CELH Fundamental Outlook

Equity financing has allowed CELH to avoid holding any meaningful debt on their balance sheet. Total revenues for CELH has grown at an impressive clip during it's 15 year history of being a public company. Despite their strong revenue growth Celsius has consistently struggled to convert their strong top line into strong EPS and profit margins, (this is partly due to the added shareholders from share dilution). The larger issues surrounding CELH stock is their inability to consistently turn a profit, also, due to their relatively small scale operating revenue and limited brand recognition they lack pricing power.

CELH has a price/book of 22. A price/sales of 13. CELH also has 6.66% of shares outstanding held short. CELH is overvalued . Celsius is growing revenues rapidly, but there are numerous macro and geopolitical risks that all businesses are facing at the moment and small companies with low profitability historically underperform the broader market in extra turbulent times.

The CELH health energy drink business model may at some point pay off, but I do not believe that day will come anytime soon. In fact, one of CELH's biggest competitors MNST did well over 10x the total revenues of CELH in 2021. One of Celsius's other competitors KO, currently holds 10.25 billion in free cash flow which is over double the total market cap of CELH. Albeit these stats are biasedly handpicked by myself, but they do encapsulate the overall message here, which is: CELH is very small relative to competitors and they lack the fire power that the titans in the drink industry have. The fact is that CELH will need to expand if they want to continue to grow revenues and attract investment, which means more buildings, more employees, more advertising, etc. CELH will therefore have to pay inflated prices on these new assets and projects which most established drink companies like KO, and MNST can avoid doing (at least temporarily).

The outlook does not look pleasant for CELH in the coming years. The company will need to establish itself as a dominant brand among drink consumers in the U.S. market. As for right now, 397 million in yearly revenue is not going to cut it. Especially when there is a war in Europe, inflation at 40 year highs, and U.S. interest rates are at their highest levels in a decade.

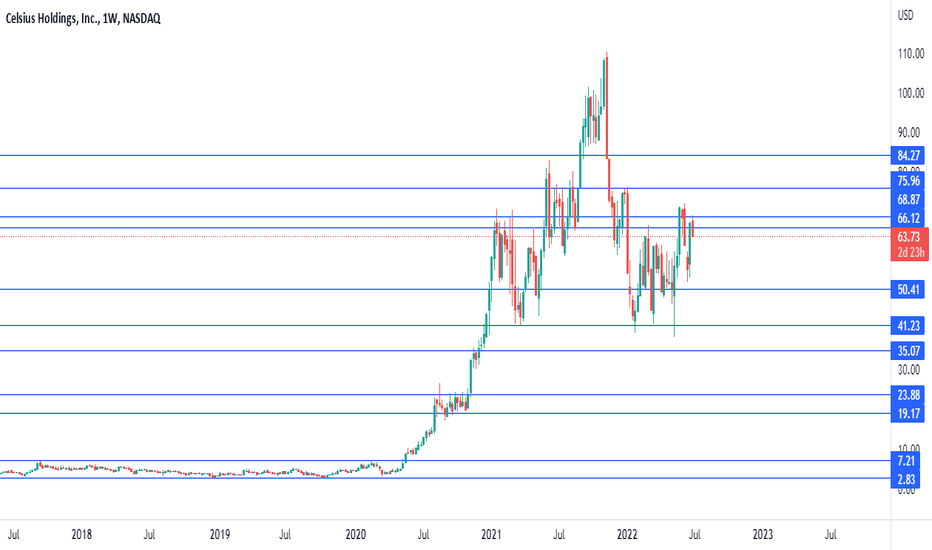

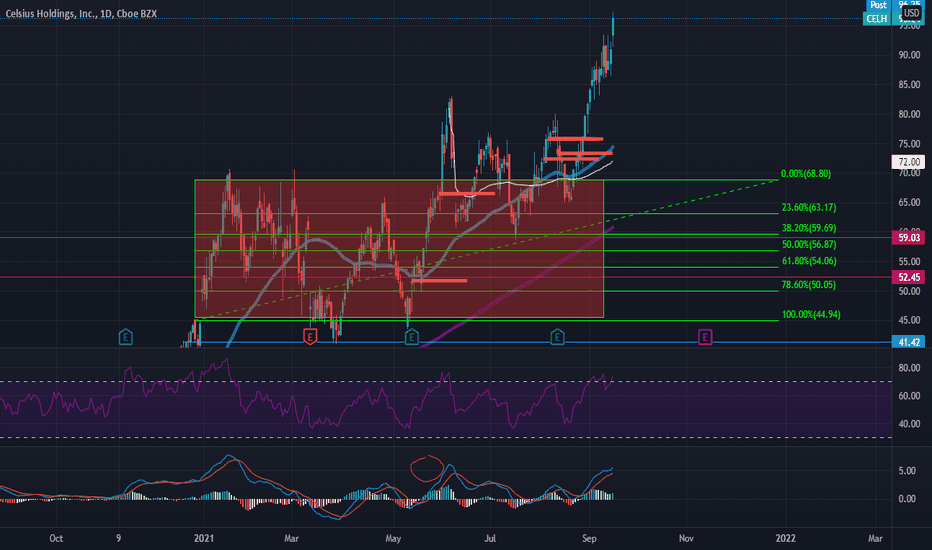

Price Prediction: I am expecting a breakdown in share price to the support area at around 24 a share within the next six months or so. I believe a move down to the support area of 7.21 a share is in store before any long term bottoms are formed.

