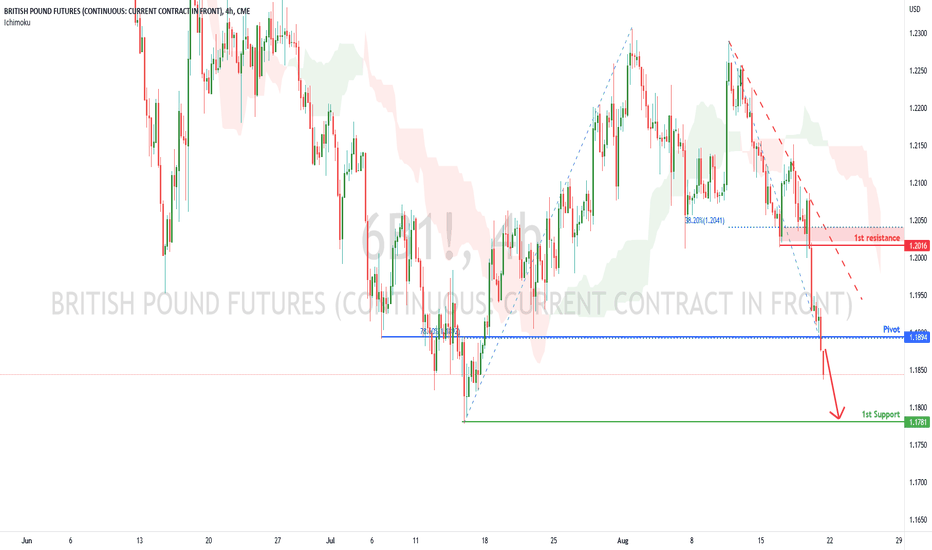

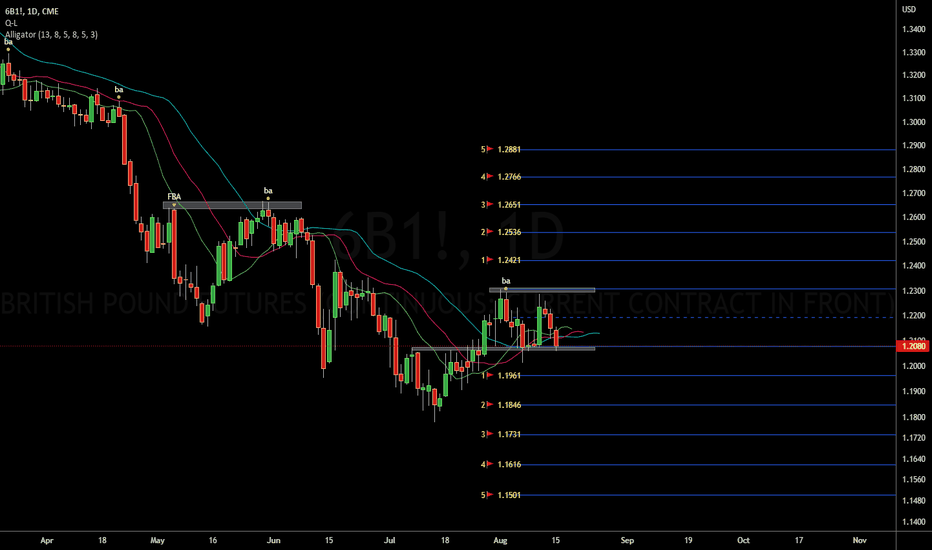

BRITISH POUND Futures (6B1!), H4 Potential for Bearish DropType : Bearish Drop

Resistance : 1.2016

Pivot: 1.1894

Support : 1.1781

Preferred Case: On the H4, with the price moving below the ichimoku cloud and moving within the descending trend line , we have a bearish bias that the price may drop from the pivot at 1.1894, which is in line with the 78.6% fibonacci retracement to the 1st support at 1.1781, where the swing low is.

Alternative scenario: Alternatively, price may rise to the 1st resistance at 1.2016, which is in line with the 38.2% fibonacci retracement .

Fundamentals: the retail sales data (0.3%) was out today, which is higher than the expected and previous (-0.2%), which is a positive signal of economy, therefore we could expect the drop momentum decrease recently.

GBPUSD1! trade ideas

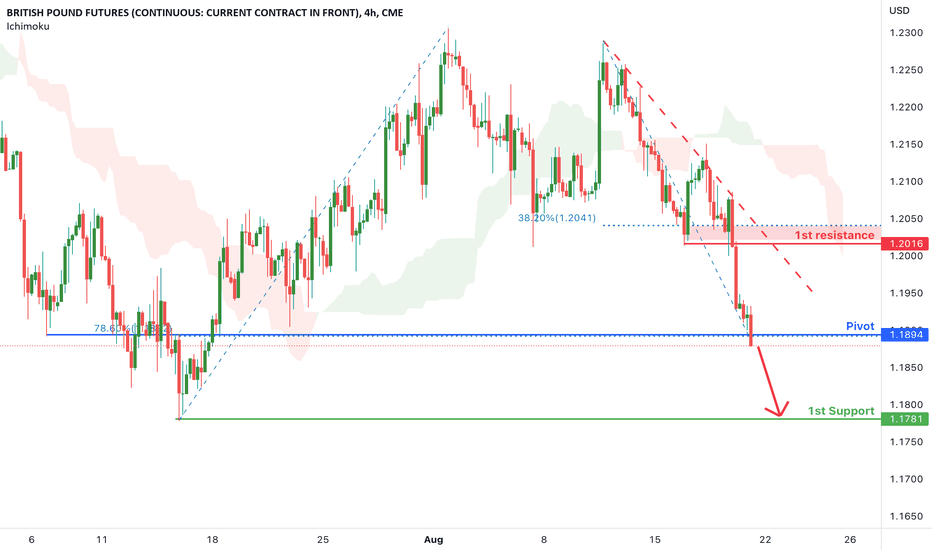

BRITISH POUND Futures (6B1!), H4 Potential for Bearish DropType : Bearish Drop

Resistance : 1.2016

Pivot: 1.1894

Support : 1.1781

Preferred Case: On the H4, with the price moving below the ichimoku cloud and moving within the descending trend line, we have a bearish bias that the price may drop from the pivot at 1.1894, which is in line with the 78.6% fibonacci retracement to the 1st support at 1.1781, where the swing low is.

Alternative scenario: Alternatively, price may rise to the 1st resistance at 1.2016, which is in line with the 38.2% fibonacci retracement.

