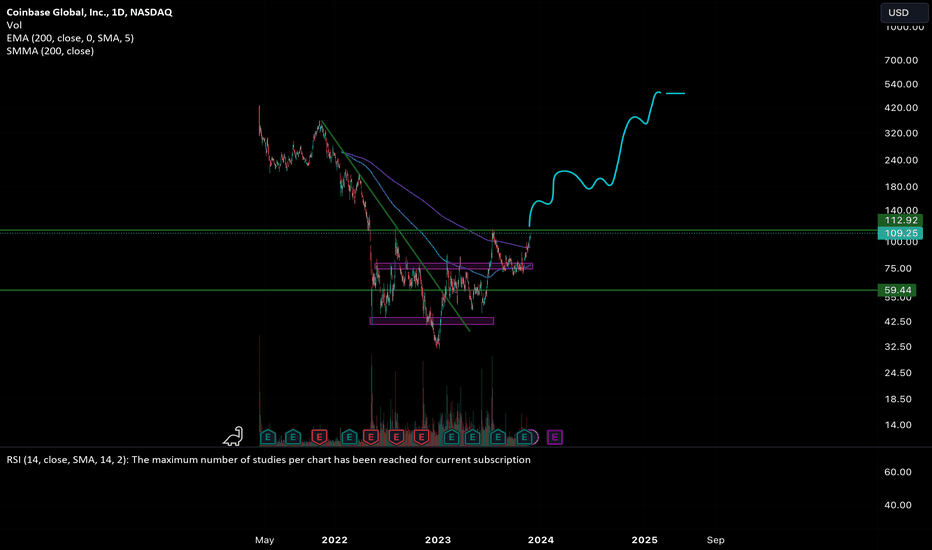

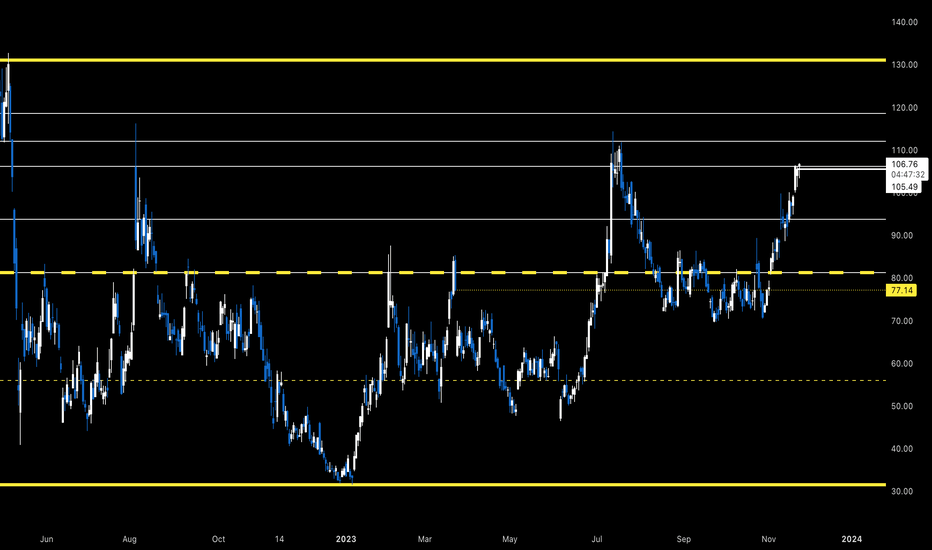

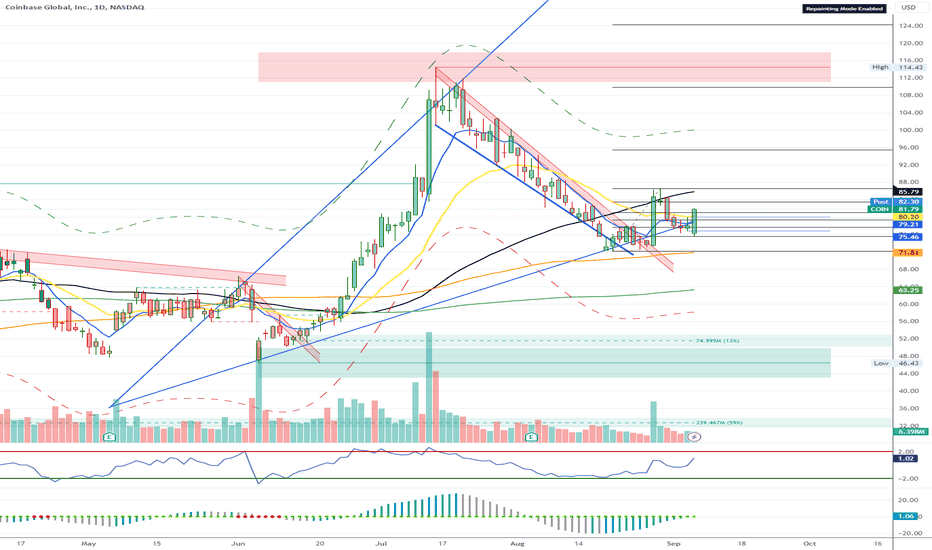

Coinbase (NASDAQ: COIN) Stock Price Charts Signal Rally To $150Coinbase stock price has picked up aggressive momentum this week, as its rival in crypto exchange Binance is facing some regulatory challenges. As a result, the Coin price has been rising for five consecutive days and reached a 4-month high of $114.4. However, a look at the daily time frame chart shows this recovery is part of a rising channel indicating the asset is poised for further rally.

