E-Commerce! CHWY This pandemic is not going away anytime soon. I believe it is a lot like the flu in terms of length, and will be here for the long run. With this being said, this is scaring people from doing the things they used to love doing, such as shopping, going out for a night on the town, or even going to a basic dinner with some family/friends. This mindset has made the industry of E-Commerce go crazy in a positive way. People can do practically whatever they have to do nowadays, online. Buying food, drinks, and other things someone may need is available with one click of a button.

What is Chewy? Chewy Inc. is an American online retailer of pet food and other pet related products based in Dania Beach, Florida. In 2017, Chewy was acquired by PetSmart for $3.35 billion, which was the largest ever acquisition of an e-commerce business at the time! Why is this a good investment for a long term hold? * In 2020, pet ownership in the U.S. rose from 67% of households to an all-time high of 70%, wrote Steve King, president and CEO of the American Pet Products Association (APPA), in a preview of the association’s soon-to-be-released “2021-2022 APPA National Pet Owners Survey.” *

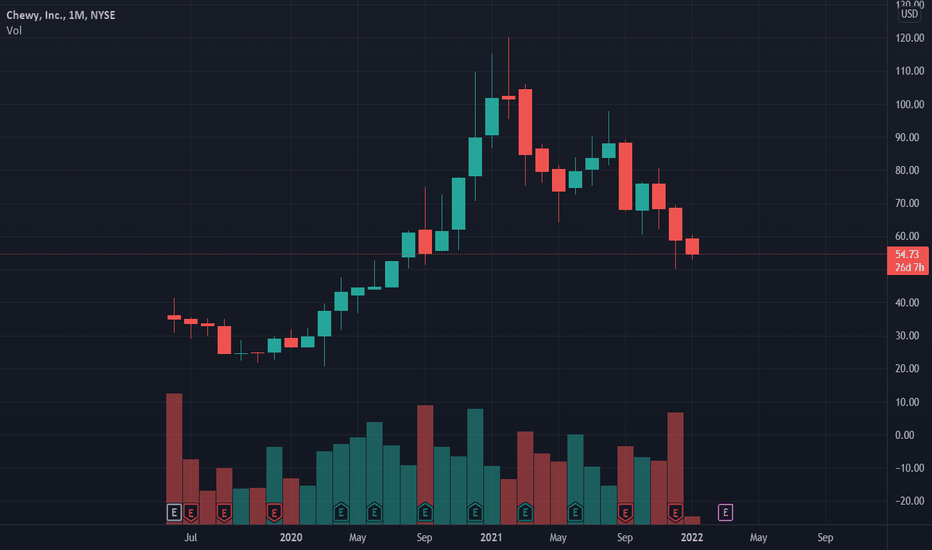

With this in mind, there are so many pet owners and the numbers seem to keep increasing, and I can tell you from EXPERIENCE being a proud dog owner myself, that majority of people spoil their pets JUST like kids, with good food, toys, bones, beds... all the good stuff. This is where Chewy will thrive. Through the pandemic as an E-Commerce company, Chewy has been demonstrating revenue growth, as well as an improving capital position. HOWEVER, they are still having trouble turning a profit the past few quarters due to the fact that their total assets pretty much exactly mirror their total liabilities. On the other hand, a positive thing to note is that their ** third quarter 2021 net sales of $2.21 billion demonstrated 24.1% year-over-year improvement, while the quarterly gross margin of 26.4% indicated year-over-year expansion of 90 basis points. ** That is good to see for bulls!

How will they overcome their lack of profitability? Chewy is looking to expand their business and to add more sources of revenue from more than just selling toys and food. They are looking to expand into the Pet Insurance industry. They recently announced a new partnership with Trupanion, a pet medical insurance provider, which hints at a big move coming. $$$$

If you are a risk tolerant investor, then this is a great pick for you! I have been an investor in this company since mid 2021, and have been following any news/moves by it the entire time. So if you have any questions, comments, concerns, feel free to reach out in the replies! Scared money makes NO money!

