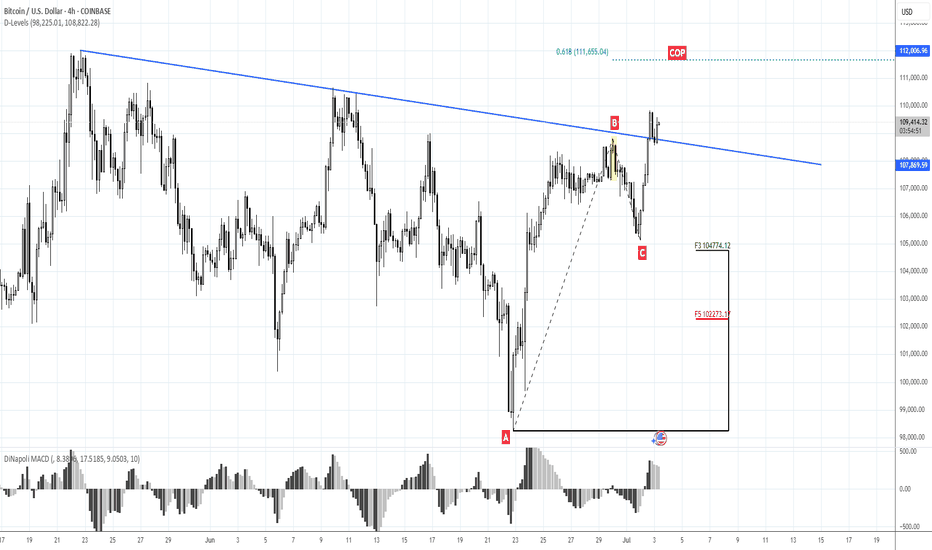

111.65 against 105KMorning folks,

So we've got great entry with our H&S but it is early to relax. To avoid long explanations - BTC has to stay above 105K lows to keep current tendency valid. So, if you still plan to buy BTC here - you do not need to watch for too deep standing Fib levels.

If BTC will still drop below 105K, we could get extended downside action to 100K and maybe even deeper.

Nearest upside target with our current plan is 111.65K.

