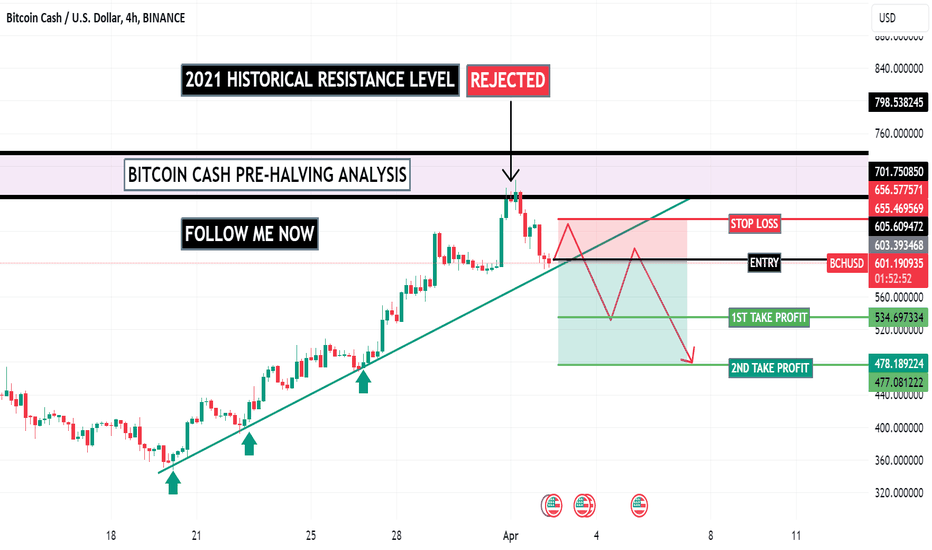

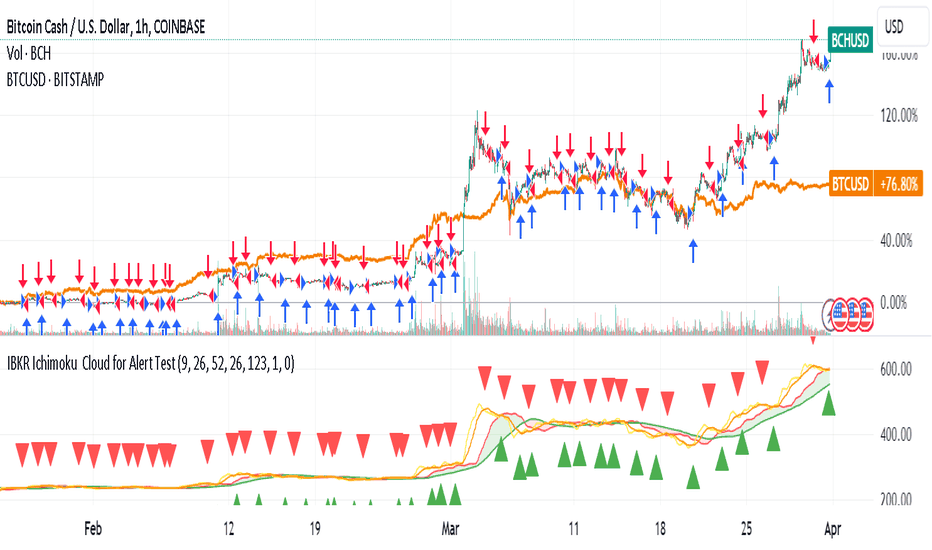

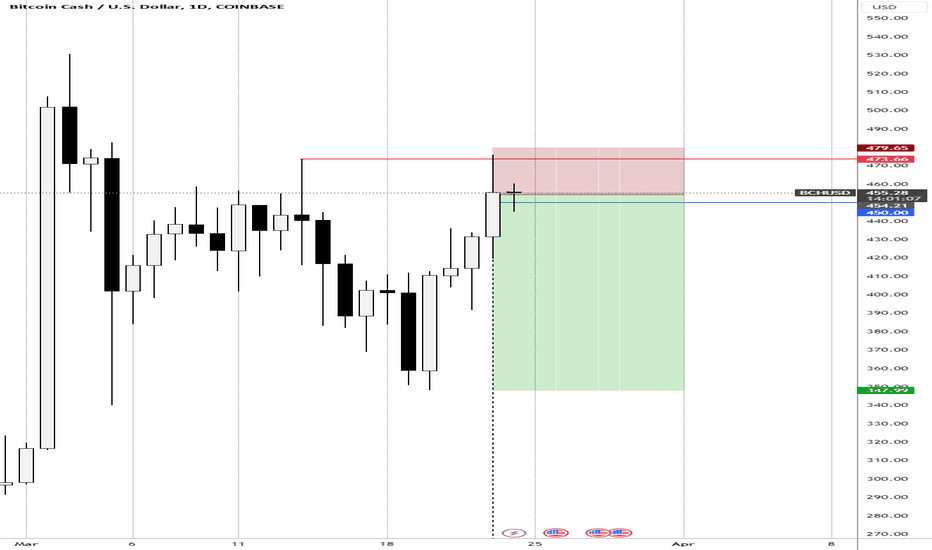

Bitcoin Cash Pre-Halving Analysis: Time to Sell the News?You know that BINANCE:BCHUSD halving will happen on the 4th of April 2024, slashing the mining rewards by half.

