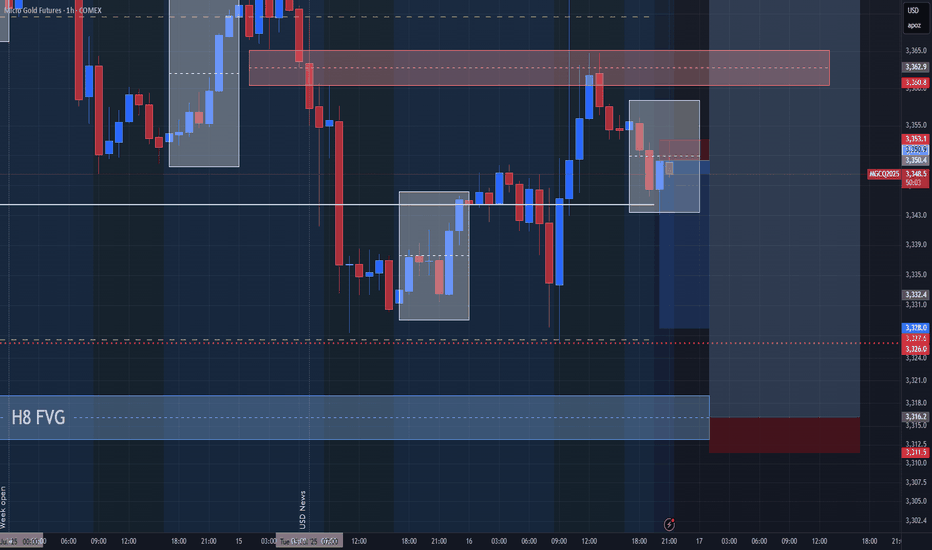

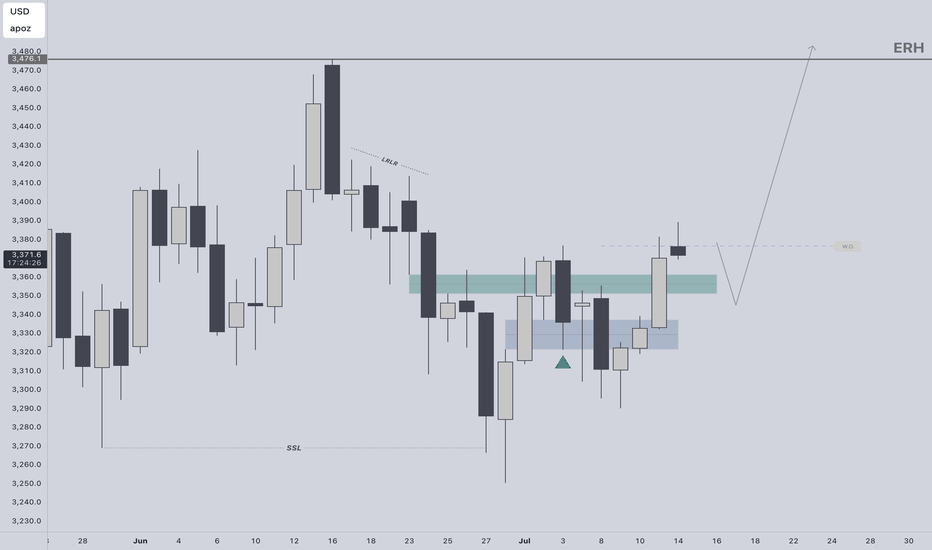

The Gold Retrace for Ultimate Entry!looking for price to continue with its pullback to find where exactly support is. Once we see price establish support we should get some type of signal for entry and price can continue with this bullish price action to make new highs. If we get a full 71.8% pullback that should make for a nice bull run. Just need to wait for the confirmations first before reacting cause we might get a lot of chop until then.