Fundamentals: the retail sales data (0.3%) was out today, which is higher than the expected and previous (-0.2%), which is a positive signal of economy, therefore we could expect the drop momentum decrease recently.

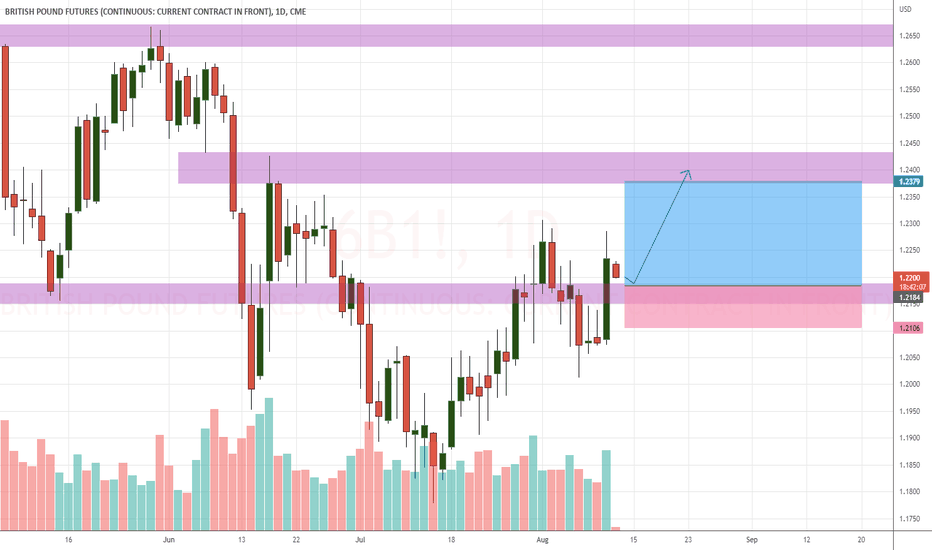

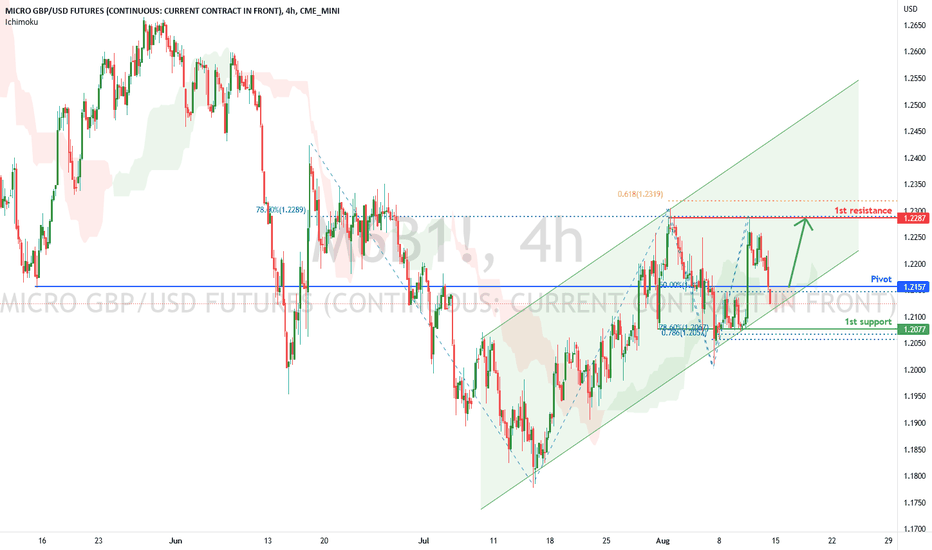

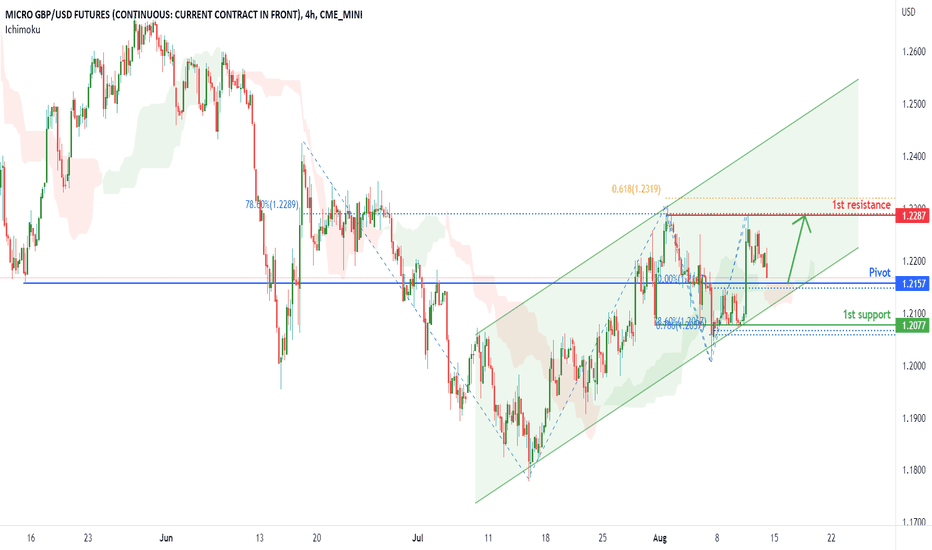

Micro GBPUSD Futures (M6B1!), H4 Potential for Bullish RiseType : Bullish Rise

Resistance : 1.2287

Pivot: 1.2157

Support : 1.2077

Preferred Case: On the H4, with price moving above the ichimoku indicator and within the ascending channel , we have a bullish bias that price will rise from the pivot at 1.2157 where the pullback support and 50% fibonacci retracement are to the 1st resistance at 1.2287 in line with swing high resistance, 78.6% fibonacci retracement and 61.8% fibonacci projection .

Alternative scenario: Alternatively, price could break pivot structure and drop to 1st support at 1.2077 where the pullback support, 78.6% fibonacci retracement and 78.6% fibonacci projection are.

Fundamentals: The UK's Prelim GDP q/q and GDP m/m are anticipated to show a decline in economic activity. This gives us a bearish view on GBPUSD . We'll need to exercise caution for this setup because our fundamentals and technicals are not completely aligned.

Micro GBPUSD Futures (M6B1!), H4 Potential for Bullish RiseType : Bullish Rise

Resistance : 1.2287

Pivot: 1.2157

Support : 1.2077

Preferred Case: On the H4, with price moving above the ichimoku indicator and within the ascending channel , we have a bullish bias that price will rise from the pivot at 1.2157 where the pullback support and 50% fibonacci retracement are to the 1st resistance at 1.2287 in line with swing high resistance, 78.6% fibonacci retracement and 61.8% fibonacci projection .