I bought the rumor early enough, and I am ready to sell the news.

I will open a partial short position now, when there is a breakdown of the trendline, I will add to my position.

Warning

- Don't overuse leverage

- Manage your risk

- Manage your trades

What are your thoughts about this analysis? Could you share them with me in the comment box?

If you like my analysis, follow me now for more and support this idea.

Cheers!

BCHUSD.P trade ideas

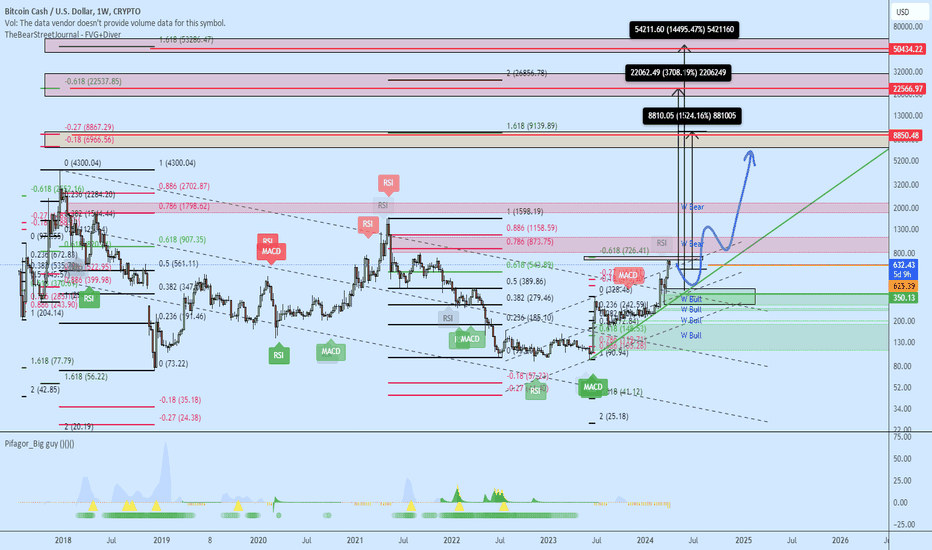

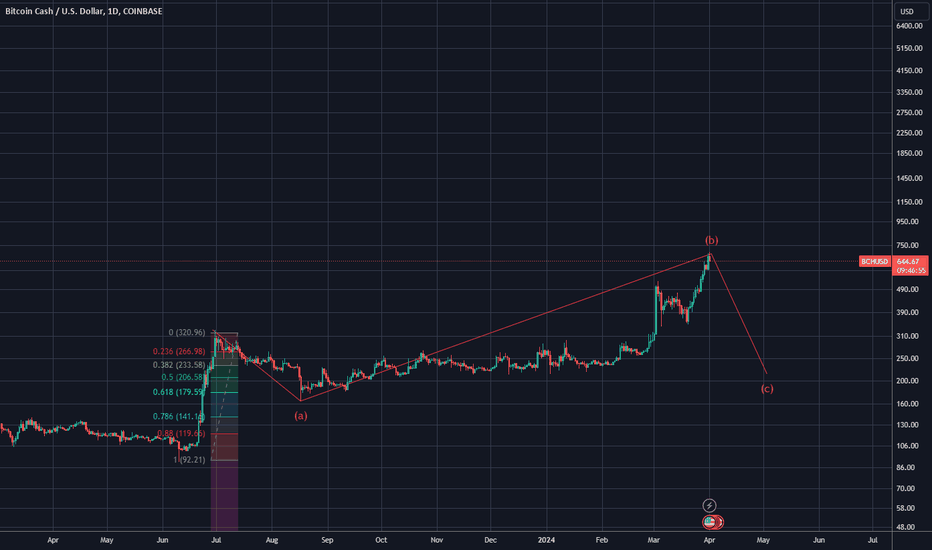

Bitcoin Cash Retracement?Indicators suggest CRYPTOCAP:BCH could be primed for a pullback before the next surge. After a 5-wave rally, we're touching multi-year resistance. The RSI is tipping into overbought territory, hinting at retracement potential. While weekly charts don't show bearish divergence, other timeframes do. If the retracement unfolds, I'm eyeing the $200-$150 range at the 0.618-0.786 Fib levels. Brace for impact, as a sharp drop could retest support line.