XAUUSDM2025 trade ideas

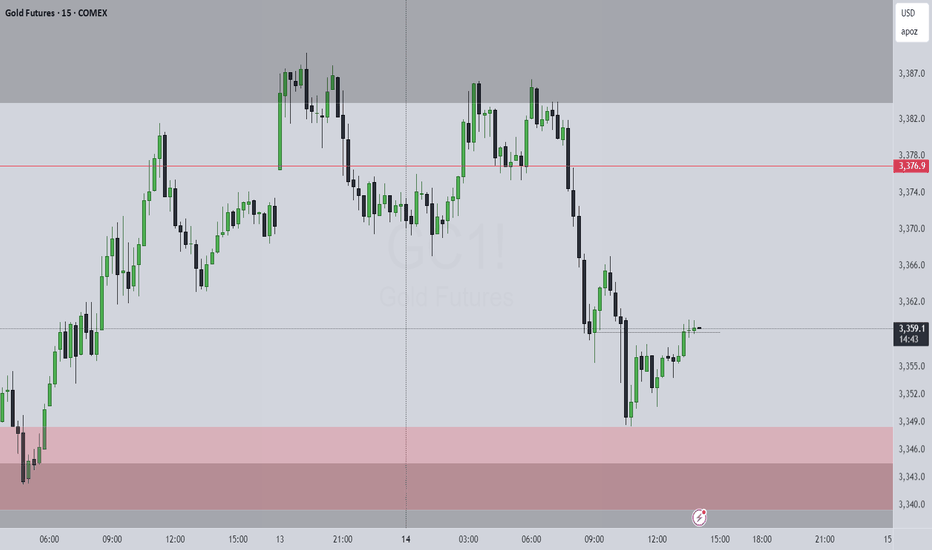

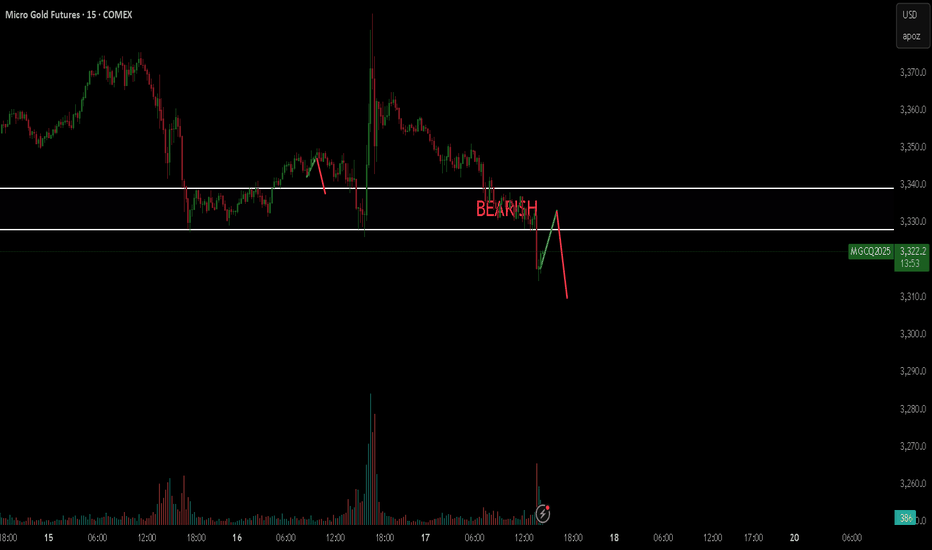

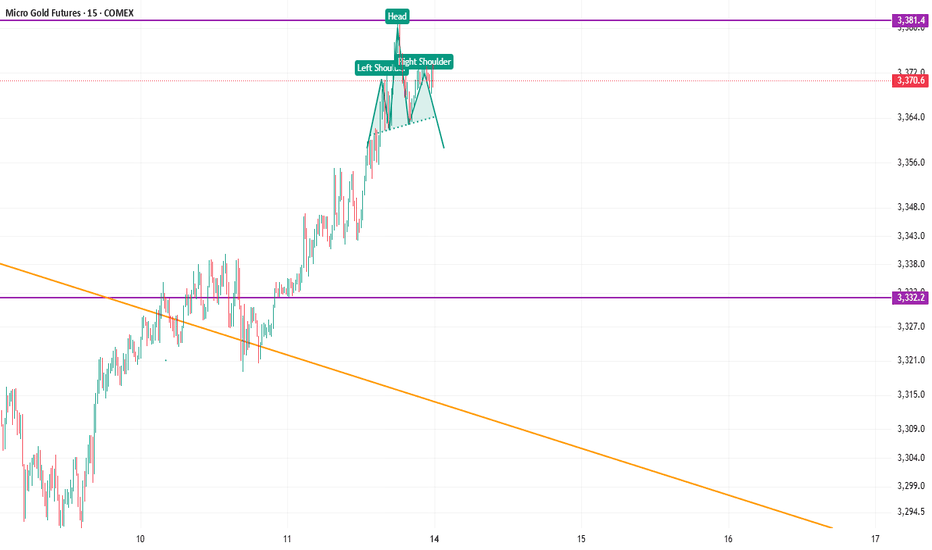

Shorting gold again Well, it does look like there is still some room for a short trade that might actually hit.

Personally, iam not 100% confident in this trade, but i would have liked to see more confirmations before taking the short entry, yet still i think it is still worth the risk.

if you want more confirmations then here is the thing, wait the price to close below this yellow line, and i mean a close not a wick, then wait the price to pullback and take a short position.

my confidence in this setup is 6 out of 10.

