BITCOIN trade ideas

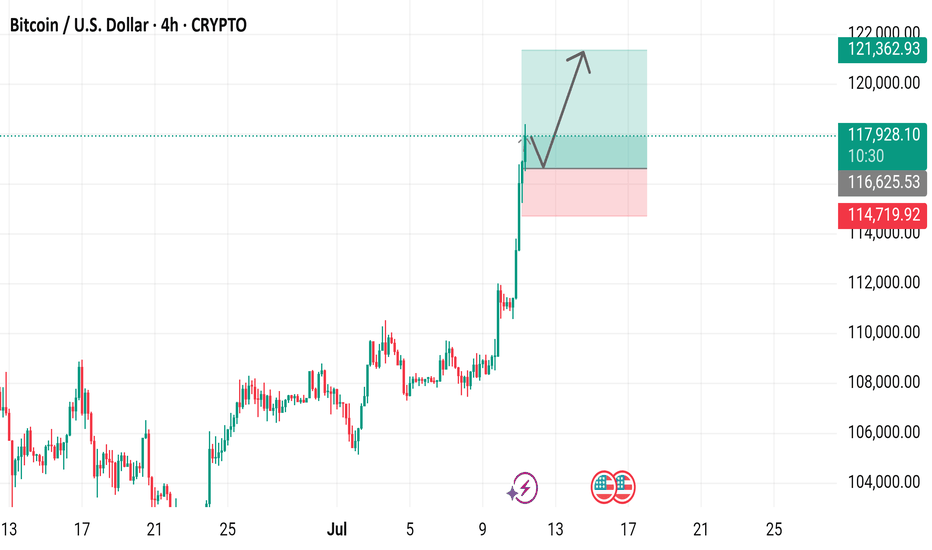

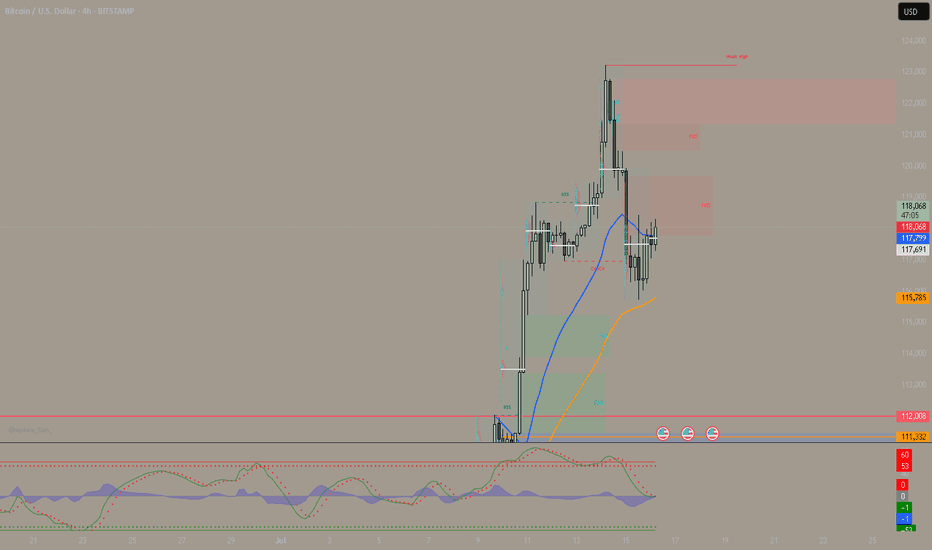

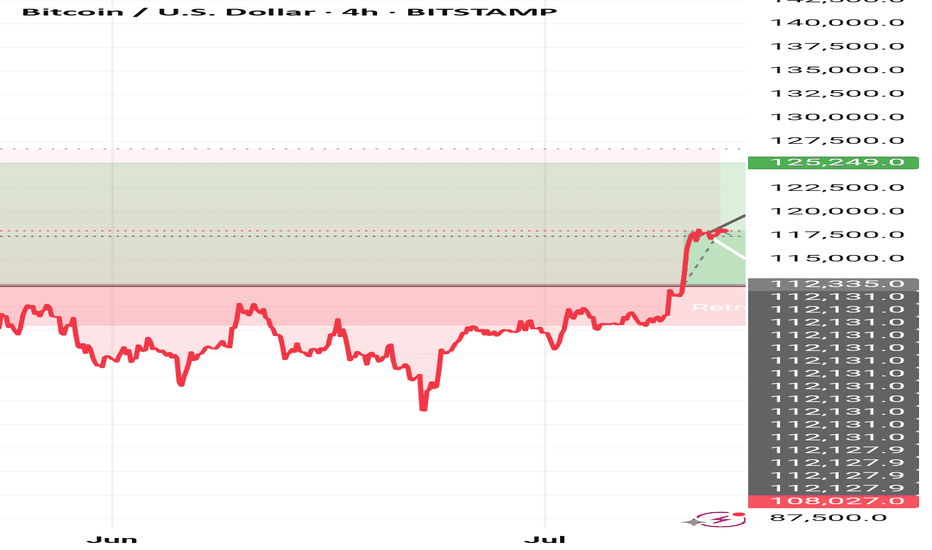

Bitcoin / U.S. Dollar 4-Hour Chart (BTCUSD)4-hour chart displays the recent price movement of Bitcoin (BTC) against the U.S. Dollar (USD) as of July 11, 2025. The current price is $117,979.53, reflecting a 4-hour increase of $1,938.91 (+1.67%). The chart highlights a significant upward trend, with a notable breakout above the $114,719.92 resistance level, reaching up to $121,362.93. Key price levels include support at $116,625.93 and resistance at $121,362.93, with buy and sell options marked at the current price.

