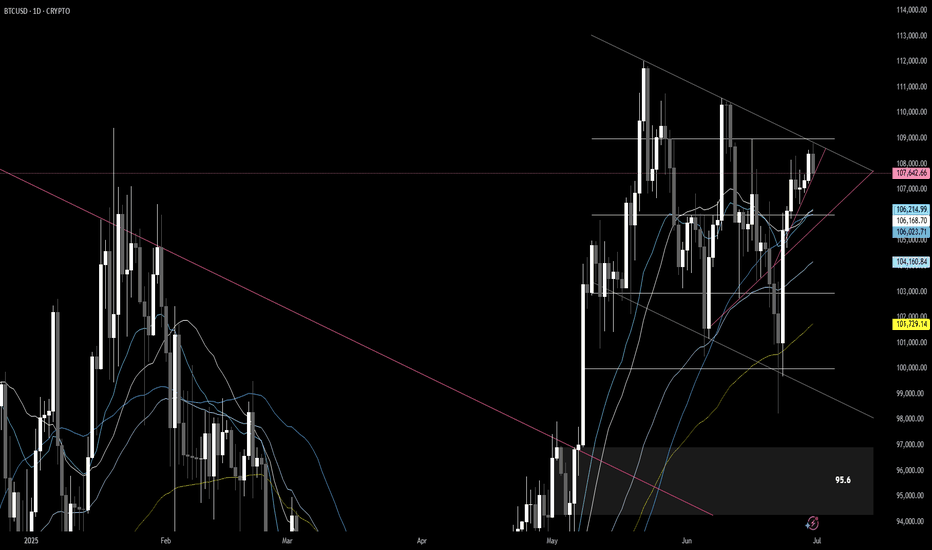

Bitcoin’s Breathing Zone – Watching for a Natural Snap Setup📊 Bitcoin Daily – Probabilistic Swing in Play

Tracking the Snap Zone & Energy Reset

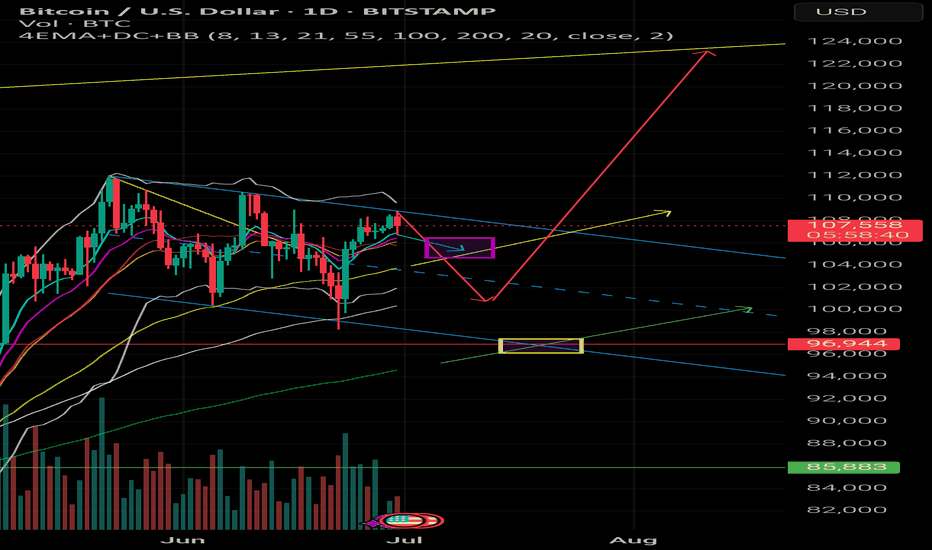

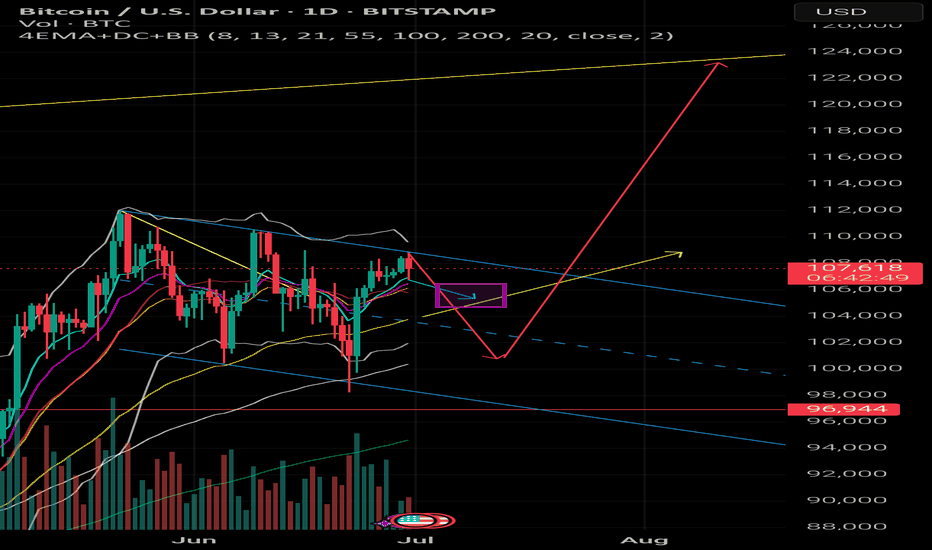

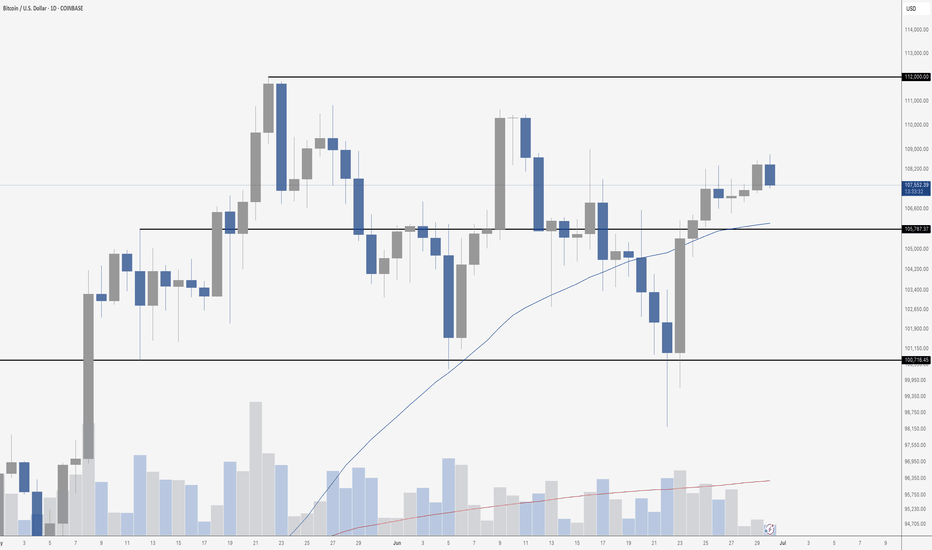

I’m watching a probabilistic swing scenario on Bitcoin where the price might need to dive into the 100k - 101k zone to build enough energy for the next major move.

The key area I’m tracking is the EMA 200 on the daily chart (~95k - 97k).

This would be the natural deep target if the price sweeps lower. The EMA 200 often acts as a long-term support where markets "reset" and gather strength.

👉 It’s also worth noting: Institutional traders traditionally view the daily EMA 200 as a key buy zone in an overall bullish market structure.

That’s where many large players reload positions, aiming to ride the next expansion wave.

What I’m expecting:

A retracement into 100k - 101k to snap the short EMAs together.

A potential liquidity sweep below the EMA 100, possibly down to the EMA 200 zone.

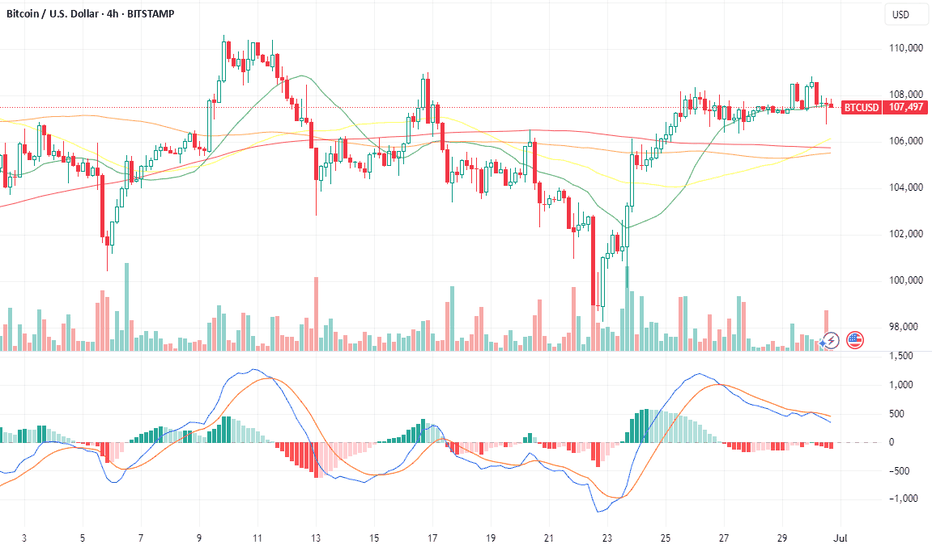

Key bullish signals: wick rejections, strong bounce candles, and engulfing patterns on the 4h or daily.

This would set up the energy for a clean bounce and a probable move towards the upper yellow trendline around 124k.

Without this deeper retracement, the move would likely run out of steam earlier, probably capping out around 112k.

I trade probabilistic scenarios based on natural price swings, EMA wave dynamics, and energy compression zones.