Alternative scenario: Alternatively, price could break pivot structure and drop to 1st support at 1.2077 where the pullback support, 78.6% fibonacci retracement and 78.6% fibonacci projection are.

Fundamentals: The UK's Prelim GDP q/q and GDP m/m are anticipated to show a decline in economic activity. This gives us a bearish view on GBPUSD. We'll need to exercise caution for this setup because our fundamentals and technicals are not completely aligned.

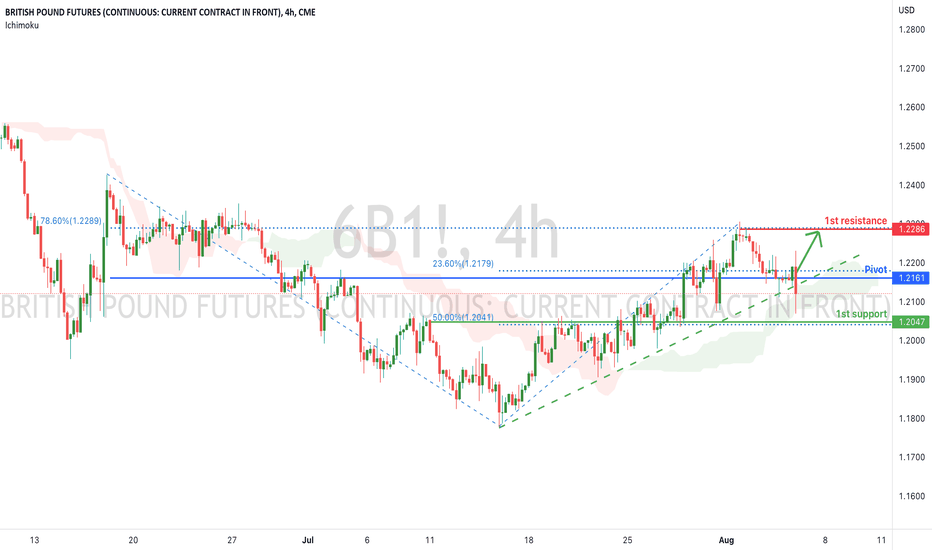

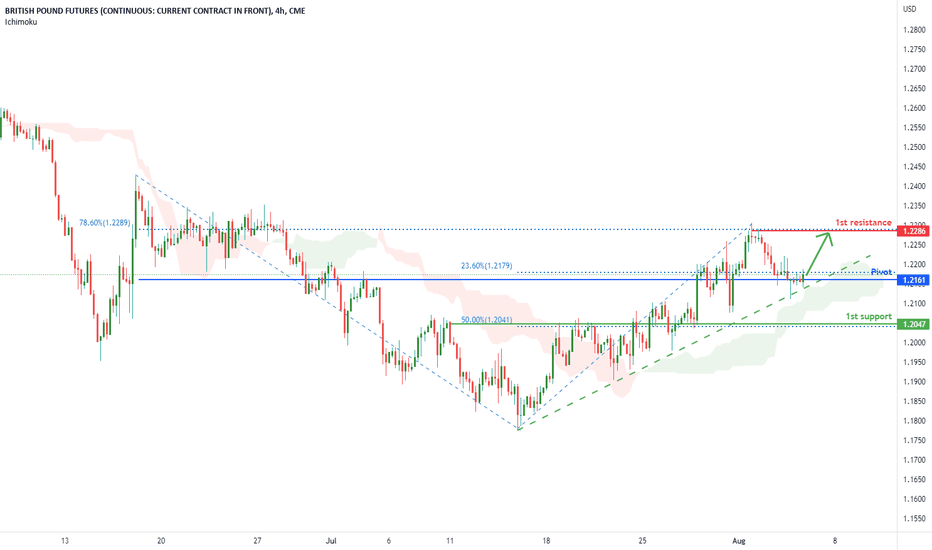

British Pound Futures (6B1!), H4 Potential for Bullish MomentumType : Bullish Rise

Resistance : 1.2286

Pivot: 1.2161

Support : 1.2047

Preferred Case: On the H4, with icpre moving along the ascending trendline and above ichimoku cloud , we have a bullish bias the price may rise from the pivot at 1.2161, where the 23.6% fibonacci retracement is to 1st resistance at 1.2286, which is in line with the 78.6% fibonacci retracement .

Alternative scenario: Alternatively, price could drop to the 1st support at 1.2047, which is in line with 50% fibonacci retracement .

Fundamentals: The interest rate in the UK is at 1.25% with the recent rate increases from the BoE failing to have an impact on slowing inflation growth, as the UK CPI stands at 9.1%, a 4-decade high. The BoE is under pressure to take on a more aggressive approach in setting future policy rates. Gov Bailey indicated that the BoE could increase interest rates by 50bps as it attempts to address the issue of persistent inflation .

British Pound Futures (6B1!), H4 Potential for Bullish MomentumType : Bullish Rise

Resistance : 1.2286

Pivot: 1.2161

Support : 1.2047

Preferred Case: On the H4, with icpre moving along the ascending trendline and above ichimoku cloud, we have a bullish bias the price may rise from the pivot at 1.2161, where the 23.6% fibonacci retracement is to 1st resistance at 1.2286, which is in line with the 78.6% fibonacci retracement.

Alternative scenario: Alternatively, price could drop to the 1st support at 1.2047, which is in line with 50% fibonacci retracement.

Fundamentals: The interest rate in the UK is at 1.25% with the recent rate increases from the BoE failing to have an impact on slowing inflation growth, as the UK CPI stands at 9.1%, a 4-decade high. The BoE is under pressure to take on a more aggressive approach in setting future policy rates. Gov Bailey indicated that the BoE could increase interest rates by 50bps as it attempts to address the issue of persistent inflation.

