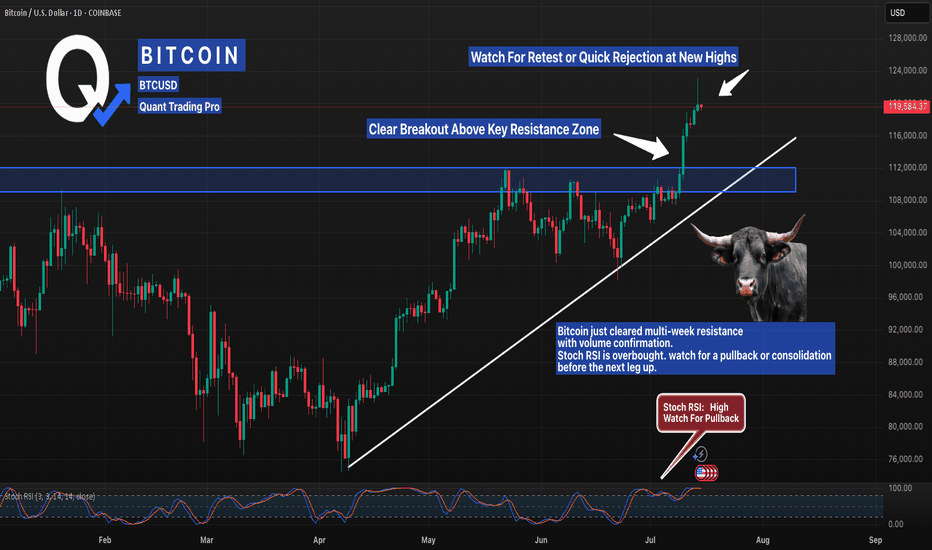

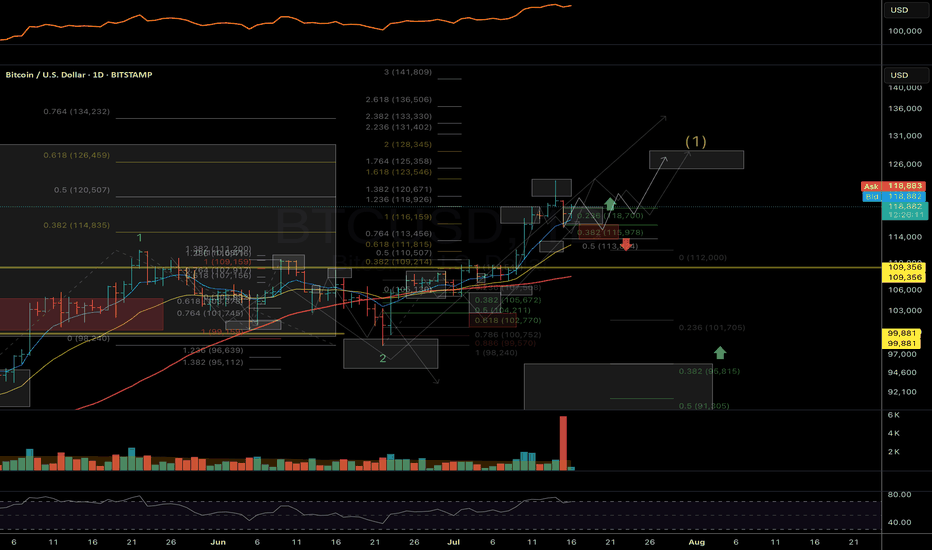

Bitcoin Just Shattered Resistance — Is a Pullback Coming Next? Bitcoin has exploded past a multi-month resistance zone with authority, confirming a breakout that’s been building for weeks. This move aligns perfectly with the rising trendline, signaling strong bullish structure. But here’s the catch — the Stochastic RSI is flashing overbought levels, a classic sign that momentum could be topping out short-term.

Smart traders are now watching two key scenarios: either we see a healthy pullback into the breakout zone (around $112K) for a textbook retest, or bulls keep control and push price into parabolic territory. If this level holds as new support, it could become the launchpad for the next major leg up.

Breakout traders, backtest your pullback strategies and manage risk — the next move could define the rest of the month.

BITCOIN trade ideas

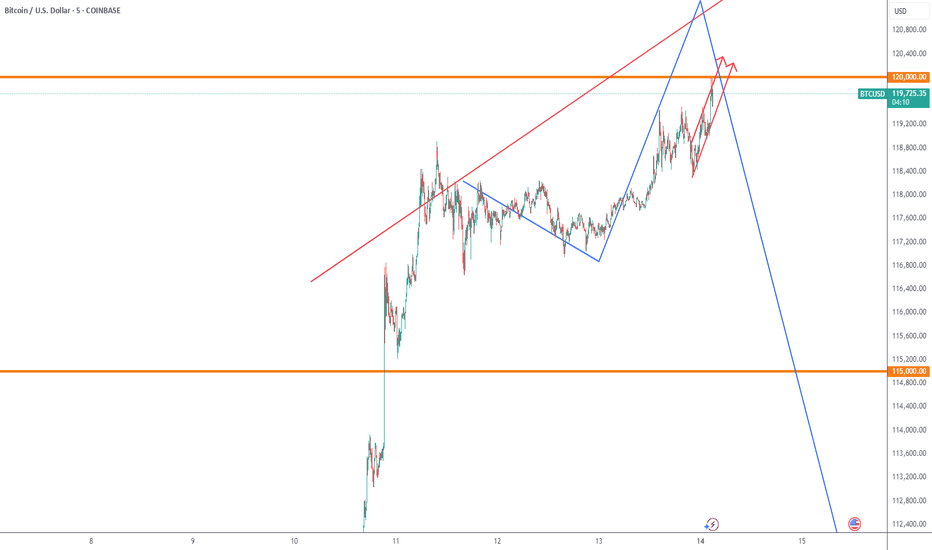

BTC bullish scenario - short term bearishMapping out BTC sideways consolidation that could wreak havoc on ALTS.

