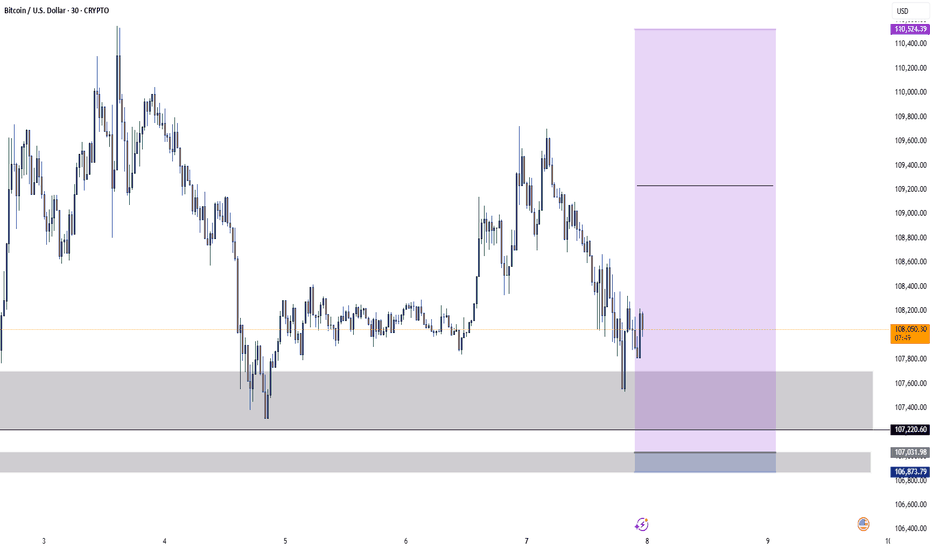

Btcusd techinical analysis.This BTC/USD 1-hour chart suggests a bullish breakout scenario. Here's a breakdown of key technical signals:

Key Observations:

1. Price Level: Current price is $109,582.1, with a recent rise of +0.59%.

2. Resistance Zones (Purple Boxes):

First resistance near $109,800 – $109,900.

Second (minor) resistance around $109,300 – $109,400.

Price is testing the upper resistance zone now.

3. Bullish W Pattern:

A sharp drop and recovery formed a “W” pattern—common before breakouts.

The neckline of this W is being challenged.

4. Trendline Breakout Projection (Blue Arrows):

The chart suggests a breakout projection towards $110,300 – $110,400.

This is based on the upward trajectory from the recent swing low.

5. Support Zone (Lower Purple Box):

Support established at $109,150 – $109,250.

