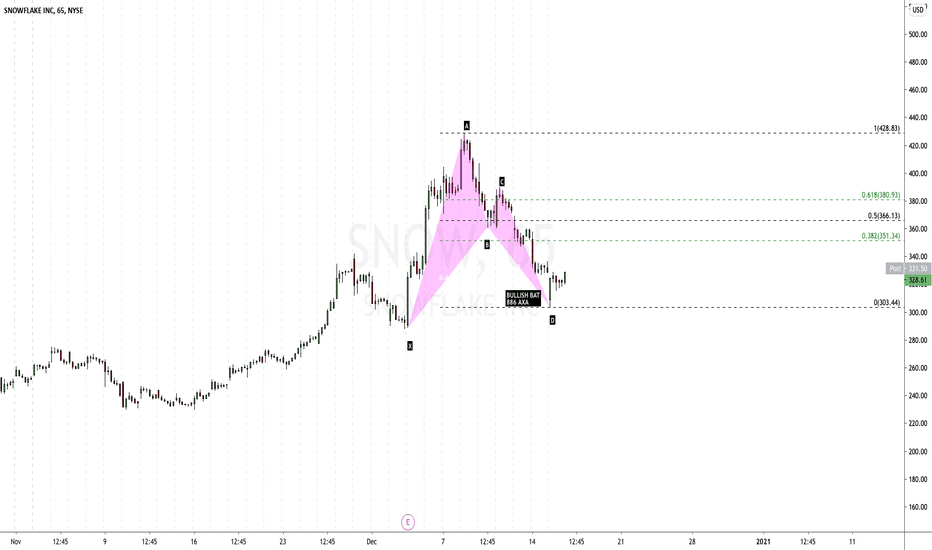

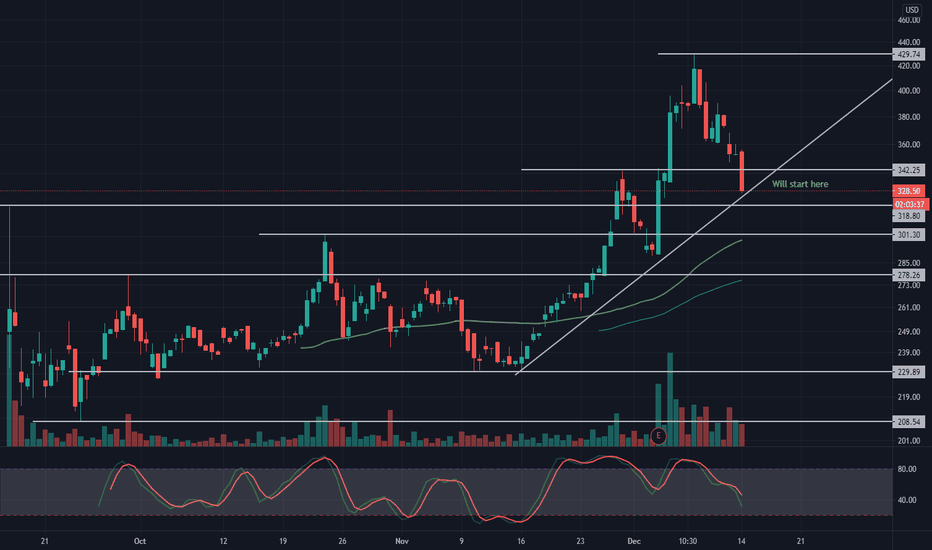

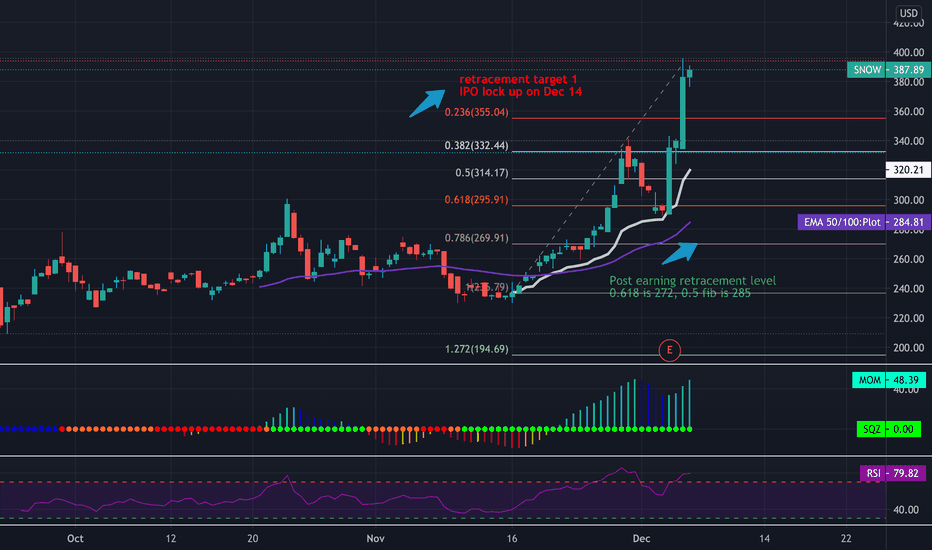

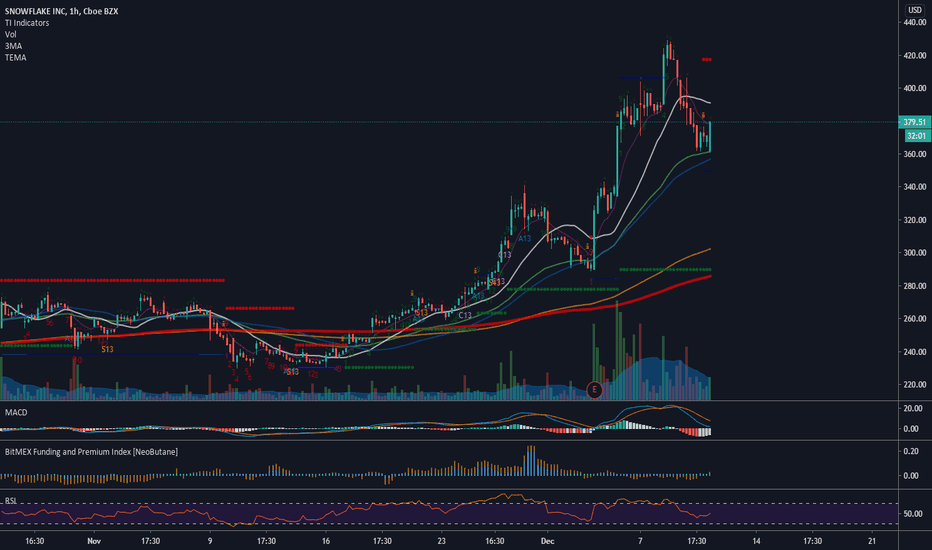

BUY THE DIP | $SNOW LONGBUY THE DIP! Good morning traders, as we look at SNOW on larger timeframes we see a well-needed correction after this IPO made a push toward even more all-time highs. This week could be the last of being able to grab it around this price.

Looking at price action, there are a few things to consider starting with the retest of $301. $301 shows as a strong level first as resistance, now as support (if it holds). SNOW is a buy