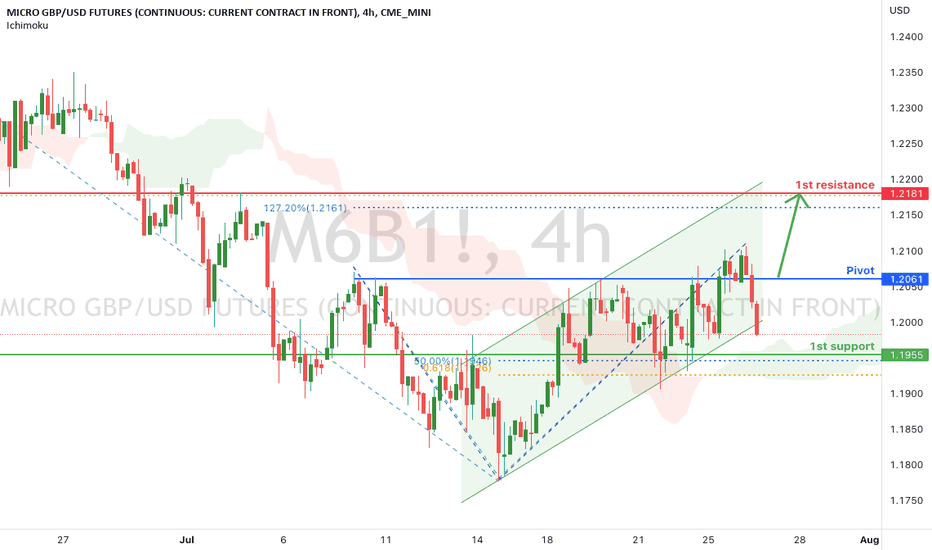

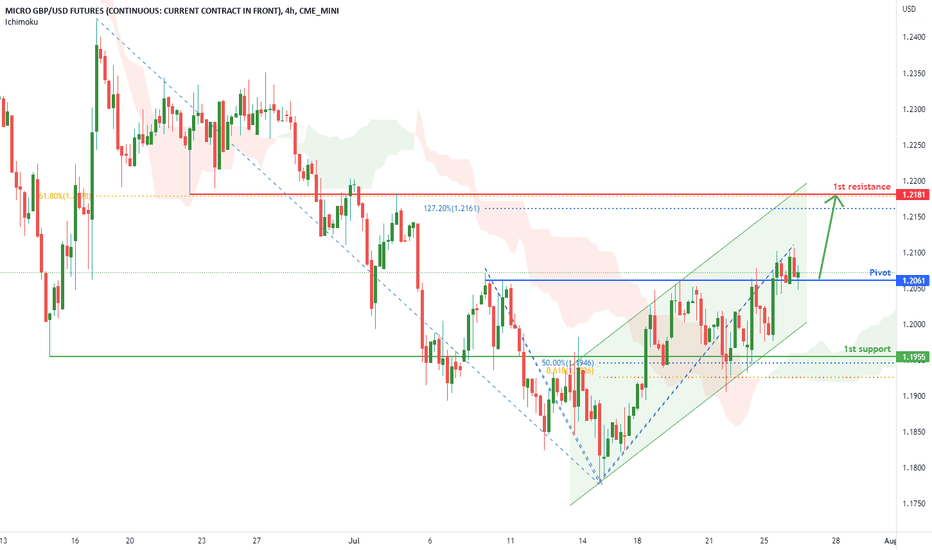

Micro GBP/USD Futures (M6B1!), H4 Potential for Bullish RiseType : Bullish Rise

Resistance : 1.2181

Pivot: 1.2061

Support : 1.1955

Preferred Case: On the H4, with prices moving within an ascending channel and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 1.2061 where the pullback support is to the 1st resistance at 1.2181 where the overlap resistance, 61.8% fibonacci retracement and 127.2% fibonacci extension are.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 1.1955 where the pullback support, 50% fibonacci retracement and 61.8% fibonacci projection are.

Fundamentals: Due to the current political uncertainty in the UK, rampant inflation and relatively modest interest rate increases, we have a bearish bias on the GBPUSD . We'll need to exercise caution for this setup because our fundamentals and technicals are not completely aligned.

Micro GBP/USD Futures (M6B1!), H4 Potential for Bullish RiseType : Bullish Rise

Resistance : 1.2181

Pivot: 1.2061

Support : 1.1955

Preferred Case: On the H4, with prices moving within an ascending channel and above the ichimoku indicator, we have a bullish bias that price will rise from the pivot at 1.2061 where the pullback support is to the 1st resistance at 1.2181 where the overlap resistance, 61.8% fibonacci retracement and 127.2% fibonacci extension are.

Alternative scenario: Alternatively, price could break pivot structure and drop to the 1st support at 1.1955 where the pullback support, 50% fibonacci retracement and 61.8% fibonacci projection are.

Fundamentals: Due to the current political uncertainty in the UK, rampant inflation and relatively modest interest rate increases, we have a bearish bias on the GBPUSD. We'll need to exercise caution for this setup because our fundamentals and technicals are not completely aligned.