If price

BITCOIN trade ideas

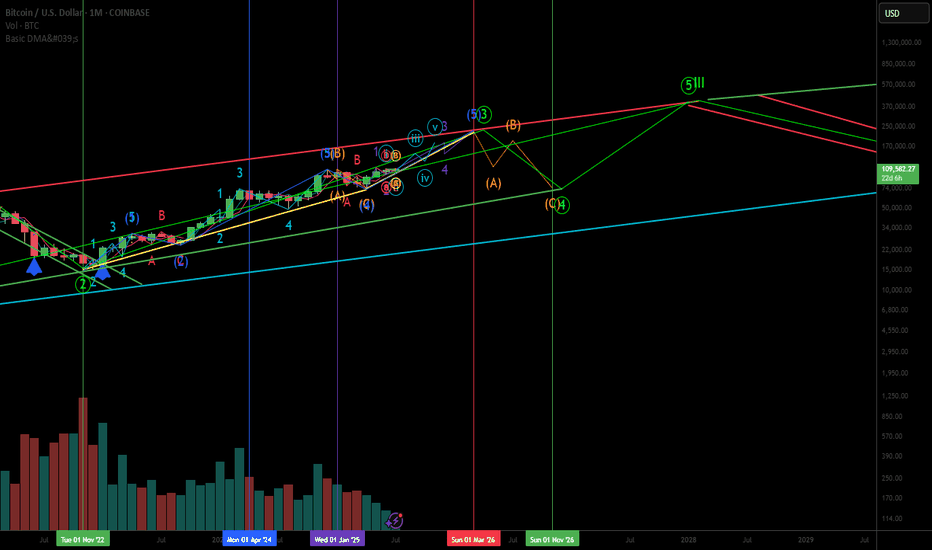

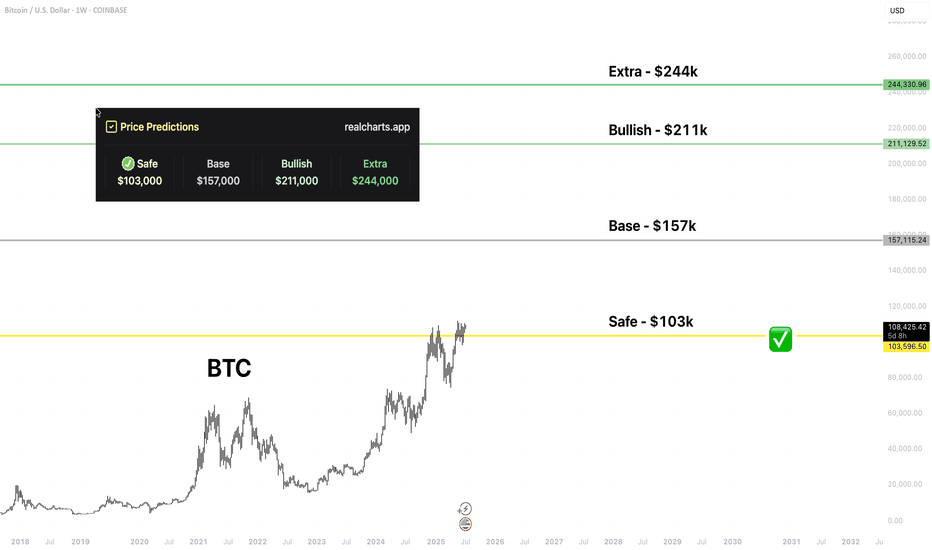

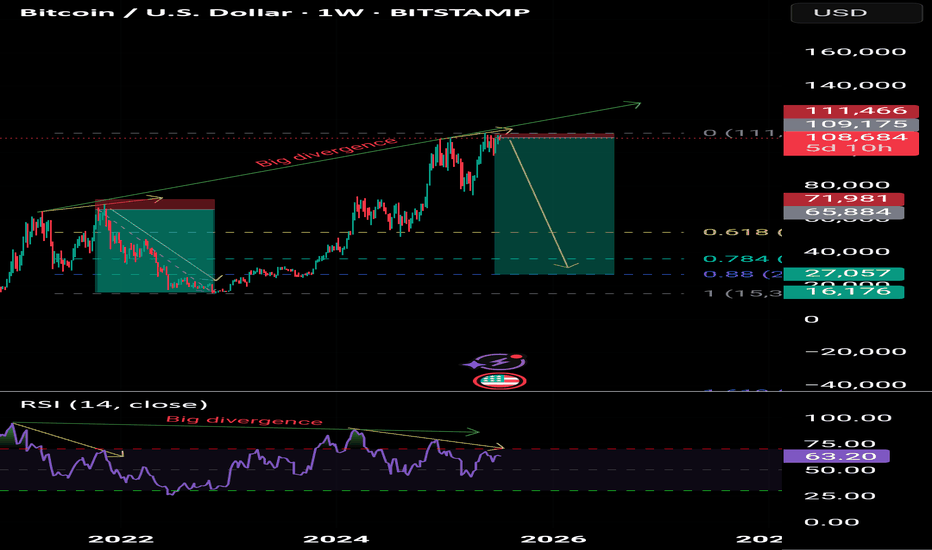

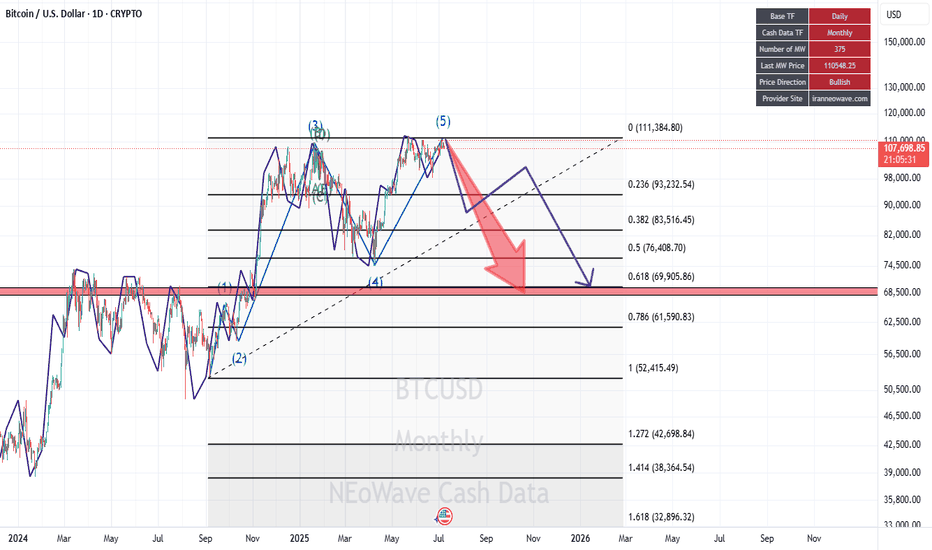

An Elliot Wave indicating a Bitcoin SupercyclePrimary cycle 3 ends approximately March 2026 at $225,000. Primary cycle 4 ends around Nov 2026 at $75,000. Primary cycle 5 and the end of cycle I ends near $400,000 in Jan 2028.

This illustrates Bob Loukas' latest thought toward an extended right translated bull Bitcoin cycle ending in early 2026 instead of the end of 2025. Then a shortened bear market that ends in Nov 2026, 4 years after the last bear cycle in Nov 2022.

Then a "left" translated cycle ending in Jan 2028 near $400,000 which completes Cycle I. It looks like a supercycle by combining the right translated current cycle with a left translated next cycle.

A good cycle strategy would be to take at least partial profit near $225,000, reaccumulate near $75,000 at the end of 2026 in anticipation of a big move up to near $400,000 by Jan 2028. A major sell at that point would be prudent. Loukas believes after a 12-16 month left translated cycle into early 2028 will be followed by a 2.5 year or more bear market to the end of 2030.

