BITCOIN trade ideas

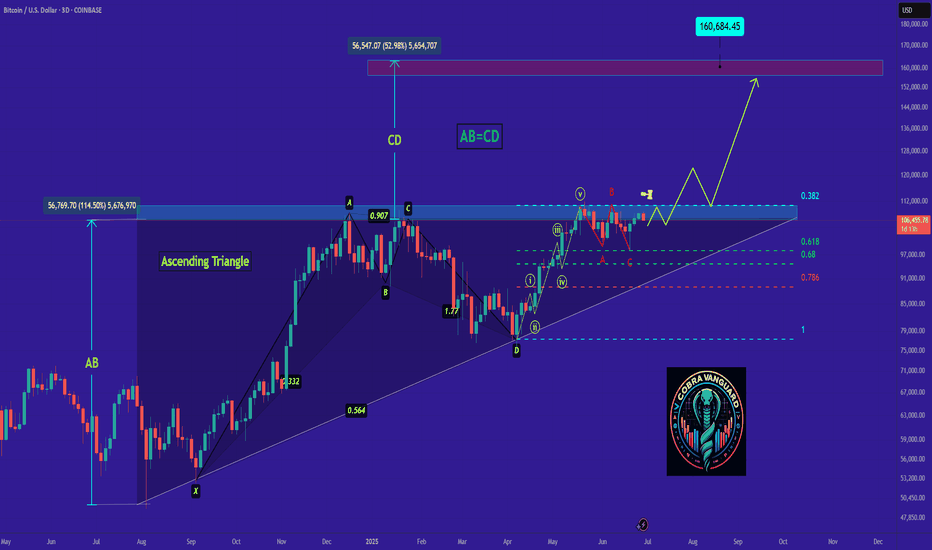

"BTC - Time to buy again!" (Update)Bitcoin is now at a point where it cannot be ignored! In my view, the bullish wave has started after the corrective wave ended. This wave could continue until it breaks the ascending triangle, then with a slight correction, push the price upward again. The current period and the coming days could be crucial in determining the market's trend.

