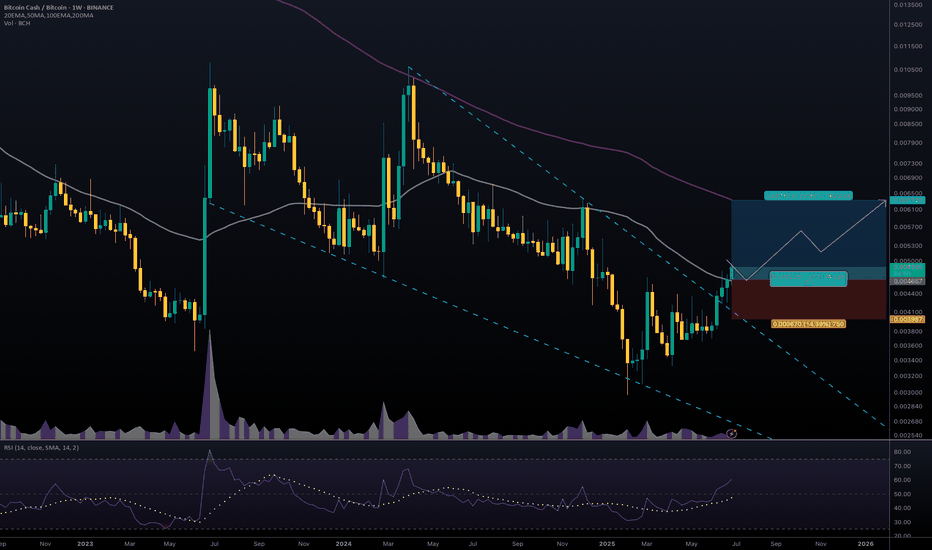

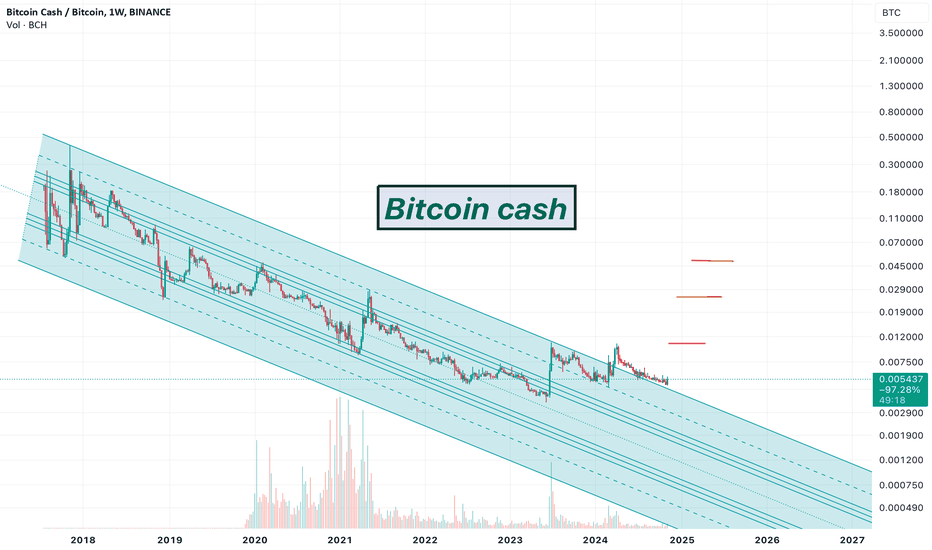

#BCHBTC #1W (Binance) Big falling wedge breakoutCRYPTOCAP:BCH just regained 50MA weekly support in sats, performing better than CRYPTOCAP:BTC

Seems likely to continue bullish towards 200MA resistance, probably after a pull-back.

⚡️⚡️ #BCH/BTC ⚡️⚡️

Exchanges: Binance

Signal Type: Regular (Long)

Amount: 7.0%

Current Price:

0.004885

Entry Targets:

1) 0.004657

Take-Profit Targets:

1) 0.006329

Stop Targets:

1) 0.003987

Published By: @Zblaba

CRYPTOCAP:BCH BINANCE:BCHBTC #BitcoinCash #PoW bitcoincash.org

Risk/Reward= 1:2.5

Expected Profit= +35.9%

Possible Loss= -14.4%

Estimated Gaintime= 4-7 months

BCHBTC trade ideas

Is the Bitcoin Cash Hype Over? BCH/BTC Ratio Flashes WarningThe Great Divergence: Why the Bitcoin Cash-Bitcoin Ratio Breakdown Signals More Than Just a Price Drop

In the unforgiving arena of the cryptocurrency markets, every chart tells a story. Some whisper of quiet accumulation, others scream of speculative frenzy. But few charts tell a story as profound and historically charged as the Bitcoin Cash to Bitcoin (BCH/BTC) ratio. For years, this ratio has been the ultimate barometer of a digital civil war, a measure of the hopes and failures of a project born from a contentious schism. Recently, that barometer has given its clearest signal in months: a decisive and powerful breakdown from a multi-month triangle pattern.

This technical event is far more than a simple squiggle on a screen for traders. It represents the potential end of a speculative, hype-driven rally and the forceful reassertion of a brutal, long-term trend. It signals that the fundamental chasm between Bitcoin, the undisputed king of digital assets, and Bitcoin Cash, its most famous and ambitious offshoot, may be widening once again. The breakdown suggests that the brief period of optimism for Bitcoin Cash, fueled by its own halving event and a broader market updraft, may be conclusively over. To understand the gravity of this moment, one must dissect not only the technical pattern itself but also the deep-seated historical and fundamental weaknesses that made this breakdown almost inevitable.

The Anatomy of a Technical Collapse: Smashing the Triangle

For much of 2024, the BCH/BTC ratio was trapped in a state of compression. On the chart, this appeared as a classic symmetrical triangle pattern. This pattern is defined by a series of lower highs and higher lows, creating two converging trendlines that form the shape of a triangle. In market terms, it represents a period of intense equilibrium and indecision. Buyers and sellers are locked in a fierce battle, with neither side able to gain a definitive edge. The price coils tighter and tighter, like a compressed spring, building up energy for an explosive move. The only question is which direction it will break.