📌 Chart and path idea attached.

What’s your view? Are you watching this zone?

BITCOIN trade ideas

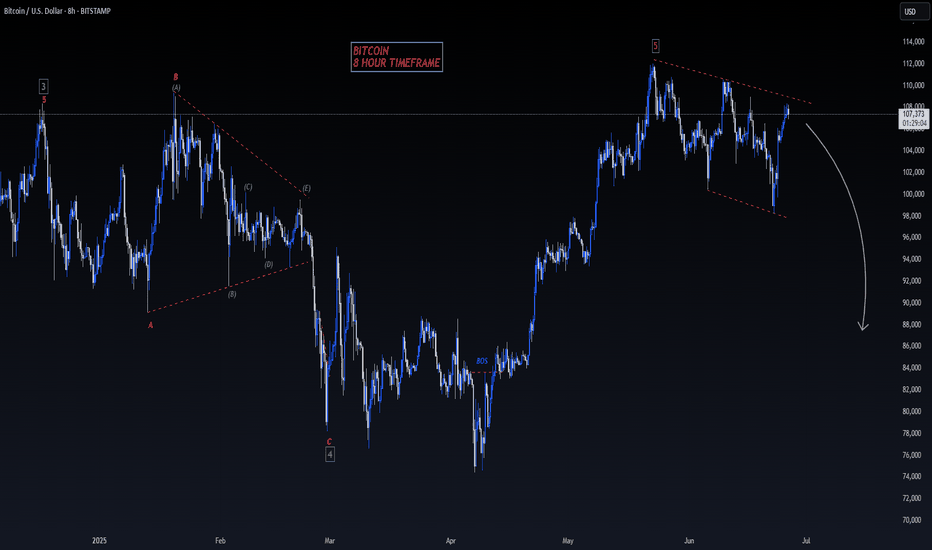

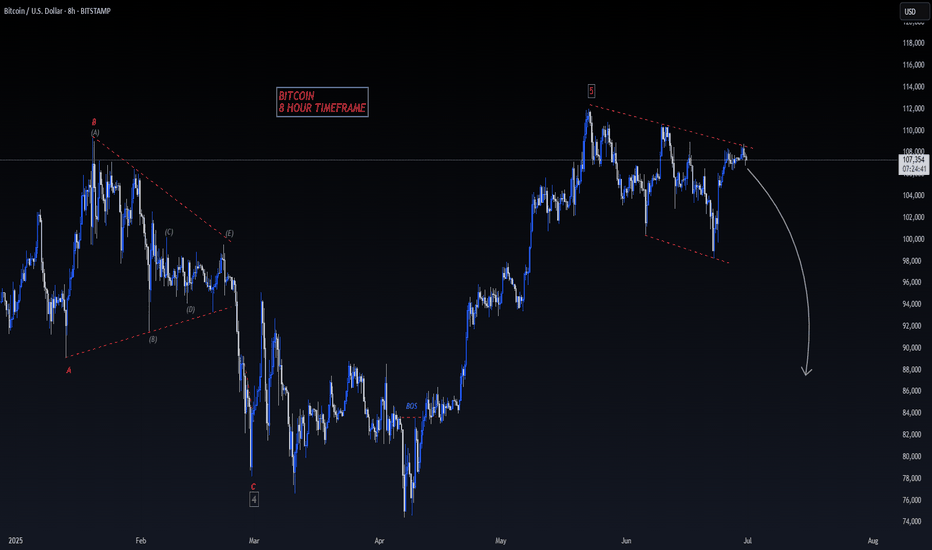

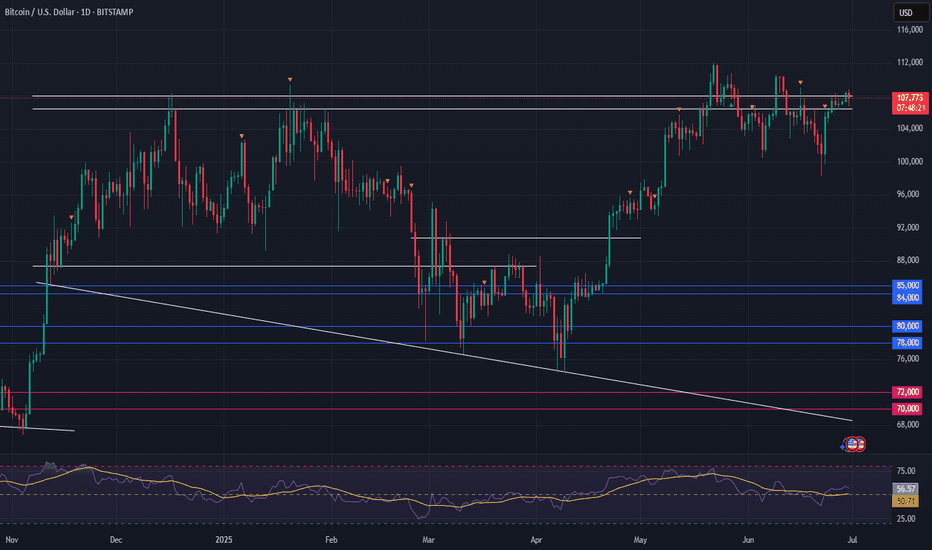

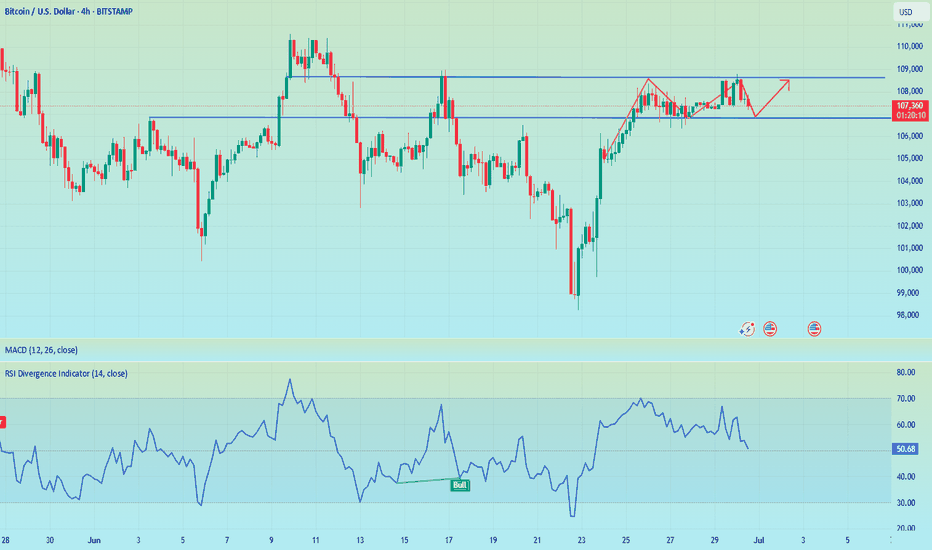

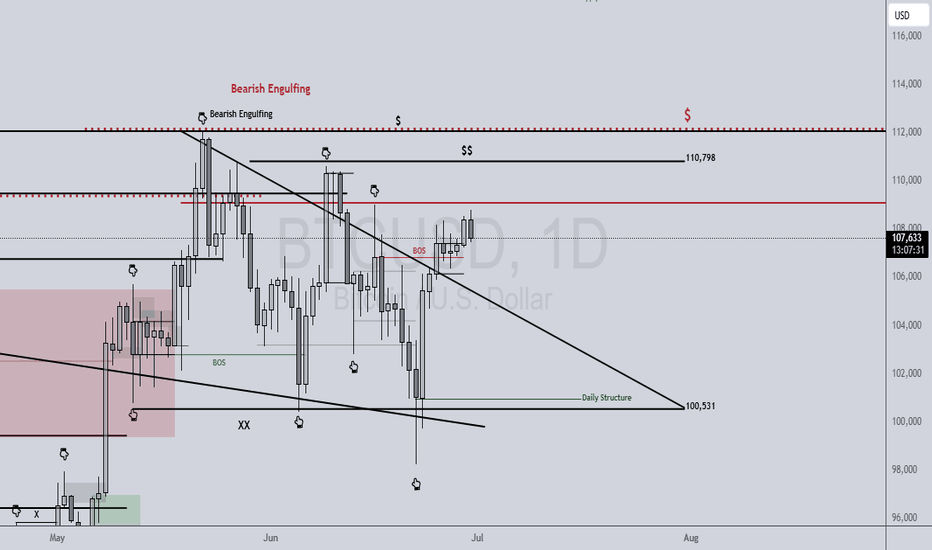

Bitcoin Analysis – June 29, 2025

Previously, we highlighted the challenge for Bitcoin in breaking above the $110,000 level —

and now on-chain data is reinforcing that expectation.

🔍 A significant portion of long-term holders (3+ years) have been taking profits near this zone,

creating a strong resistance between $100K–$110K.

💡 For now, there's room for short-term range trading within this band,

but for the next major bullish leg to begin, we may need to see a deeper pullback —

possibly toward the $93,000 level.

📌 That zone could offer a healthier base for the next upward move.