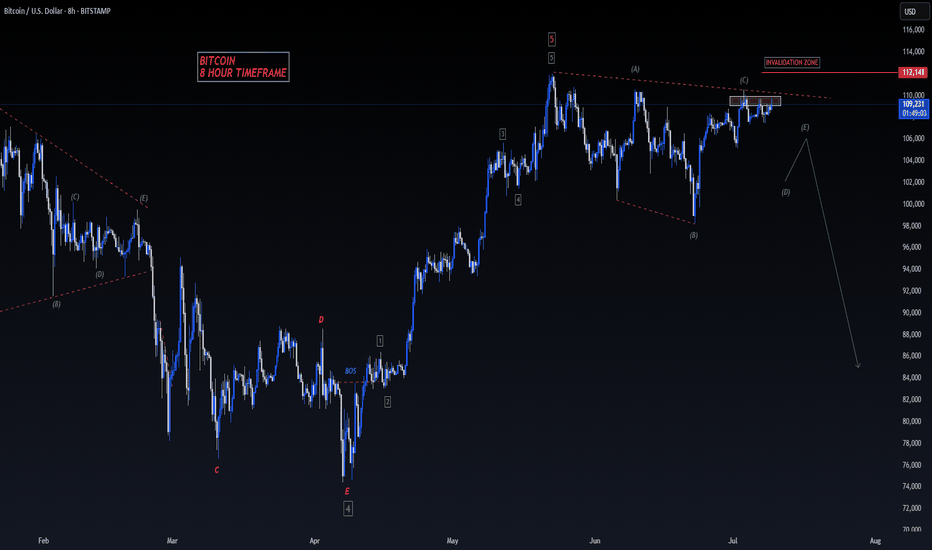

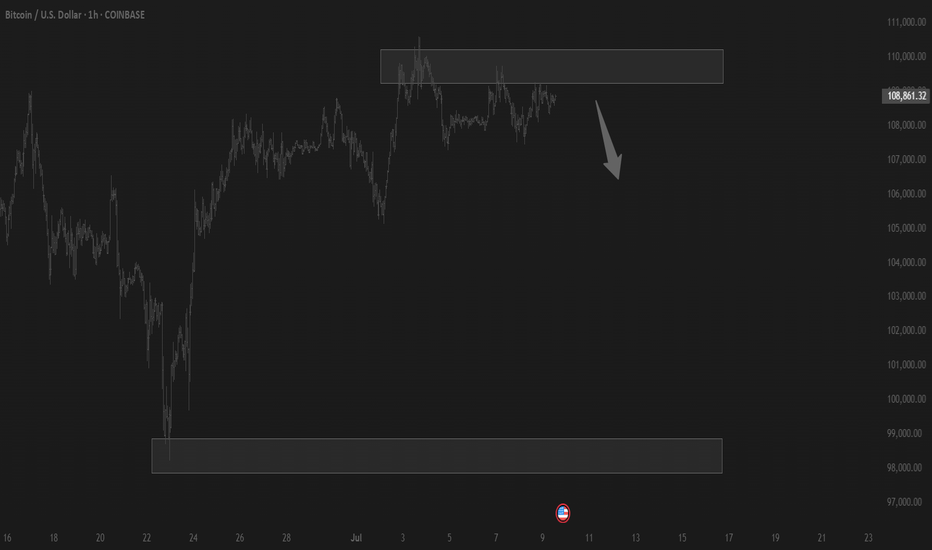

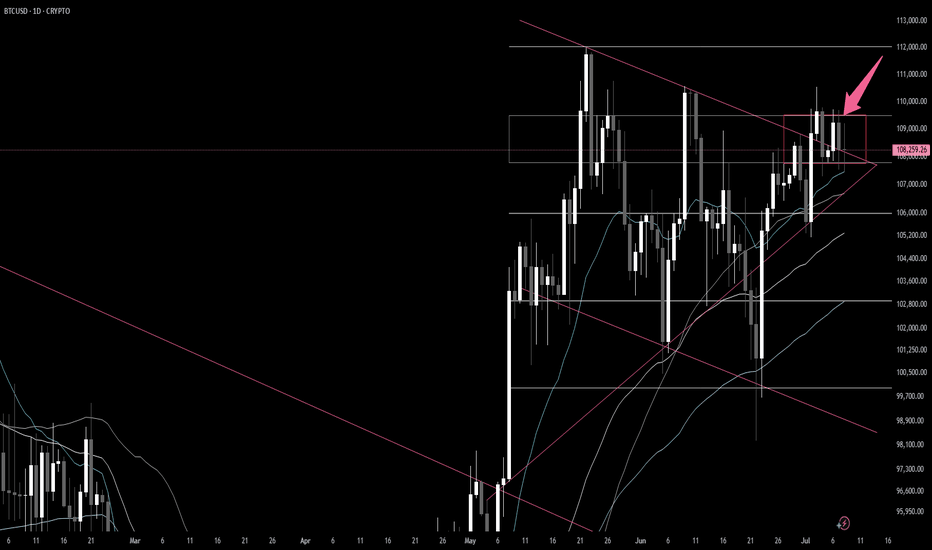

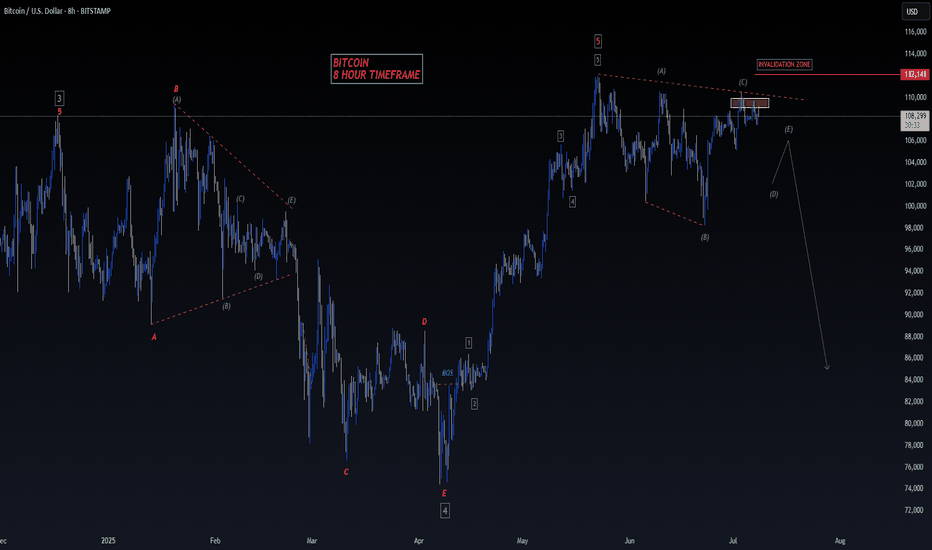

BITCOIN - SELL TO $86,000 (8H VIEW)I see selling opportunities right now for Bitcoin.

⭕️LQ Swiped Above Previous Wave 3 High ($109,000).

⭕️Wave 4 Complex Correction Complete (5 Sub-Waves).

⭕️(Wave 5 Impulse Bullish Move Complete (5 Sub-Waves of 1,2,3,4,5).

❌Invalidation Zone Above Wave 5 High ($112,140).

High risk trade as BTC could still head high for Wave 5 around $120- $130,000. Use strict risk management.

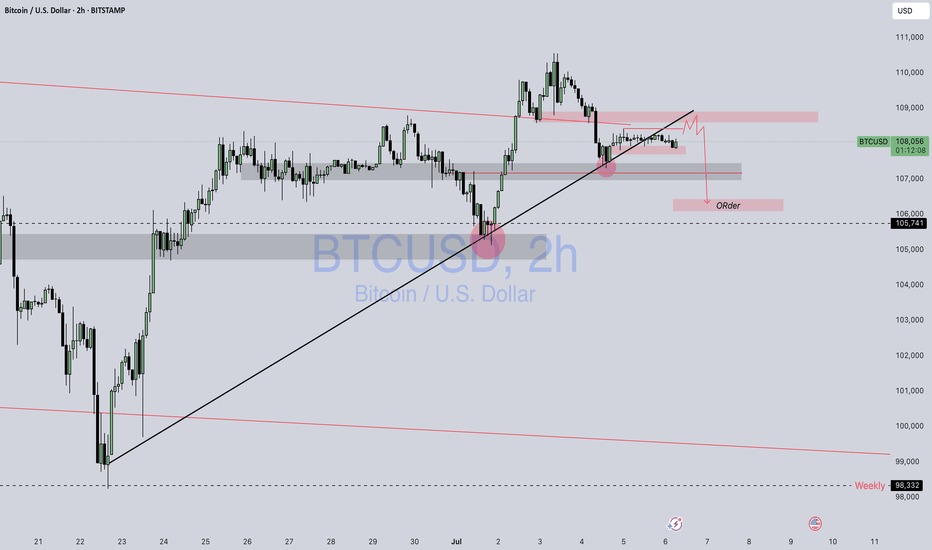

Btc / UsdtBITSTAMP:BTCUSD

1. **Current Price Zone (\~108,000):**

* Price is consolidating just under a supply zone (red rectangle), showing potential rejection from the upside.

* The price briefly pushed above the rising trendline but failed to hold it.

2. **Bearish Structure Forming:**

* Price action suggests a **lower high** and potential **head-and-shoulders** pattern.

* Red squiggle indicates a likely **short-term bearish movement** — a drop to the **demand zone** around **105,700–106,900**.