This is not financial advice. These are just my thoughts. Good luck!

CELH trade ideas

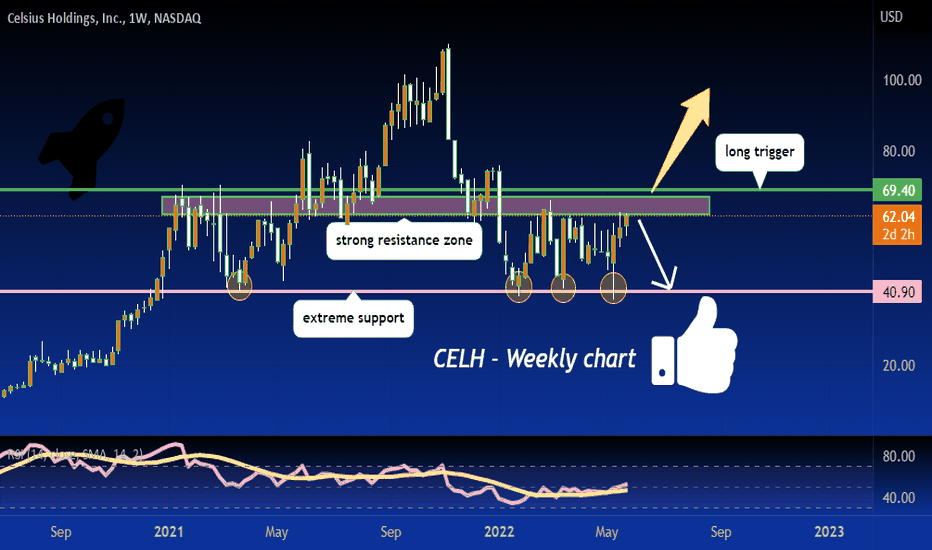

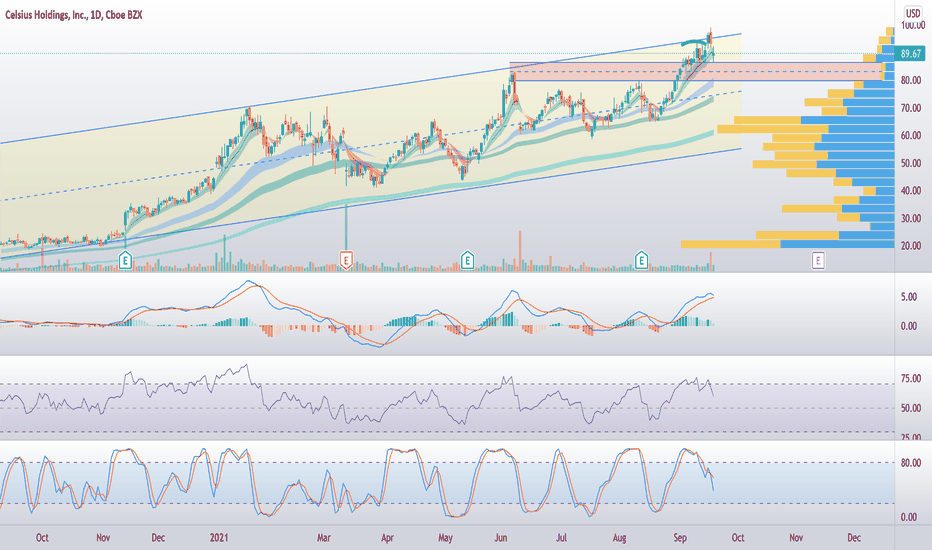

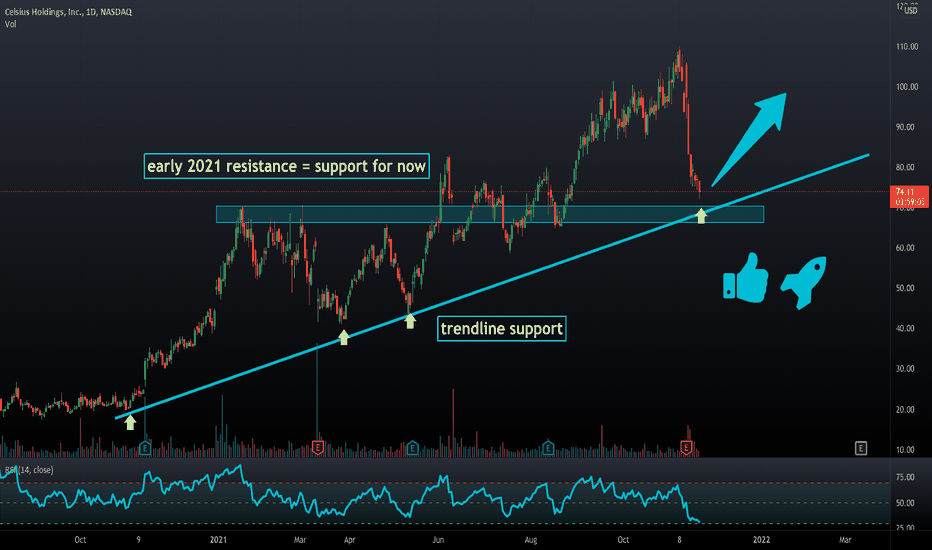

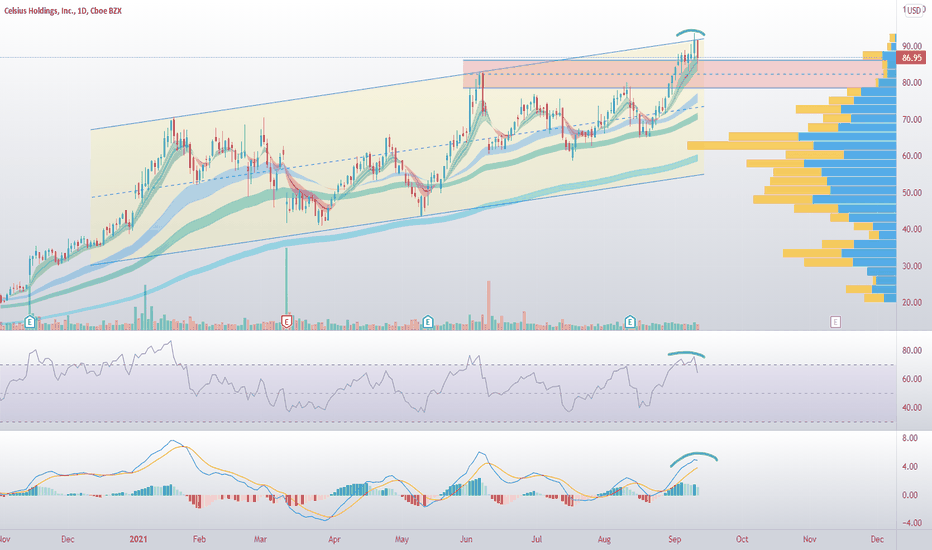

CELH - Monster Stock of 2020 & 20211) This one held up immensely well - showing good relative strength against the market recently, and was a huge winner for many in 2020 and 2021.

2) Earnings continue to beat analyst expectations with the last quarter EPS surprise being 200%.