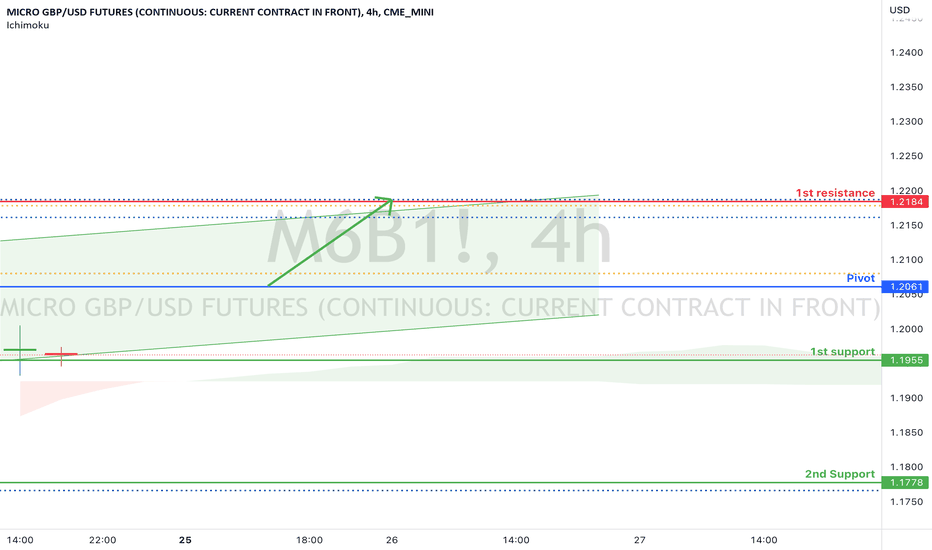

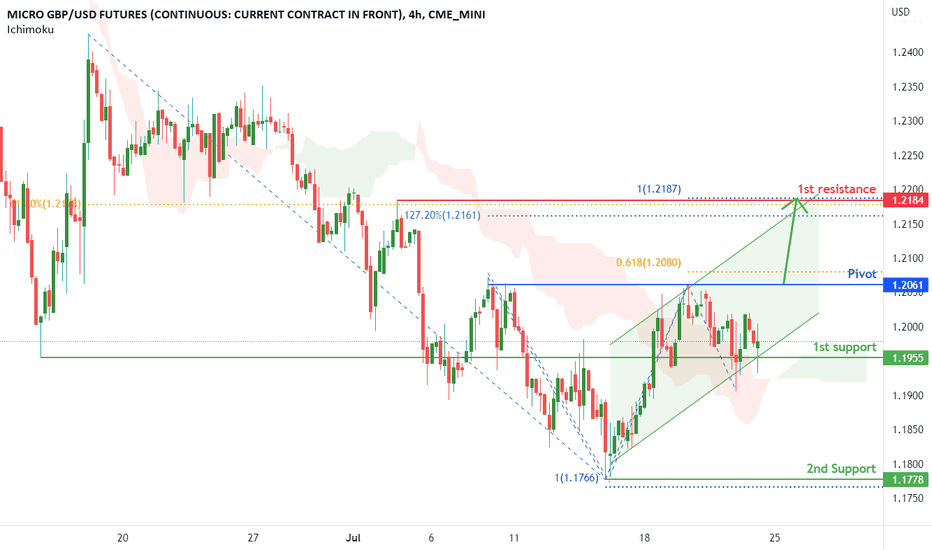

Micro GBP/USD Futures (M6B1!), H4 Potential for Bullish RiseType : Bullish Rise

Resistance : 1.2184

Pivot: 1.2061

1st Support : 1.1955

2nd Support : 1.1778

Preferred Case: On the H4, with prices moving within an ascending channel and above the ichimoku indicator, we have a bullish bias that price will rise to the pivot at 1.2061 where the swing high resistance and 61.8% fibonacci projection are. Once there is upside confirmation that price has broken the pivot , we would expect bullish momentum to carry prices to 1st resistance at 1.2184 where the swing high resistance,61.8% fibonacci retracement , 100% fibonacci projection and 127.2% fibonacci extension are.

Alternative scenario: Alternatively, price could drop to the 1st support at 1.1955 where the pullback support is. Should price break 1st support, we would have a bearish bias that price will drop to 2nd support at 1.1778 in line with swing low support and 100% fibonacci projection .

Fundamentals: BoE Gov Bailey commented that in order to bring UK inflation towards the 2% target, the BoE could consider more aggressive rate increases of 50bps. This gives us a bullish bias towards the GBPUSD forex pair.

Micro GBP/USD Futures (M6B1!), H4 Potential for Bullish RiseType : Bullish Rise

Resistance : 1.2184

Pivot: 1.2061

1st Support : 1.1955

2nd Support : 1.1778

Preferred Case: On the H4, with prices moving within an ascending channel and above the ichimoku indicator, we have a bullish bias that price will rise to the pivot at 1.2061 where the swing high resistance and 61.8% fibonacci projection are. Once there is upside confirmation that price has broken the pivot, we would expect bullish momentum to carry prices to 1st resistance at 1.2184 where the swing high resistance,61.8% fibonacci retracement, 100% fibonacci projection and 127.2% fibonacci extension are.

Alternative scenario: Alternatively, price could drop to the 1st support at 1.1955 where the pullback support is. Should price break 1st support, we would have a bearish bias that price will drop to 2nd support at 1.1778 in line with swing low support and 100% fibonacci projection.

Fundamentals: BoE Gov Bailey commented that in order to bring UK inflation towards the 2% target, the BoE could consider more aggressive rate increases of 50bps. This gives us a bullish bias towards the GBPUSD forex pair.

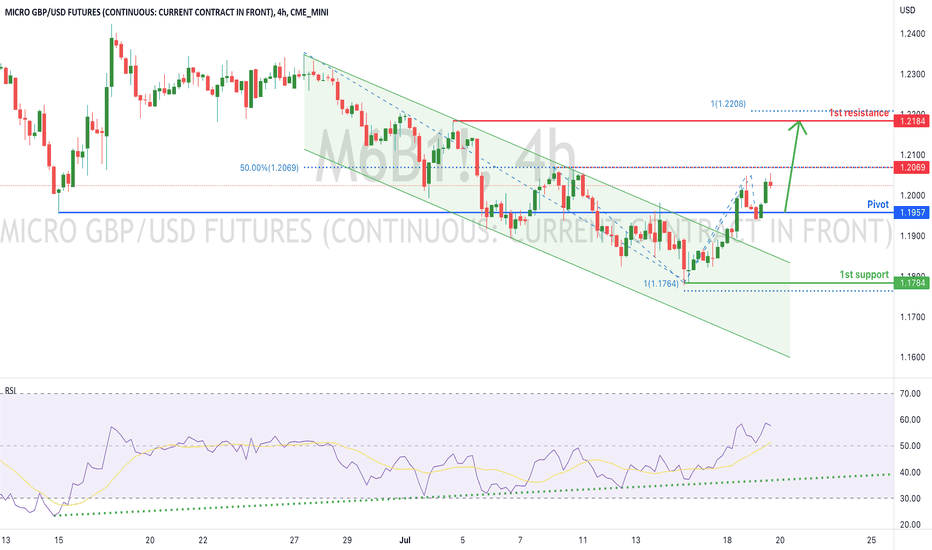

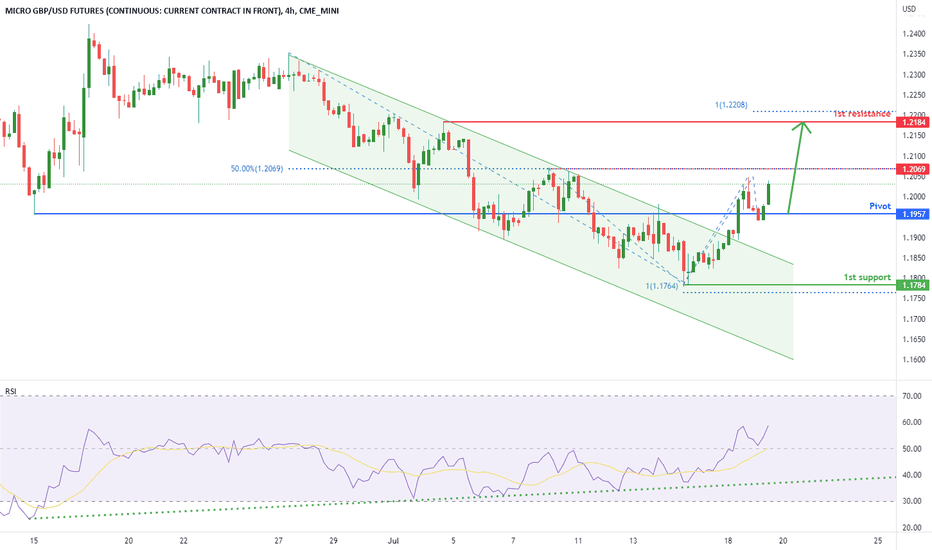

Micro GBP/USD Futures (M6B1!), H4 Potential for Bullish RiseType : Bullish Rise

Resistance : 1.2184

Pivot: 1.1957

Support : 1.1784

Preferred Case: On the H4, as prices has broken out of descending trendline and RSI moving along an ascending trendline, we have a bullish bias that price will rise from the pivot at 1.1957 in line with the pullback support to the 1st resistance at 1.2184 where the swing high resistance and 100% fibonacci projection are. Take note of intermediate resistance at 1.2069 where the swing high resistance and 50% fibonacci retracement are.

