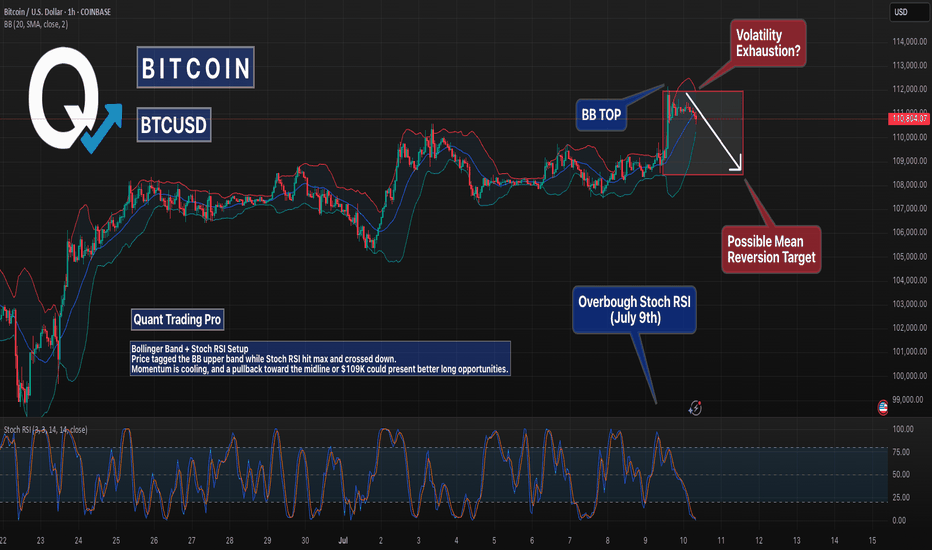

BTC Just Hit the Brakes – Is the Pump Over?Bitcoin just tagged the upper Bollinger Band on the 1H chart while Stoch RSI maxed out and crossed down — a classic signal of volatility exhaustion combined with a momentum slowdown.

Technical Breakdown:

Bollinger Band Top: Price tapped the upper band, often a sign of near-term overextension

Overbought Stoch RSI (July 9th): RSI hit 97+ and flipped — momentum may be shifting

Cooling Phase? Price is stalling inside a tight range with low follow-through

arget Zone: $109K or BB midline as a possible mean reversion area

This is a high-probability zone for a pullback setup or a more attractive long opportunity if momentum resets.

BITCOIN trade ideas

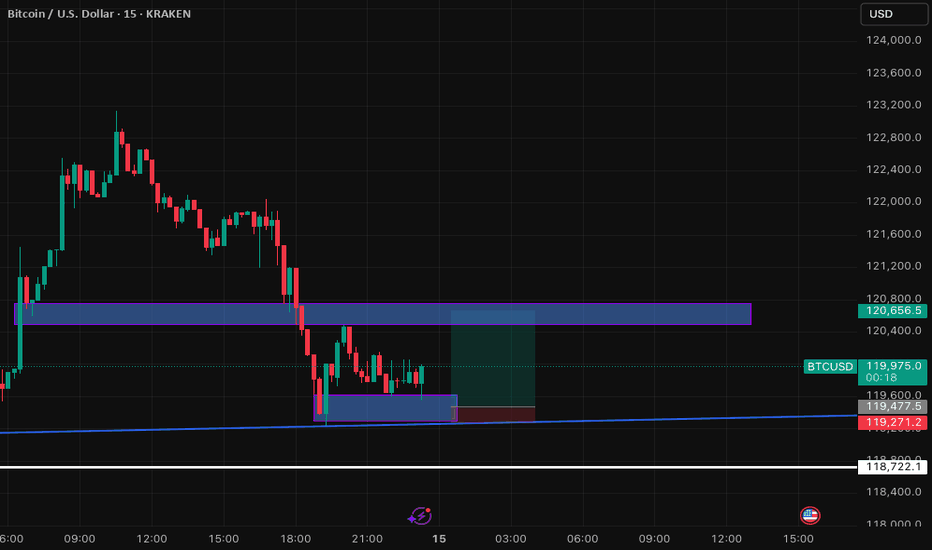

BTC/USD: 15-Min Reversal Attempt at Key Trendline SupportThis 15-minute chart for BTC/USD highlights a potential reversal opportunity following a significant downtrend. Price has found support at a confluence of a rising long-term trendline and a defined demand zone around 119,271 - 119,477.5. The analysis focuses on the current consolidation at this support, looking for bullish candlestick patterns to confirm a move towards retesting the prior breakdown level (now resistance) at 120,500 - 120,700. Key observations include the breakdown from a previous support, the current bounce, and the defined risk-reward setup for a potential long entry."

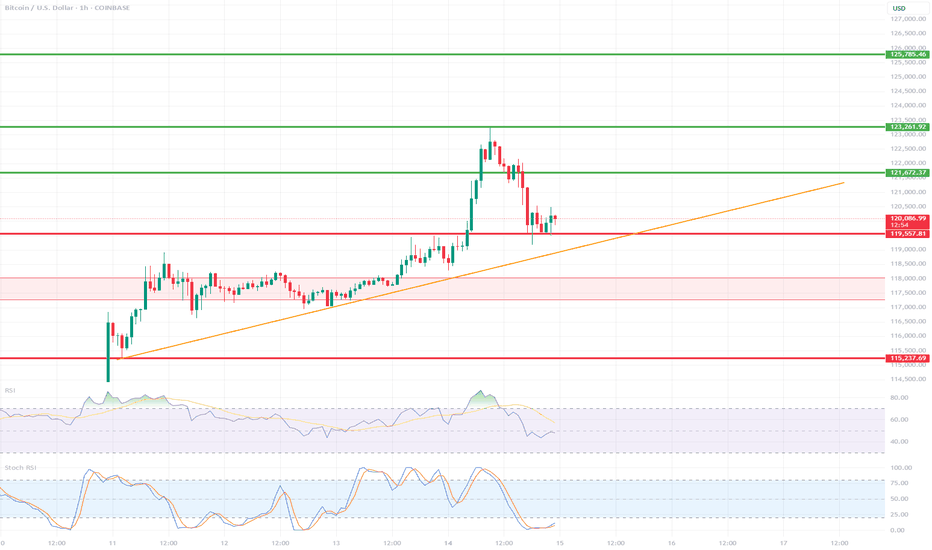

BTC/USD 1H ShortTerm🔍 Trend:

The short-term uptrend remains in effect, supported by the orange trendline.