COIN Price to $150?

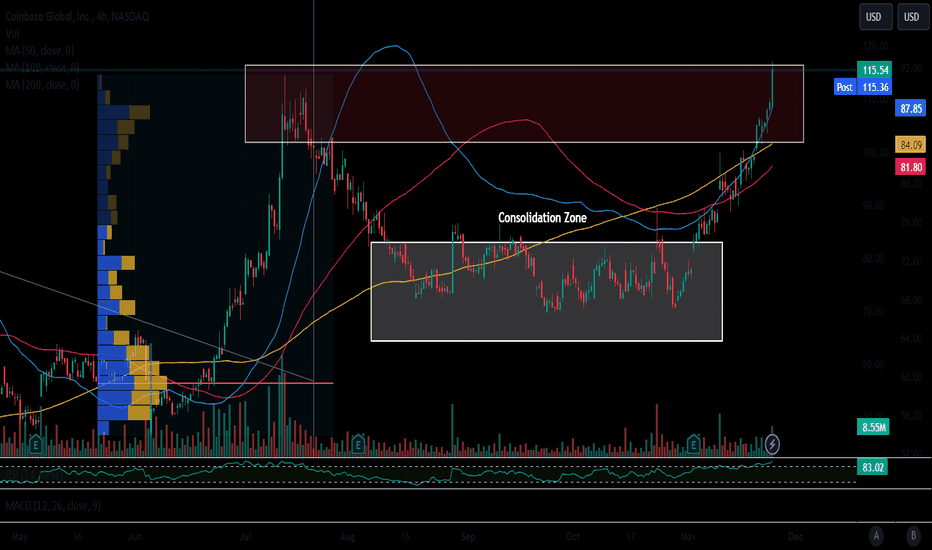

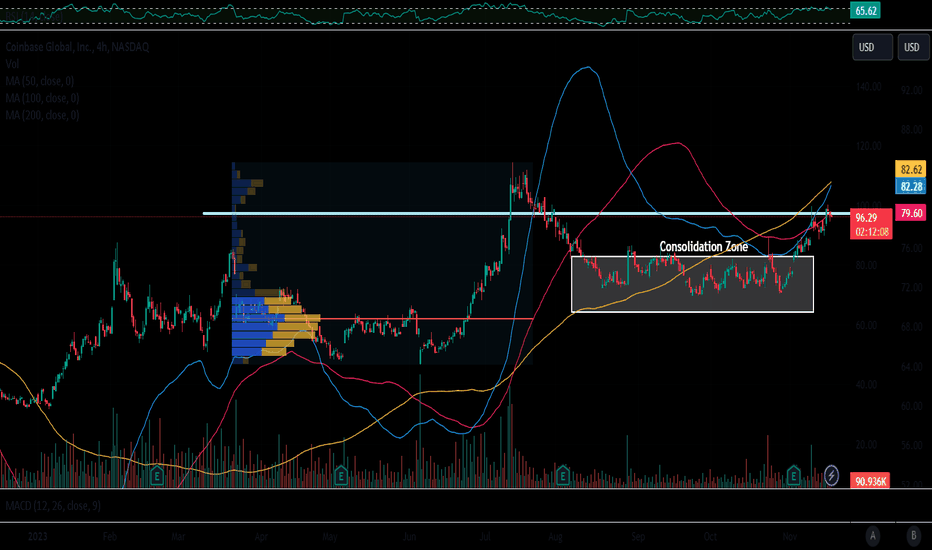

A rising channel pattern leas the current recovery trend in COIN Stock. The ongoing recovery trend may witness intense supply at the $135 mark. The 20 EMA could offer a strong pullback to buyers.

The Coinbase stock price has demonstrated a remarkable recovery in November, bouncing back robustly from a psychological support level of $70. Over the past three weeks, this momentum has propelled the asset price to an impressive $115, translating to a 63% increase.