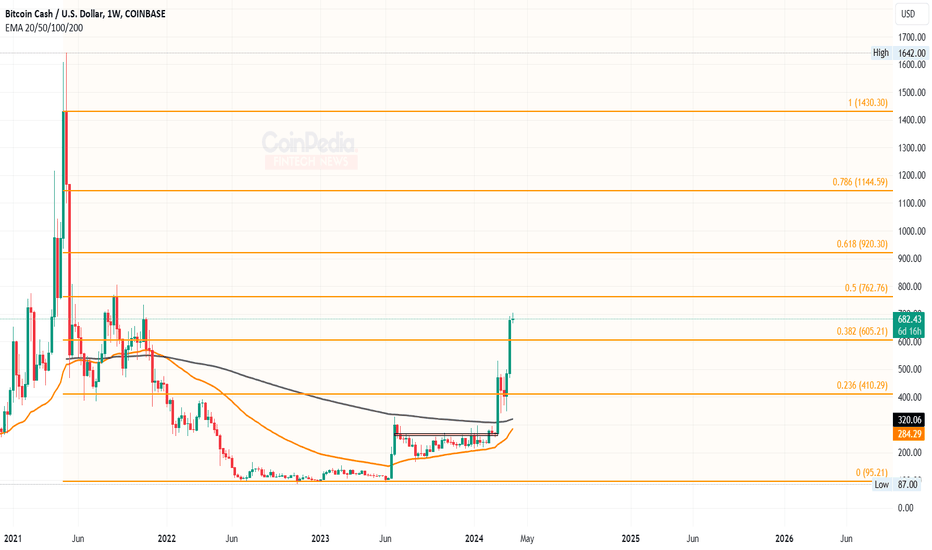

BCH Price Ready To Hit $1,00040% Weekly Jump: Bitcoin Cash (BCH) has outperformed Bitcoin in weekly returns with a significant 40% increase.

$700 Breakout Aim: The uptrend is aiming for a breakout at the $700 resistance level.

Potential $1000 Target: Overcoming the $700 mark could set BCH on a path to reach $1000.

Bullish Trend Motion: Despite Bitcoin's bearish start, BCH showcases a strong bullish trend.

Bitcoin Halving Boost: Anticipation around Bitcoin Halving is expected to benefit Bitcoin Cash as a cheaper alternative.

Market Cap and Returns: BCH's market cap is at $13.40 Billion, with a 68% return over the last 30 days.

Bullish Flag Pattern: A range breakout indicates a bullish flag pattern, leading to massive engulfing candles.

Fibonacci Levels: BCH has surpassed the 23.60% and 38.20% Fibonacci levels, aiming next for the 50% level at $762.

Current Trading Price: Trading at $678, BCH exhibits an indecisive pattern with a Doji candle formation.

Bollinger Bands Expansion: The uptrend stretches the upper Bollinger Band, showing buyer dominance.

Next Resistance Level: After $762, the next notable resistance level is at $920, with potential sights set on $1000.

Sentiment-Driven Rally: The bullish sentiment around the crypto market could push BCH towards the $1000 mark.

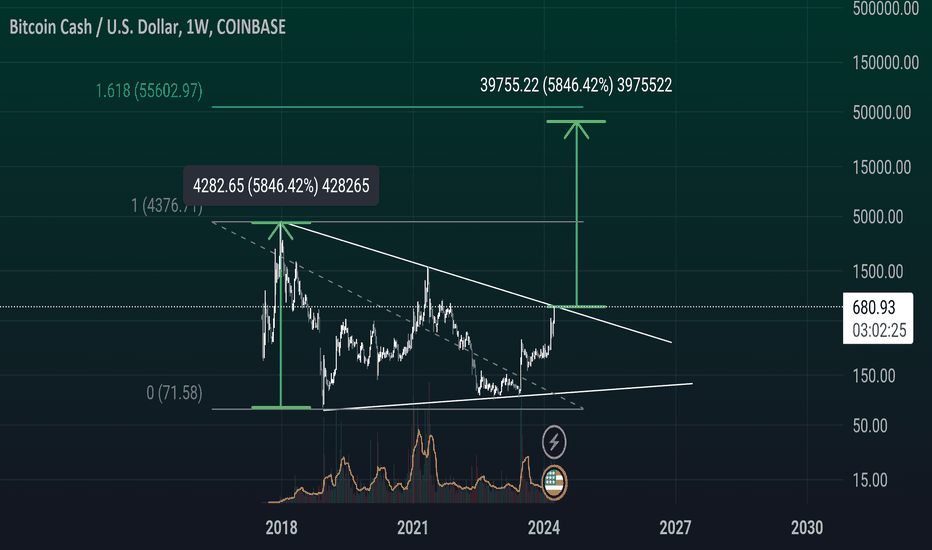

BCH Price action conceptI know, I know. BCH. Nobody cares abut BCH. That's make me bullish on this one. Put away the ideology and look at this pattern. What if it really lagging so badly behind BTC? What if it follow similar pattern like the Papa? It could reach 7000 Dollars? And right now it's so dirt cheap. Risk to reward is looking good. I'm grabbing this bargain. No financial advice. Just a concept.

Celebrate the Success of Bitcoin Cash Post-Halving!I wanted to take a moment to share some exciting news with you - Bitcoin Cash (BCH) has been outperforming Bitcoin (BTC) since the recent halving event!

In the weeks following the halving, BCH has shown remarkable resilience and growth, surpassing BTC in terms of price appreciation and overall market performance. This is a clear indication of the strength and potential of BCH as a valuable investment opportunity.