3) The stock has very recently reclaimed both the 50 and 200 SMA. However, its recent price action might provide an opportunity for an early entry, with price tightening last week on relatively lower volume.

4) I want to see price break out of the downward wedge on higher volume to consider an entry into CELH.

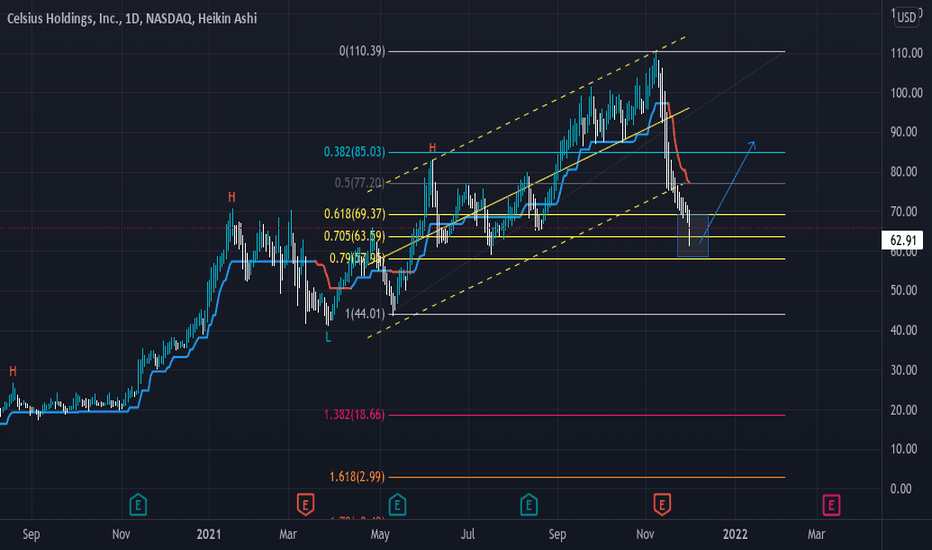

Celsius (CELH) ain't Red Bull but...it's BULLish!Celsius (CELH) ain't Red Bull but...it's BULLish!

