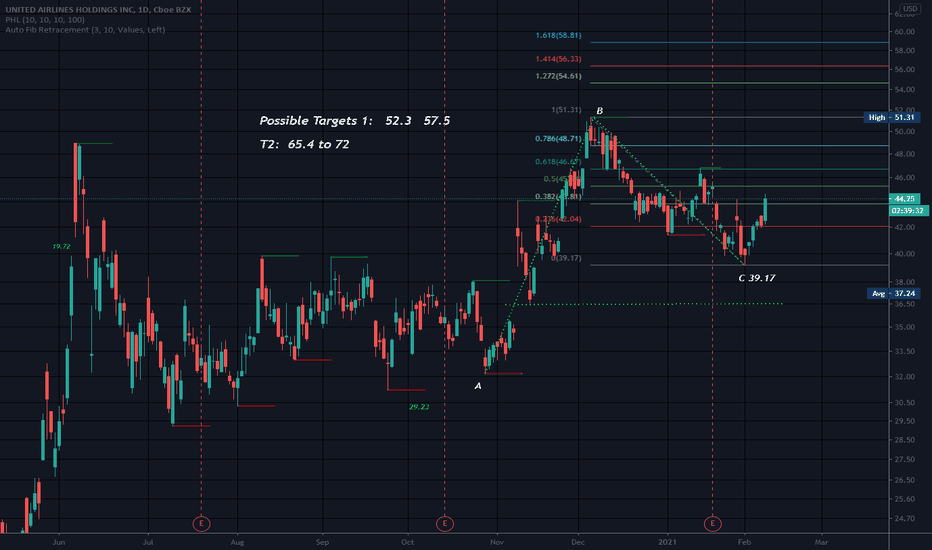

UAL trade ideas

UALShares of United Airlines Holdings Inc. UAL, +2.56% rose 1.20% to $53.31 Monday, on what proved to be an all-around favorable trading session for the stock market, with the S&P 500 Index SPX, -1.31% rising 2.38% to 3,901.82 and the Dow Jones Industrial Average DJIA, -0.39% rising 1.95% to 31,535.51. This was the stock's second consecutive day of gains. United Airlines Holdings Inc. closed $10.22 short of its 52-week high ($63.53), which the company reached on March 3rd.

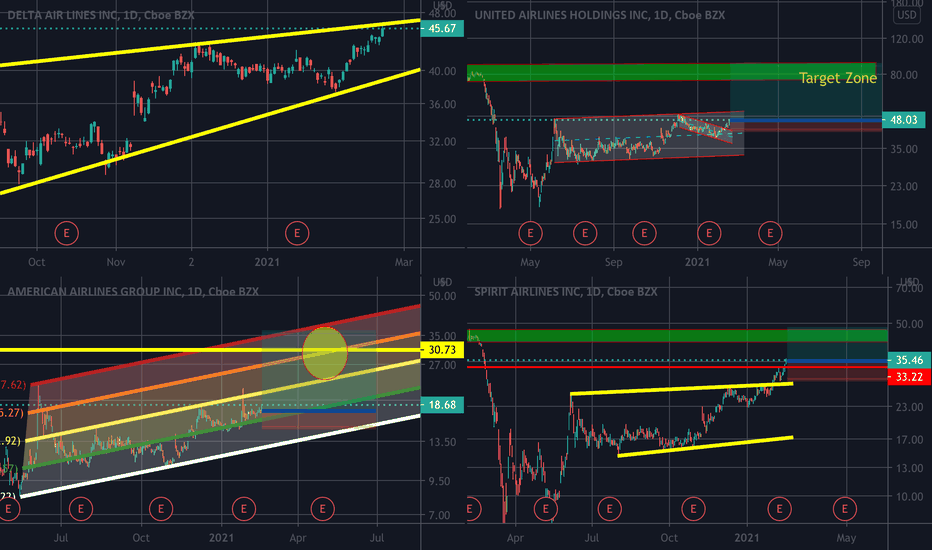

The stock outperformed some of its competitors Monday, as Southwest Airlines Co. LUV, +0.02% fell 0.12% to $58.06, Delta Air Lines Inc. DAL, +0.25% rose 0.25% to $48.06, and American Airlines Group Inc. AAL, +3.40% rose 1.15% to $21.18. Trading volume (19.4 M) eclipsed its 50-day average volume of 14.7 M.

United Airlines Lines GroupUnited Airlines Mission Statement

Our approach is treating diversity and inclusion like a core leadership competency, taking diversity well beyond compliance. The goal is for leaders to create a culture where acceptance and appreciation of everyone is the norm and each employee is comfortable bringing their full selves to work. Our mission is to create an inclusive work environment, characterized by dignity and respect, that empowers every employee to serve the global marketplace and contribute to our success.