The price has tested dynamic support but has not yet broken it.

🟥 Supports (Important Levels):

🔻 1. 119.550

Key support.

The price is currently testing it. Holding = potential upside rebound.

Breaking = greater downside risk.

🔻 2. 117.260–118.040 USD

Clear demand zone (reinforced by prior consolidation).

If the price breaks below current support, this is the next logical stopping point.

🔻 3. 115.237–115.500 USD

Strong weekly support – very important in the event of a stronger correction.

Historically, it has responded many times.

🟩 Resistance:

🔼 1. USD 121.673

The nearest local resistance – this could pose a problem for further growth.

🔼 2. USD 123.961

The last local high. Breaking it confirms the continuation of the uptrend.

🔼 3. USD 125.785

The next resistance – a potential target after a breakout to the upside.

📈 Technical Indicators:

RSI (classic):

Still below 50, but starting to reverse slightly upward – neutral with a slight potential for a rebound.

Stochastic RSI:

Gives a long signal – the lines have crossed in the oversold zone and are pointing upward.

📊 Scenarios:

🟢 Bullish:

Maintaining the current support zone (119.5–120k).

Breakout above 121.673 → target: 123.961.

Breakout of 123.961 = trend confirmation and target: 125.8k+

🔴 Bearish:

Break of the trend line and support at 119.550 → possible quick decline to 117.2k–118k.

If this doesn't hold, target: 115.2k

✅ Summary:

Decisive moment – tested trend line + support = rebound or breakout point.

The Stochastic RSI indicates a potential upside breakout, but the RSI needs confirmation.

Careful monitoring of volume and reaction to 120k in the coming hours.

Valtrix Group: Crypto Today – Bitcoin Explodes Toward $120,000The global cryptocurrency market continues to surprise: Bitcoin is confidently approaching the $120,000 mark, reinforcing the role of digital assets as an integral part of the global financial system.

Record Growth: What’s Behind Bitcoin’s New Surge?

Amid rising institutional interest, growing retail demand, and expectations of interest rate cuts in the U.S., Bitcoin is demonstrating impressive growth. Over the past few weeks alone, the cryptocurrency has surged by more than 20%, and Valtrix Group analysts believe the psychological threshold of $120,000 could be crossed in the near future.

Key drivers of this growth include:

Active institutional buying, including investment funds and major banks;

Reduced Bitcoin supply following this year’s halving;

Stabilizing regulatory environment in regions like the U.S., Europe, and Southeast Asia;

A shift by traditional investors into digital assets amid geopolitical instability and inflationary concerns.

How Is the Market Reacting?

Altcoins are also experiencing significant growth, following the market leader. Ethereum has surpassed $7,000, while tokens such as Solana and Avalanche have jumped more than 30% in a week.

Investors are increasing trading volumes and locking in profits, but interest in long-term HODL strategies is also on the rise. According to Valtrix Group, this is not just a short-term speculative wave, but a sustainable trend backed by strong fundamentals.

What’s Next? Forecast from Valtrix Group

Our analysts believe that Bitcoin could reach $125,000–$130,000 in the short term if the current momentum continues. However, we advise investors to proceed with caution: high volatility remains a defining feature of the crypto market.

Valtrix Group recommends:

Diversifying portfolios to include digital assets;

Applying risk management strategies;

Monitoring news cycles and macroeconomic indicators.

Valtrix Group continues to closely monitor market developments, providing clients with up-to-date analytics, investment guidance, and digital finance support.