3. **Demand Zone/Order Block:**

* Marked below near **105,741** with label **"Order"**, showing where potential buy orders may sit.

* This is the first major area where price might find support.

4. **Downside Levels:**

* **106,933** and **105,741**: Potential short-term supports.

* **98,332 (Weekly level)**: If the structure breaks fully, price could revisit this major demand zone.

5. **Upside Resistance:**

* **Red supply zone above 109,000** acts as strong resistance — if BTC breaks that with volume, bullish bias resumes.

---

### 📉 **Short-Term Bias:**

* **Bearish** unless BTC breaks and holds above **109,000**.

* Expecting a pullback toward **106.9k** or **105.7k**, which may offer **buy-the-dip** opportunities.

Disclaimer : Not Financial Advice

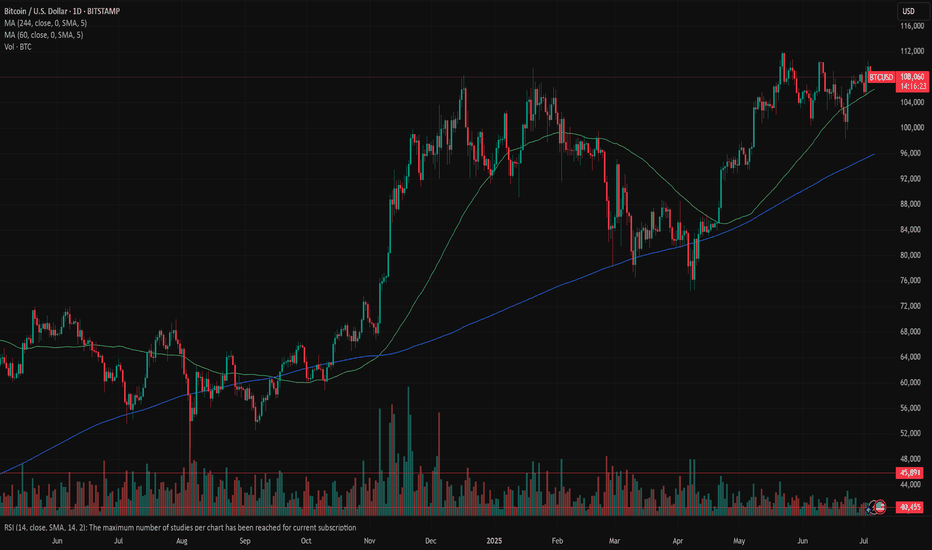

Bitcoin: higher for longer?The investors optimism supported by better than expected US jobs data was reflected mostly in the US equity market, but the crypto market was not left behind on this occasion. Although the week for crypto was quite volatile, it showed that investors are still strongly considering investments in crypto coins for diversification of portfolios, especially BTC. The BTC spent a week struggling around the level of $107K, while making its final breakthrough toward the upside, reaching the highest weekly level at $110K. It is ending the week around the level of $108K, with an equal level of buying and selling order during the weekend.

Although the price was pushed toward the $110K, the RSI did not reach the overbought market side. Actually, the indicator continued to move between levels of 50 and 60, indicating that the market is still not ready to finish the cycle and revert it toward the oversold market side. Although slowed down, the MA50 is still oriented toward the upside, same as MA200, without an indication that the cross might occur anytime soon.

Current charts are indicating the probability that the support line at $106K might be tested again in the coming period. This short reversal is necessary for BTC in order to collect enough interest for a further push toward the upside. Whether the BTC will have strength to try to reach old ATH, remains unclear from current charts, but some indication holds. However, there is some probability that the $110K might be tested for one more time.

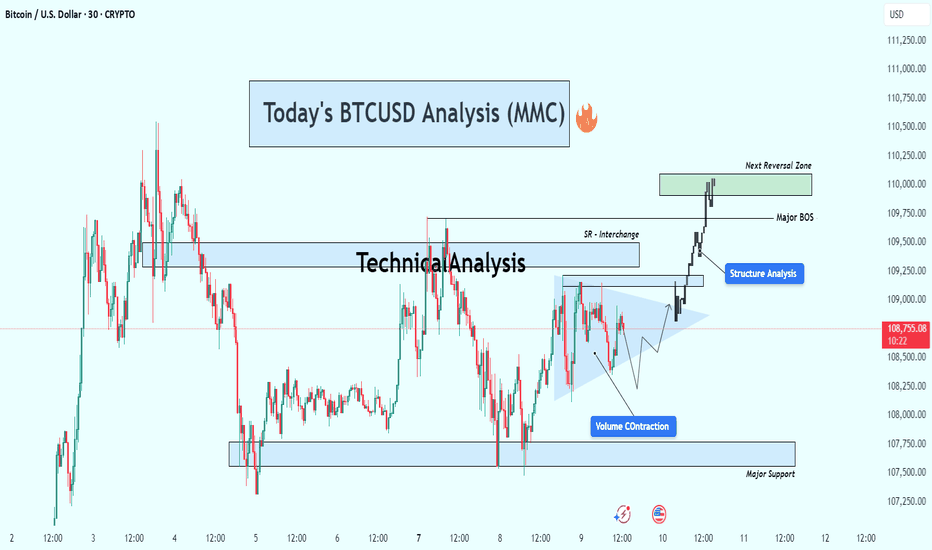

BTCUSD Breakout Confirmed – Targeting Next Reversal ZoneBitcoin (BTC/USD) is currently trading around $108,700, showing strong bullish momentum after breaking out of a consolidation structure. Price action has shifted significantly, with clear structural developments pointing toward continued upside — but not without caution around the next reversal zone.

🔍 Key Technical Insights:

🔹 1. Volume Contraction Triangle (Bullish Breakout)

The chart initially shows a volume contraction pattern forming a symmetrical triangle.

This pattern is often associated with market compression — a setup where smart money accumulates before a breakout.

BTC broke out of the triangle with strong bullish candles, confirming buyers have stepped in with conviction.

🔄 2. Structure Shift & Break of Structure (BOS)

A major BOS (Break of Structure) occurred as price broke previous swing highs, confirming a bullish market structure.

This BOS zone now acts as a potential support area if BTC pulls back.

A short-term SR interchange zone (Support becomes Resistance) was also respected and flipped again to support during the breakout — a clear sign of structural strength.

🧭 3. Next Reversal Zone – Supply in Sight

Price is approaching a major supply/reversal zone between $109,750 and $110,250.

This zone has previously shown strong selling interest.

Traders should watch for rejection or continuation patterns within this zone — such as bearish divergence, exhaustion candles, or confirmation of resistance.