Looking at the daily chart, this consolidation is still bullish as BTC price action is still likely respecting this ascending channel.

However, each move down on BTC could mean a significant dump on alt coins.

IMO, based on how the chart looks, BTC price still needs to come and test the bottom and coincidentally there is a huge FVG left when BTC rose impulsively. In all likelihood, I am expecting at the very least for a quick wick down to fill the gap before BTC can then start some bullish price action.

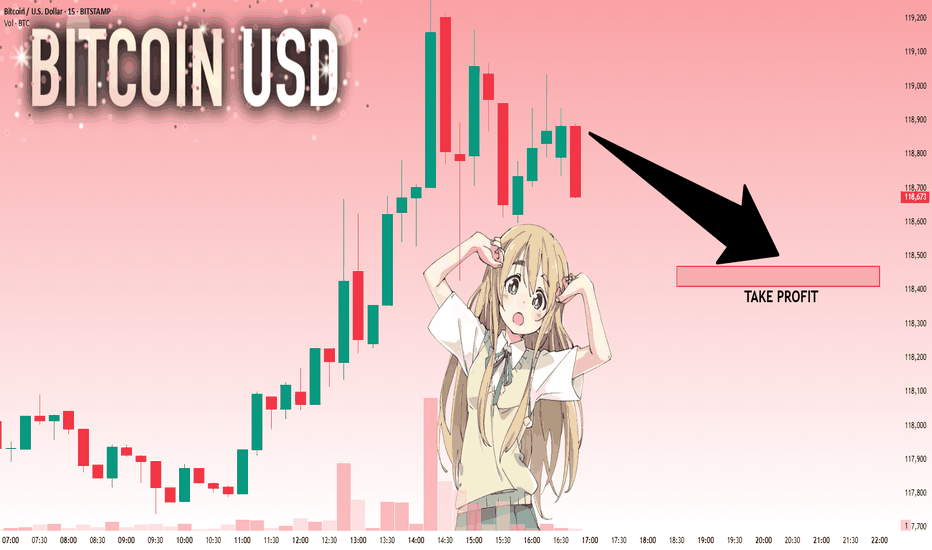

BTCUSD: Next Move Is Down! Short!

My dear friends,

Today we will analyse BTCUSD together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 118.878 will confirm the new direction downwards with the target being the next key level of 118.470.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

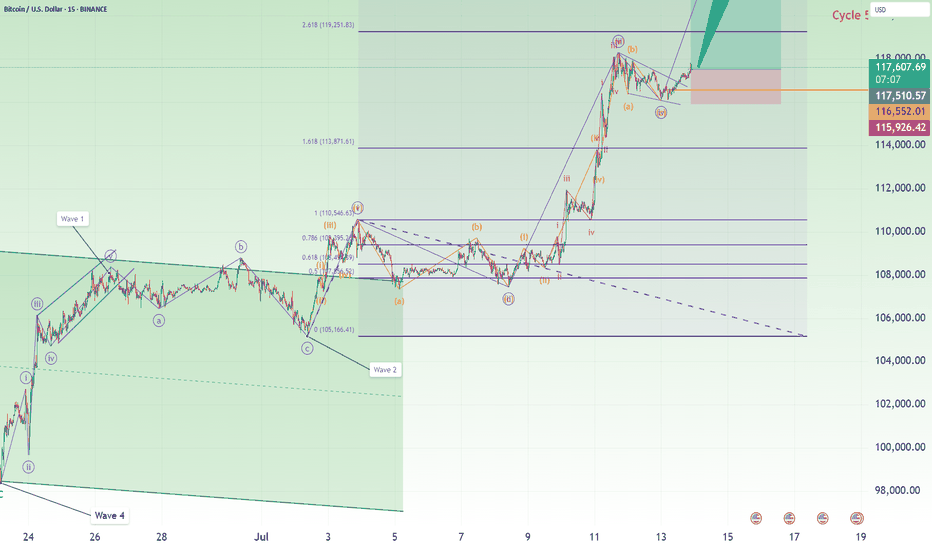

Bitcoin Long: Expects New High; Target 124,632Over in this video, I update on the Elliott Wave counts for Bitcoin and explain why I think that Bitcoin is going higher for a wave 5 of 3 of 5.

The stop loss will be below the wave 4 and given some leeway, will be around 115,900. There are 2 Take profit targets:

1. 119,251, and

2. 124,632

I made it known that my personal preference is $124,632 but note that once a new high is made, this wave counts will already be validated even if it then drops to our stop.

I talk about the possibility of trailing the stop once a new high is reached but commented that every trader must trade based on their own style and risk preference.

Finally, Good luck in your trading!

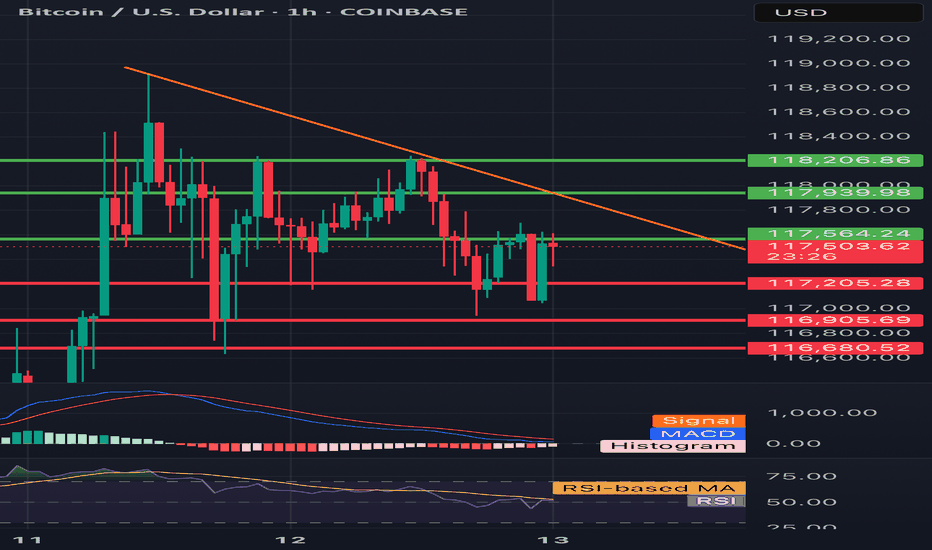

BTC/USD 1H chart short-term🔻 Trend:

• Currently visible inheritance channel - confirmed by the yellow inheritance trend (decreasing peaks).