As we continue to navigate the ever-changing landscape of the cryptocurrency market, I encourage you to consider diversifying your portfolio and investing in BCH over BTC. With its strong performance post-halving, BCH presents a promising opportunity for traders looking to maximize their returns and capitalize on the current market trends.

Don't miss out on the potential gains that BCH has to offer - seize the opportunity to invest in a cryptocurrency that is on the rise and poised for success. Join me in celebrating the success of BCH and take action today by adding BCH to your trading portfolio.

Let's ride the wave of BCH's success together and make the most of this exciting time in the cryptocurrency market. Happy trading!

Bitcoin Cash (BCH) Price Soars Ahead of HalvingBitcoin Cash ( CRYPTOCAP:BCH ) has been on a meteoric rise, surging 7.54% in the last 24 hours and 43% over the past week to reach $586. As the crypto market stages a recovery led by Bitcoin, BCH's rally has been even more pronounced, fueled by anticipation surrounding its upcoming halving on April 3.

The imminent halving event, which will see CRYPTOCAP:BCH block rewards reduced from 6.25 to 3.125 per block, has sparked investor enthusiasm and contributed to BCH's bullish momentum. Analysts predict that this reduction in supply could potentially drive prices even higher, with some suggesting the potential for 10X gains in the near future.

The recent surge in CRYPTOCAP:BCH price has been characterized by multiple waves of growth, breaking through major resistance levels and signaling a bullish trend. Relative Strength Index (RSI) further supports this bullish outlook.

Despite facing resistance levels at $650, $700, and $750, CRYPTOCAP:BCH has already reached a two-year high, with its current price levels not seen since November 2021. Whether CRYPTOCAP:BCH can sustain its upward trajectory or encounter a pullback in the short term remains uncertain, contingent on traders' behavior in the coming hours.

With BCH's halving just days away and market sentiment turning increasingly positive, investors are closely watching for further price surges and potential entry points. As the crypto sector continues to evolve, BCH's performance in the coming days could offer valuable insights into the broader market trends and the future of digital assets.

