BITCOIN trade ideas

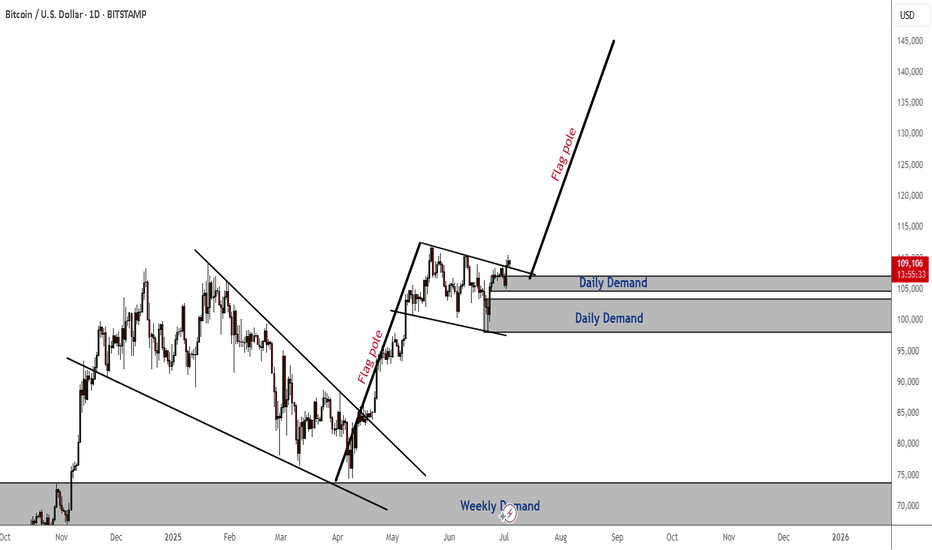

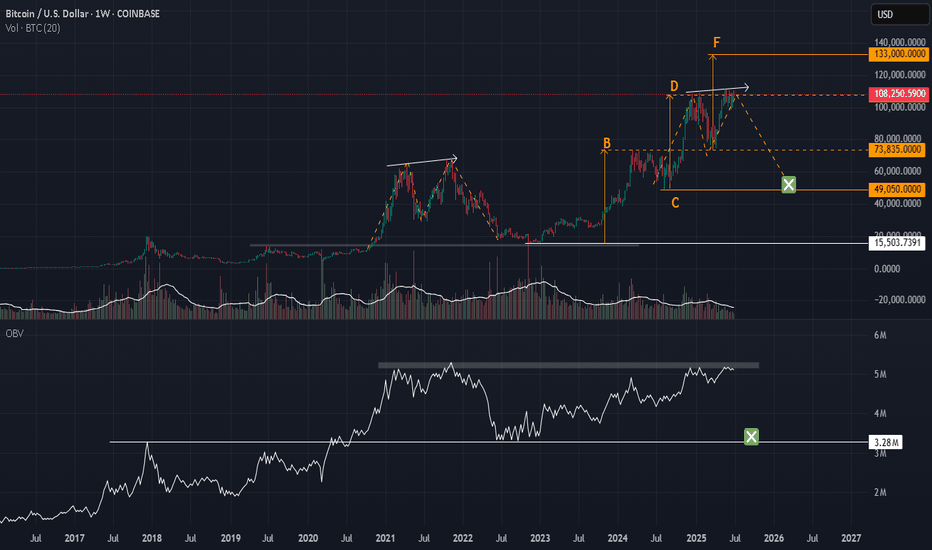

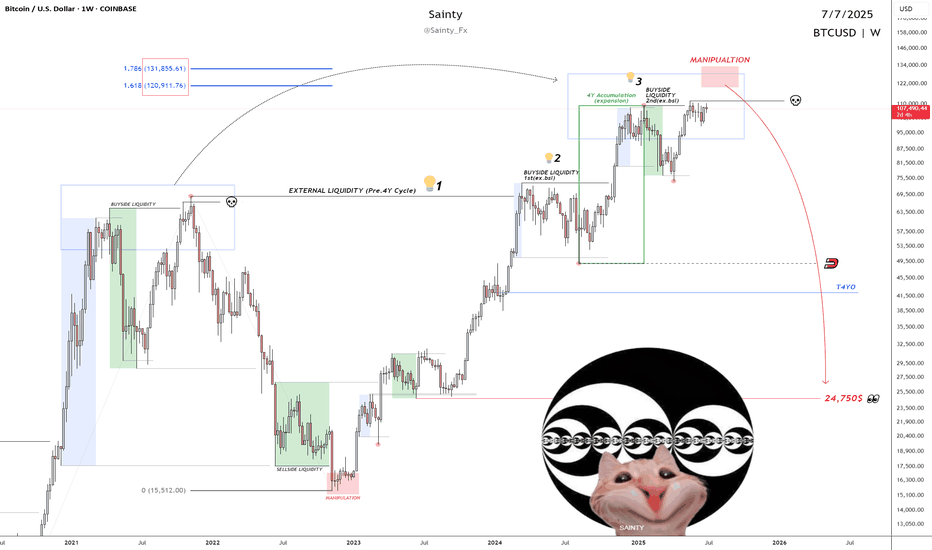

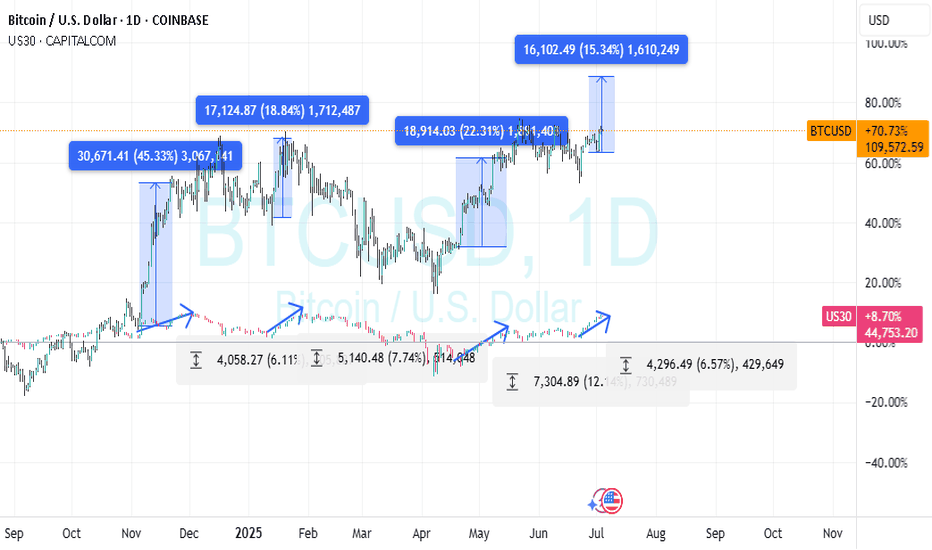

BTCUSD Daily TF Bull FlagThe daily timeframe bullish flag is a strong indication that the market is preparing for another bull run. The target for this will be around $140k - slightly higher.

I am anticipating a minor pullback to either one of the daily demand zones - (most likely the highest one) before the bulls take over.