United Airlines Vision Statement

Through our Diversity and Inclusion strategy, we find innovative and effective solutions to engage employees from diverse backgrounds and cultures in taking our flyer-friendly service around the globe. We are driving to become recognized as an airline where: leaders embrace diversity and inclusion as a business advantage employees feel highly valued, are actively engaged and are treated with dignity and respect customers value our inclusive approach to delivering flyer-friendly service

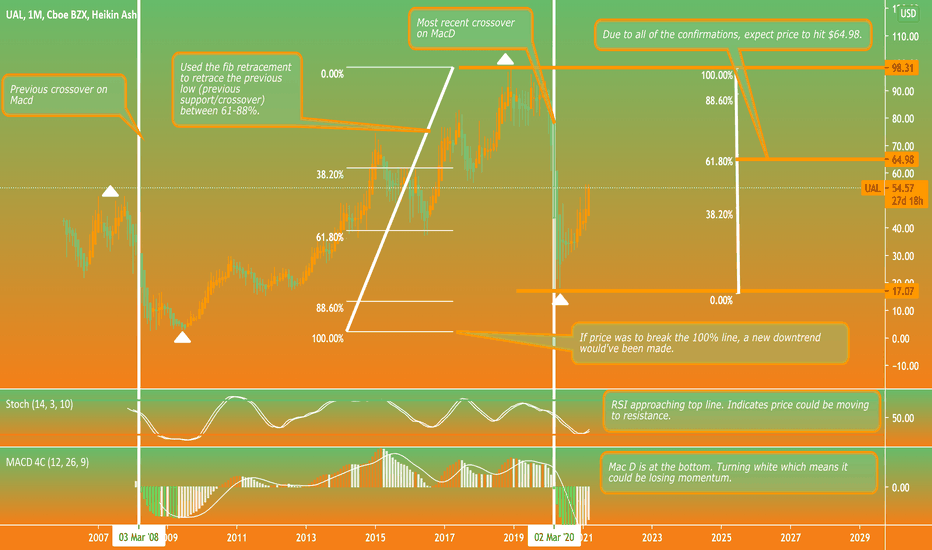

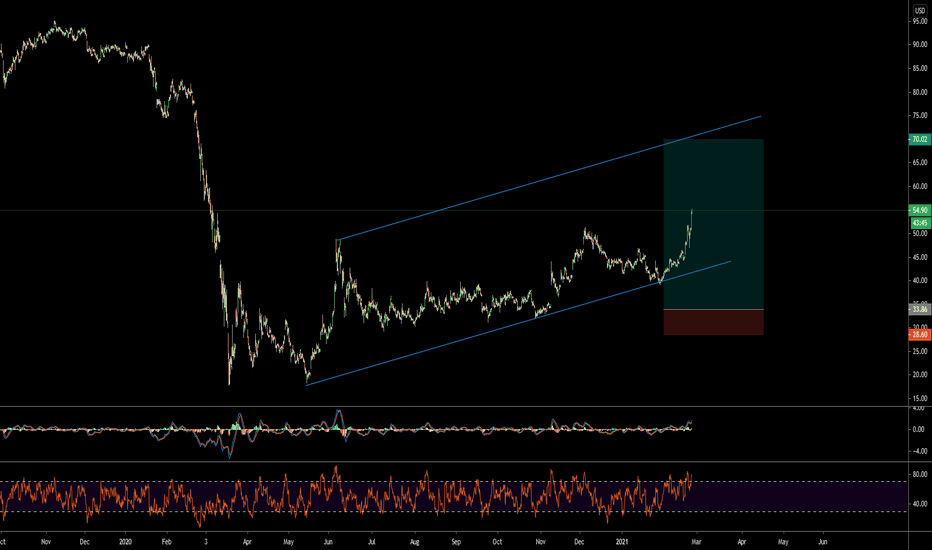

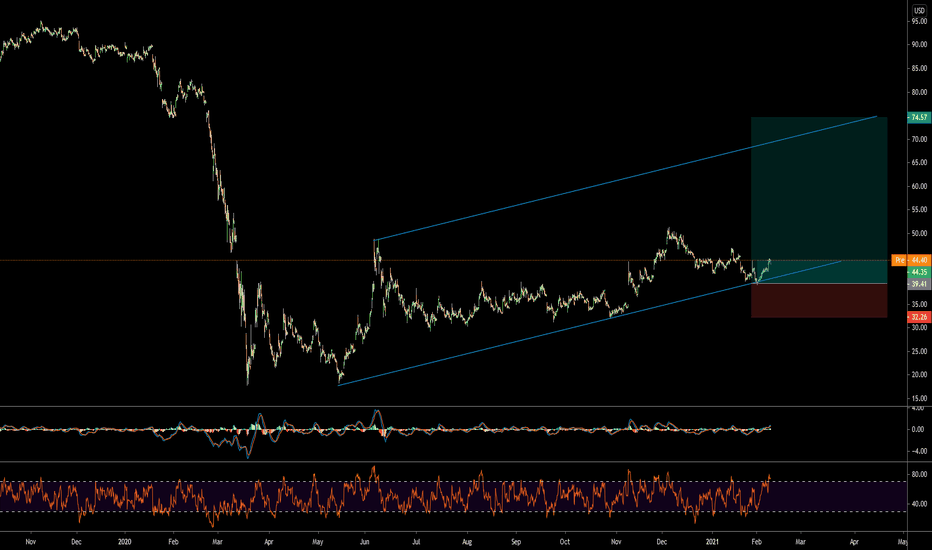

I expect price to hit $64.98!