Alternative scenario: Alternatively, price may break pivot structure and drop to the 1st support level at 1.1784 in line with the swing low support and 100% fibonacci projection .

Fundamentals: The GBP released weaker than expected employment data, with average earnings at 6.2% (Forecast: 6.7%), and claimant count change at -20.0K (Forecast: -41.2K). However, the overall impact of the data was subdued for several reasons, the DXY is under pressure from a strong Euro , and the data was released earlier than scheduled, catching markets by surprise. This gives us a bullish bias for GBPUSD .

Micro GBP/USD Futures (M6B1!), H4 Potential for Bullish RiseType : Bullish Rise

Resistance : 1.2184

Pivot: 1.1957

Support : 1.1784

Preferred Case: On the H4, as prices has broken out of descending trendline and RSI moving along an ascending trendline, we have a bullish bias that price will rise from the pivot at 1.1957 in line with the pullback support to the 1st resistance at 1.2184 where the swing high resistance and 100% fibonacci projection are. Take note of intermediate resistance at 1.2069 where the swing high resistance and 50% fibonacci retracement are.

Alternative scenario: Alternatively, price may break pivot structure and drop to the 1st support level at 1.1784 in line with the swing low support and 100% fibonacci projection .

Fundamentals: The GBP released weaker than expected employment data, with average earnings at 6.2% (Forecast: 6.7%), and claimant count change at -20.0K (Forecast: -41.2K). However, the overall impact of the data was subdued for several reasons, the DXY is under pressure from a strong Euro, and the data was released earlier than scheduled, catching markets by surprise. This gives us a bullish bias for GBPUSD.

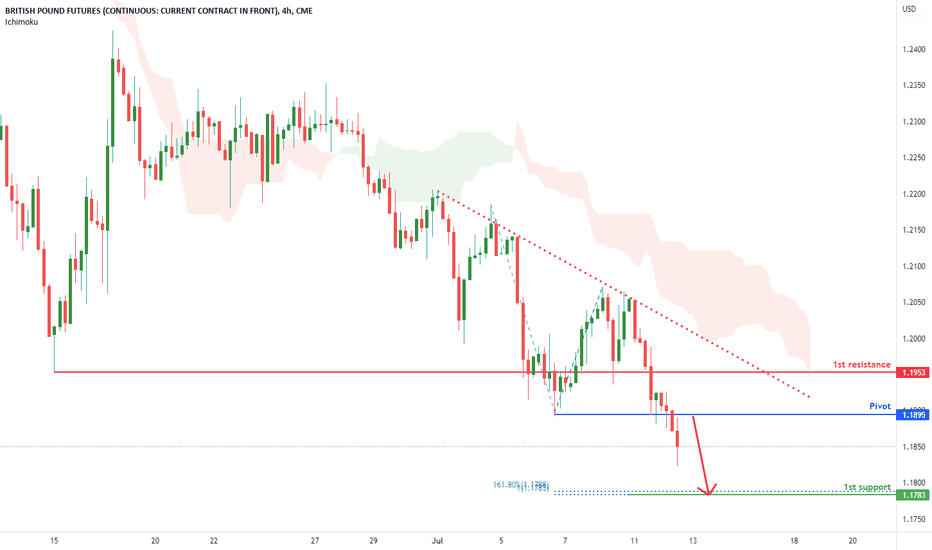

BRITISH POUND FUTURES (6B1!), H4 Potential for Bearish DropType : Bearish Momentum

Resistance : 1.1953

Pivot: 1.1895

Support : 1.1783

Preferred Case: On the H1, with price moving below the ichimoku cloud and along the descending trendline, we have a bearish bias that price will rise and drop from the pivot at 1.1895 in line with the pullback resistance to the 1st support at 1.1783 where the 161.8% fibonacci extension and 100% fibonacci projection are.

Alternative scenario: Alternatively, price may break pivot structure and rise to the 1st resistance at 1.1953 where the pullback resistance is.

Fundamentals: With no major news events ahead, and the dovish sentiment across the UK and the Eurozone, further downside can be expected, which gives us a bearish bias on the British Pound.