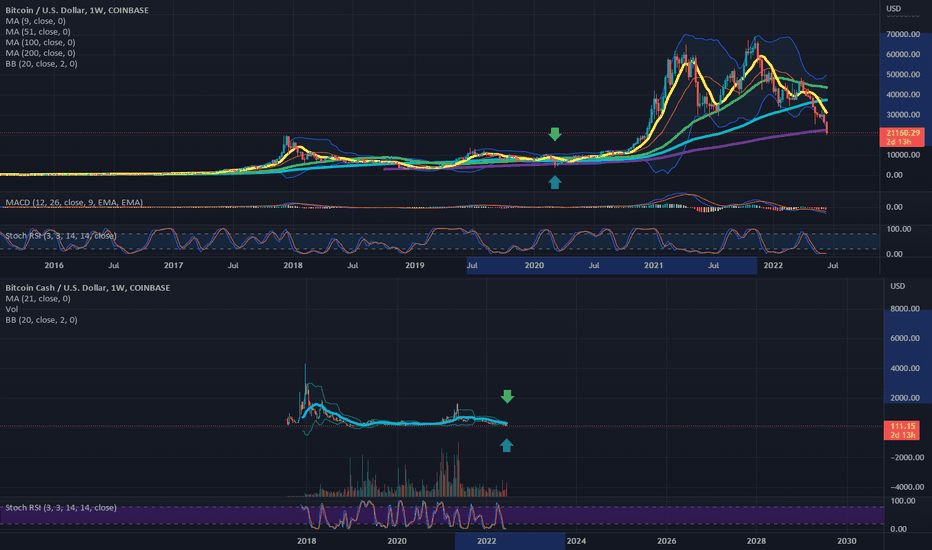

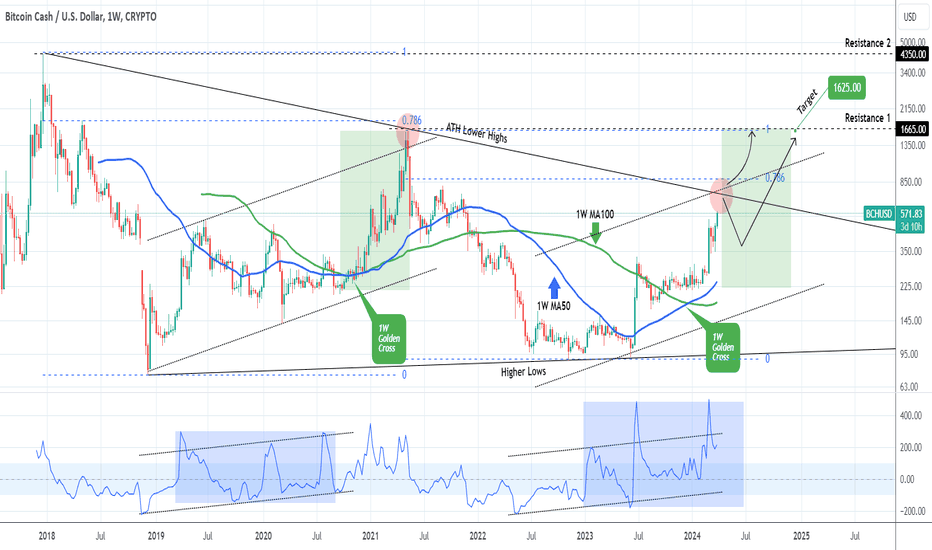

BCHUSD Strong rally but needs to break this historic ResistanceBitcoin Cash (BCHUSD) is posting a very aggressive 2-week rally but short-term buyers should get too comfortable as it is approaching a landmark Resistance. That is the Lower Highs trend-line that started on the December 2017 All Time High (ATH). The previous Bull Cycle got rejected on that trend-line, guided by a Channel Up, below the 0.786 Fibonacci retracement level.

As a result, we can only issue a buy signal above that trend-line, until then we will be looking for a buy entry close to the 1W MA50 (blue trend-line). In both cases (break-out and pull-back buy) our Target will be 1625 (Resistance 1 and previous Cycle's High).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

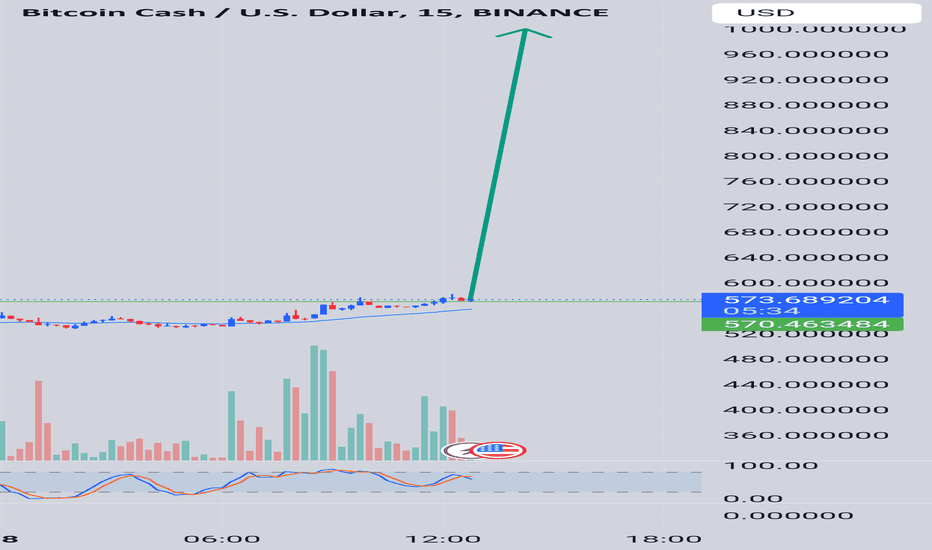

Bitcoin Cash (BCH) PUMPRecently, Bitcoin Cash has been pumping so strongly that everyone is puzzled why. Technical-wise, not important why. The important thing is the pattern or patterns that happened before the pump. There is a pattern that occurs not very often, but when do, a strong wave can follow after that. It's called a double triangle pattern; as in the case of BCH, we can see this pattern. As said before, this pattern does not happen very often, but when do, it's lucrative to catch it.

If you see any crypto or token that might be forming this pattern, please share the name or your analysis here. For start, it seems Fantom (FTM) is forming its second triangle pattern; Check out its analysis. So, keep an eye on it.

Coinbase Sets to Launch Futures Contracts for Bitcoin Cash Coinbase, the largest American crypto exchange, is poised to launch futures trading contracts for Dogecoin ( CRYPTOCAP:DOGE ), Litecoin ( CRYPTOCAP:LTC ), and Bitcoin Cash ( CRYPTOCAP:BCH ) on April 1st, 2024. This bold step by Coinbase Derivatives marks a significant expansion of offerings, opening new avenues for traders and investors alike.

The decision to introduce futures contracts for these three cryptocurrencies underscores their growing prominence within the crypto space. Despite Dogecoin's humble origins as a meme coin, its meteoric rise in market capitalization has propelled it into the upper echelons of the crypto world. Similarly, Litecoin and Bitcoin Cash, both stemming from Bitcoin's lineage, have garnered substantial attention and adoption, making them prime candidates for futures trading.

Coinbase's move to list futures contracts for CRYPTOCAP:DOGE , CRYPTOCAP:LTC , and CRYPTOCAP:BCH represents a strategic maneuver to tap into the burgeoning demand for diverse investment instruments in the crypto market. By leveraging the self-certification approach under CFTC Regulation 40.2(a), Coinbase can swiftly introduce these products while ensuring compliance with regulatory requirements.

The introduction of futures trading for these cryptocurrencies not only provides investors with additional avenues for portfolio diversification but also underscores the maturation of the crypto market. As cryptocurrencies continue to gain mainstream acceptance, traditional financial institutions are increasingly recognizing their potential as viable investment assets.