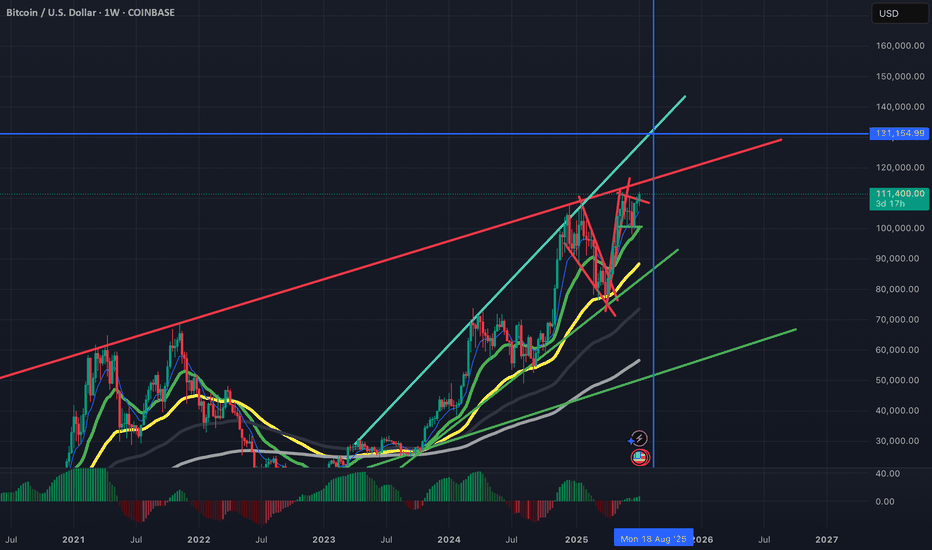

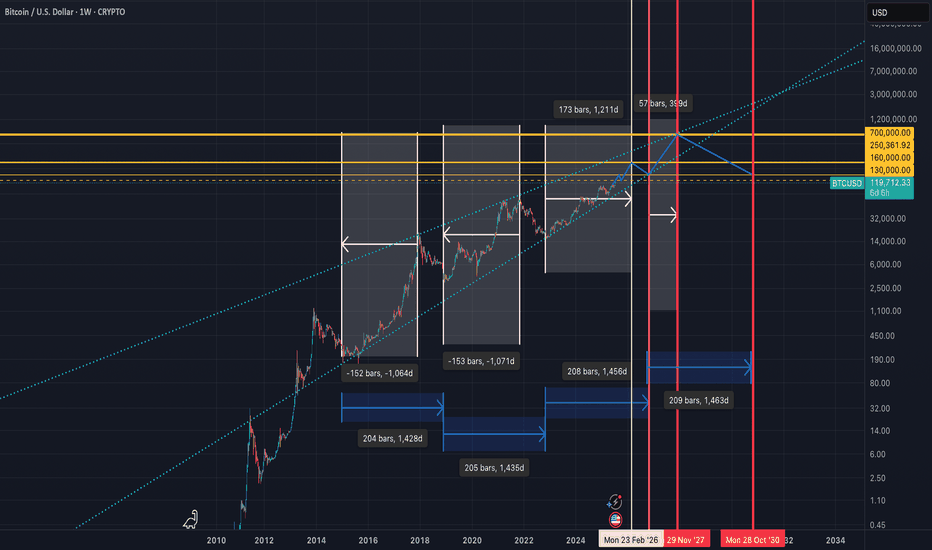

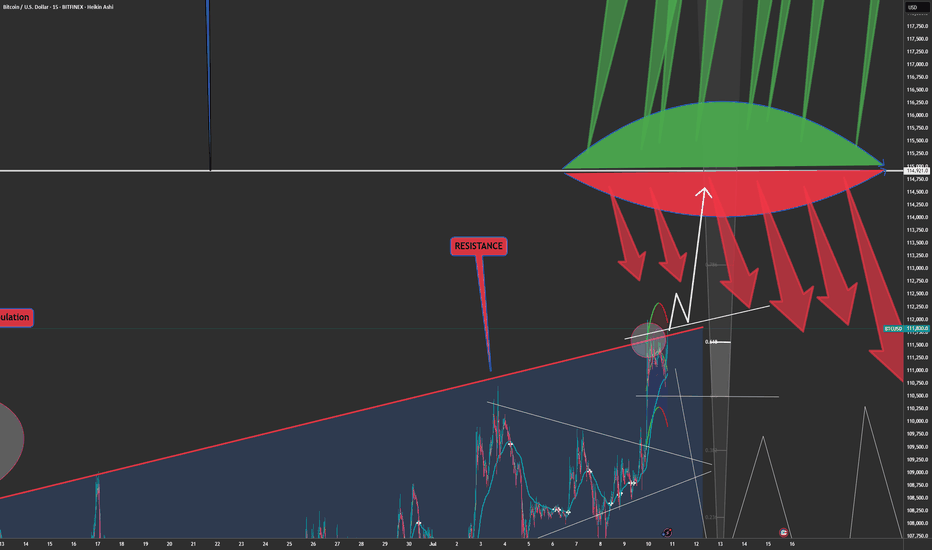

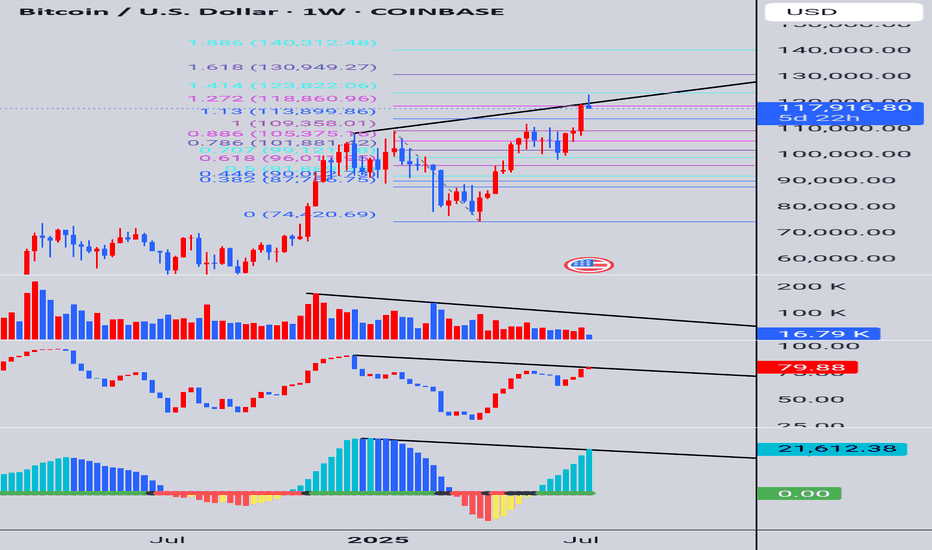

What if Analysis for BitcoinNormal Cycles are dead!! According to extended measurements, elliot waves, fib retracements, trend analysis, cyclic lines and QE timeframes, we might see a different play this time, which will leave everyone sidelined i.e Max Pain. We saw for the first time a Bitcoin bull run while we are in a Quantitative Environment. This means that BTC from now on works as a risk off asset. So, imagine we have a local top on September 2025, where the normal cycle ends around 160k then a quick drop at 130k where everyone thinks the bear market is here and after that quick pump on 250k. Then 9 months bear market (usually 12 months) but now shorter cause we have an extended short term cycle for bull run and after that we hit on 2027 directly 700k USD, where we find the huge bear market which will last longer than usual leading to 100k usd on 2030. The target of 700k usd alligns perfectly with fib levels, trend resistances Larry Fink prediction of BTC going to 700k and lastly and most important due to the published data of FED of wanting to revalue gold to buy 1 million btc in the next years. If we multiply gold's price around 3400k per ounce, multiply USA gold reserves (which is in tons, so we have to convert ounces to tons) and then divide that number with 1,000,000 BTC, guess the price--> yes correctly 700k per BTC!!!!!!!!! Let's go boyz!