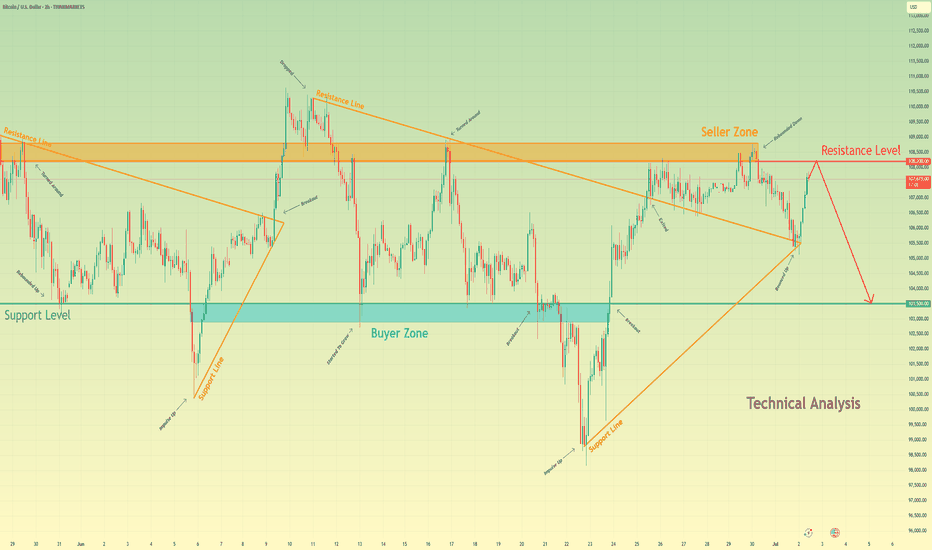

July 3 Bitcoin Bybit chart analysis

Hello

This is Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

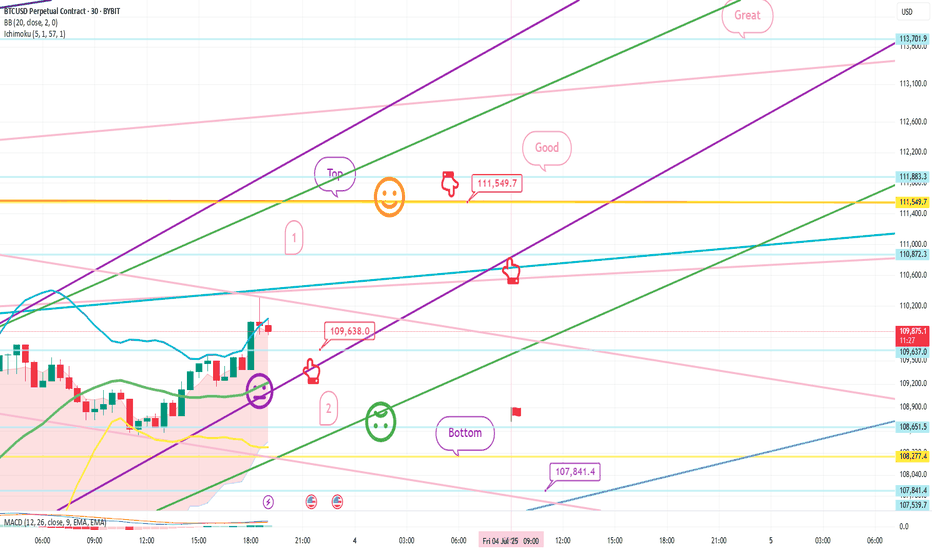

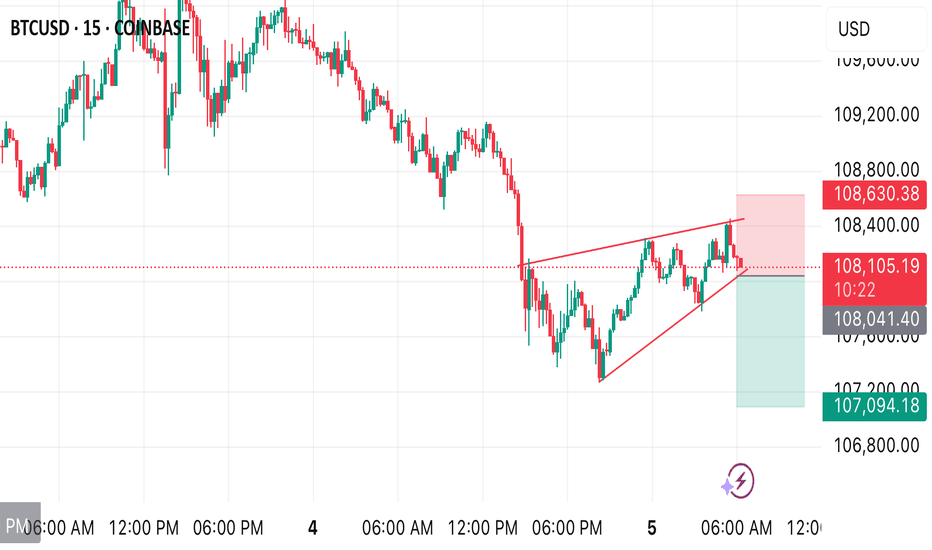

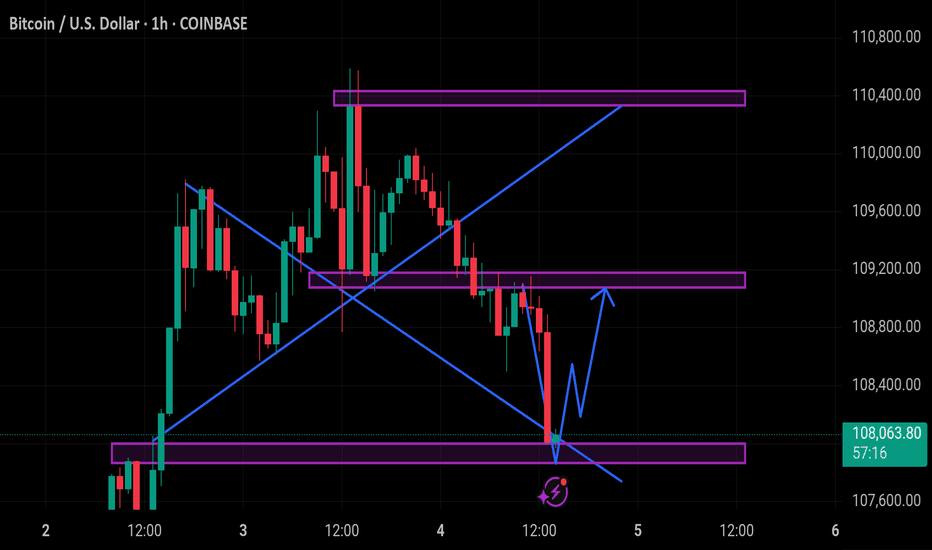

Here is the Bitcoin 30-minute chart.

There will be a Nasdaq index announcement at 9:30 and 11:00 in a little while.

I created today's strategy based on the Nasdaq pattern and Tether dominance vertical decline conditions.

*One-way long position strategy when the red finger moves

1. $109,838 long position entry point / stop loss price when the purple support line is broken