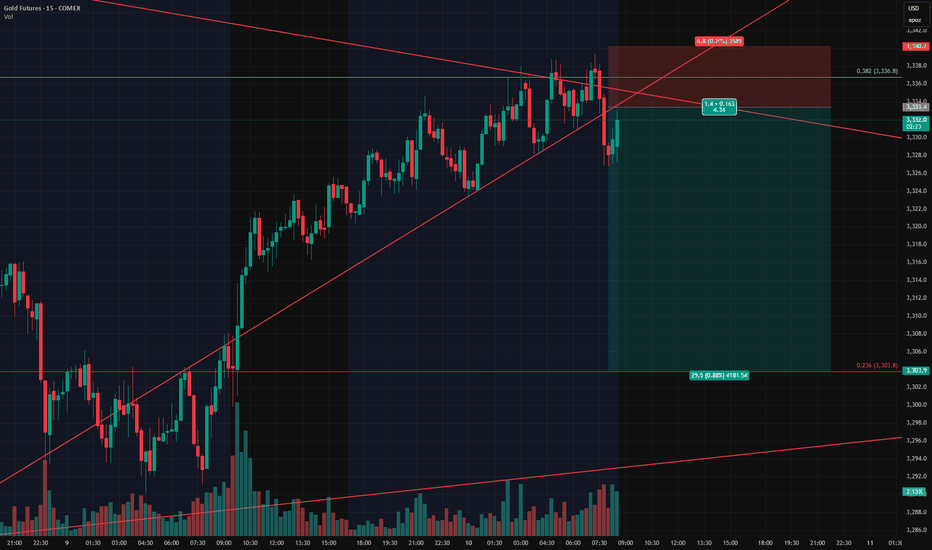

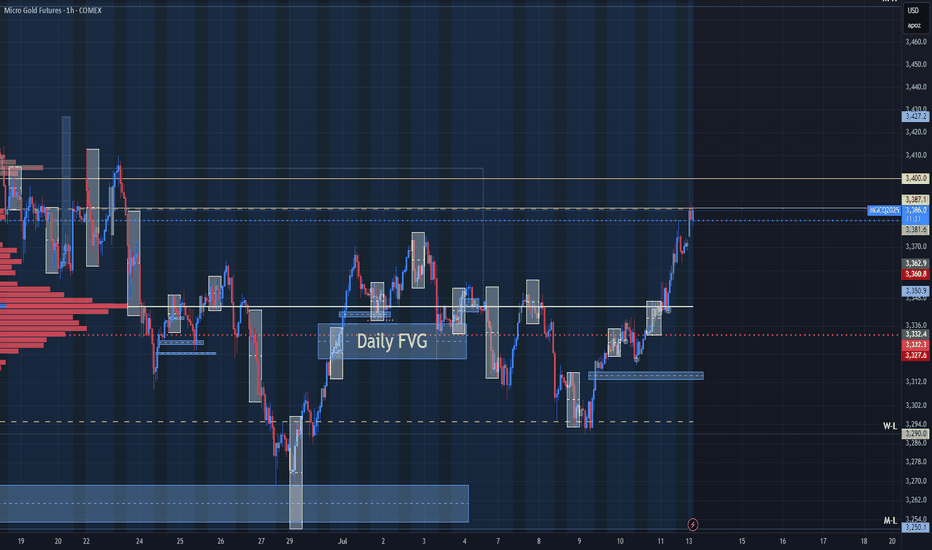

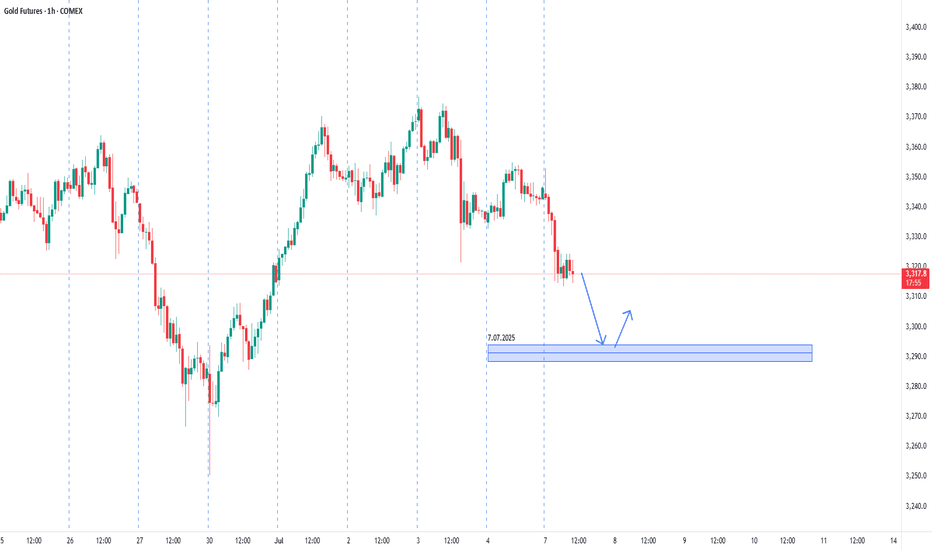

Gold LongsFollowing last weeks bias. Looking for REQH target.

Want to pair longs with a weekly profile. Ideally Monday or Tuesday creates the low of week. Will look to get onside with longs once theres a clear intraweek reversal. Trade the continuation higher. A close below 3320 is invalidation. Expecting previous week low to be protected and expansion to the upside

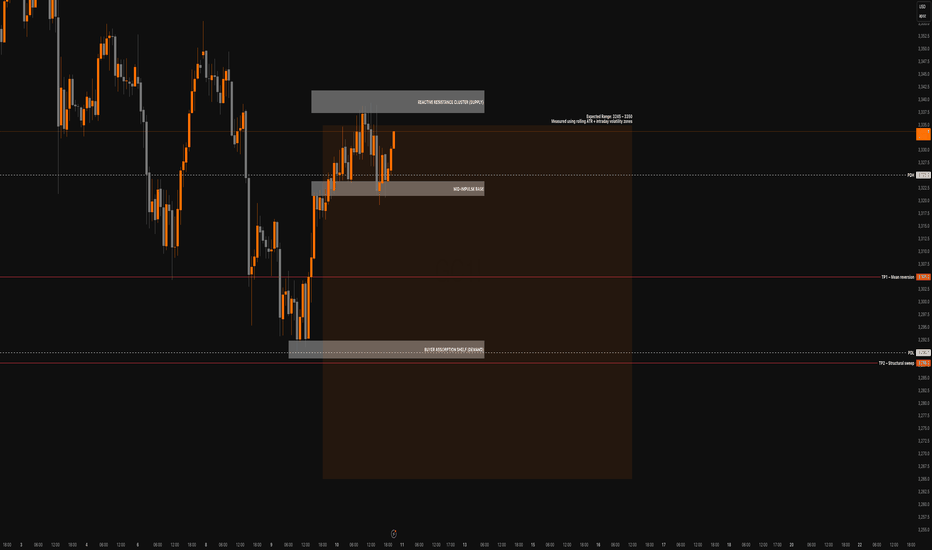

Gold Futures Short Bias Into NY CloseGC is stalling beneath the 3330–3336 resistance cluster after failing to break out during NY session. Price rejected the fair value gap (3312–3318) and is now compressing just above the mean-reversion anchor (LWN). There’s no momentum reclaim from buyers, and structure suggests weakness into Friday.