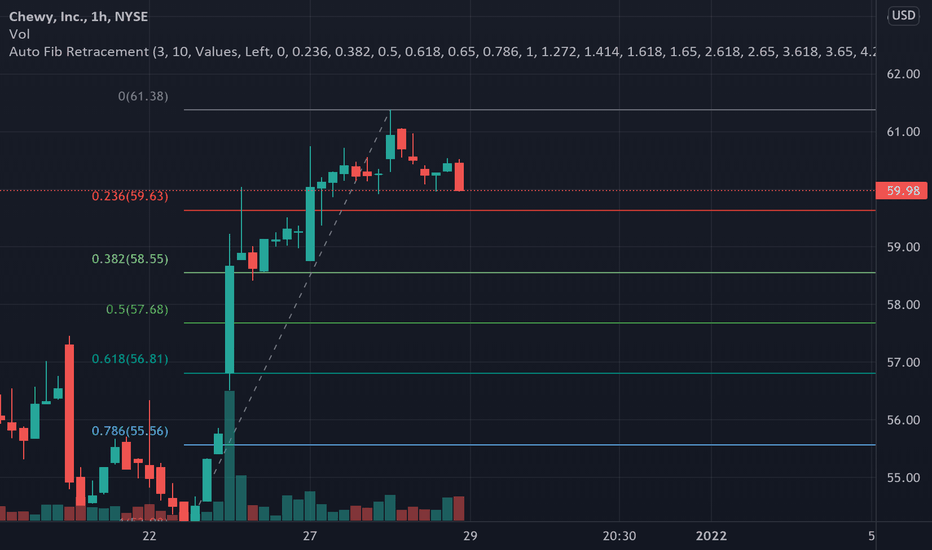

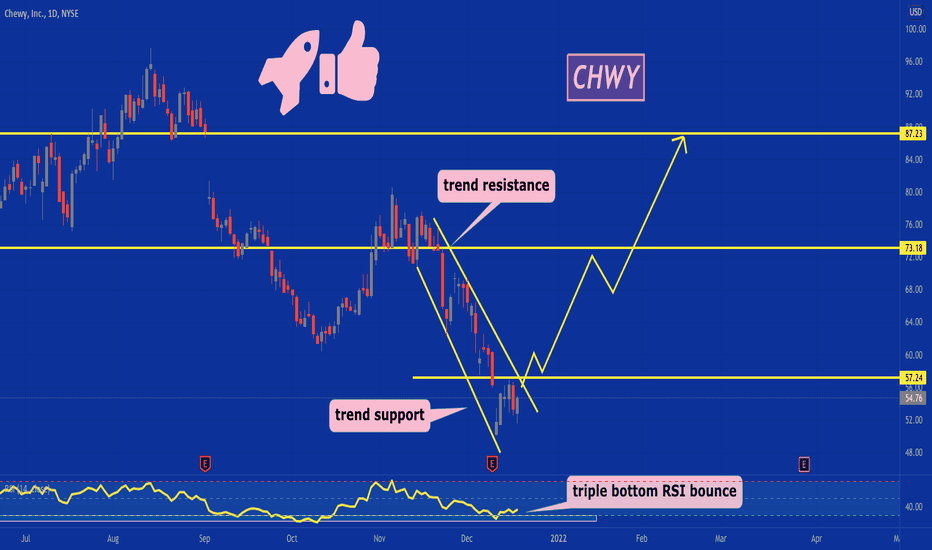

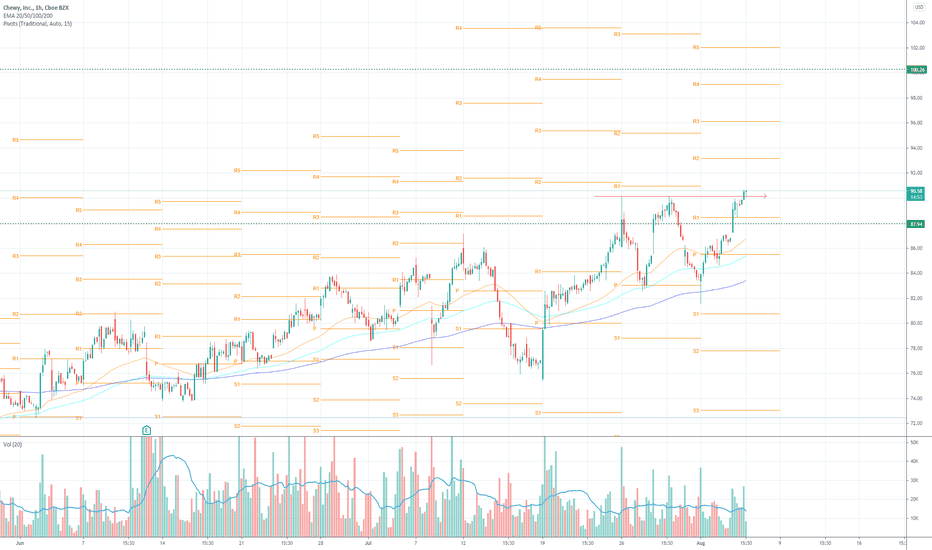

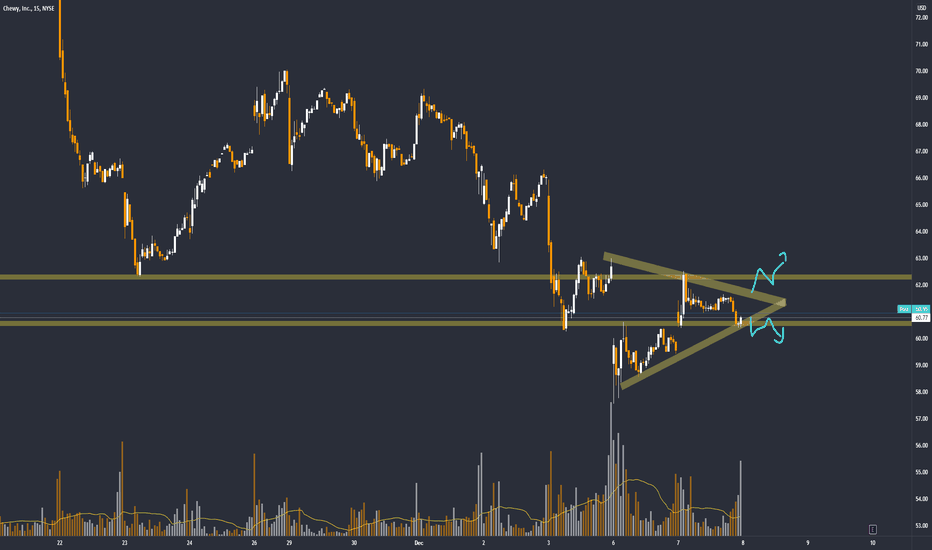

