BERAUSDT trade ideas

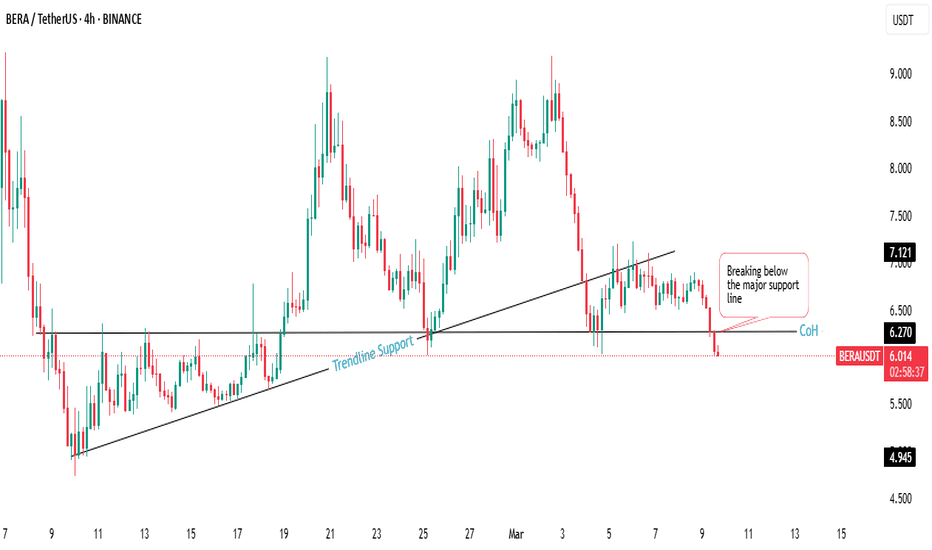

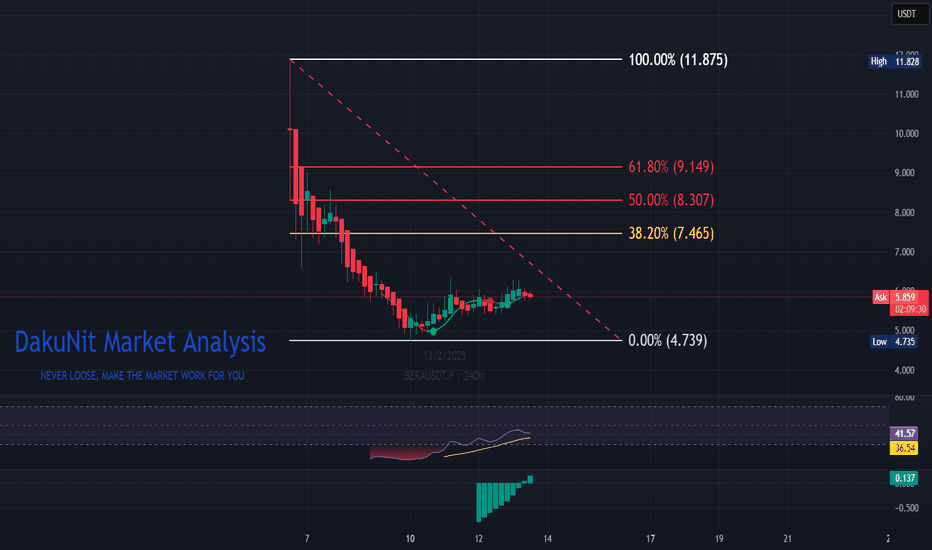

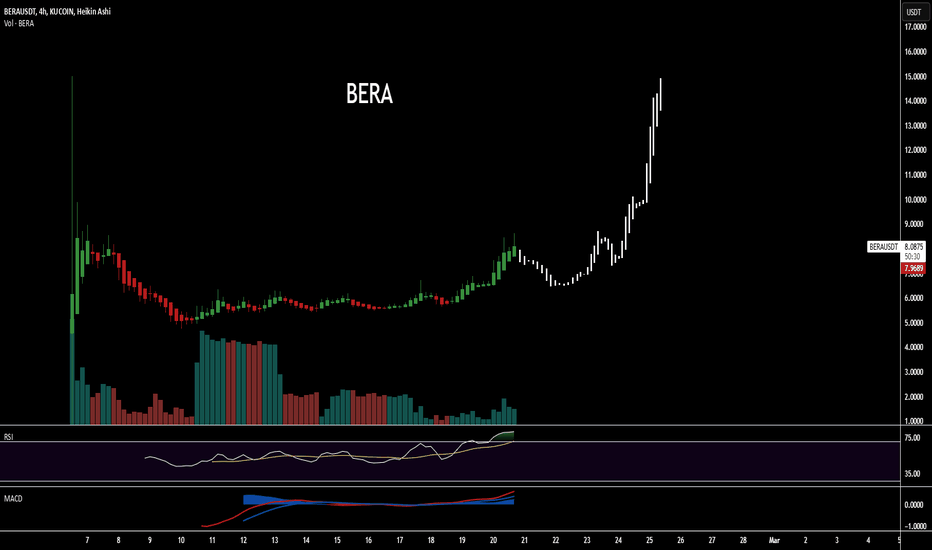

BERAUSDT SHORT 4H Based on the obtained market variables , most likely the BERA coin will continue its downward movement towards the designated targets on the chart.

I want to wait for the local price return in blocks OB 4H and FGV 4H to search for potential entry points. If the reaction is positive and the 15th TF is confirmed, I will apply a short position as indicated on the trading chart.

Targets:

$6,909

$6,019

$5.417

$4.752

Risk management - 1% on stop order

Technical Analysis of BERA/USDT – Outlook and Key Levels1. Trend and General Direction

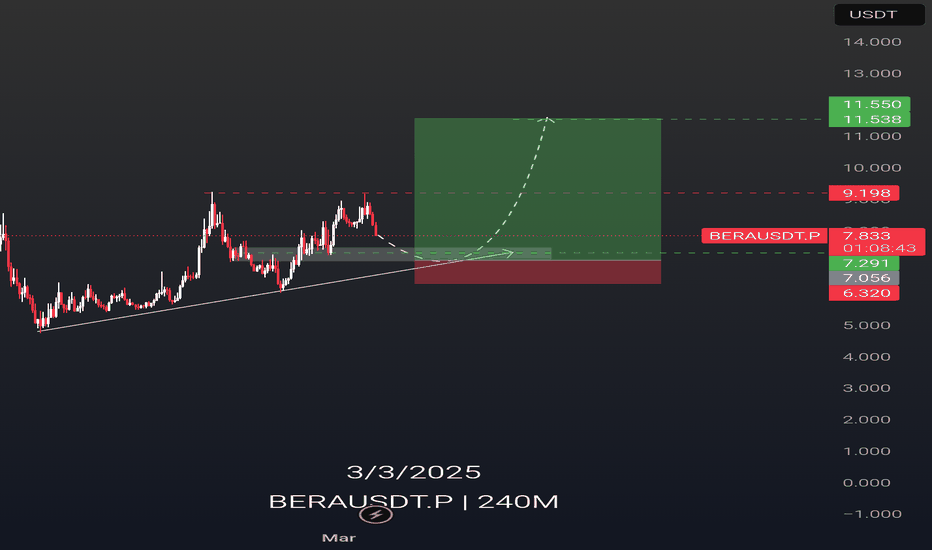

The price has been moving within an upward trend channel, but a recent pullback occurred.

Currently, the price is near the $7.035 level, which aligns with the 0.786 Fibonacci retracement level, acting as a strong support.

If this support holds, the next resistance levels are $8.871 (0.618 Fib) and $10.161 (0.5 Fib).

2. Fibonacci Levels and Key Zones

Support levels: $7.035 (0.786 Fibonacci level), $6.717 (previous low), $4.695 (1.0 Fib, extreme case).

Resistance levels: $8.871 (0.618 Fib), $10.161 (0.5 Fib), $11.451 (0.382 Fib), $13.047 (0.236 Fib).

3. RSI (Relative Strength Index)

The RSI indicator suggests that the price was recently in an oversold state and is now starting to recover.

If the RSI continues to rise, this could indicate a bullish continuation.

4. Gann Fan and Trendlines

The price found support around an ascending Gann fan line, which could act as a potential reversal point.

If the price breaks above key trendlines, the next targets could be in the $9–$10 range.

5. Summary and Outlook

✅ Bullish Scenario: If the price holds the $7.035 support and moves upward, the next targets will be $8.87–$10.16.

❌ Bearish Scenario: If the price breaks below this support, further downside could lead to $6.5 or even $5.

Recommendation: Keep an eye on the price movement in the coming days. If the price recovers above $7.5–$8, the uptrend is likely to continue.

