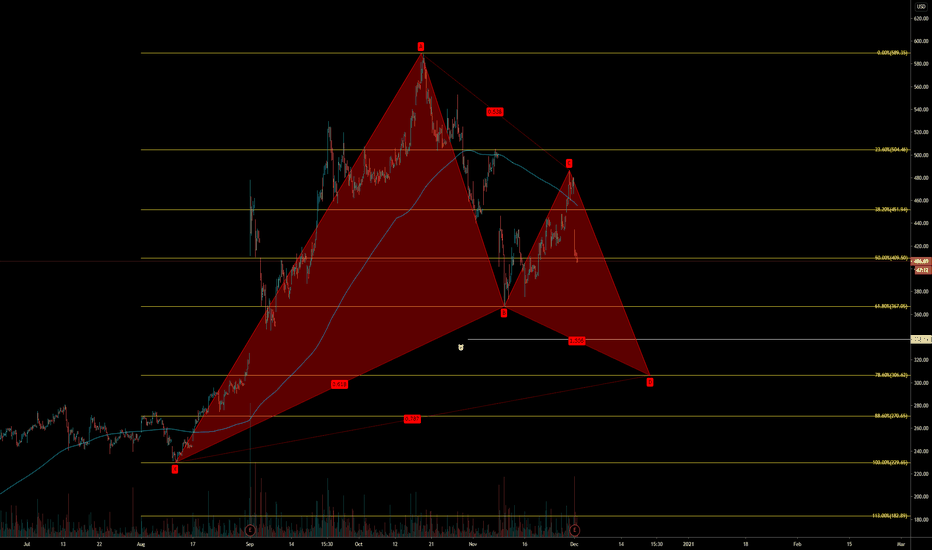

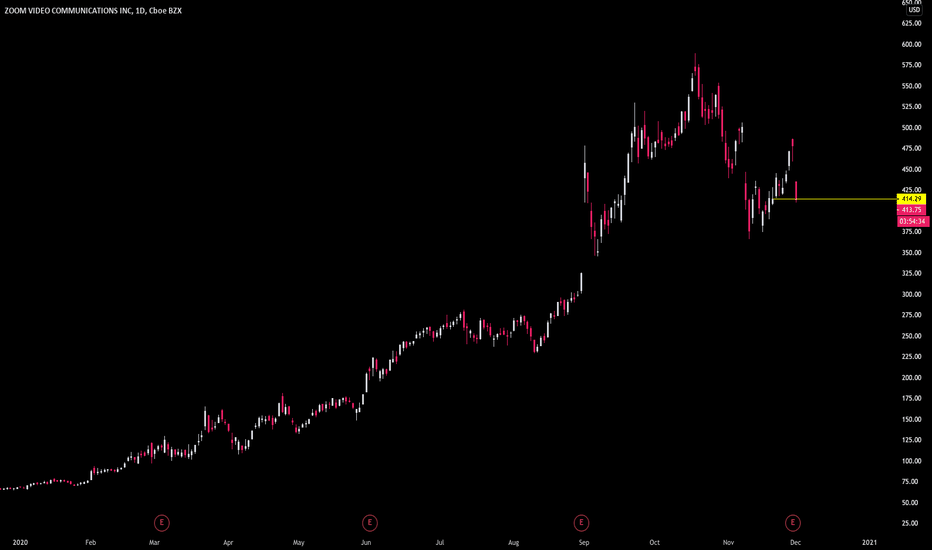

Almost A BuyAfter an earnings defeat, Zoom is almost a buy again. There are many indicators that explain why I believe it still has room to fall.

I see Zoom hitting or nearing a previous low of $366. Here are the indicators that support my thesis.