Bitcoin’s Breathing Zone – Watching for a Natural Snap Setup📊 Bitcoin Daily – Probabilistic Swing Scenario

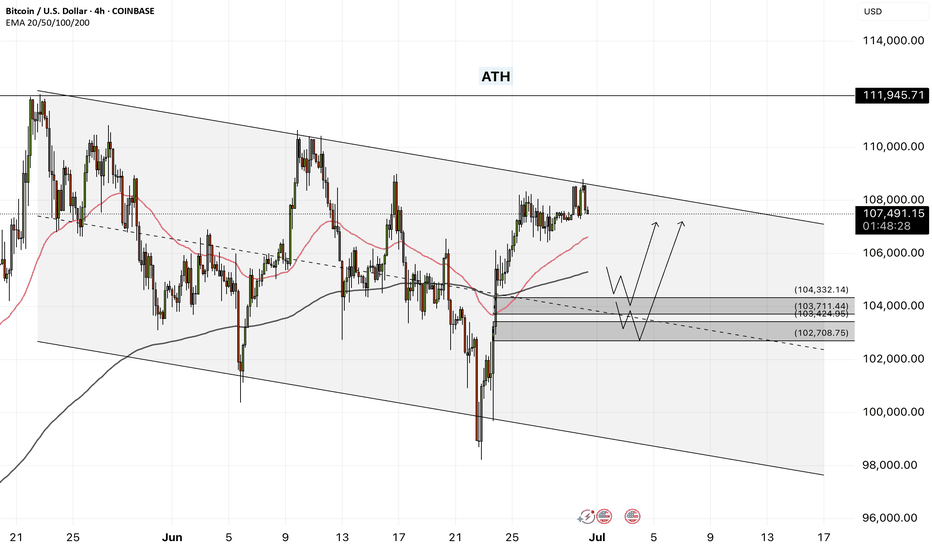

I’m closely watching a probabilistic swing setup based on natural price oscillations and EMA wave dynamics.

The current structure suggests that Bitcoin could need a deeper retracement to the 100k - 102k zone to allow the short-term EMAs to snap together just above the 55 EMA.

This is typically where the market builds energy for significant moves.

I've highlighted this potential snap zone and the expected price flow in the chart.

If the price compresses in this area, it could trigger a move towards the upper yellow trendline around 124k.

A clean pullback followed by EMA clustering is usually the kind of natural swing that opens the door for explosive price action.

From there, a retest around 108k - 110k would not only be healthy – it would likely serve as the launchpad for a possible extension towards the macro target zone of 160k - 180k.

I trade probabilistic scenarios based on natural market rhythms, EMA waves, and energy compression zones.

What’s your view on this? Are you tracking a similar path?

Whales Dump on Wall Street, Fueling Bitcoin's 'Inevitable' SurgeIn the high-stakes world of cryptocurrency, where fortunes are made and lost in the blink of an eye, a new narrative is taking shape. With Bitcoin's price hypothetically hovering around a robust $107,000, a significant portion of market analysis now suggests that a new all-time high is not just a possibility, but an inevitability. This confidence stems from a complex interplay of technical strength, unprecedented institutional demand, and a massive, yet healthy, transfer of wealth from early adopters to the new titans of finance.

The market is currently witnessing a fascinating dynamic: while the price consolidates above the monumental $100,000 psychological barrier, long-term holders, often referred to as "OG whales," are systematically selling their holdings. This activity, which could be misconstrued as bearish, is being interpreted by many as a necessary and constructive phase. Instead of suppressing the price, this distribution is meeting a voracious appetite from Wall Street, primarily through the mechanism of spot Bitcoin Exchange-Traded Funds (ETFs). This creates a state of equilibrium, a period of sideways consolidation where the market digests enormous gains and builds a foundation for its next explosive move. The target on the horizon is a liquidity cluster around $109,000, a key level that, if decisively flipped to support, could unlock a path to uncharted territory.

This article will delve into the multifaceted dynamics of this hypothetical market scenario. It will explore the significance of consolidating above $100,000, dissect the "great transfer" of Bitcoin from early believers to institutional giants, and analyze the technical and on-chain metrics pointing toward an imminent breakout. Finally, it will consider the potential risks and counterarguments that could challenge the prevailing bullish thesis, providing a comprehensive overview of a market at a pivotal crossroads.

Part 1: The New Paradigm - Consolidating Above $100,000

The act of breaking and holding a price level as significant as $100,000 represents more than just a numerical achievement; it is a profound psychological and structural shift for Bitcoin. In this hypothetical scenario, the market is not just visiting this level but is actively building a base above it, a process known as consolidation. This phase is crucial, characterized by sideways price movement within a defined range, often accompanied by decreasing trading volume, as the market takes a collective breath and establishes a new sense of fair value.

The Psychology of a Six-Figure Asset

For years, $100,000 was a distant, almost mythical target for Bitcoin. Surpassing and, more importantly, sustaining this level transforms market perception. It solidifies Bitcoin's status as a mature, global macro asset, moving it further away from its speculative past. This psychological victory attracts a new wave of capital from more conservative investors, wealth funds, and corporations who may have been hesitant to enter before such a milestone was reached. The consolidation phase above this level acts as a proof of stability, demonstrating that the asset can absorb significant profit-taking without collapsing, thereby building trust and confidence for the next wave of adoption.

Market Structure and Institutional Support

This period of stability is not happening in a vacuum. It is underpinned by a fundamental change in market structure, primarily the advent and overwhelming success of spot Bitcoin ETFs. These regulated financial products have provided a seamless bridge for Wall Street to pour billions of dollars into Bitcoin, creating a formidable wall of buy-side demand. In this scenario, where Bitcoin oscillates between $102,000 and $110,000, spot ETFs would be consistently recording massive net inflows, absorbing the supply being offered by sellers.

This dynamic is a textbook example of healthy consolidation. It is a tug-of-war where the immense selling pressure from profit-takers is effectively matched by the persistent buying pressure from new institutional entrants. This prevents a sharp price decline and allows the market to methodically transfer coins from one cohort to another without inducing panic. Technically, this phase often forms recognizable patterns like sideways ranges, bullish flags, or ascending triangles, all of which suggest that pressure is building for an eventual breakout to the upside. The decreasing volume during this time indicates that the market is reaching an equilibrium before the next major directional move.

Historical Precedent in a New Era

Bitcoin has experienced consolidation phases after breaking previous major milestones, such as $1,000 and $20,000. However, the current hypothetical consolidation above $100,000 is fundamentally different in both scale and participants. Previous cycles were largely driven by retail investors and a smaller group of early adopters. The current cycle is defined by the heavyweight presence of institutional players who bring not only massive capital but also a long-term strategic investment horizon.

The amount of capital required to absorb selling pressure at a six-figure price point is orders of magnitude greater than in any previous cycle. The fact that the market can achieve this stability highlights the depth and maturity it has developed. While past consolidations were precursors to further retail-driven mania, the current phase is about the systematic absorption of early investor supply by the largest financial institutions in the world, setting the stage for a rally built on a much stronger and more diverse foundation. This isn't just a pause; it's the construction of a launchpad for the next chapter in Bitcoin's story.

Part 2: The "Great Transfer" - Long-Term Holders vs. Wall Street

At the heart of the market's current dynamic is a historic transfer of wealth. This is the moment where the earliest and most steadfast believers in Bitcoin, the "OG Whales" or Long-Term Holders (LTHs), are realizing their life-changing gains by selling to the new behemoths of the financial world: Wall Street institutions. This process is not the bearish signal it might imply, but rather a critical market function that fuels the bull run's continuation.

Defining the Players: "OG Whales" and Long-Term Holders

Long-Term Holders (LTHs) are typically defined in on-chain analysis as addresses that have held their Bitcoin for more than 155 days (approximately five months). These are investors who have weathered significant volatility and have a deep conviction in the asset. "OG Whales" are a subset of this group, representing individuals or entities who accumulated vast amounts of Bitcoin in its nascent stages, often at prices of three figures or less. For them, selling at over $100,000 represents astronomical returns on their initial investment.

Their motivation to sell is rational and expected. It is a common market pattern for patient bottom buyers to take profits as the market approaches and surpasses new all-time highs. They understand that the euphoria surrounding these record prices is what attracts the necessary buy-side demand to absorb their large sell orders. This selling, or "distribution," is a hallmark of every Bitcoin bull market peak. The key question is whether the demand is strong enough to absorb this supply without crashing the price.

Deconstructing the "Dumping on Wall Street" Narrative

The essence of this transfer is that since the launch of spot Bitcoin ETFs, LTHs have been the primary source of selling pressure. They are, in effect, providing the liquidity that the newly launched ETFs require to meet the relentless demand from their clients.

This dynamic is precisely why the price has been able to stabilize at such high levels. The institutional buying frenzy is absorbing the supply unloaded by LTHs. This is not a malicious act of suppression but a symbiotic relationship: LTHs need massive buyers to sell to, and Wall Street needs massive sellers to source coins from. This is simply the natural ebb and flow of a market cycle where supply and demand are meeting at a new, higher equilibrium.

On-Chain Evidence of a Healthy Distribution

Several on-chain metrics provide a clear window into this phenomenon, confirming that the current selling is a sign of a healthy bull market, not an impending top.

• Spent Output Profit Ratio (SOPR): This metric shows the degree of realized profit for all coins moved on-chain. In this scenario, the LTH-SOPR would be extremely high, indicating that the coins being sold were acquired at a much lower cost basis and are now being sold for massive profits. While this signals profit-taking, it is typical of a bull market and, on its own, does not signal a top.

• Realized Profit: On-chain data would show a massive spike in realized profits, confirming that sellers are locking in gains. The market's ability to absorb these profits and continue consolidating is a sign of immense strength.

• Coin Days Destroyed (CDD) / Value Days Destroyed (VDD): These metrics measure the activity of older coins. A spike in VDD is synonymous with the LTH cohort spending their coins. This typically peaks shortly after breaking all-time highs because sellers need the liquidity that new buyers bring. The fact that this selling is being met with such strong institutional demand prevents it from turning into a bear market trigger.

• Long-Term Holder Supply: While some LTHs are selling, the overall supply held by this cohort may still be growing or stabilizing. This is because investors who bought six months prior are continuously "aging" into LTH status. This indicates that while the oldest hands are selling, a new generation of convicted holders is forming, providing a solid foundation for the market.