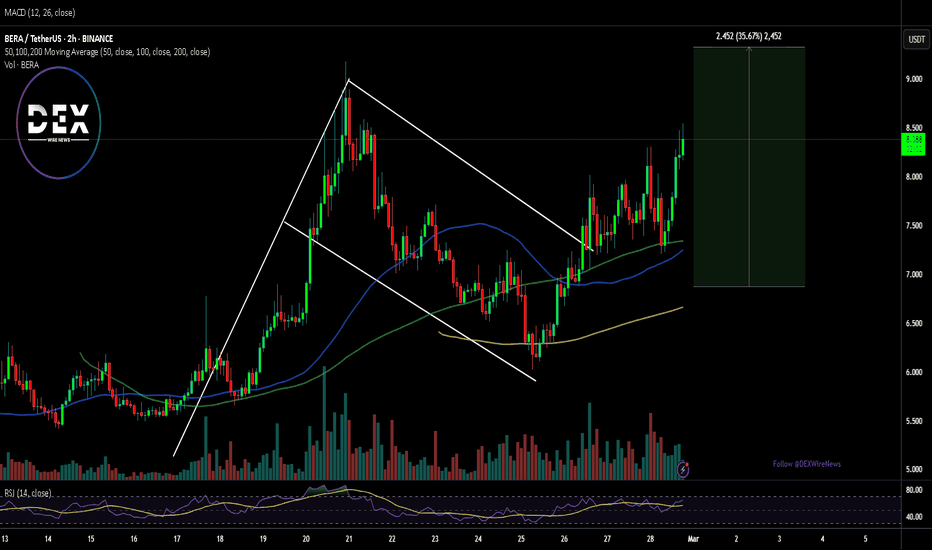

BERA Defies Market Odds: Can the Bullish Flag Lead to 30% Surge?The recently launched BIST:BERA token, built on the Berachain blockchain, has caught the attention of traders and investors after surging 8% today, defying market odds. With a well-formed bullish flag pattern, technical indicators suggest a potential rally of 30% or more if key levels hold.

Technical Analysis

BIST:BERA has been consolidating within a bullish flag pattern, a continuation signal that often precedes a significant breakout. The Relative Strength Index (RSI) is at 65, indicating strong momentum without being overbought, allowing room for further upside.

The 38.2% Fibonacci retracement level serves as key support. A break below this level could invalidate the bullish outlook and lead to a potential trend reversal.

With these factors in play, a breakout above resistance could send BIST:BERA soaring toward the anticipated 30% upside target.

Berachain's Explosive Growth

Beyond the technical setup, Berachain boasts impressive fundamentals that add to its bullish case:

- $3.212 Billion TVL: Data from DeFiLlama reveals that the Berachain ecosystem holds an astonishing $3.212 billion in Total Value Locked (TVL), an extraordinary achievement for a blockchain launched just months ago.

- $798.24 Million in Stablecoins: The ecosystem also has $798.24 million locked in stablecoins, further demonstrating the network’s credibility and adoption.

Berachain Price Live Data

As of now, BIST:BERA is trading at $8.28, with a 24-hour trading volume of $492,482,647. It has climbed 8.17% in the last 24 hours with a market cap of $890,051,046*and a circulating supply of 107,480,000 BERA.

Conclusion

With strong technical indicators and robust fundamentals, BIST:BERA is positioned for a potential rally. If it breaks out from its bullish flag pattern while maintaining key Fibonacci support, a 30% surge could be on the horizon. However, a drop below support might trigger a pullback, so traders should stay vigilant.

#BERA: Capitalizing on Proof-of-Liquidity Innovation

Description

This trading idea focuses on BERA, the native token of Berachain, an EVM-identical Layer 1 blockchain that introduces a novel consensus mechanism called Proof-of-Liquidity (PoL). Unlike traditional Proof-of-Stake systems, Berachain's PoL allows users to stake and provide liquidity simultaneously, enhancing both security and liquidity within the ecosystem. The BERA token serves multiple functions: it is used for gas fees, staking, and as a medium for governance within the network. Berachain's architecture also includes two other tokens: BGT, a non-transferable governance and rewards token earned through active participation, and HONEY, the platform's native stablecoin. The combination of these tokens aims to create a robust and dynamic DeFi environment, positioning BERA as a promising asset for investors interested in innovative blockchain solutions.

However, it's important to recognize that the cryptocurrency market is highly volatile and subject to various external factors, including regulatory changes, technological advancements, and market sentiment shifts. As of February 2025, BERA is trading at approximately $7.75, with a market capitalization of around $827 million.