BITCOIN trade ideas

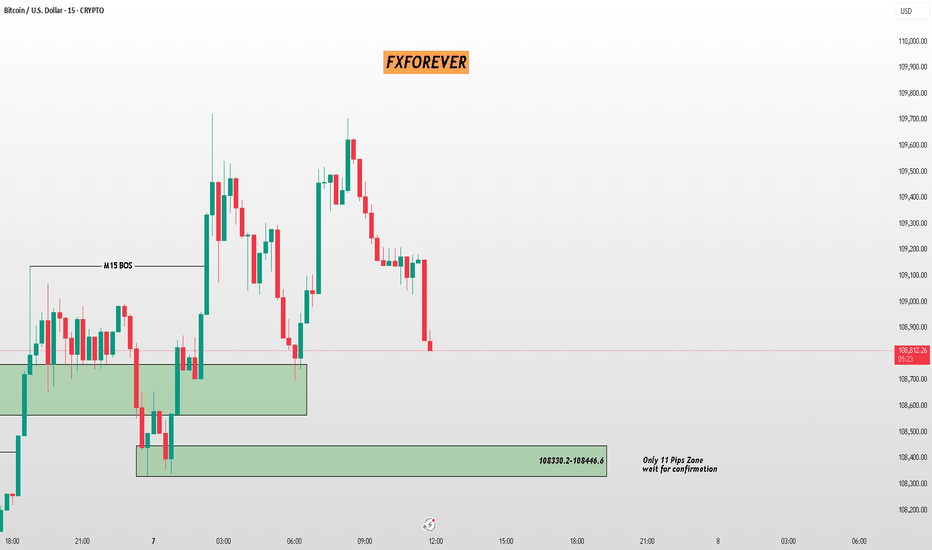

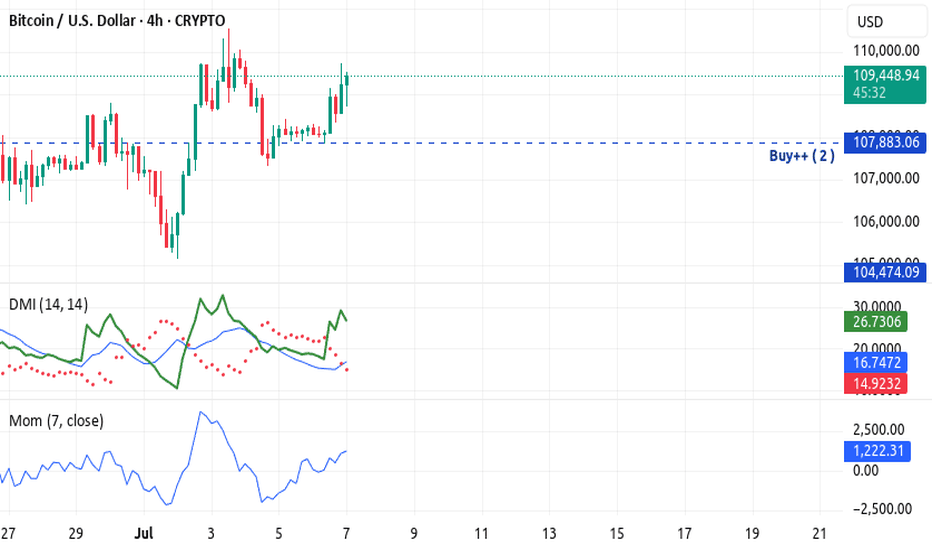

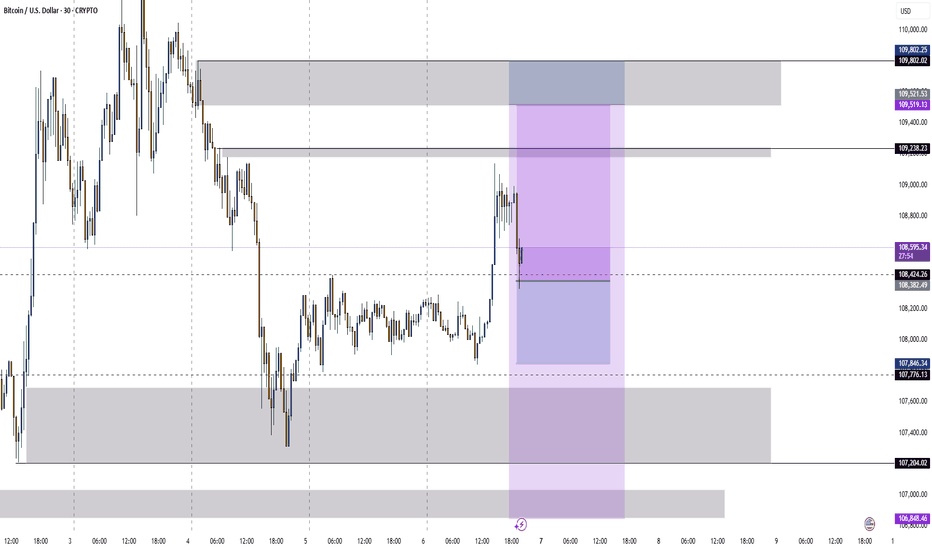

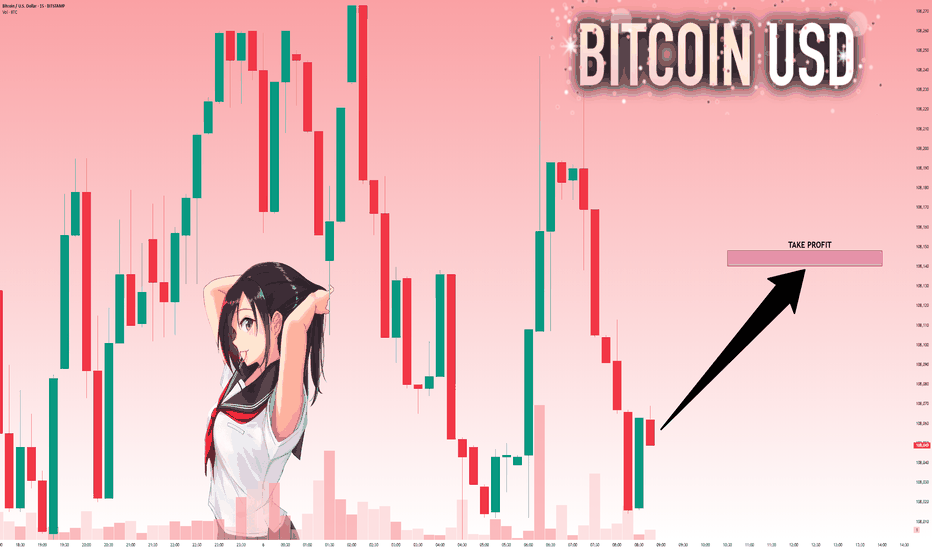

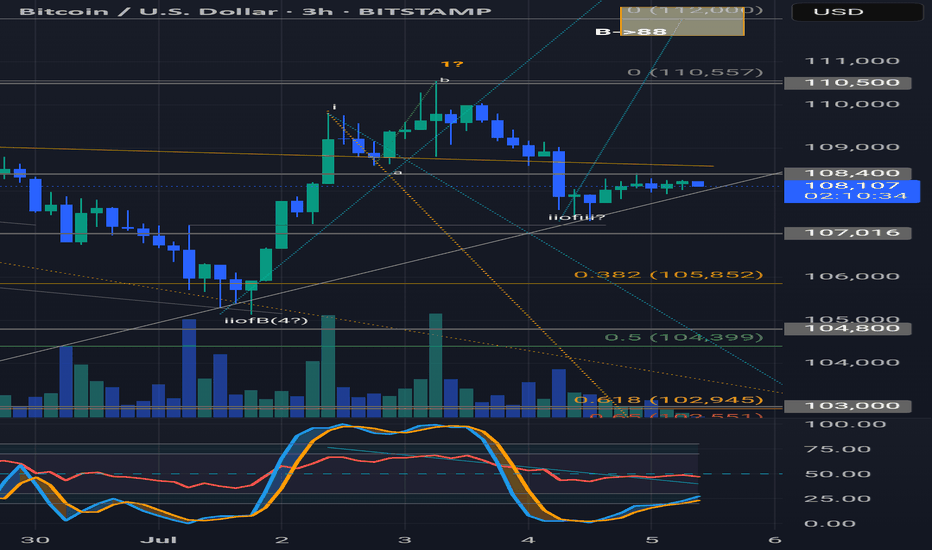

BTC/USD – Sharp Drop Into Micro Demand Zone (7 July 2025)📉 BTC/USD – Sharp Drop Into Micro Demand Zone (7 July 2025)

Price broke structure on M15 and is now falling into a tight 11-pip demand zone (108330.2–108446.6).

📊 Key Details:

🔸 M15 BOS already formed

🔸 Zone Size: Only 11 pips – requires extra caution

🔸 Setup: Wait for confirmation before reacting

📍 Aggressive buyers might watch for LTF CHoCH or engulfing from the zone. Safer entries lie in confirmation-based setups.

🎯 FXFOREVER – Precision levels. Calculated decisions.

#BTCUSD #FXFOREVER #SmartMoneyTrading #DemandZone #BreakOfStructure #M15Chart #CryptoSetup #BitcoinStrategy #PriceActionForex