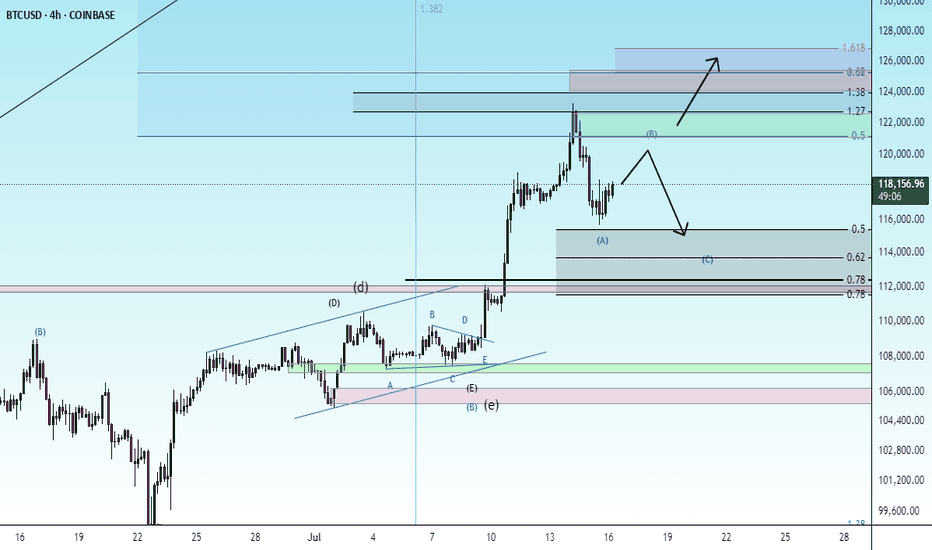

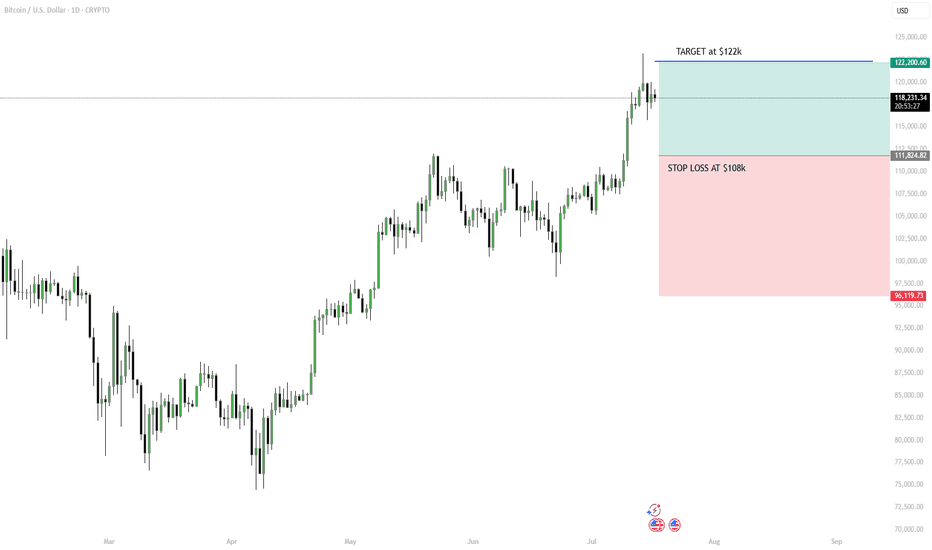

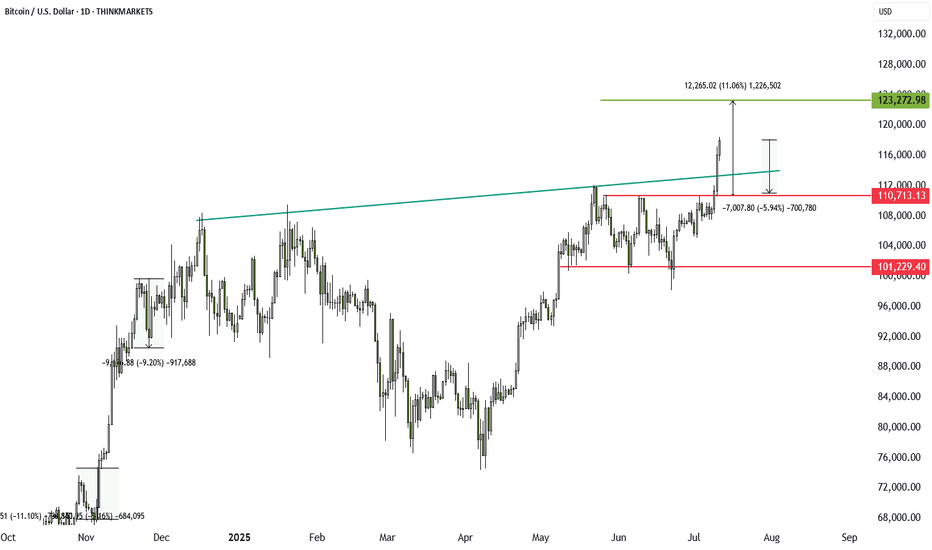

Strategy: “Breakout Bounce” – Buy the Retest, Ride the WaveHello Traders! BTC has broken out above $118K–$120K after a strong uptrend. Now it’s pausing, and a short-term pullback looks likely. Instead of buying the top, we wait for the price to retest previous resistance (around $112K–$114K), which could turn into support.

MY PLAN:

Wait for pullback to $112K–$114K zone.

Look for a bullish candle (daily or 4H) to confirm entry.

Target: $122K short-term or trail stop if trend continues.

Stop loss: Below $108K to manage risk.

Tip: Don’t chase. Be patient, follow the setup, and use proper risk management.

Please leave a comment and don't forget to support a fellow trader! Also, you can leave in the comments your target and plan ideas!

Have a great day y'all!

