PYPL trade ideas

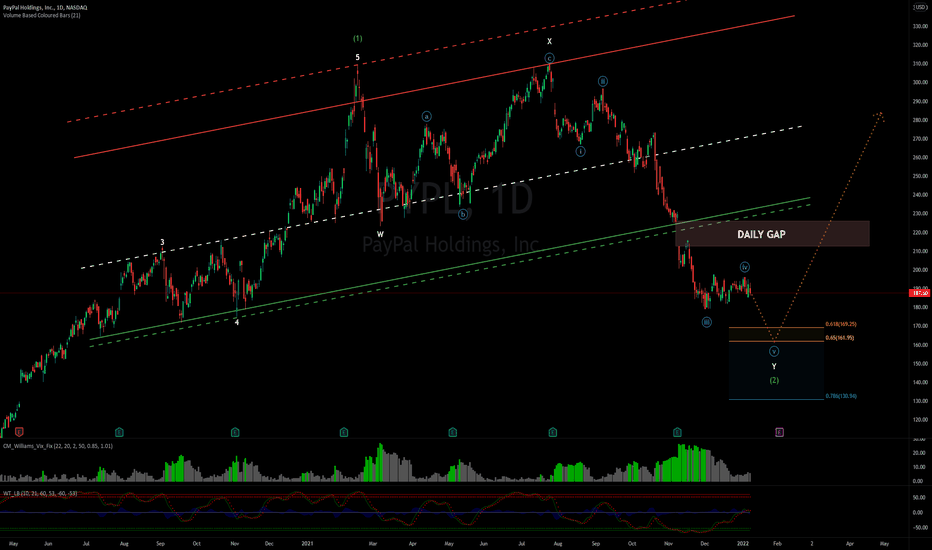

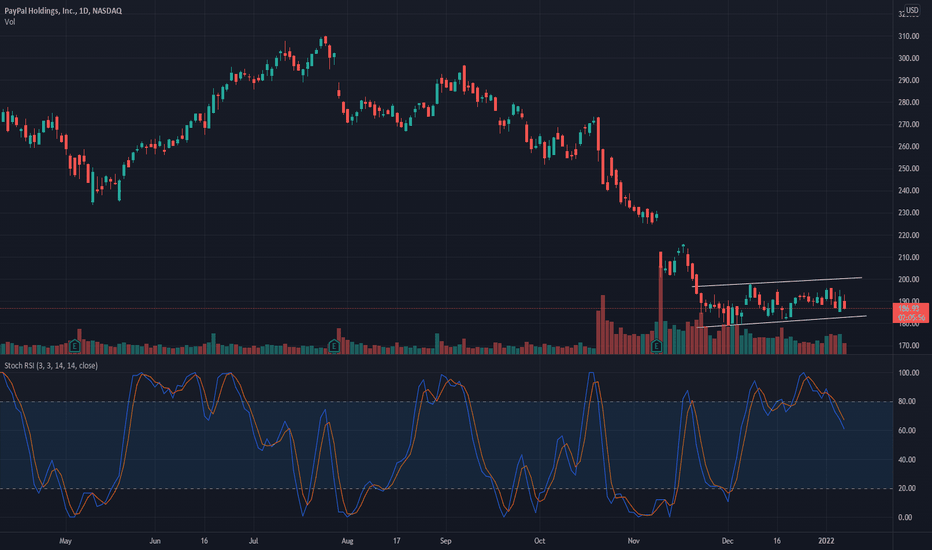

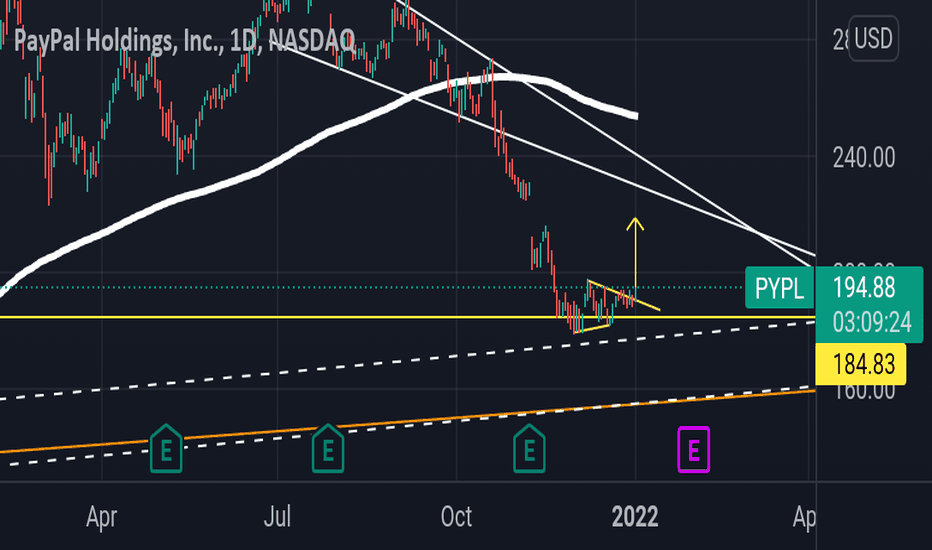

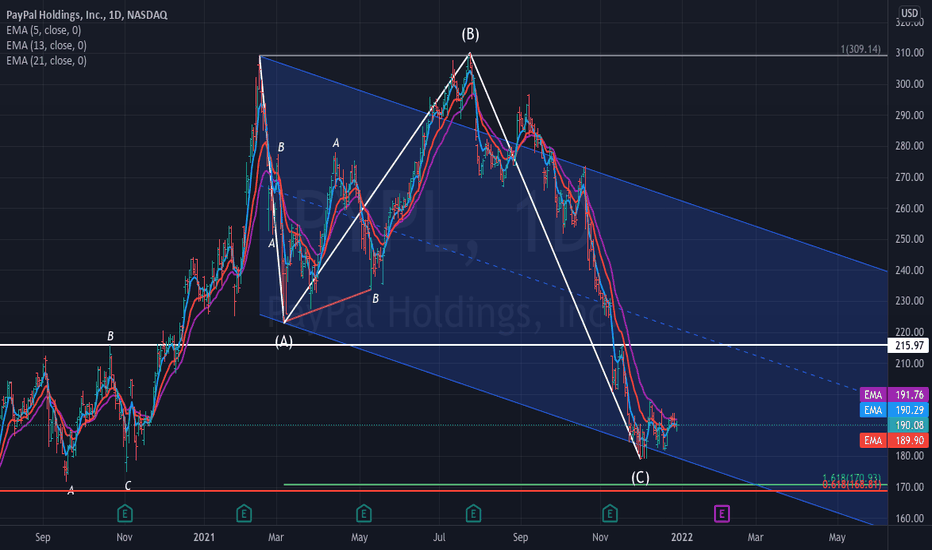

PAYPAL DOWNISDE TARGET WAVE 4 ENDED LOOK FOR 162/154 PYPL seems to finally ending its abcde 4th wave triangle I been waiting to see unfold .We should see new lows and I hope it is on heavy vol to end its declining wave structure most fib relationships are in the 162 to 154 area do not catch this falling knife yet .