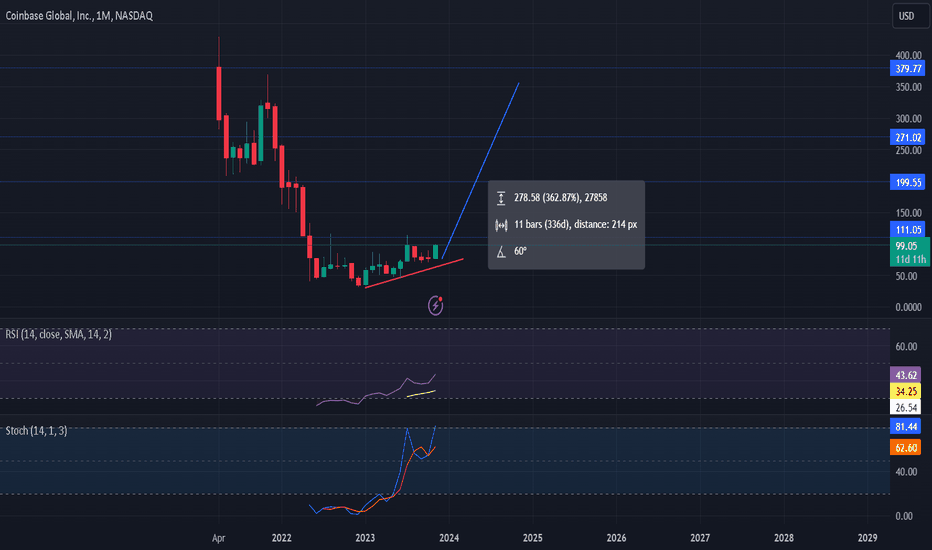

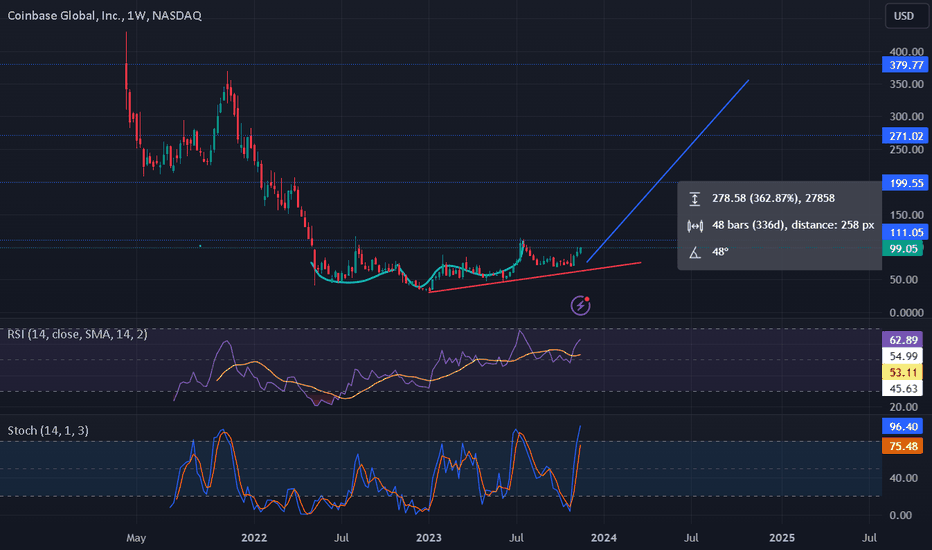

This upward trend is part of a bullish swing within a rising channel pattern, which has been shaping the stock’s recovery trajectory for over a year.

This pattern, characterized by two parallel trendlines, has consistently provided dynamic resistance and support for the Coinbase stock. Currently, the recovery momentum seems poised to continue, potentially driving the price approximately 15% higher to the upper trendline of the channel, around the $135 mark.