We’re positioning short into expected downside continuation.

Key Levels

Reactive Resistance Cluster: 3330–3336

FVG (rejected): 3312–3318

Mean-Reversion Anchor (LWN): 3290–3300

Absorption Shelf (Target Zone): 3275

PDH/PDL (provisional): 3325 / 3280

VWAP: Flattened, near 3302

Short Setup (Active)

Entry: 3332

Stop: 3340

TP1: 3305 – Mean reversion

TP2: 3288 – LWN sweep

TP3: 3275 – Absorption shelf

Staakd Setup: 1:5.7 R:R to final target

Bias confirmed by rejection from inefficiency and absence of buyer follow-through

QM Probabilities

Bear Move 60–65% Structure favoUrs continued rejection + flush to 3275

Bull Move 35–40% Requires reclaim of 3318 + aggressive close above VWAP

Range/Flat Possible pre-close Tight range unless displaced overnight

Staakd Bias:

Structure is holding beneath resistance. Without a reclaim of 3318, we remain short-biased into Friday with eyes on 3275. Probability favours continuation unless buyers reclaim initiative fast.

Follow for post-close recap and updated levels ahead of Friday's NY open and we hope your trades worked out how you expected today.

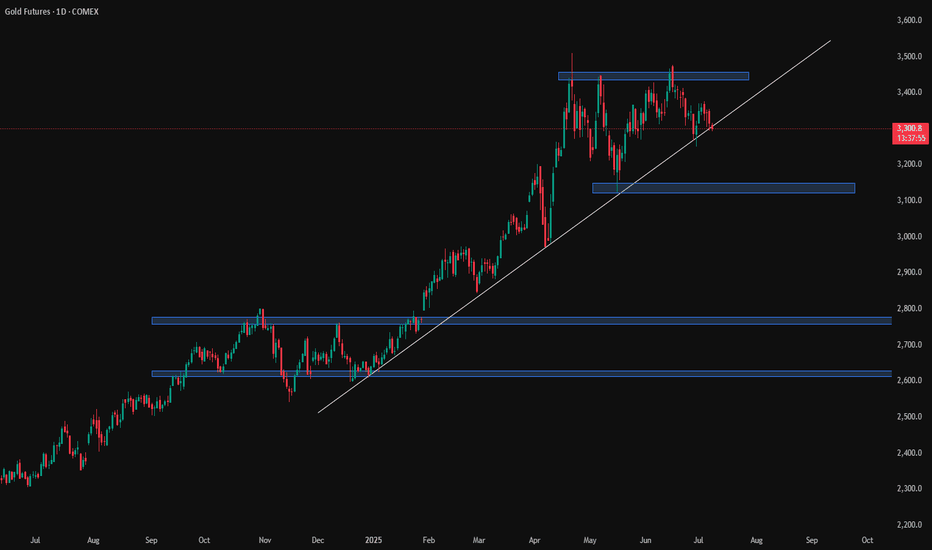

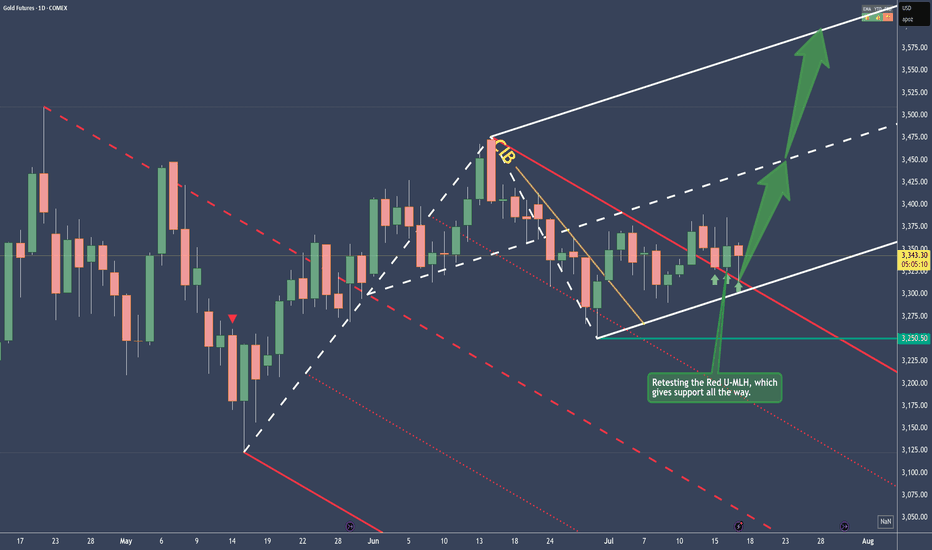

Gold Trade Setup – Long Invalidated, Watching Retest for ShortGold has been consolidating between $3,200 and $3,500, recently pressing against a descending resistance line that has rejected price several times. I was favoring the upside, but our long setup was invalidated — the stop loss at $3,330 was hit.

Price is now retesting ascending support, and I'm shifting focus to a short opportunity, using our previous long entry level (~$3,333) as a key area of interest for entries.

Here’s the updated plan:

Short Entry: Around $3,333

Stop Loss: $3,340

Take Profit: $3,303

Remaining cautious but opportunistic — the larger structure is vulnerable and could break further if support fails.