2. $111,549.7 long position 1st target -> Great 2nd target

The 1st section at the top and the 2nd section at the bottom are sideways sections.

Even if the strategy fails, if the green support line is not broken,

it is good for a long position.

Below that

Bottom -> Please note that it is open up to 107,841.4 dollars

Up to this point, I ask that you simply use my analysis for reference and use only

I hope that you operate safely with principle trading and stop loss prices.

Thank you.

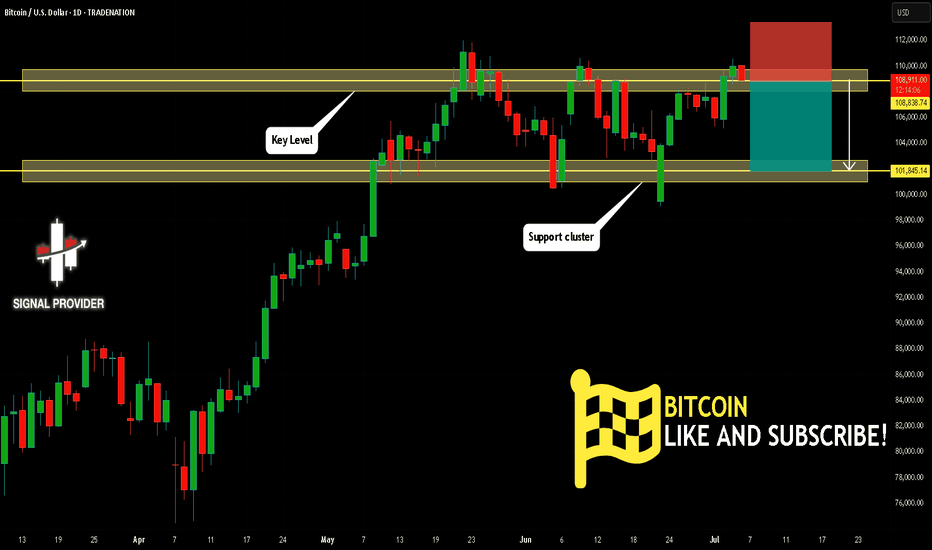

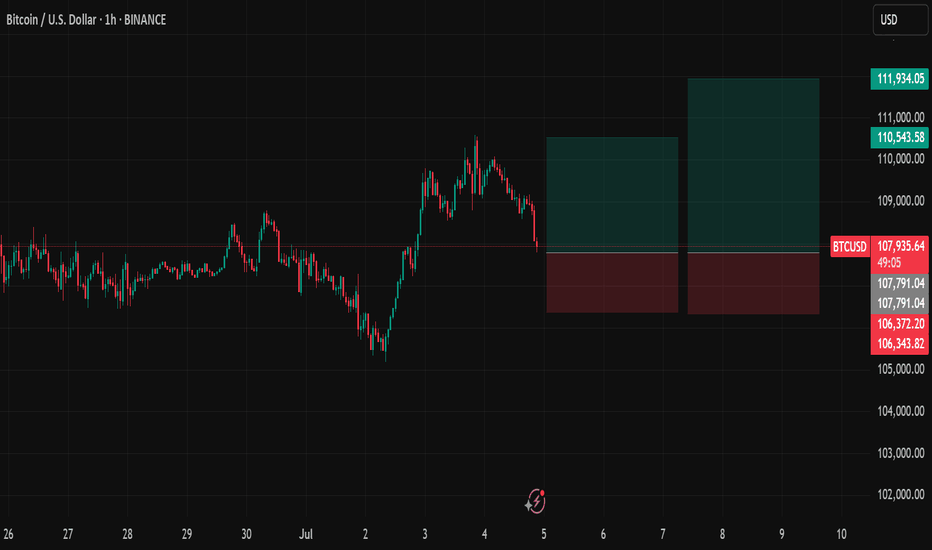

BITCOIN Will Fall! Sell!