Best regards CobraVanguard.💚

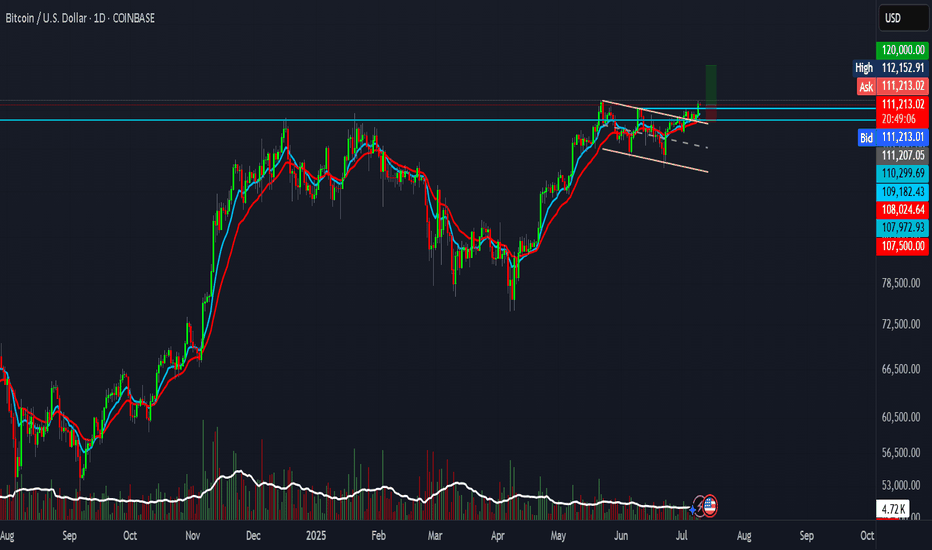

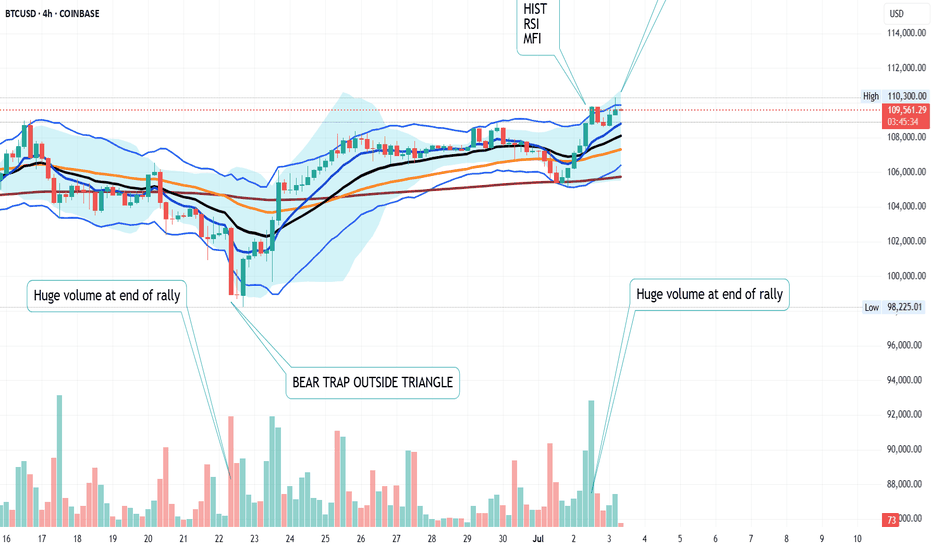

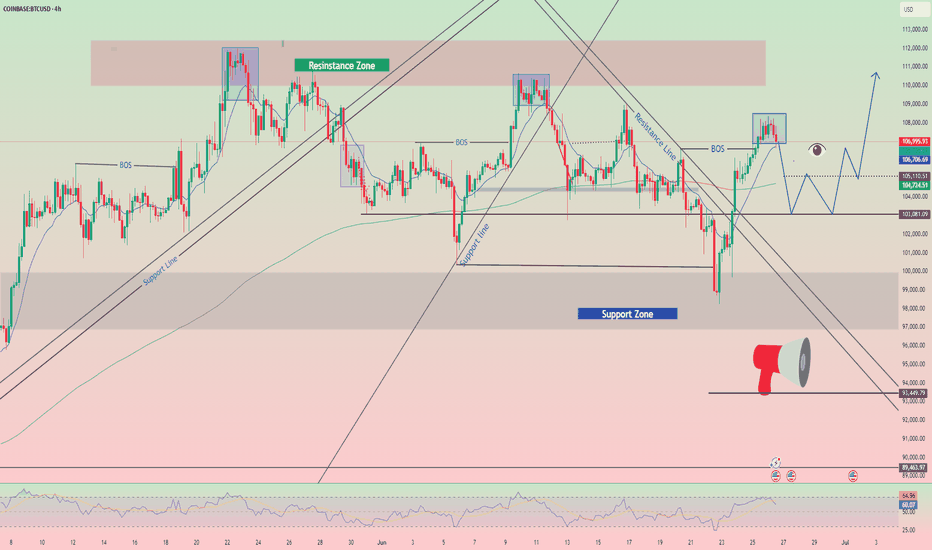

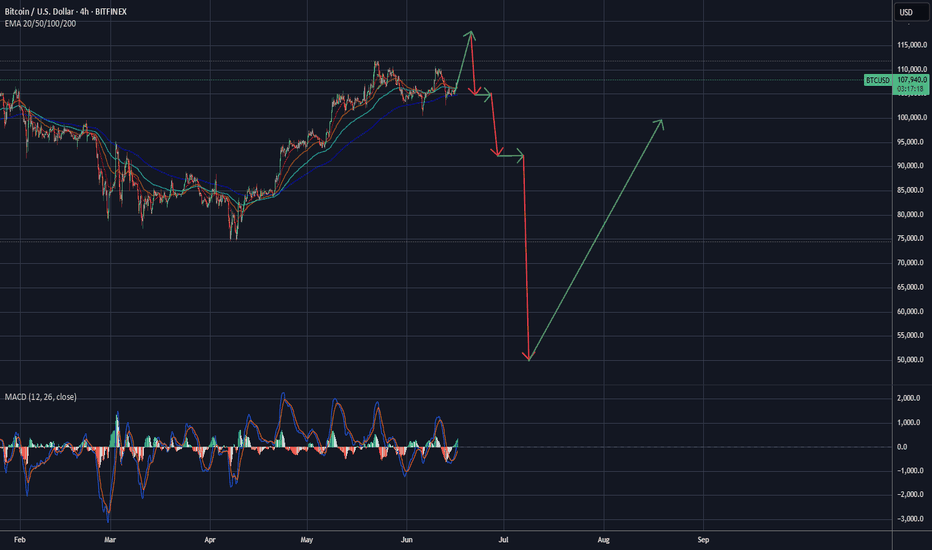

BTC POTENTIAL BULLS TRAP IN DEVELOPMENTI am inspecting the 4 hour candle in comparison to the daily chart on BTC and it seem we have all the characteristics of a bulls trap on the chart. If the next 4 hours candle does not close bullish, it will confirm a bulls trap and price will likely pullback into the triangle. So be cautious trading at this resistance level.

Bull Trap Chart Characteristics

Look for:

A strong bullish candle that breaks above recent highs or resistance.

Volume spike on the breakout — signs that traders are buying.

Followed by a sharp bearish candle (like a shooting star, bearish engulfing, or long wick).

Price falls back below resistance, turning the breakout into a fakeout.

Cheers !!

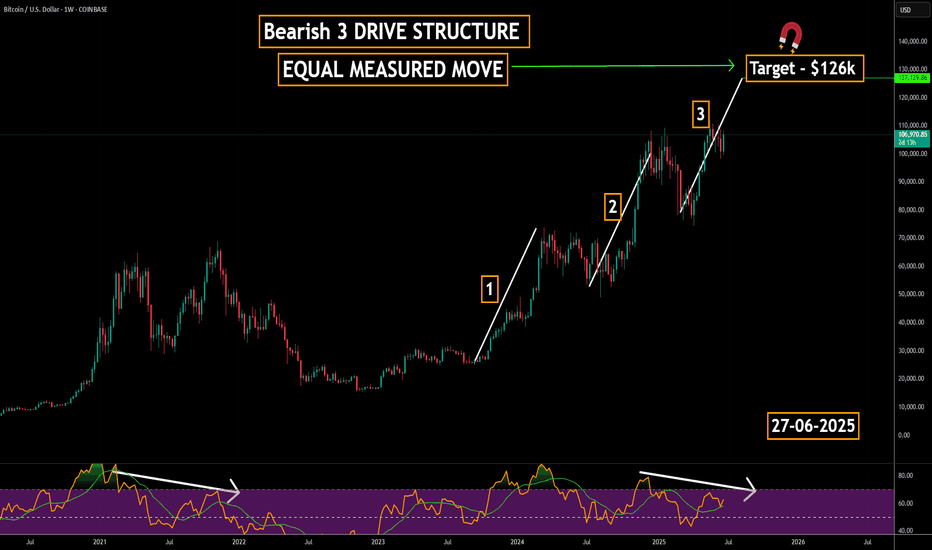

MACRO 3-Drive Pattern on Bitcoin | Major Reversal Ahead?Is Bitcoin completing a massive 3-drive structure on the macro chart?

Three clear pushes higher, each with fading momentum, are flashing a major reversal signal.

This could be the final phase before a long-term shift — are you ready for what’s next?

📚 3-Drive Structure Trading Strategy — Full Breakdown

The 3-Drive Pattern is a powerful reversal-based price structure used to spot major turning points in trending markets. It works by identifying three consecutive drives (or pushes) in one direction, typically ending with exhaustion and a high-probability reversal.

Each drive forms a new high or low, but with weakening momentum — especially visible using RSI, MACD, or volume divergence.

🔍 What is the 3-Drive Pattern?

3 consecutive higher highs (or lower lows)

Each drive followed by a shallow pullback

Momentum weakens on each push (divergence forms)

Fibonacci symmetry often present:

- Drive extensions: 127.2%–161.8%

- Pullbacks: usually 61.8%

📉 Bearish 3-Drive (Reversal from Uptrend):

Drive 1: Price makes a higher high with strong momentum

Drive 2: Another higher high, weaker strength

Drive 3: Final high with clear divergence

Reversal: Entry when price breaks below structure

🎯Entry Criteria:

Wait for all 3 drives to form

Confirm with divergence on Drive 3

Use a confirmation candle or structure break

Stop-loss: just beyond the 3rd drive’s high

🎯 Targets:

Conservative: Return to Drive 2 base

Aggressive: Full trend reversal (50%–100% Fib retracement)

🧠 Pro Tips:

Best on 4H, 1D, 3D or 1w timeframes

Confirm with RSI, MACD, or volume divergence

Combine with key S/R or supply-demand zones

💡 Summary:

The 3-Drive pattern is one of the most reliable reversal structures when combined with divergence and Fibonacci symmetry. It's especially powerful at market exhaustion zones and works best with confirmation-based entries.