🛡 4. Major Support Level

Below current price, a major support zone around $107,500–$107,800 remains intact.

This zone has provided a solid base during past consolidations and would be the first area of interest for buyers if a retracement occurs.

📌 Strategy Plan:

🔼 For Bullish Traders:

Those already in the breakout can hold with targets toward $110,000–$110,250.

If not in yet, wait for a retest of BOS/SR zone (~$109,000) for a safer re-entry.

Consider partial take-profits within the green reversal zone.

🔽 For Bearish Traders:

Watch for price exhaustion or a fake breakout in the reversal zone.

Potential short setups could form only if price fails to hold above the BOS zone and prints a lower high.

🔧 Technical Summary:

✅ Structure: Bullish Break of Structure confirmed

🔺 Momentum: Strong upside following volume contraction

📍 Next Key Resistance: $110,000–$110,250

📉 Major Support: $107,500–$107,800

⚠️ Caution Zone: Reversal area ahead – watch price action closely

Conclusion :

Bitcoin looks set to challenge the $110K psychological level as buyers remain in control. However, the reversal zone above is critical. A clean break and hold above it could open doors to further highs, while rejection here may trigger short-term pullbacks or range-bound conditions.

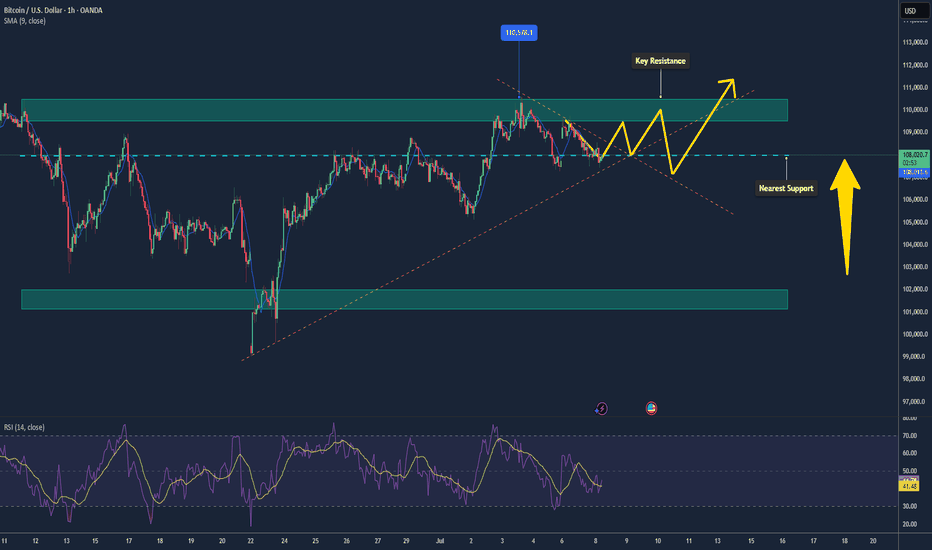

Bitcoin Ranging Below $110k – Poised for a Breakout📊 Market Overview:

Bitcoin is consolidating around $108–109k, reflecting indecision as investors await clearer signals. Institutional ETF inflows remain strong, and recent moves from 2011-era dormant wallets sparked concern but no major sell-off. Positive ETF news or supportive crypto policies could propel the next move upward.

📉 Technical Analysis:

• Major resistance: $109,500 – $110,500

• Nearest support: $108,000; secondary support at $102,000

• EMA09 (1 h): Price is above the 20 EMA and has reclaimed the 200 SMA on the 1 h chart, signaling a technical rebound

• Candlestick / Volume / Momentum: A mild bounce from $108k with low volume; Bollinger Bands show a mid-range price, hinting at sideways action .

📌 Outlook:

Bitcoin may remain range-bound between $108k and $110k. A breakout above $110.5k with strong volume could push toward $112k–115k. Conversely, a break below $108k might trigger a dip toward $102k.

Suggested Trading Strategy

SELL Bitcoin/USD at: 109,000 – 110,000

🎯 TP: 108,000 / 105,000

❌ SL: 110,800

BUY Bitcoin/USD at: 108,000 – 107,500

🎯 TP: 109,500 / 112,000

❌ SL: 107,000

BITCOIN - SELL TO $86,000 (8H VIEW)I see possible shorting opportunities right now for BTC.

⭕️LQ Swiped Above Previous Wave 3 High ($109,000).

⭕️Wave 4 Complex Correction Complete (5 Sub-Waves).

⭕️(Wave 5 Impulse Bullish Move Complete (5 Sub-Waves of 1,2,3,4,5).

❌Invalidation Zone Above Wave 5 High ($112,140).

High risk trade as BTC could still head high for Wave 5 around $120- $130,000. Use strict risk management.