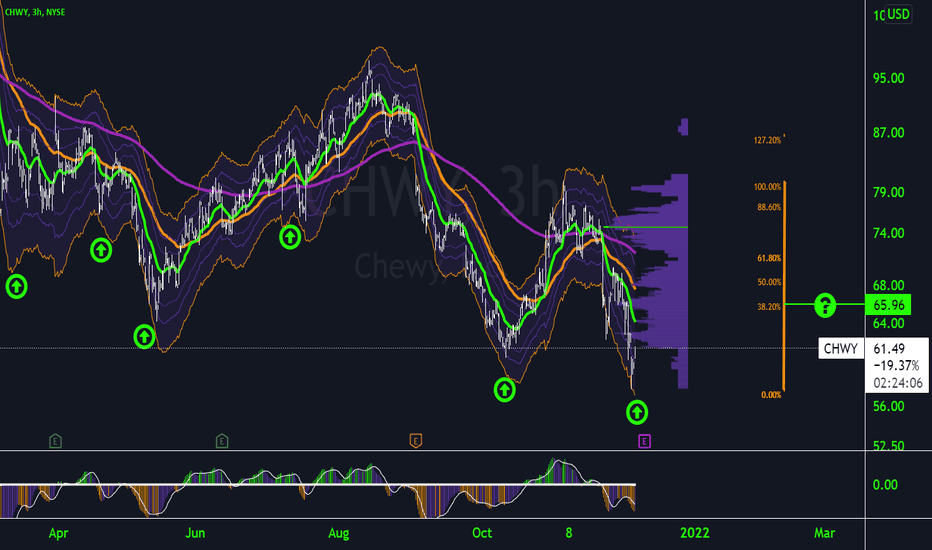

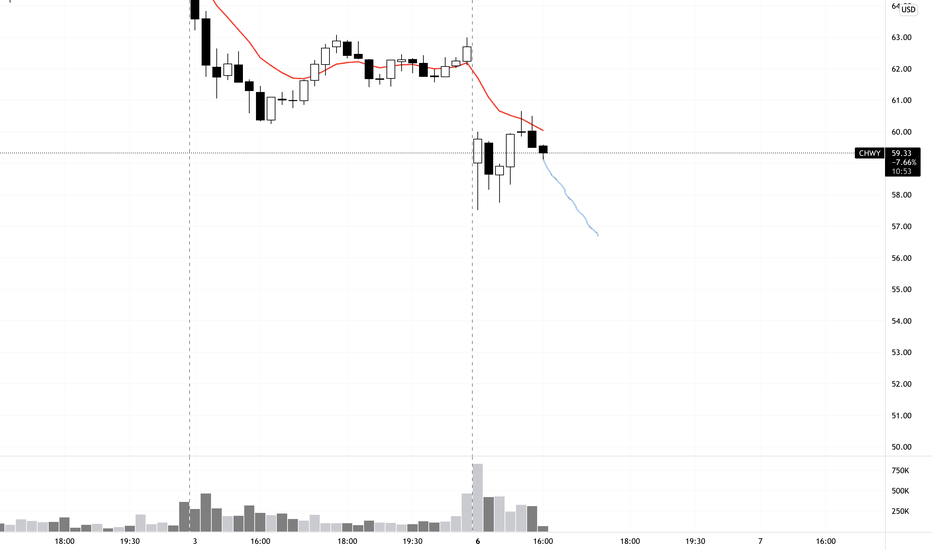

CHWY trade ideas

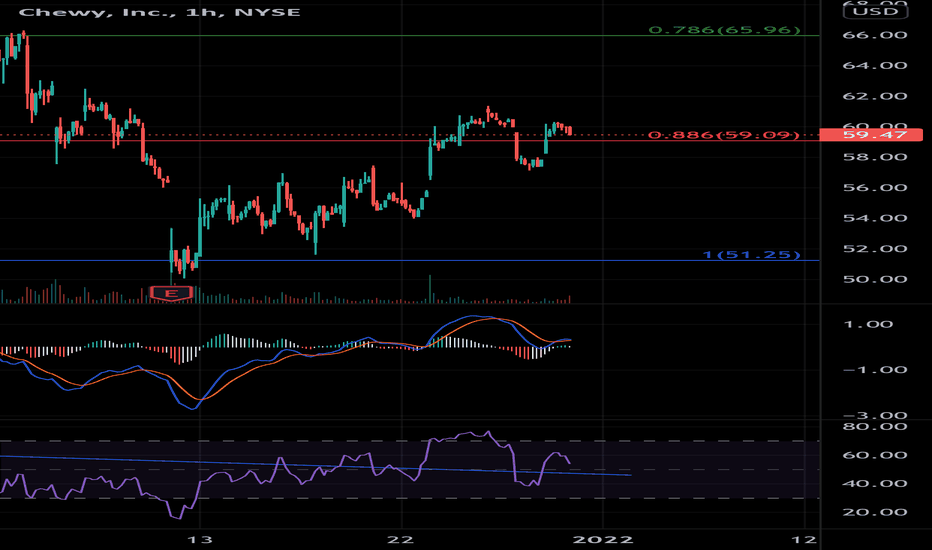

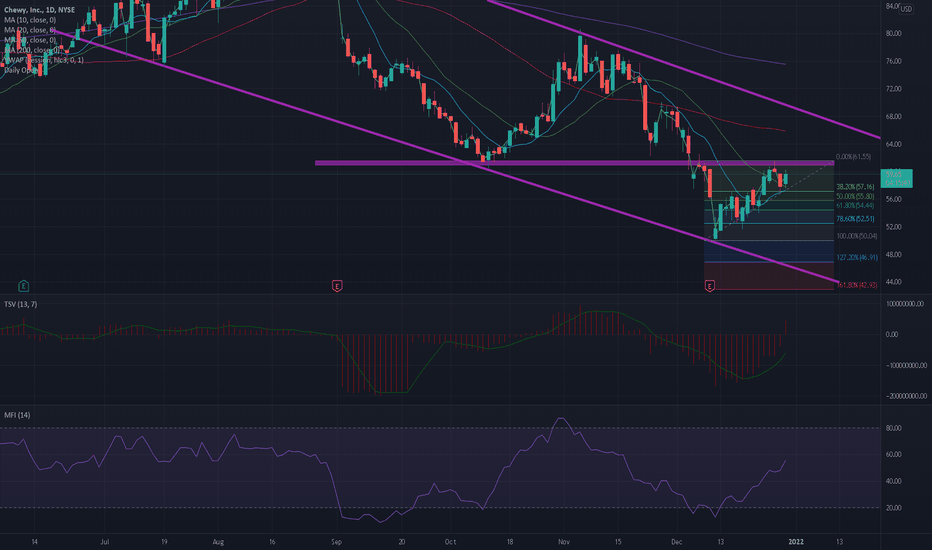