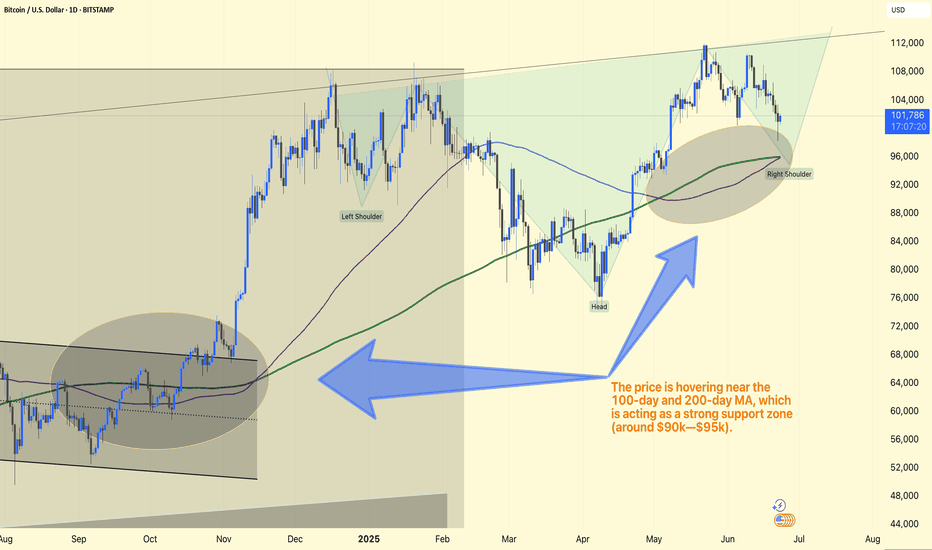

BTC/USD Analysis Update. Chart Pattern:

The chart clearly shows an Inverse Head & Shoulders structure:

Left Shoulder

Head

Right Shoulder

This is a strong bullish reversal pattern.

Moving Averages:

Price hovers near the 100-day and 200-day MA, acting as a strong support zone (around $90k–$95k).

This area is critical for sustaining long positions.

Expected Move:

Strong bullish potential towards the $113k–$115k zone, aligned with the upper trendline target.

RSI also suggests room for a bullish recovery from this zone.

Trade Plan:

Ideal Entry: Near $90k–$95k (Right Shoulder area)

Stop Loss: Just below $88k

Target: $113k–$115k

This structure is very favorable for long positions if the price confirms strength within the right shoulder zone.

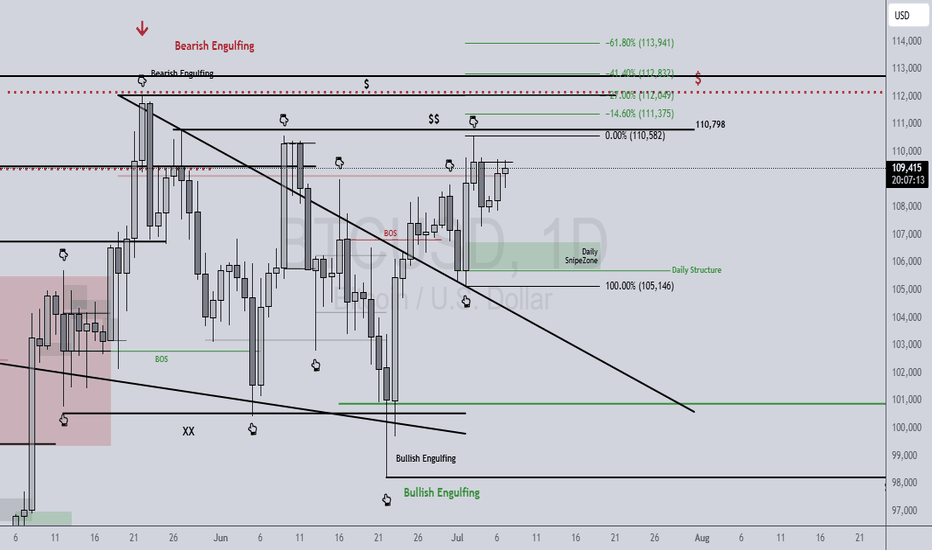

BTCUSD 7/6/2025Come Tap into the mind of SnipeGoat, as he gives you a Weekly Market Breakdown of Bitcoins current Price Action to determine Price's next move.

_SnipeGoat_

_TheeCandleReadingGURU_

#PriceAction #MarketStructure #TechnicalAnalysis #Bearish #Bullish #Bitcoin #Crypto #BTCUSD #Forex #NakedChartReader #ZEROindicators #PreciseLevels #ProperTiming #PerfectDirection #ScalpingTrader #IntradayTrader #DayTrader #SwingTrader #PositionalTrader #HighLevelTrader #MambaMentality #GodMode #UltraInstinct #TheeBibleStrategy

Bitcoin 4H Rocket Booster Strategy – Bullish Setup with EMA Bitcoin 4H Rocket Boost Strategy – Bullish Setup with EMA Alignment, Gap Action, ADX Strength, and Stoch RSI Signal

Bitcoin (BTC/USD) is currently displaying a textbook bullish setup on the 4-hour chart, closely matching the Rocket Boost Strategy

criteria. Traders using a trend-following system with momentum confirmation will find this setup particularly appealing.

1. Price Above the 50 EMA

Bitcoin is trading firmly above the 50 EMA, a key sign that short-term momentum is tilted in favor of the bulls. The 50 EMA often

acts as dynamic support during strong uptrends, and current price action respecting this level shows the market is in a healthy

bullish phase.

2. Price Above the 200 EMA

The long-term trend is also confirmed as bullish, with price positioned well above the 200 EMA. This alignment of the 50 and

200 EMAs forms what many traders call a “bullish stack,” which strengthens confidence in long opportunities.

3. Gap Action / Aggressive Breakout Behavior

While cryptocurrencies don't technically gap in the same way as stocks or forex (due to 24/7 trading), Bitcoin has shown strong

impulsive breakout candles with little to no wick retracement—often referred to as "synthetic gaps" or aggressive breakouts.

This behavior typically reflects institutional buying or whale-driven momentum entering the market suddenly.

4. ADX Indicator Confirms Trend Strength

The ADX (Average Directional Index) is rising above the 20–25 level, which indicates that the current trend is gaining strength. A

rising ADX while price moves higher means that the upward momentum is not just temporary noise—it’s a signal that buyers

are firmly in control.

5. Stochastic RSI Gives Reversal Buy Signal

The Stochastic RSI recently dipped into oversold territory and has now crossed back upward. This reversal buy signal, especially

when aligned with a trending environment, often marks the end of a short-term pullback and the beginning of a new impulse leg upward.