COIN trade ideas

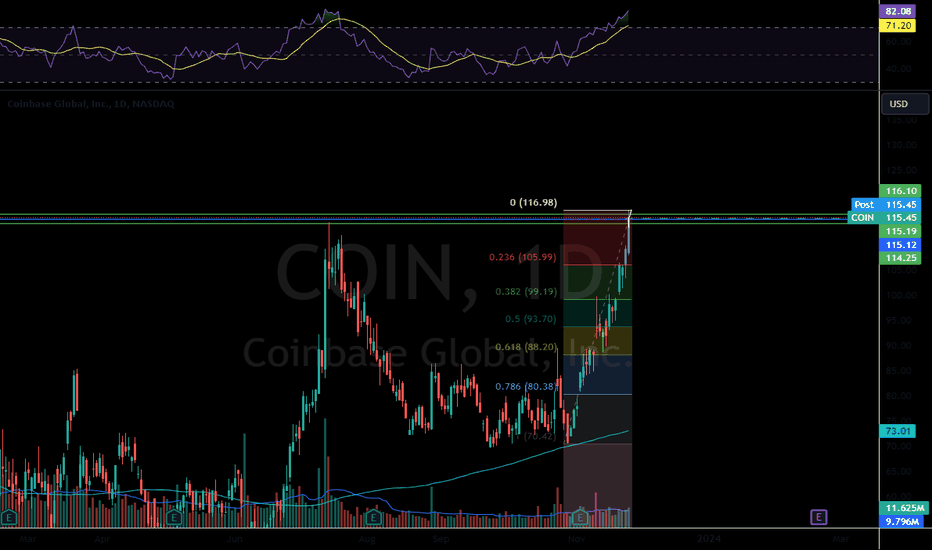

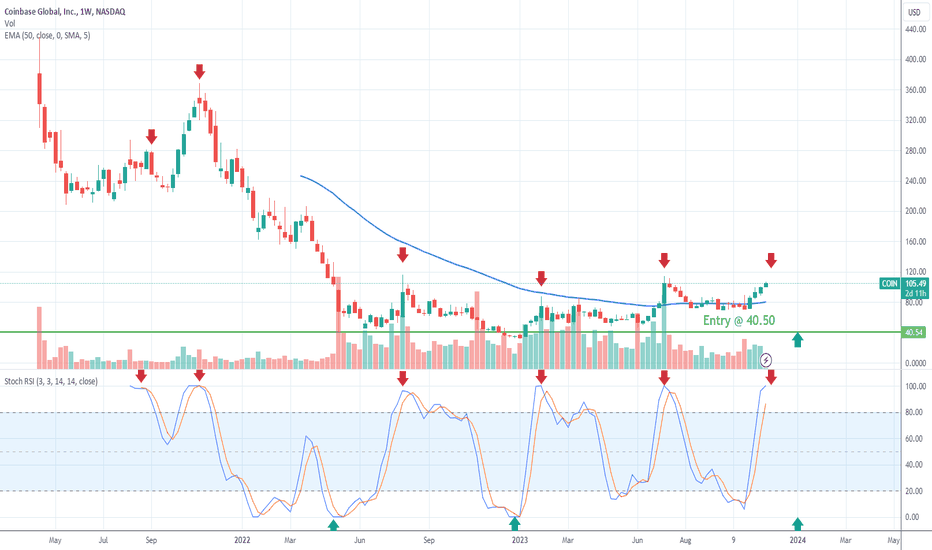

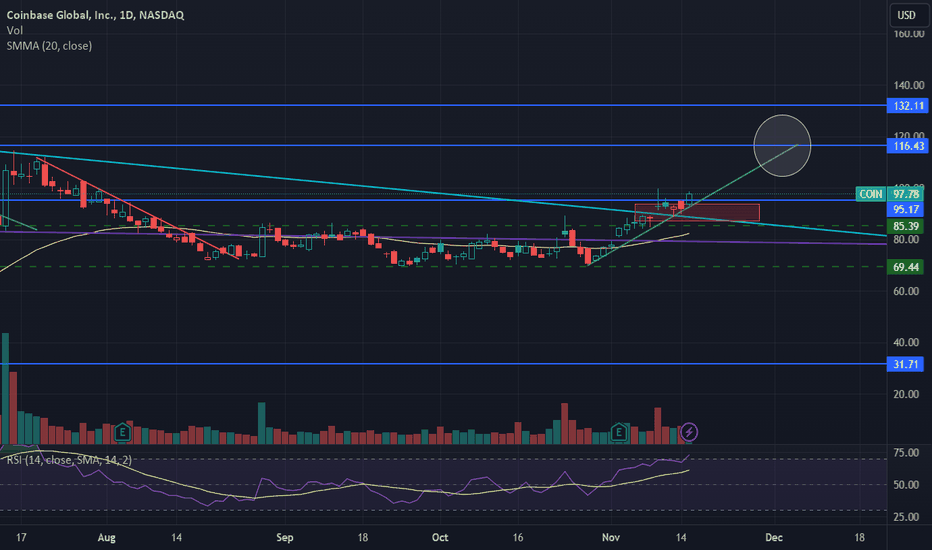

Coin marching to holiday targetThis is a chart I shared a while back and the trend is working out perfectly. Coin is meeting my circle target sooner than expected. With the ETF looming, Coinbase designated as the custodian, and binance law suit decided, Coin is looking for a huge upside in the coming year. I have spot that I entered around 40$ and I plan on rolling long term calls all next year. The gold line is the powerful .5 fib.