• The price tests resistance in the area 117.564 - possible to break out, but requires confirmation of the volume.

⸻

📊 levels of support and resistance:

• resistance:

• 117,564 (here we are now - resistance test)

• 117,939

• 118,206 (key level - potential breaking from the channel)

• Support:

• 117,205 - a recent hole, valid short -term

• 116,905

• 116,680 - deeper support, possible target with further decline

⸻

📉 Macd:

• The histogram begins to decrease, but the MacD line and the signal line still below zero → still weakness.

• Possibility to build a base for reversing the trend, but there is no clear signal intersection.

⸻

📉 RSI (Relative Strength Index):

• RSI below 50, but it starts to reflect slightly.

• MA RSI is still falling → no strong growth dynamics.

⸻

🔍 Applications:

• The downward trend still dominates, but the price is trying to pierce local resistance (117.564).

• If it breaks above 117,939–118,206 and persists, a possible change in the direction at a short interval.

• If he rejects the resistance - a quick descend to 117.205 or lower (116,900-116,680).

⸻

⚠️ Signals for observation:

• Closing the candle 1h above 118.206 - Bullly Breakout.

• Rejection of level 117.564 and descent below 117,200 - confirmation of further decline.

• MacD and RSI - 50 - potential change of direction.

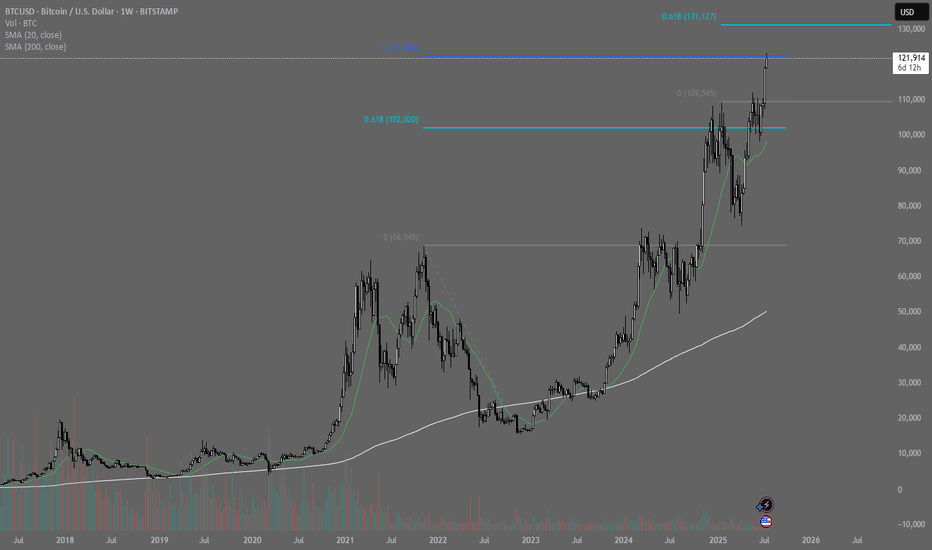

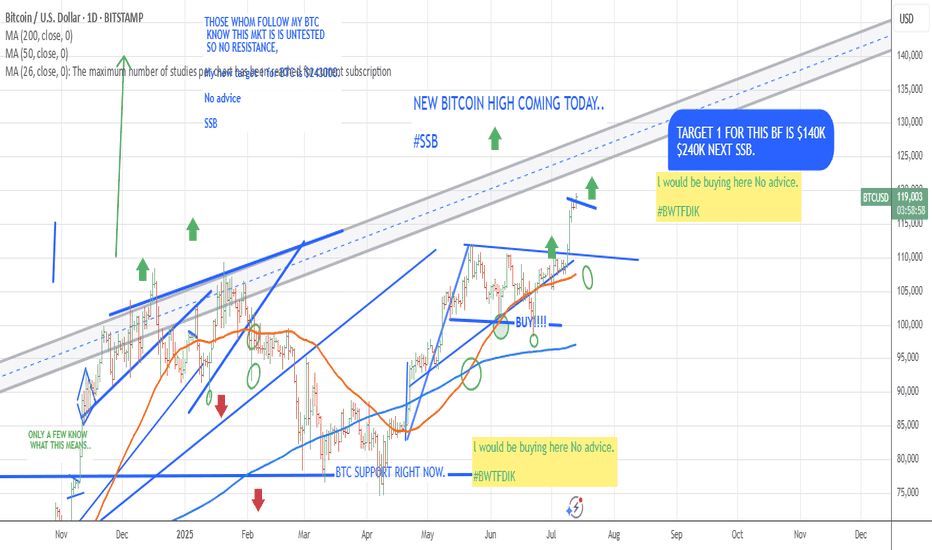

BITCOIN ABOUT TO BLOW UP OR TOP NEAR? Read my thoughts below Definitely Bitcoin looks strong compared to the rest of the crypto market.

we have been consolidating on top of the previous all time highs, and that is bullish, now price has broken out from its resistance and strong support remains around 108K area.

If momentum continues, 120K could be strong target, and if broken 135K is next by end of July.

BUT... Predictions is only in our minds, we need to look at Daily, Weekly and Monthly open and closes to determine bullishness or either momentum to the Upside, Distribution or Downside.

The fact that Bitcoin is making new ATH and the media is silent is a good thing.. But right now is trying to break the long top trendline that goes from 2017 top.