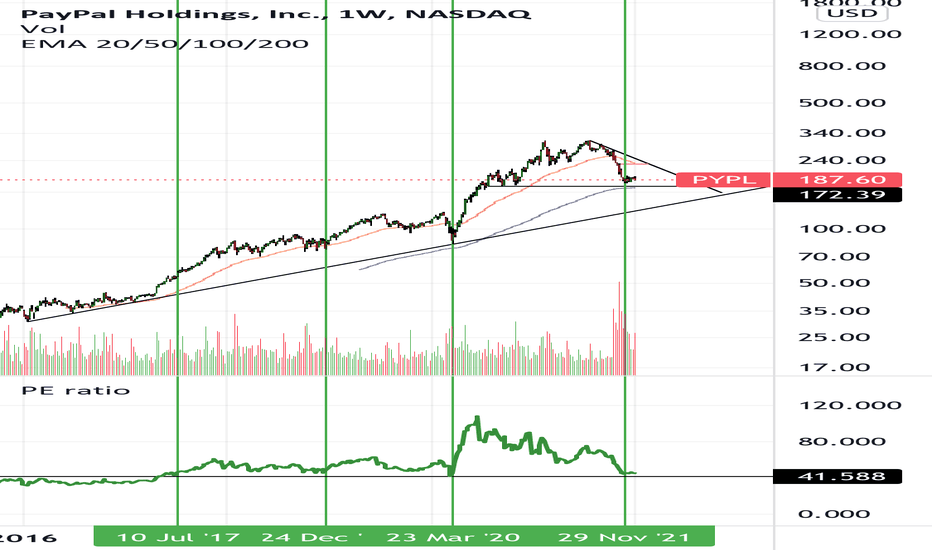

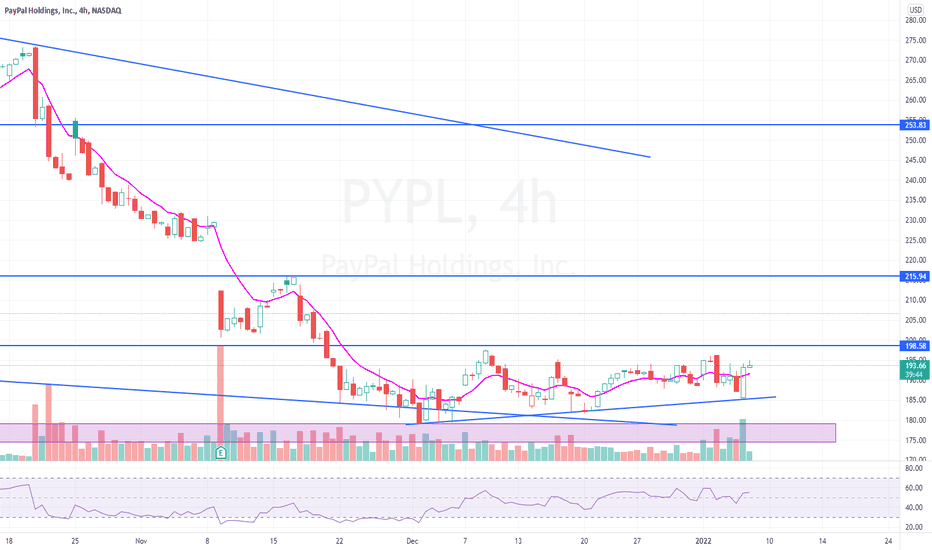

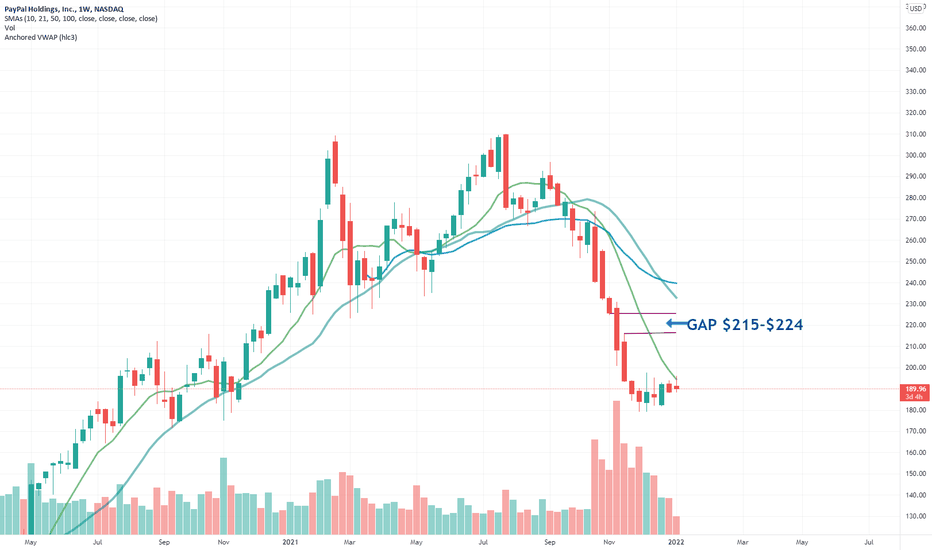

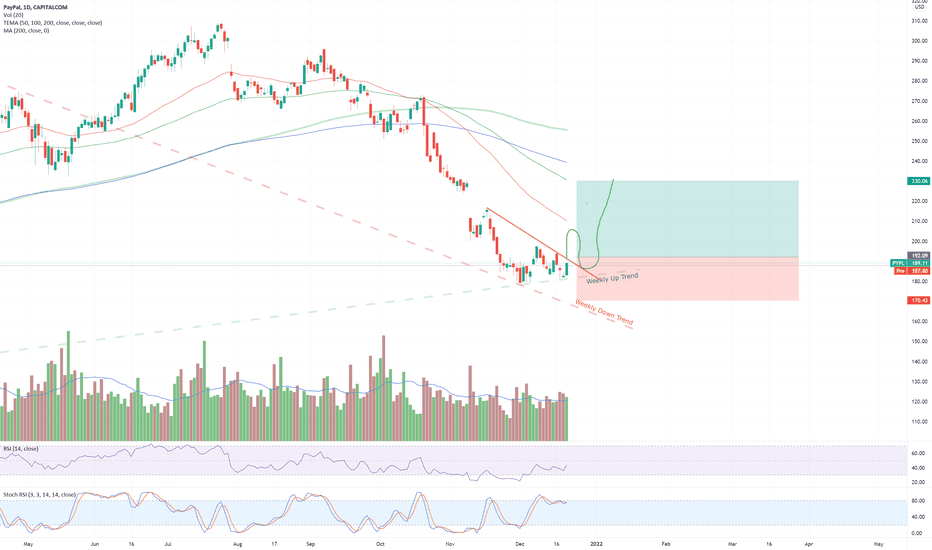

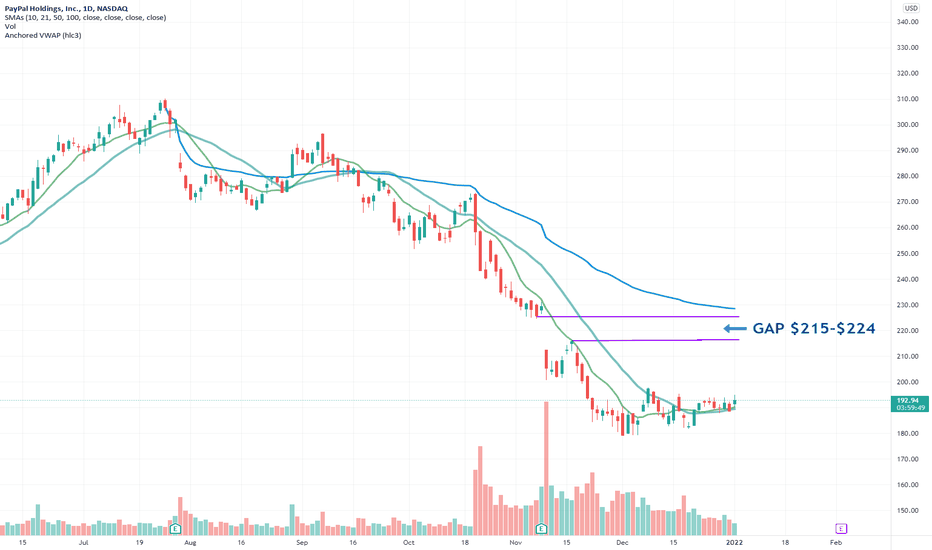