In essence, the "great transfer" is a feature, not a bug, of the current bull market. It is a sign of Bitcoin's maturation, where the asset is moving from the strong hands of early pioneers to the deep pockets of the global financial system. This process allows the market to de-risk, shed its over-leveraged players, and build a stronger base for what many believe is the inevitable next leg up.

Part 3: The Path to $109K and Beyond - Technical and Liquidity Analysis

With the market having established a strong foundation above $100,000, all eyes turn to the next key resistance levels. Technical and on-chain analysis points to a significant cluster of liquidity around the $109,000 mark, which is viewed as the final hurdle before Bitcoin can enter a new phase of price discovery. The argument for the "inevitability" of a new all-time high rests on a confluence of bullish technical patterns, resetting momentum indicators, and the overwhelming force of market liquidity.

Understanding Liquidity at $109,000

In financial markets, liquidity refers to the ease with which an asset can be bought or sold without causing a significant price change. On a price chart, liquidity is concentrated at levels with a high density of buy and sell orders. The area around $109,000 to $111,000 represents a major liquidity cluster. This is composed of:

• Sell Orders (Asks): A large number of investors who bought at lower prices have placed take-profit orders at this psychological and technical level.

• Short Position Liquidations: Traders who are betting against Bitcoin have placed their stop-losses above this resistance. If the price breaks through, these short positions are automatically closed with a buy order, creating a "short squeeze" that adds explosive fuel to the rally.

Analysis of order book data shows significant liquidation levels stacked just above this zone. Successfully breaking through and absorbing this sell-side liquidity would remove a significant barrier, clearing the path for a rapid move higher. A decisive flip of the $109,000 level from resistance to support is what bulls are watching for as the ultimate confirmation of upward momentum.

Bullish Technical Indicators

The consolidation phase has allowed Bitcoin's technical indicators to cool off and prepare for the next advance.

• Chart Patterns: On higher timeframes, the price action is forming classic bullish continuation patterns. There is potential for formations like an inverted head-and-shoulders pattern or a bullish engulfing candlestick, both of which have historically high success rates in predicting upward moves. A bullish engulfing pattern on the daily chart, for instance, has shown a high probability of leading to new local highs when appearing in a broader uptrend.

• Momentum Oscillators: Indicators like the Relative Strength Index (RSI) and the MACD (Moving Average Convergence Divergence) have likely reset from "overbought" conditions during the consolidation. This reset is healthy and necessary, allowing momentum to build again from a neutral base rather than an overheated one. It signals that the market has shed its speculative froth and is ready for a more sustainable trend.

• Moving Averages: Throughout the consolidation period, the price would find strong support at key moving averages, such as the 21-week exponential moving average (EMA) or the 50-day simple moving average (SMA). These levels act as dynamic support, with dip buyers consistently stepping in, reinforcing the strength of the underlying trend.

•

The "Inevitability" Thesis Synthesized

The argument that a new all-time high is "inevitable" is built on the convergence of these powerful forces:

1. Unprecedented Demand: The constant, price-agnostic inflows from spot Bitcoin ETFs provide a demand floor that the market has never experienced before.

2. Supply Absorption: The selling pressure from long-term holders, which would have crushed the market in previous cycles, is being successfully absorbed by this new institutional demand.

3. Healthy Reset: The market has undergone a healthy consolidation, allowing technicals to cool off, leverage to be flushed out, and a strong support base to be built.

4. Psychological Breakthrough: The conquest of the $100,000 level has fundamentally altered market perception and opened the door to price discovery, with the next logical target being the liquidity pool at $109,000.

While no outcome in financial markets is ever truly guaranteed, the confluence of persistent institutional buying, constructive on-chain dynamics, and bullish technical setups creates a powerful case that Bitcoin is coiling for a significant breakout. The move through $109,000 is seen not as a question of "if," but "when."

Part 4: Risks and Counterarguments

Despite the overwhelmingly bullish sentiment in this hypothetical scenario, a prudent analysis requires examining the potential risks and counterarguments that could challenge or delay the ascent to new all-time highs. The cryptocurrency market remains susceptible to a variety of internal and external shocks, and overconfidence can be a precursor to sharp corrections.

Macroeconomic Headwinds

Bitcoin's increasing integration into the global financial system means it is more sensitive to macroeconomic conditions than ever before. A sudden and severe global recession, an unexpected spike in inflation leading to aggressive monetary tightening by central banks, or major geopolitical conflicts could trigger a "risk-off" event across all asset classes, including Bitcoin. Investors might flee to the perceived safety of cash or government bonds, causing even the strong institutional demand for Bitcoin to waver. It is often noted that traders wait for clarity on key macroeconomic data and policy updates before committing to a trend, and any negative surprises could trigger a sell-off.

Overwhelming Profit-Taking

The thesis of a new all-time high hinges on the ability of institutional demand to absorb the selling from long-term holders. However, there is a risk that this supply could become too overwhelming. The profits held by early investors are immense, and there may be a price point—perhaps on the approach to $110,000 or just beyond—where profit-taking accelerates to a pace that even the ETFs cannot sustain. If a large cohort of whales decides to sell in unison, it could create a supply shock that temporarily breaks the market structure and forces a deeper correction.

Market Exhaustion and Valuation Metrics

While consolidation is healthy, a prolonged sideways period can sometimes signal exhaustion rather than accumulation. On-chain metrics that compare Bitcoin's market value to its realized value are crucial for gauging how overheated the market is. These tools help identify periods of extreme overvaluation. If such metrics were to enter their highest zones, it would suggest that the market is reaching peak froth, making it vulnerable to a sharp reversal, regardless of the positive narrative. It is understood that while Bitcoin's price has a strong correlation to global liquidity, internal market dynamics can cause it to decouple, especially during periods of extreme valuation.

Regulatory and Black Swan Risks

The risk of unforeseen "black swan" events always looms over the market. This could include a sudden and harsh regulatory crackdown in a major jurisdiction, the collapse of a major crypto exchange or institution, or the discovery of a critical flaw in the Bitcoin protocol itself. Furthermore, the concentration of Bitcoin within a few large ETF products, while providing demand, also introduces a new vector of risk. If these institutions were to face regulatory pressure or decide to offload their holdings for strategic reasons, the resulting sell pressure could be catastrophic.

In conclusion, while the path to a new all-time high appears clear and well-supported by current dynamics, it is by no means guaranteed. A combination of adverse macroeconomic shifts, overwhelming selling pressure, extreme valuations, or an unexpected black swan event could easily derail the bullish momentum. Investors and analysts must remain vigilant, balancing the optimistic on-chain and technical data with a realistic appreciation of the inherent risks in this volatile asset class.

Conclusion

The hypothetical scenario of Bitcoin consolidating above $100,000 while eyeing a breakout to $109,000 and beyond represents a pivotal moment in the asset's history. It paints a picture of a market that has achieved a new level of maturity, driven by a paradigm shift in its investor base. The central thesis—that a new all-time high is now "inevitable"—is not born from baseless hype, but from a powerful confluence of observable market forces.

The successful establishment of the six-figure price level as a support floor, rather than a speculative peak, is the first pillar of this argument. This consolidation is made possible by the voracious and sustained demand from Wall Street institutions, which are using spot Bitcoin ETFs to absorb the immense selling pressure from early adopters. This dynamic, the "great transfer" of Bitcoin from OG whales to institutional treasuries, is not a sign of a market top but a healthy and necessary distribution that de-risks the market and fuels the next leg of the bull run.

The on-chain analysis provides a framework for understanding this phase not as stagnation, but as a constructive consolidation where the market builds energy for a parabolic advance. This narrative is supported by bullish technical patterns, resetting momentum indicators, and a clear liquidity target at $109,000, which, once breached, could trigger a powerful short squeeze and propel Bitcoin into a new phase of price discovery.

However, this bullish outlook must be tempered with an awareness of the significant risks that remain. Macroeconomic instability, the sheer scale of potential profit-taking, and the ever-present threat of regulatory or black swan events could challenge the prevailing trend.

Ultimately, this analysis reveals a Bitcoin that is at a crossroads, but one where the path forward appears more clearly defined and well-supported than ever before. The interplay between the old guard of crypto and the new titans of finance is forging a stronger, more resilient market. While no outcome is certain, the evidence strongly suggests that Bitcoin is not at the end of its run, but is merely pausing to build a higher launchpad for its journey into the financial mainstream.

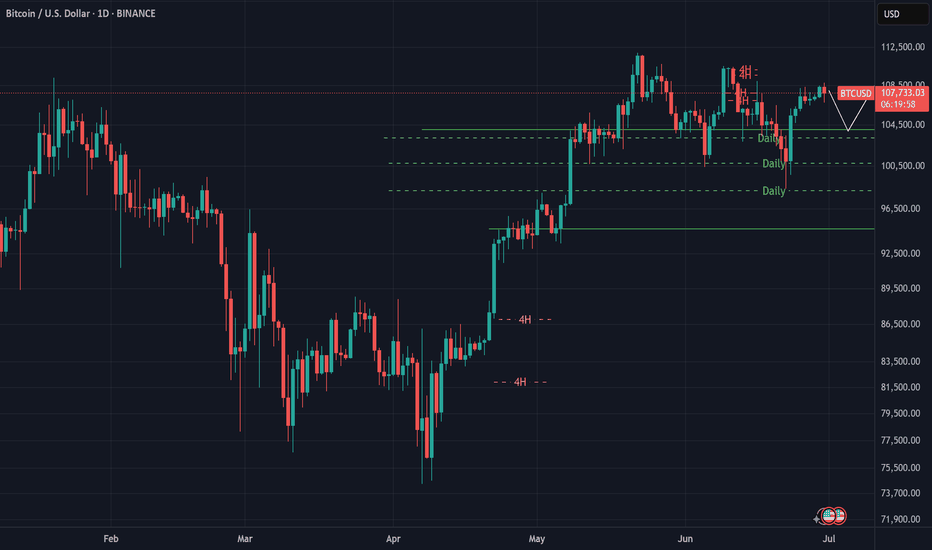

BTC Consolidates Above $100K — Bullish Structure Remains IntactKey Support Holding Firm:

Bitcoin is consolidating above the critical $100,000–$105,000 support zone, a former resistance area from early 2025. Holding this level preserves the broader bullish structure.