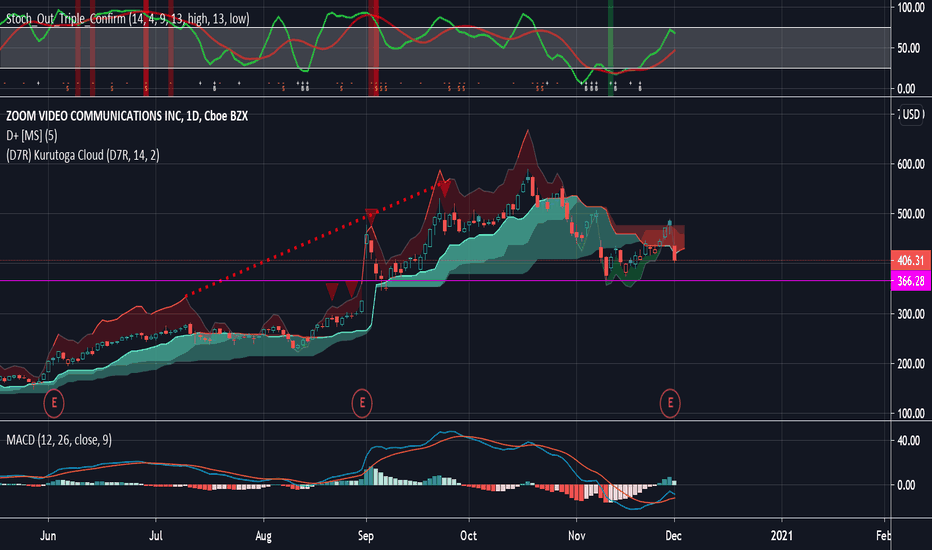

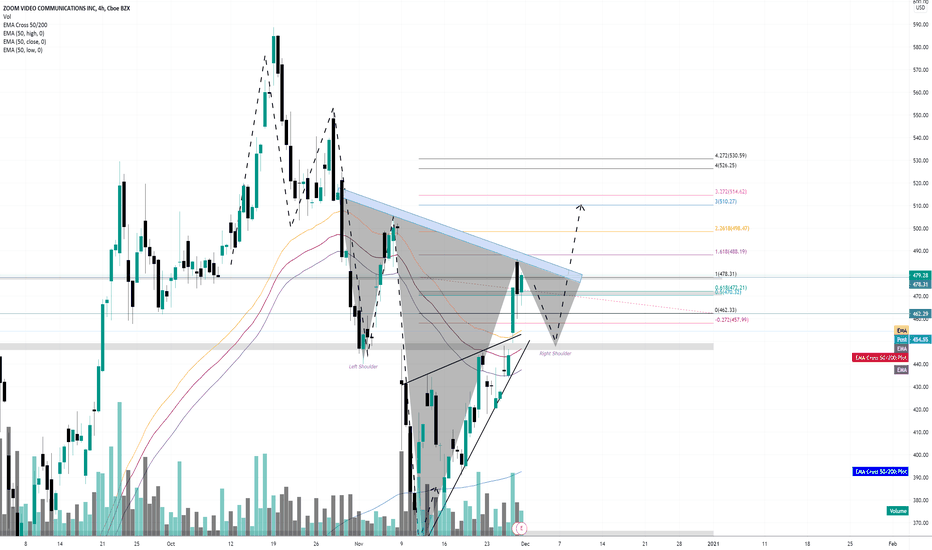

MACD: Shows weakening bull strength giving the bears more opportunity to take over as the stock continues to trend down.

Divergence+: Shows no sign of bearish divergence and I believe the stock still has room to fall before retesting a new support

Bollinger Bands: Show that the stock is still at a strong buying point, but trending downward which supports the value to decrease

Kurotoga Cloud: With the candles just falling below the cloud, which shows support and resistance, we can see that a bear cycle is about to start.

Once MACD starts to trend up and bullish divergence grows, I will be buying in.