Like, Follow, Agree, Disagree!

My name is Ski Mask and I've been making bad decisions all my life

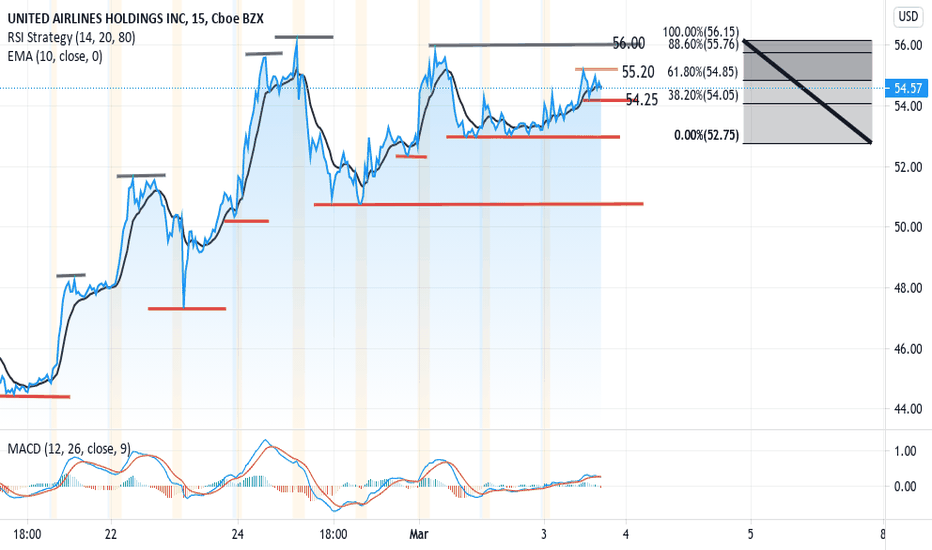

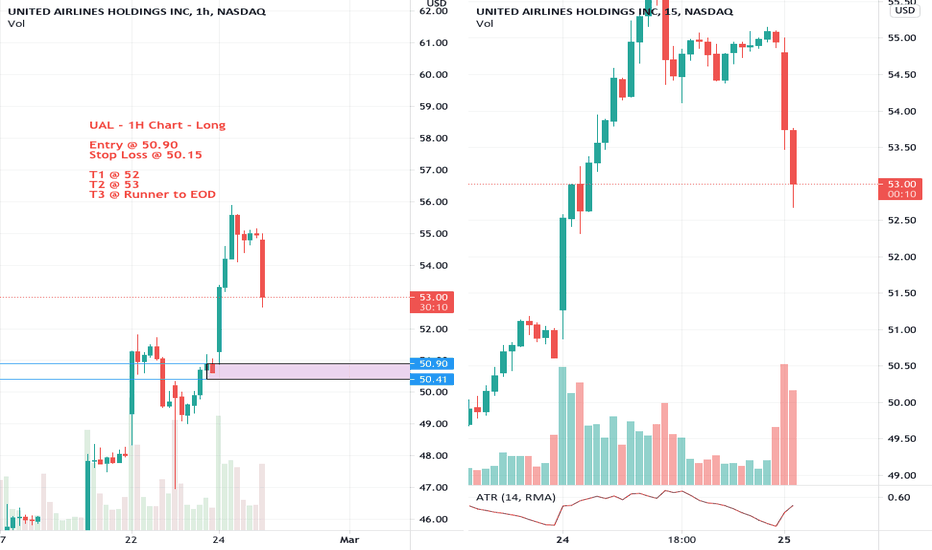

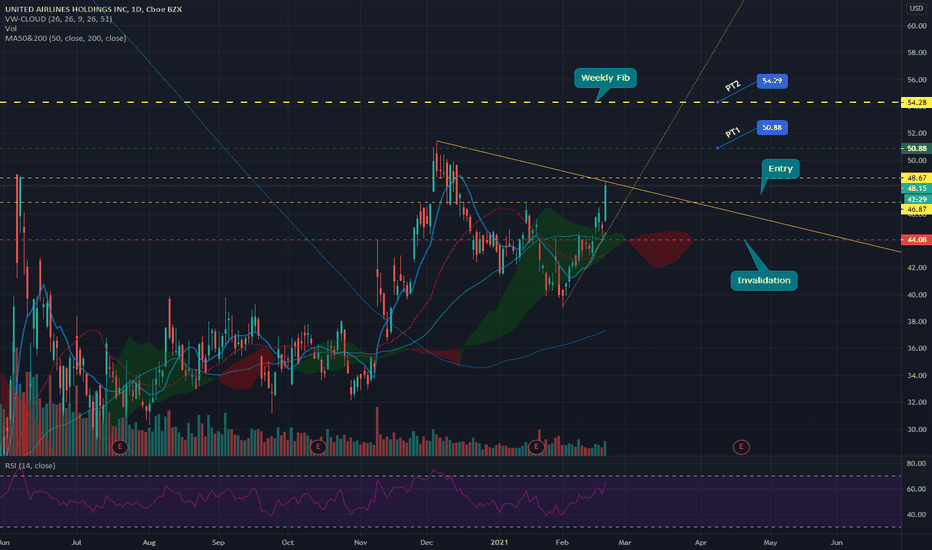

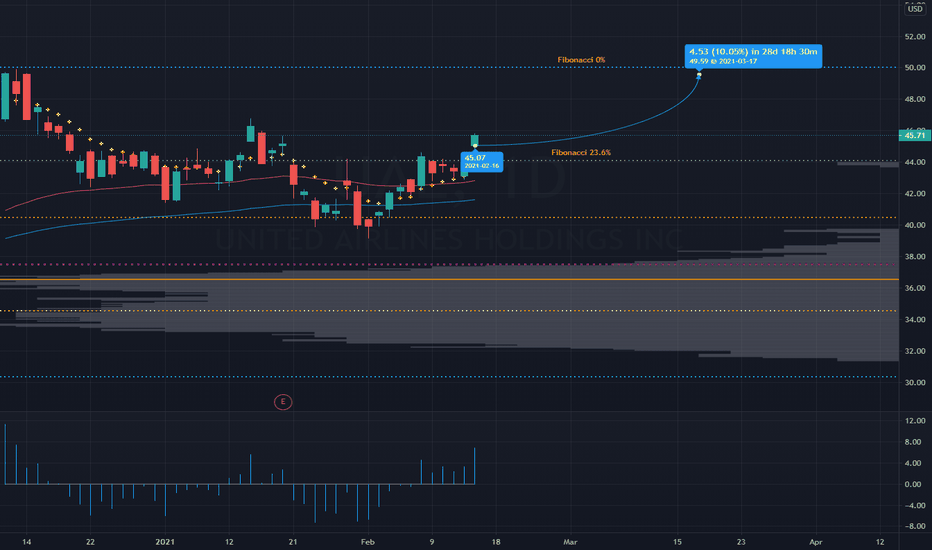