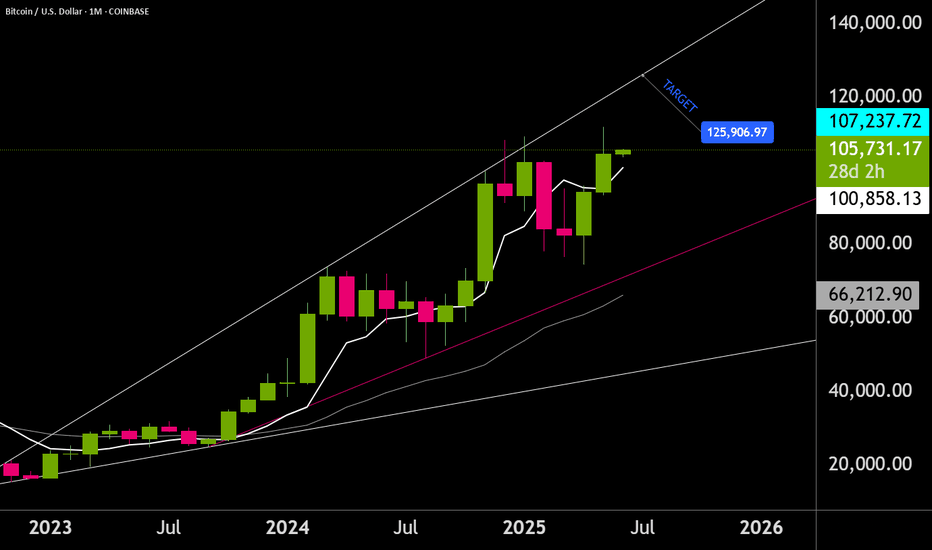

Trading Recommendations for BTC/USDBitcoin and Ethereum are demonstrating stable growth amid new forecasts regarding the number of interest rate cuts expected from the Federal Reserve this year. Another dovish stance from the Fed Chair and criticism from Trump over Powell's inaction triggered buying on the U.S. market, which also impacted the cryptocurrency market.

Investor enthusiasm is fueled by expectations of more accessible financial resources, which typically drive capital into riskier assets like cryptocurrencies. Bitcoin, as the flagship of the crypto market, traditionally reacts first to changes in macroeconomic conditions. However, one should not forget the inherent volatility of the crypto market. Even positive macro signals do not guarantee sustainable growth-especially as Bitcoin has been hovering near its historical highs, where buyer interest has been waning recently. It's essential to c consider technical factors, market sentiment, and regulatory risks, all of which can significantly influence price dynamics.

Meanwhile, alongside Strategy, Japanese investment company Metaplanet purchases Bitcoin for its balance sheet. Data shows the company acquired an additional 1,234 BTC for approximately $132.7 million just one day after announcing a $515 million capital raise to fund its Bitcoin treasury strategy. The Tokyo-listed firm stated that this latest purchase at around $107,557 per Bitcoin raised its total holdings to 12,345 BTC. The company holds about $1.3 billion worth of Bitcoin based on current market prices. This makes Metaplanet the seventh-largest publicly listed corporate holder of Bitcoin, surpassing Tesla, which holds 11,509 BTC.

As for intraday strategy in the cryptocurrency market, I will continue to act based on any major pullbacks in Bitcoin and Ethereum, expecting the medium-term bullish market to persist

For short-term trading, the strategy and conditions are described below.

Buy Scenario

Scenario #1: I will buy Bitcoin today if it reaches the entry point around $106,227 aiming for a rise to $ 107,042. Near $107,042 I plan to exit the long position and sell on pullback. Before buying on a pullback, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario #2: If the market does not react to a breakout, Bitcoin ca also be bought from the lower boundary at $105,039 with targets at $106,221 and $106,748.

Sell Scenario

Scenario #1: I will sell Bitcoin today if it reaches the entry point around $107,695 aiming for a drop to $106,008. Near $106,008, I plan to exit the short position and buy on a bunce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario #2: Bitcoin can also be sold from the upper boundary at $106,753 if there is no market reaction to a breakout, targtion the $104,651 and $103,888 levels.

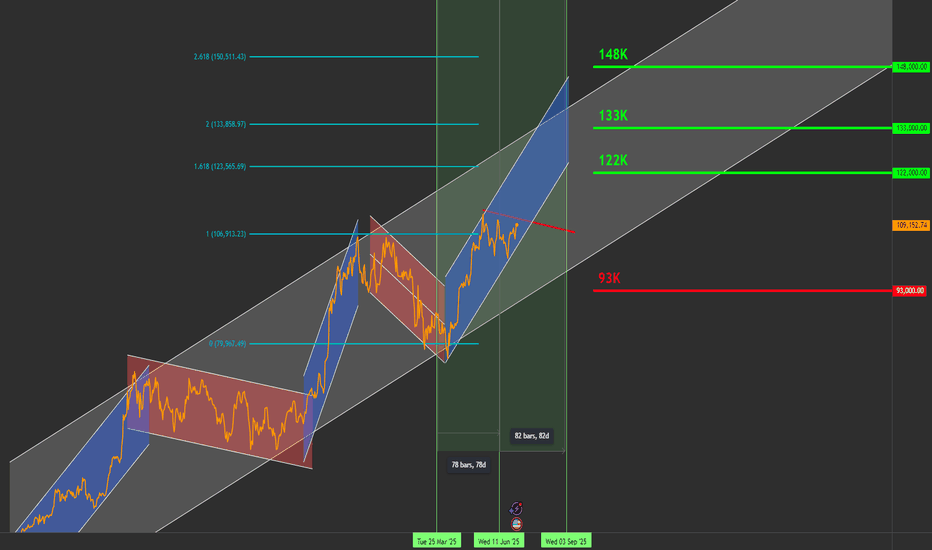

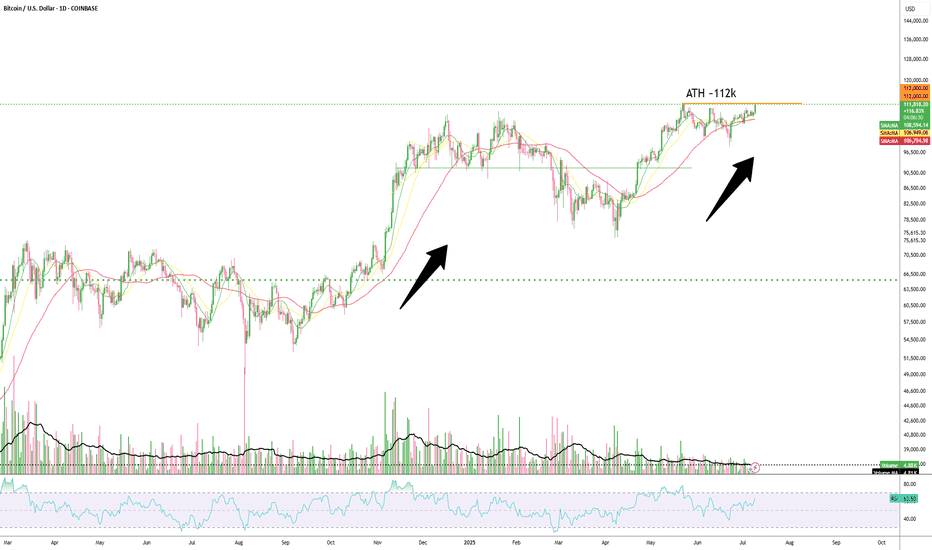

Bitcoin Roadmap to $144K by September – Daily Chart Breakout SetHello traders,

I'm sharing my current outlook on Bitcoin using the daily timeframe. Price is ~109K below a key descending trendline (in red), which has defined the structure since 21 May.