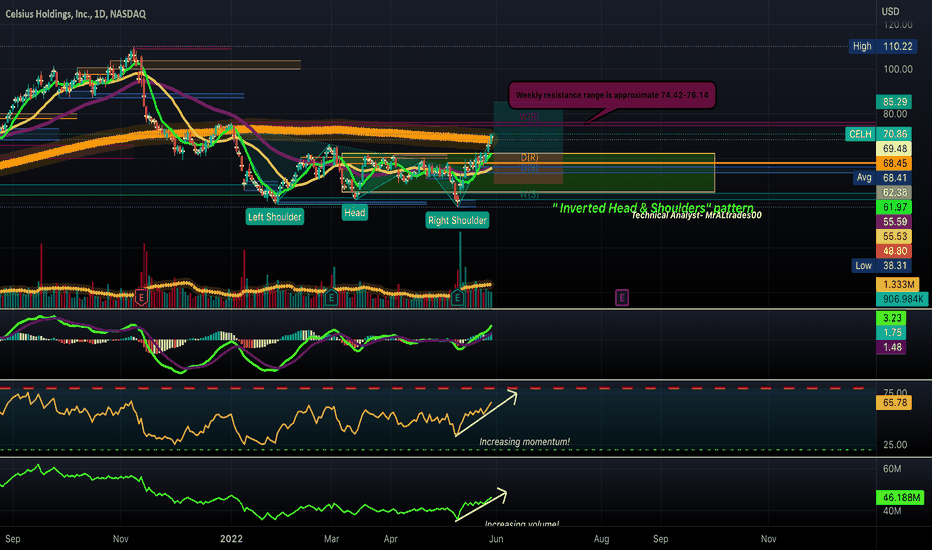

Patten Identified

Inverted Head & Shoulders on the daily timeframe

The daily chart displays the following information-

-9 MA is above 21 and the 50 MA!