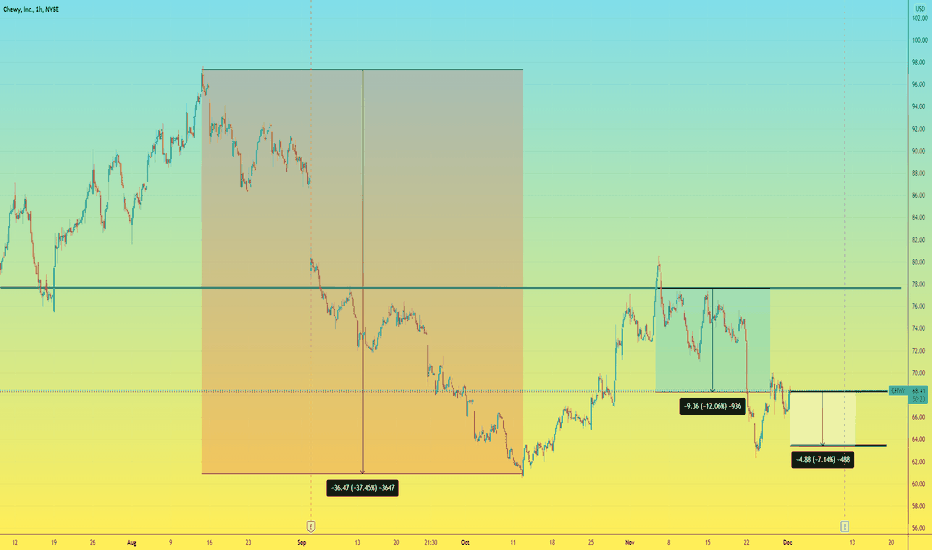

CHWY headed back to challenge prior resistance area on dailyCHWY headed back to challenge prior resistance area on daily. Daily also still in an overall downward trend. Worth watching, would make a great swing trade if you short near the trendline or wait for the break of the resistance area to fail.