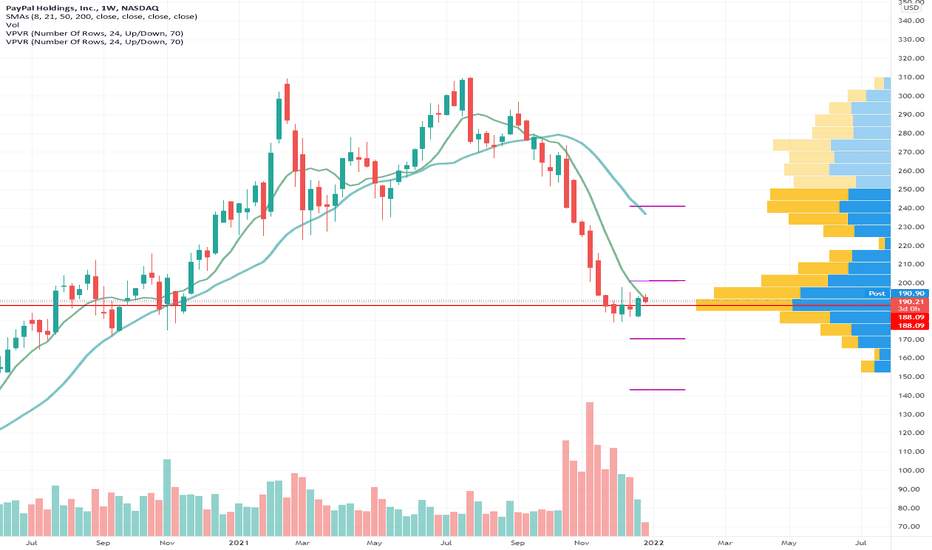

#PayPal bouncing on weekly supportPYPL Is looking forward to a strong recovery. We had a nice bounce of the weekly support. A potential gap-fill to the upside is in the play.