Short-Term Noise, Long-Term Strength:

While recent price action shows some lower highs and lows, the long-term uptrend that began in April remains fully intact. This is typical consolidation behavior within a strong bull market.

Wedge Formation Points to Breakout:

A six-month wedge pattern continues to develop, often a precursor to a powerful breakout. If resolved to the upside, the next leg could target the $130,000–$135,000 range.

Outlook Remains Bullish:

As long as Bitcoin holds above $100,000, there’s no technical basis for a bearish scenario. This remains a constructive pause within a dominant uptrend.

#Bitcoin #BTC #CryptoMarket #TechnicalAnalysis #Bullish #SupportAndResistance #WedgeBreakout #LongTermTrend #MarketOutlook #PriceAction

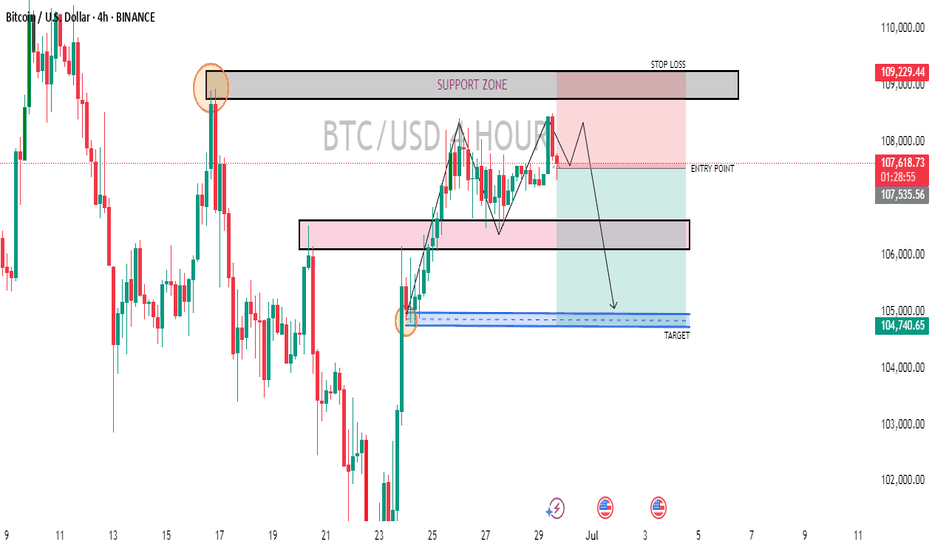

Analysis and layout of BTC trend in the third quarter📰 News information:

1. Pay attention to the movement of the cryptocurrency market

2. The impact of DAA, etc.

📈 Technical Analysis:

As demand weakens and supply pressure rises, BTC's network valuation exceeds the speed of activity. Exchange inflows and negative DAA divergences indicate that despite price stability, the risk of selling remains. Currently, BTC is experiencing a retracement after a rebound. In the short term, it is still possible to retrace to 106,500 and then rise after stabilizing.

🎯 Trading Points:

SELL 108000-107500

TP 107000-106500

BUY 106500-106000

TP 107500-108000

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

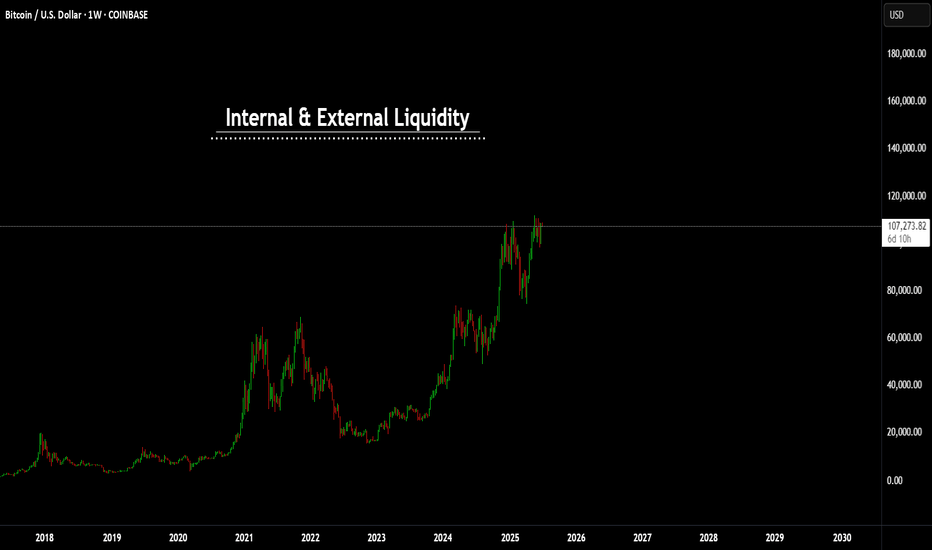

Internal and external liquidity Here's another mechanical lesson for you.

In my last post I covered a mechanical technique to identify swing ranges. Rule-based, simple and repeatable.

In this post, I want to share another little technique, again part of the mechanical series. But this time I want to talk about liquidity.

Most traders talk about liquidity, they might even have a grasp of what it is. But most do not know how liquidity forms the sentiment and how that creates a type of algo for the market.

You might have heard of Elliott wave theory. There is a saying along the lines of "you ask 10 Elliott traders for their count and you get 11 answers".

But the point is here, when you simplify the concept, it's clear to see that sentiment caused by liquidity swings is what causes a repeatable pattern in the market.

Let's take the idea of the ranges from my last post.

Now after a fair amount of accumulation, this level becomes "defended" - the price will gradually move up until old short stop losses are tagged and new long entries are entered into.

This allows the institutional players to open up their orders without setting off the alarm bells.

Price then comes back from external liquidity to find internal liquidity (more on this in a later post).

But then it looks for the next fresh highs.

As the highs are put in, we can use the range technique to move our range to the new area as seen in the image above.

Next we will be looking for an internal move, not just internal to the range, but a fractal move on the smaller timeframe that drives the pullback down. See this in blue.

The logic here is simple; on the smaller timeframes we have witnessed an accumulation at the 2 region and as we spike up for 3; we will witness a distribution on the smaller timeframes.

Wyckoff called this the accumulation, followed by a mark-up and then the distribution and a mark-down.

It is this pattern, over and over again that leads to this type of structure.

This will then be re-branded by various analysts who will call it things like a head and shoulders, smart money will see a change of character and a retest before breaking the structure.

This is all the same thing - just a different naming convention.

Again, I hope this helps some of you out there!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

106 Retest?Could very well be possible that we see BTC revisit 106 for a final retest to solidify it as a firm base of support before truly attacking 109-110. BUT, once 109-110 has been broken through it will likely be retested to create another layer of support before seeking new ATHs and price discovery. I am also still of the belief that we will see BTC.D start to really crap the bed in the coming weeks with euphoria finally arriving in middle August according to BTC.D's key support levels.

Stand fast. Keep faith. Remain vigilant.

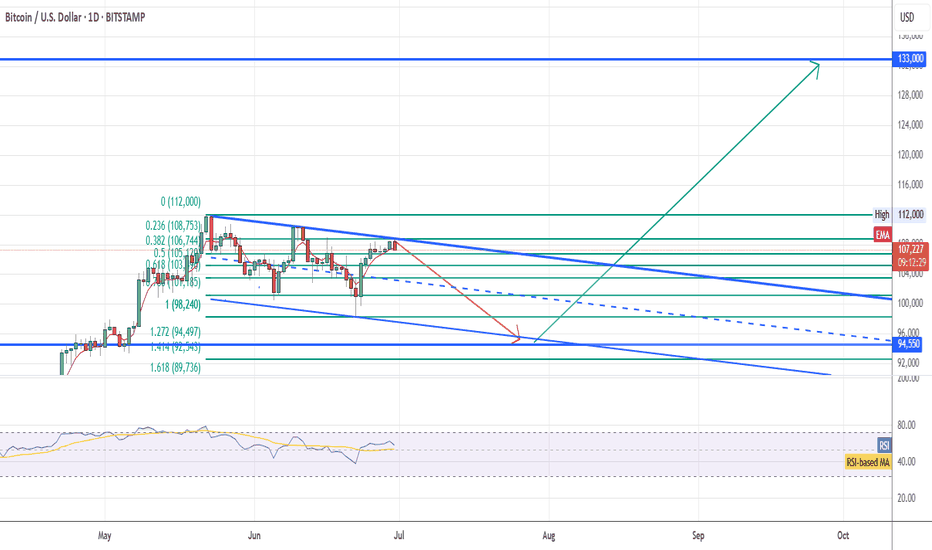

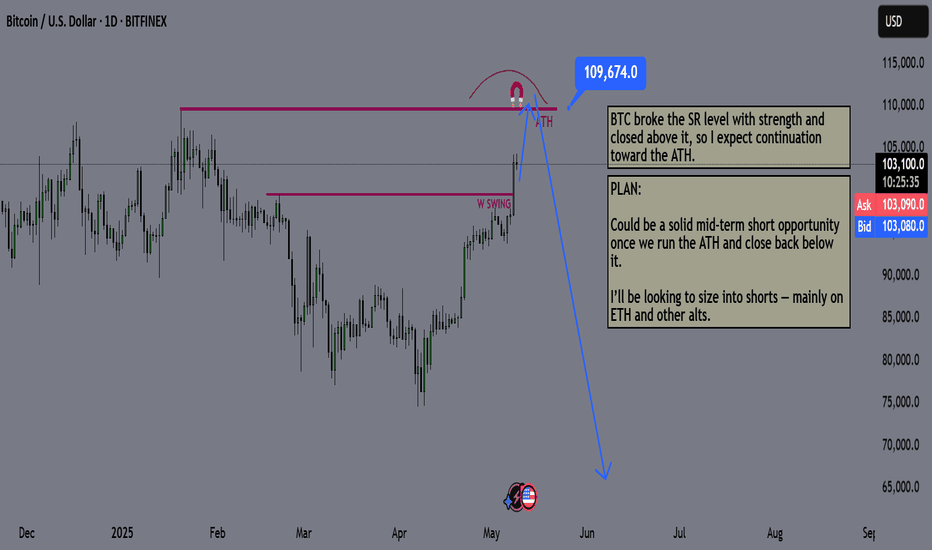

Bitcoin Mid Term Game Plan - BTC PLANBitcoin just broke a key resistance level with strength.