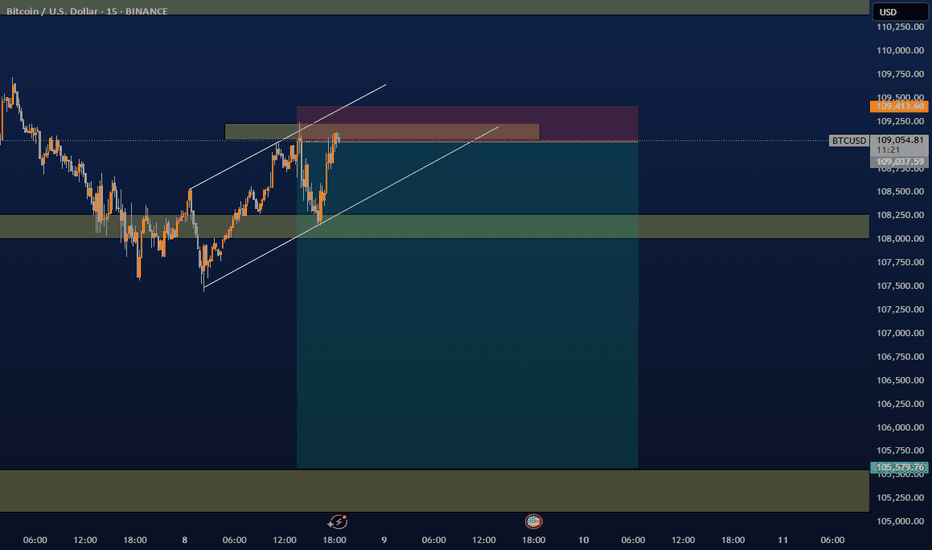

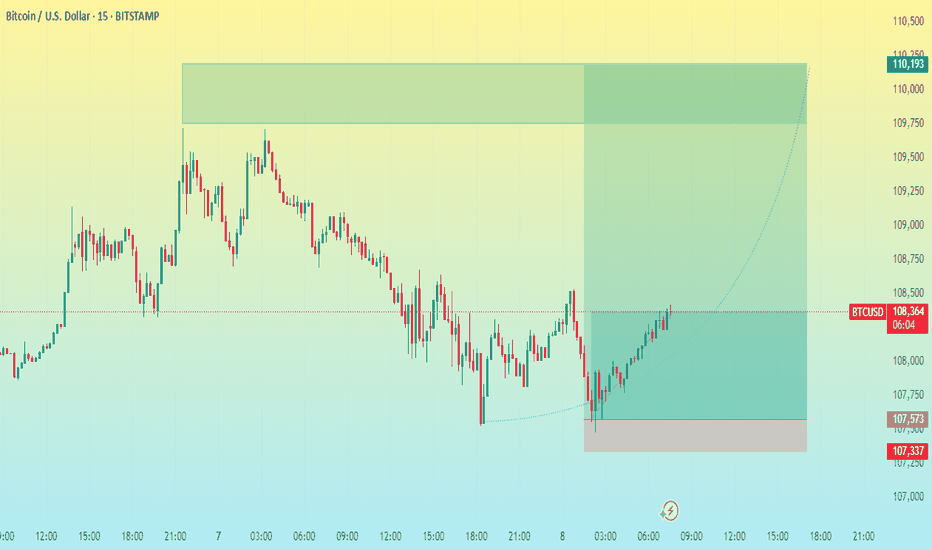

BTC/USD 15M CHART PATTERNHere’s a clear breakdown of your BTCUSD trading plan:

---

📈 Trade Setup (Buy Position)

Entry Price: 108,380

🎯 Take Profit Levels

1. TP1: 109,000

2. TP2: 109,300

3. TP3: 110,193

🛑 Stop Loss

SL: 107,337

---

🧮 Risk & Reward (Quick Overview)

Risk (SL): 1,043 points

Reward (TP1): 620 points

Reward (TP2): 920 points

Reward (TP3): 1,813 points

This gives you approximate Reward:Risk ratios:

TP1: ~0.59 : 1

TP2: ~0.88 : 1

TP3: ~1.74 : 1

---

✅ Notes

TP1 is conservative — may secure quick

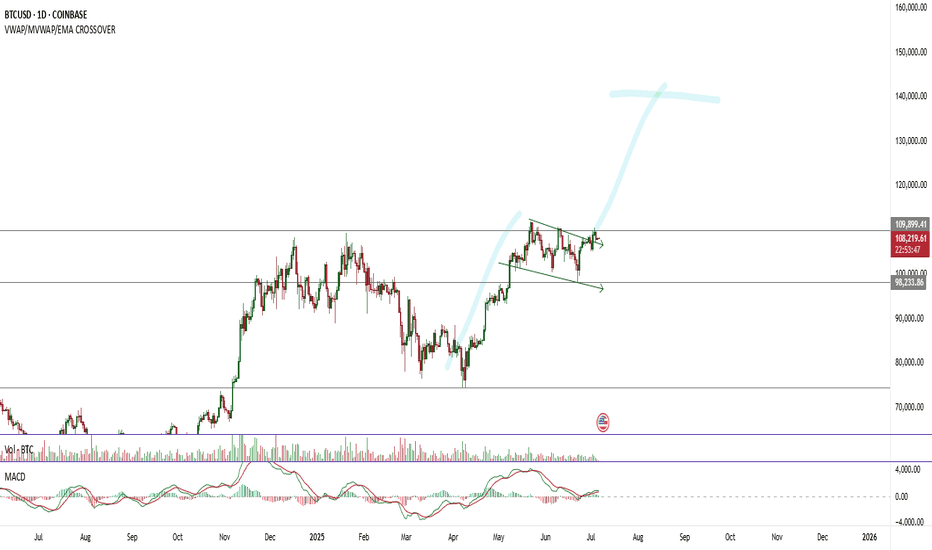

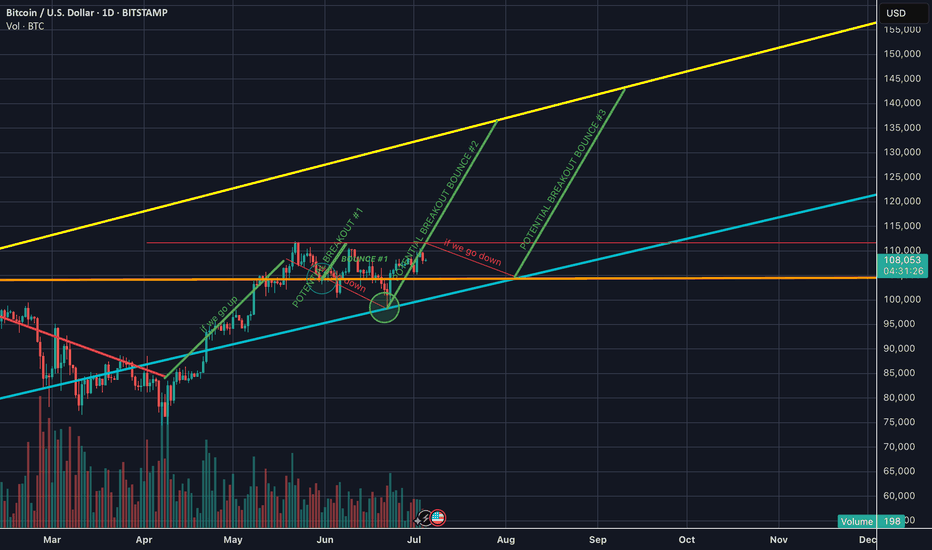

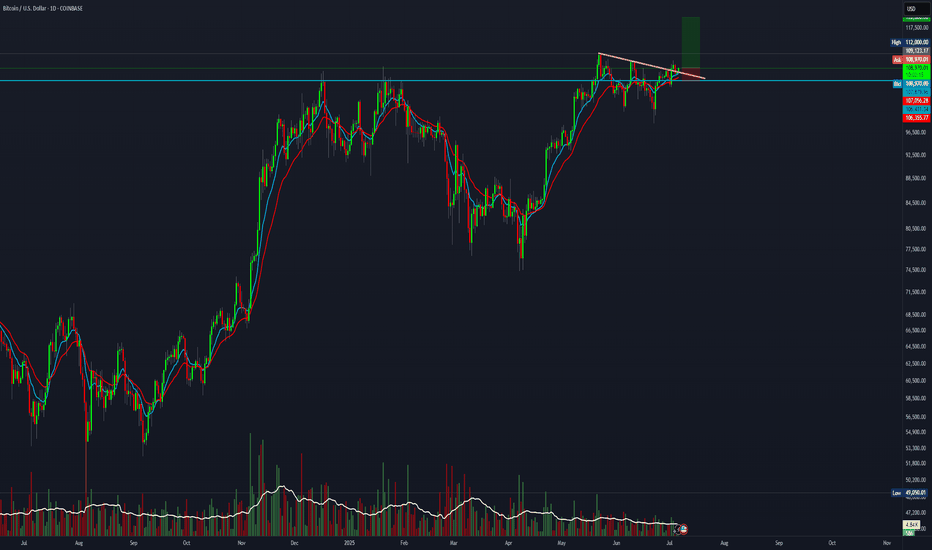

Are we breaking this resistance ? or not yet? BTC is currently trading around $108,000, sitting at a key trendline support zone. The market is at a critical decision point, with two main scenarios: a bullish breakout or a rejection and move lower.