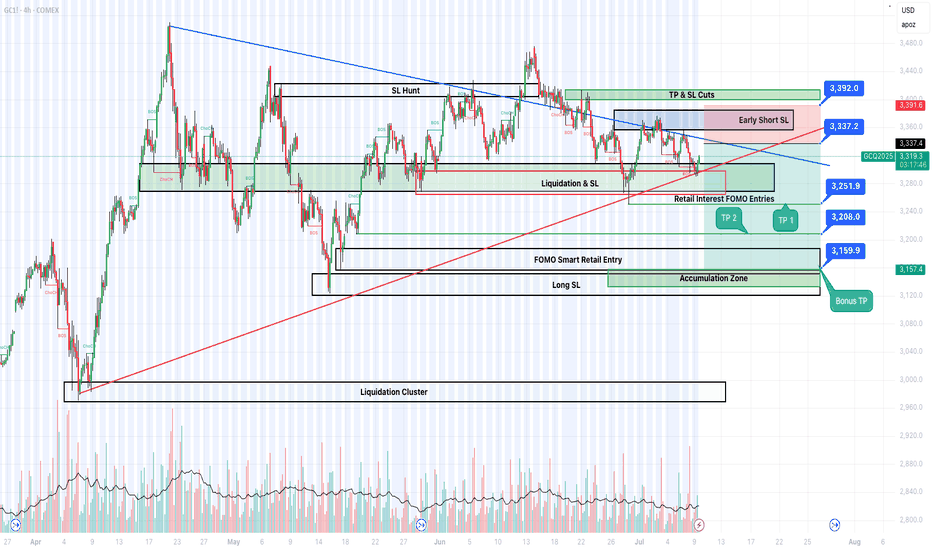

Retail trapped. Volume confirmed. Liquidity targeted.🔻 We are in a highly reactive zone where emotional long entries and early short SLs create perfect liquidity magnets.

🔍 Key Levels & Zones:

• Early Short SL Zone → 3337.2

• Retail FOMO Entry Block → 3251.9

• Volume-based Rejection Point → 3392.0 (SL/TP sweep)

• TP1 & TP2 Zones → 3251.9 / 3208.0

• Bonus TP → 3159.9 → Complete sweep of long SLs and demand exhaustion

• Final Trap Exit Zone → 3157.4 — Institutional reload zone

💡 Volume confirms this cycle of:

• Trap > SL hunt > Emotional entry > Volume fade > Dump > Accumulation > Reversal

🧠 This is NOT financial advice. I post to share deeper insight into manipulation mechanics & sniper-level liquidity structure analysis.

If you’re still trading candles, you’re playing retail games. Start seeing the architecture.

🧷#XAUUSD #SmartMoney #LiquiditySweep #VolumeStrategy #TradingPsychology #RetailTrap #SniperMindset

This is a good video7.14 . 25 this is a great video because there are so many examples of patterns to look at and there weren't that many markets that I was following and about 3 or 4 of the markets actually had dramatic movement in the direction you would expect and this is an example of setting up your pattern and letting the pattern take care of you as it gives you the probable Direction the market would take and there would have been no significant drawdowns or retest associated with stops... As was seeing in the coffee Market.

New Week on Gold! Will the Bullishness continue?I was bullish on gold and price ended up doing as expected last week and looking for it to continue this week. But i have to sit on hands for now to see how they want to play Monday. Will they move to create a Low for the week first? or will they break out to start early on new highs? I have to see some type of confirmation first. Then we can get active.

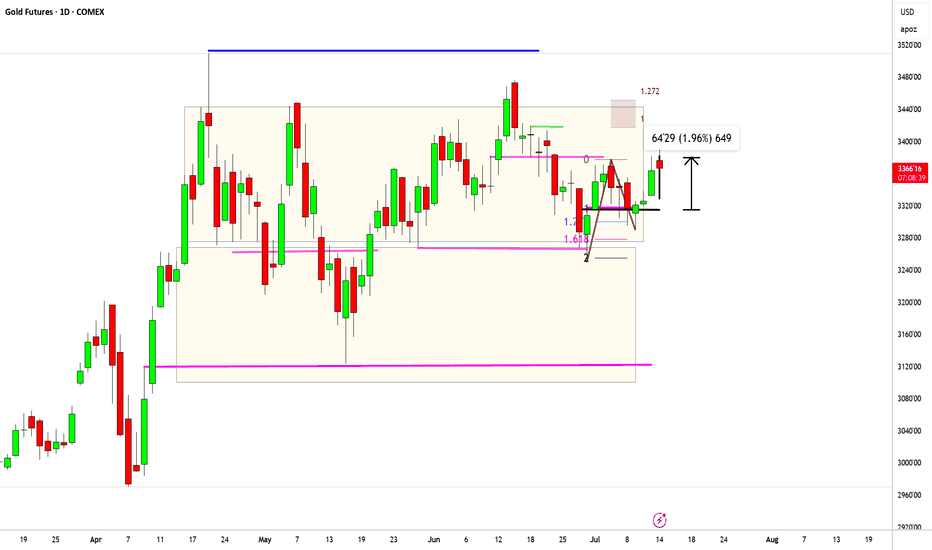

Gold - Bullish and here's whyPrice traveled within the Red Fork, until it broke the CIB Line, which is indicating a Change In Behavior.

From there on, sideways action, until the break of the Red U-MLH happened.

After the close above the Red U-MLH, price has tested it the 3rd time now. At the time of writing, the Bar looks like a PinBar. So it has good sepparation from the bottom, or a long Down-Wick. That's indicates good strenght.