What This Means for Bitcoin Traders

When all these components align—price above both EMAs, strong ADX trend, breakout behavior, and a fresh Stoch RSI buy

signal—it often results in what traders using the Rocket Boost Strategy refer to as a “momentum ignition point.” It’s not just a

signal to enter, but a signal that the market may accelerate in the current direction.

This could lead Bitcoin to test new resistance zones or even break psychological levels if volume supports the move. Key zones to

watch would be previous highs and Fibonacci extensions drawn from the most recent swing.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always perform your own due

diligence and use proper risk management when trading.

To learn more about this kind of setup, search for Rocket Boost Strategy content.

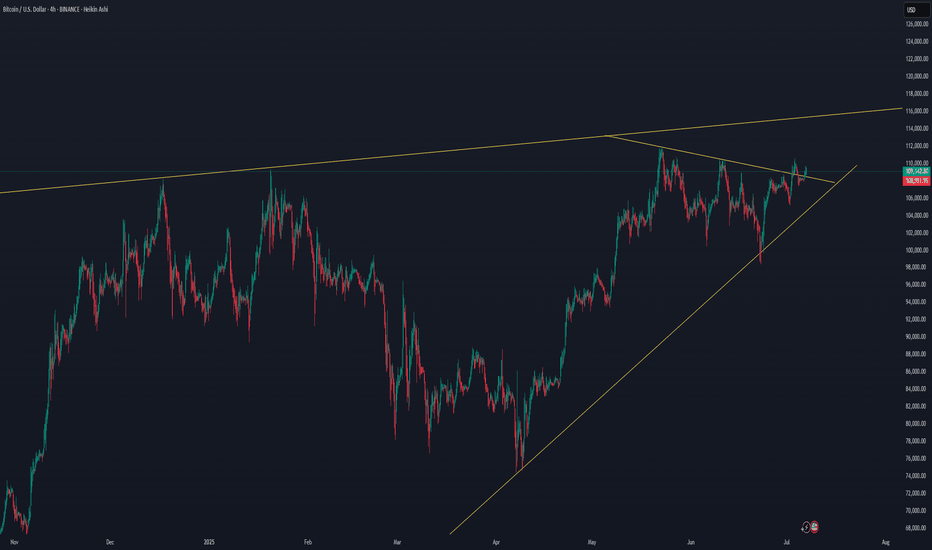

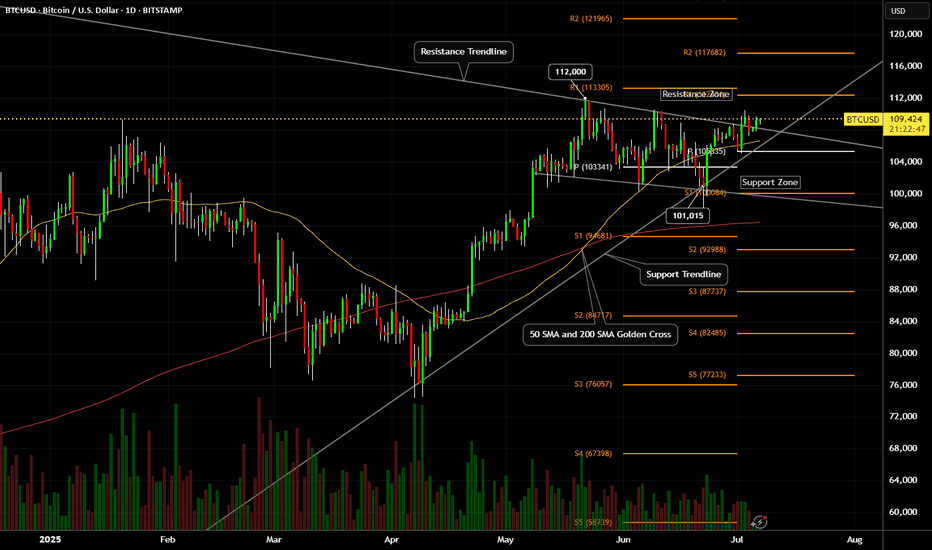

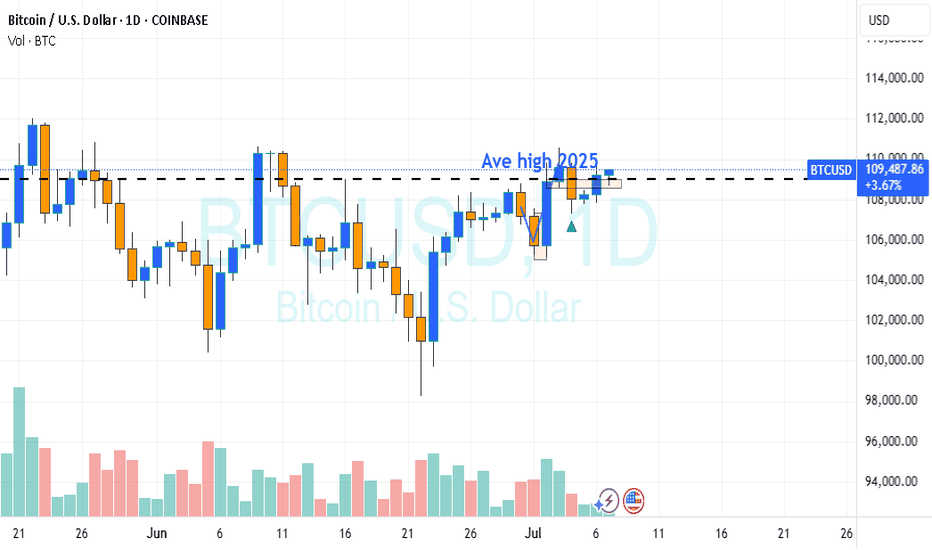

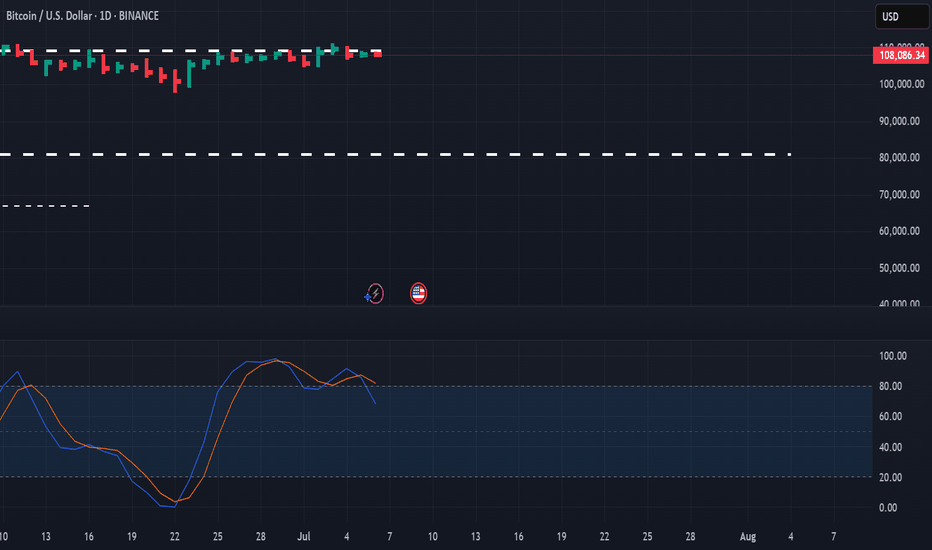

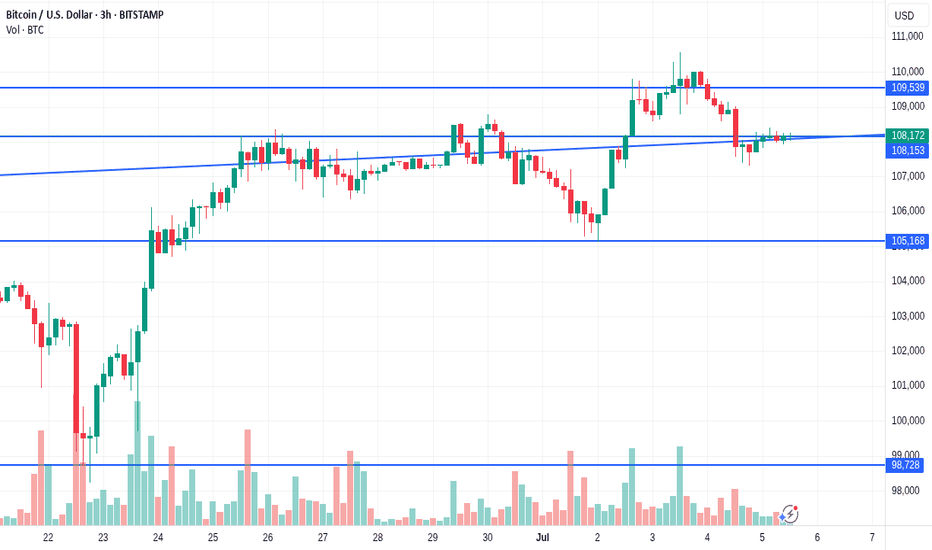

Bitcoin (BTCUSD) - Daily Price Uptrend, Resistance Breakout TestBitcoin (BTCUSD) has been in a recent Daily price Uptrend, rallying up from the $100,000 price support level.

A SMA Golden Cross printed on May 21st, 2025.

Bitcoin price is attempting a resistance zone test and has yet to breakout and hold above the $111,000 to $112,000 price zone.