🔍 Technical Structure Overview

Chart timeframe: 1D (Daily)

Major support: $104,000 (horizontal) & ascending trendline (cyan)

Major resistance: $110,000–$112,000 zone

Long-term resistance channel: Yellow trendline capping BTC near $140,000

Volume: Currently low — needs a spike to confirm any breakout

🟢 Bullish Scenario

BTC bounces off the ascending trendline (current zone)

A strong breakout above $112,000 with volume would confirm a Potential Breakout Bounce #2

Targets:

$120,000 (short-term)

$130,000–$140,000 (upper yellow trendline in long-term channel)

✅ Confirmation needed:

Daily candle close above $112K with high volume

RSI rising above 50, MACD bullish crossover would help confirm move

🔴 Bearish Scenario

BTC fails to hold the trendline and breaks below $104,000

This confirms a rejection and a likely move toward $96,000

If momentum weakens, this could turn into a deeper correction or sideways consolidation

BTC is in a tight consolidation range, nearing a major decision point. A breakout above resistance could send prices to new local highs, while failure to hold trendline support will likely trigger a correction. Watch key levels carefully and let volume + momentum indicators confirm your trade.

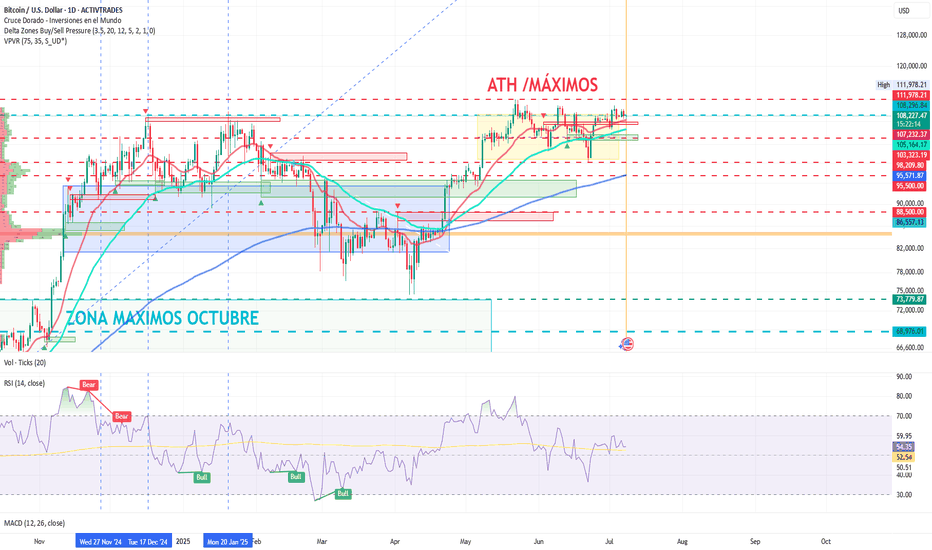

BTCUSD: Whales Move 80,000 BTC, Shaking the MarketBTCUSD on Alert: Whales Move 80,000 BTC, Shaking the Market

By Ion Jauregui – Analyst at ActivTrades

The cryptocurrency market witnessed one of the year’s most puzzling moves this week. Over 80,000 Bitcoins—worth more than $8.6 billion—were transferred from wallets that had been inactive since the early years of the crypto ecosystem. These transfers, originating from addresses linked to 2010 and 2011, sparked a wave of reactions among investors, analysts, and crypto enthusiasts.

Fundamental Analysis: Mass Sell-Off or Simple Restructuring?

The market's initial response was uncertainty. It’s unusual for wallets from the so-called “Satoshi era” to become active again. However, research led by Arkham Intelligence and other on-chain analysis firms indicates that this was not an immediate sale. The BTC was not sent to exchanges, but to new addresses—possibly with enhanced security (SegWit or multisig technologies)—suggesting an internal reorganization rather than a liquidation.

On a macro level, the environment remains favorable for Bitcoin:

– Institutional inflows via ETFs have already surpassed $14 billion in 2025.

– Broader adoption is expected, driven by proposals such as the creation of a strategic Bitcoin reserve in the U.S. and clearer regulations in advanced economies.

– The market has shown resilience in the face of similar events in the past, reducing the risk of a structural correction.

Technical Analysis: Consolidation Zone with Key Resistance at $112,000

From a technical perspective, Bitcoin has maintained a strong bullish structure in recent weeks but is currently in a consolidation phase near its all-time highs:

• Key support: $103,477, located mid-range of the current consolidation zone. The lower bound sits at $98,209, where the price has reacted positively following the whale movements. The delta pressure zone is positioned at the upper part of the range, near current price levels.

• Immediate resistance: $111,978.21, a breakout of which could open the door to a move toward $112,000–$115,000.

• Daily RSI: Neutral bias with slight overbought conditions at 54.11%.

• Moving averages: The 50- and 100-day EMAs show clear compression—typically a precursor to a breakout—while the 200-day EMA remains well expanded, appearing to support the current consolidation.

Volume remains elevated but without speculative spikes, and funding rates in the derivatives market are still positive, suggesting sustained buying interest.

Conclusion: A Symbolic Shake-Up Rather Than a Threat

Although the whale movements have made headlines and stirred speculation about a possible sell-off, the signs point to a technical update rather than a shift in trend. The market has remained stable over the past 48 hours, with technical indicators and macro fundamentals supporting a short-term neutral-to-bullish outlook.

The key will be whether these funds remain dormant or begin to disperse in smaller transactions. For now, the crypto ecosystem has weathered the shake-up without major consequences, reinforcing the growing maturity of an increasingly institutional market.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success. Regulated status does not guarantee security.