To me this looks like a good long trade, but as everytime, play it save and don't let greed eat your brain ;-)

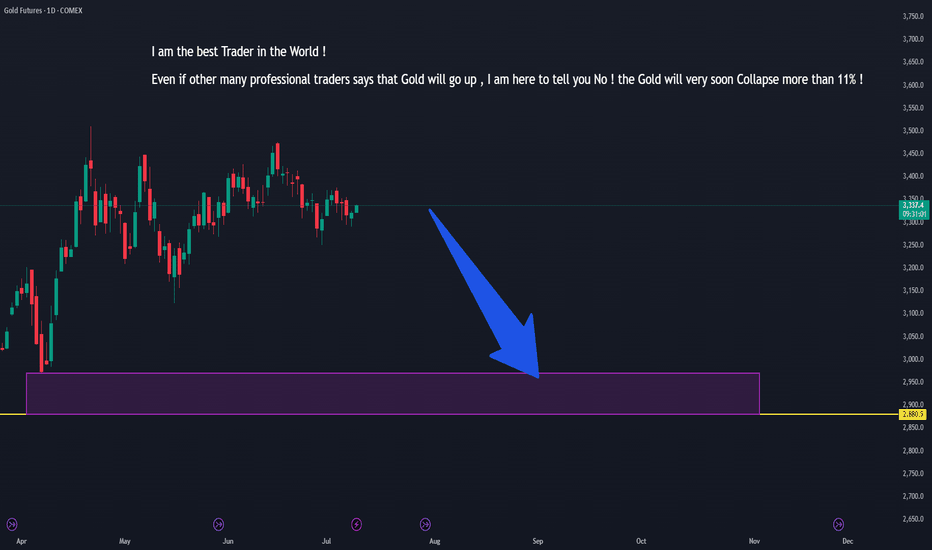

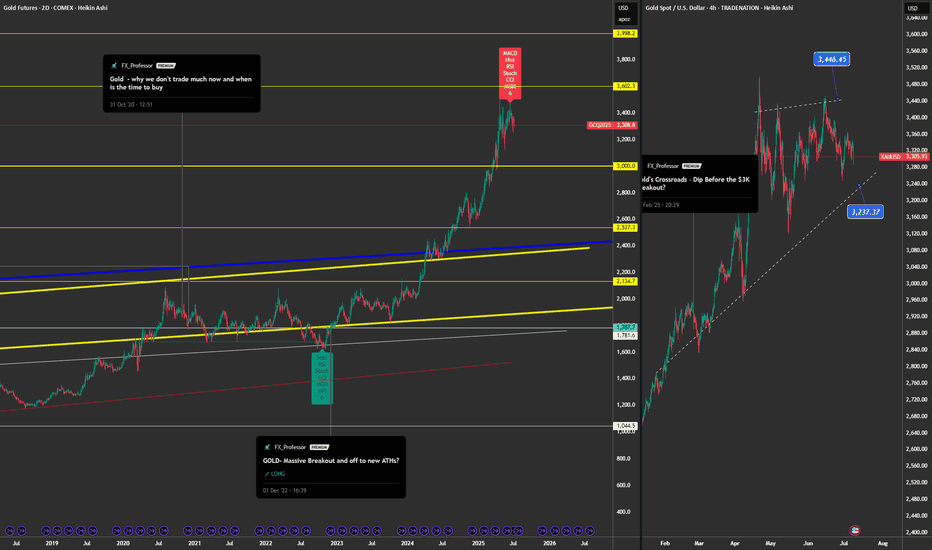

Goldman Says $4K – My Chart Says Sell💥📉 Gold Analysis – Divergences, Resistance, and a Short Bias 🪙⚠️

Hey Traders,

As promised in the latest video, here's the official chart update for Gold – and the message is clear: I'm short.

📊 What I See on the Chart

We're now well below the 3,446 resistance, with early signs of weakness showing up across multiple timeframes. I’ve laid out both the 2-Day and 4H charts in this post, and here’s what I’m tracking:

⚠️ Technical Warning Signs:

🔻 2D chart: Six bearish divergences

– RSI, Stochastic, CCI, OBV, MFI, and MACD all flashing red

📉 1D chart: Same thing — six divergences, telling me momentum is fading

⏳ 4H chart: Price action breaking trendlines, and support at 3,237 looks shaky

🚨 If that breaks, my main support zone is at $3,000 – and that’s where I believe we’re heading.

This is not just a pullback. This is the kind of confluence you can’t ignore if you trade technically.

🔁 Sentiment Shift

Back in December '22 and again earlier this year, I was long Gold – and it was the right call. But now?

📌 This chart has gone from momentum to exhaustion.

📌 I see less demand, softer momentum, and strong bearish divergence stacking across every major timeframe I watch.

🎯 Trade View

✅ I’m short Gold.

🎯 Targeting the $3,000–3,050 zone.

📉 Invalidated if we reclaim and close above $3,446 with strength.

It’s that simple. Nothing personal – just structure, divergence, and flow.

🧠 The Chart vs. The Narrative

Recently, I saw a note from Goldman Sachs forecasting $4,000 Gold. Maybe they’re right.

But I’ll be honest with you – I don’t buy the media hype.

I'm not here for the headlines.

I'm a chart guy. Always have been. Always will be.

The chart is the map to the treasure – and that’s the only thing I follow.

🧠 I cover this and the broader macro setup (Dollar, BTC, DAX, Tech, BTC.D, and more) in the full 20-min video just dropped. If you haven’t watched it yet, go catch up — it explains the logic and why this isn’t just a gold story.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Shoring GoldSo here we go again with gold.

there are two theories at this point, a bullish case and a bearish case.