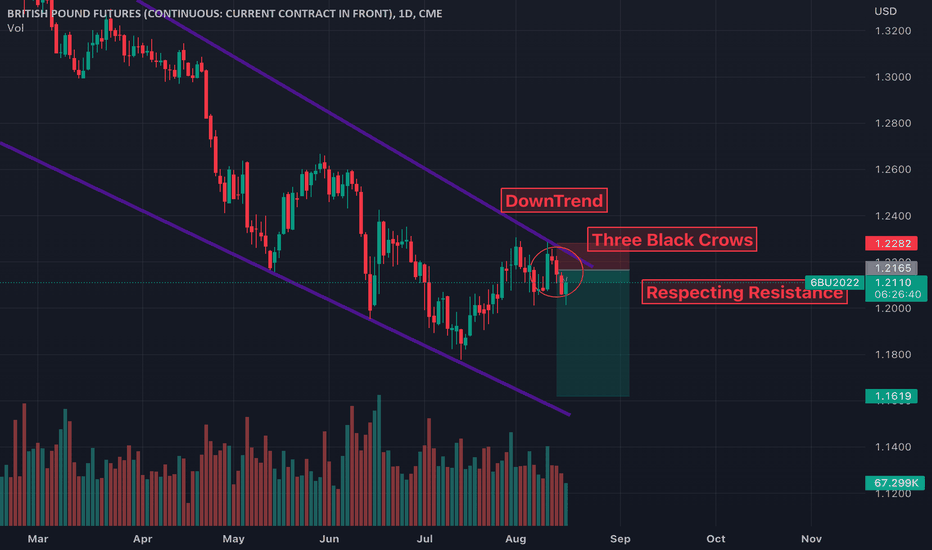

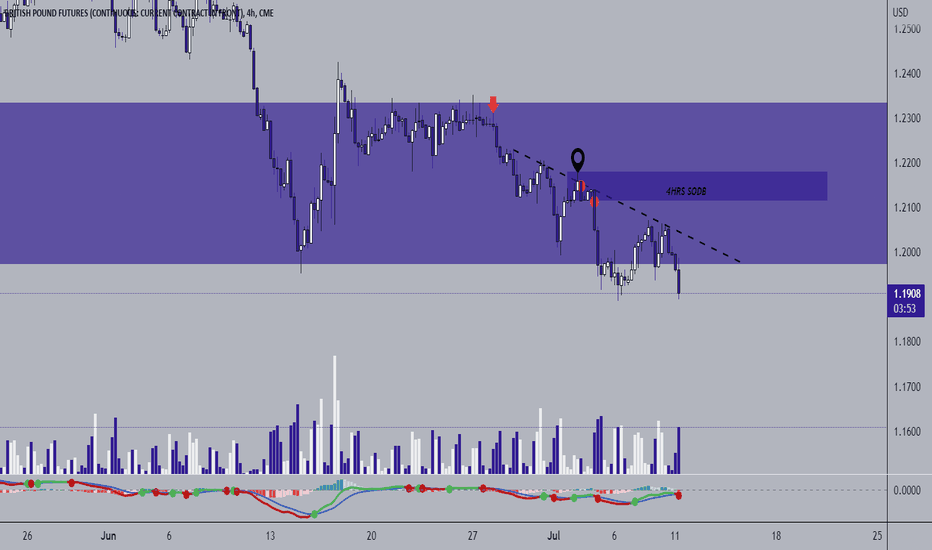

BORIS JOHNSON OR NOT GBP STILL BEARISH!🦊¶REDFOX CAPITAL™¶🦊,

GBP FUTURES!

British pounds have been falling now for several months and now lying on historical support....

Last few days back this currency created a new historical low and bounced up aggressively but still came back into the support that is to say the buy was sponsored by the Government to support the currency from seeing further dumps now after Boris johnson announced resignation this currency once again saw a minor surge up but STILL the PA is still bearish IMO and will continue to see for a while,change can't happen overnight with inflation rate this high.