To me distribution and consolidation before the last leg makes sense. but nothing really does, markets can remain unpredictable and crazy more than you stay solvent. So if you are trading the move, use stop loss depending on your time horizon and timeframe.. AND DONT TRY TO PREDICT TOPS unless you are going for quick scalps or you might burn your money away.

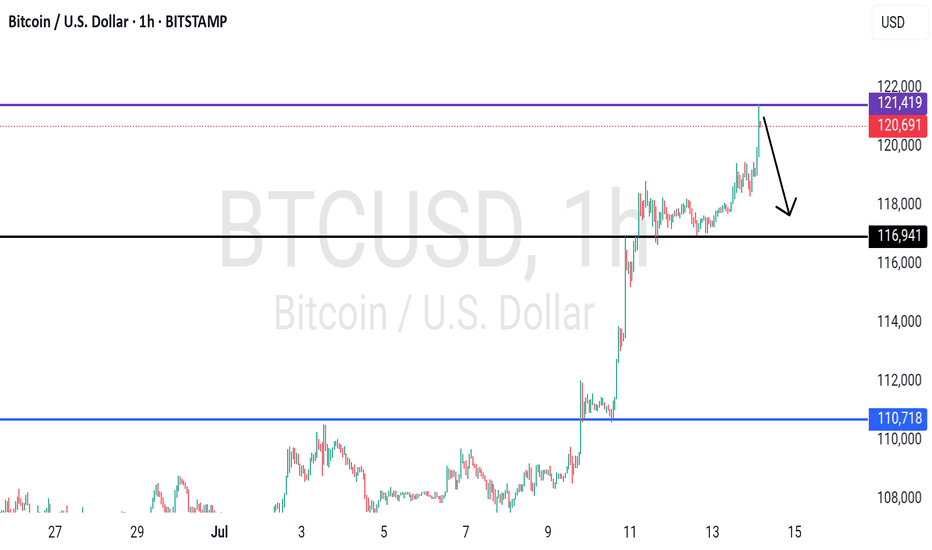

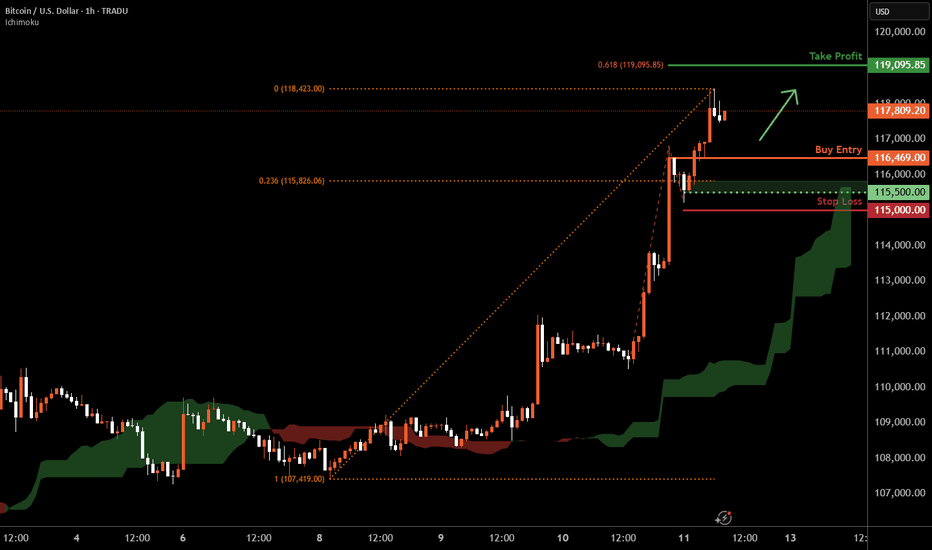

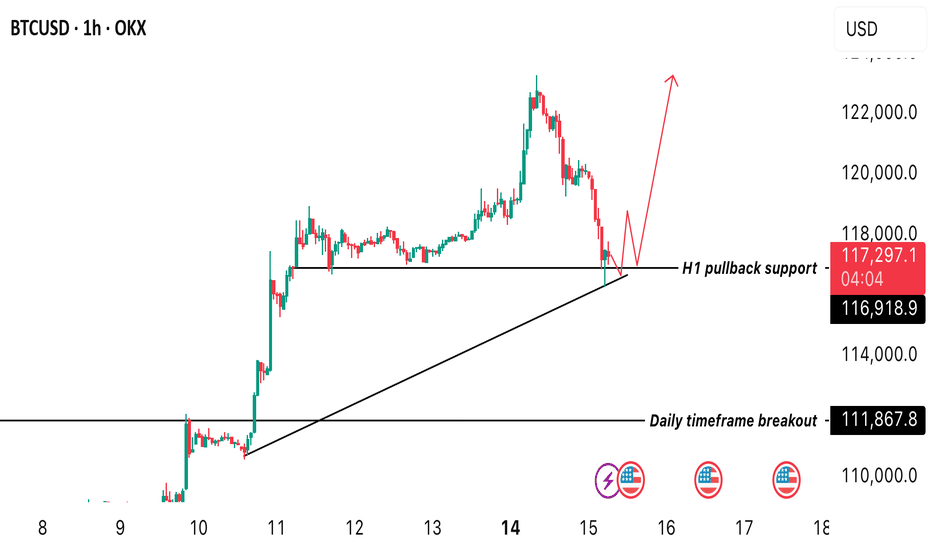

Bitcoin H1 | Bullish uptrend to extend higher?Bitcoin (BTC/USD) could fall towards a pullback support and potentially bounce off this level to climb higher.

Buy entry is at 116,469.00 which is a pullback support.

Stop loss is at 115,000.00 which is a level that lies underneath a swing-low support and the 23.6% Fibonacci retracement.