🔍 Key Levels to Watch:

Resistance: $111,000

Support: $91,000

Current Price: ~$109,000

⚡ Breakout Scenario:

If Bitcoin closes above $111K on the daily chart, backed by strong volume (ideally 30% above the 20-day average), I expect the next targets to unfold as:

✅ $122,000

✅ $133,000

✅ $144,000

🗓️ Target date for $144K: Around 22 September 2025

This projection is based on a pivot structure I’m tracking:

🟢 25 March 2025: Pivot low at ~$84K

🔴 12 June 2025: Pivot high

🟡 Expected pivot high: ~4 September 2025 (if symmetry holds)

This pattern suggests a 1-2-3 formation that could lead to a breakout move.

🧯 Failure Scenario:

If BTC fails to break out, I’m watching for a pullback toward the $91K support zone.

🛑 Current Stance:

I’m not in a position yet. Waiting for a daily candle close above $111K with volume confirmation and momentum indicators.

📣 Stay Updated

I’ll be sharing daily updates as the price action evolves.

Follow me here on TradingView, and feel free to share your analysis or ask questions in the comments!

🏷️ Hashtags:

#BTCUSD #BitcoinAnalysis #CryptoTrading #BTC #TechnicalAnalysis #SwingTrade #BreakoutSetup

Let me know your comments.

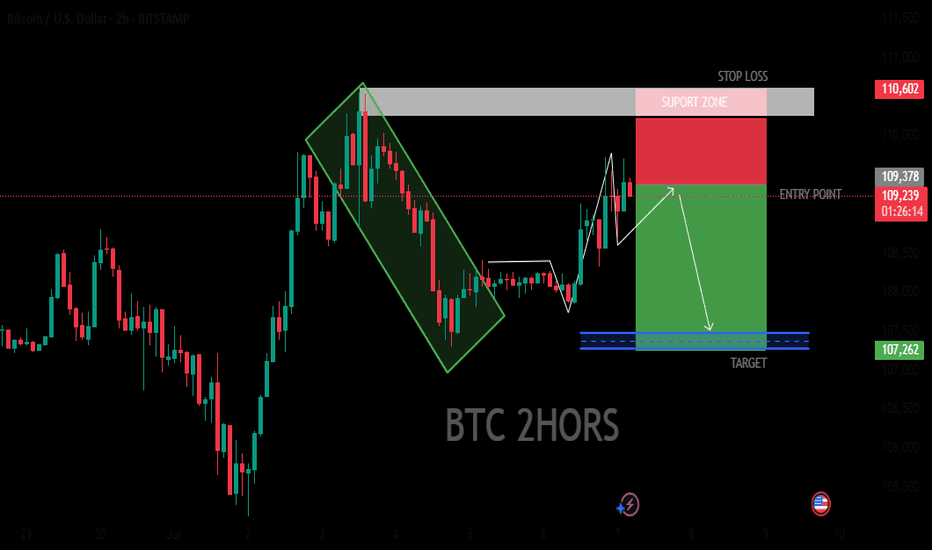

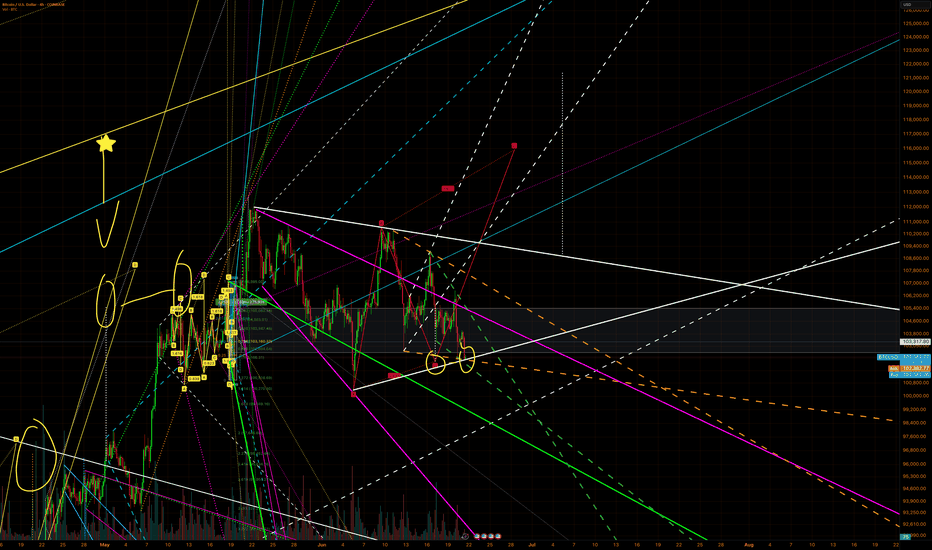

BTC 2HORS BEARISH ANALYSIS

The image suggests that the trader is using technical analysis to identify potential trading opportunities in the Bitcoin market. The use of specific patterns and indicators, such as the descending triangle and target price level, indicates a systematic approach to trading. However, it's important to note that trading carries inherent risks, and past performance is not necessarily indicative of future results.