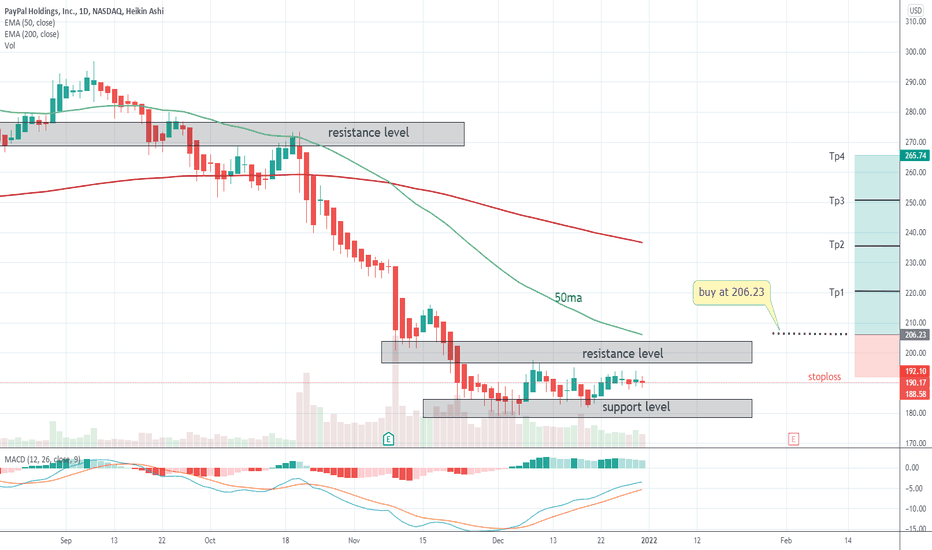

PayPal is a strong company with good fundamentals. I believe the current price is not fare and we should visit $200+ channel soon.

I am planning to add to my long position as soon as we break the local downtrend and add more on retest of the same downtrend.

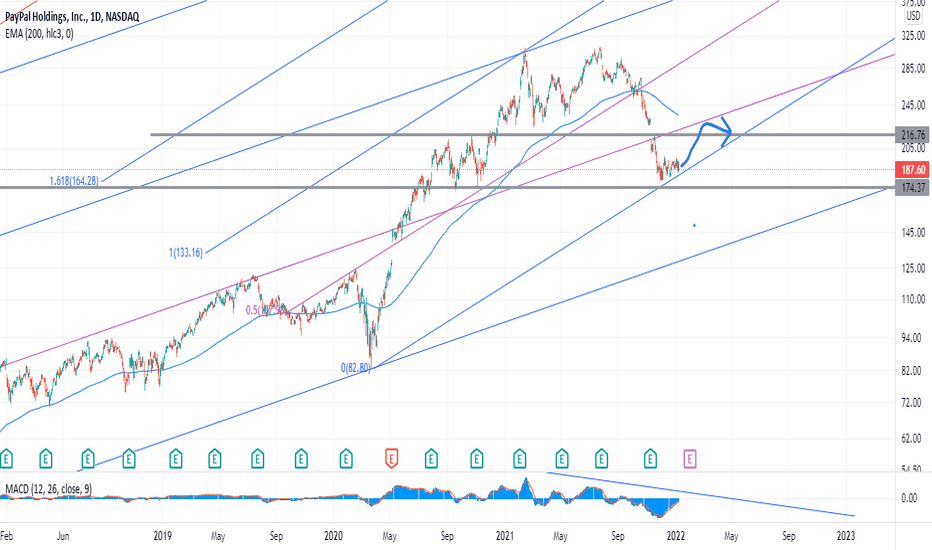

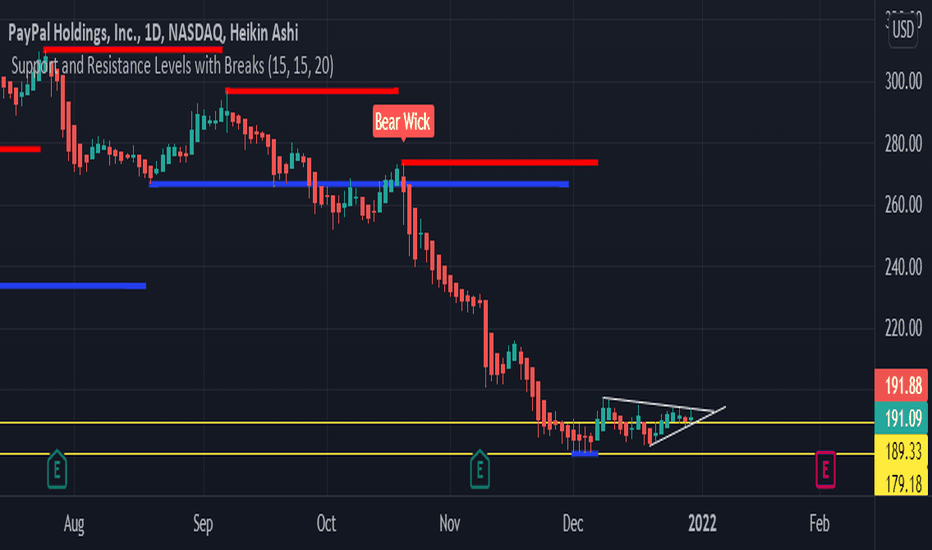

PayPal expectations for 2022PYPL (PayPal) is at the bottom of monthly correction and from here I expect it to bounce to at least 0.382 fib, or even to 0.5 fib.