Disclaimer:

This trading idea is provided for educational purposes only and should not be construed as financial advice. Trading cryptocurrencies like BERA involves significant risk, including the potential loss of your entire investment. It is essential to conduct thorough research, assess your financial situation, and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

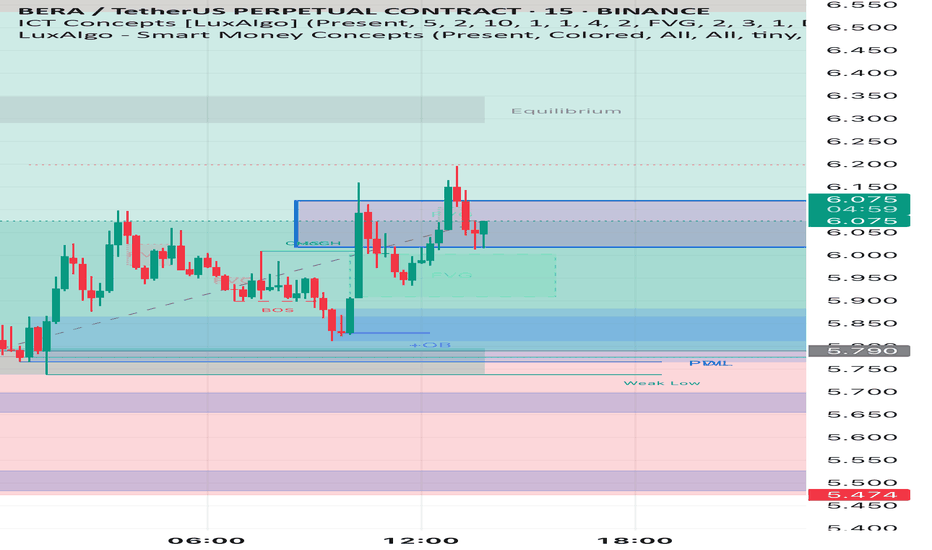

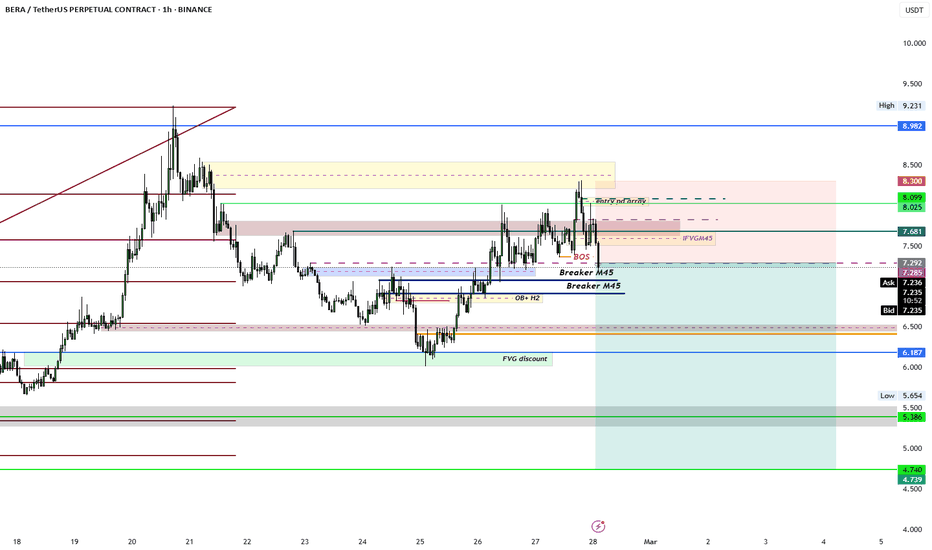

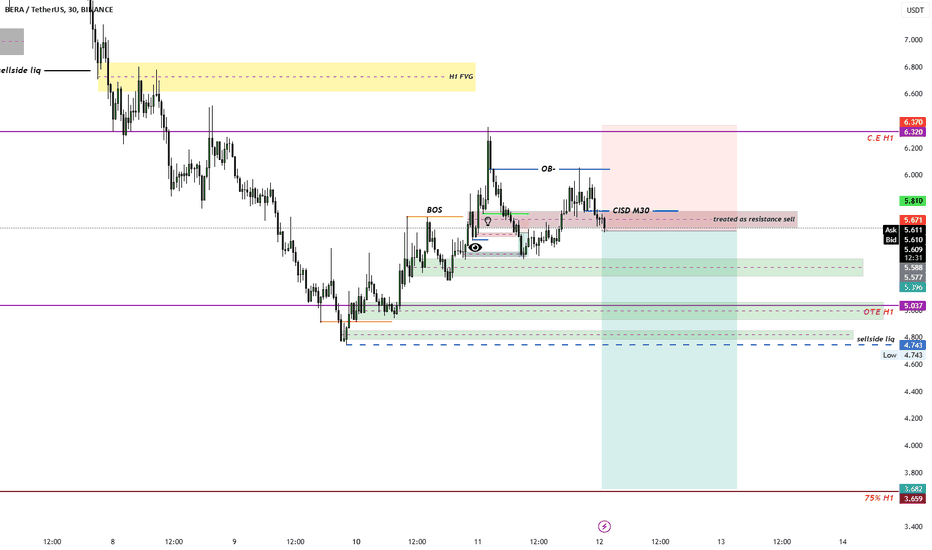

Bearish opportunity in BERA1. We have structure shift in M15

2. We have price rejecting off the entry pd array in H1

3. We have draws as the lowest low in this chart

4. All the PD ARRAYS marked on the chart should act as RESISTANCE AS WE ARE IN A SELL PROGRAM NOW

Fundamental twist;