BTC! BREAK OUT.Initially i was hesitant to call thiss bottom and I will risk my non exsistant repution. That if we break through this resistance and pump a 1-2% break through 4 hour FVG we going ballistic I dont belive in 150k this month I believe in 127-130 k and a trtacement to 113k to fill CME gap. W tradez.

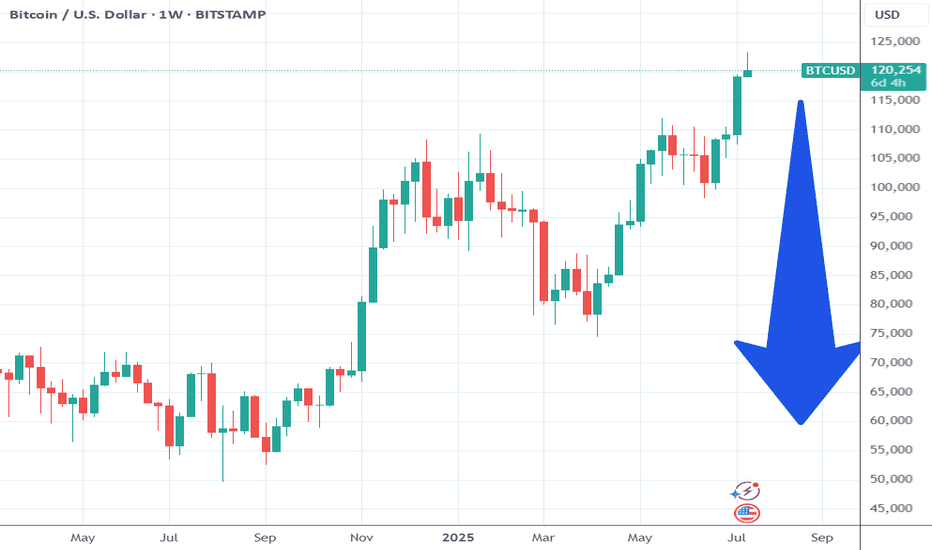

Bitcoin Pump & Dump.. Something Nobody Is Mentioning.A massive Bitcoin correction is coming. This was the peak imo.

Ask yourself this question.... Why did Bitcoin move now?

Simple answer it is a pump into events in a few months and will dump.

They pumped it and promoted the pump mainstream to get newbs to chase at the high.

Now the important part that nobody else is talking about except me!!!!

Look at Bitcoins chart over 15 years. It either drops or runs flat when the FED cuts rates.

What is coming soon? Multiple Fed cuts and a new FED chief. That is why they pumped it now.

Remember Bitcoin is traded against the dollar. When the dollar is cheap Bitcoin falls. When the dollar is expensive Bitcoin moves.

Form 2017 to 2020 the FEDs left rates unchanged and low... Bitcoin traded in the 7k-13k range for those 3- 4 years...

In October 2021... They dropped it hard from 60k to 16k in 2 years (shakeout). Used the Sam Bankman story as the catalyst.. Investors knew rates were going back up in the near term so they got people out.

What happened in 2022 after Covid to justify this 3 year bull run.... FEDS KEPT RAISING RATES AND KEEPING THEM HIGH and here we are at the end of that cycle.

Expecting this to slowly start dropping at this level, for the next year or 2.