However I expect it to go sideways till at least February 10 to complete a small monthly candle.

We can expect turnaround in February-March, but we will see how support holds the price.

The best entry will be at trendline breakout, which hasn't formed yet.

This analysis is more like a discussion/possible prediction, there's no entry at the moment, but there's definitely a possibility in the future.

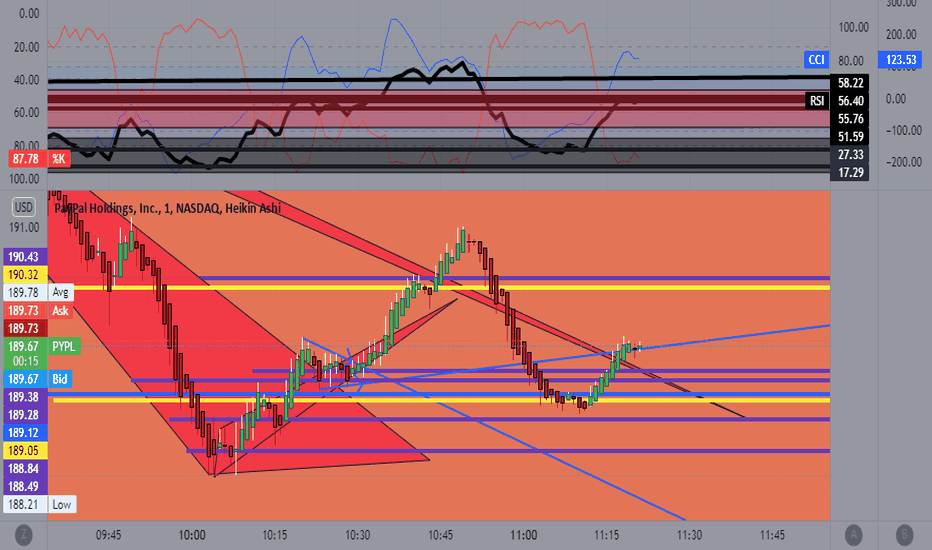

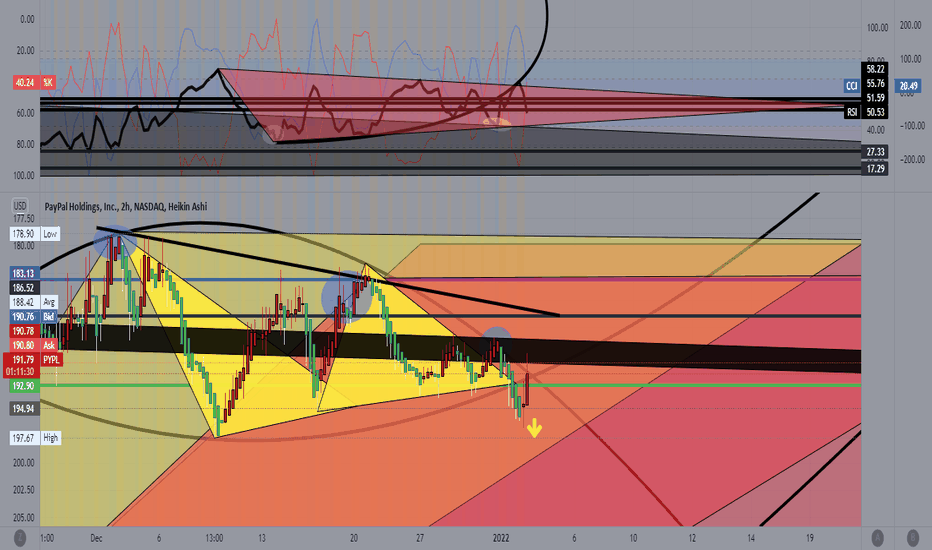

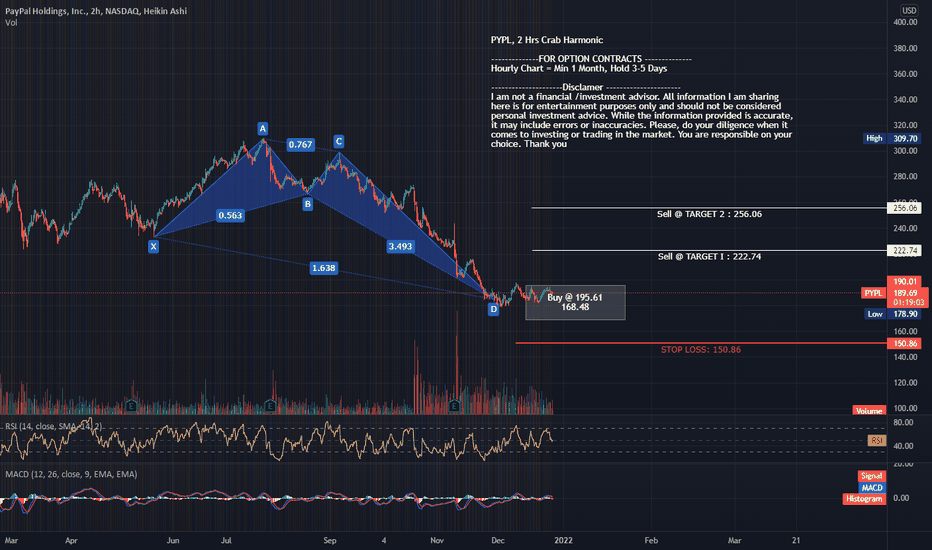

PYPL, 2 Hrs NASDAQ:PYPL . PYPL, 2 Hrs Crab Harmonic

--------------FOR OPTION CONTRACTS --------------

Hourly Chart = Min 1 Month, Hold 3-5 Days

---------------------Disclamer ----------------------

I am not a financial /investment advisor. All information I am sharing here is for entertainment purposes only and should not be considered personal investment advice. While the information provided is accurate, it may include errors or inaccuracies. Please, do your diligence when it comes to investing or trading in the market. You are responsible on your choice. Thank you