Please, check our technical outlook for BITCOIN.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 108,838.74.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 101,845.14 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

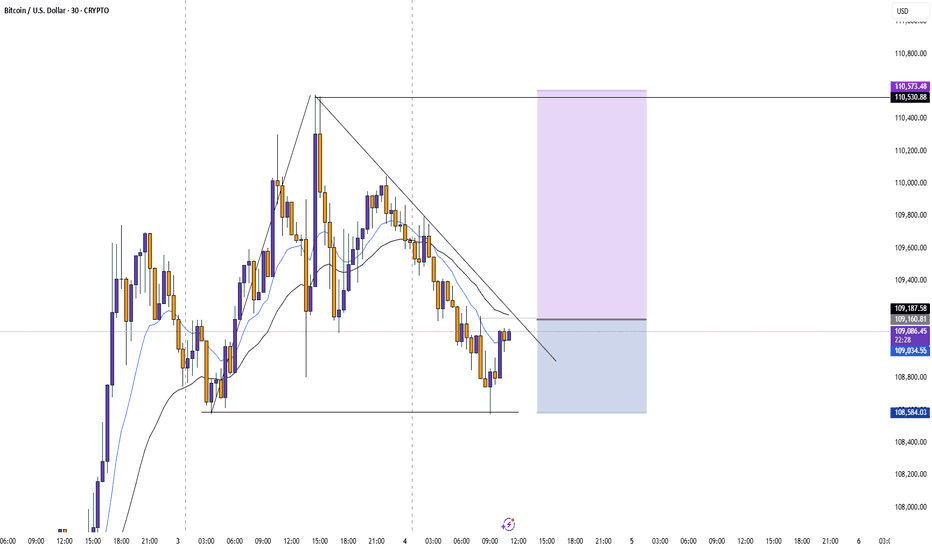

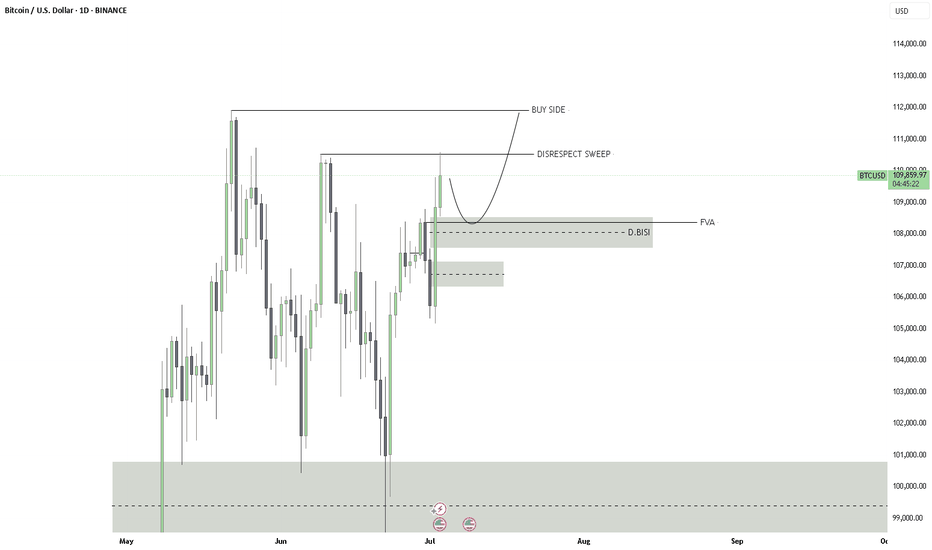

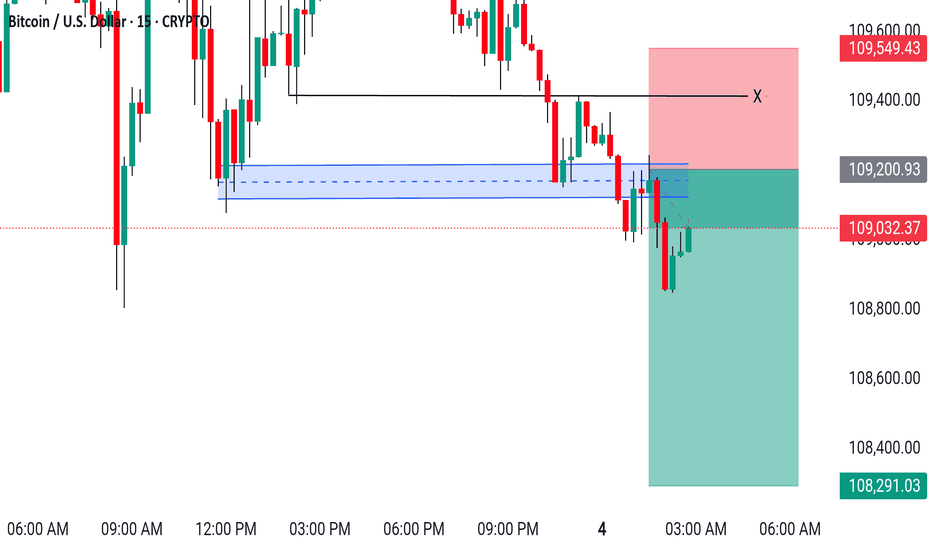

BTC Setup: 2.7 R:R"Bitcoin Poised for New Uptrend After Bull Flag Breakout Retest"

Bitcoin appears ready to begin a new uptrend after successfully retesting the breakout from a bull flag pattern and completing consolidation above key support.