-Neo

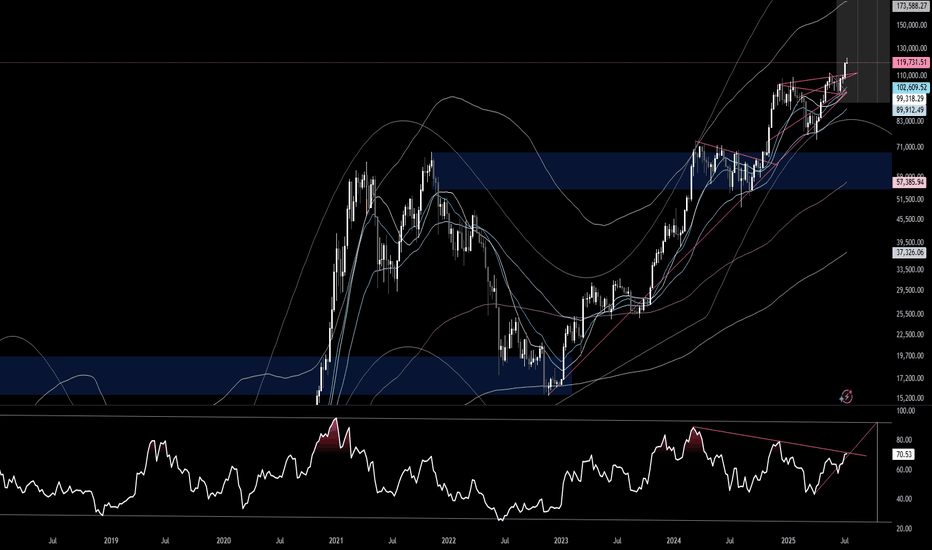

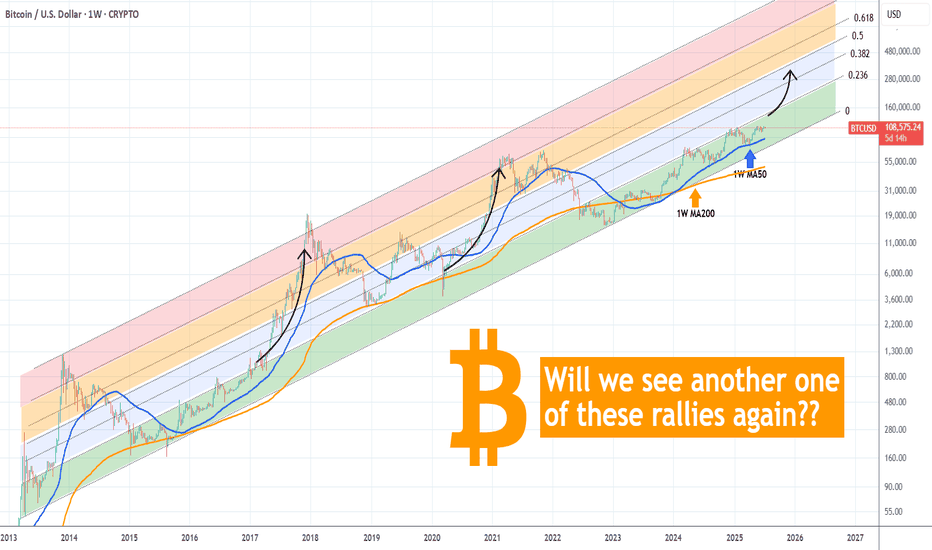

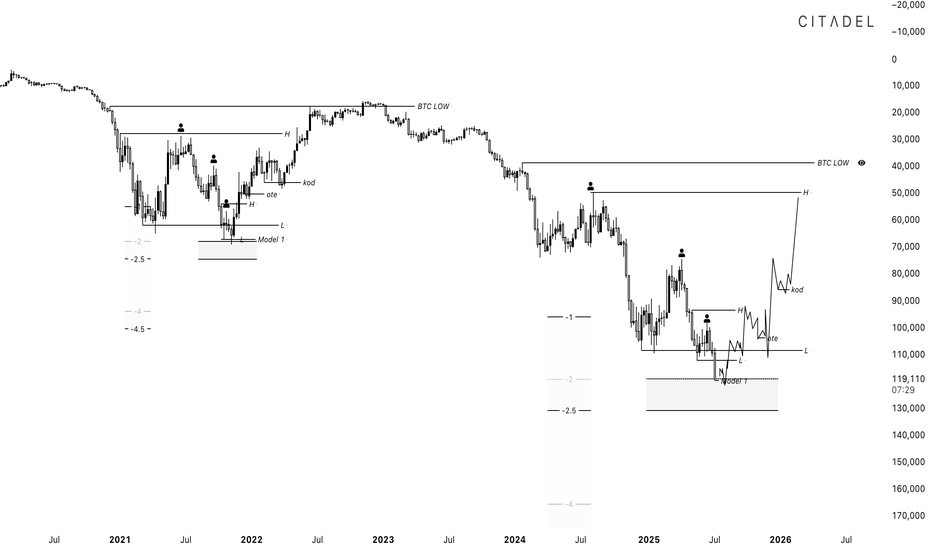

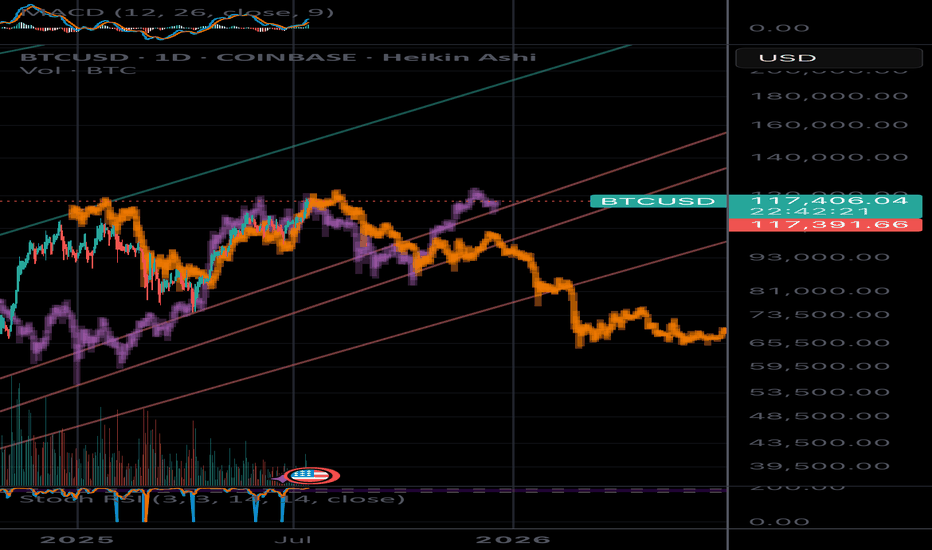

BITCOIN Is there enough time for another parabolic rally?Bitcoin (BTCUSD) is practically consolidating on the short-term, having just recently been rejected off its new All Time High (ATH). Despite the short-term volatility, the long-term outlook is still a very strong, structured uptrend, a Channel Up pattern that is now technically aiming for its next Higher High.

Incredibly enough, this Channel Up since the November 2022 market bottom, has been almost entirely within the Buy Zone (green) of the Fibonacci Channel Up going back all the way to April 2013!

As you can see during the previous two Cycles, every time BTC got above that Buy Zone, it started a parabolic rally. So far, we haven't got such rally on the current Cycle and with time running out (assuming the 4-year Cycle model continues to hold), do you think we will get one this time around?

Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

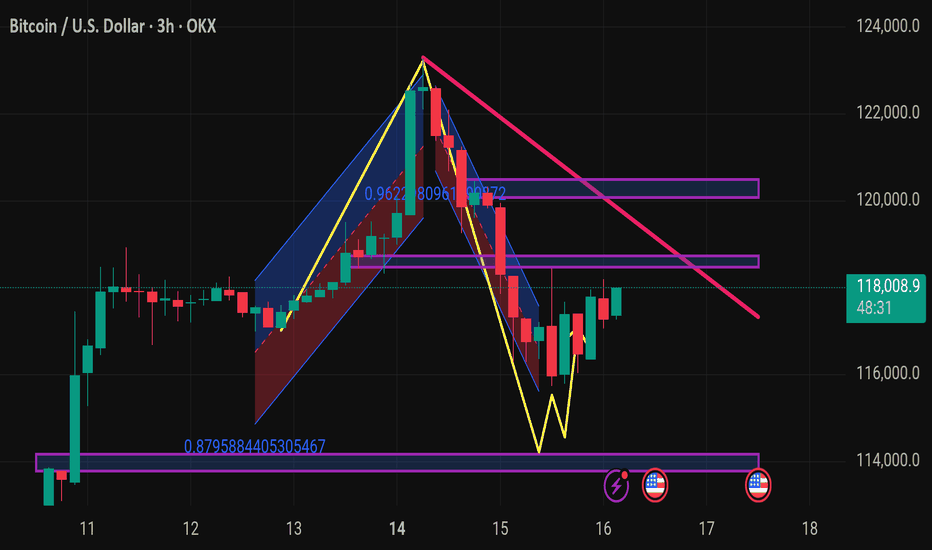

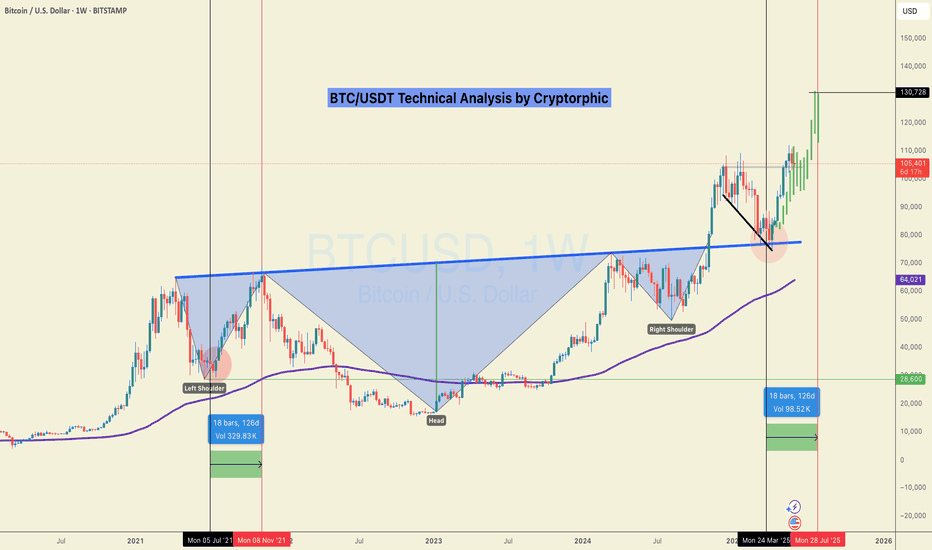

Double Top Monthly TimeframeBitcoin Monthly – Double Top + Bearish Divergence (MACD & RSI) | Bull Cycle Over? [/b

Technical Breakdown:

We're witnessing strong signals that the Bitcoin bull cycle could be over. Here's why:

1. Monthly Double Top

Price has failed to break convincingly above the previous ATH 112k

Two clear peaks on the monthly chart, forming a classic double top pattern.

2. Bearish Divergence – RSI & MACD

MACD and RSI: Lower highs while price made equal/higher highs → Momentum weakening.

Trend reversal likely - level to watch 89k breaking this bullish trend line level, bitty will be shifting to a bearish trend..

It's too early and too bold to short and call the top is in — you need to trust your chart.

Bearish divergence confirmed

Likely end of 2023-2025 bull cycle

The permabulls won’t like this — but charts don’t bend to hopium

Key Insights: Financial Markets Transformation by 2030For years, this page has been my space to share in-depth market research and personal insights into key financial trends. This post reflects my perspective — a strategic outlook on where I believe the digital finance industry is heading.

The financial world is evolving at an unprecedented pace, and it's easy to overlook subtle shifts. But the undeniable fact is that we are now standing at the intersection of three powerful industries — financial markets, blockchain, and artificial intelligence. We are positioned at the cutting edge of technology, where innovation is not a future concept but a present reality.

This post serves as a reference point for future trends and a guide to understanding the transformative forces shaping financial markets by 2030. These are not just facts, but my vision of the opportunities and challenges ahead in this rapidly converging digital ecosystem. Staying ahead today means more than following the market — it means recognizing that we are part of a technological shift redefining the core of global finance.

📈 1. Electronic Trading Evolution

Full transition from traditional trading floors to AI-driven digital platforms.

Integration of blockchain and smart contracts ensures transparency, automation, and risk reduction.

Real-time data analytics democratizes market access and enhances strategic decision-making.

🤖 2. Algorithmic Trading Growth

Accelerated by AI, machine learning, and big data analytics.

High-frequency trading (HFT) boosts efficiency but introduces new volatility factors.

Adaptive algorithms dynamically adjust strategies in real time.

Strong focus on regulatory compliance and ethical standards.

🔗 3. Tokenization of Real World Assets (RWA)

Transforming asset management with projected growth to $18.9 trillion by 2033. (now 18.85B)

Enhances liquidity, accessibility, and transparency via blockchain.

Institutional adoption is driving mainstream acceptance.

Evolving regulations (DLT Act, MiCA) support secure tokenized ecosystems.

🏦 4. Institutional Adoption & Regulatory Frameworks

Digitalization of fixed income markets and exponential growth in institutional DeFi participation.

Key drivers: compliance, custody solutions, and advanced infrastructure.

Global regulatory harmonization and smart contract-based compliance automation are reshaping governance.

💳 5. Embedded Finance & Smart Connectivity

Embedded finance market to hit $7.2 trillion by 2030.

Seamless integration of financial services into everyday platforms (e-commerce, mobility, etc.).

AI, blockchain, and IoT power real-time, personalized financial ecosystems.

Smart contracts reduce operational friction and enhance user experience.

🛡 6. Financial Crime Risk Management

Market expected to reach $30.28 billion by 2030.

AI-driven threat detection and anomaly monitoring strengthen AML compliance.

Blockchain ensures data integrity and automates cross-border regulatory adherence.

Global collaboration (FATF, EU AML) fortifies defenses against evolving financial crimes.

🌍 7. Consumer Behavior & Financial Inclusion

Digital banking bridges the gap for underbanked populations, especially in emerging markets.

Mobile solutions like M-Pesa revolutionize access to financial services.

Biometrics, microfinance, and AI-powered engagement tools foster inclusive economic participation.

🚀 Conclusion

By 2030, financial markets will be defined by technology-driven efficiency, regulatory adaptability, and inclusive growth.