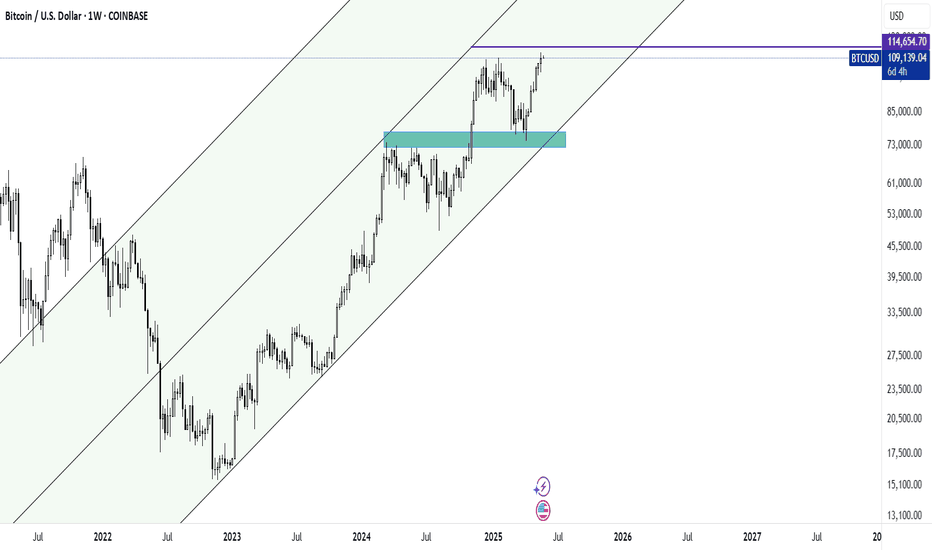

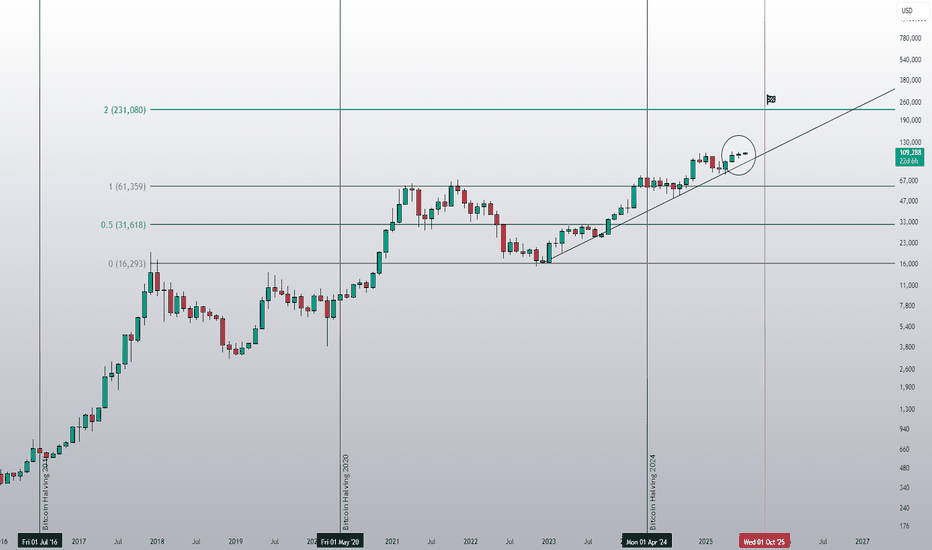

Old but accessible price targetIt was around the end of 2024 that I had an interesting price target for BTC, but the entry points only looked attractive in the green box area.

This green box was obtained solely based on my personal strategy, and the final and near target was obtained based on the trend lines and channel, from which I personally draw appropriate conclusions with price targets!

The excellent return from BTC, although time-consuming, was very attractive for spot traders!

Good luck!

MJ.REZAEI

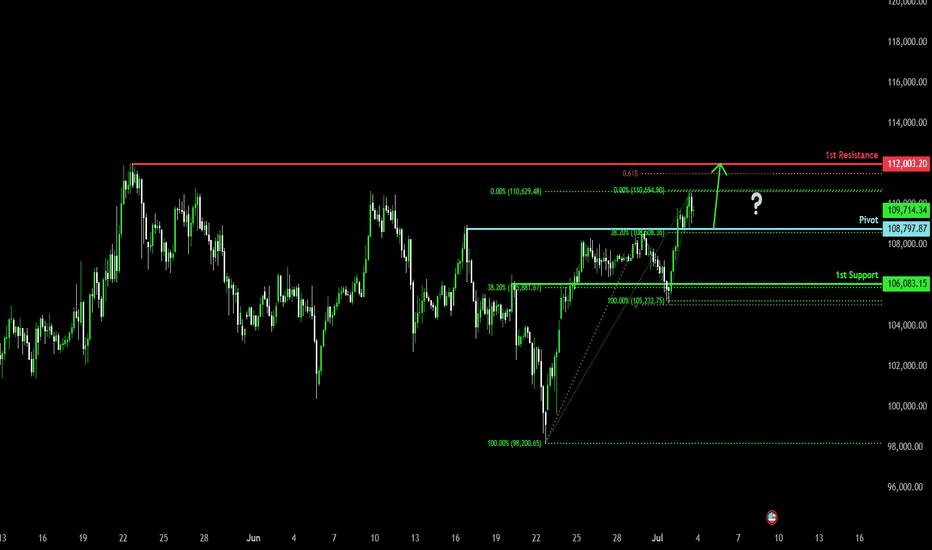

Bullish bounce for the Bitcoin?The price is falling towards the pivot which is a pullback support and could bounce to the 1st resistance.

Pivot: 108,797.87

1st Support: 106,083.15

1st Resistance: 112,003.20

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

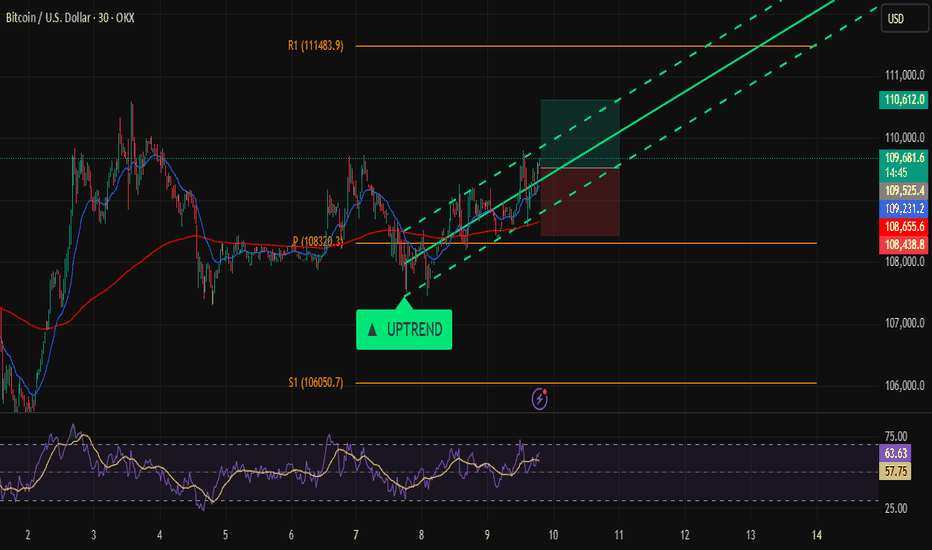

Bitcoin on Fire: Targeting $110K in Relentless Uptrend!Hi traders! , Analyzing BTC/USD on the 30 minute timeframe, price is currently respecting an upward channel and showing consistent higher highs and higher lows. The recent bounce from dynamic support suggests bullish continuation.