Resistance levels: $110,000 , $112,000 , $117,000 , $121,000.

Support levels: $108,000 , $107,000 , $105,000 , $104,000 , $100,000.

Recent crypto industry, government legislation news, and institutional crypto purchases have helped to keep Bitcoin price above $100,000 support.

Stock market correlation volatility could also affect the crypto market and prices for the next 30 to 45 days.

BTC?

Hi

We have a predicament when we enter a trade

Buy or Sell

That's all

We need to have a belief

How do we have the bias?

Knowledge base

In your research : Is it valuable in 6months till 24mo & why?

If it is push button buy; if not going to be why would youu.??

So laymen.. and not so complex.

The issue is leverage, greed and get it quick and you need to have it now.

Again.

Not a guru

NB/ patience boss

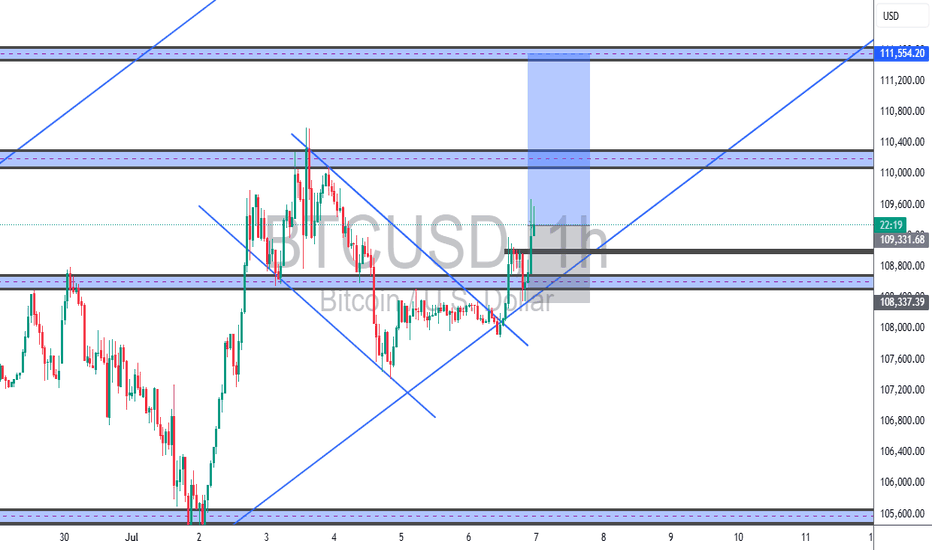

BTCUSD – Bullish Breakout (TCB Strategy A+ Setup)📈 BTCUSD – Bullish Breakout from Falling Wedge (TCB Strategy A+ Setup)

Timeframe: 1H

Strategy Phase: ✅ Countertrend Phase (bullish breakout)

🔍 Analysis:

BTCUSD formed a well-defined falling wedge (countertrend structure) during a bullish market environment. After a clean liquidity sweep of the wedge lows and several failed breakdowns, price broke out with strong bullish momentum.