The bullish case that the price broke a bearish trend and moving upwards.

For a bearish case, the price didn't close that strong above the last swing. Also the whole structure is bearish so this last up move could be very well a trap for buyers.

On the 4h tf, there is an FVG, bearish one that the price so far is reacting to.

So Even though there is a strong up move, i still lean bearish.

Later today once i get a confirmation, i will update the idea.

I might be very wrong on this trade, my confidence in this trade is 4 out of 10. So Use smaller size position.

Also iam expecting the price to revisit 3320 USD

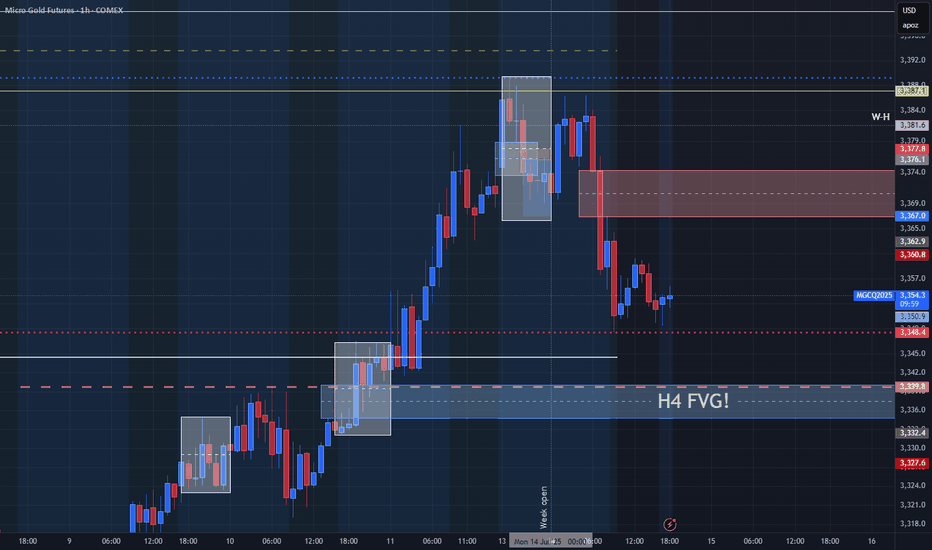

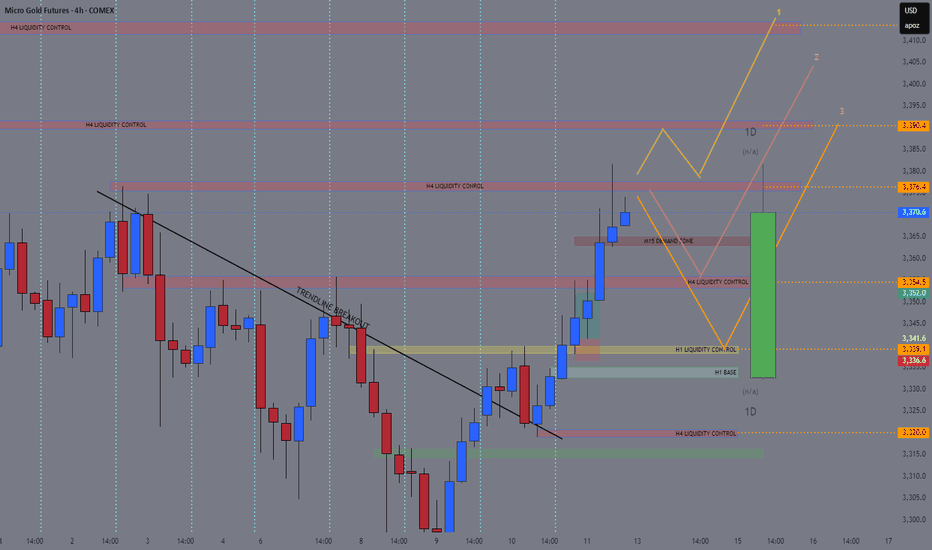

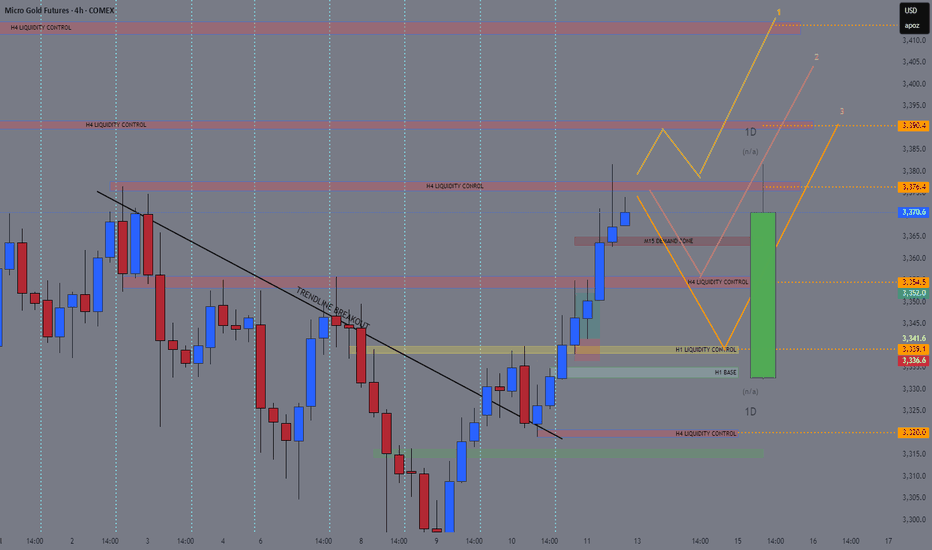

GOLD TRADING IDEA FOR 14-18 JULY 2025The price of Gold currently at the H4 liquidity control area at 3376. It's seem like there candlestick H4 rejection at that area but still not valid for market structure shift direction.

