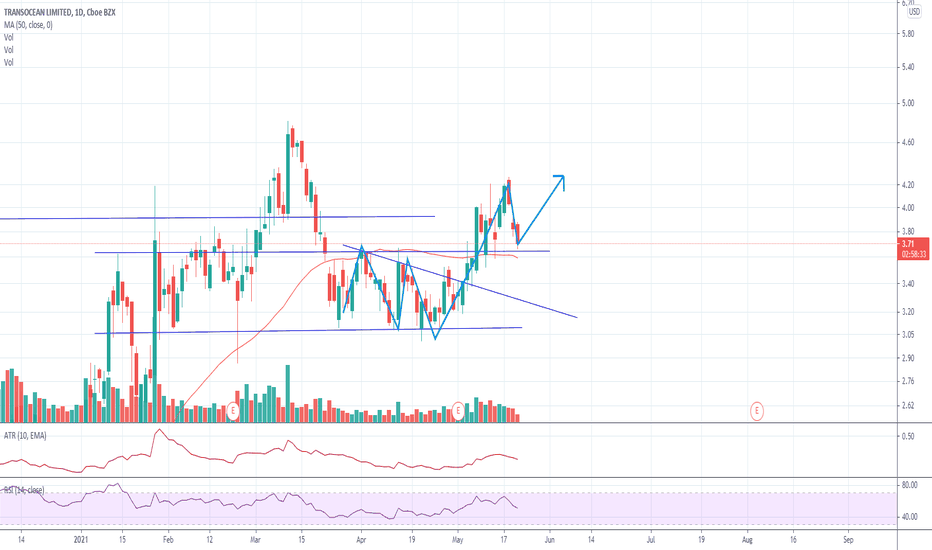

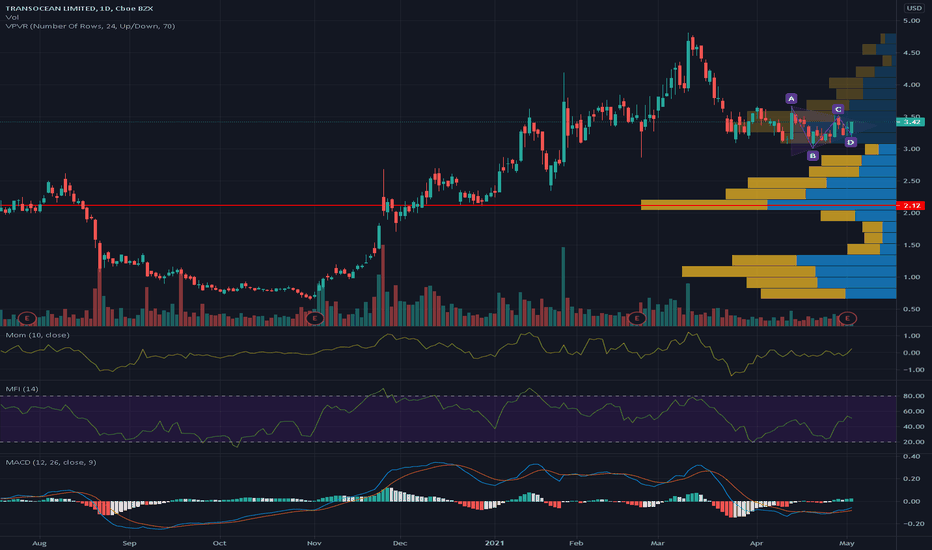

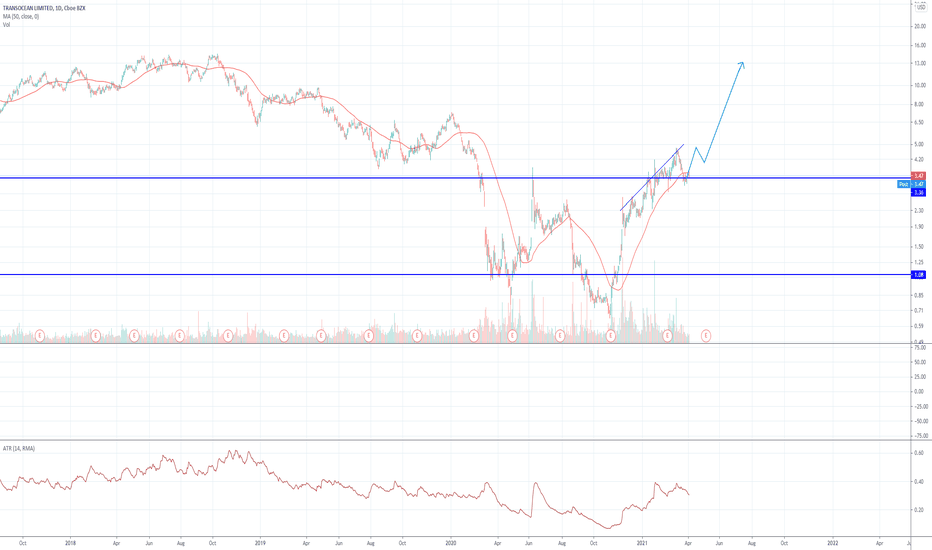

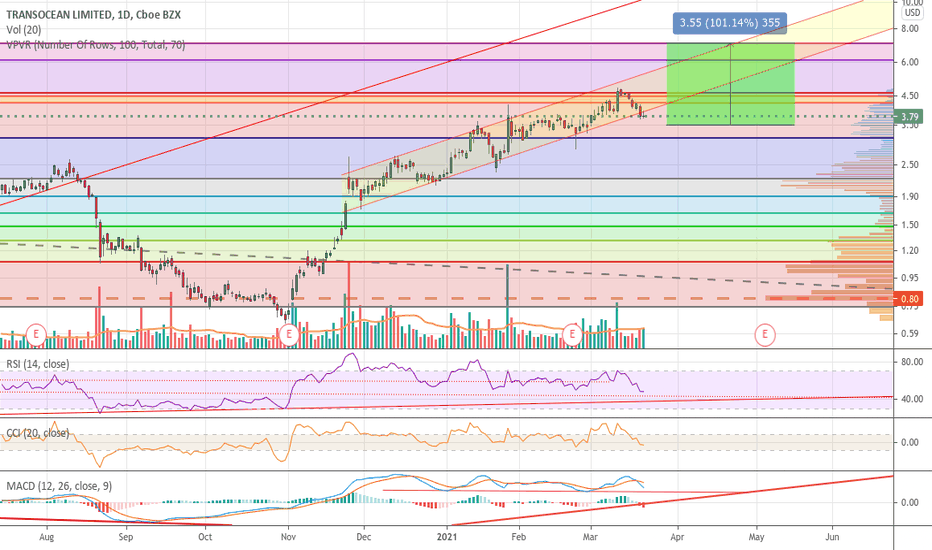

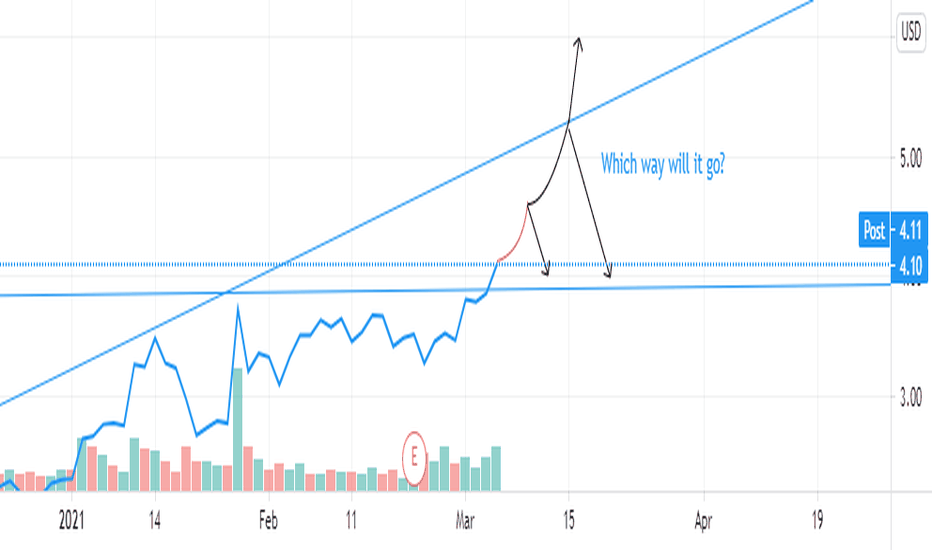

Breakout and pull back...As expected with the strong momentum of oil RIG pushed out of the the consolidation period and broke out. it reached a high of 4.31, and pulled back to the new support level of 3.71, which was previously the resistance level. This is a perfect breakout, and pull back before it takes off. RIght now it presents a great buying opportunity.

Dangers and cons:

The first major con i would say is in relation to the price of oil. Previously RIG had reached a high of 4.9, when the price of oil was at a high of 64, but when OIL hit a high of 67 this month RIG wasnt at a higher price than when the price of oil was lower. This is a big set back in my opinion.

The second danger I see is that the price of oil has pulled back significantly. The price of oil currently lies on support, and appears to have fallen out of the bullish ascending channel. The past few weeks OIL tried to break past the 67 price resistance, but no success. There is strong selling pressure at that level. If the price of oil doesnt recover back soon it could present a really dangerous downside for rig.

The last and major danger to the whole energy sector is the Iran deal. There is significant progress being made in the IRAN deal, although there is barriers that they need to overcome. In the event that the IRAN deal is struck I recommend getting out of all energy companies. The Iran deal is an extremely bearish catalyst, as could be seen in 2014 when the IRAN deal was struck, which led to a massive glut in oil that lasted well over 3 years.

Pros:

The set up is extremely bullish, and inventories where better than expected this week. The Pros are not as big as the cons, but could be a profitable position if the right cards are dealt. RIG moves in big steps, as oppose to steady rises. If no position is held I say the current price presents an attractice price. The second best price is buying above the 4.35, and hopefully catching the next big breakout.