Success will favor those who embrace innovation, leverage automation, and engage in cross-sector collaboration.

The future belongs to agile stakeholders navigating a landscape shaped by AI, blockchain, tokenization, and smart finance connectivity.

Best regards, EXCAVO

_____________________

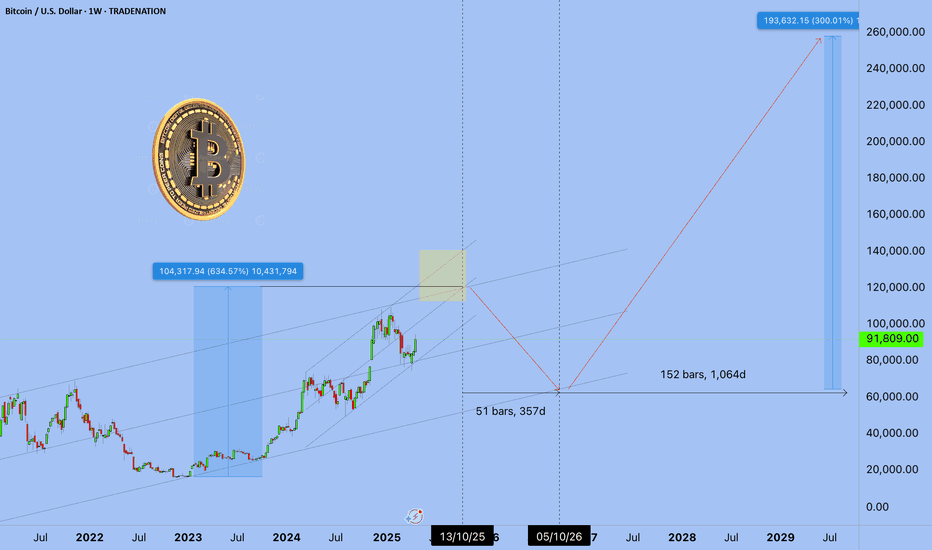

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

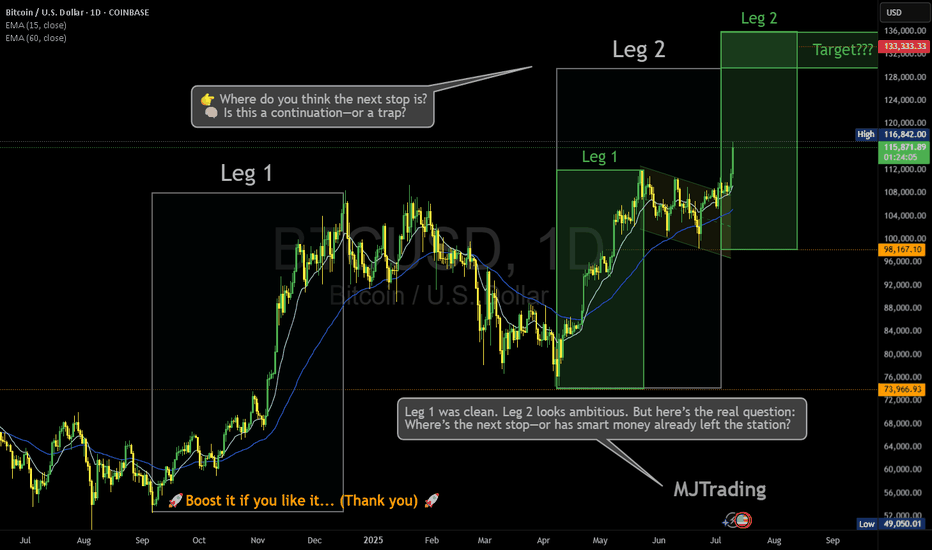

Where is the next stop? 133,333?Leg 1 was clean. Leg 2 looks ambitious. But here’s the real question: Where’s the next stop—or has smart money already left the station?

BTC just sliced through both EMAs with conviction, now hovering above $116K. Volume’s decent, sentiment’s euphoric… but is this rally genuine markup, or a cleverly disguised distribution phase?

🔍 Price targets like $133K are seductive—but what if consolidation isn’t horizontal anymore?

Vertical consolidation is real. And it’s where retail gets baited hardest.

📊 Leg 2 might still play out—but don’t ignore the possibility that this is the final markup before a liquidity sweep.

👉 Where do you think the next stop is? 🧠 Is this a continuation—or a trap?

Drop your guess...

Who has entered here:?

Who can let the winners run in this situation:

#MJTrading #ATH

#Bitcoin #BTC #CryptoTrading #SmartMoney #MarketStructure #WyckoffMethod #LiquiditySweep #DistributionPhase #TechnicalAnalysis #TradingView #CryptoChart #PriceAction #EMA #Consolidation #CryptoStrategy #TrendReversal #CryptoCommunity