🔹 Entry: 109,545

🔹 Take Profit (TP): 110,612

🔹 Stop Loss (SL): 108,438

Price is trading above both the 50 and 200 EMA, confirming bullish momentum. The RSI remains above the midline, indicating buyers are still in control. This long setup offers a favorable risk-reward ratio within the context of the broader uptrend.

A confirmed breakout from the short-term resistance, combined with trendline support and channel structure, adds confluence to this idea. Watch for potential resistance near the 110,612 zone.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for their own decisions and risk management.

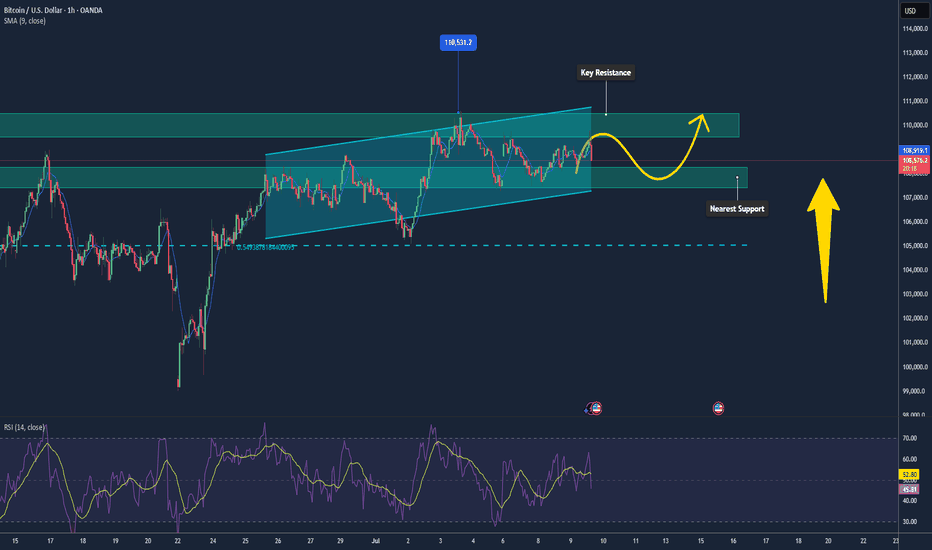

Bitcoin Maintaining Mild Uptrend, Poised Toward $110k📊 Market Overview:

• Strong ETF inflows continue, with over $13.5 billion in YTD flows into BTC, now making up nearly 70% of gold ETF inflows.

• Institutional investors like BlackRock (IBIT currently holds ~700k BTC) are still accumulating. The U.S. is also building a “Strategic Bitcoin Reserve,” reinforcing long-term confidence.

📉 Technical Analysis:

• Key Resistance: $109,000–$110,000, opening the path toward $110,500–$110,600 (Supertrend around $110,174).

• Nearest Support: $108,300 (EMA), followed by $107,800–$108,000; deeper pullback support at $105,000.

• EMA 09: Price is above this EMA → short-term trend remains bullish.

• Candlestick/Volume/Momentum: RSI is neutral around 58; MACD is converging near the zero line, signaling weakening bearish momentum and possible base formation.

📌 Outlook:

Bitcoin may continue its mild upward movement if it holds above $108,300–$108,000 and breaks clearly above $109k–110k with strong volume. Failure to do so could trigger a pullback toward $107,000–$108,000.

💡 Suggested Trading Strategy:

📉 SELL BTC/USD at: 109,500–110,000

🎯 TP: 108,000

❌ SL: 110,400

📈 BUY BTC/USD at: 108,200–108,500

🎯 TP: 109,500–110,000

❌ SL: 107,800

BTC/USD H4 Downfall ⚠️ Disrupted Market Perspective

🟩 False Resistance Zone

The marked resistance area (~109,000) has been breached multiple times with high volatility, suggesting weak resistance strength. Instead of rejecting price, this zone acts more like a liquidity trap — luring in sellers before price spikes higher. Expect fake-outs or bullish traps near this area.

🟨 Questionable Bearish Pattern

The projected zig-zag drop is speculative. The current market structure shows higher lows forming, hinting at potential accumulation rather than breakdown. If price consolidates above 108,000, this setup might flip bullish instead of heading to the 106,000 target.

🟥 Support Area Disruption

The labeled support zone around 106,000 may not hold if broken, but it has been respected multiple times in the past. If bulls defend it again, we might see a sharp rebound rather than a continuation downward. Therefore, the “Target” area could instead become a springboard for upward reversal.

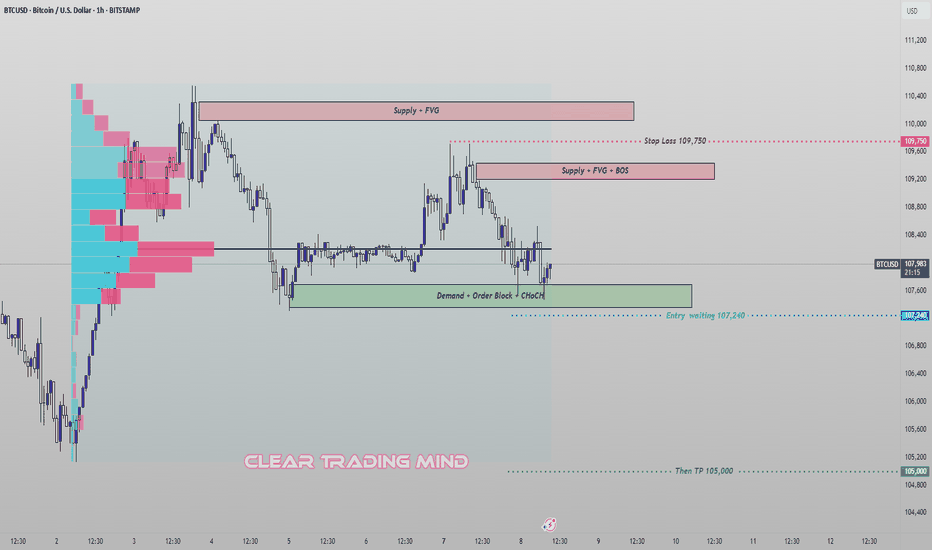

BTCUSD – Breakout Plan from Demand Zone (CHoCH + OB Setup)🔹 Current View:

I'm closely watching the 107,240 zone, where we have a strong Demand + Order Block + CHoCH (Change of Character) setup. This is a key support area that could trigger a fresh bearish move if broken.

🔹 My Plan:

I'm waiting for a clear breakout below 107,240 to enter a short position.

➡️ Entry: 107,240 (after confirmed breakout)

➡️ Stop Loss: 109,750 (above supply + BOS zone)

➡️ Target: 105,000 (previous inefficiency zone)

🔹 Supply Zones Noted:

- 109,250–109,500: Supply + FVG + BOS

- 110,000–110,500: Strong Supply + FVG

This trade is based on price breaking demand structure and retesting key supply areas above. Volume profile also shows heavy activity above, indicating possible resistance on any pullbacks.