Coinbase's bold move signals a growing convergence between traditional finance and the crypto sphere. As cryptocurrencies continue to redefine the financial landscape, innovative initiatives like futures trading for CRYPTOCAP:DOGE , CRYPTOCAP:LTC , and CRYPTOCAP:BCH pave the way for broader adoption and acceptance.

In conclusion, Coinbase's decision to launch futures trading contracts for Dogecoin, Litecoin, and Bitcoin Cash heralds a new era of possibilities for the cryptocurrency market. As these digital assets gain traction and legitimacy, investors stand to benefit from increased accessibility and diversity in trading options. While regulatory challenges persist, Coinbase's initiative underscores the transformative potential of cryptocurrencies in reshaping the future of finance.

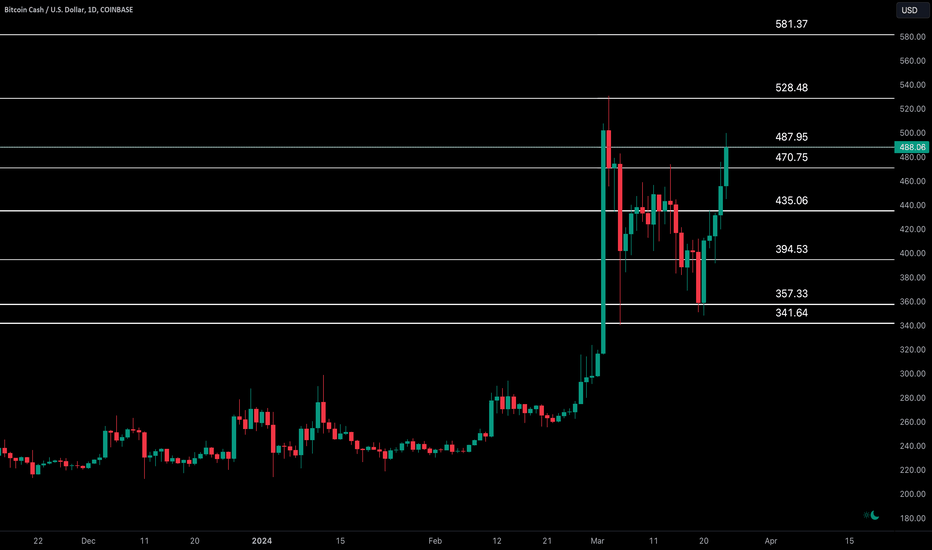

Cryptolean Bitcoin Cash BCH UpdateBitcoin Cash is moving strongly bullish and trying to break through the key resistance zone of $471-$488.

A bullish break-out and a daily candle closure above $488 will lead to re-test of $528 and a strong bullish move towards $600.

An inability to sustain the price action above $471-$488 will lead to a dip to $435.

Dovish BCHUSDBitcoin Cash (BCH) is a cryptocurrency that originated from a fork of the Bitcoin (BTC) blockchain in 2017. It was created to address some of the scalability issues of Bitcoin by increasing the block size, allowing for more transactions to be processed at a faster rate and with lower fees. The goal of BCH is to serve as a global peer-to-peer payment system. Despite sharing some technical similarities with Bitcoin, such as the same consensus mechanism and a capped supply of 21 million coins, BCH focuses on being a practical payment method rather than just a store of value.

Yes, you can use Bitcoin Cash (BCH) to buy goods and services online. Many retailers and online stores have started accepting Bitcoin Cash and other cryptocurrencies as a form of payment. For instance, you can add funds to your Microsoft account using Bitcoin Cash, which can then be used to purchase games, movies, and apps in the Windows and Xbox stores1. Additionally, there are online marketplaces like Crypto Emporium that accept Bitcoin Cash for a wide range of products, including electronics, luxury items, and even real estate2.

To make a purchase with Bitcoin Cash, you typically need to transfer BCH to a mobile wallet, select an online store that accepts cryptocurrency payments, add your desired product to the shopping cart, and then transfer the BCH to the wallet address provided by the merchant2. It’s important to note that while the adoption of cryptocurrency payments is growing, it’s still not as widespread as traditional payment methods, so you’ll need to check if the retailer or service provider accepts BCH before making a purchase.