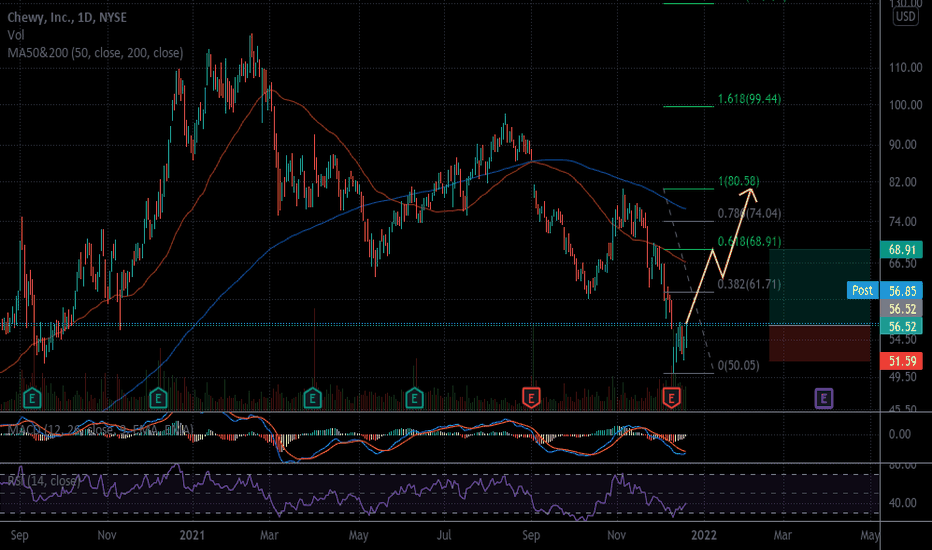

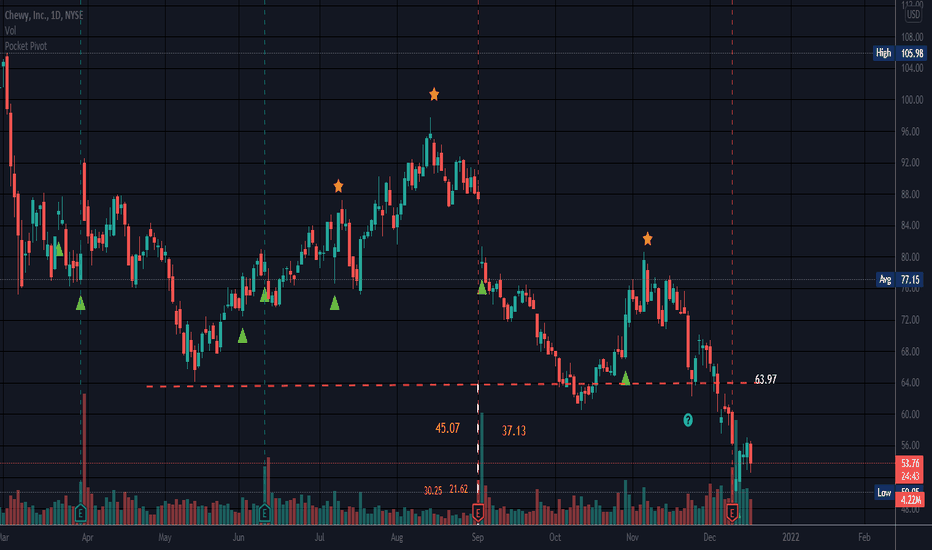

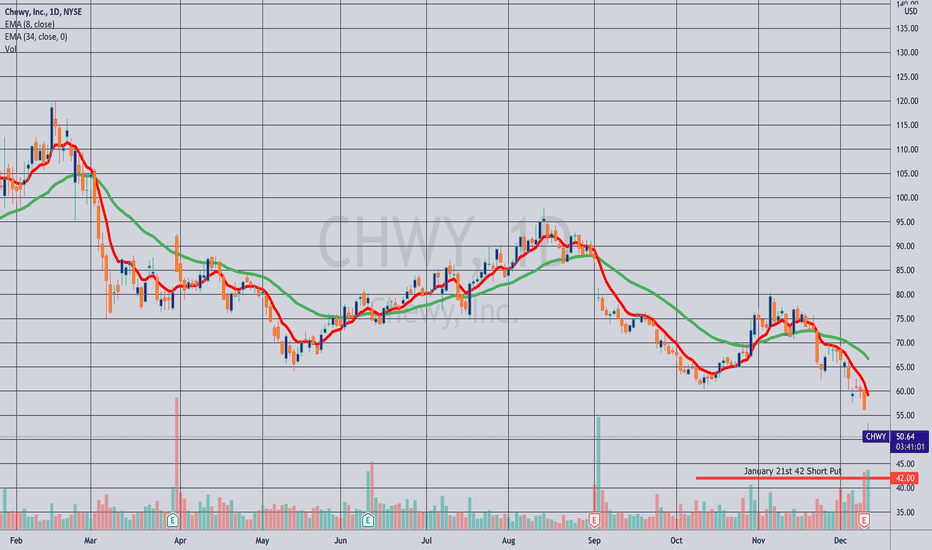

Opening (Margin): CHWY January 21st 42 Short Put... for a 1.00 credit.

Comments: Selling some 16 delta premium in CHWY post-earnings in the implied volatility afterglow (30-day is still currently at 66.9%). I considered short strangling it, but there's some skew to the call side with wonky five wides, so am just going bullish assumption on it instead.

Delta/theta: 15.79/3.03; 1.00 max profit on buying power effect of 4.22 (on margin): 23.7% ROC as a function of buying power effect; 11.8% ROC at 50% max.