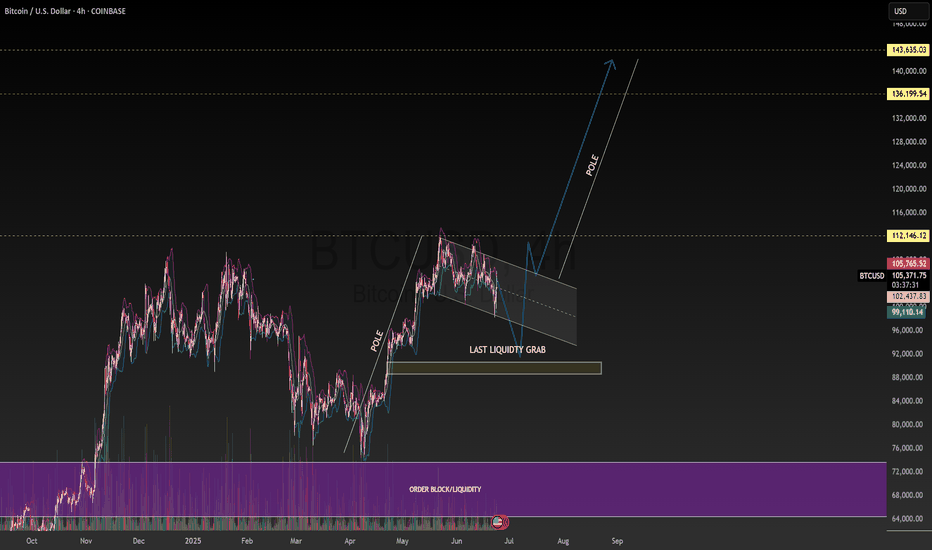

BTC/USDI've been calling for a crash for a while.

The closer to the top you are, the more hatred that you'll get for calling one.

It's a difficult position being contrary to the crowd. I think that's why Peter denied Jesus.

In any case, positive sentiment must end and as overdue as it is, I'm expecting a bang, after a final wave of FOMO.

BITCOIN BREAKOUT IMMINENT (120K)The Trend is your Friend. Bitcoin’s current action is the kind of bull‐market digestion you want to see before the next big surge. We’ve powered up from roughly $50 K on the Trump‐election narrative to flirt with all‐time‐high territory around $112 K, and now we’re simply consolidating in a tight $100 K–$110 K range. What really grabs my attention is how volume has dried up inside that band: fewer sellers stepping up means less fuel for a deep pullback, and an ebb in liquidity often precedes the kind of compressed buildup that launches a sharp move. That liquidity squeeze tells me smart money is biding its time rather than panicking out, and that sets the stage for a clean breakout once a new catalyst arrives.

Technically, the setup could hardly be neater. The 10-, 21- and 50-period moving averages have converged, running almost in lockstep. When those averages come together like train tracks, it signals a market in “healthy pause” — neither exhausted by an overextended rally nor capitulating under bearish pressure. It’s the kind of feature you love to see: price has had its run, it’s caught its breath, and it’s ready to go again on fresh conviction. Meanwhile, the RSI sits squarely in the middle of its range, neither overbought nor oversold, meaning there’s plenty of room for buyers to step in without an immediate pullback risk from extreme readings. In other words, momentum indicators are calm, not frothy or fearful, which further supports the case for a measured upward thrust rather than a sudden crash.

On the macro side, fundamentals are lining up, too. Monthly passive inflows into Bitcoin ETPs and ETFs continue at a robust clip, with institutions quietly adding to their positions out of the spotlight. If the Fed pivots toward rate cuts later this year, capital that’s been chasing yield elsewhere could flow back into risk assets — and Bitcoin, with its “digital gold” narrative, stands to gain especially when you consider its roughly $2 trillion market cap versus gold’s $20 trillion. That leaves a lot of upside potential if institutional demand keeps accelerating. Even more compelling: real‐world use cases for blockchain—everything from proof‐of‐ownership to decentralized finance—continue to mature behind the scenes, reinforcing Bitcoin’s narrative as not just a speculative asset, but a foundational piece of tomorrow’s financial system.

Of course, we can’t ignore the risks. We’ve already seen Bitcoin price near $112 K once, and there’s always the chance it carves a frustrating double-top if it stalls again. External narratives—Middle‐East tensions, renewed Ukraine tensions, fresh tariff skirmishes—could throw cold water on the rally and trigger a quick sell-off. But given the current setup—low‐volume consolidation, converging moving averages, balanced RSI and steady capital flows—a 10 % push toward $120 K feels not just possible but probable. Keep your eye on $112 K as your breakout trigger, size your positions sensibly, and plan your stop-loss around the lower end of the range. If Bitcoin can clear that level on strong volume, we’re likely to see this bull market extend rather than roll over into a double-top scenario. Happy trading, stay disciplined, and let’s see where this market takes us next!

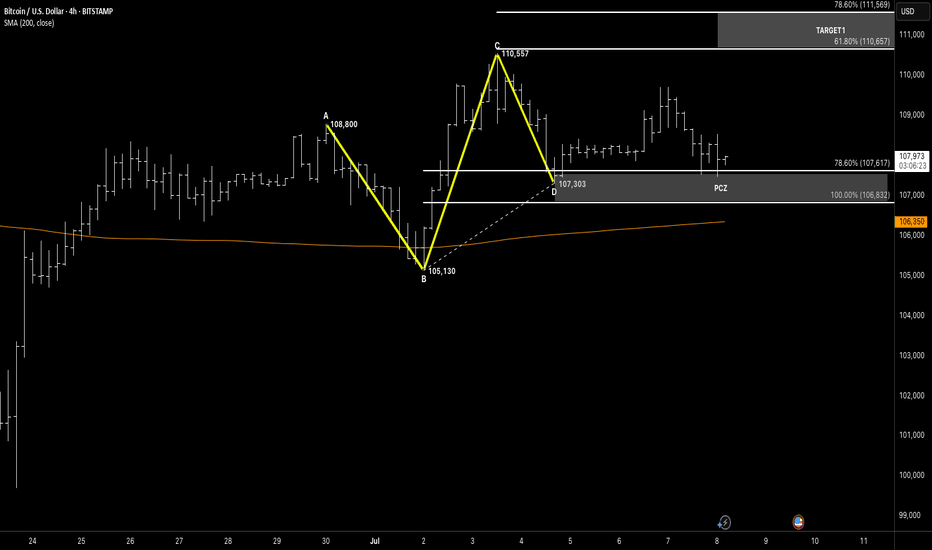

SYMMETRYHey traders, hope you’re crushing it this week! 🚀 Quick note on our BTC/USD 4-hour ABC setup: the symmetry I’m talking about is purely price-based—AB and BC move roughly the same number of ticks, not the same amount of time.