Take profit is at 119,095.85 which is a resistance that aligns with the 61.8% Fibonacci projection.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

[UPD] BTC / ETH / XRP / SOL / HYPE and other alt and mem-coins A new video update with insights on the intermediate trend structure with key support and resistance zones to keep on radar in the coming sessions

Coins discussed in the video: CRYPTOCAP:BTC / CRYPTOCAP:ETH / CRYPTOCAP:XRP / GETTEX:HYPE / CRYPTOCAP:SOL / CRYPTOCAP:LINK / CRYPTOCAP:SUI / $BRETT / SEED_DONKEYDAN_MARKET_CAP:FLOKI and others

Hope this is helpful in guiding you through the crypto market. Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re tracking - feel free to ask in the comments (just don’t forget to boost the idea first 😉).

BTC at pullback support in H1 timeframe! Possible rebound?BTC reacted a pullback support of 117,140 this is a crucial point where we look forward to seeing a rebound. We anticipate a bullish rally from this week. Keep an eye at this level as the week progresses. A rebound indicates possible gains. A break below might take us back to 110k level.

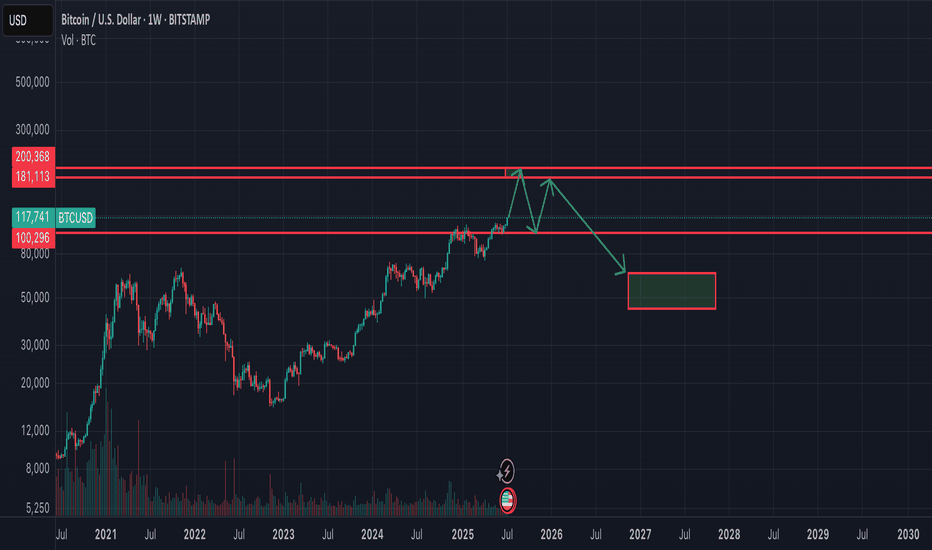

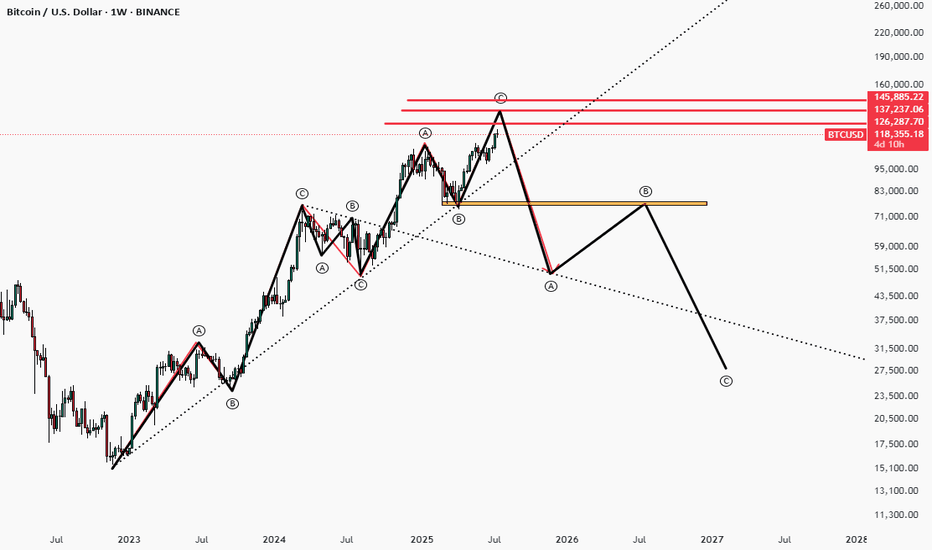

End of Bitcoin cycle this Year nearly 180-200k$ The Great Depression 2.0 ahead and all politicians already know it and prepare to blame all their troubles on the crisis.. I think Bitcoin will reach 180-200k$ till the beginning or the end of september. Need to track the price of gold - Bitcoin ATH near the 55 oz of gold!

After reaching the peak - there will be dump -50%. September and October as the best months for bitcoin in 2025 would be the worst months. November and December maybe green - to close some nice year candle (giving to altcoins last chance for performing) and after that going into the bear market.