Chewy USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

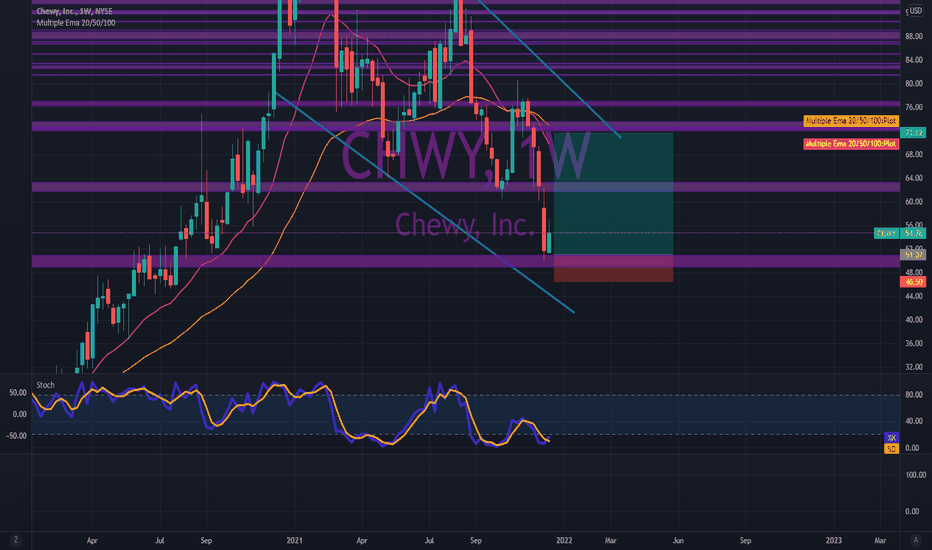

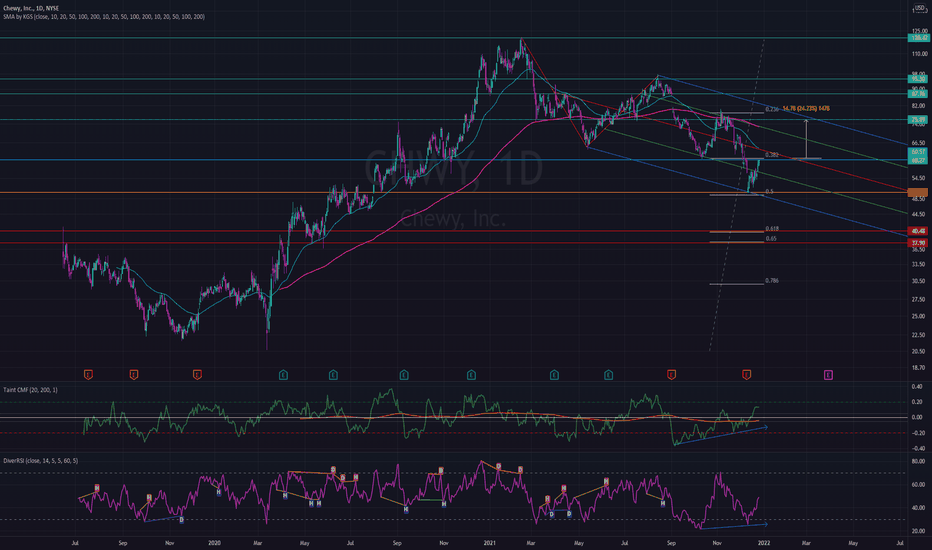

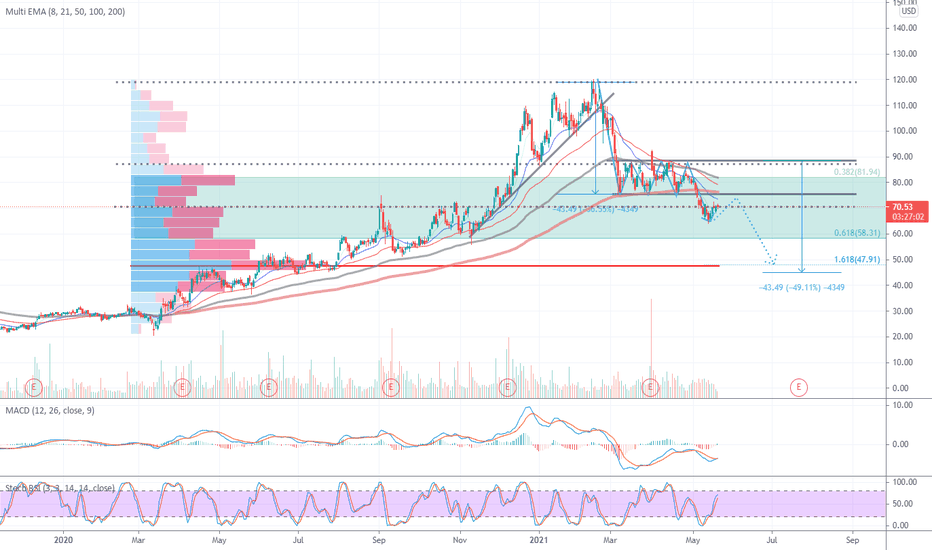

Learn from someone who has intelligence and knowledgeBecause looking at your charts kids.. stay off youtube. That is no place to learn. Its hysterical and I am laughing but here you go........ if you call this chart incomplete or don't know how to read it. Well, that is why you keep losing all your money. Just being honest. Get mad. I dont care. It's just honesty.