DCJ | Happy Holidays

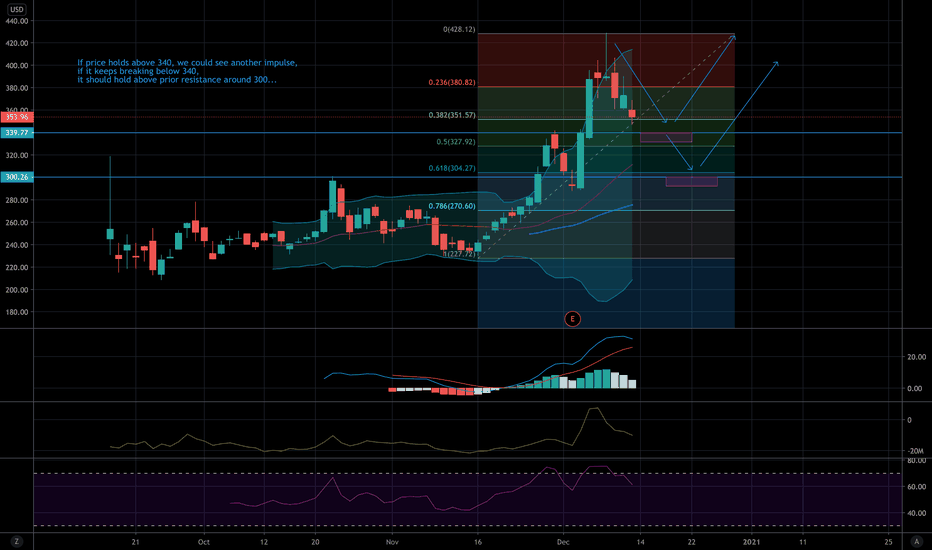

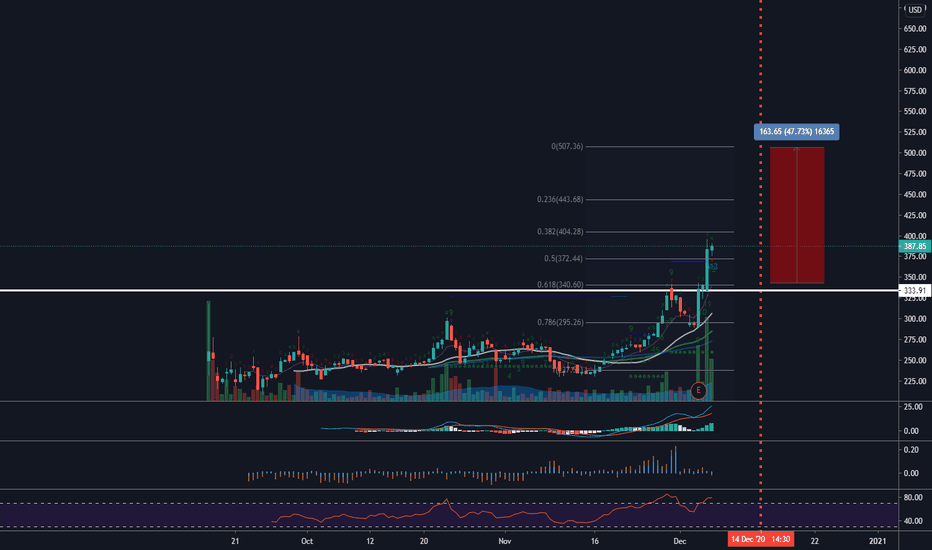

SNOW: It's a White Xmas for Insiders and MoMo TradersSnow has skied upwards to 398 today, from a post earning low of 272. With 20% short, the squeeze the short play has worked out great for the longs. With lock-up free coming up in 10 days (Dec 14) and market cap reaching over $100 bil, it's very probable the stock will retracet back to $355, then 320 around the VWAP.

Info about the co: As of the first quarter, research firm Forrester identified Snowflake’s data management products as being roughly as strong or stronger than Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), and Alphabet (NASDAQ:GOOG,NASDAQ:GOOGL). Snowflake did, however, trail IBM (NYSE:IBM), Teradata (NYSE:TDC), Oracle (NYSE:ORCL) and SAP (NYSE:SAP) by significant amounts in the metric.

However, Snowflake’s pricing model, which enables its customers “to only pay for what they use in terms of computational processing and data storage,” differentiates it, according to a Seeking Alpha columnist. Further, Snowflake’s customer-satisfaction ratings, as measured by third-party websites, is the highest.

investorplace.com

SnowFlake Support off Expanding Triangle/Support on Channels.SnowFlake Support off Expanding Triangle/Support on Channels.

New issue low institutional ownership tiny float, tiny shares outstanding.

Important 90B IPO, owned by the best, underwritten by the best and managed by the best.

Buffett and Salesforce validated on the business/tech growth side.

Relatively unknown.

Must own.

36% shorted float.

Monster Stock.

Direction:Up