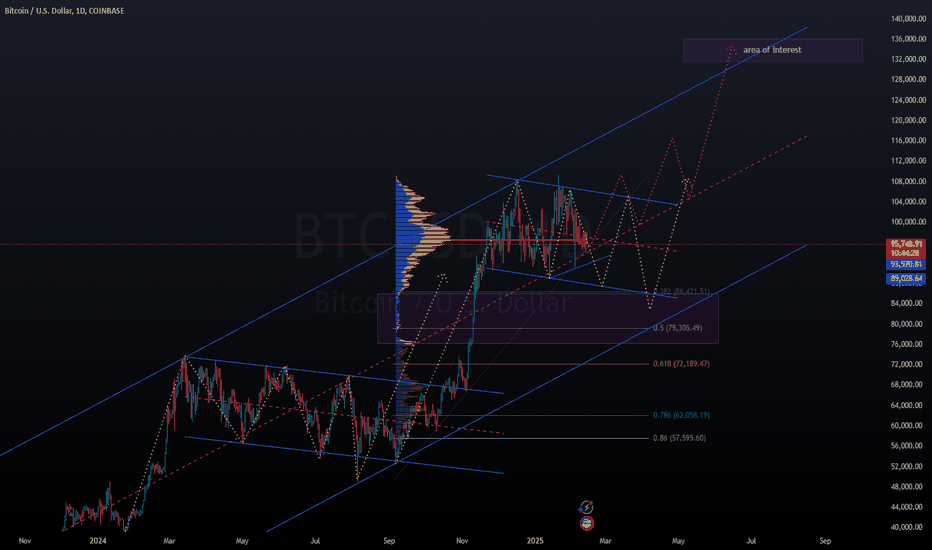

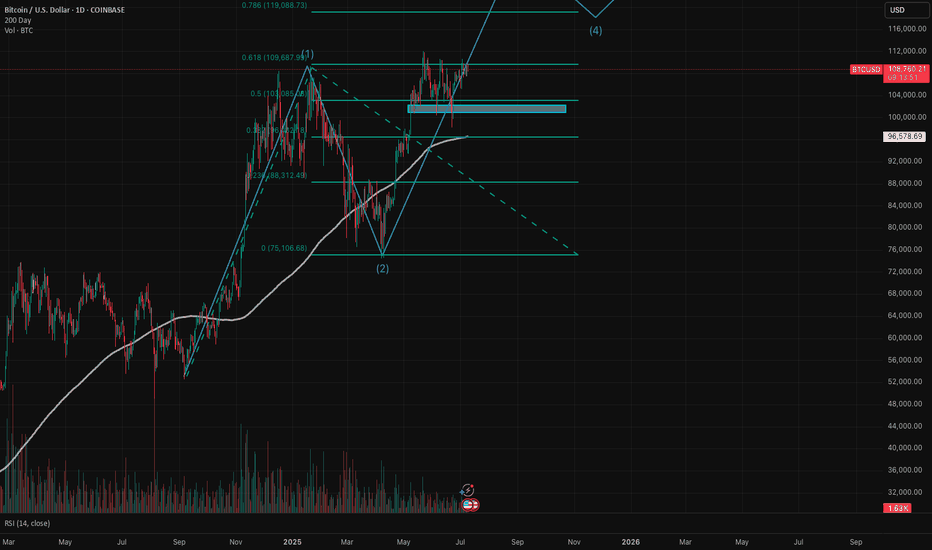

Bitcoin (BTC/USD) is currently in wave 3 of a 5 (Elliott Wave)BTC/USD experienced a halving last year on April 20, 2024. We have been seeing the typical post-halving cycle with exponential upside, followed by deep pullbacks. The price action we've seen to date follow Elliott Wave Cycle quite nicely. I believe we are in wave 3 of a bull cycle that has really been in place since Sep 2024.

- Wave 1: Sep 2024 - Jan 2025 - parabolic upside from $54K to $109K - absolutely explosive!

- Wave 2: Jan 2025 - Apr 2025 - we saw price peak and pull back all the way to the 61.8% Fibonacci level right around $75K. Remember, that in wave 2, a healthy pullback is 50% - 61.8% of the first wave.

- Wave 3: Apr 2025 - we have since rallied to around $109K as of this analysis. We are likely in subwave 3. Subwave 1 was from the low in April to the high in May (around $112K). Subwave 2 was a very nice 3-wave zig zag (reaching low of $98.3K in June). I believe we are currently in the middle of wave 3.

My next price target based on Fibonacci extension is $118K-$120K with the $78.6% level right at $119K. Note current resistance that we need to turn into support ($109.7K level) is the 61.8% Fibonacci extension level. I do expect a meaningful pullback after the peak of wave 3, which would be wave 4. The rest is TBD and I will continue to update this idea.

Remember, Elliott Wave theory is one tool in the toolbox. I do believe there is a larger post-halving cycle narrative that is dominant and most reliable, especially since BTC has largely followed this blueprint that we see every four years, but as of now EWT fits in quite nicely. I also look at the pi cycle top indicator and believe we need to use multiple indicators to understand where we are in the cycle.