In the case of the BCH/BTC ratio, that question has been answered with a resounding crash. The price has decisively broken below the lower trendline of the triangle. This is known as a "breakdown," and it is a powerfully bearish signal. It signifies that the sellers have overwhelmed the buyers, the equilibrium has been shattered, and the path of least resistance is now firmly downwards.

Traders often measure the potential target of such a breakdown by taking the height of the triangle at its widest point and projecting that distance downwards from the point of the breakdown. Given the scale of this particular pattern, this technical measurement points to a significant further decline in the ratio, potentially revisiting and even surpassing its all-time lows. This isn't just a minor dip; it's a structural failure on the chart that suggests a new, sustained leg down in Bitcoin Cash's performance relative to Bitcoin. The "hype rally" that saw the ratio climb in the lead-up to the Bitcoin Cash halving has been effectively erased, and the market is signaling that the fundamental gravity of the long-term downtrend is taking hold once more.

A Ghost in the Machine: The Lingering Shadow of the 2017 Fork

This technical breakdown did not occur in a vacuum. It is a single chapter in a long and bitter saga that began in 2017. To grasp its significance, we must revisit the great "Block Size War" that tore the Bitcoin community apart. At its heart was a philosophical disagreement about how to scale Bitcoin to accommodate more users.

One camp, which included many of the earliest adopters and evangelists, argued for a simple solution: increase the block size. By allowing more transactions to fit into each block, the network could process more volume and keep fees low, preserving what they saw as Bitcoin's original vision of a "peer-to-peer electronic cash system."

The other camp, which ultimately retained control of the Bitcoin protocol, argued for a more cautious approach. They feared that large blocks would lead to centralization, making it too expensive for ordinary users to run a full node and validate the blockchain. Their solution was to keep the base layer small and secure, and to build scaling solutions on top of it, such as the Lightning Network.

This ideological impasse led to a "hard fork" in August 2017, creating Bitcoin Cash. For a brief, euphoric period, BCH was seen as a legitimate contender. Fueled by a powerful narrative and influential backers, its price soared, and the BCH/BTC ratio hit an all-time high of over 0.5 in late 2017, sparking serious talk of a "flippening"—the moment BCH would overtake BTC in market capitalization.

That moment never came. Since that peak, the BCH/BTC ratio has been locked in a devastating, multi-year downtrend. The recent triangle pattern was merely a pause, a brief consolidation within this much larger waterfall decline. The breakdown from the triangle is therefore not a new event, but a continuation of a historical trend. It is the market's brutal verdict on the outcome of that civil war.

The Fundamental Chasm: Why Bitcoin Cash Keeps Losing Ground

A chart pattern is ultimately a reflection of underlying fundamentals. The relentless decline of the BCH/BTC ratio is a direct consequence of the widening gap between the two networks across every meaningful metric.

1. Narrative and Brand Identity: Bitcoin has successfully cultivated a simple, powerful, and globally understood narrative: it is digital gold. It is a store of value, a hedge against inflation, and a pristine, unconfiscatable asset. This narrative has attracted institutions, nation-states, and trillions of dollars in potential capital. Bitcoin Cash, meanwhile, has struggled to define itself. Its narrative as "peer-to-peer electronic cash" is less compelling in a world with countless low-fee payment options, including stablecoins and Bitcoin's own Lightning Network. Without a clear and unique value proposition, it has failed to capture the market's imagination.

2. Security and Hash Rate: The most critical measure of a proof-of-work blockchain's health is its hash rate—the total computational power dedicated to securing the network. Here, the difference is staggering. Bitcoin's hash rate is orders of magnitude higher than Bitcoin Cash's. This makes Bitcoin exponentially more secure and resistant to a 51% attack, where a malicious actor could gain control of the network. Bitcoin Cash, with its comparatively minuscule hash rate, remains theoretically vulnerable, a fundamental flaw that deters serious institutional capital.

3. Developer Activity and Innovation: The heart of any technology is its developer community. The most innovative and exciting developments in the Bitcoin ecosystem are happening on the main chain. The activation of Taproot, the explosion of Ordinals and Inscriptions, and the continued growth of the Lightning Network all demonstrate a vibrant and evolving protocol. In contrast, the developer ecosystem for Bitcoin Cash has been far less dynamic. While it has its dedicated builders, it has not produced the kind of groundbreaking innovation needed to attract new users and capital.

3. Adoption and Network Effects: Bitcoin's network effect is its ultimate moat. It has spot ETFs trading on major stock exchanges, granting it unparalleled access to traditional finance. It is held on the balance sheets of public companies and is recognized as legal tender in some countries. Bitcoin Cash has none of these things. Merchant adoption has stalled, and institutional interest is virtually non-existent. In the world of networks, winners tend to take all, and Bitcoin's lead has become seemingly insurmountable.

The Aftermath: What Comes Next for the BCH/BTC Ratio?

With the triangle pattern now shattered, the path forward for the BCH/BTC ratio looks precarious. The most likely scenario is a continuation of the bearish trend that has been in place for over six years. The breakdown has released the coiled energy to the downside, and the ratio will likely seek out lower levels of support, potentially bleeding towards its all-time lows. For investors, this serves as a stark reminder of the risks of holding assets that are fundamentally and technically weaker than the market leader.

Is there any hope for a reversal? A bull case for Bitcoin Cash would require a monumental shift. It would need to carve out a sustainable niche that Bitcoin cannot serve, perhaps in ultra-low-fee microtransactions. It would require a renaissance in developer activity, producing a "killer app" that draws in millions of users. More likely, any significant bounce in the BCH/BTC ratio would probably be a result of a massive, indiscriminate altcoin rally that lifts all boats, rather than a specific vote of confidence in Bitcoin Cash itself. Even then, history suggests such bounces are temporary and ultimately present better opportunities to sell than to buy for the long term.

Conclusion: The Market Has Spoken

The breakdown of the BCH/BTC ratio from its multi-month triangle is a technically significant event with profound fundamental implications. It is the market's latest verdict in the long-running war for the "real Bitcoin" title. The verdict is clear: the hype is over. The dream of a "flippening" is a distant memory, a ghost from 2017.