-Price is above the 200 MA

-Increasing momentum and volume

*This is not financial advice

Drink your water,

MrALtrades00

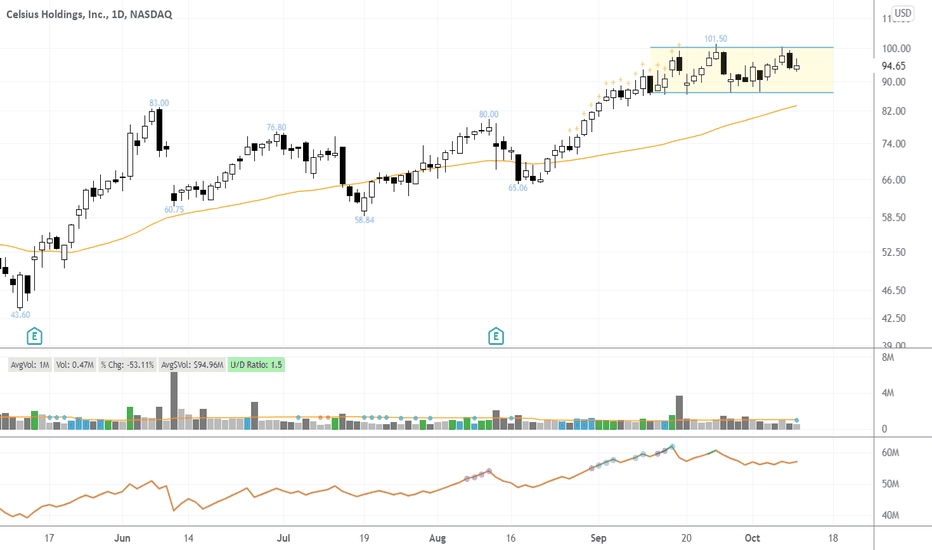

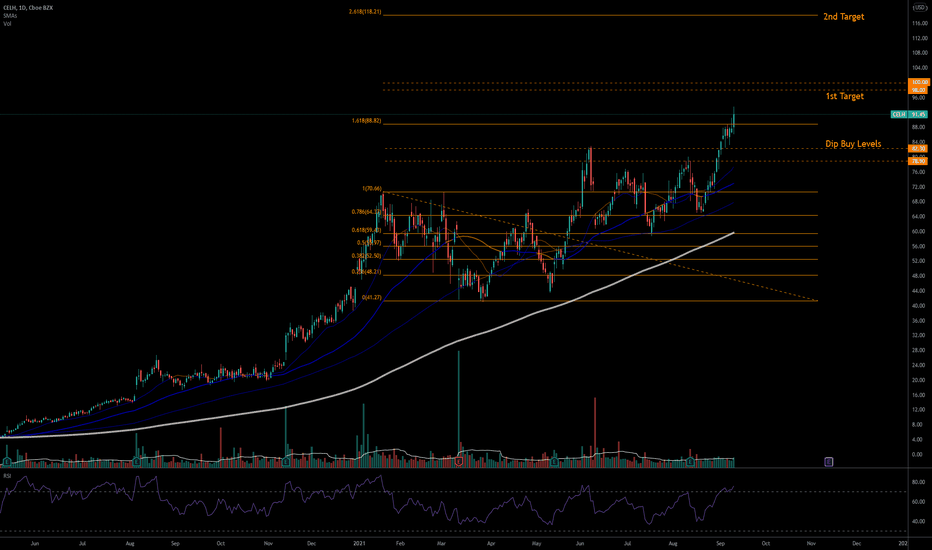

11/7/21 CELHCelsius Holdings, Inc. ( NASDAQ:CELH )

Sector: Consumer Non-Durables (Beverages: Non-Alcoholic)

Current Price: $108.07

Breakout price trigger: $100.00 (hold above)

Buy Zone (Top/Bottom Range): $101.50-$95.40

Price Target: $117.80-$118.20 (2nd)

Estimated Duration to Target: 21-23d (2nd)

Contract of Interest: $CELH 11/19/21 115c

Trade price as of publish date: $5.50/contract

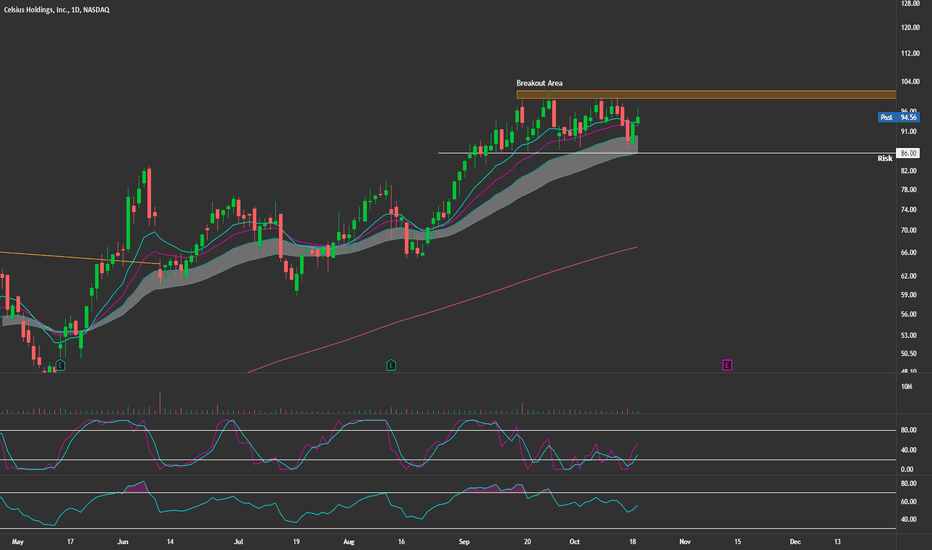

CELH - 10.19.20211 month consolidation at all-time highs and just below $100 psyche level.

CELH stock has been on solid uptrend of late giving it good momentum to break 100 strong.

Increasing sales gives it good fundamental momentum into ER date mid November.

Breakout area is your entry, mange ATH breakout with 65min, 15min charts depending on your risk level and trading strategies.

$110 first target near-term.