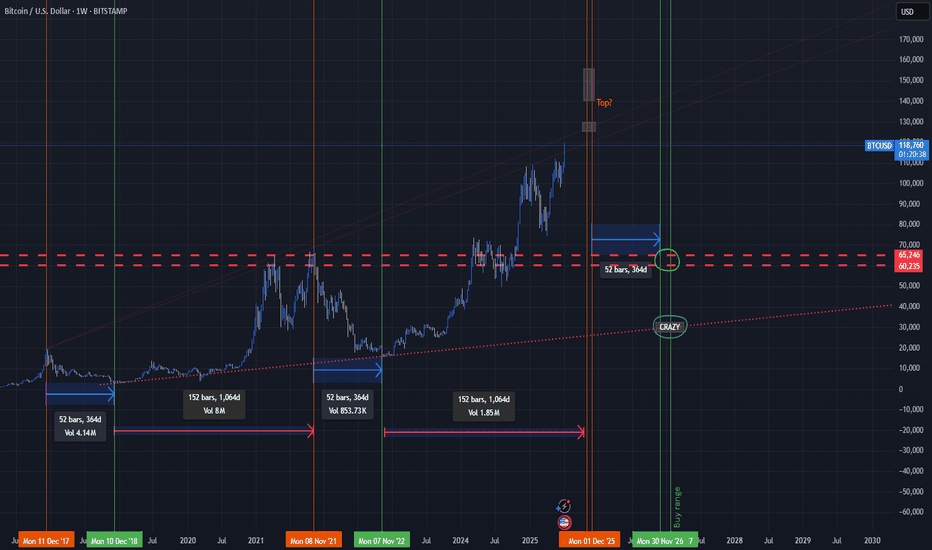

top in november and bottom early 2027?top in november and bottom early 2027?

I market out the exact top on the weekly

and exactly 364 days after that that was the exact weekly candle bottom in the bearmarket

and after 1064 days after the bottom that was the approximate top

would bring us to a top in november and bearmarket bottom early 27

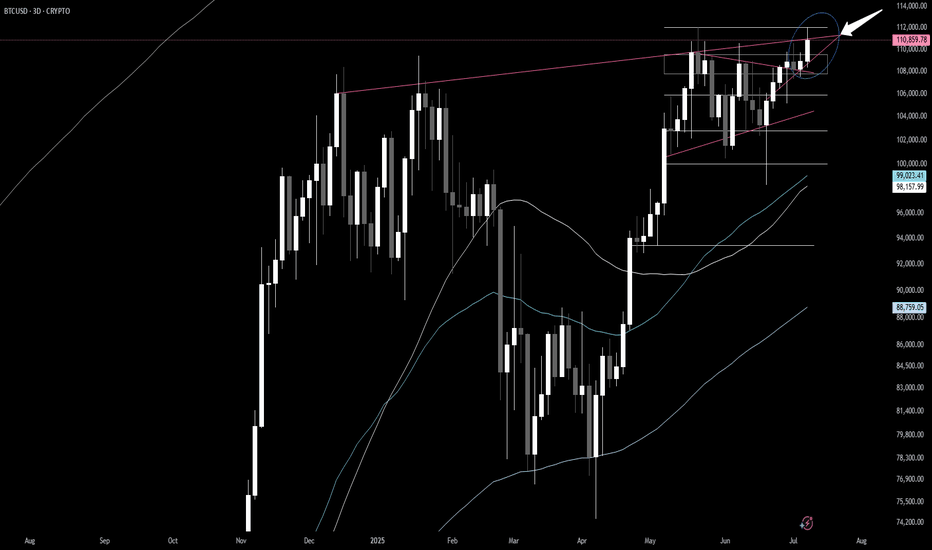

111-112 Resistance LevelOnce BTC breaks above the 111-112 resistance level and flips it into support we should see price run to 125+ rather quickly. If history echoes, price discovery could easily touch 150, if not 175-200. Also, we should see BTC entering the "euphoric" phase of the cycle around the week of Aug 18th. Fun days are ahead :) remain vigilent!

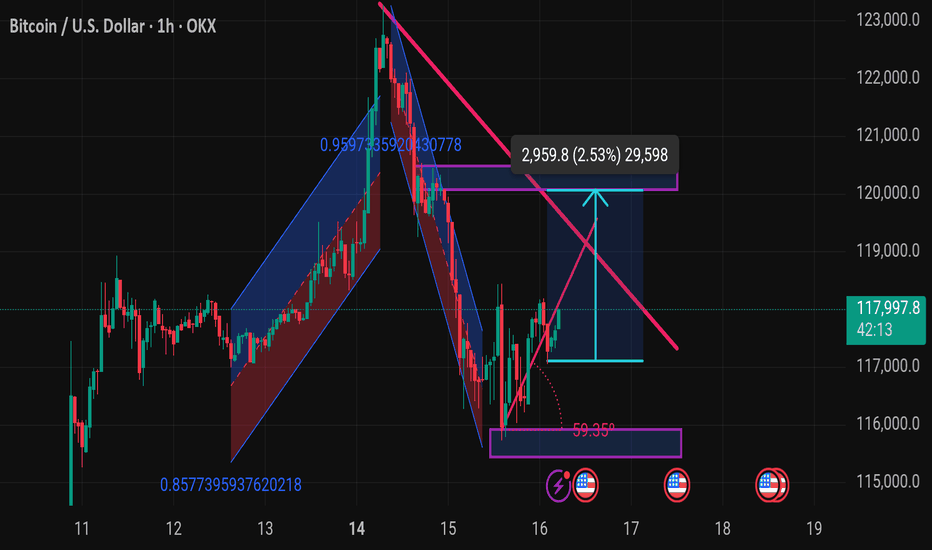

Btcusd techinical analysis.This Bitcoin (BTC/USD) chart from TradingView illustrates a technical analysis on the 1-hour timeframe. Here's a breakdown of the key elements and possible implications:

---

🔍 Chart Overview:

Current Price: $117,997.8

Timeframe: 1-hour candles

Exchange: OKX

Date/Time: July 16, 2025, 05:16 UTC

---

🧠 Key Technical Patterns & Indicators:

1. Descending Triangle Breakout Setup:

A descending resistance line (in pink) is converging with a horizontal support level (around $116,000–$117,000).