If the candlestick breakout above at H4 liquidity control ,I will looking opportunity for long position with target at next H4 liquidity control at 3390 or extension target at 3410.

short term SELL

Price retracement before the price going up.

If small timeframe show market structure shift or develop bearish engulfing pattern at H1 0r m30 below 3376 . The target will be h4 liquidity control at 3354 or 3320 depend on how price act at that area.

Shorting Gold again and againYep, Iam still thinking that gold should be shorted. Even though that i can see there is some huge liquidity up which should draw the money to it, but still on bigger timeframes, it shows weakness.

So here it is with targets. hopefully it goes through.

Good luck everyone.

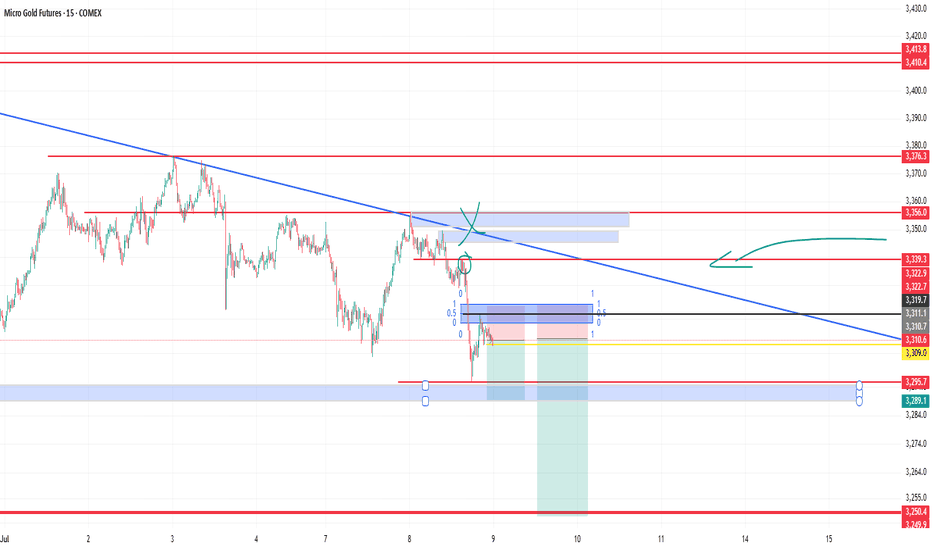

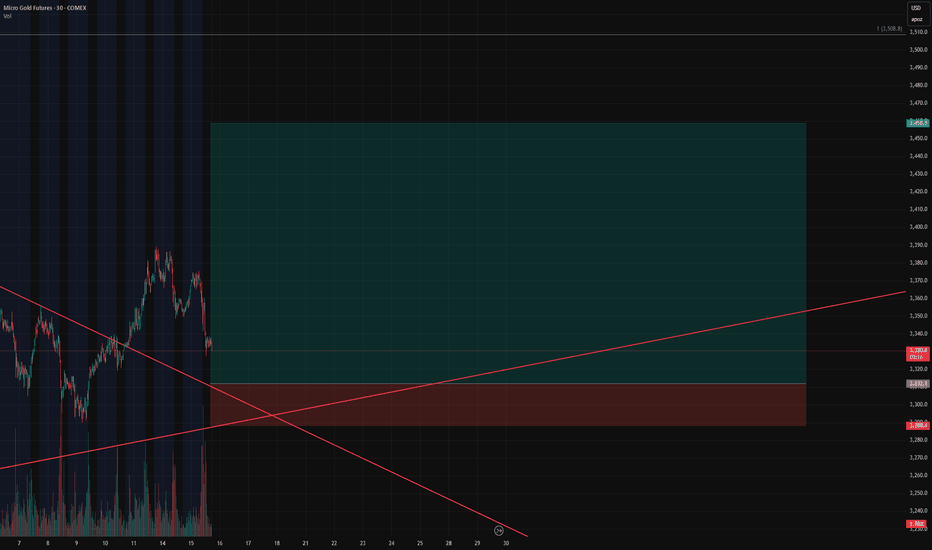

Gold Bulls Loading Up – Our Short Squeeze Trigger is Set!🚨 Gold Bulls Loading Up – Our Short Squeeze Trigger is Set!

We’re flipping the script on COMEX_MINI:MGC1! After a prolonged downtrend and textbook wedge compression, our breakout long is LIVE – but not without trapping the late shorts first.

💥 Entry: $3,312.1

🛑 Stop: $3,288.4

🎯 Target: $3,458.9

🧮 Risk/Reward: 6.19

Price just bounced at the retest of the wedge apex, and volume is confirming the move. If this holds, we’re riding momentum all the way up – and letting short pressure fuel the breakout.

📈 Trendline breached.

⏳ Time compression converging.

⚠️ If you’re still short, watch your stops!

Gold.. in the fog of global chaosNotes:

Markets for metals are at a ATH.

Global events are evolving rapidly.

Most of the time, war=raging gold prices

Markets are ripe to retrace and or maybe reverse at all. Taking setups on gold with a grain of salt.

Gold is an event driven market. I expect for now a consolidation until bearish signals show.