since it there was a free airdrop sellers might sell off their holdings

BERACHAINBerachain's PoL mechanism fundamentally changes how L1 economics are structured by creating an efficient marketplace between validators, users, and applications. Validators stake BERA (250K-10M) to secure the network and receive BGT rewards, which they can direct to application reward vaults in exchange for protocol incentives. This system allows chain rewards to scale with actual demand for economic security and chain liquidity.

BERAUSDTThe BERA/USDT trading pair is showing a moderate upward trend. The price is gradually increasing, indicating a steady buying interest without significant volatility. While the movement is not aggressive, it reflects a positive market sentiment. Key support and resistance levels should be monitored to assess potential breakout points or retracements.

BERA Defies Market Trends, Eyes 160% Surge Amid Bullish MomentumIn a market facing significant volatility, BIST:BERA has emerged as a top-performing Layer 1 (L1) blockchain coin, surging 13% in 24 hours and inching closer to its all-time high (ATH) of $15.20. With a resurgence in buying pressure, increased spot inflows, and a strong technical outlook, BIST:BERA is positioning itself for a remarkable recovery.

Why is BIST:BERA Pumping?

- Strong Buying Pressure: The Chaikin Money Flow (CMF) indicator stands at 0.04, signaling bullish inflows.

- Capital Movement: After witnessing $2.6 million in outflows, BIST:BERA has now recorded $316K in fresh spot inflows, indicating renewed investor interest.

- Investor Sentiment: Holders are choosing to accumulate rather than sell, reinforcing long-term confidence in the asset’s value.

Moby Expands to Berachain, Strengthening Its DeFi Ecosystem

A pivotal development for the Berachain ecosystem is the launch of Moby, the No.1 options protocol on Arbitrum, on the Berachain Mainnet. Moby has facilitated over $3.5 billion in total trading volume and is now set to transform on-chain derivatives trading within the Berachain network.

Berachain distinguishes itself as an EVM-identical Layer 1 blockchain that operates on the revolutionary Proof of Liquidity (PoL) consensus mechanism. Unlike traditional Proof-of-Stake (PoS) networks, PoL embeds liquidity provisioning directly into the security model, ensuring that validators, applications, and users benefit from a seamless and capital-efficient ecosystem.

Moby’s selection for Berachain’s prestigious Request for Application (RFA) program signals its critical role in the ecosystem. The protocol has also forged key partnerships with Kodiak, Infrared, PumpBTC, and GMX, further expanding its influence in DeFi.

Technical Outlook: BIST:BERA ’s Bullish Setup

At the time of writing, BIST:BERA is up 4%, ranking among the top-performing altcoins of the week. Despite a 65% decline from its listing price, key indicators suggest that BIST:BERA could be on the verge of a substantial breakout:

- Relative Strength Index (RSI) at 65: Holding strong, indicating sustained momentum without being overbought.

- Falling Wedge Pattern: A classic bullish reversal pattern, hinting at an imminent uptrend.

- Potential 160% Surge: BIST:BERA could aim to reclaim its previous ATH of $15.20, presenting a significant upside opportunity.

Conclusion

With a combination of **strong technical indicators, surging capital inflows, and an expanding DeFi ecosystem**, BIST:BERA is well-positioned for a significant rally. As the asset gains traction, traders and investors should closely monitor its price action, as the next leg up could be the most explosive yet.

Will BIST:BERA reclaim its ATH and set new records? The market is watching, and the momentum is undeniable.