I expect a new all-time high soon, likely the summer top.

Summer markets are usually weak for risk assets and strong for gold. Seasonality matters, keep that in mind.

I expect risk markets to sell off until mid-July to early August. I’ll start buying once we break structure again.

The plan:

Wait for BTC to hit $110K

Look for a reversal from that level

Start aggressively shorting alts, beginning with ETH and memecoins

Hold shorts until late July / early August

Close positions and shift back to buying

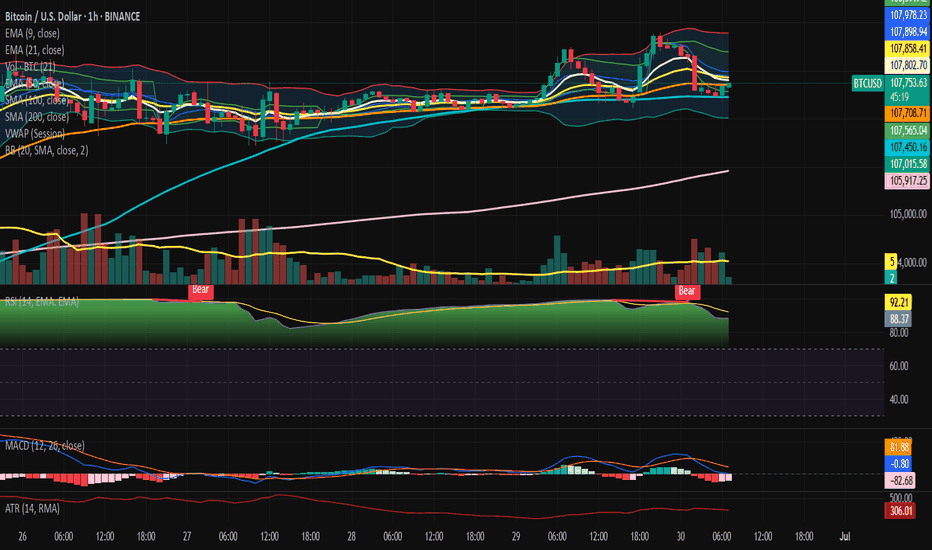

Bitcoin H1 Reversal – Codex Arcanvm + Tactical Breakdown.⊢

⟁ BTC/USD – BINANCE – (CHART: 1H) – (Date: Jun 30, 2025).

◇ Analysis Price: $107,599.99.

⊢

⨀ I. Temporal Axis – Strategic Interval – (1H):

▦ EMA 9 – ($107,799.64):

∴ The 9-period EMA remains above the current price, signaling downward rejection from short-term momentum line;

∴ It recently crossed below the EMA21, reinforcing a weakening of bullish impulse.

✴ Conclusion: EMA9 now acts as intraday resistance, confirming that immediate market strength has decayed and volatility expansion may continue unless reclaimed.

⊢

▦ EMA 21 – ($107,861.93):

∴ EMA21 is sharply curved downward, validating loss of directional conviction from the previous bullish run;

∴ This level aligns with a former consolidation zone, now potentially serving as a resistance pivot.

✴ Conclusion: EMA21 confirms a short-term trend break, and the inability to reclaim this line would prolong corrective action.

⊢

▦ EMA 50 – ($107,703.87):

∴ The EMA50 was breached decisively in the previous candle cluster, now positioned above price;

∴ Slope is turning neutral-to-down, reflecting a transition from trend to turbulence.

✴ Conclusion: EMA50 shift implies structural vulnerability in the intermediate frame, amplifying bearish tactical weight if no recovery emerges swiftly.

⊢

▦ SMA 100 – ($107,007.08):

∴ SMA100 is currently positioned just below price, offering momentary support in case of further weakness;

∴ Horizontal alignment indicates a pause or inflection zone, lacking directional strength.

✴ Conclusion: SMA100 is a neutral-bullish support shelf, but could flip to active resistance if breached intraday.

⊢

▦ SMA 200 – ($105,890.26):

∴ The SMA200 remains firmly upward-sloping and untouched — a sign of medium-trend resilience.

∴ It defines the lower structural boundary for this time-frame.

✴ Conclusion: SMA200 still holds bullish structural integrity, but if reached, it would represent a full reversion of recent strength.

⊢

▦ Volume + EMA 21 – (Current Vol: 5.31 BTC):

∴ Volume shows an uptick during bearish candle clusters — indicative of active sell-side participation;

∴ The EMA21 on volume reveals a rising slope, confirming that volatility is not passive, but driven by conviction.

✴ Conclusion: Volume action supports the thesis of deliberate distribution, not merely rotational choppiness.

⊢

▦ VWAP (Session) – ($107,995.35):

∴ Price has broken decisively below VWAP, showing institutional disengagement or absence of bid reinforcement;

∴ VWAP now serves as magnetic resistance during any mean-reversion attempts.

✴ Conclusion: VWAP position confirms that price is under fair-value, and current path is dominated by tactical sellers.

⊢

▦ Bollinger Bands – (Lower Band: $107,007.08):

∴ Bands have widened, with price hugging the lower edge - a hallmark of volatility expansion;

∴ Mean price ($107,895.00) sits significantly above spot, reinforcing downside pressure.

✴ Conclusion: BB's suggest momentum breakdown, with price entering statistically stretched, yet uncorrected territory.

⊢

▦ RSI + EMA 9 – (RSI: 87.06 | EMA: 92.92):

∴ RSI has sharply fallen from extreme overbought, but remains above the 70-level — reflecting ongoing exit from euphoric levels;

∴ The EMA over RSI is crossing below, signaling loss of short-term strength and potential trend reversal.

✴ Conclusion: RSI behavior implies a momentum peak has passed, though correction may still be in early phase.

⊢

▦ MACD – (MACD: 1.87 | Signal: -99.46 | Histogram: 101.33):

∴ MACD histogram turned sharply positive following a steep drop, suggesting a potential pause in bearish acceleration;

∴ Lines are converging but remain well below the zero axis - no bullish crossover yet.

✴ Conclusion: MACD reflects oversold relief, but not reversal. Current state favors tactical caution rather than confidence.

⊢

▦ ATR (14, RMA) – (315.31):

∴ ATR remains elevated, confirming ongoing high volatility and larger-than-average candle bodies;

∴ This level sustains a risk zone scenario, where price swings may be unpredictable.

✴ Conclusion: ATR indicates volatility expansion persists, further validating the need for defensive tactical posture.

⊢

🜎 Strategic Insight – Technical Oracle:

∴ The technical constellation on the 1H chart reveals a clear breakdown of short-term bullish structure, now transitioning into a tactically bearish phase;

∴ The rejection from VWAP and convergence of all EMA's above price confirm that any recovery must reclaim the 107.800–108.000 cluster to negate downside bias;

∴ The current support rests on SMA100, yet its flat orientation and proximity to price suggest fragility, not strength. Meanwhile, SMA200 at 105.890 represents a more significant structural floor - its breach would mark a deeper tactical deterioration;

∴ Volatility metrics (BB and ATR) indicate that the market is no longer coiled - it has entered expansion, and directional bias is momentarily controlled by sellers. RSI exiting overbought and MACD’s unresolved negative zone further support the thesis of ongoing correction, not mere pause;

✴ Conclusion: In essence, the market has shifted into a correctional pulse, guided by structural breakdowns and expanding volatility. Tactical recoveries remain possible, but fragile and likely limited unless EMA's are reclaimed with force.

⊢

∫ II. On-Chain Intelligence – (Source: CryptoQuant):

▦ Exchange Netflow Total – (All Exchanges) – (Last Recorded: +2.1K BTC):

∴ Recent spike in netflow reveals a sudden influx of Bitcoin into centralized exchanges, marking the first positive divergence after a long series of outflows;

∴ Such inflows historically precede tactical distribution events or profit-taking phases, especially following extended rallies.

✴ Conclusion: Netflow confirms that holders are actively preparing to sell, giving real on-chain weight to the price rejection seen on the 1H chart.

⊢

▦ Short-Term Holder SOPR – (Latest Value: 1.012):

∴ SOPR sits slightly above 1.0, but descending - indicating a transition from profit realization to potential break-even or loss selling;

∴ If the trend continues and dips below 1.0, it marks capitulation from recent buyers — often a trigger for volatility spikes or local bottoms.

✴ Conclusion: Current STH SOPR signals weakening conviction among short-term holders, supporting a corrective narrative rather than trend continuation.