The story of the BCH/BTC chart is a powerful lesson in market dynamics. It shows that in the brutal competition of open-source protocols, a superior narrative, impenetrable security, and a powerful network effect are the ultimate weapons. Bitcoin Cash began its life as a legitimate contender with a compelling vision. But over time, it has been outmaneuvered, out-developed, and out-adopted. The chart does not lie. It simply reflects this divergent reality, and its latest signal suggests that the great divergence between Bitcoin and its most famous offspring is set to continue.

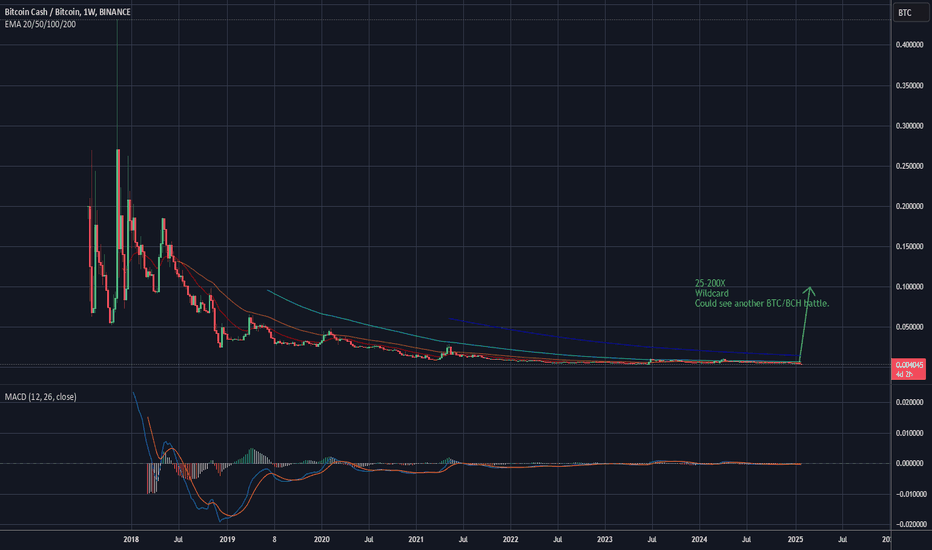

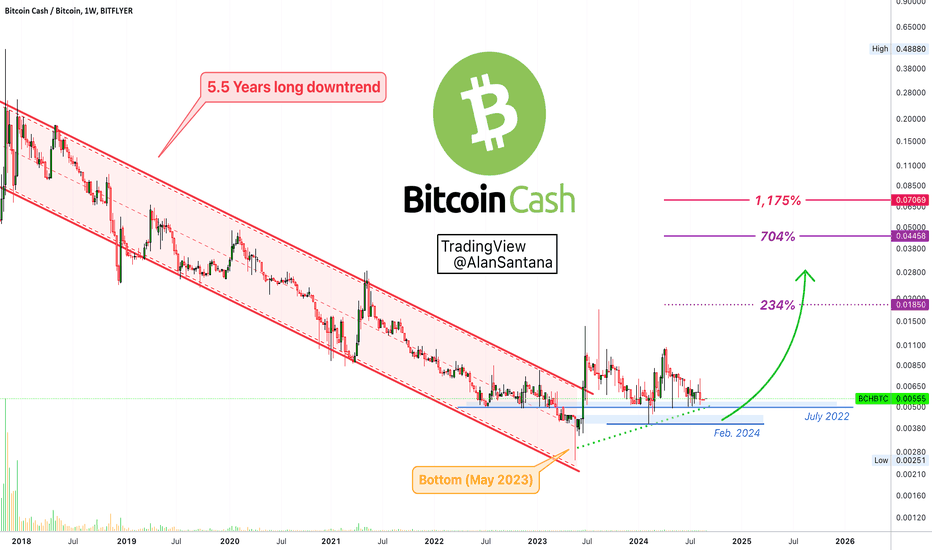

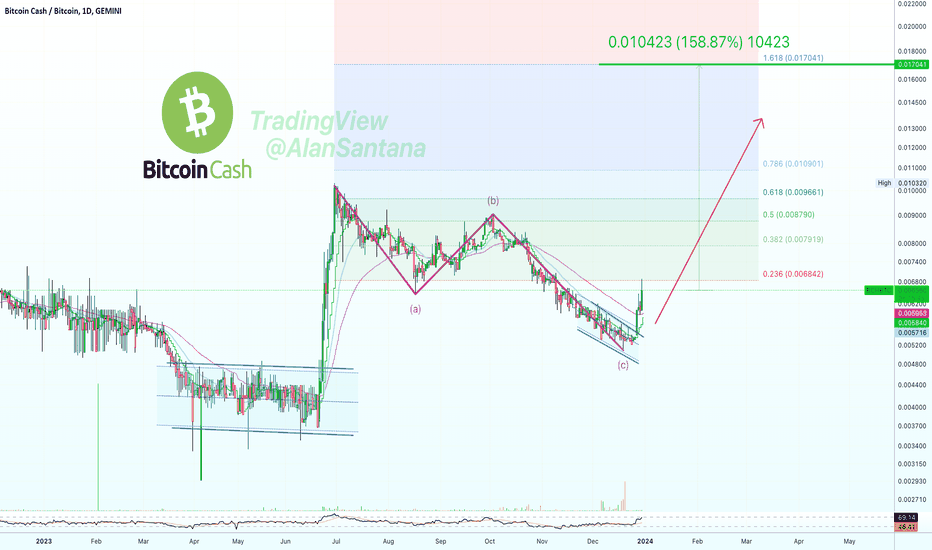

Bitcoin Cash (BCHBTC) Goes BullishThis is an extreme signal that I am about to show you. Notice the active/current candle, it wicked below the February 2024 support level as well as June 2022 and is now back in the green.

This active candle is now leading to a long-term higher low, vs May 2023, and is about to close as a hammer (if the week closes near current price or higher). These are very strong bullish signals.

So BCHBTC went down for more than 5 years and later entered a prolonged consolidation phase. The period between now and May 2023 is all sideways. The downtrend ends and sideways starts; we now have bullish signals, a long-term higher low... This can lead to an uptrend. The first ever and this can produce long-term growth.