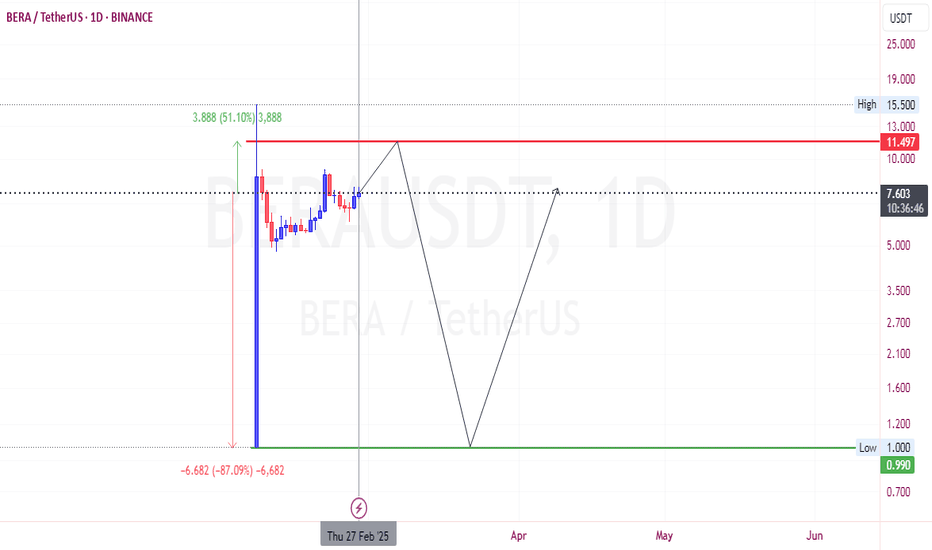

After Losing About 65% of Value Is There Hope for $BERA?The cryptocurrency market is no stranger to volatility, and BIST:BERA , the native token of the newly launched Berachain blockchain, is a prime example. After reaching an all-time high of $15, BIST:BERA has plummeted by 65%, currently trading at around $5.37. Despite this steep decline, the token is showing signs of resilience, with a 4.68% gain in recent trading and a strong Relative Strength Index (RSI) of 54. This raises the question: Is there still hope for BIST:BERA , or is this just a temporary reprieve before further downside?

What is Berachain?

Berachain is an EVM-compatible Layer 1 blockchain that introduces a novel consensus mechanism called Proof of Liquidity (PoL). Unlike traditional Proof of Stake (PoS) systems, PoL aligns network security with liquidity provision, creating a unique incentive structure for participants. This approach aims to address some of the key challenges in decentralized finance (DeFi), such as liquidity fragmentation and inefficient capital allocation.

Two-Token Model

Berachain operates on a dual-token system:

- BIST:BERA : The gas and staking token used for transactions and securing the network.

- NYSE:BGT : A non-transferable governance and rewards token designed to incentivize long-term participation and alignment with the network’s goals.

This model is designed to foster sustainable growth and reduce speculative trading, which could benefit BIST:BERA in the long run.

Market Performance and Sentiment

Despite its recent price drop, BIST:BERA has a live market cap of $576 million and ranks #112 on CoinMarketCap. The token’s 24-hour trading volume of $432 million indicates significant interest and liquidity. However, the initial sell-off was largely driven by airdrop participants cashing out their tokens, a common occurrence in new crypto projects. This suggests that the dip may be more about short-term profit-taking than a reflection of the project’s fundamentals.

Technical Analysis

BIST:BERA is currently forming a falling wedge pattern on the charts, which is typically a bullish reversal signal. This pattern occurs when the price consolidates between two converging downward-sloping trendlines, indicating that selling pressure is weakening. A breakout above the upper trendline could signal the start of a new upward trend.

RSI Holding Strong

The token’s RSI is at 54, which is in neutral territory but leaning toward bullish momentum. This suggests that BIST:BERA is not overbought or oversold, leaving room for further price appreciation if buying pressure increases.

Key Support and Resistance Levels

- Support: The $1 mark is a critical psychological and technical support level. If the price falls further, this level could act as a strong floor.

- Resistance: The immediate resistance lies near the $6-$7 range. A breakout above this level could pave the way for a retest of higher prices.

Why is BIST:BERA Showing Resilience?

1. Innovative Technology: Berachain’s Proof of Liquidity (PoL) mechanism and two-token model are unique value propositions that could attract developers and users to the ecosystem.

2. Strong Community Interest: Despite the sell-off, the project has maintained a high trading volume, indicating ongoing interest from traders and investors.

3. Market Positioning: As an EVM-compatible blockchain, Berachain is well-positioned to tap into the growing demand for scalable and efficient Layer 1 solutions.

Risks and Challenges

- Volatility: As a new token, BIST:BERA is highly susceptible to market swings and speculative trading.

- Competition: The Layer 1 blockchain space is crowded, with established players like Ethereum, Solana, and Avalanche dominating the market.

- Adoption: The success of BIST:BERA will depend on Berachain’s ability to attract developers and users to its ecosystem.