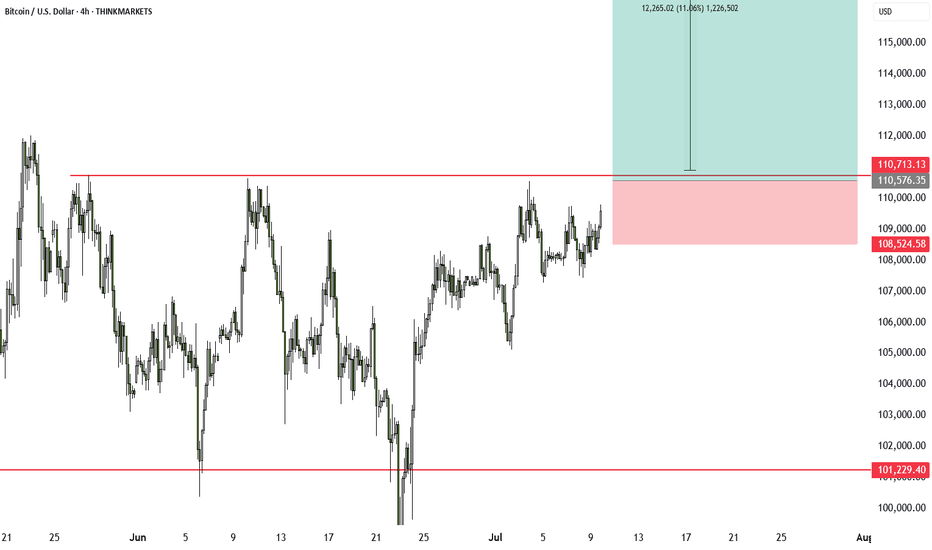

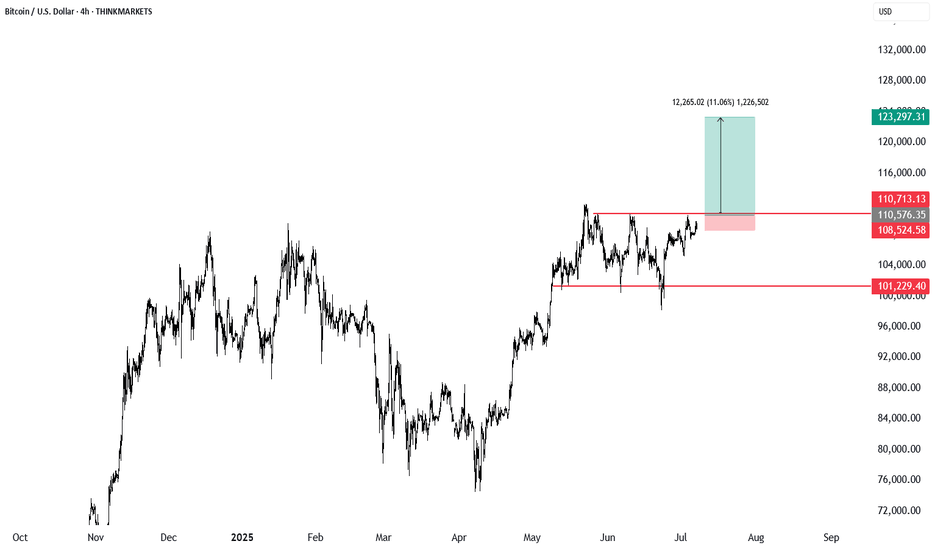

XRP breaks out: 19% rally in sightXRP has just broken out of an inverse head and shoulders pattern, a classic bullish setup that points to a potential 19% rally. The breakout comes at a time when the US is expected to deliver key crypto regulation updates by July 22. If the legal outcome is positive, it could fuel further upside not only in XRP but across the broader crypto market. This setup offers a strong risk-to-reward profile, especially if Bitcoin also breaks out of its current rectangle pattern.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

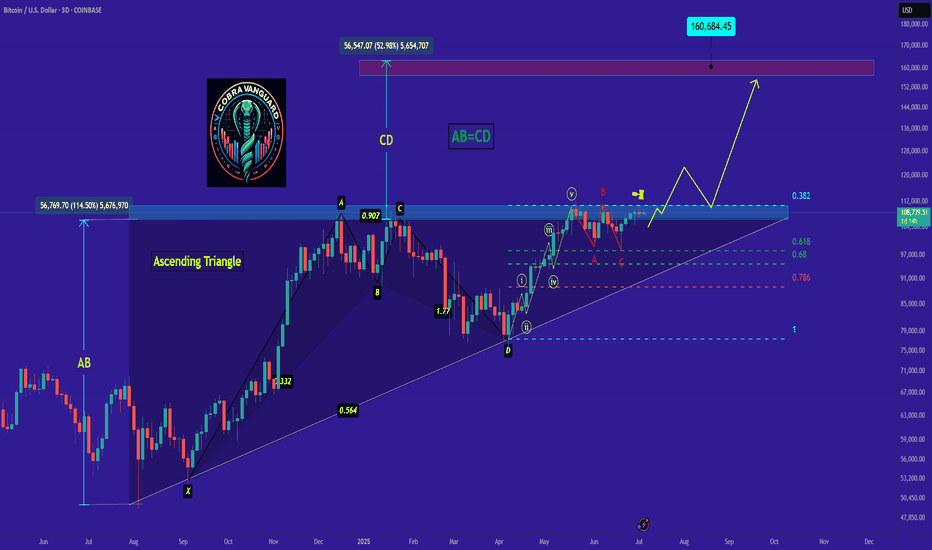

BTC's Situation, A Comprehensive Analysis !!!Bitcoin is now at a point where it cannot be ignored! In my view, the bullish wave has started after the corrective wave ended. This wave could continue until it breaks the ascending triangle, then with a slight correction, push the price upward again. The current period and the coming days could be crucial in determining the market's trend.

Best regards CobraVanguard.💚

Triangle, Flag, or Wedge? How to Trade These Chart PatternsWhat is the real difference between an ascending triangle, bull flag, and wedge? We break down these common patterns using real examples from gold and Bitcoin, explain why trendlines can be tricky, and discuss what actually matters when trading these setups.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

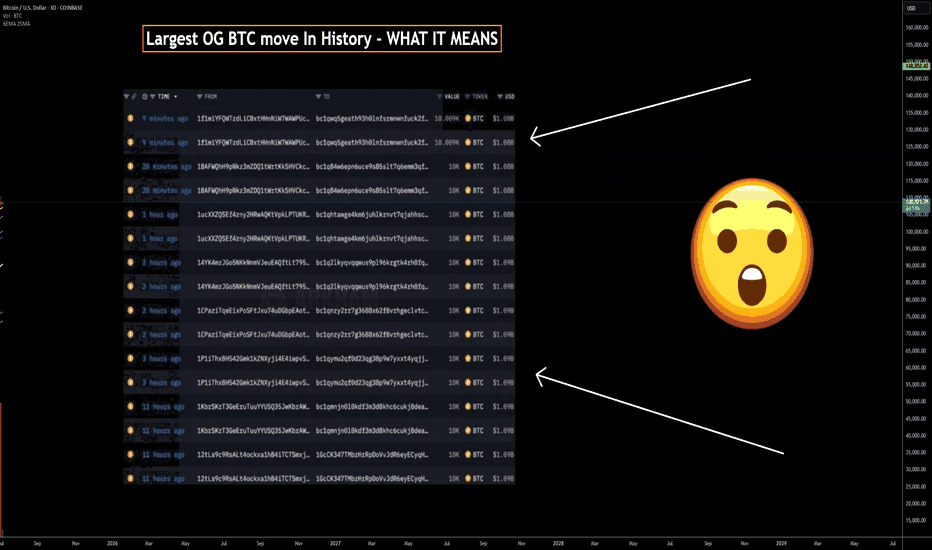

80k BTC On The Move - WHAT It Means 80,000 BTC Wallet Movement (2011 Miner)