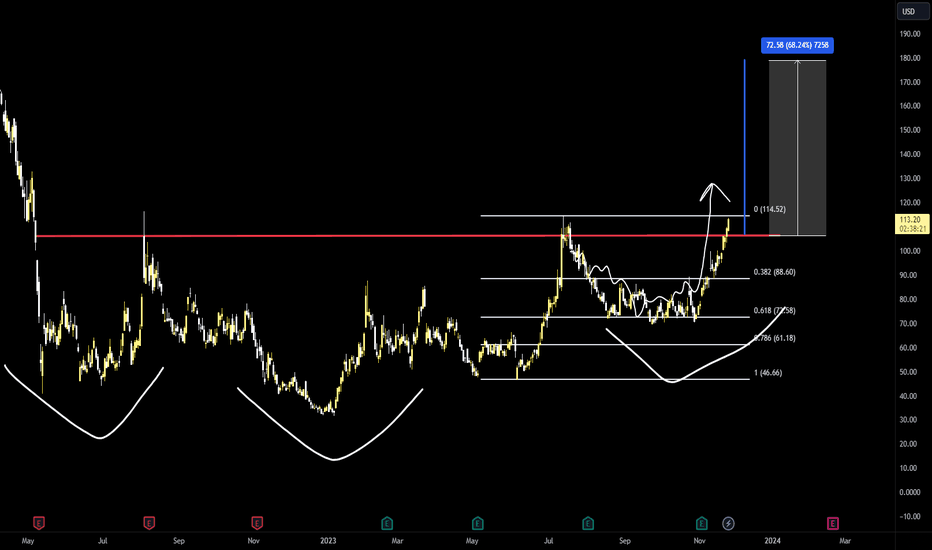

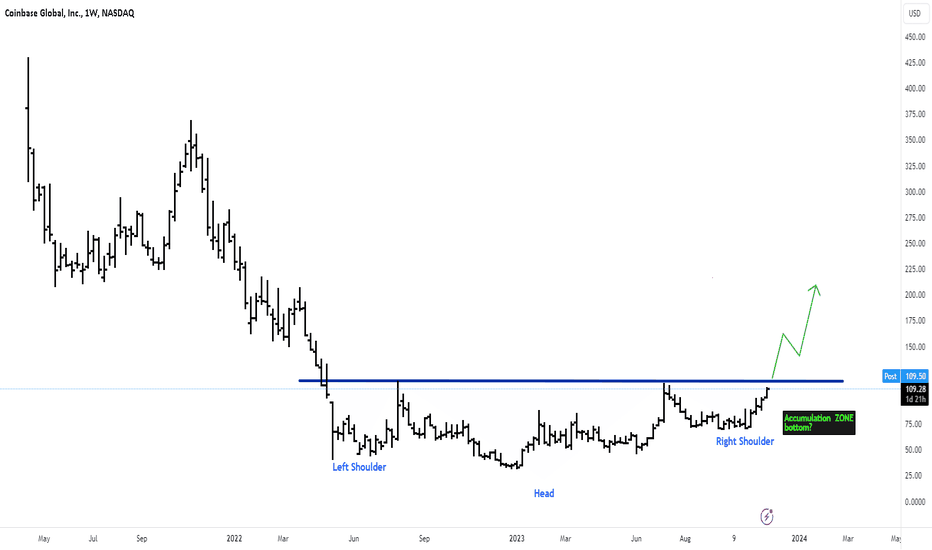

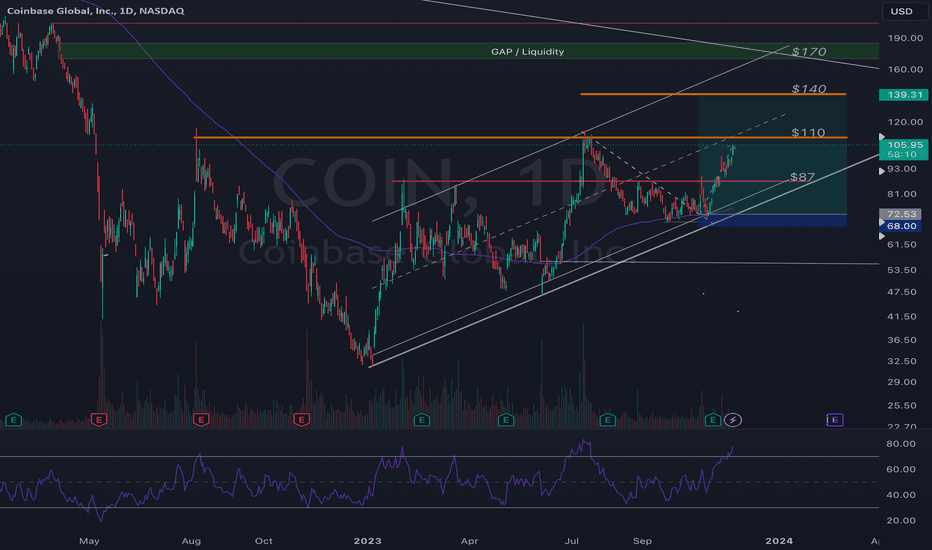

Even Picasso couldn´t have painted it better - COIN to 180$- update on my last COIN analysis