ZMD trade ideas

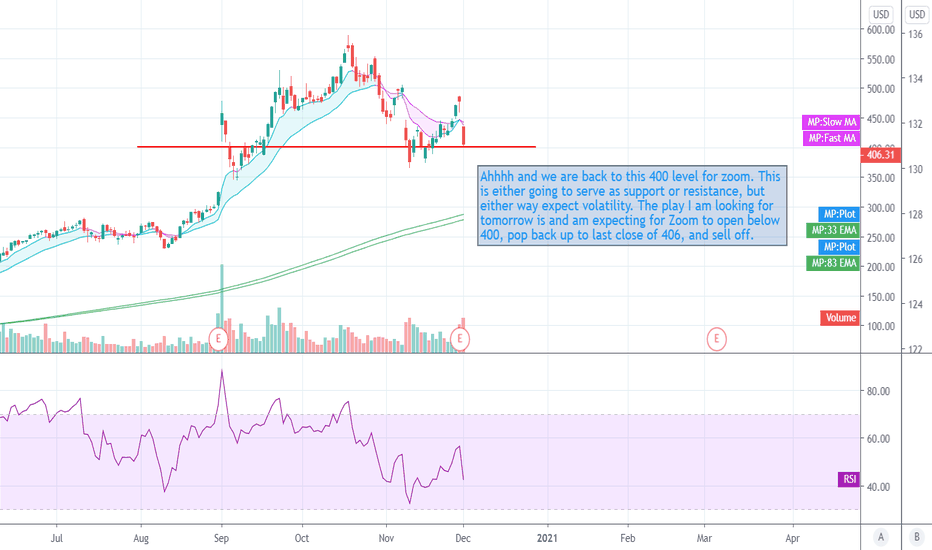

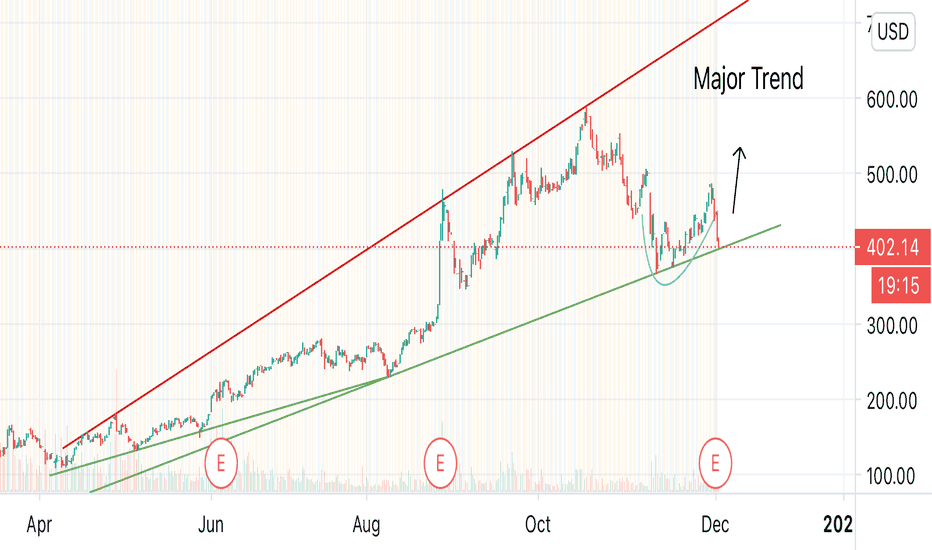

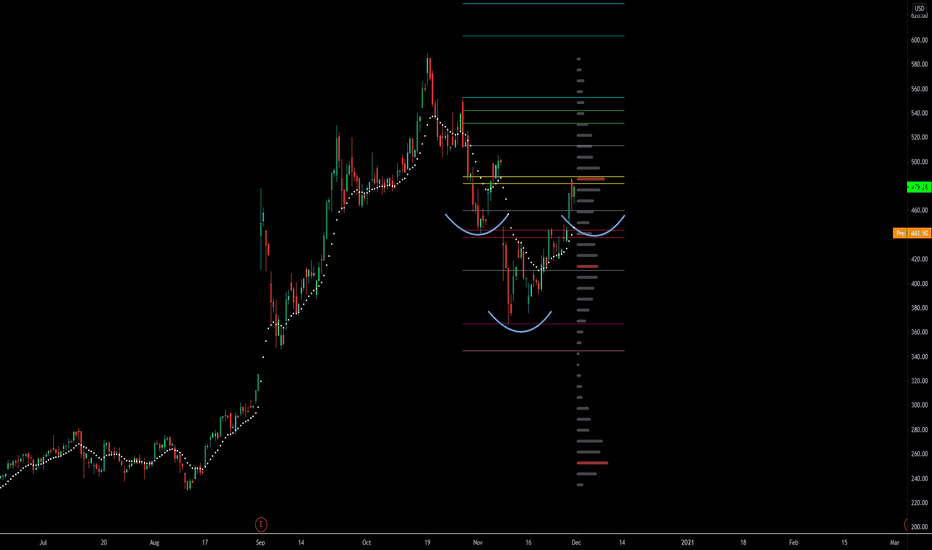

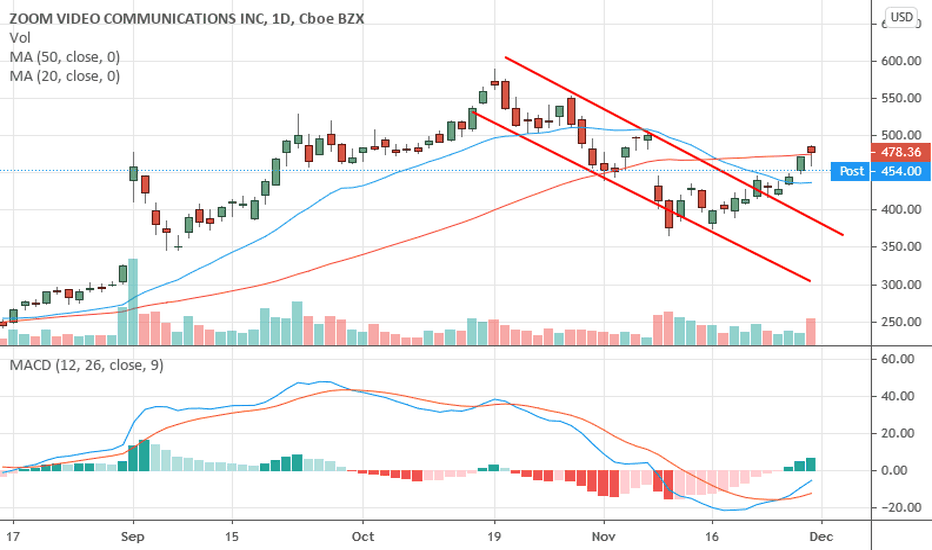

What’s next for ZM Just to put out what I have on $ZM after my recent prediction that proved 100% correct. I am now watching it for possible entry. Negative COVID news is starting to make way just as much as vaccine news. And today $MRNA took a big hit (down -10% give or take). And some of what the media iterated as the cause for $ZM drop in the first place was positive vaccine news.

On the TA side, I identified what I believe is the major trend and it’s currently at the major support, with what looks to be a cup and handle pattern.

Bottom line I see a a lot of space for it to fill on the upside. And what can also make a long position credible is the fact that they did crush earnings after all.

