FCX trade ideas

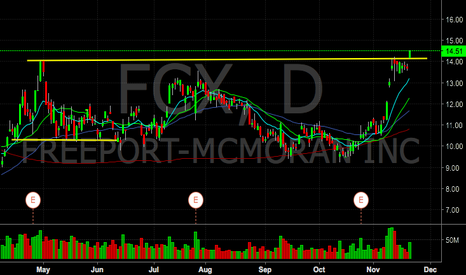

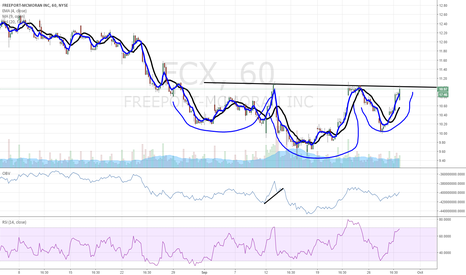

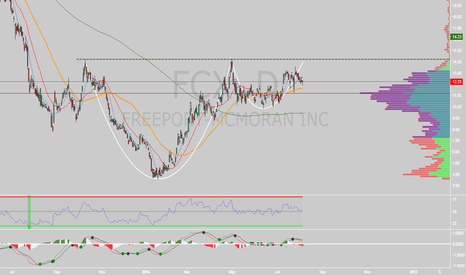

FCX On Verge Of Dropping 21%FCX is on the verge of dropping 21%. Investors need to take note of these this major factor that dictates price action. Notice on the stock chart below, how over the last two weeks Freeport-McMoRan has been unable to make new highs while the stock market has made multiple new all-time highs. In addition, the stock chart over those same two weeks has a clear bear flag pattern formation. This usually forms when small investors are buying but big institutional traders are gently selling into them, dumping shares. All in all, these are huge bearish signals on the Freeport-McMoRan and investors should be selling or shorting the stock heavily. The first target to the downside is $13.20, a net profit from the current price of 14% for shorts. The second target is $12.10, a net profit for shorts of 21%. This trade will likely play out in the next six weeks, if not sooner.

View all of my trades VERIFIED right here: verifiedinvesting.com

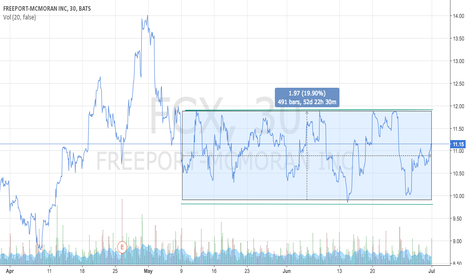

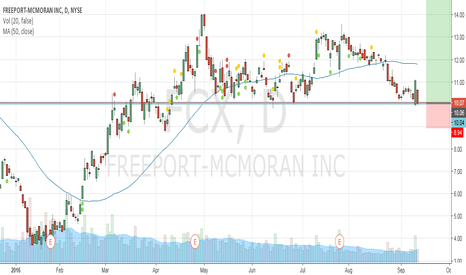

Long FCX on supportLong FCX on strong daily support at $10. Long term FCX has enormous upside with its goldmine and copper mine interests. The value of its gold reserves alone tops $25 Billion (it has a large share in the worlds largest gold mine in Indonesia). As long as the company can continue to restructure and pay down some of its debt its long term prospects are 3x current valuations. I look for a stop at $9.00 with reentry on large dips below that level. I don't have a price target below $20, but rather see this as a long term buy and hold (I recommend trading around the long position on volatility). If you follow my 10000 USD base account recommendations I advise a 200 share long position at 10.05.