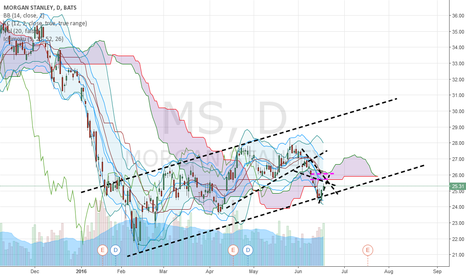

MORGAN STANLEY going to file BANKRUPTCY by 2021In 200 it peaked then in 2007 it peaked again and now in 2015 it peaked. But all the time it went high it made lower lows in historical prices trend. The support is near $10-$10 but when it penetrates guess what? -all the hell will break loose. There are couple of ways to stop it. Stock reverse split, bail out or short ban or buy out. But the problem is when other financial institutions are struggling their own who want to buy MS ? Due to their corrupt accounting system we can't even get the real values of the junk assets they are holding. may be only few pennies on the dollar. The other options also will not work out in long term. Think by 2012 it will be vanish their foot print from earth.

MS trade ideas

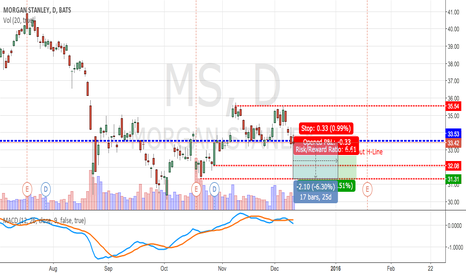

200 MA breakoutLooking for a long entry here on $MS as it breaks above it's 200 day moving average on the 5 year chart. The 40 and 50 day moving averages are beginning to curve for a possible upward movement reflected. Current Trend is up for the year. I am looking for an entry today above yesterday's high with a stop loss around previous highs in the $27 range. $3 downside for possible $6+ upside leaving a 2:1 ratio or better.

Morgan Stanley $MS earnings before the bell on Monday There are no actionable signal, this company seems cheap to me. I don’t think this is a buy but, had a good month opening. This Financial company is under priced if you look at the weekly chart. This Monday morning we are going to get Morgan Stanley $MS earnings before the bell. I don’t think this financial stock is a buy or a hold

MS heading towards key levelA move above 437.50 would appear to be an interesting level which we would look to a bought call to take advantage of any further move higher.

the price site above all key moving averages and Fridays pull back on low volume medoks like pre-earnings nerves which now should be caled

Bankers ready to share profitMorgan Stanley stocks look set to take off. Breaking out of the flag pattern above USD 35.70 will also mark the breach of a strong historical level. In this case, the stock could move towards the triangle’s highs of USD 36.30, which, if crossed, would pave the way for 50% upside over the next couple of months. The price band of USD 52-54 will also be attractive for speculative traders, so the stock will most likely reach that range. A new bout of consolidation can be expected at this level, the exit from which, in terms of the direction and time, is still hard to predict for the time being. So far, buy what bankers have to offer, with a target price of USD 52-54.

My forecast participates in the Market Forecaster contest. Follow the link s30061920484.whotrades.com

to vote for it and help me win the top prize. Thank you.