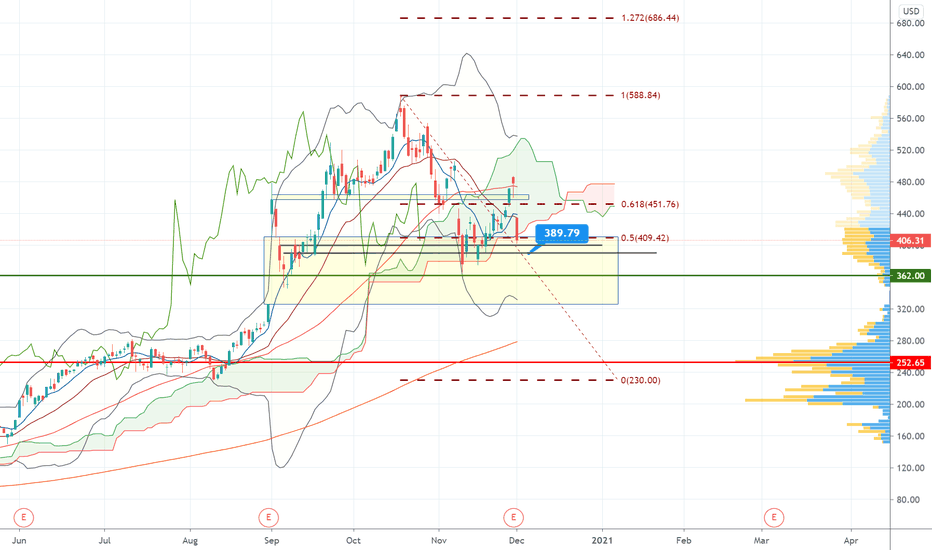

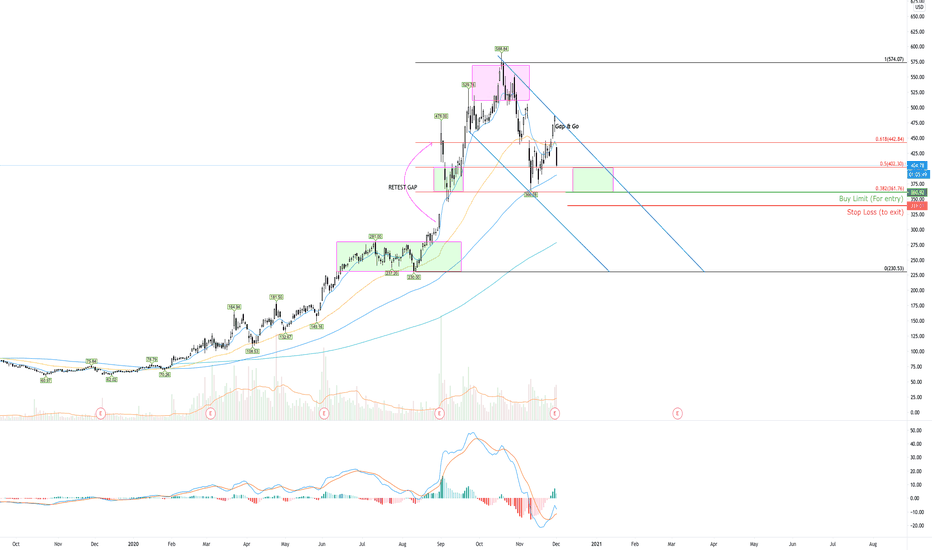

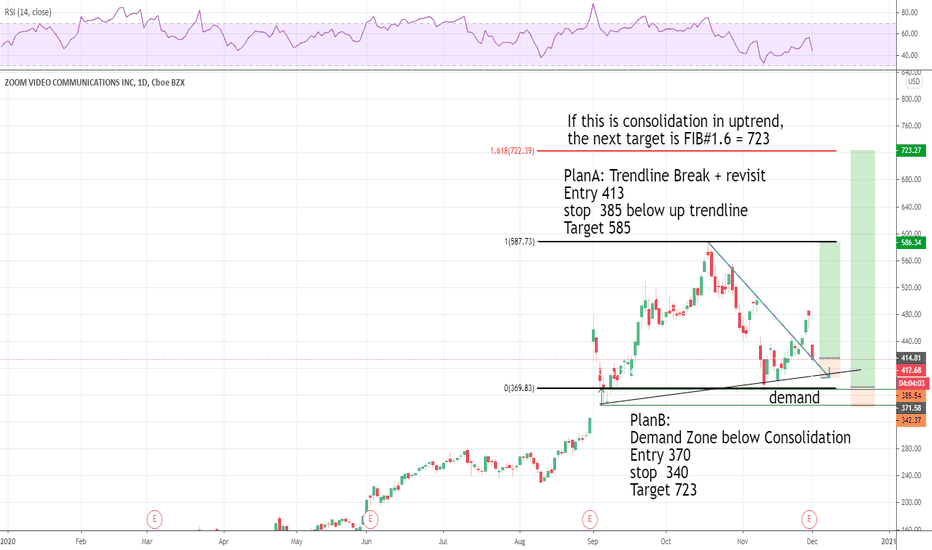

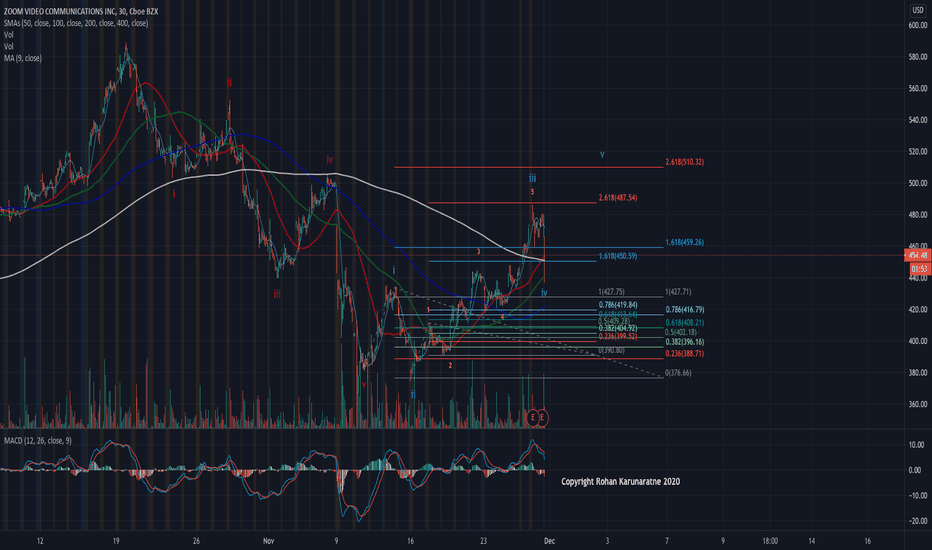

ZM LongIf this is consolidation in uptrend, the next target is FIB#1.6 = 723

PlanA: Trendline Break + revisit

Entry 413

stop 385 below up trendline

Target 585

PlanB: Demand Zone below Consolidation

Entry 370

stop 340

Target 723

I am not a PRO trader. I need few months to practice trading strategies.

If you like this idea, please use SIM/Demo account to try it, until my trading plans get high winning rate.