A successful retest of the broken wedge + horizontal support zone (~108,926) provided a perfect entry opportunity, aligning with the TCB Countertrend Strategy rules.

📌 Entry: 108,926

📉 Stop Loss: ~108,200 (below wedge low)

📈 Take Profit: 111,554 (next major resistance zone)

💡 Risk-to-Reward: ~1:3+

🎯 Checklist Score: ✅ 100% (A+ Setup)

📋 TCB Confluences:

Countertrend Falling Wedge ✅

Breakout with Momentum ✅

Retest of Structure + Demand ✅

Liquidity Sweep Below Lows ✅

Clean Market Structure to TP ✅

🧠 Trade Management:

SL to BE at 1:1 RR (~110,100)

Optional partial TP around 110,400–110,800

Re-entry only on new continuation flag or structure retest

📚 Strategy: TCB Strategy (Trend – Countertrend – Breakout)

Focus: Identifying high-probability setups by combining structure, momentum, and confluence for precision

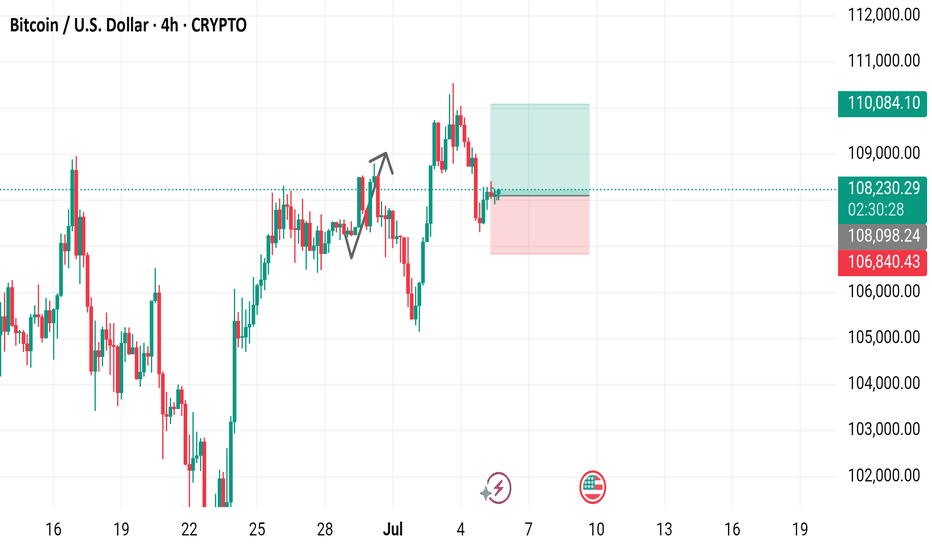

Bitcoin / U.S. Dollar 4-Hour Chart - CRYPTO4-hour candlestick chart displays the Bitcoin (BTC) to U.S. Dollar (USD) price movement, currently at $108,252.17 with a 0.21% increase (+$230.82). The chart highlights a recent upward trend with key price levels marked, including a buy price of $108,252.17 and a sell price at the same level. Support and resistance zones are indicated with a pink shaded area around $106,840.43 to $108,252.17 and a green shaded area near $110,084.10. The chart spans from late June to July 7, 2025, with the latest data point at 06:27 PM PKT on July 5, 2025.

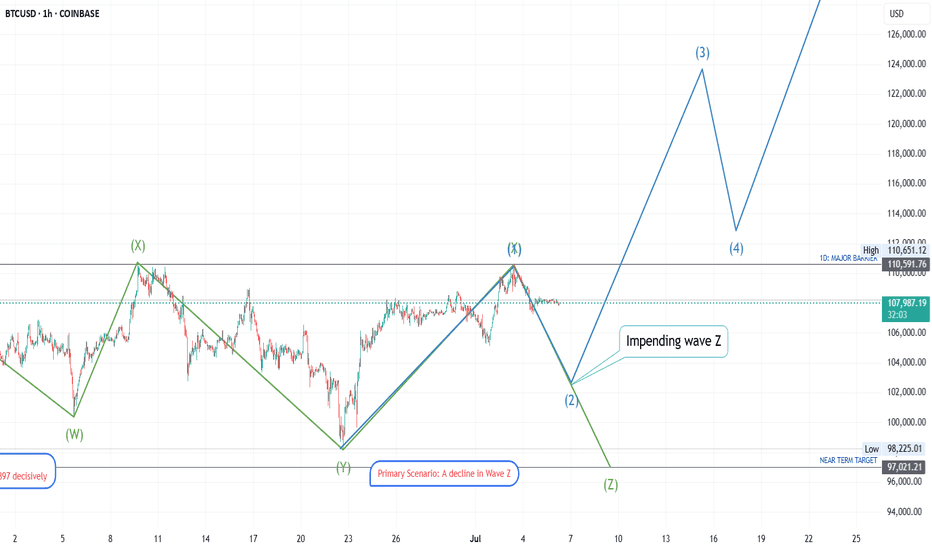

BEARISH ELLIOTT WAVE PATTERN ON BITCOINIn this short video, I explain the complex Triple Three Elliott wave pattern identified on the hourly chart on Bitcoin.

Based on the identification of the second wave X at $110,600 my most probably expectation is the completion of wave Z which will take the corrective form of an A-B-C pattern to an intended target below $98,225.

The alternative scenario is that the corrective wave ended at wave Y and the depicted Y-X wave is an impulse wave 1 and were likely on wave 2 to continue to a wave 3 which will break into a new all time high above $125,000.

Currently, I am personally in favor of the completion of wave Z as wave Y-X could not break above the MAJOR Resistance at $112,000.

BTCUSD: Target Is Up! Long!