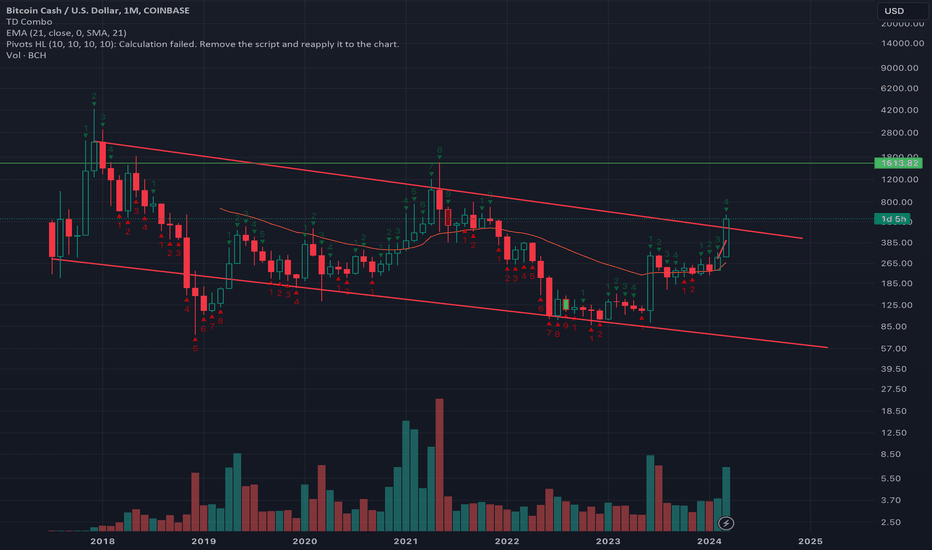

Bitcoin Cash Halving 2024: A Golden Opportunity for Investors?Bitcoin Cash ( SET:BCH ) enthusiasts and investors are eagerly eyeing the upcoming halving event scheduled for April 4, 2024. With just a few weeks left until this critical network event, the cryptocurrency community is abuzz with speculation about its potential impact on BCH's price trajectory. As miners prepare for reduced block rewards, questions arise about whether Bitcoin Cash's halving presents a lucrative buying opportunity for investors.

Understanding Bitcoin Cash Halving:

Bitcoin Cash ( SET:BCH ) operates on a four-year or 200,000-block halving cycle, a mechanism designed to control inflation and ensure the scarcity of the cryptocurrency. The upcoming halving will see the block reward slashed from 6.25 BCH to 3.13 BCH, compelling miners to reassess their strategies in light of reduced profitability.

Miner Sell-Off and Market Dynamics:

In anticipation of the halving, miners have engaged in a significant selling spree, offloading approximately 2.51 million SET:BCH worth around $1.1 billion. This trend, driven by the desire to capitalize on high prices before rewards diminish, has led to a decrease in miner reserves. However, historical data suggests that such sell-offs tend to reverse post-halving, with miners accumulating reserves once again.

Impact on Mining Difficulty and Revenue:

As unprofitable miners exit the network due to reduced rewards, mining difficulty is expected to decrease, potentially enhancing revenue for remaining participants. This phenomenon was observed during the 2020 halving, where a decrease in mining difficulty coincided with significant price gains for Bitcoin Cash.

Analyzing Price Trends:

Bitcoin Cash's price has experienced a notable dip of around 20% in the lead-up to the halving, mirroring patterns observed before previous halving events. However, past performance indicates that such downturns often precede bullish cycles post-halving. With SET:BCH currently trading around $464 as at the time of writing, investors may view this correction as an opportune moment to enter the market.

Long-Term Holder Sentiment:

On-chain data suggests that long-term holders are positioning themselves for a bullish post-halving cycle, indicating confidence in Bitcoin Cash's future prospects. This sentiment aligns with historical precedents, where halving events have often catalyzed significant price appreciation for cryptocurrencies.