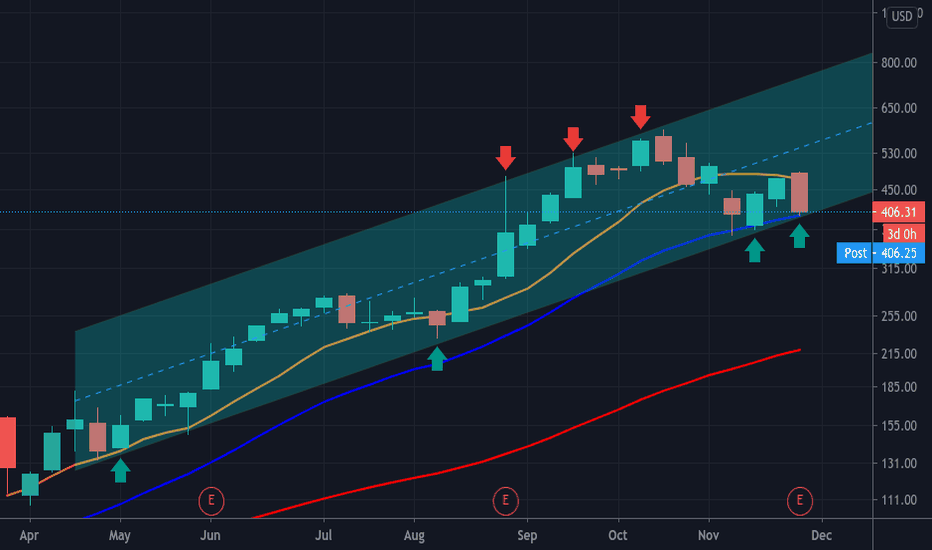

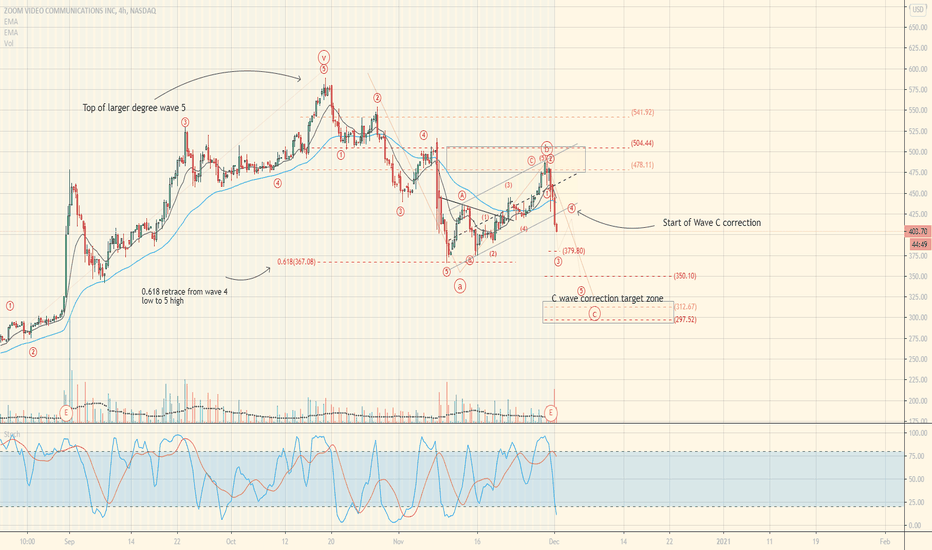

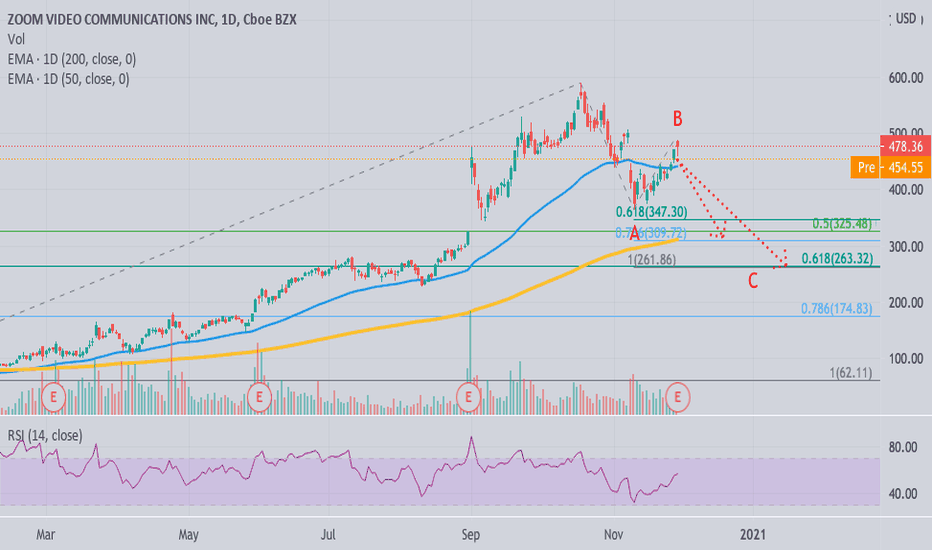

ZM : Zoom in correctionHype around Zoom is being replaced by hype around Moderna.

P/E for Zoom declines from 600 to 450 as earnings grow. Forward P/E is currently estimated at 150 projecting further earnings growth. That's a lot! Forward PEs for Salesforce and Netflix are 65 and 56 respectively.

If Zoom earnings grow 2x than projected and stock price declines by 33% then PE comes to 50 (years of earnings to justify the stock price). At least comparable to other hot techs.

And what the chart tells us about possible end of correction in Zoom?

Nearest level is probably 310-325 and more distant one is 260-265.