This setup offers a 2.7:1 risk-to-reward ratio, with the following trade parameters:

Entry: $109,965.79

Stop Loss: $106,300

Target: $120,000

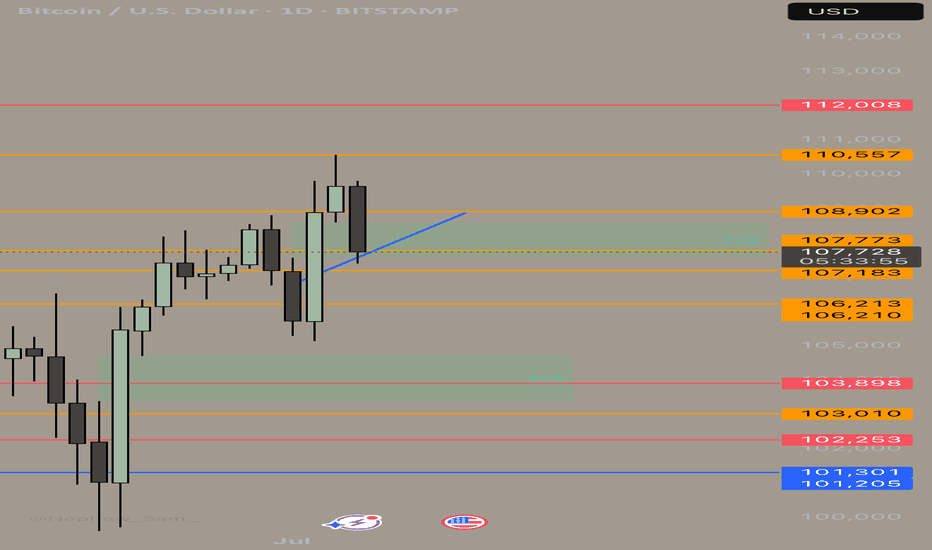

BTC : Looking at the supplyPrice is stalling at the D @ 108,800 for some time now.

I think it is not because of a lack of demand. Just that there is no one selling. Owners prefer to keep the limited supply. Buyers are unwilling to chase after the few available at a higher price. We have a stalemate.

In 2022, to break this stalemate, price needs to drop, with sellers taking a profit and making supplies available. Then we will have buyers scrambling again to BUY.

Watch the OBV.

So, I should wait to BUY, but at the right price.

Good luck.

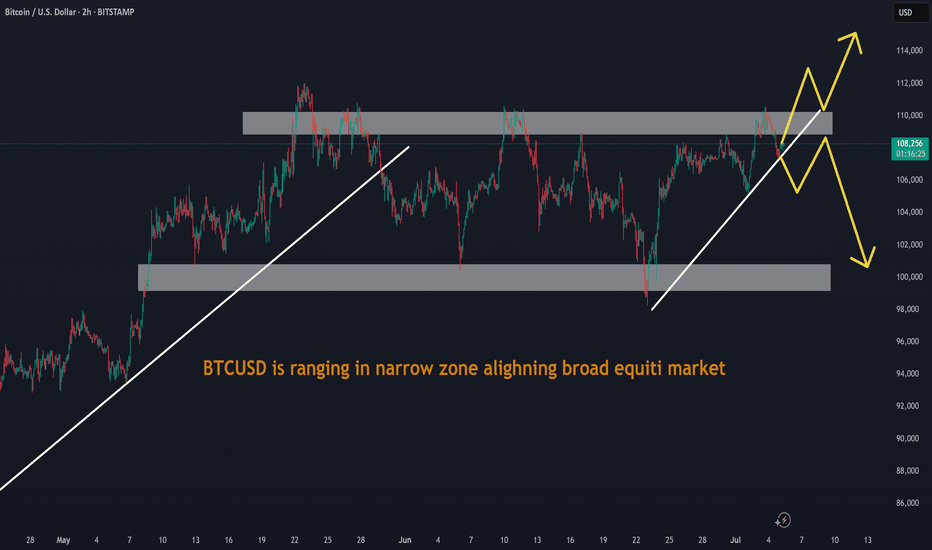

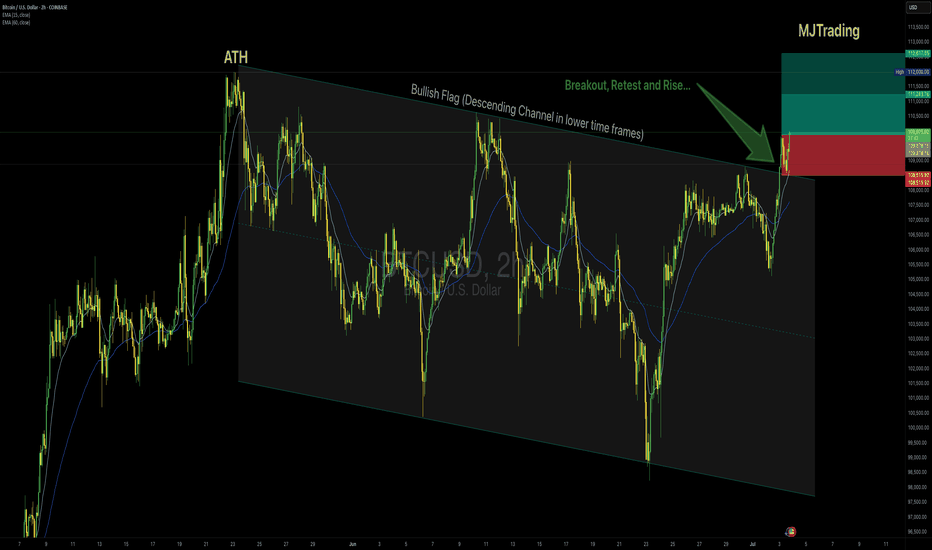

BTCUSD – Long Setup (2H Chart)👆👆🚀🚀Boost it if you like it (Thanks)🚀🚀👆👆

Idea:

Bitcoin is breaking out above the descending Flag after testing the upper boundary multiple times, showing bullish momentum confirmed by price holding above the 15 EMA and 50 EMA. The breakout aligns with strong impulse candles and sustained buying pressure.