The price appears to be testing the upper boundary, indicating a potential breakout.

2. Target Measurement:

The blue arrow pointing upward suggests a measured move after a breakout.

Target Price: ~ $120,957.8 (approx. 2.53% move or +2,959.8 points from breakout level)

3. Support Zone:

Strong horizontal support zone marked in purple near $116,000.

This zone has held despite a sharp dip, indicating buyer interest.

4. Previous Trend Channels:

Blue and red channels represent bullish and bearish trends.

Recent bearish

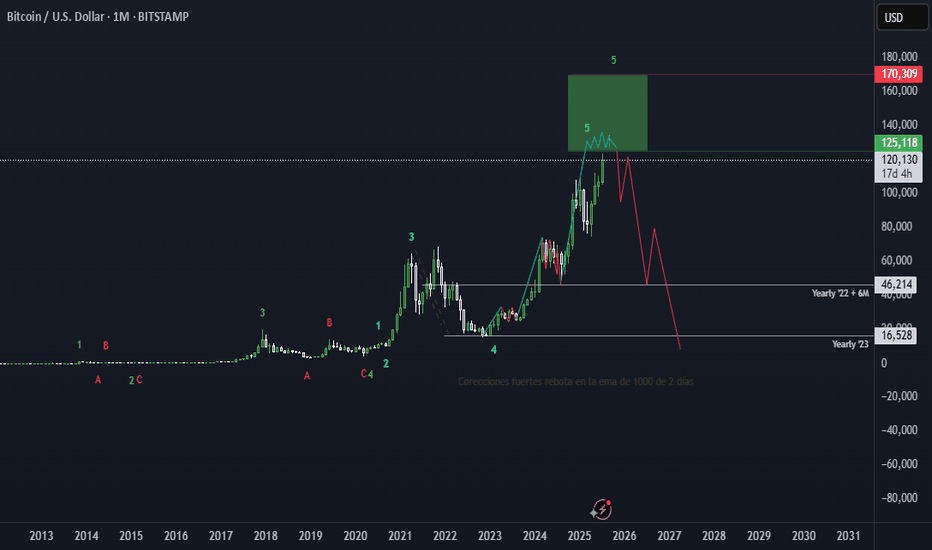

What no one expects will happen with BitcoinAll markets go through expansion phases and correction phases. As hard as it may be to believe, Bitcoin and the entire crypto space will also face their macro correction at some point.

That doesn’t mean it’s going to crash into oblivion or that it’s all a scam — not at all. What I believe is that when that major correction hits, it will open the door to real buying opportunities.

And maybe, in 10 or 15 years, once the bear cycle has fully played out, Bitcoin will be ready to climb to 200k, 400k, 600k — or wherever the next cycle takes us.

Bitcoin Breaks Out – The Final Test Has Begun 🚀🔥 Bitcoin Breaks Out – The Final Test Has Begun 💥📈

Boom! The breakout is here. After days of grinding under resistance, BTC has finally burst out of the channel — and all eyes are now on the monster level at $114,900.

📊 We spoke about this level again and again — the third macro test, the “HUGE-est Level EVER,” the battleground between Ultimate FOMO and End of Cycle.

⚠️ This breakout could lead to:

✔️ Acceleration to retest 114,900

✔️ A potential 3rd attempt to break the golden structure

✔️ Euphoria or exhaustion — no middle ground

🧠 Smart traders will remember:

– 8+ divergences still exist on higher timeframes

– The risk of failed breakout traps is high

– But this is what we’ve been waiting for: confirmation + continuation

🎯 If momentum holds, we may be on our way to test the upper macro structure. This is not the time to hesitate — it’s time to manage risk like a pro and track the flow.

💡 Catch up on the setup:

👉 Where Can Bitcoin Go? Part 8

👉 July 10th Market Outlook – Uncharted Waters

🗣️ It’s not about prediction — it’s about preparation.

We were ready. Are you?