My dear friends,

Today we will analyse BTCUSD together☺️

The market is at an inflection zone and price has now reached an area around 108,067 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 108,140. Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

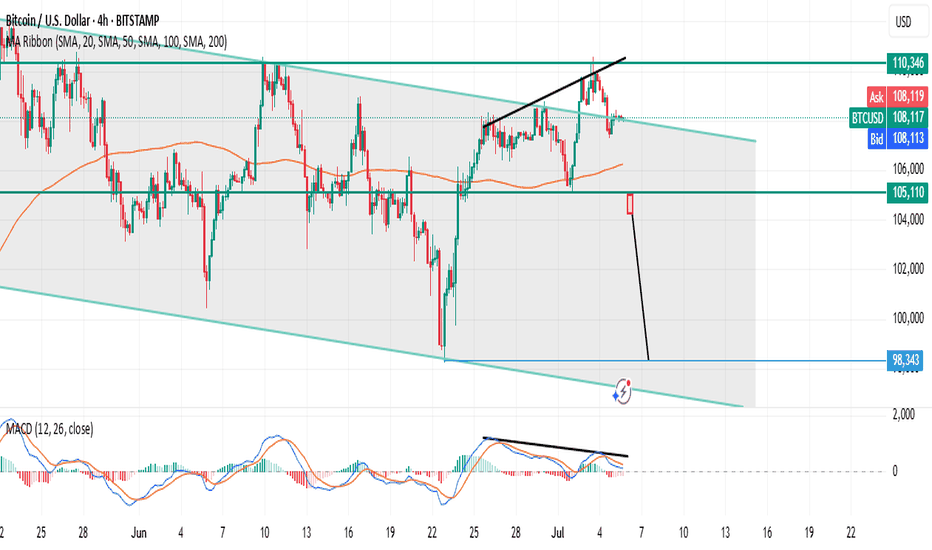

BTC/USD (4H): Classic FRL short setup unfoldingTrading = capital management under uncertainty.

Bitcoin is trading inside a clear descending channel on H4.

Price recently tested the upper boundary of this channel while forming a bearish divergence on MACD. This divergence hints at a weakening upward phase, signaling a possible phase shift according to Fractal Reversal Law (FRL).

Why is this a classic FRL setup?

✅ Phase Identification:

The prior local upward phase within the descending channel is weakening.

✅ Reversal Pattern:

A double top / wedge has formed at the upper boundary with a bearish divergence.

✅ Neckline:

The neckline aligns with the MA100 cluster on H4, now acting as a horizontal rubicon.

✅ Confirmation:

We wait for a full candle close below the neckline on H4 to confirm the phase shift.

✅ Targets:

– TP1: Mid-channel grey zone.

– TP2: Lower boundary of the channel.

✅ Stop:

Above the recent highs or channel top, depending on your risk management.

Plan:

Wait for H4 close below neckline → enter short.

Use the channel structure for target planning.

Manage risk with a tight, structure-based stop.

This is a clean FRL textbook scenario:

Phase → Pattern → Neckline → Confirmation → Target.

It aligns with the larger market structure, using the combination of price action, divergence, and structure clarity to guide your trade decisions.

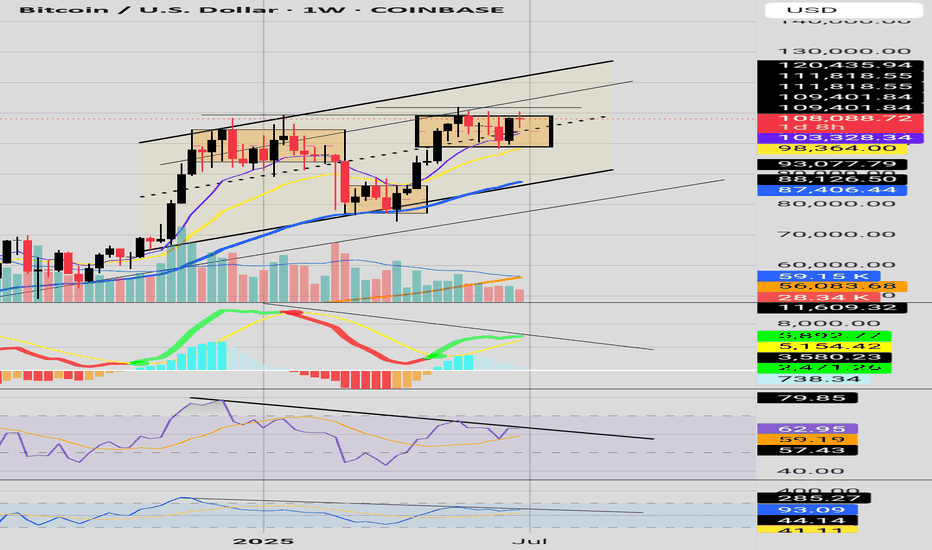

Triple Bearish DivergenceWe have bearish divergence on the MACD(Chris Moody) and the CCI and the RSI. Also the MACD looks like it can make a bearish cross over in the future. BTC is near all time high and volume is drying up and this week candle is forming a hanging man(week is not over yet). If the Bulls can keep price above the 10 EMA 103,333.98(purple curve) they have a fighting chance but the bears are patiently waiting.

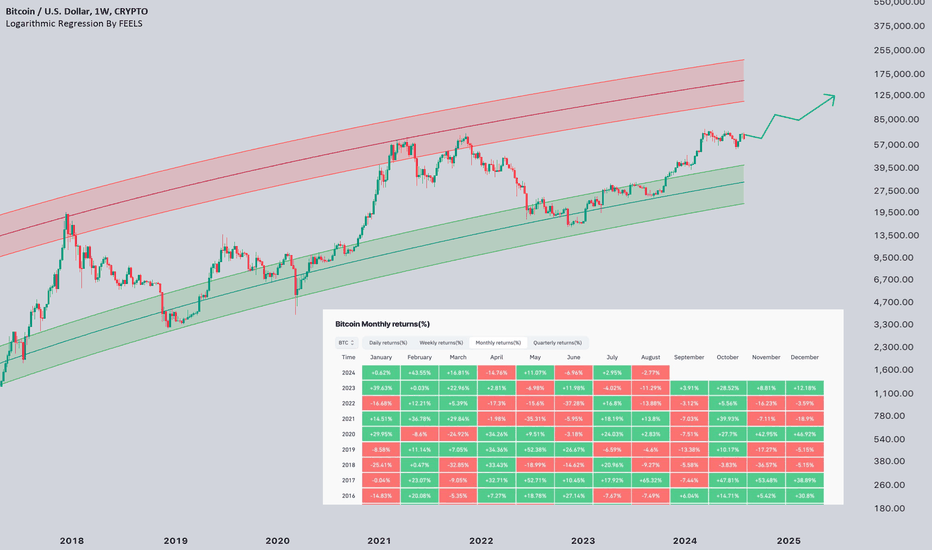

Why Bearish?Why are we falling and why do I think there will be no deep correction?