Entry:

✅ Buy near $110,000

Stop Loss:

🔴 Below $108,500, under the breakout structure to protect against a false breakout.

Take Profit:

🟢 Tp1 $111,245

🟢 Tp2 $112,600

Rationale:

Clear breakout of the channel top resistance.

Bullish EMAs crossover with sustained slope.

Strong impulse move suggesting continuation.

Risk Management:

Position size accordingly, max risk 1–2% capital per trade.

#Bitcoin #BTCUSD #CryptoTrading #Breakout #LongSignal #TradingView #TechnicalAnalysis

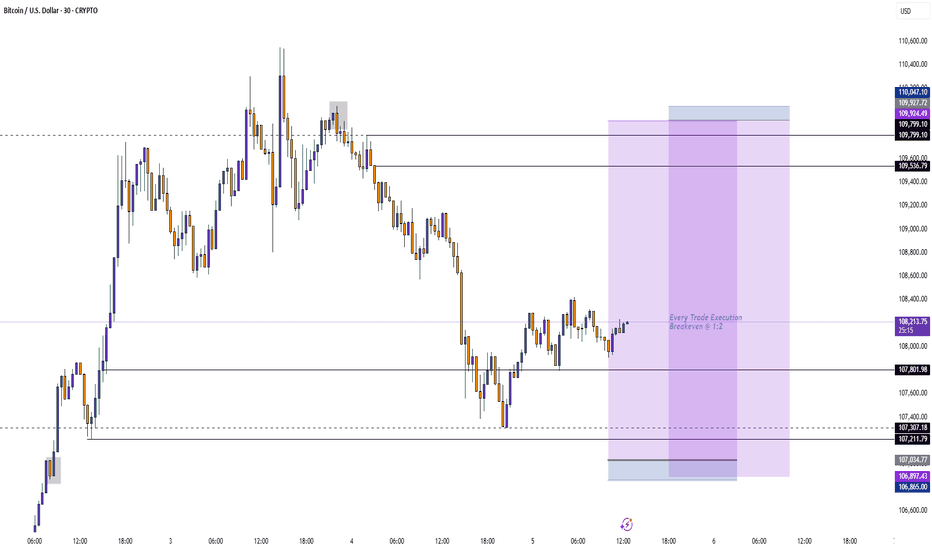

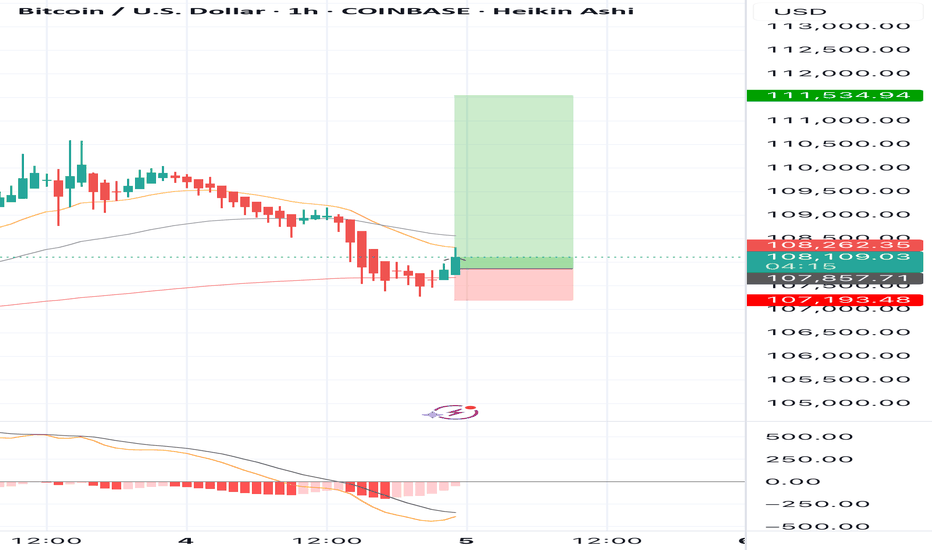

BUY BTCUSD now for a four hour time frame bullish trend continuBUY BTCUSD now for a four hour time frame bullish trend continuation ...............

STOP LOSS: 107,194

This buy trade setup is based on hidden bullish divergence trend continuation trading pattern ...

Always remember, the trend is your friend, so whenever you can get a signal that the trend will continue, then good for you to be part of it

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything...

Remember to risk only what you are comfortable with... trading with the trend, patient and good risk management is the key to success here

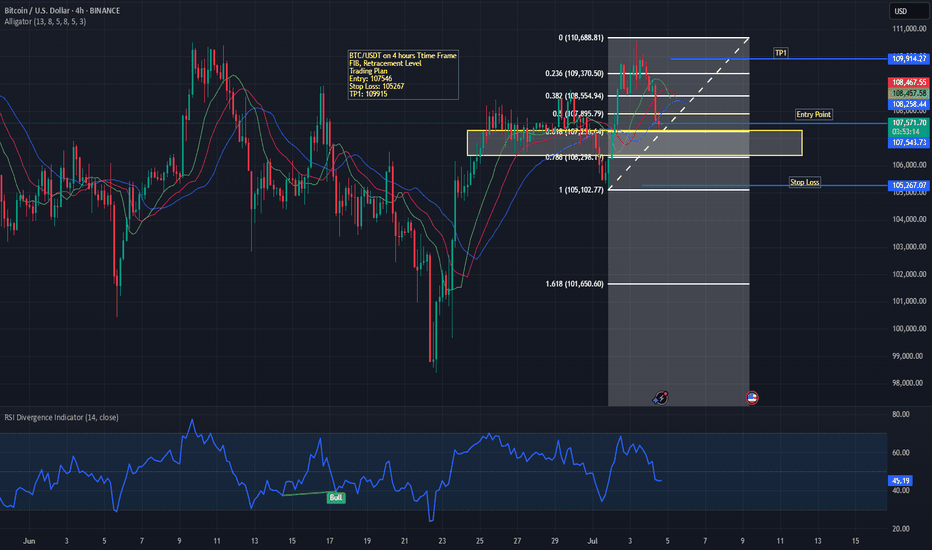

BTC/USDT on FIB Retracement LevelsThe price is currently retracing after a recent upward move and is testing the 38.2% Fibonacci level (≈107,805).