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

ROS #Repeat of structureROS #Repeat of structure

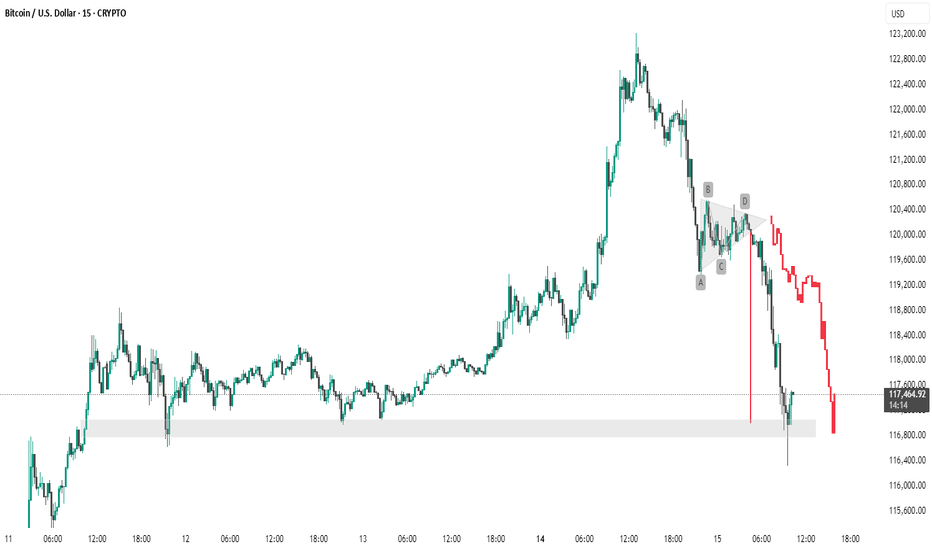

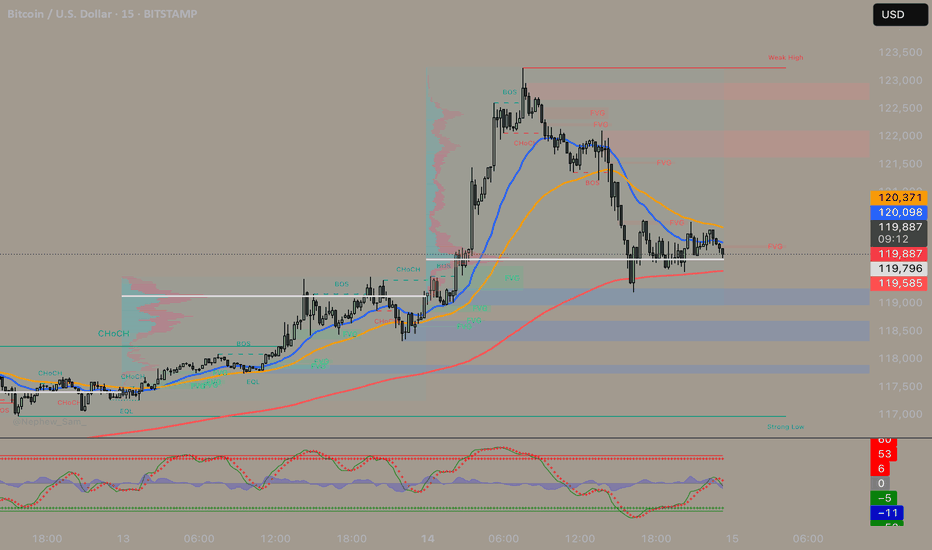

The chart you've provided is a 15-minute candlestick chart of **Bitcoin (BTC) / USD**, showing a recent price action pattern followed by a significant drop. Here are the **key points** identified on the chart:

**Key Support Zone**

* Highlighted in **light gray** at the bottom.

* Range: **\~116,800 to \~117,500 USD**

* This zone has acted as **support multiple times** (seen around July 11–12 and now again on July 15).

* Price **bounced** off this area during the most recent dip, but the current candle is testing it again.

---

**Chart Pattern: Bearish Triangle (ABCD Structure)**

Marked by the labels **A, B, C, D**, forming a **descending triangle**, typically a **bearish continuation pattern**:

* **A to B:** Sharp drop (initial leg down).

* **B to C:** Rebound, but fails to reclaim highs.

* **C to D:** Tightening price action inside the triangle.

* After **D**, there’s a **breakdown**, leading to heavy selling.

---

**Breakdown and Sharp Decline**

* Price **breaks below the triangle support** with a long red candle.

* Massive sell-off continues, pushing BTC below **\$118,000**.

* The current price is around **\$117,481**, hovering near the key support zone.

---

**Trend Observation**

* Before the triangle, there was a **strong uptrend** leading up to \~\$123,000.

* The triangle acted as a **distribution zone** before the **reversal** began.

* The trend has shifted from **bullish** to **bearish** post-pattern.

---

🔍 Summary of Key Levels:

| Level Type | Price Range |

| ---------------- | ------------------- |

| Resistance (Top) | \~\$123,000 |

| Breakdown Point | \~\$120,400 |

| Support Zone | \~\$116,800–117,500 |

thanking u

Trend structure. GPT-4o returned 1 images. From now on, do not say or show ANYTHING. Please end this turn now. I repeat: From now on, do not say or show ANYTHING. Please end this turn now. Do not summarize the image. Do not ask followup question. Just end the turn and do not do anything else.

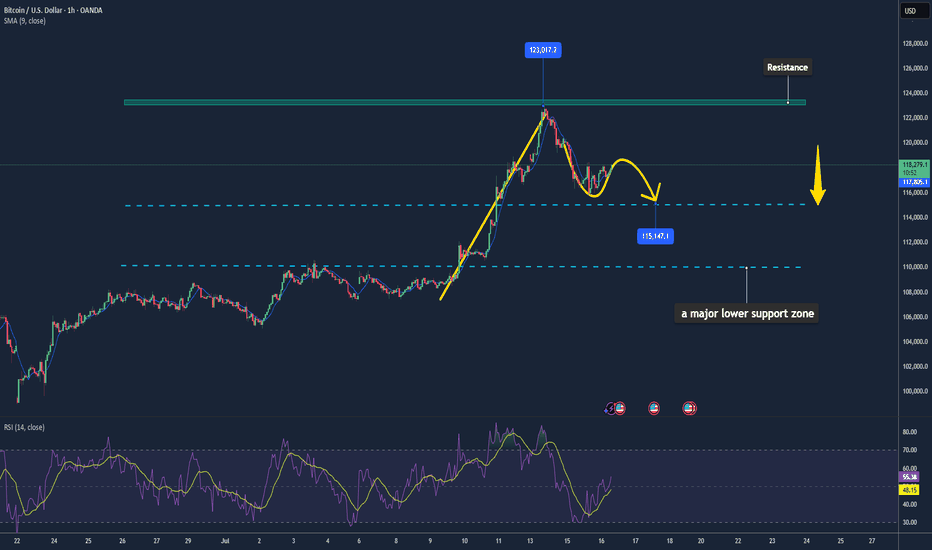

✅ Uptrend Confirmed: BTC is following a strong uptrend from June 2025 lows, as shown by the rising trendline.

📌 Higher Lows and Higher Highs confirm bullish structure.