- since then coinbase stock has indeed consolidated and put in the right shoulder of what appears to be a macro bottoming inverse head and shoulders formation

- target of the formation is anywhere between 170 - 180

- with COIN projected to increase by almost 60% it is likely such a move comes alongside a big fundamental catalyst

In other words: this coin breakout suggests Bitcoin spot ETF approval is around the corner

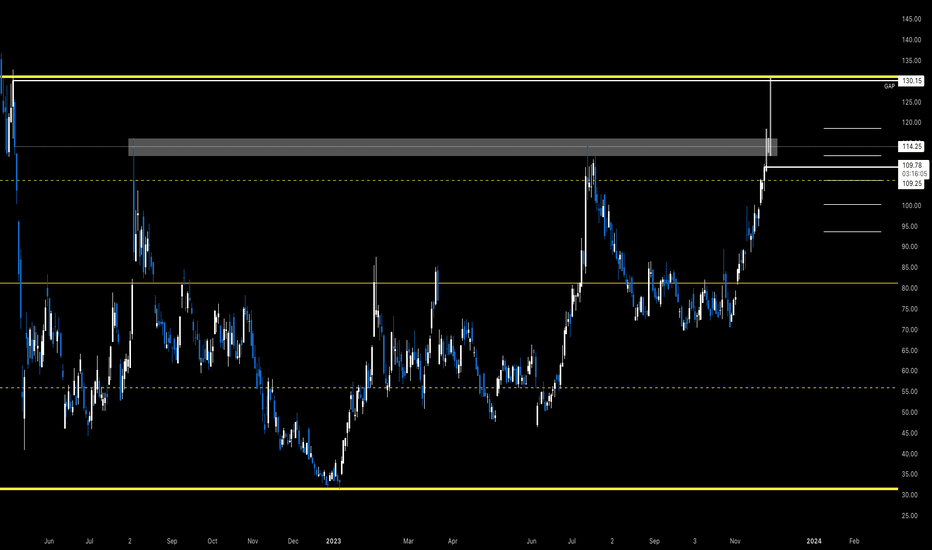

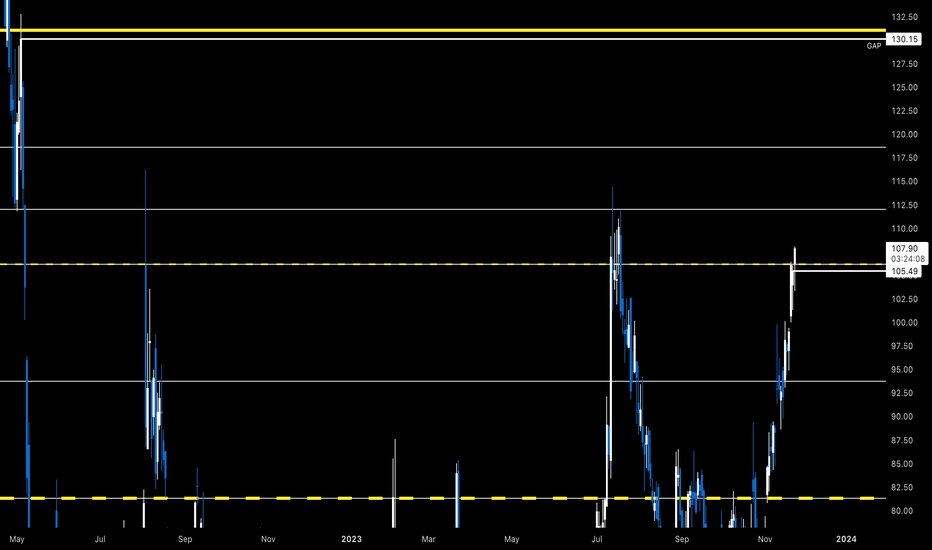

Will CoinBase be spared? CoinBase stock price can be in for a bumpy ride after receiving the unexpected news from Binance. Sometimes, fundamentals align with technicals and this looks like to be one of those moments.

If this is the case, looking for my first entry into the stock at $ 40.50 if Binance causes a rout in the market. If not, CoinBase shares will slowly creep higher to find resistance @ 120 and track the 50-week EMA.