The entry zone is defined around 107,546, marked in yellow, suggesting a possible support area where buyers may step in.

The stop loss is placed slightly below at 105,267, around the 78.6% Fibonacci retracement level, to manage risk if the market breaks this zone.

The take-profit (TP1) target is set near 109,867, close to the previous high and aligning with the 0.236 Fib level (≈109,370).

📉 Indicators & Patterns

EMAs are converging, with price slightly under them, showing possible weakness but not a confirmed downtrend yet.

RSI (Relative Strength Index) at the bottom is around 45, signaling neutral momentum—neither overbought nor oversold.

A bullish divergence was marked earlier on RSI, which supported the previous price rise.

📈 Trading Plan Summary

Entry: 107,546

Stop Loss: 105,267

TP1: 109,867

Bias: Watching for a bullish reversal from the yellow support zone.

If price fails to hold above 106,296, it may head toward 105,102 and the 1.618 Fib extension (101,650).

This setup suggests a high-risk, reward potential if price bounces in the support zone, but caution is advised as RSI and EMAs currently show mixed signals.

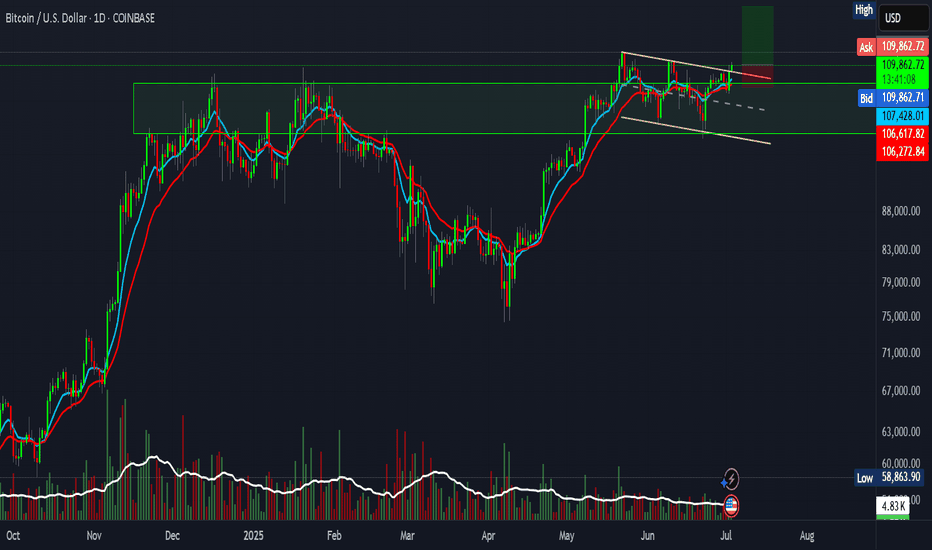

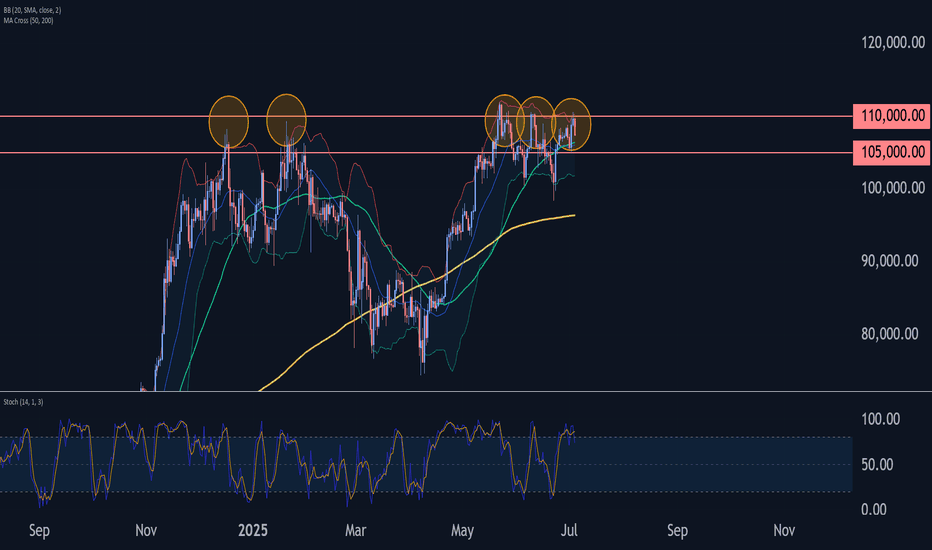

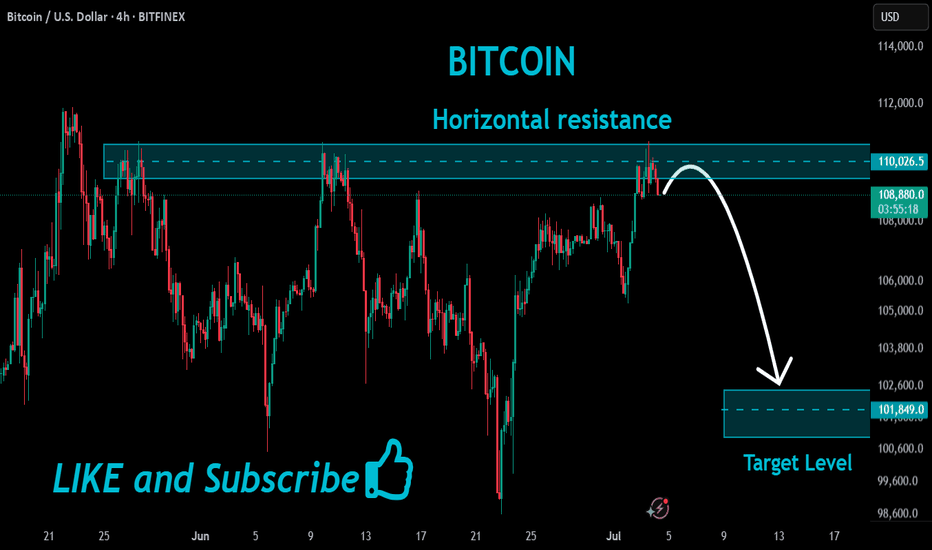

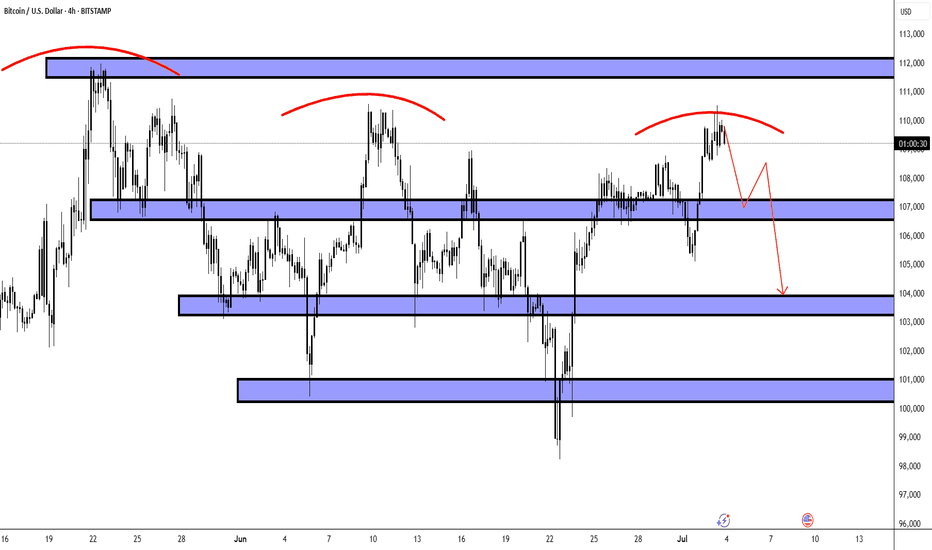

Bitcoin Wave Analysis – 4 July 2025- Bitcoin reversed from long-term resistance level 110000.00

- Likely to fall to support level 105000.00

Bitcoin cryptocurrency recently reversed down from the major long-term resistance level 110000.00 (which has been steadily reversing the price from the start of this year, as can be seen below) – intersecting with the upper daily Bollinger Band.

The downward reversal from the resistance level 110000.00 stopped the previous medium-term impulse wave (3) from the start of June.

Given the strength of the resistance level 110000.00 and the overbought daily Stochastic, Bitcoin cryptocurrency pair can be expected to fall to the next support level 105000.00 (low of the previous correction (2)).

Btc will test 112 next! With some simple technical analysis I wouldn’t be confident calling in bottom but at this time I’m hedging with a short to take small profits and transfer it into spot for more BTC!! There is a FVG on a daily chart and for now on1H we can see certain resistance. RSI is relatively strong heading to neutral making me believe we may call this bottom for now. Smart money (institutional) has eaten BTC supply and just recently 7 dormant wallets are moving money. Something big may be brewing. Be careful out there.