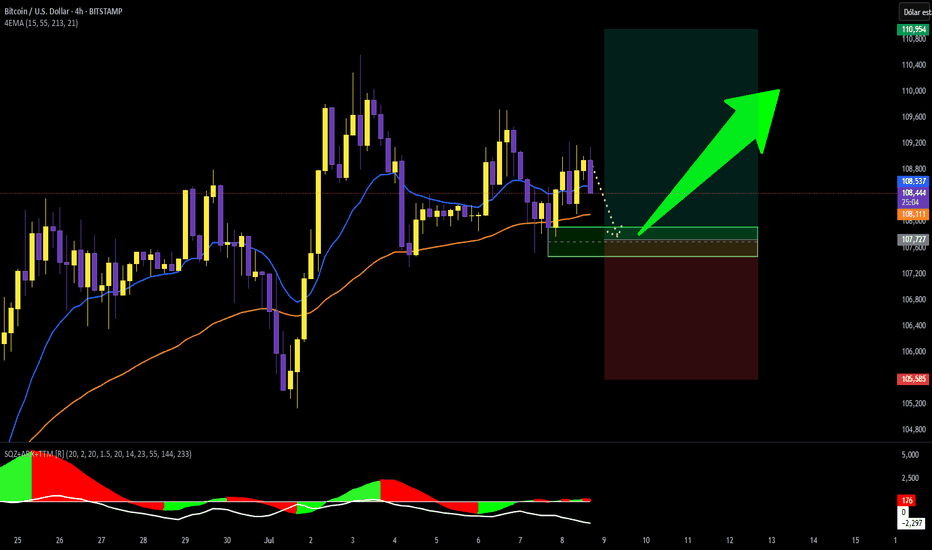

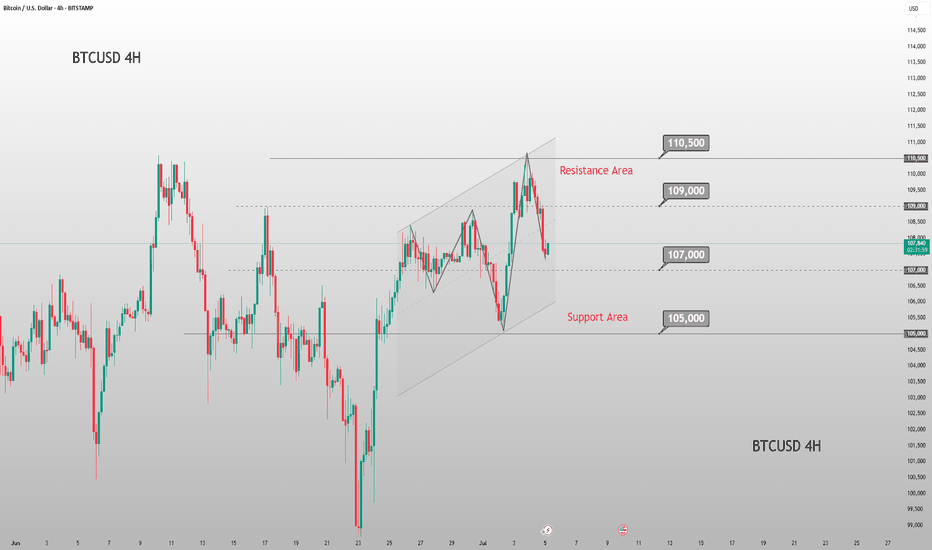

Weekend BTC Trend Analysis and Trading SuggestionsLet's review this afternoon's market performance. The BTC price, as we anticipated, rebounded to around 109,000 in the afternoon before plummeting sharply. Living up to "Black Friday", this violent drop was well within our expectations. In the afternoon's live trading, we also reminded everyone that as long as there was a rebound to the upper zone, it was a good opportunity to go short. This drop has created a space of nearly 1,500 points. Currently, the BTC price has pulled back to around 107,800.

From the current 4-hour K-line chart, after a strong upward surge, the market encountered significant resistance near the upper track of the Bollinger Bands. As bullish momentum gradually faded, the price started to come under pressure and decline, suggesting that the short-term upward trend may come to a temporary halt. At present, the market has recorded multiple consecutive candlesticks with large bearish bodies. The price has not only effectively broken below the key support level of the Bollinger Bands' middle track but also caused the Bollinger Bands channel to switch from expanding to narrowing, indicating that market volatility is decreasing. In terms of trading volume, it showed a moderate increase during the price pullback, which further confirms the authenticity of the bearish selling pressure.

BTCUSD

sell@108000-1085000

tp:107000-106000

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

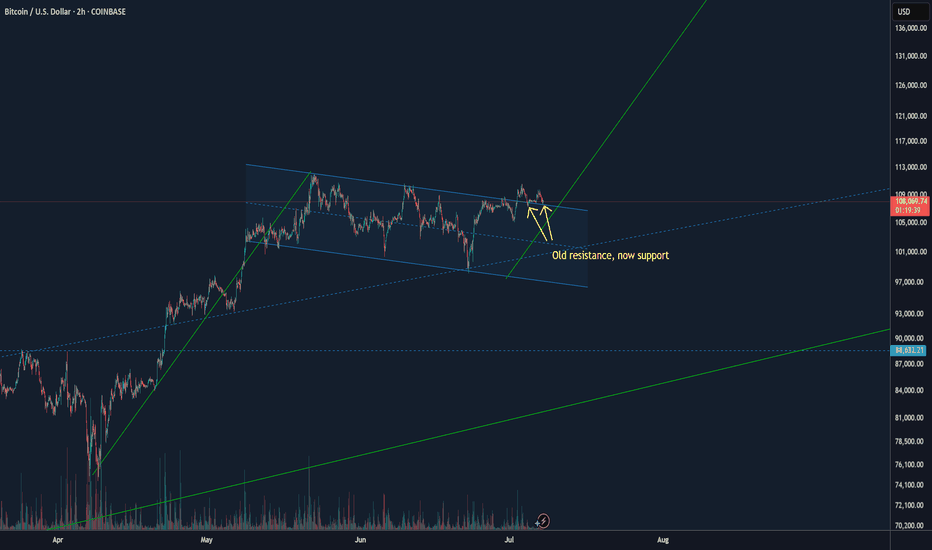

BTC moving higher, 140K not that crazyIf you're looking to short BTC around the 110K range thinking "oh yeah, this is the fourth or so time its been at 110, I'll make a quick buck".. don't. This is looking very different.

BTC has already broken out of its current resistance channel and its now acting as support. You can see its bounced off of support once and its hovering around there again.

All that BTC needs to do it do a small move up past its ATH and it's off to the races.

If the bull flag pattern holds true the move could go as high as $140k.