• Source: 8 wallets containing 10,000 BTC each — mined in 2011, dormant for 14 years

• Total Value: Over $8.6 billion USD

• Timing: Moved on July 4, 2025 — largest dormant BTC transfer in history

• New Addresses: Funds moved to modern SegWit wallets

• Probable Owner: Likely a single early miner with 200k+ BTC history

Possible Reasons for the Move

• Key Rotation: Upgrading to modern wallets for better security

• Recovered Access: Private keys may have been recently recovered

• Market Strategy: Positioning for profit-taking or major sell-off

• Yield Farming: Preparing COINBASE:BTCUSD for use in DeFi/lending platforms

• Collateral Use: Possibly for loans, stablecoin leverage, or RWAs

• Estate Planning: Legal restructuring or generational wealth setup

• OTC Transfer: Could be prepping for off-exchange institutional sale

• Psychological Warfare: Could be intended to spook or manipulate the market

• Regulatory Response: Aligning with new compliance or tax jurisdiction

Market Reaction

• COINBASE:BTCUSD Price Dip: Price briefly fell below $108,000 post-move

• ETF Context: Movement occurred despite record ETF inflows

Key Note: These wallets had not been touched since COINBASE:BTCUSD was worth ~$0.78. Their reactivation adds uncertainty and opportunity in a fragile macro environment.

• What to do????: Watch the orderbook to find these large bitcoin moves in case of exchange selling

Near term support & resistance

$106000 support

$109500 first resistance

👍 If this breakdown helped your trading, smash that Like and drop a comment below—let me know what you think will happen with the 80k COINBASE:BTCUSD . 👍

Best Reguards

MartyBoots, 17-year market trader

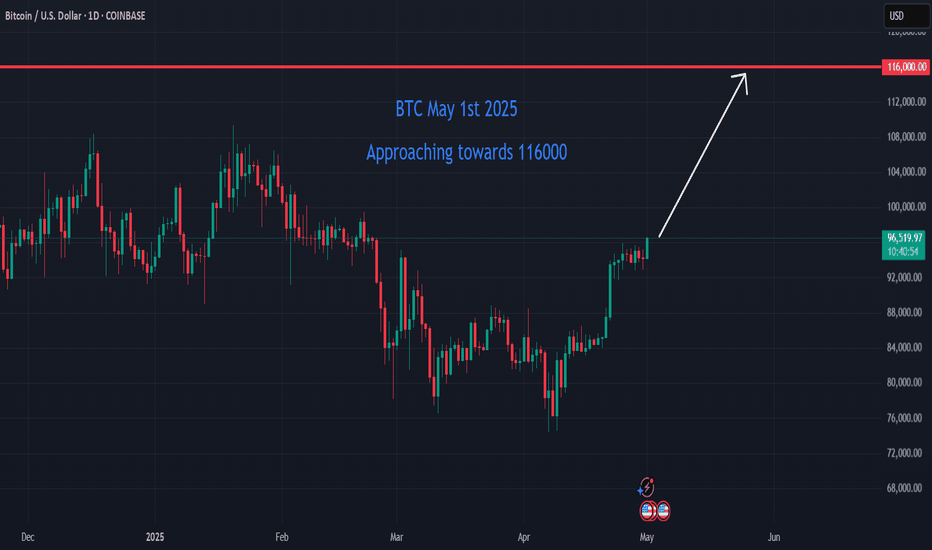

Bitcoin on the Brink: Short-Term Surge Toward $116K Bitcoin (BTC) is currently trading at approximately $96,390, approaching the $116,000 mark. Here's a short-term analysis using Cycle Analysis, Elliott Wave Theory, and Gann Analysis to inform potential trading strategies.

________________________________________

📈 Cycle Analysis: Mid-2025 Surge

Historical patterns suggest that Bitcoin tends to reach its peak between 518 and 546 days after a halving event. Given the most recent halving in April 2024, analysts anticipate a potential price peak around mid-2025, approximately 1.5 years post-halving. Notably, Bitcoin is currently about 35 days ahead of its typical cycle, indicating a possible acceleration in price growth.

________________________________________

📊 Elliott Wave Analysis: Wave 3 in Progress

Elliott Wave Theory suggests that Bitcoin is currently in the third wave of its bullish cycle, which is typically the most powerful and extended wave. Recent analyses indicate that the third wave is unfolding, with potential targets ranging from $114,500 to $120,500. A conservative estimate places the peak of this wave between $127,000 and $150,000

________________________________________

📐 Gann Analysis: Price-Time Equilibrium

Gann Analysis utilizes geometric angles to predict price movements. The "2×1 Fan" line, representing a 45-degree angle, is considered a fair value line. Historically, Bitcoin's price has peaked near this line during parabolic run-ups. Currently, Bitcoin's price is approaching this level, suggesting a potential peak.

________________________________________

🧭 Short-Term Trade Setup

✅ Entry Points:

• Accumulation Zone: $85,000 to $90,000

• Current Price: $96,390

🎯 Target Levels:

• Short-Term Peak: $116,000 to $135,000

• Medium-Term Peak: $150,000

⚠️ Risk Management:

• Potential Correction: After reaching the peak, anticipate a significant pullback, possibly 30–50%.

• Exit Strategy: Consider taking profits as Bitcoin approaches upper resistance zones.

________________________________________

🧾 Conclusion

Bitcoin is in the final stages of its current bullish cycle, with projections indicating a potential peak between $150,000 and $278,000. However, caution is warranted as market corrections are typical following such surges. Investors should consider taking profits as Bitcoin approaches upper resistance levels and prepare for potential pullbacks.