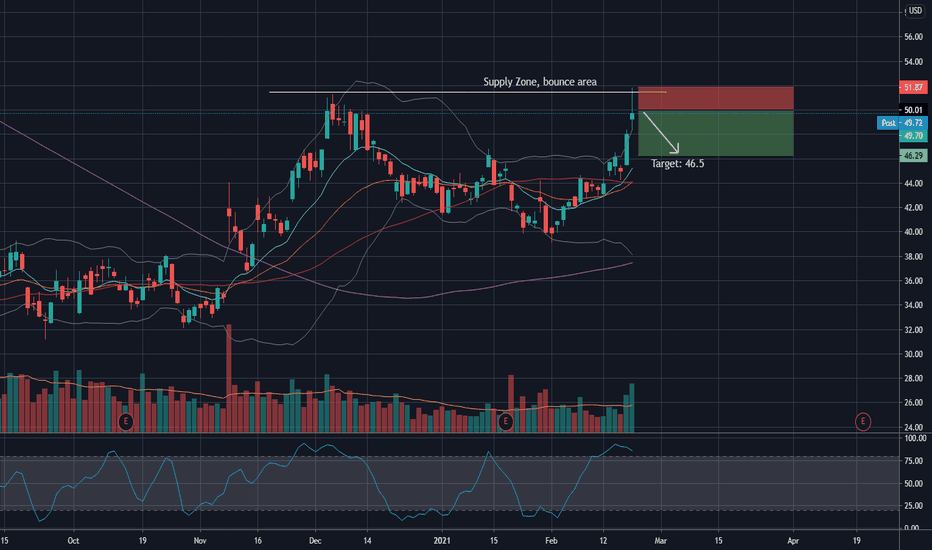

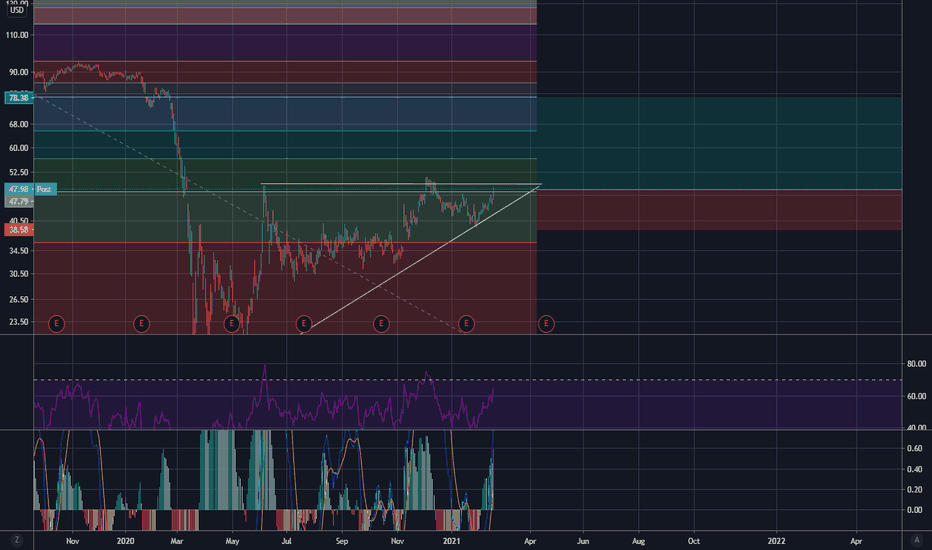

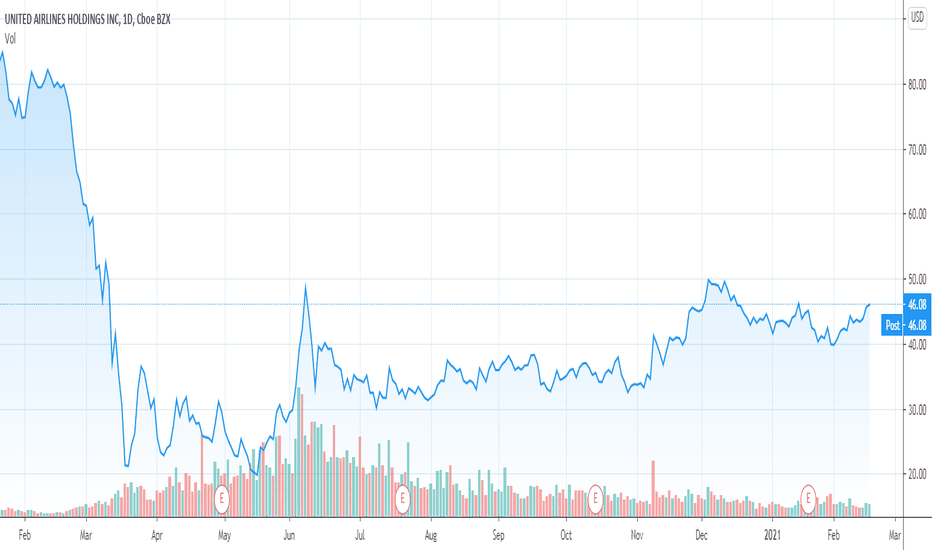

UAL Lots of rotation in the travel sector and UAL was hit a good amount today in flow. RSI is a bit high so looking to enter around $48 if it continues with volume or a pullback