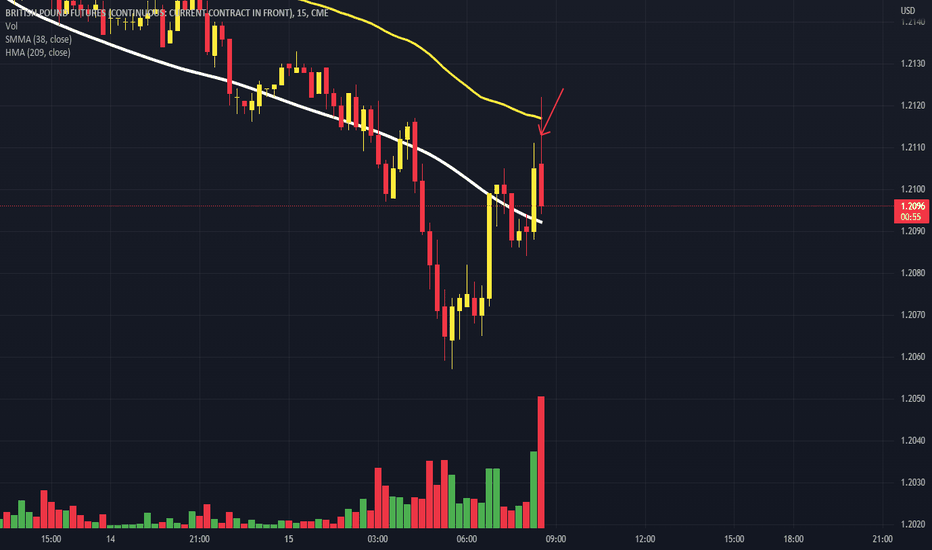

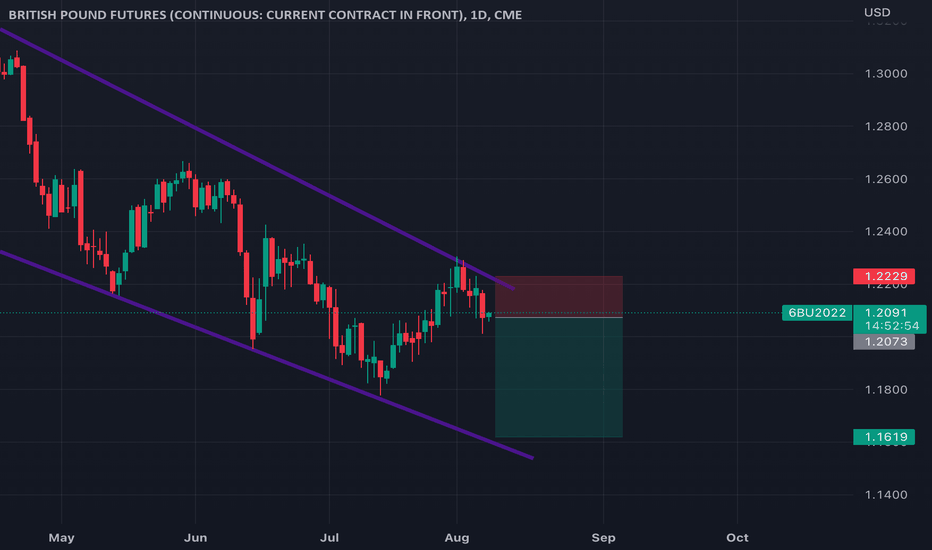

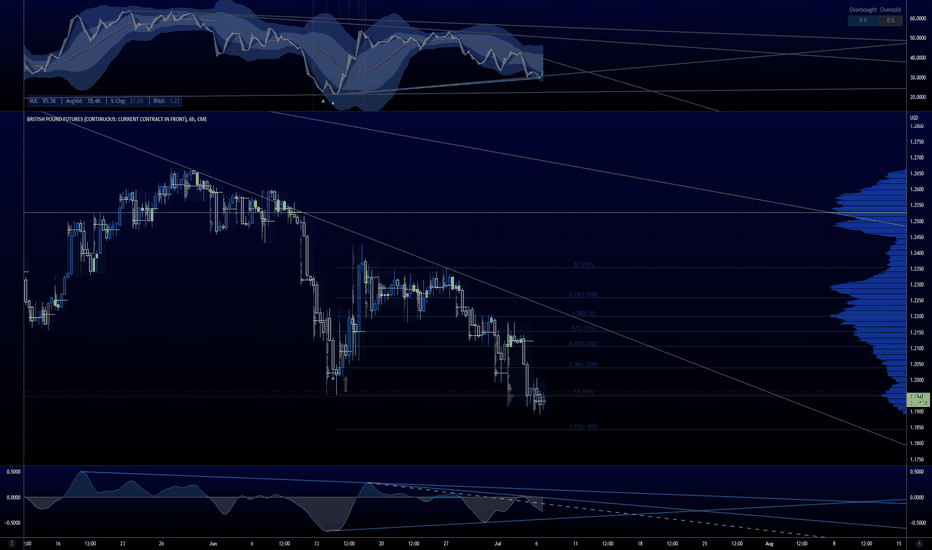

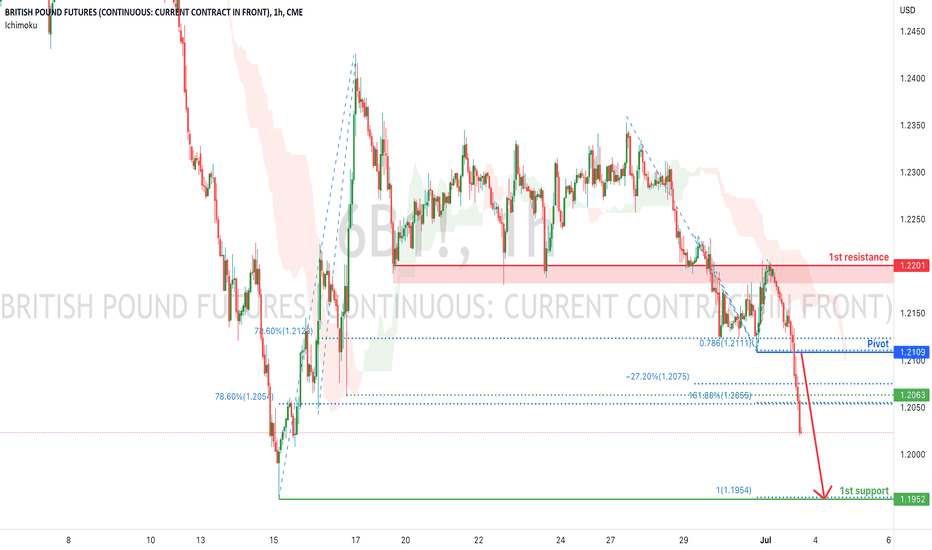

BRITISH POUND FUTURES (6B1!), H1 Potential for Bearish DropType : Bearish Momentum

Resistance : 1.2201

Pivot: 1.2109

Support : 1.1952

Preferred Case: On the H4, with price moving below the ichimoku cloud , we have a bearish bias that price will drop to the pivot at 1.2109 in line with the swing low support, 78.6% fibonacci projection and 78.6% fibonacci retracement . Once there is downside confirmation, we would expect bearish momentum to carry price to intermediate support at 1.2063 where the swing low support, -27.2% fibonacci expansion , 161.8% fibonacci extension and 78.6% fibonacci retracement are. Should price break intermediate support structure, we would expect price to drop to the 1st support at 1.1952 where the swing low support and 100% fibonacci projection are.

Alternative scenario: Alternatively, price may rise rise to the 1st resistance at 1.2201 where the overlap resistance is.

Fundamentals: With inflation at 9.1 percent, the BoE raised the UK interest rate to 1.25 percent. Retail sales in the UK decreased by 4.7% year over year as a result of rising costs having an impact on consumer spending. This gives us a medium bearish bias towards the British Pound.

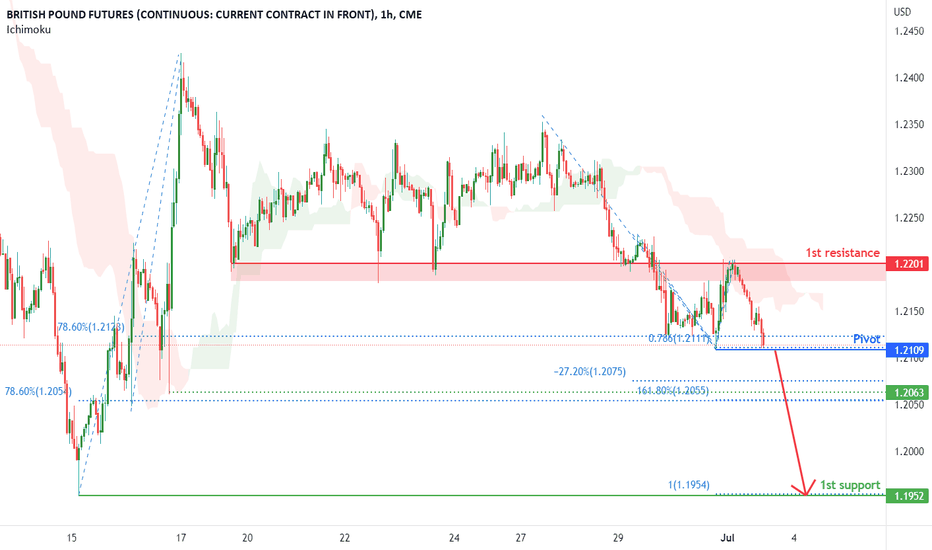

BRITISH POUND FUTURES (6B1!), H1 Potential for Bearish DropType : Bearish Momentum

Resistance : 1.2201

Pivot: 1.2109

Support : 1.1952

Preferred Case: On the H4, with price moving below the ichimoku cloud, we have a bearish bias that price will drop to the pivot at 1.2109 in line with the swing low support, 78.6% fibonacci projection and 78.6% fibonacci retracement. Once there is downside confirmation, we would expect bearish momentum to carry price to intermediate support at 1.2063 where the swing low support, -27.2% fibonacci expansion, 161.8% fibonacci extension and 78.6% fibonacci retracement are. Should price break intermediate support structure, we would expect price to drop to the 1st support at 1.1952 where the swing low support and 100% fibonacci projection are.

Alternative scenario: Alternatively, price may rise rise to the 1st resistance at 1.2201 where the overlap resistance is.

Fundamentals: With inflation at 9.1 percent, the BoE raised the UK interest rate to 1.25 percent. Retail sales in the UK decreased by 4.7% year over year as a result of rising costs having an impact on consumer spending. This gives us a medium bearish bias towards the British Pound.