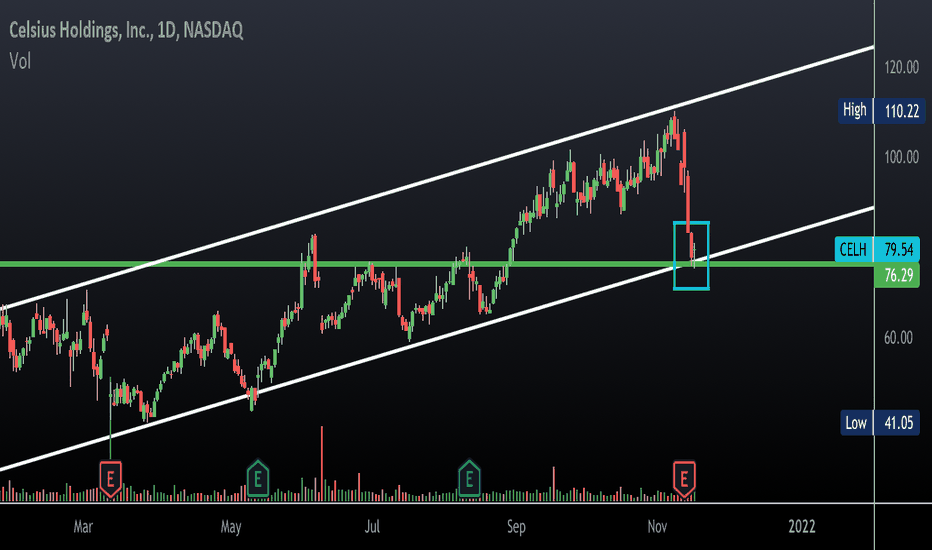

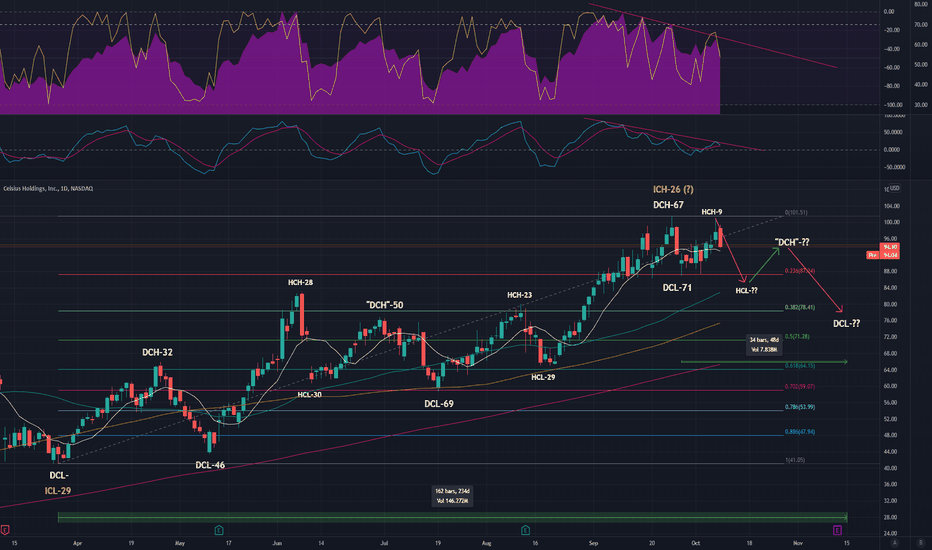

CELH is approaching the end of the channel (UPDATE)As an update, CELH is still in the ascending channel which started around the last earnings report.

The last 3 similar rallies have lasted 45, 32, and 17 trading days respectfully so this one is still completely normal in length.

Rallies 1 and 3 corrected to the 33 daily moving average while rally 2 corrected to the 165 dma; importantly, all 3 peaked at the top of their channels with high RSI.

A risky, but much more lucrative trade would be to purchase puts the next time CELH hits the channel top (and RSI hits the top of descending wedge pattern); however, a more reasonable trade is to wait until the channel bottom is broken.

In my opinion, the price will probably continue upward for a couple of more days, hit the 105 area and then deeply correct downward to at least the 33 dma (then around $85).

My trading strategy is to wait until the top of the channel and purchase $70 puts expiring on October 15th, definitely higher risk, but the payout if/when the price returns the 33 dma is around 2,000-3,000% profit.

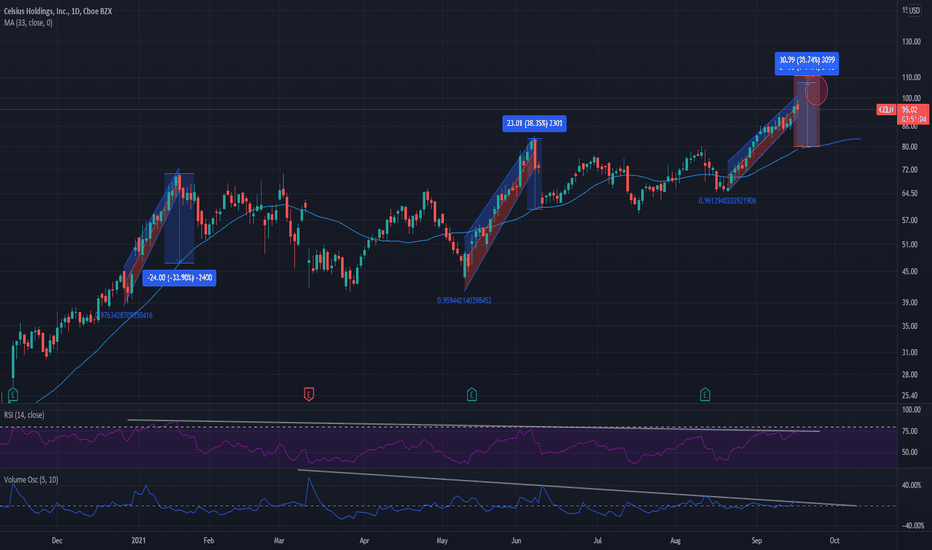

Celsius has the potential to correct deeply.The last 3 times CELH has beat earnings forecasts, it rallies extremely high. At the end of 2020, it increased over 200%, this Summer it increased nearly 100%, and it looks like this time around it will increase nearly 50%.