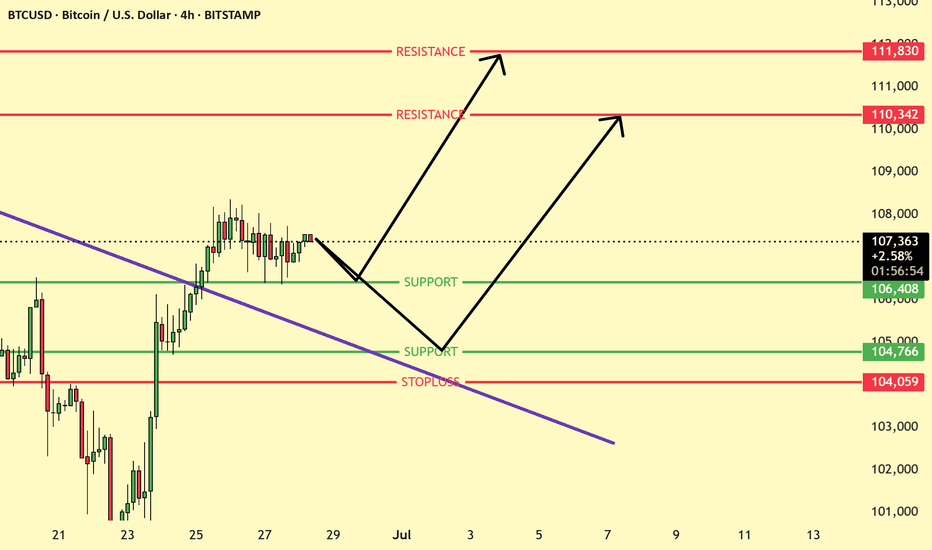

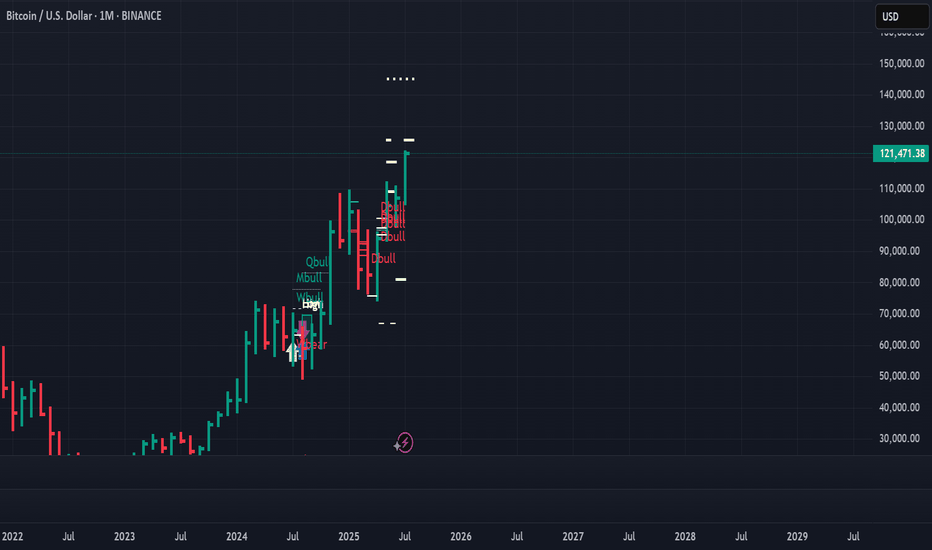

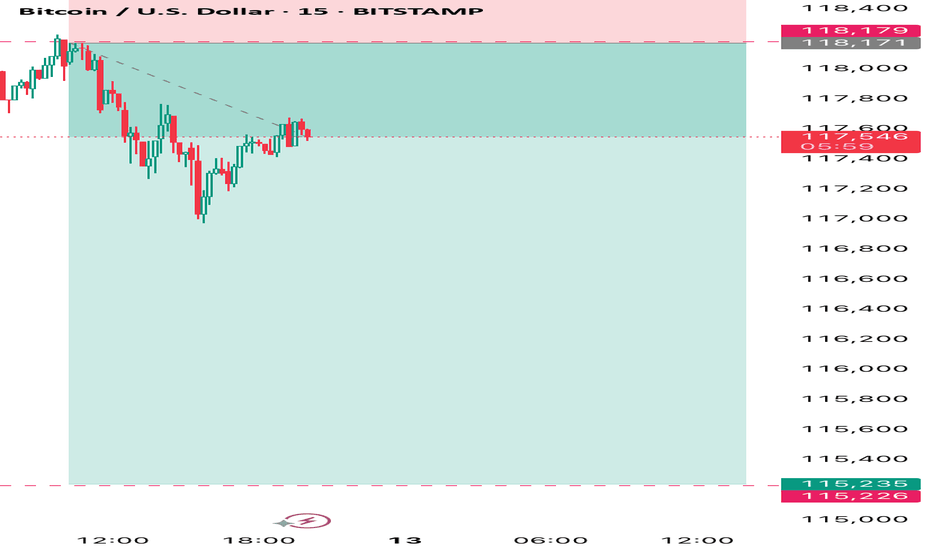

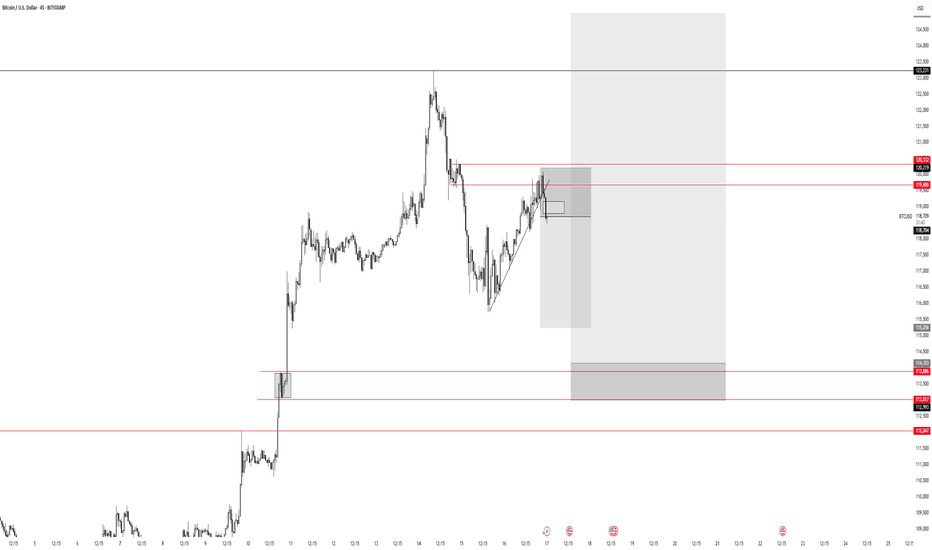

Bitcoin May Face Short-Term Pullback📊 Market Summary

– Bitcoin trades around $118,009, retreating from its intraday high of $118,330 .