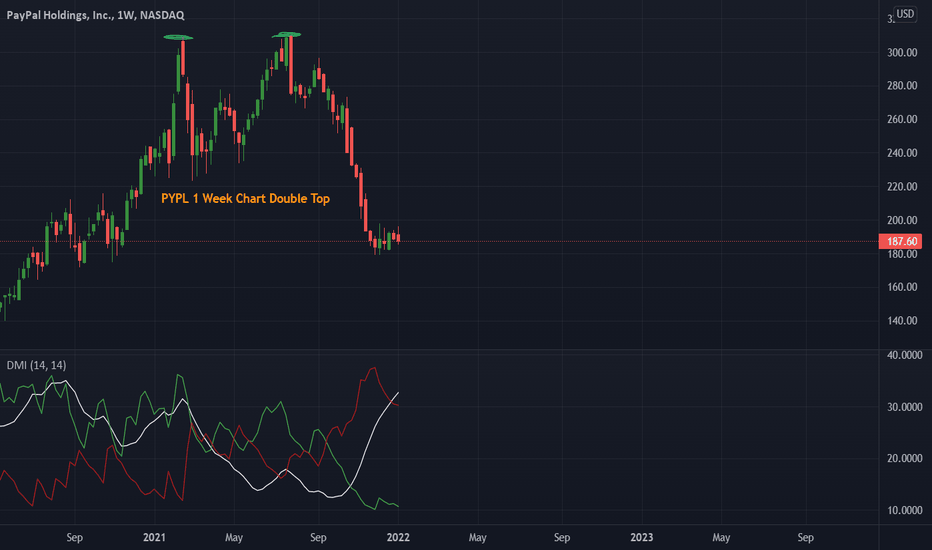

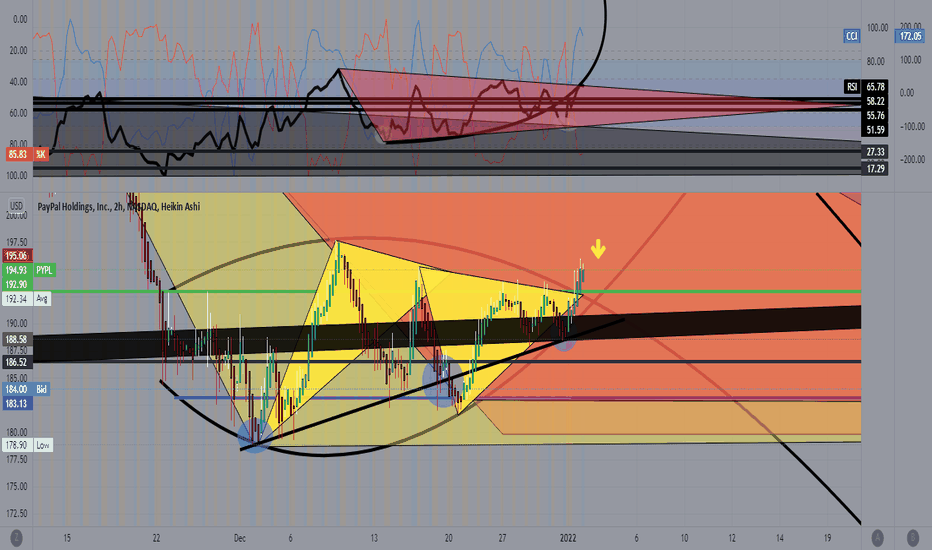

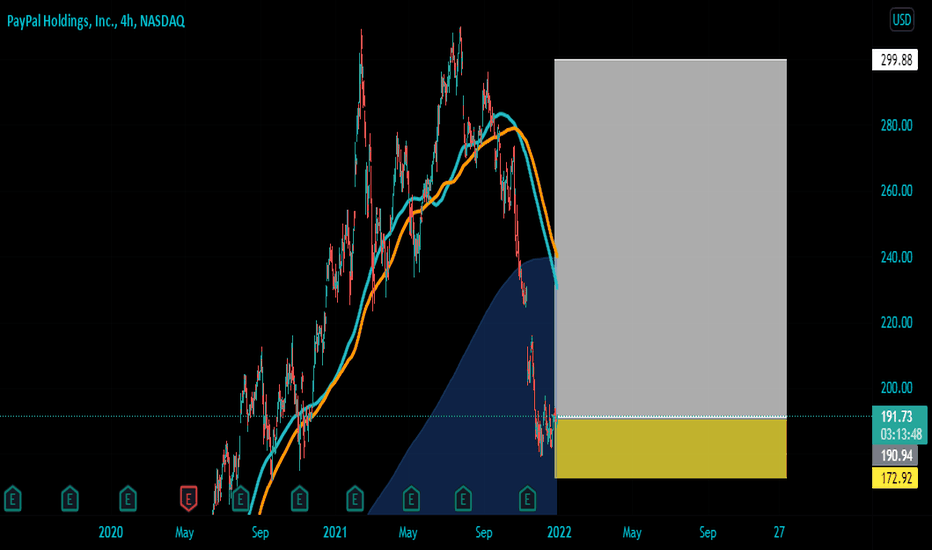

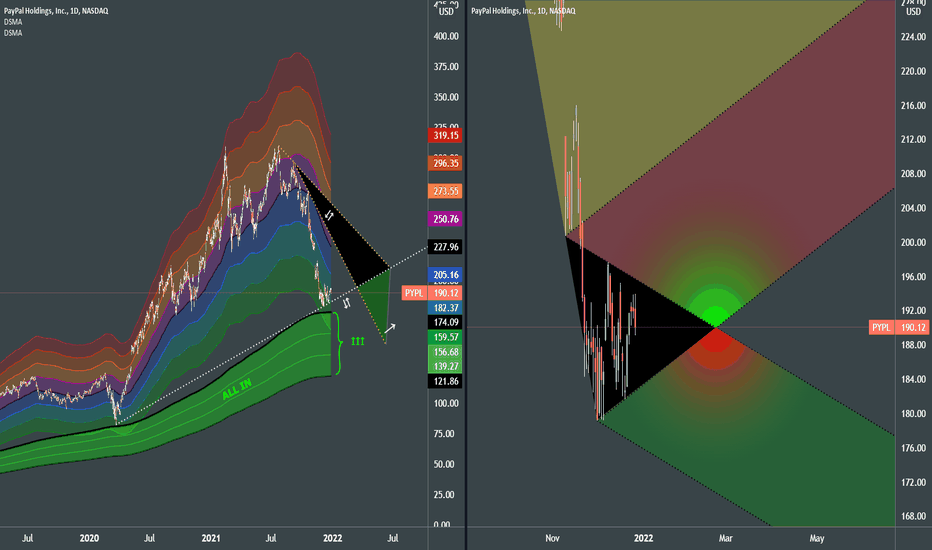

Paypal OpportunityAfter serious decline it's about time to expect some sort of pullback. I mean a drop from 310 to current prices must trigger new wave of inverstors entering the market, as low levels are attractive for those who missed out.

It's already inside demand range colored from blue to green. Overall I qualify this as buy. However we know that markets are unpredictable, hence I deduce that there is a slight chance of falling further even a little bit.

That's why there is a "safety pillow" light green Demand MA's that will reverse the market at higher chance than current DSMA.

Now it's been quite a while that price is testing white dotted support line, the longer time it takes for price WITHOUT CROSSING below the line, the higher the chances get for market reversal without another drop.

A breakout of triangular shape is the signal of thinking about long entry.