Each time it seems to follow a simple channel as it peaks, subsequently correcting down to the 33 DMA. The stock managed to spike 34% and 39% above the DMA during the last 2 rallies, the 2 boxes (blue and red) represent what a repeat of those 2 peaks would look like, but aligning with the channel it is in, it looks like the price should top in the red circle.

There is some major RSI and volume bearish divergence taking place as well over the span of months.

The PE ratio is about 700 right now and no analysis could justify this valuation. If the price continues on this channel for a few more days and approaches $105 I'll be purchasing $85 puts for OCT15.

Be careful with this one if anyone is planning on doing the same, from what I've seen many traders end up losing money on CELH because it tends to rally further than most expect.

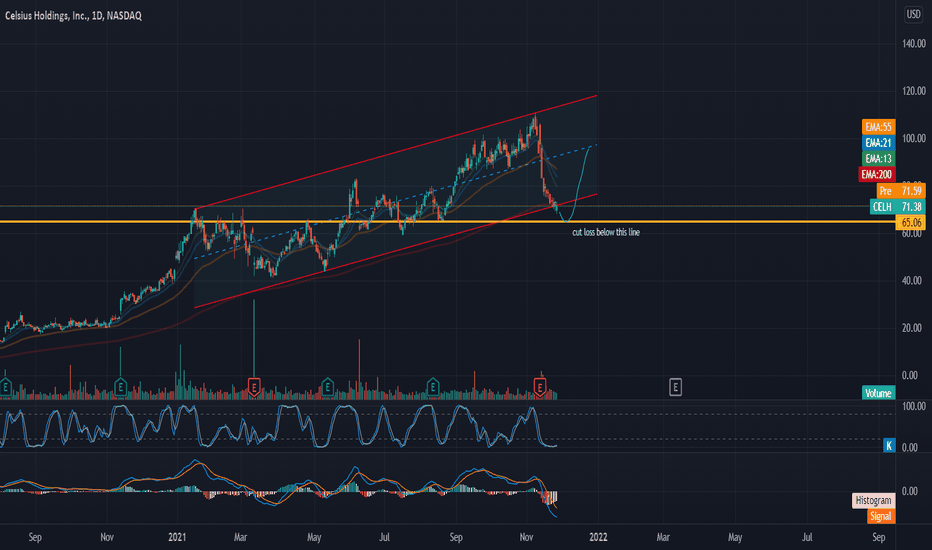

The Gift That Keeps On GivingI love this company from the top on down; the drinks are AMAZING the cash is beautiful and they are truly ready to explode on an international scale. I've yet to see any stores keep their stock of the drinks longer than 24 hours and their specialty flavors are on backorder online... This will be a wonderful trade in the future. I have been scaling into Celsius since $14, again at $44, and will hopefully get another opportunity to buy here soon. In 10 years we will look back and understand what this monster is capable of.

$CELH Short IdeaTook profits on my longs and flipped short (10/15 $85 Put) on Celsius .

Appears to be a top channel rejection with a pretty bearish engulfing candle. Small volume pocket below bears and profit taking could easily push this to $79. Bearish confluence on indicators as well.

Just praying reddit doesn't mention the ticker and it pumps to $500 : )

CELH 9/12/2021Celsius Holdings, Inc. (CELH)

Sector: Consumer Non-Durables (Beverage)

Current Price: $91.45

Breakout price trigger: $90.00 (hold above)

Dip Buy levels: $88.80, $82.30, $79.80

Price Target: $98.00-$100.00 (1st), $117.80-$118.20(2nd)

Estimated Duration to Target: 13-15 days (1st), 105-115 days (2nd)