to occur and then try and get in around $46 or so. If it can break through that weekly fib it has some room to run.

Long term pros:

Stimulus news is upcoming + vaccine rollout.

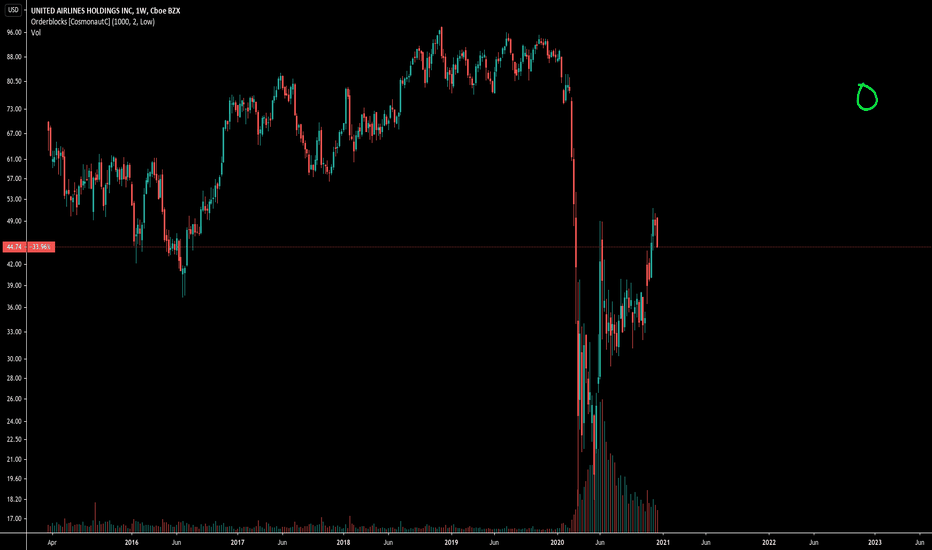

Still down about half from COVID highs

Short Term Pros:

Lots of flow

Long Term Cons:

Airlines may never pick up where they were before in terms of price

Vaccine Rollout

Short Term Cons:

RSI looks to be a bit high so a pullback is due

PT:

$54 by the end of March depending on if pullback occurs

Invalidation:

$44

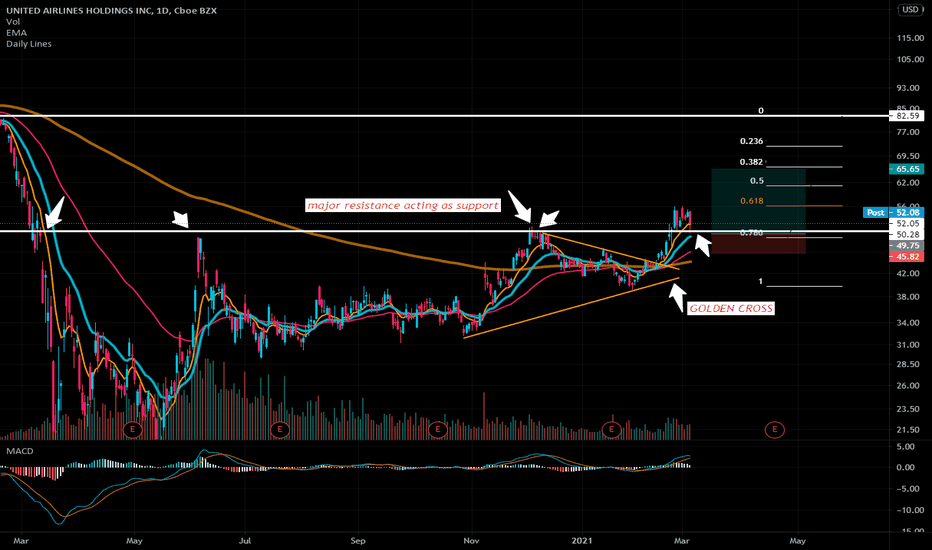

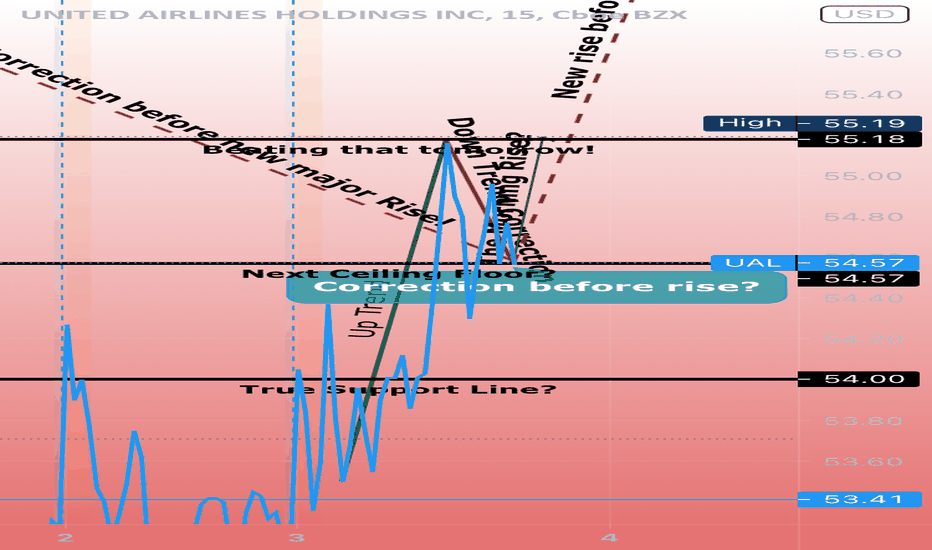

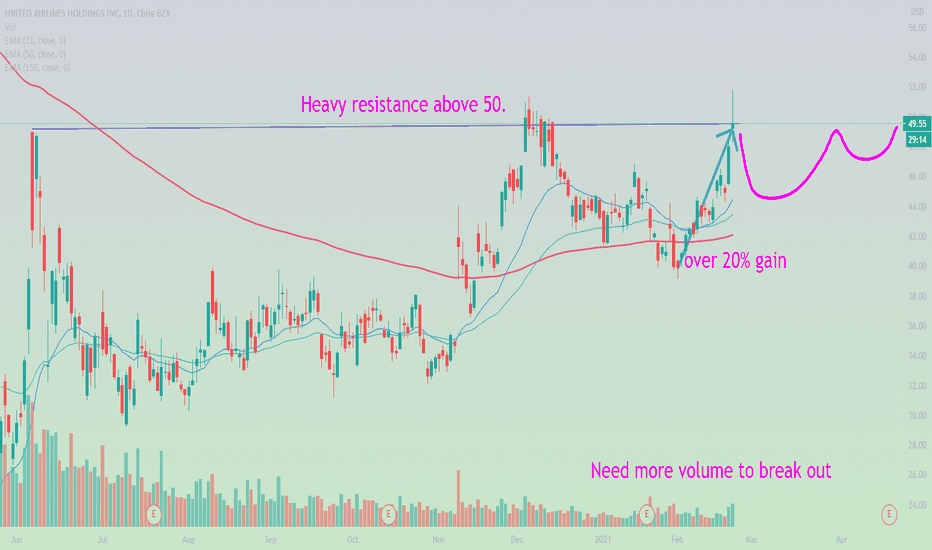

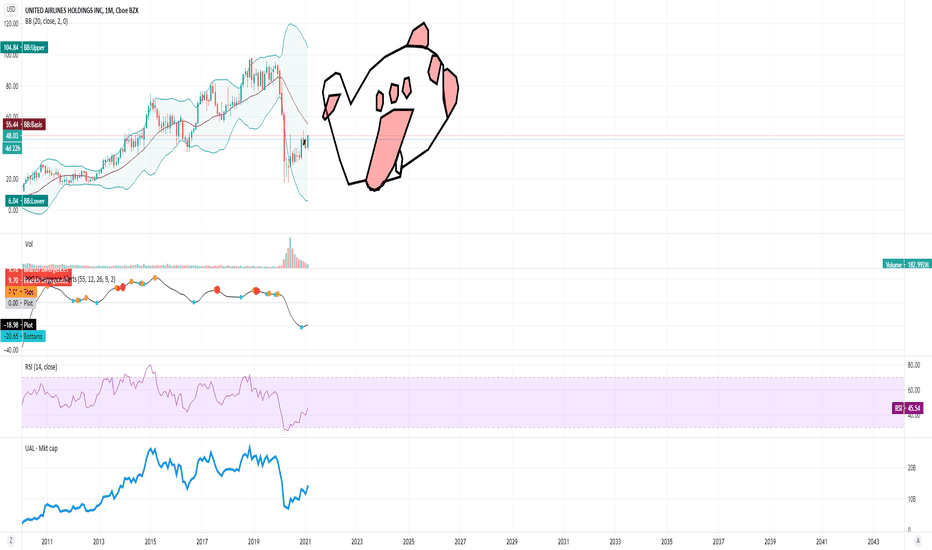

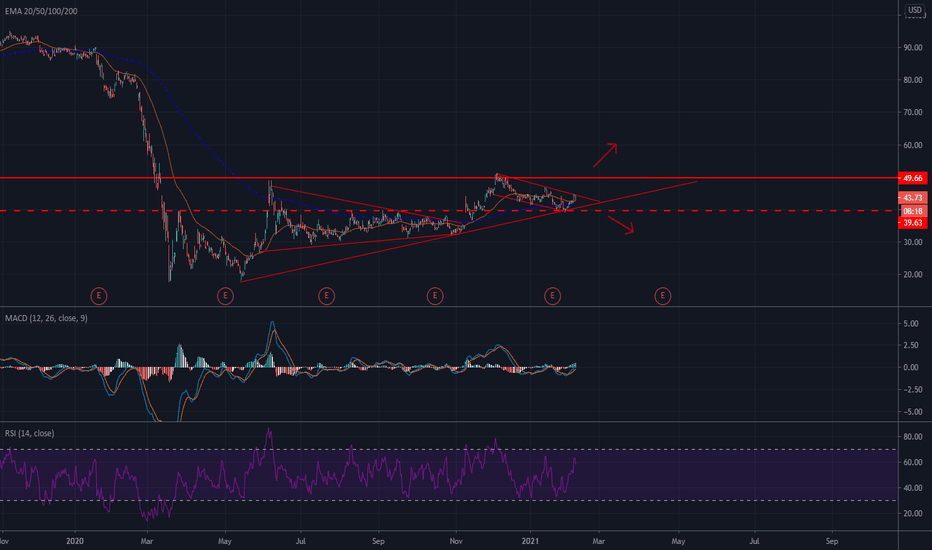

UAL meets strong resistance above 50. More consolidation neededStrong resistance above 50. Definitely require a greater volume to break out. MAs are lined up which looks great! However, too big of a swing from 40-50. More than likely, we will need a few more swings to build a solid VCP pattern before a solid break-out occurs.

Consolidation underway. Be patient it is happening

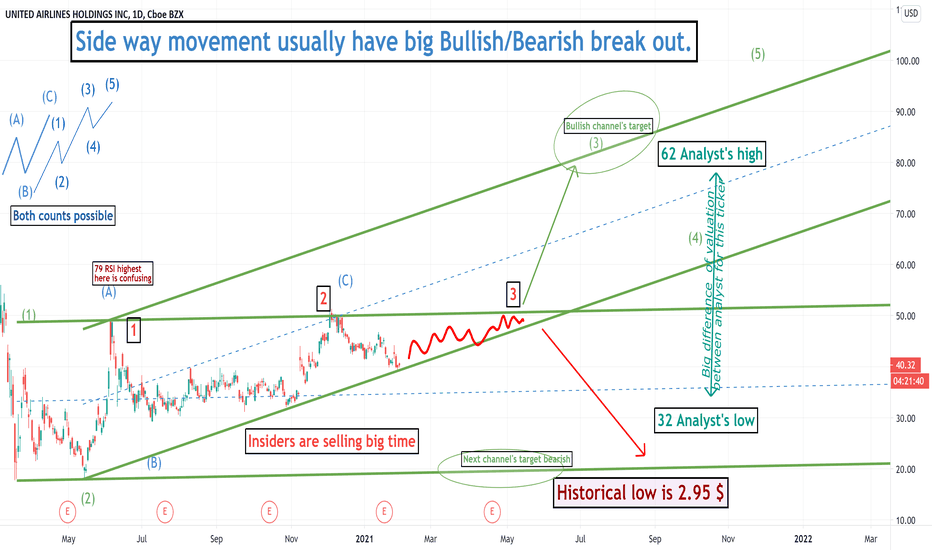

United Air lineBased on analysts offering 12 month price targets for UAL in the last 3 months. The average

price target is $48.91 with a high estimate of $62 and a low estimate of $32.

Analyst Firms Making Recommendations

B OF A GLBL RES

BARCLAYS CAPITA

BERENBERG BANK

CITIGROUP

COWEN & COMPANY

DEUTSCHE BK SEC

EVERCORE ISI

EXANE BNP PARIB

GOLDMAN SACHS

JEFFERIES & CO.

JP MORGAN SECUR

MORGAN STANLEY

RAYMOND JAMES

SANFORD BERNSTE

SEAPORT GLOBAL

STIFEL NICOLAUS

SUSQUEHANNA

UBS

VERTICAL RESEAR

WOLFE RESEARCH

*** at least there some insider bought

Insider Ownership Percentage: 0.40%

Insider Buying (Last 12 Months): $93,100.00

Insider Selling (Last 12 Months): $14,330,625.40

***Assets more than liabilities.

Period Ending: Dec 31, 2020 Dec 31, 2019 Dec 31, 2018 Dec 31, 2017

Total Assets 59548 52611 49024 42346

Total Liabilities 53588 41080 38982 33612

Total Equity 5960 11531 10042 8734

Strong institutional ownership is an indication that hedge funds, large money managers

and endowments believe a company will outperform the market over the long term.

Well Institutional Ownership Percentage: 60 % 3ed in ranking

74% of South West air line shares are owned by institutional investors

73.1% of Alaska Air Group shares are owned by institutional investors

-60.9% of United Airlines shares are owned by institutional investors

-59.5% of Delta Air Lines shares are owned by institutional investors

--44.4% of American Airlines Group shares are owned by institutional investors

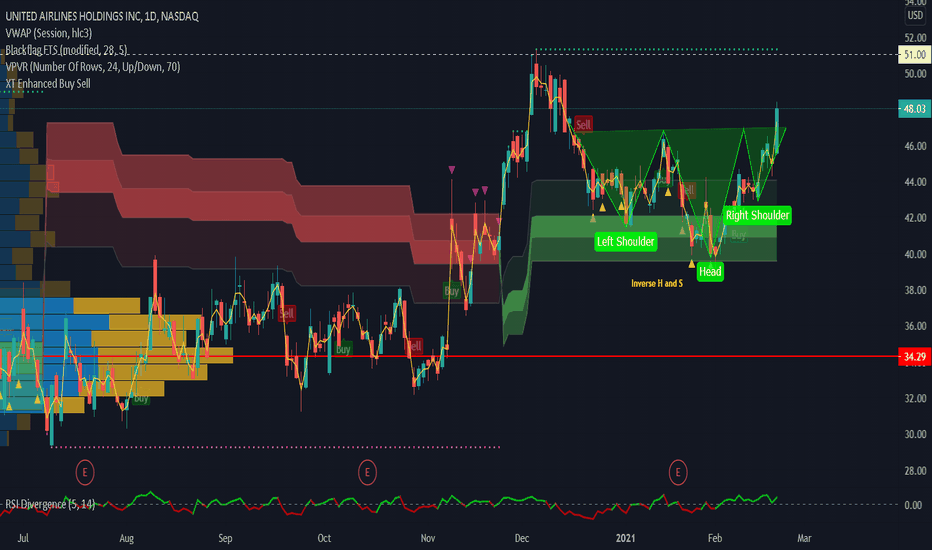

UAL - Bullish Inverse head and shoulders patternUAL - United airlines has a bullish Inverse head and shoulders pattern on daily chart. Options flow - Over 27,000 June $50 calls traded friday. 6000 $45 April calls traded vs 8 in open interest. More flights starting as more vaccines get to people , you could call this a "re-opening" trade. I own march calls in JETS etf. Cheers!