BITCOIN Short From Resistance!

HI,Traders !

#BITCION went up sharply

Made a retest of the

Horizontal resistance level

Of 110026.5 from where we

Are already seeing a local

Bearish reaction so we

Are locally bearish biased

And we will be expecting

A local bearish correction !

Comment and subscribe to help us grow !

Bitcoin will drop from resistance level and fall to 103500 levelHello traders, I want share with you my opinion about Bitcoin. Some days ago, price entered the pennant, where it turned around from the seller zone, which coincided with the resistance level, and dropped to the 103500 support level. Then it bounced and tried to grow, but soon failed and dropped below the 103500 support level, which coincided with the buyer zone and reached the support line of the pennant. Following this movement, BTC experienced an upward impulse, breaking the 103,500 support level and subsequently exiting the pennant pattern, before rising to the resistance level. Price broke this level and then started to decline inside another pennant pattern. In this pattern, the price dropped top 103500 support level again and then tried to bounce back, but failed and continued to decline. In a short time, it fell to the support level, broke it, and then fell to the support line of the pennant. Next, BTC turned around and repeated an impulse up to the resistance line of the pennant and exited from this pattern. Then it rose to the seller zone, where it rebounded from it and fell, but recently it rebounded and started to grow. Now, I expect that price will reach the resistance level and then drop to the 103500 support level. For this case, this level is my TP. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

BTC? and

It's alliance..

I have this knowledge will like to share: Use it caveat emptor Okay.

US30 and BTC correlate 1:2 approximately.

If US30 moved 10% BTC will move 20%

I will plot from the bottom till now (example) and get the % for US30

Then will double that % from bottom for BTC

This is no mean a crystal ball, but it gives a sense of confidence.

You will then be on a lookout in BTC for??

Whatever you like / preference on BULLISH SIDE; fav pattern bla bla..

All the best.

Do your own research. I am not guru.

NB/ May you will bless with abundance