So when we say “symmetry,” we mean:

A→B drop: ~3,670 ticks

B→C rally: ~3,427 ticks

That close price match gives us confidence in our PCZ at 107,600–107,300 (78.6%–100% retrace of B→C).

⚔️ Trade Plan Recap

Entry: Long between 107,300–107,600

Stop: Below 107,000 (keeps risk tight)

Targets:

Zone 1: 61.8–78.6% of B→C → 110,657–111,569

Zone 2: 127.2–161.8% extension of A→B → 114,206–116,084

Remember: look for that bullish pin-bar or engulfing candle down in our PCZ before pulling the trigger, and bail if we lose 107,000. No time-based symmetry here—just clean price alignment. Trade with structure, not emotion, and keep an eye on any macro or on-chain news for extra context. ✌️

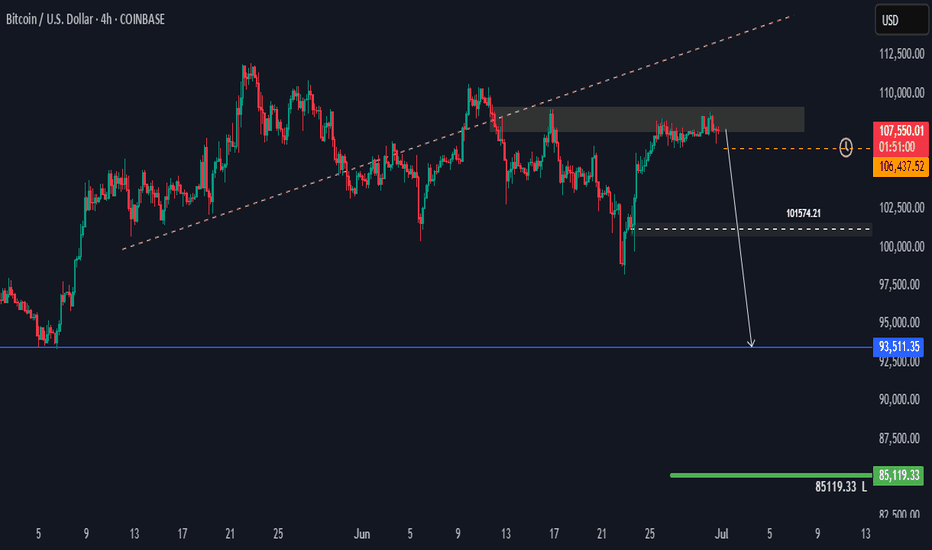

BTCUSD H4 Potential DropHi there,

BTCUSD H4: As long as the 85,119.33 level holds, the overall trend remains bullish in a larger scope.

Currently, the price is trading below the diagonal dotted trendline. The further it stays below this trendline, the stronger the bears' position.

The level of 101,574.21 is open for a bias towards 93,511.35.

Happy Trading,

K.

Not trading advice.

symmetrical triangle in progressBitcoin has been consolidating at this level for several weeks, easing some of the pressure in order to push above 120K. As of today, we have a clear formation—a large symmetrical triangle—which confirms the continuation of the upward trend and rules out any possibility of returning to lower levels.

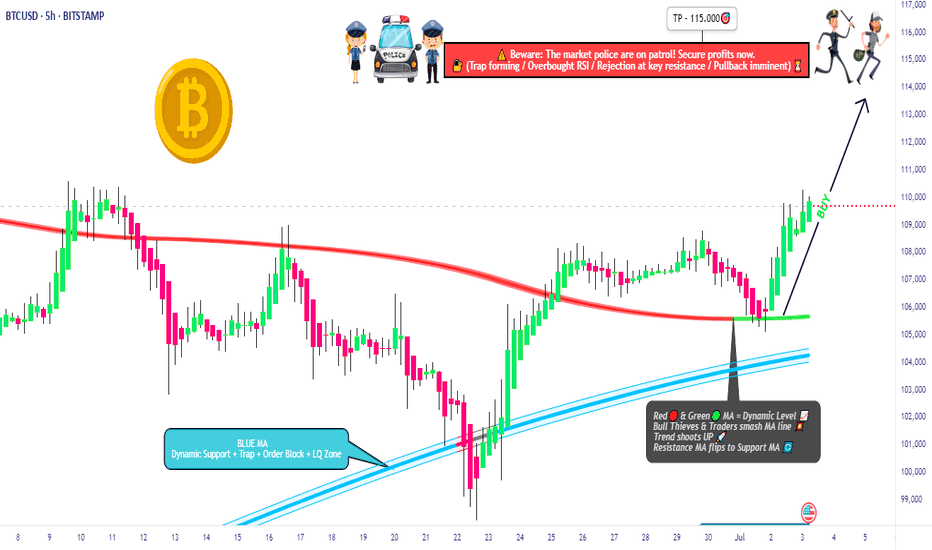

BTC/USD Heist Mode: Buy Low, Escape Rich🔓 BTC/USD Crypto Vault Breach: Thief Strategy for Long Entry Robbery (Swing/Day Setup) 🔓

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰💸✈️

🚨 Welcome to our next Thief Trading-style breakout mission — this time targeting the mighty BTC/USD vault. Using a fusion of technical precision and macro-level insight, we're charting a long entry blueprint for a profitable heist.

🔑 Entry Plan

"The vault is open!" 💥

Buy at current price or set Buy Limit near swing lows (15–30min timeframe pullback entries). We're timing the entry with stealth—precision over panic.

🛑 Stop Loss Setup

SL set near recent swing low (4H TF reference: ~104.000).

Adjust based on position sizing, risk appetite & multi-order tactics.

🎯 Take Profit Target

Targeting 115.000—or exit earlier if price action stalls. Get in, get out. Efficiency is the code.

👀 Scalpers' Notice

Only work the Long side. If your bag’s heavy, strike instantly. If light, ride with swing robbers. Use trailing SLs to protect your bag.

📈 Why We’re Bullish

Market momentum favors the bulls:

Overbought zones acting as lures

Bearish traps ready to flip

Key confluences from sentiment, COT, on-chain & macro analysis

➡️ Full supporting breakdown available 👉👉🔗🔗.

📢 Risk Note – Stay Sharp

Major news events = increased volatility ⚠️

Avoid entries during news. Trail stops to protect running profit. Rob smart.

💖 Boost the Crew

If this blueprint aligns with your mission, hit that Boost button. It fuels the team, and together, we profit like pros. One heist at a time. 💪🎉

🧠 Stay ready—next plan drops soon. Until then, rob safe, rob smart. 🐱👤