Conclusion

While BIST:BERA has lost 65% of its value since its all-time high, the token is showing signs of stabilization and potential recovery. The innovative Proof of Liquidity mechanism, combined with a strong technical setup (falling wedge pattern and neutral RSI), suggests that BIST:BERA could be poised for a rebound. However, investors should remain cautious, as the token’s price action will largely depend on broader market conditions and Berachain’s ability to deliver on its promises.

For risk-tolerant investors, BIST:BERA represents a high-potential opportunity in the evolving blockchain space. Keep an eye on key support and resistance levels, and watch for developments in the Berachain ecosystem that could drive long-term value.

$BERA H1 Chart IdeaBerachain is a high-performance EVM-compatible blockchain built on Proof-of-Liquidity consensus. It is a cryptocurrency project that has been gaining popularity in 2024. The project aims to address some of the current limitations within the blockchain space, such as scalability and interoperability.

Berachain's price is experiencing a downward trend, consistently reaching new lows. However, it may experience temporary rebounds between $3.4 and $3.9, and if it does, it could potentially bounce back up to the $5 range when market conditions improve. Safe trades.

🎩🎩🎩

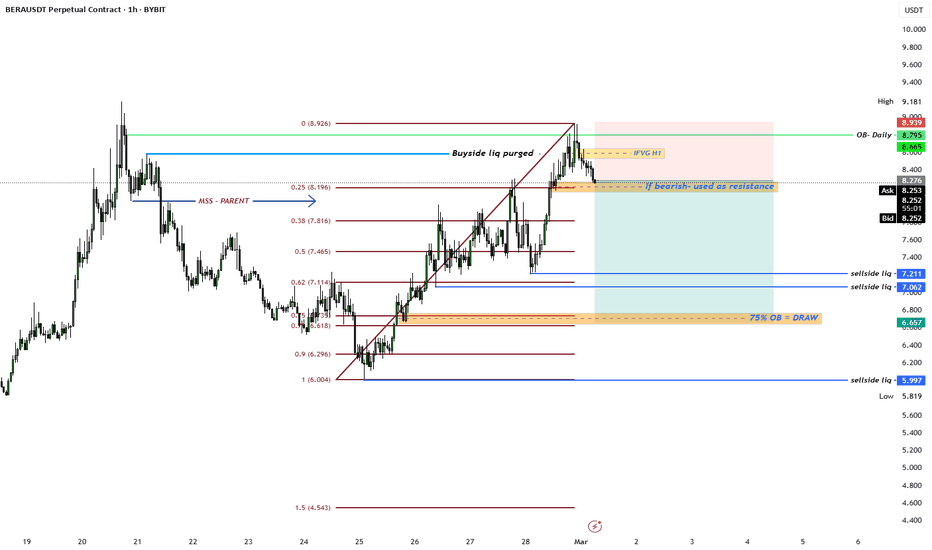

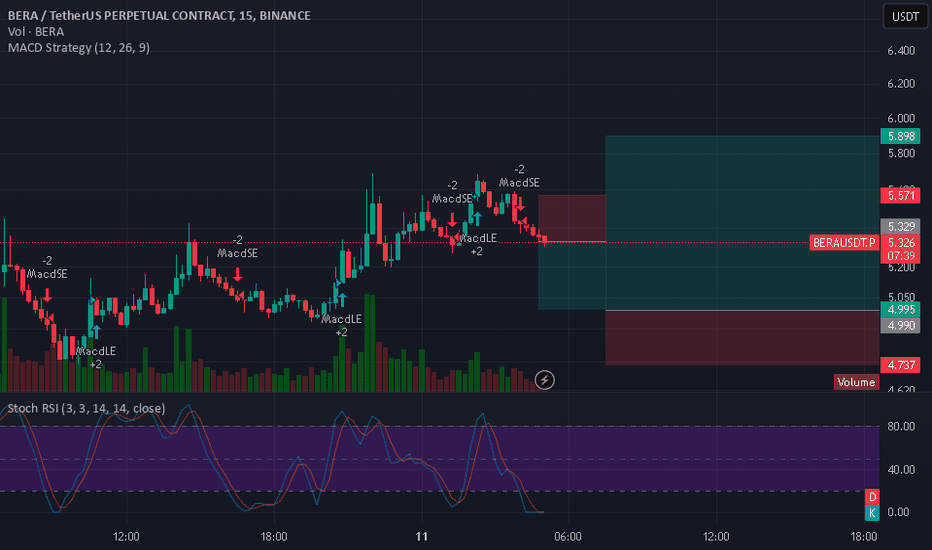

#BERAUSDT Expecting a reversal and price drop📉 SHORT BYBIT:BERAUSDT.P from $5.635

🛡 Stop Loss: $6.380

⏱ 1H Timeframe

✅ Overview:

➡️ BYBIT:BERAUSDT.P is facing strong resistance around $5.635, signaling a potential price reversal.