Long-term or not long-term doesn't really matter, the fact is that a great trading opportunity is present and we have a bullish chart setup.

If Bitcoin were to enter a 3 months sideways period, pairs like this one can produce massive growth.

You saw it here first...

Thanks a lot for your continued support.

Make the most of this information.

Use it in the best way you can.

What would you do and how would you act now if you knew a certain event would happen before it takes place?

I would position myself to profit from this upcoming event.

Everybody wins.

Thank you for reading.

Namaste.

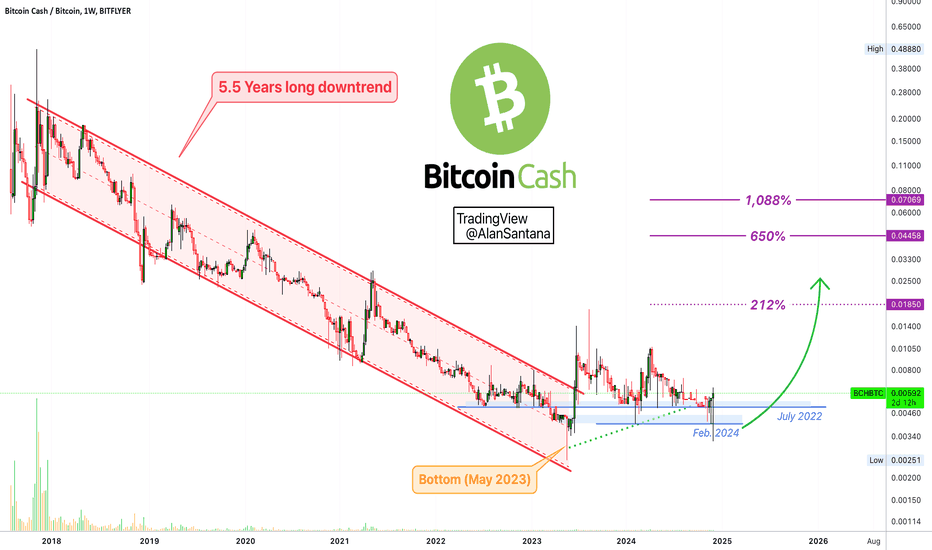

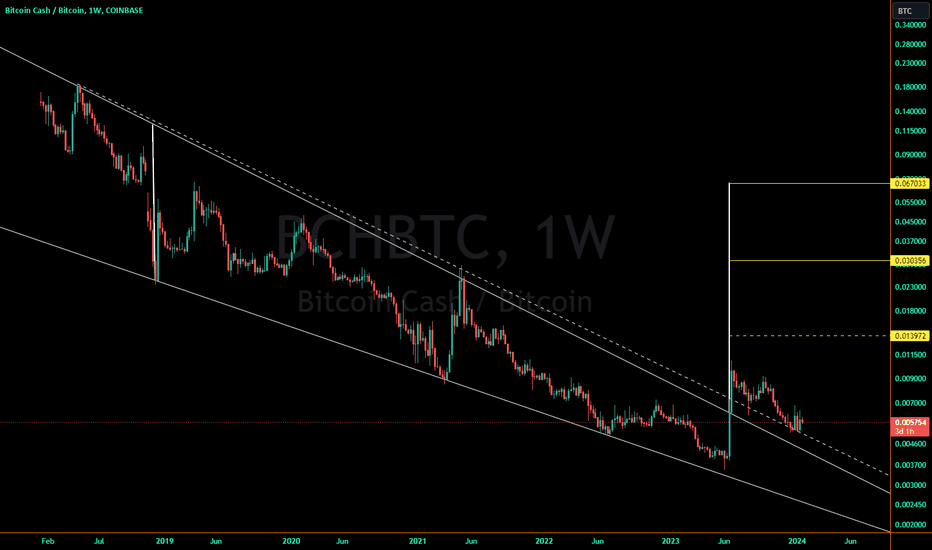

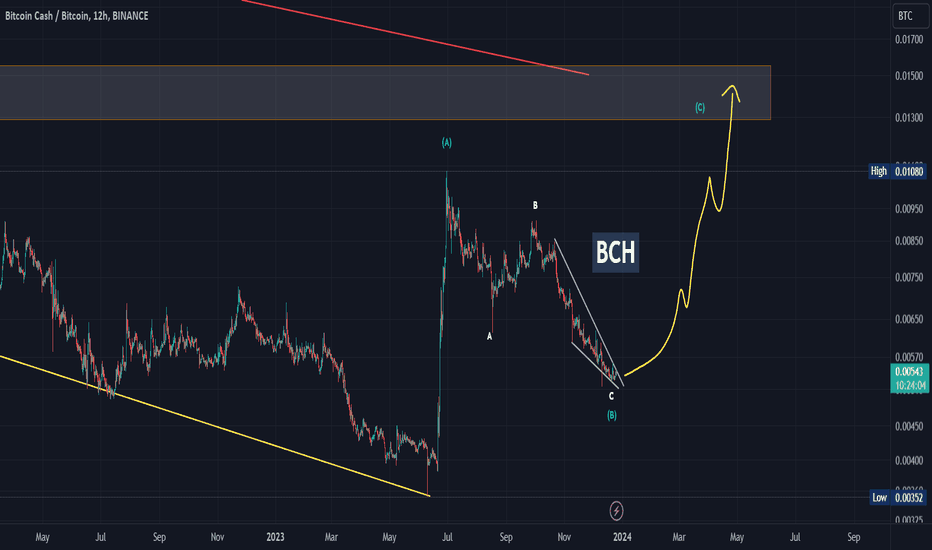

The Bitcoin Cash/Bitcoin bull run updateThe falling wedge retest is completed, Bitcoin Cash started its bull run in June 2023.

Long entry: 4800 sats

Take profit: between 0.60 / 1.40 btc

This is my personal opinion and this is not a financial advice! Good trading!

Bitcoin cash , sleeping giant waking up .One of the scariest charts you’ve ever seen, the mighty bch is about to wake up . It broke the multi year channel and warming up , what i can assume and imagine is very surprisingly ath from bch which leave half of the crypto population speechless. Chart is telling me that we might hear a good news in the new year , probably an bch etf ? Who knows but to be honest i like this coin and i like Roger and i own some , it always makes me happy if i see those long sharp candles in its chart . There’s 3 key levels in the chart that you can keep an eye on.