⊢

🜎 Strategic Insight – On-Chain Oracle:

∴ The on-chain substrate aligns precisely with the tactical weakness shown in the chart. The positive exchange netflow acts as a material indicator of sell-side readiness;

∴ This inflow, breaking the historical trend of outflows, marks a shift in intent - from holding to liquidation;

∴ Simultaneously, the Short-Term Holder SOPR sits on a critical edge. Its descent toward the 1.0 threshold implies that recent buyers are either approaching breakeven or beginning to capitulate;

∴ This fragile posture typically amplifies local corrections, especially when coupled with rising volatility;

∴ On-chain momentum no longer supports bullish continuation. Instead, it reflects hesitation, rotation, and distribution - all hallmarks of a short-term correction phase, in alignment with the temporal analysis;

✴ Conclusion: The on-chain field confirms that the technical breakdown is not speculative - it is supported by active internal dynamics, signaling a pause or reversal in trend strength at a structural level.

⊢

⧈ Codicillus Silentii – Strategic Note:

∴ The current H1 formation is a textbook example of post-euphoric fragility. What appeared as steady accumulation has now transitioned into a volatile de-leveraging phase. The confluence of bearish momentum, increased volume, and netflow reversal suggests the market is entering a tactical contraction zone;

∴ No structural collapse is yet confirmed - but the absence of bullish defense at VWAP and EMA clusters denotes reduced resilience. Until these are reclaimed, all attempts at recovery must be viewed with caution.

✴ Conclusion: Silence in structure signals preparation - not passivity. The next move shall emerge not from noise, but from the void left by exhaustion.

⊢

𓂀 Stoic-Structural Interpretation:

∴ Structurally Bearish – Tactically Suspended ;

∴ The 1H chart shows a break below short-term momentum zones (EMA's, VWAP), confirming structural fragility;

∴ Despite momentary support on SMA100, the loss of upward slope across the EMA's and RSI reversal validate a structural bearish bias;

✴ Conclusion: Tactical direction remains suspended until one of two pivots is breached: either VWAP (~107.995) reclaimed, or SMA200 (~105.890) broken.

⊢

⧉

⚜️ Magister Arcanvm – Vox Primordialis!

𓂀 Wisdom begins in silence. Precision unfolds in strategy.

⧉

⊢

BTCUSD 6/30/2025Come Tap into the mind of SnipeGoat, as he gives you ANOTHER update, to ANOTHER successful call-out, with ANOTHER Top-Down Analysis.

_SnipeGoat_

_TheeCandleReadingGURU_

#PriceAction #MarketStructure #TechnicalAnalysis #Bearish #Bullish #Bitcoin #Crypto #BTCUSD #Forex #NakedChartReader #ZEROindicators #PreciseLevels #ProperTiming #PerfectDirection #ScalpingTrader #IntradayTrader #DayTrader #SwingTrader #PositionalTrader #HighLevelTrader #MambaMentality #GodMode #UltraInstinct #TheeBibleStrategy

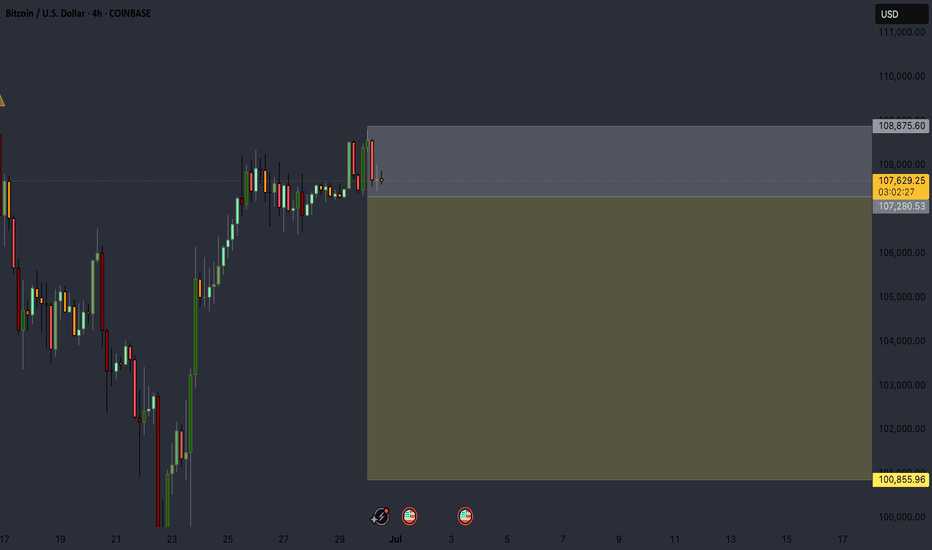

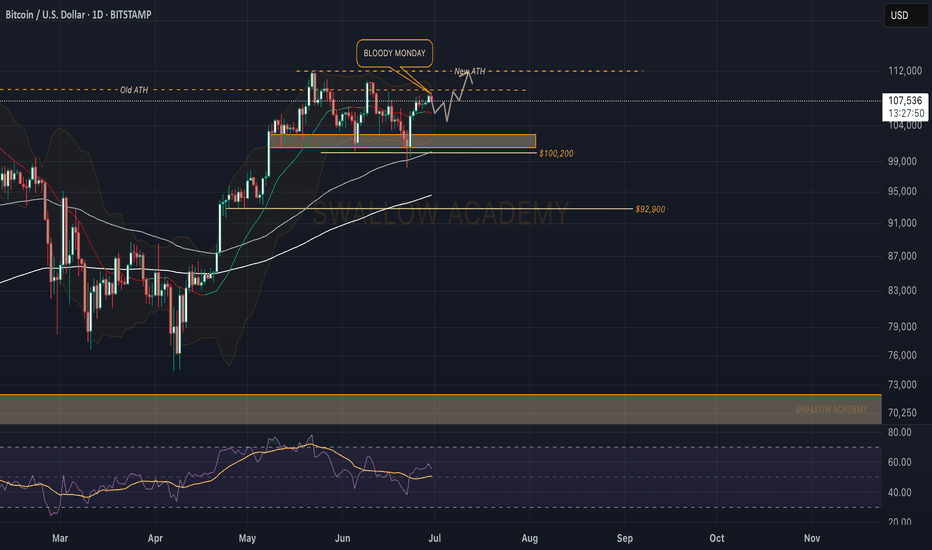

Bitcoin (BTC): Bloody Monday | Sellers Taking Over...or Not?Bloody Monday, as many call it, sellers are gaining dominance over the current area, which might send prices back as low as $105,900, where our middle line of BB is sitting.

As of now, we are expecting to see slight downward movement, and once near that middle line, we want to see some buyside volume to accumulate, as if we do not see it, then further movement to lower zones is our play here.

Swallow Academy

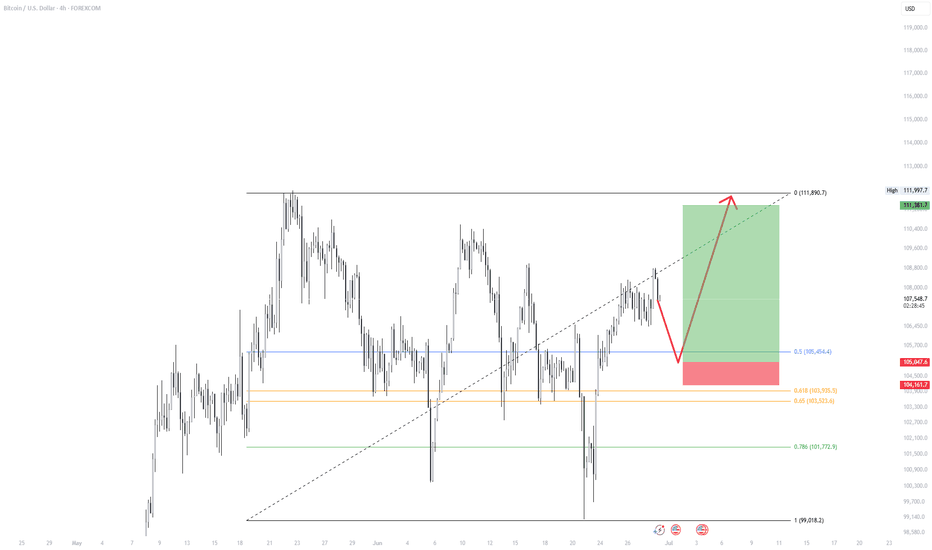

BTC/USD Long Setup – Buy the Dip into SupportMarket Context:

Bitcoin is currently in a retracement phase after rejecting from the local high near 111,900. Despite the short-term pullback, the broader structure remains bullish. This setup is based on a retracement into a key support zone, offering a potential entry for the next leg up.

Setup Idea:

Price is pulling back into a confluence area that includes:

The 0.5 Fibonacci retracement at 105,454

Previous structure support

A retest of the broken diagonal trendline

This zone is expected to act as demand, providing a favorable long entry opportunity.

Trade Plan:

Entry zone: Around 105,400

Stop loss: Below 104,100 (beneath structure and fib zone)

Target: Retest of the previous high near 111,890

Risk/Reward: High R potential with clearly defined invalidation

Notes:

If price breaks below 105,000 and fails to show buying strength, the setup becomes weaker. A decisive break below 103,900 invalidates the trade idea. Wait for bullish confirmation (e.g. higher low or volume reaction) in the entry zone before committing.

This is a clean, structured opportunity aligned with the prevailing trend. Patience and confirmation are key.

BTC CONTINUES TO PUSHBitcoin continues to press higher with quiet confidence. After reclaiming the $106,787 resistance level with a strong daily close last week, BTC has held the breakout and is now consolidating just above it – a textbook bullish retest. The 50-day moving average is rising beneath price, offering additional support as momentum builds. We’re seeing a small cluster of tight candles, hinting that the market is coiling for a potential move.