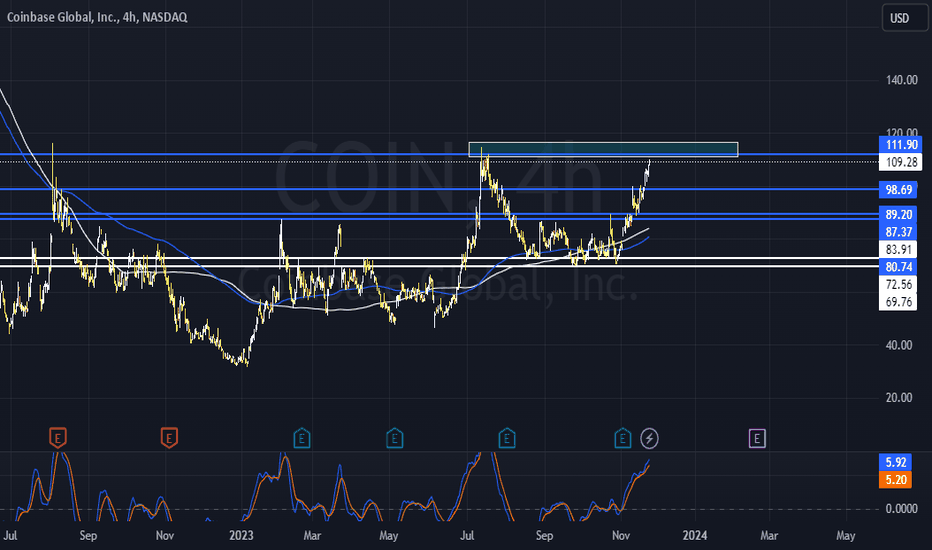

Has COIN got the momentum to keep pushing? Huge inverse head and shoulders is visible which has played out over the recent crypto bull market and we could be in a nice up trend channel. The question is can the market sustain us continuous momentum, or is it time for more legs down first.

Resistance at $110. Maybe $140 next then $170 OR we head back down to $87 to build some more momentum.

COIN base preparing for Triple digitsThe presence of an inverse head and shoulders pattern on the weekly time frame, coupled with the ascending annual trend, suggests that NASDAQ:COIN is poised to undergo a test of its all-time highs of the monthly time frame. Additionally, with the imminent approach of the BTC halving event, our analysts at NIXXWORLD anticipate a corresponding increase in the market capitalization of COIN.

Weekly Time frame:

Inverse Head & Shoulder on $COINThe presence of an inverse head and shoulders pattern on the weekly time frame, coupled with the ascending annual trend, suggests that NASDAQ:COIN is poised to undergo a test of its all-time highs. Additionally, with the imminent approach of the BTC halving event, our analysts at NIXXWORLD anticipate a corresponding increase in the market capitalization of COIN.

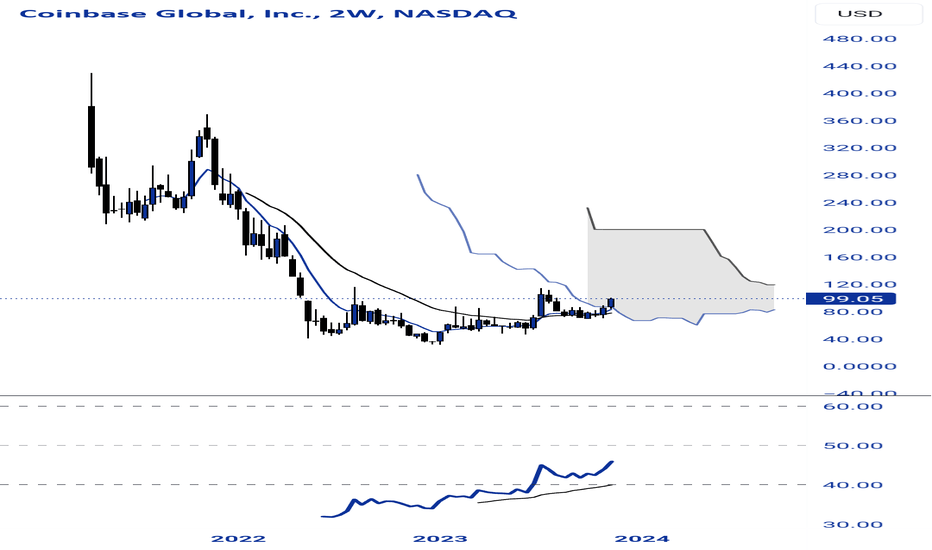

Double up your stack by May 2024 with $coinOn high time frame chart standards, NASDAQ:COIN Coinbase is a fresh chart. In the past week we have entered the cloud and an edge to edge trade would put price from $99 to double that at $200. Time frame is roughly 5 months. With the majority of the spot etfs going to go through Coinbase, this, in my opinion, is a great play. Spot ETFs for Bitcoin will likely be approved by January 10th, 2024.

(NASDAQ: COIN) South Korea’s NPS Invests in CoinbaseSouth Korea's NPS invests $19.9M in Coinbase, marking a pivotal shift in pension funds embracing digital assets. South Korea’s National Pension Service (NPS), recognized as the world’s third-largest pension fund, has invested $19.9 million in Coinbase shares.

This investment marks a significant foray into digital assets for the pension fund, which manages assets exceeding $755 billion.