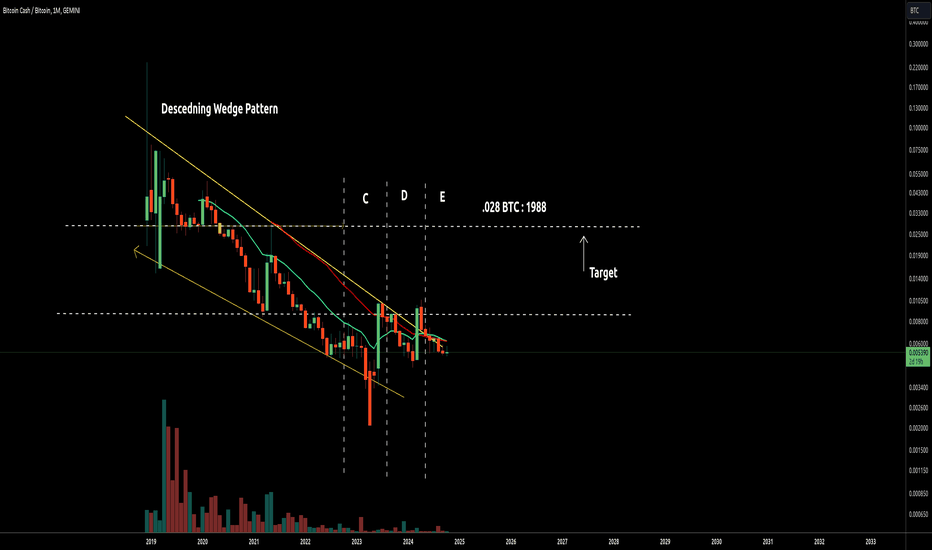

BCHBTC Targeting movement to 1988BCHBTC appears to be exiting a Wyckoff accumulation pattern of a Descending wedge.

Currently BCHBTC appears to be on Wyckoff Phase E

Wyckoff Phase E is where price attempts to break out of the top of the range

In the current BCHBTC setup the top of the range is close the area on the graph marked 'Target'

Hence I'm expecting BCHBTC to target close to this area at around .028 btc or approx 1988 USD.

Note: this is a monthly candle setup and BCH is not the fastest moving cookie in the box hence be patient and HODL

Bitcoin Cash Likely To Surprise You! (704% - 1,175% Potential) In June 2023 Bitcoin Cash recovered against Bitcoin and entered bulls territory, it has been green ever since. By green I mean out of the downtrend, a major downtrend that lasted a massive 2,023 days or 5.5 years.

This is an interesting pair, we know the history of it. In the end, all worked out well; we have Bitcoin and we have Bitcoin Cash, a stable and promising Altcoin project.

The bottom of the downtrend was hit May 2023. The following month, June, produced a very strong recovery. This recovery placed the action above the low that was hit in July 2022. Above this level this pair, BCHBTC, can be considered a good buy with very strong bullish potential.

In February 2024 BCHBTC wicked below the July 2022 support level but closed above it. This level has been tested many times and continues to hold. As this level is being tested, volume has come to a halt. This is a consolidation phase. After consolidation comes the bullish wave.

It is only a matter of time now before a bullish breakout shows up and we have great potential for growth. Additional details (targets) can be seen on the chart.

Thank you for reading.

Namaste.

The Bitcoin Cash/Bitcoin bull runThe falling wedge retest is completed, Bitcoin Cash started its bull run in June 2023.

Long entry: 6600 sats

Take profit: between 0.60 / 1.2 btc

This is my personal opinion and this is not a financial advice! Good trading!

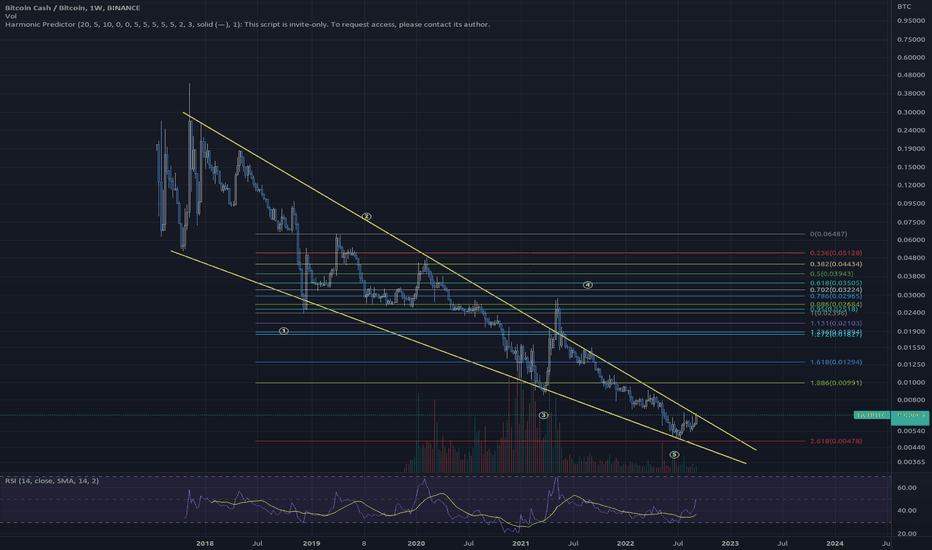

BITCOIN CASH BOOMLets take a quick look at the BTC pair in LOG SCALE:

Consider this to be pornographic chart content

BCH is gonna finish a 5+ year long falling wedge after hitting exactly 2.618 fib level

Once this break out, its gone with a BOOM !

Hold my beer pls

----

No financial advice, do your own research, don't be stupid

BITCOIN CASH - To finally gain back some ground v #BTCBCH has been a one way trade since those heady post fork in 2017

But at this point time

there is an argument to be made in having a punt

u got a fairly low defined risk --- where u must exit and call it a loss

but there is upside potential , that suggests the risk may indeed be worth it.

Higher low ,

excellent pull back into a fib reload zone

gotta Risk it for the biscuit!