➡️ The $5.635 - $6.000 area has acted as a liquidity zone before, and if buyers start taking profits, a correction downward is likely.

➡️ The primary target for the decline is $4.145, a level where previous buy activity was observed.

➡️ Volume is starting to decline, indicating a potential shift from buyers to sellers.

⚡ Plan:

📉 Bearish Scenario:

➡️ Enter SHORT from $5.635 if the price fails to hold above resistance.

➡️ Risk management with Stop-Loss at $6.380, above key resistance.

🎯 TP Target:

💎 TP1: $4.145 — strong support and profit-taking zone.

🚀 BYBIT:BERAUSDT.P Expecting a reversal and price drop!

📢 After a strong upward move, BYBIT:BERAUSDT.P is approaching a potential reversal zone. If the price fails to hold above $5.635, a decline towards $4.145 is likely.

📢 However, if buyers manage to push the price above $6.000, the short scenario may be invalidated, leading to further bullish momentum.

Breaking: $BERA dips -50% Just A Day After Listing. The cryptocurrency market is no stranger to volatility, and the recent performance of BIST:BERA , the native token of Berachain, is a testament to this. Launched just yesterday, BIST:BERA has already experienced a whirlwind of price action, capturing the attention of traders and investors alike. After an initial surge of 650%, the token has since dipped by 50%, currently trading at $7 per coin. This dramatic price movement has left many wondering: Is this a temporary shakeout or a sign of deeper issues?

Technical Analysis

From a technical perspective, BIST:BERA ’s price action is forming a symmetrical triangle pattern on its daily chart. This pattern is typically a continuation signal, suggesting that the asset is consolidating before making its next significant move. The key levels to watch are the upper resistance (ceiling) and the lower support (floor) of the triangle.

- Bullish Scenario: If BIST:BERA breaks above the triangle’s ceiling, it could trigger a bullish run with an estimated upside potential of 107%. This would likely attract fresh buying interest, pushing the price toward new highs.

- Bearish Scenario: Conversely, if the price fails to break out and instead falls below the triangle’s support level, BIST:BERA could test the $5 support zone. This scenario would likely be driven by profit-taking from early investors and airdrop participants.

The current price dip of 28.06% in the last 24 hours may seem alarming, but it could also be a healthy correction after the initial euphoria. The symmetrical triangle pattern suggests that the market is undecided, and the next major move will depend on whether buyers or sellers gain control.

Berachain’s Innovative Approach to Blockchain

Beyond the price action, BIST:BERA ’s underlying technology and ecosystem are worth examining. Berachain is not just another Layer 1 blockchain; it introduces several innovative features that set it apart from its competitors.

1. Proof of Liquidity (PoL): A Novel Consensus Mechanism

Berachain’s Proof of Liquidity (PoL) is a groundbreaking consensus mechanism that aligns network security with liquidity provision. Unlike traditional Proof of Work (PoW) or Proof of Stake (PoS) systems, PoL incentivizes users to provide liquidity to the network, ensuring a more robust and efficient ecosystem.

2. EVM Compatibility and Modular Design

Berachain is fully compatible with the Ethereum Virtual Machine (EVM), making it an attractive option for developers looking to build or migrate decentralized applications (dApps). Its modular design allows for the creation of customized Layer 1 blockchains without sacrificing interoperability or performance.

3. Two-Token Model: BERA and BGT

Berachain operates on a unique two-token model:

- BERA: Used for gas fees and staking, BERA is the utility token that powers the network.

- BGT: A non-transferable governance and rewards token, BGT aligns the interests of network participants by incentivizing long-term engagement.

Market Sentiment and Exchange Listings

The current market cap of $806 million and a circulating supply of 107.48 million BERA coins indicate that the token is still in its early stages. With a max supply yet to be determined, BIST:BERA has room for growth as the ecosystem matures and adoption increases.

Conclusion

While the 50% dip may deter some investors, the technical and fundamental factors suggest that this could be a buying opportunity for those with a higher risk tolerance.

As always, it’s crucial to conduct thorough research and consider your risk appetite before investing in any cryptocurrency. BIST:BERA ’s journey is just beginning, and its future will depend on both market dynamics and the team’s ability to deliver on its ambitious vision. Whether you’re a trader or a hodler, BIST:BERA is undoubtedly a coin to watch in the coming weeks and months.