Contract of Interest: $CELH 1/22/22 100c

Trade price as of publish date: $12.55/cnt

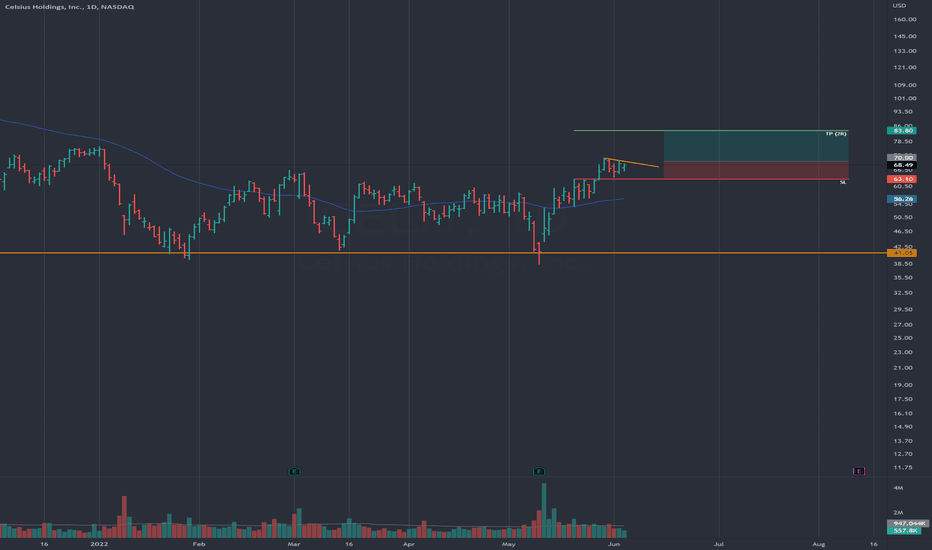

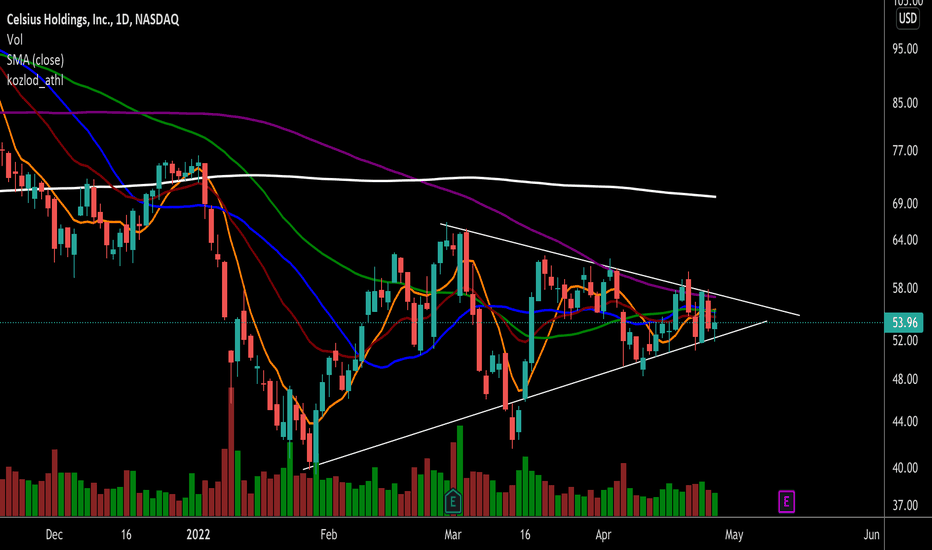

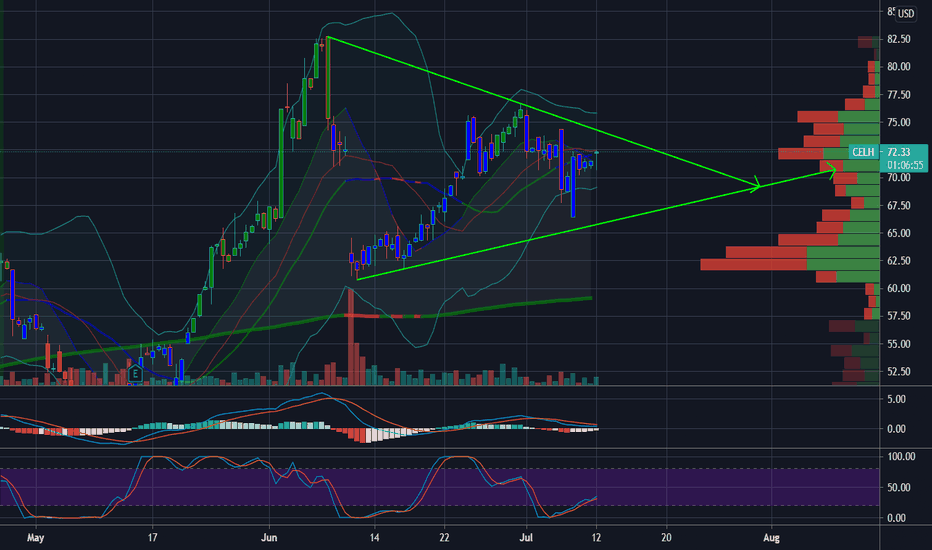

$73 Resistance, $66 SupportRight now is a consolidation phase. I wouldn't buy any options right now until a direction is confirmed. It could be a few weeks before CELH breaks out of the current pennant. Given the current volume and MACD action, it is more than likely going to trend a little lower before making an attempt to breakout. Breaking out of the current trend could signal a test of the BBand of $75. Falling out of the pennant could mark a test of long term support around $60.