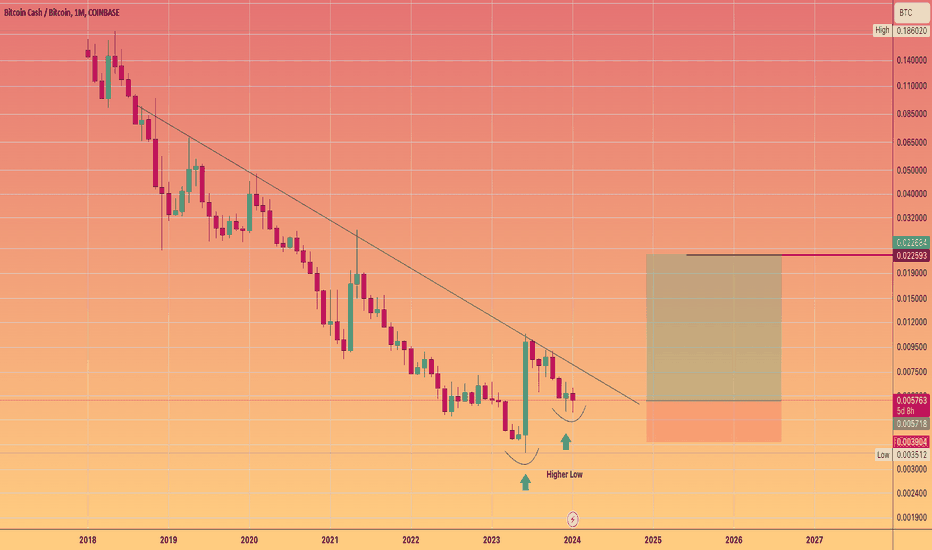

✳️ Bitcoin Cash Finds Support, Higher Low & Relation To BitcoinA higher low has been confirmed late 2023, early 2024 for the trading pair BCHBTC.

How are you feeling in this beautiful Sunday my fellow Cryptocurrency trader?

Let's dive into this Bitcoin Cash chart together.

Let me start by telling you that I am strongly bullish on this pair. The fact that we have the chart is one thing but when you combine strong bullish signals together with the market cycle it is just potent... Let us see how it goes.

➖ BCHBTC produced a strong higher low recently compared to mid-2023.

Within this higher low we have three price bounce off support (blue line) and today a break of EMA50 as resistance is taking place.

➖ We also have a volume breakout supported by a strong RSI. That's like eight classic bullish signals combined. You know these are the same bullish signals we have been using since 2017 and they simply work great, it is amazing.

One signal in isolation means nothing, can even be bad but see here, we have a multitude of bullish signals combined.

We are expecting a correction on the BTCUSD pair and this can match BCHBTC going up.

Just as I mentioned in the TWTUSDT trade idea, we can ignore the partial inverse relation because this chart is really strong on its own. But we like to look around for proof that supports our bias.

If we see a bearish potential on the Bitcoin chart on a bullish trend, we have to have plenty of confirmation from other sources or else we just adapt and change.

Wishing you success, wealth, health, profits, prosperity, joy and fun.

I am sending you good vibes now... Let's hope we can all succeed together, achieve abundance and long-term growth.

You deserve the best.

We are all humans and we all make mistakes.

Life will always give you a second chance and third, and fourth and more... We are eternal living souls.

Thank you for reading.

Namaste.

Breakout & Re-test of ~5.5 year Falling WedgeBitcoin Cash was in a falling wedge for nearly five and a half years before it broke out of it back in June of 2023. Presently, it is re-testing the top of a dashed-line wedge drawn from wick to wick and has failed to reach the top of the solid wedge drawn from the line chart.

Holding above the wedge could lead to an approx 5.25x move against Bitcoin from its current position at 0.0057 to TP 1 at 0.030 and an 11.75x move should it reach TP 2 at 0.067.

It's possible we could see a double-bottom with a slightly higher low around 0.0041 or 0.0040 if it re-tests the solid wedge's top over the next weeks or into March or June, before moving up towards targets.

Should a wedge re-test and double-bottom occur first, the possibility for already major gains vs. Bitcoin increases to 7.3-7.5x at TP 1 or 16.34-16.75x at TP 2.

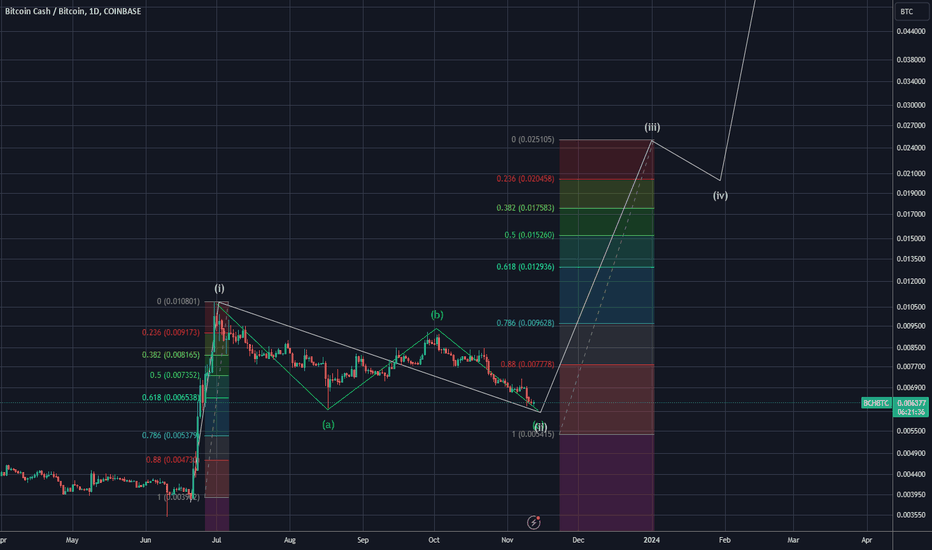

✳️ Bitcoin Cash 6 Months Long Correction Ends (160% Potential) Good Saturday my fellow Cryptocurrency trader and Happy New Year, may 2024 bring awesome profits to your trading as well as lots of wealth, enjoyment and health to your lifestyle.