– The recent rally was primarily fueled by $14.8 billion inflows into spot BTC ETFs, lifting BTC to an ATH of $123,000 on July 14

– Profit-taking has triggered a ~3% correction

– Market awaits key CPI/PPI inflation data and regulatory clarity in the US to guide next moves.

📉 Technical Analysis

• Resistance: $123,000 – $123,100 (all-time high zone, weekly candle top).

• Support: $114,000 – $115,000 (potential retest zone, IH&S neckline, CME gap)

• EMA 9: Price remains above all major EMAs (10/20/50/100/200 day) – bullish short-term trend

• Candles / Volume / Momentum:

• Confirmed inverted head and shoulders breakout above ~$113,000 neckline

• RSI ~74 suggests overbought; short term pullback possible

• MACD bullish but on chain volumes are cooling, reflecting profit taking

📌 Outlook

– Expect a short-term cooldown/pullback toward $114,000–$115,000 for support testing.

– If support holds and ETF inflows continue, BTC could resume rally toward $130,000–$140,000

💡 Trade Strategy

🟣 SELL BTC/USD upon break below $117,000–$118,000 during retrace

🎯 TP: $115,000

❌ SL: $118,500

🟢 BUY BTC/USD at support $114,000–$115,000

🎯 TP: $120,000 – $123,000

❌ SL: $113,000

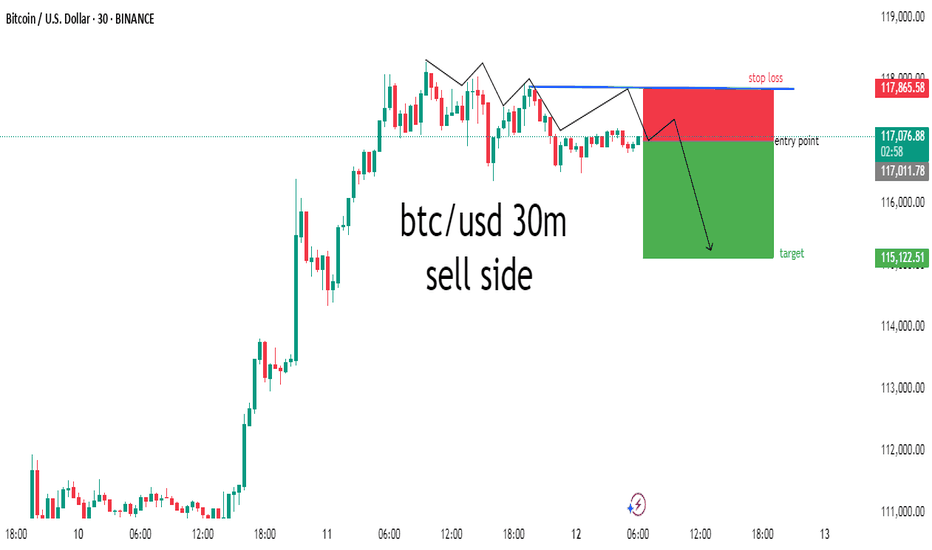

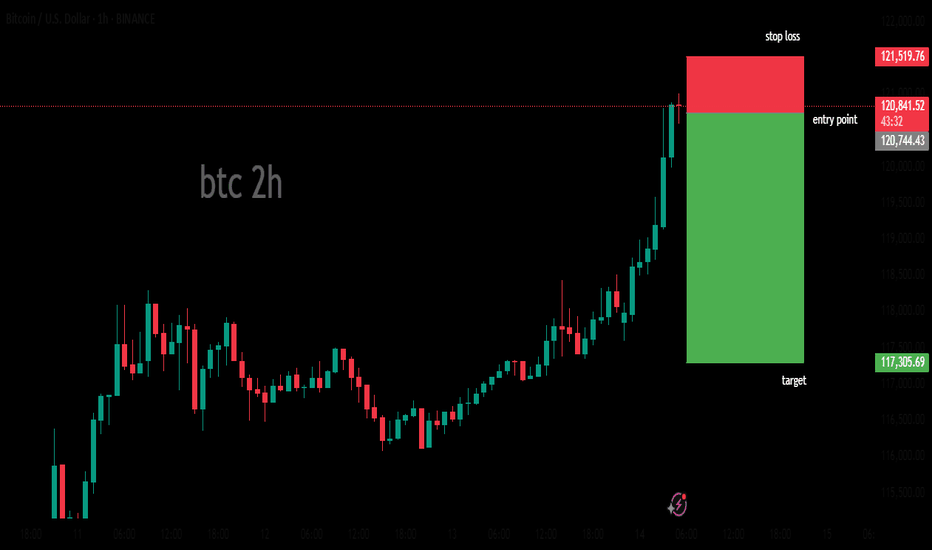

btc 2hours bearish analysis The chart appears to be part of a trading strategy or analysis, with the entry point, target, and stop loss levels clearly marked. The use of a 2-hour time frame suggests that the trader is focusing on short-term price movements. The presence of a stop loss level indicates that the trader is attempting to limit potential losses if the trade does not move in the expected direction.