This acquisition represents NPS’s first venture into the cryptocurrency sector, opting for a more indirect approach to the burgeoning industry. Instead of direct investments in digital assets, NPS has channeled its investment through Coinbase, a leading name in the digital asset sector. This decision aligns with the conservative strategy typically seen in large institutional investors, where direct exposure to cryptocurrencies is often avoided in favor of investing in related companies.

Coinbase’s Rising Prominence

Coinbase, a company synonymous with the growth and development of the digital asset industry, has recently demonstrated a notable surge in its business metrics. With a reported third-quarter revenue of $6741.1 million, the company has significantly exceeded market expectations, underscoring its robust position in the industry. This financial prowess has undoubtedly played a role in attracting the attention of substantial institutional investors like NPS.

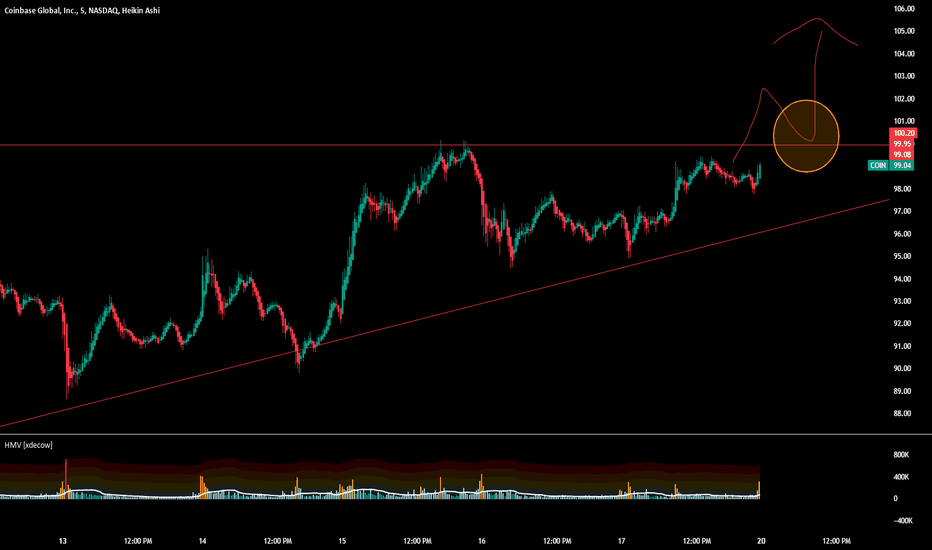

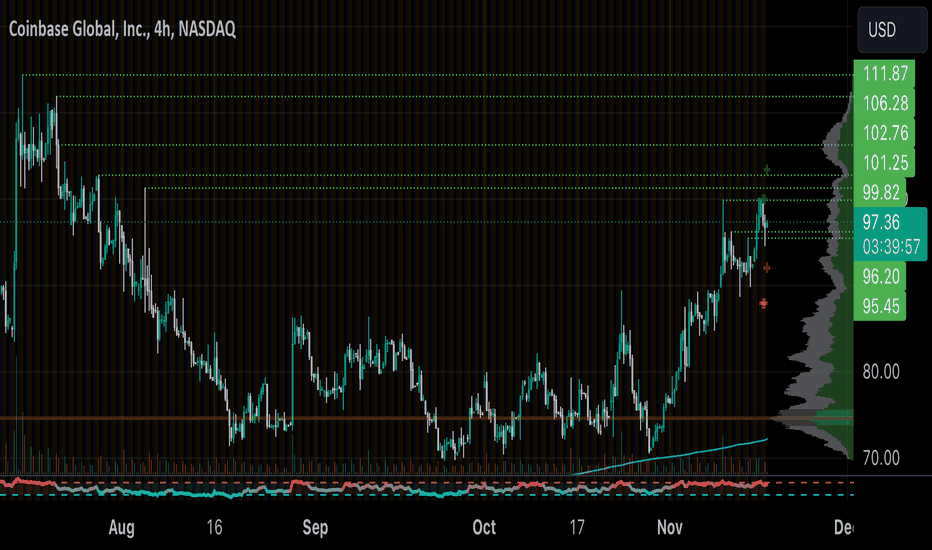

Coin breaking through daily supplyCoin looks to be breaking through supply after a few tests with a clear uptrend in both price and RSI. The stock is looking to retake the daily .786 fib level as well. We are looking at 115 UPCOM:ISH by end of year if the market stays excited about this CPI print and potential rate cuts next year.

COIN stock - Bullish on longtermCOIN is breakoing out from the channel. Probably correlated with BTC movements, which is also bullish yet. Now looks great to reach the last ATH or more :) Of course it's depend on a lot of things.

I bought around 80-82 USD, so my SL is around 85. I'm in winning position now, just the profit amount is the question :)

I'm a beginner trader so I charting for myself only. I mostly trading with crypto but sometimes I wanna check my ideas are working or not.

This is not a financial advice!