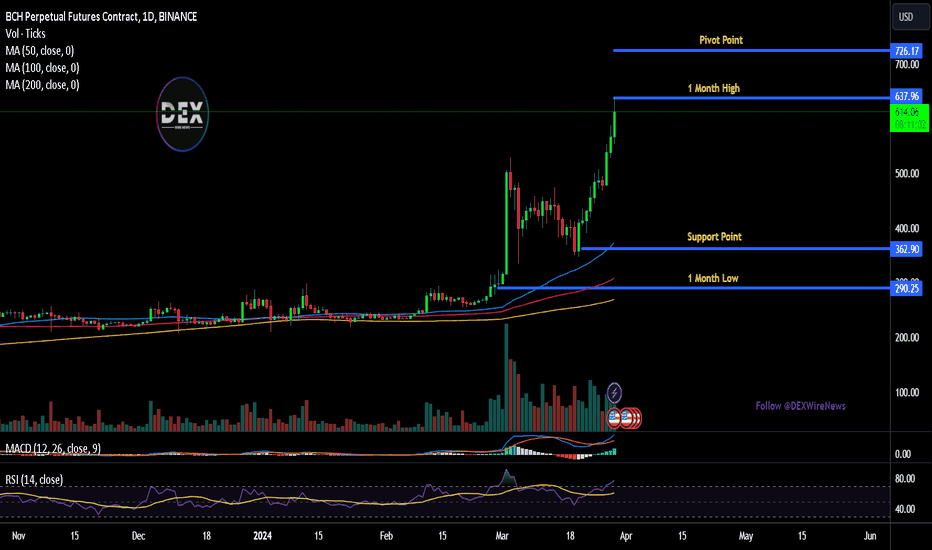

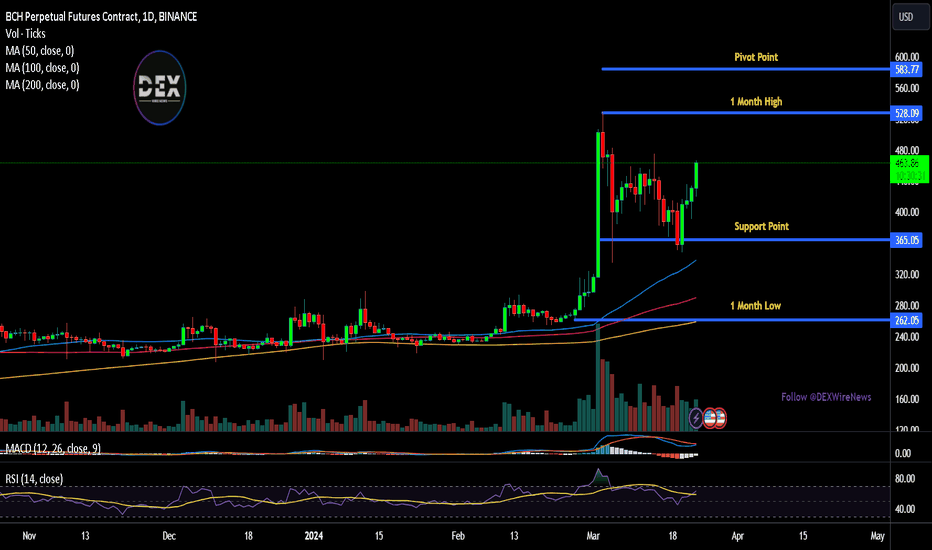

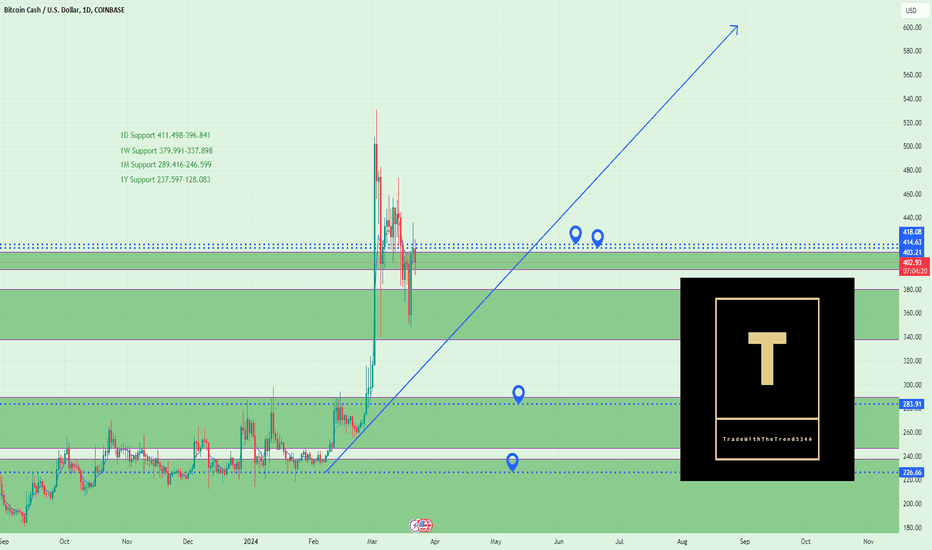

BCHUSD: Confirming Long-Term Buy Above Pivot PointsHello Everyone,

BCHUSD has established a solid foundation at its weekly support and is now exploring the daily support thresholds. The key indicator we seek is a consistent positioning above the 1D/1W Pivot Point to affirm stability. In the long run, BCHUSD maintains its status as a favorable investment.

TradeWithTheTrend3344

Bitcoin Cash: History Repeating Itself?Bitcoin Cash: History Repeating Itself?

Bitcoin Cash (BCH) is a fork of Bitcoin that was created in 2017. BCH has a history of forming long sideways patterns, followed by sharp breakouts.

The pattern:

Sideways accumulation: BCH typically spends 200-300 days in a sideways accumulation pattern.

Breakout: After the accumulation phase, BCH breaks out of the pattern and rallies sharply.

Magnitude of the breakout: The breakouts typically result in a 2-2.5x increase in price.

Is history repeating itself?

BCH has been trading in a sideways pattern since May 2022. This suggests that the accumulation phase is nearing its end and a breakout could be imminent.

Factors supporting a breakout:

Increased development activity: There has been a significant increase in

development activity on the BCH network in recent months.

Growing adoption: BCH is becoming increasingly adopted by merchants and businesses.

Positive technical indicators: The technical indicators for BCH are bullish, suggesting that a breakout is likely.

Potential targets: 3300.

Cryptolean Bitcoin Cash BCH Update Bitcoin Cash is trying to reverse from the daily support zone of $377-$395.

A bullish reversal from this support zone will result in a move to re-test $435-$451.

A bearish break-out of $377-$395 will push BCH price lower towards $341.

Intraday Chart

The BCHUSDT 4-Hour chart is trying to escape bearish zone and get back to above $389.

A bearish rejection of $389 will lead to Bitcoin Cash price declining to $303-$327, the key intraday support zone, however on the way to this zone BCH will have to deal with $361 support.

A bullish break-out of $389 will push price to re-test $442, however the price action may be slow and choppy.

Support once read!

Thank you.