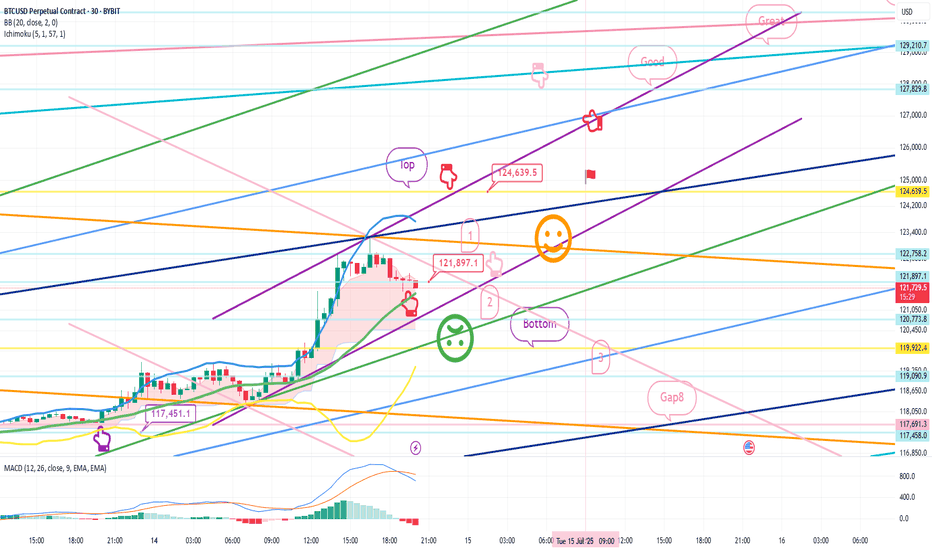

July 14 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

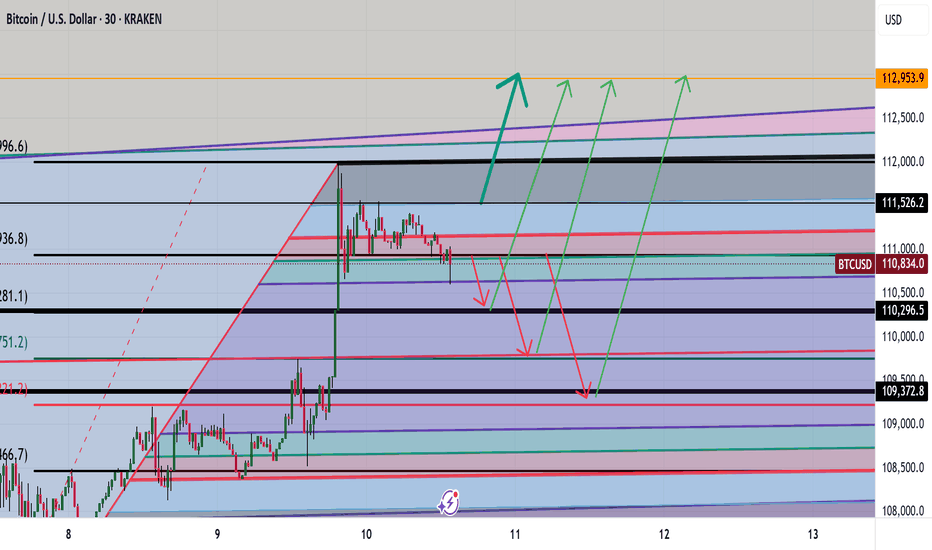

This is a Bitcoin 30-minute chart.

There is no separate Nasdaq indicator announcement.

Nasdaq upper gap reversal condition and

Bitcoin is moving sideways after a sharp rebound until the afternoon.

I created today's strategy based on the vertical decline condition based on the 5-minute trend reversal in Tether Dominance.

On the lower left, I connected the long position entry section of 117,451.1 dollars that I entered on the 11th.

* In the case of the red finger movement path,

This is a one-way long position

current position chase purchase strategy.

1. Chasing purchase at 121,897.1 dollars / Stop loss price when the green support line is broken

2. 124,639.5 dollars long position 1st target -> Good, Great in order of target price

Since I left a simulation in the middle,

I think it would be good to use it for re-entry after liquidating the long position.

The movement within the 1st section at the top and the 2nd section at the bottom

is an extreme sideways movement, and from a long position,

if it succeeds in rebounding within the 2nd section, it becomes a strong upward condition.

From the 3rd section breakout today,

the low point is broken in the newly created weekly and daily chart candles this week,

so please note that the upward trend may be delayed.

The next support line is the Gap8 section created last week.

Up to this point, I ask that you simply refer to and utilize my analysis

and I hope that you operate safely with principle trading and stop loss prices.

Thank you.

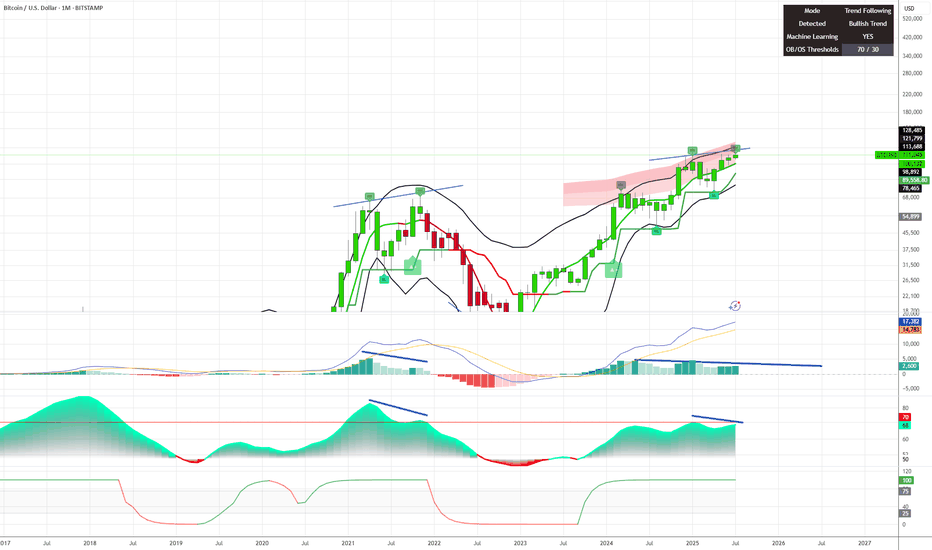

BITCOIN's PUMPs are Getting LARGER this Bull Market...However, it may take a bit longer to realize those expansionary moves.

If Bitcoin adheres to the established cycle pattern, we can anticipate a minimum surge of 103% that should carry us into the fourth quarter of this year.

Consolidation ----> Fake breakdown ----> then expansion.

Are you ready?

Educational: how to spot bitcoin tops before they happenBitcoin is rising, but how far can it go? In this video, I walk through key tools to spot local tops, including funding rates, Twitter sentiment, and pattern targets. We also discuss setups in XRP and Solana, and what to watch ahead of the US crypto regulation update on July 22.

BTC crash to 50kLooks like the top is in!

This should propagate into a nice bear run.

Crypto community got BTC to 100,000$

That’s the PUMP

Then the ETF opens the flood gates for corrupt / corporate money supply… that’s the DUMP signal!

Take their money and run!

Where to? Maybe the park… I’m gonna run my DOGE!