Here we can see Bitcoin Cash ending a six months long classic ABC correction.

Very clearly depicted on the chart.

The end of the correction alone is a strong enough signal to support a bullish wave, a reversal but, we have additional signals supporting this one such as:

➖ BCHBTC trades above EMA50 & EMA100.

➖ BCHBTC has a strong daily RSI reading reaching almost 70.

➖ We have the biggest green sessions in the last 3 days since June.

➖ Volume is higher on the recent low (red) but if we corroborate across exchanges we can see it going high up... Supporting this bullish break.

➖ Bitcoin consolidating (sideways) after more than a year of sustained growth is a bullish sign for the Altcoins, specially the ALTSBTC pairs.

All these combined... Boom! Rise UP!

Namaste.

P.S. Additional growth is possible beyond 160%.

📈📊 #ChartPattern Alert! 📈📊 📈 Falling Wedge 📈📈 What is a Falling Wedge? The Falling Wedge is a bullish chart pattern characterized by two converging trendlines, with the lower trendline sloping upward more than the upper trendline. It typically signals a potential bullish reversal, with the price likely to break upward after the wedge pattern.

📈 How to Identify:

Draw a trendline connecting at least two higher highs (upper trendline).

Draw another trendline connecting at least two higher lows (lower trendline).

📈 What it Signals: The Falling Wedge suggests a potential bullish reversal, with buyers gaining strength as the price reaches higher lows within the wedge. It often forms during downtrends and can precede a significant price move to the upside.

📈 Trade Strategy:

Consider buying when the price breaks above the upper trendline of the Falling Wedge.

Set profit targets based on the pattern's height added to the breakout point.

Implement a stop-loss to manage risk in case of a false breakout.

Remember to validate your analysis with other technical indicators and conduct thorough research before making any trading decisions. Happy charting and trading! 📈💹

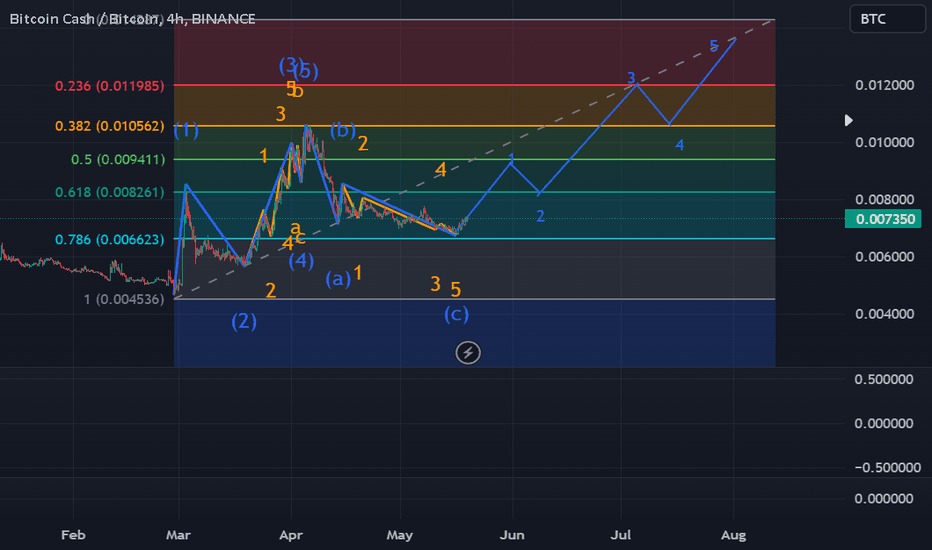

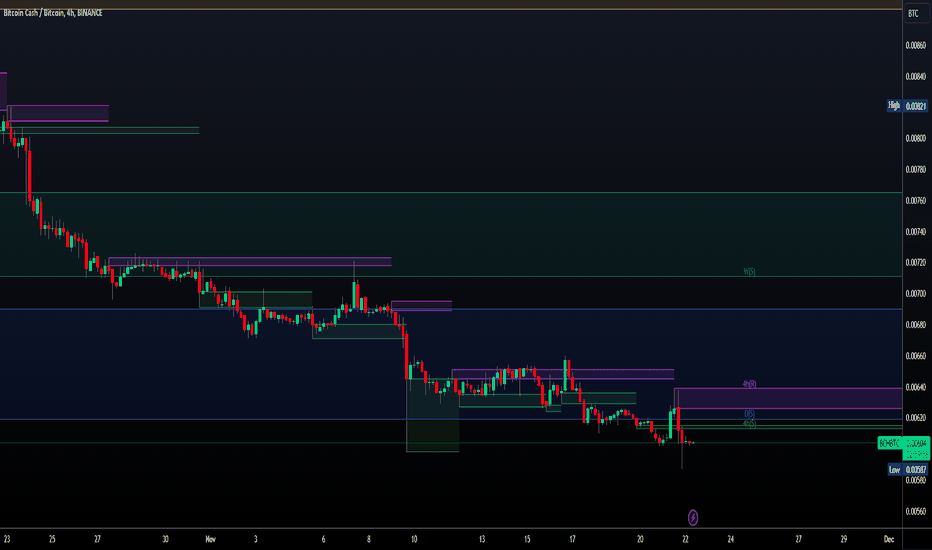

BCH/BTC - Bitcoin Cash: Elliott Wave 12345◳◱ On the $BCH/ CRYPTOCAP:BTC chart, the Elliott Wave 12345 pattern suggests an upcoming trend shift. Traders might observe resistance around 0.00647 | 0.00678 | 0.00728 and support near 0.00597 | 0.00578 | 0.00528. Entering trades at 0.00604 could be strategic, aiming for the next resistance level.

◰◲ General info :

▣ Name: Bitcoin Cash

▣ Rank: 21

▣ Exchanges: Binance, Kucoin, Huobipro, Gateio, Mexc, Bittrex

▣ Category/Sector: Payments - Currencies

▣ Overview: Bitcoin Cash is a Bitcoin hard fork advocating for and building towards a literal interpretation of Bitcoin as a "peer-to-peer electronic cash system". It views cheap peer to peer transactions as the core value proposition of the network and is dedicated to increasing block sizes and on-chain transaction throughput in pursuit of this goal. Bitcoin Cash believes that starting as a medium of exchange is the superior route to becoming money in opposition to Bitcoin's strategy of first optimizing for securely storing value.

◰◲ Technical Metrics :

▣ Mrkt Price: 0.00604 ₿

▣ 24HVol: 45.006 ₿

▣ 24H Chng: -2.423%

▣ 7-Days Chng: -7.33%

▣ 1-Month Chng: -15.82%

▣ 3-Months Chng: 13.61%

◲◰ Pivot Points - Levels :

◥ Resistance: 0.00647 | 0.00678 | 0.00728

◢ Support: 0.00597 | 0.00578 | 0.00528

◱◳ Indicators recommendation :

▣ Oscillators: NEUTRAL

▣ Moving Averages: STRONG_SELL

◰◲ Technical Indicators Summary : SELL

◲◰ Sharpe Ratios :

▣ Last 30D: -2.16

▣ Last 90D: 1.46

▣ Last 1-Y: 1.26

▣ Last 3-Y: 0.45

◲◰ Volatility :

▣ Last 30D: 0.42

▣ Last 90D: 0.63

▣ Last 1-Y: 0.78

▣ Last 3-Y: 1.05

◳◰ Market Sentiment Index :

▣ News sentiment score is N/A

▣ Twitter sentiment score is 0.56 - Bullish

▣ Reddit sentiment score is 0.90 - V. Bullish

▣ In-depth BCHBTC technical analysis on Tradingview TA page

▣ What do you think of this analysis? Share your insights and let's discuss in the comments below. Your like, follow and support would be greatly appreciated!

◲ Disclaimer

Please note that the information and publications provided are for informational purposes only and should not be construed as financial, investment, trading, or any other type of advice or recommendation. We encourage you to conduct your own research and consult with a qualified professional before making any financial decisions. The use of the information provided is solely at your own risk.

▣ Welcome to the home of charting big: TradingView

Benefit from a ton of financial analysis features, instruments and data. Have a look around, and if you do choose to go with an upgraded plan, you'll get up to $30.

Discover it here - affiliate link -

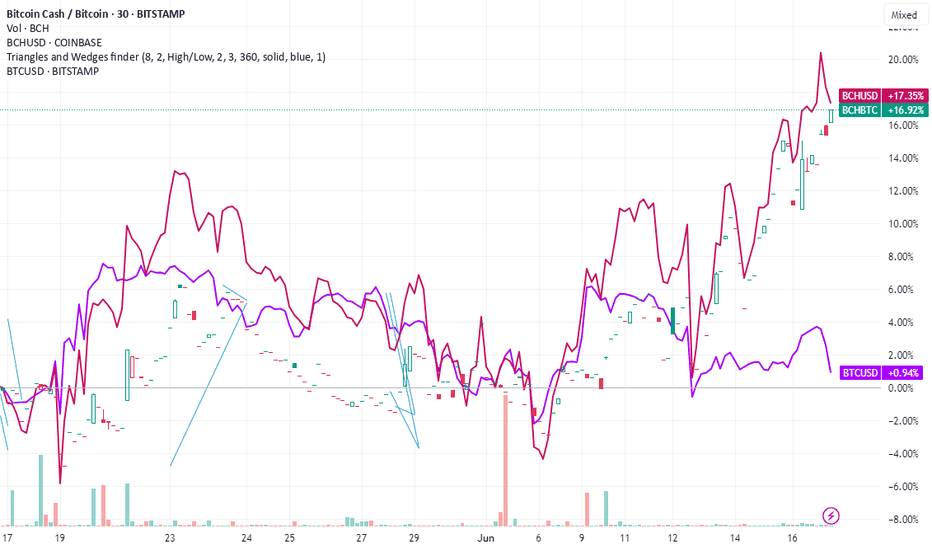

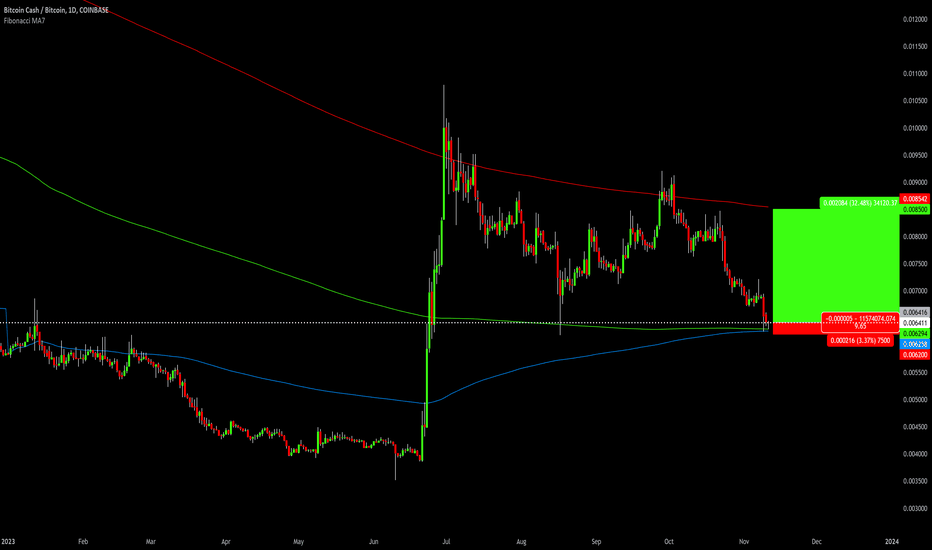

Bitcoin Cash is readyThe BCH/BTC pair is ready for a bullish impulse. As you can see Bitcoin Cash has been consolidating while Bitcoin took off the past month. But now the BCH/BTC pair is sitting at it's YTD anchored VWAP and fibSMA610. Ever since Bitcoin Cash made a +2x parabolic move starting on 6/21/23, the BCH/BTC pair has been in a range between fibSMA987 high and fibSMA610 low. Therefore, unless it is proven otherwise, it is time to once again, go long Bitcoin Cash.

fibSMA987 = .008542

fibSMA610 = .006294

YTD AVWAP = .006258

BCH/BTC Trade idea:

Long = .006416

Stop = .006200

Profit = .008500