🗣The first is, of course, geopolitics, risks are growing again in the Middle East,

🗣The second is additional liquidity from the US government and mt GOX.

🗣A crisis of narratives, nothing very positive will happen in the next 2 months, and the seasonality in those months also does not give anything positive.

🗣Fears that key rates will be lowered will bring negativity to the market, as has been the case historically.

Why these are not big problems?

💡Geopolitics. I don't want to delve into possible options, but in the basic version, I expect a repetition of the option as it was in April, after which the situation cooled down.

💡The market will absorb the liquidity here and as in the past, as we saw in the story with the sales of the German government.

💡I think there will be narratives, and seasonality does not show us a deep correction, only consolidation.

💡I consider that the negative will be only in snp500 and then very short-term. In general, lowering rates is positive, both for business and for risky assets such as cryptocurrencies.

P.S. In the table of seasonality, I left only the necessary months, taking away bear years and too early years.

Current Pivot Points on the BtcUsd Pair📈 Classic Pivot Points (Daily Timeframe)

Using yesterday’s data:

High = $109,723.7 (Jul 3)

Low = $108,544.8

Close = $108,590.5

investopedia.com

+15

marketmilk.babypips.com

+15

dailyforex.com

+15

investing.com

+1

coinlore.com

+1

Compute:

Pivot Point (PP) = (109723.7 + 108544.8 + 108590.5) / 3 ≈ $108,953.0

Resistance 1 (R1) = (2 × PP) – Low ≈ $109,361.2

Support 1 (S1) = (2 × PP) – High ≈ $108,182.3

Resistance 2 (R2) = PP + (High – Low) ≈ $109,912.0

Support 2 (S2) = PP – (High – Low) ≈ $108,023.0

These central and level lines offer key zones where price might reverse, pause, or breakout.

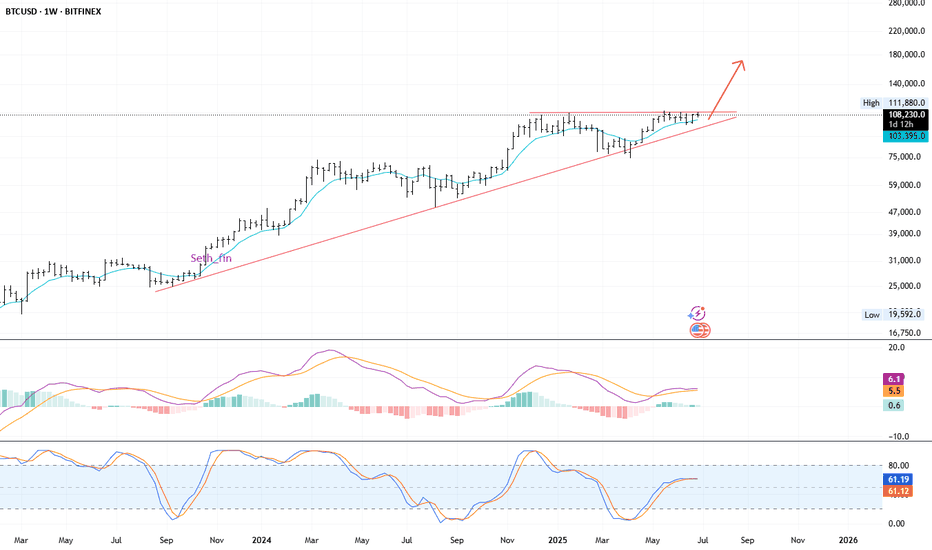

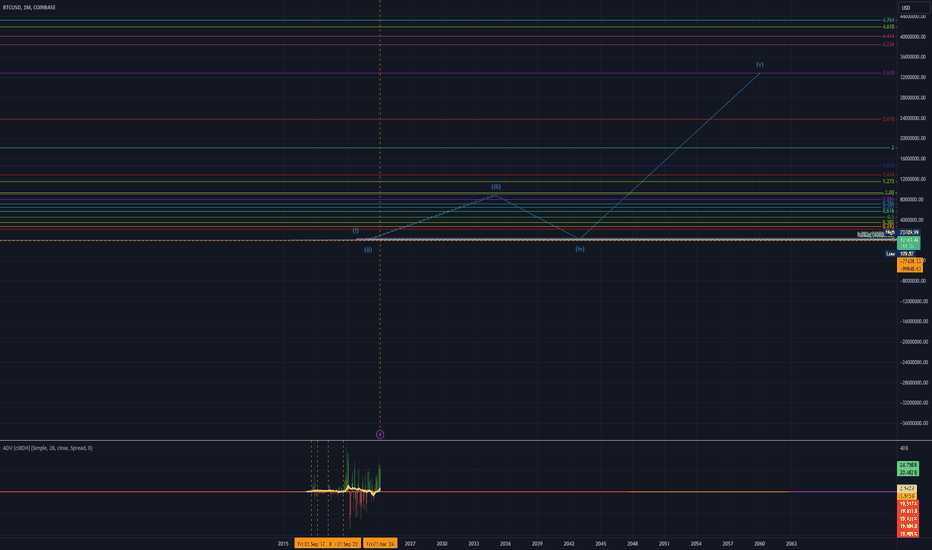

40 Year Rough EstimateThis chart looks silly, I know. Turn on log to see it a bit better. It sounds absurd, but so does just about any market.

The only thing I can see stopping this is a return to the gold standard. As long as money can be printed for free, it will. Bitcoin can't.

I suspect we'll start seeing the qSAT (quadrillionSAT) shorthand or something, because you can always add more zeroes.