Bitcoin - Trust the higher timeframe!⚔️Bitcoin ( CRYPTO:BTCUSD ) is still 100% bullish:

🔎Analysis summary:

For the past couple of months we have been seeing an overall consolidation on Bitcoin. But looking at the higher timeframe, Bitcoin remains in an underlying strong bullrun. Consolidations are always expected and no reason to freak out since everything is still bullish.

📝Levels to watch:

$100.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader

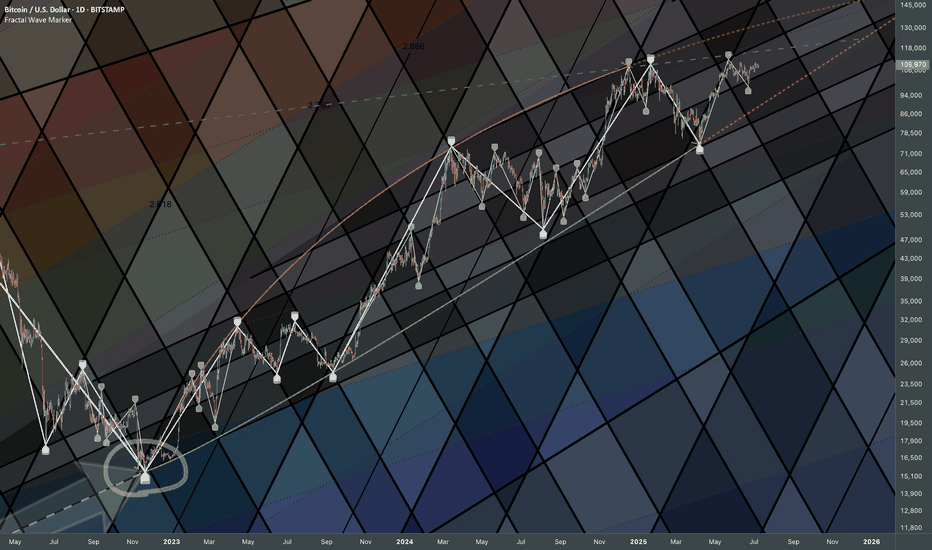

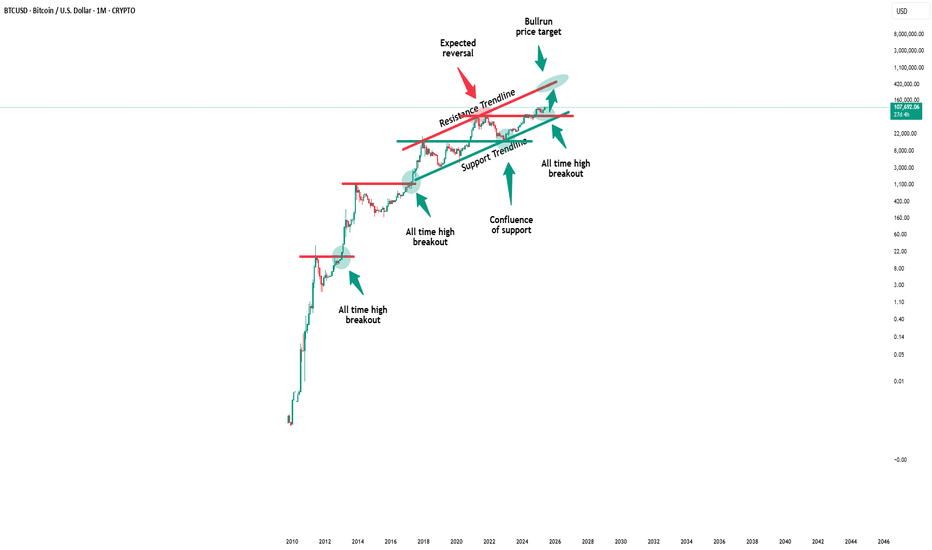

#BTC/USDT It's not over yet! Eying at 130K +ALTCOIN CHEAT SHEET!The last time I shared this chart was on April 14th, when Bitcoin was trading around $84,000 — right when panic was setting in across the market.

The message back then was simple: don’t panic, it’s just a retest.

And here we are again, revisiting the same sentiment with a new chart!

There are a lot of “double top” charts circulating in the space right now, but let me be clear: it’s not over yet.

Before jumping to conclusions, go through this chart and analysis to understand the full picture.

Bitcoin closed the week at $105,705 — certainly higher than most expected just a few days ago.

This marks the first red weekly candle after seven consecutive green closes, which is normal in the context of a healthy uptrend. We're still midway toward the broader target, so there’s no reason to panic or shift into disbelief.

Yes, we may see further corrections in BTC over the coming days or week, potentially down to $98K, and in a less likely scenario, even $ 92K. But this time, Ethereum is showing signs of strength and is likely to outperform Bitcoin, creating high-quality entry opportunities across the altcoin market. In other words, this phase is not a threat, it's an opportunity. BTC is still destined to hit $130k+ as per charts and other important metrics.

Here’s a typical market structure and reaction flow to help put things in perspective:

1. Bitcoin rallies — Altcoins underperform or get suppressed due to capital rotation into BTC.

2. Bitcoin corrects — Altcoins correct further as fear increases and dominance rises.

3. Bitcoin stabilises — Ethereum begins to gain strength, often leading the altcoin recovery.

4. ETH/BTC ratio increases — Ethereum holds up better while many altcoins continue to lag.

5. Bitcoin breaks ATH — This triggers a gradual recovery in altcoins.

6. BTC dominance peaks — Altcoins start gaining serious momentum.

7. Capital rotates from BTC and ETH into altcoins — Sectors tied to the current narrative (like meme coins this cycle, and Metaverse/NFTs in the last one) begin to lead.

8. Altcoin season begins — Utility and mid-cap tokens follow, often delivering strong returns in the final phase.

This pattern has repeated across cycles. Currently, we appear to be in the transition between Bitcoin stabilising and Ethereum gaining dominance — typically the stage that precedes a strong altcoin rally.

Now is not the time to assume the move is over. Stay objective, monitor capital rotation closely, and prepare for what comes next.

If your views resonate with mine, or if this post adds any value to you, please boost with a like and share your views in the comments.

Thank you

#PEACE

BRIEFING Week #27-28 : Distancing from US MarketsHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil