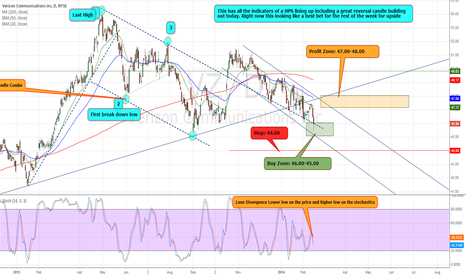

Verizon: Potential Bullish Resumption - UpdateBullish breakout above multiple key resistance levels, and that comes in the context of retesting a major long term support level at around 45, check the related link for the overall view.

Near Term target at 51.20 resistance, followed by the latest major swing high at 54.25. A longer term target mentioned in my earlier analysis at 60.00 areas.

Only a break below 45 will threaten for a serious reversal.

Good Luck, Join me at twitter.com

VZCL trade ideas

VZ Fails at Long Support Line with MAC, Now Back Above 50D EMAAt the start of 2014, VZ tested and failed it's support line from August 2011. At this time there was also a conversion of moving averages (MAC). Now VZ is back above it's 50 Day EMA and looks to test its resistance line which formed in May 2013. If it brakes out above that, it should retest it's fib level at $49.11. A break above that level would result in a retest of the former line of support at around $52.

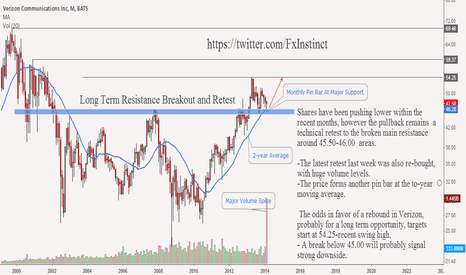

Verizon: Potential Bullish ResumptionShares have been pushing lower within the recent months, however the pullback remains a technical retest to the broken main resistance around 45.50-46.00 areas.

-The latest retest last week was also re-bought, with huge volume levels.

-The price forms another pin bar at the to-year moving average.

The odds in favor of a rebound in Verizon, probably for a long term opportunity, targets start at 54.25-recent swing high.

- A break below 45.00 will probably signal strong downside.

twitter.com

thefxchannel.com