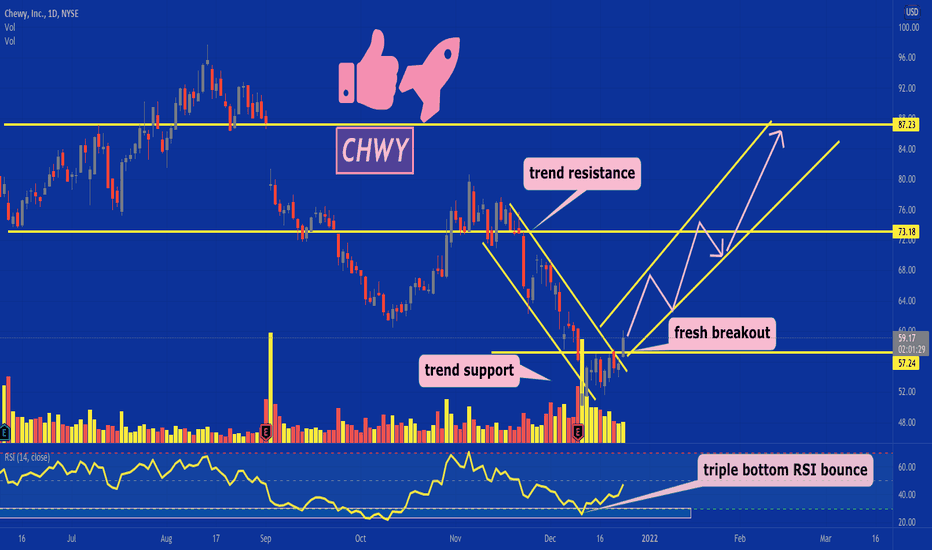

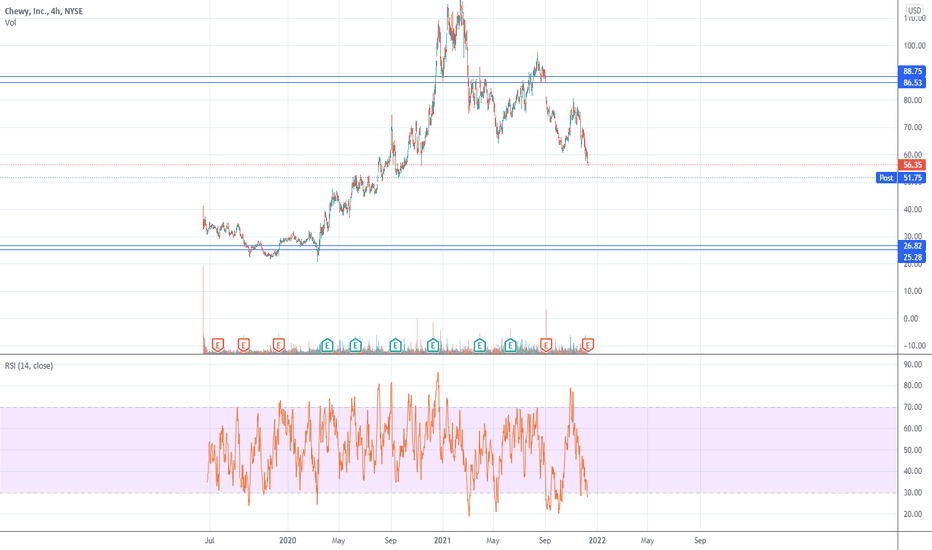

CHWY long

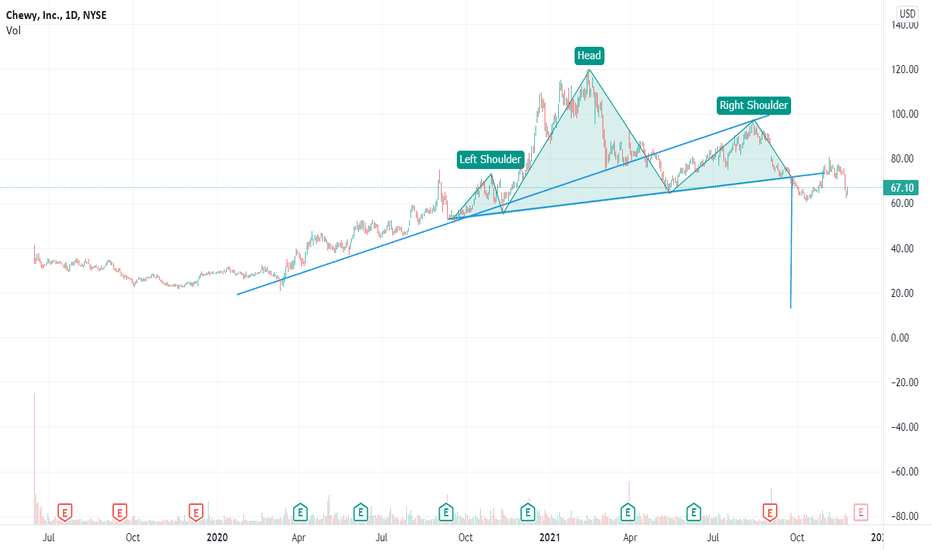

The pet care industry is forecast to exceed $150 billion by 2025. Of all the competitors, Chewy is in my opinion the most fairly valued at this time. I am already long in this position, and looking to add on a possible drop to or around POC.

This is not financial advice. Do not take advice from someone who calls himself Pleb.