Volume has pulled back slightly since the breakout, but there’s no sign of aggressive selling. The structure remains clean: higher highs, higher lows, and a clear path toward the next major resistance at $112,000.

For now, it’s a bullish posture with strong technical support below and a stair-step climb in progress. Unless price falls back below $106,787, this looks like a base being built for continuation – not exhaustion.

Bitcoin - Will Bitcoin Hit a New ATH?!Bitcoin is trading above the 50- and 200-EMAs on the four-hour time frame and is within its short-term descending channel. Bitcoin can be bought from the demand zone indicated. A break of the channel ceiling would pave the way for Bitcoin to rise to a new ATH.

It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market and compliance with capital management in the cryptocurrency market will be more important. If the downward trend continues, we can buy within the demand range.

In recent days, Bitcoin has been trading in a range of around $107,000, and the market is going through a consolidation phase with complex but deeply fundamental characteristics. What matters at this point is not just the current price, but the precise mix of capital flows, the behavior of major players, on-chain data, and macroeconomic ratios that shape Bitcoin’s short- and medium-term trajectory. Overall, although Bitcoin’s rapid growth after the halving has stopped, internal market signals point to a continuation of the upward trajectory in a more stable framework.

The first important component is the significant influx of institutional capital into the market via ETFs. In the past week, according to CoinShares, more than $1.24 billion in new capital entered crypto products, with Bitcoin accounting for more than $1.1 billion. This marks the 10th consecutive week of capital inflows into the market, bringing the total inflows for 2025 to over $15 billion. Prominent ETFs such as BlackRock’s IBIT and Fidelity’s FBTC are attracting hundreds of Bitcoins per day, indicating steady institutional demand that has weathered the momentary volatility and is more focused on long-term asset building.

Alongside this capital inflow, the Onchain data also paints a mixed but highly interpretable picture. While the average active address rate has declined slightly and the MVRV (market value to realized value) has fallen from 2.29 to 2.20, these changes are more indicative of profit-taking by investors than selling pressure! In fact, rather than fear of a correction or crash, the market is witnessing a “gentle shift of ownership” between short-term and long-term holders. UTXO data also shows a roughly 5% increase in Bitcoin held for over 8 years, a strong sign of long-term accumulation and a decrease in the willingness to sell at current prices!

This can be seen as a period of supply and demand equilibrium; a period in which large investors have entered, but on the other hand, some older players are taking reasonable profits. This has led to a kind of price consolidation, which in June showed itself with only 2% growth—the weakest monthly growth since July last year. However, CoinDesk and Glassnode analysts rightly emphasize that this consolidation is not a sign of market weakness, but rather evidence of the maturity of Bitcoin’s price behavior. The price is reacting to data rather than becoming emotional.

From a macroeconomic perspective, Bitcoin remains highly sensitive to the Federal Reserve’s monetary policy, the value of the dollar, and interest rates. While the market is still waiting for interest rate cuts in the second half of the year, Bitcoin will remain in a quasi-expectant state until then, reacting to macro data, short-term and reactive. However, given that most ETFs follow long-term accumulation models, any stabilization in interest rates or easing geopolitical pressures could trigger a new wave of upside. Common analyst scenarios predict a range of $120,000-$130,000 for Bitcoin by the end of the summer if current conditions are maintained and capital inflows continue. In summary, Bitcoin is now at a stage where the dynamic combination of institutional accumulation, supply and demand balance, and on-chain data has transformed it from a purely risky asset into a strategic investment vehicle. The market has moved beyond the emotional phase and entered a phase of stability and maturity. This is a promising sign for long-term investors, provided that risk management is maintained and sensitivity to macro events is maintained. Bitcoin is preparing for the next stage of its rally—but unlike in the past, this time it is standing on the shoulders of fundamentals that are much stronger than at any time in the asset’s history.

ETFs with the most volume traded on Friday

Total: $501M

BlackRock: $153M

Fidelity: $165M

Grayscale: $0M

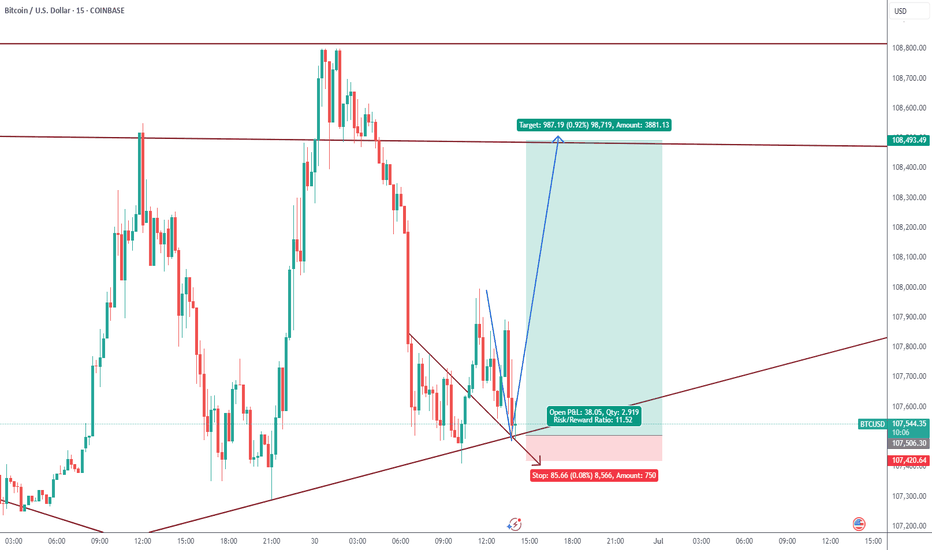

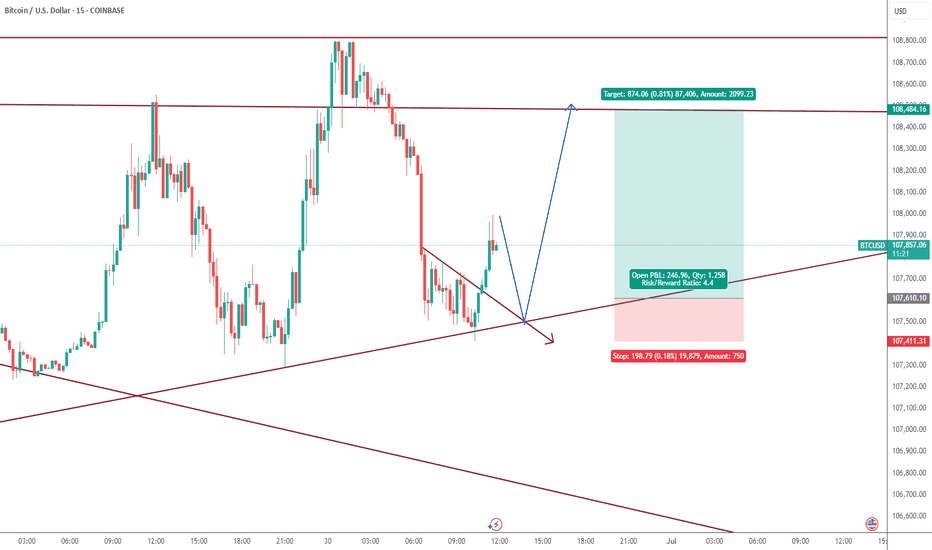

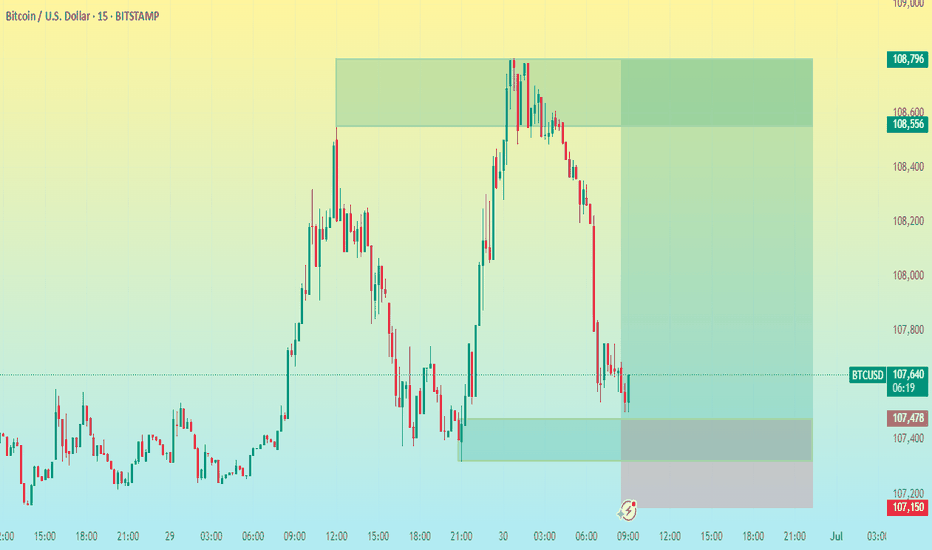

BTC/USD 15M CHART PATTERNHere's a summary of your BTCUSD 15-minute trade setup:

---

Trade Type: Buy

Entry Price: 107,500

Take Profit Levels:

1. TP1: 108,000

2. TP2: 108,300

3. TP3: 108,796

Stop Loss: 107,150

---

Risk-Reward Analysis:

Risk (SL): 107,500 - 107,150 = 350 points

Reward:

TP1: 500 points → ~1.43 R/R

TP2: 800 points → ~2.29 R/R

TP3: 1,296 points → ~3.70 R/R

---

Would you like me to turn this into a trading journal entry, script (e.g., for TradingView/MetaTrader), or analyze the probability based on recent price action?