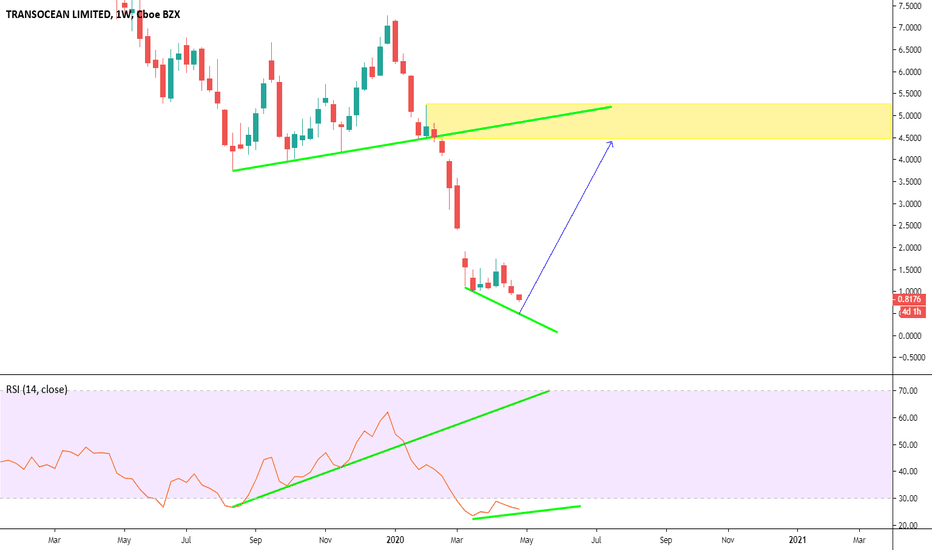

RIG/N trade ideas

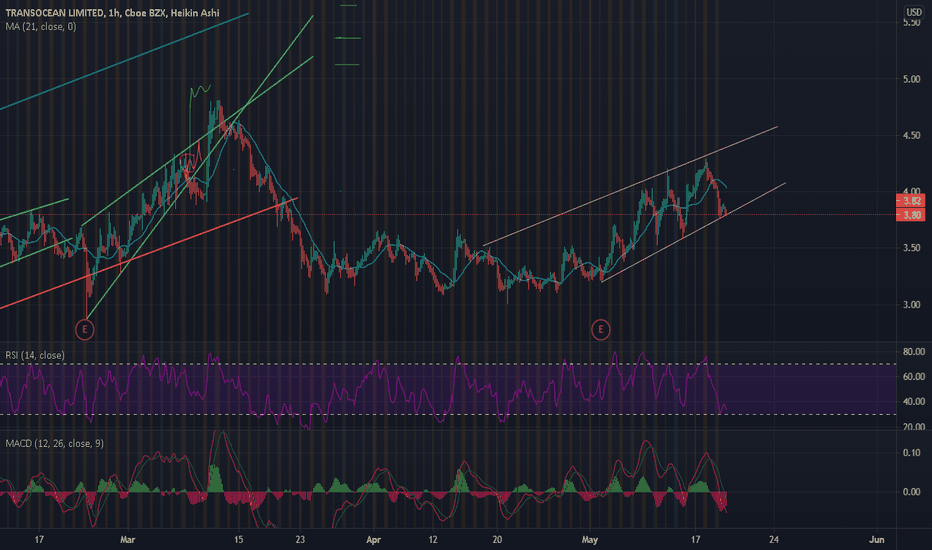

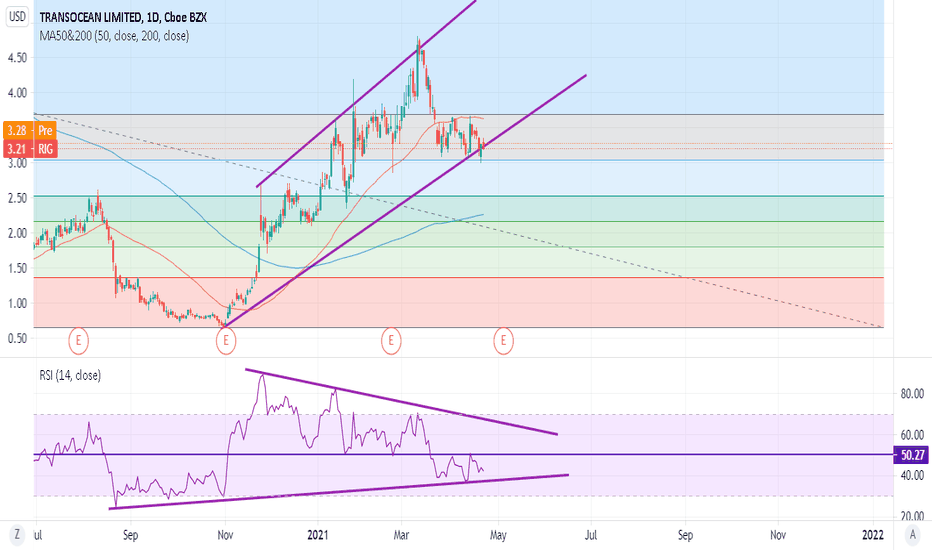

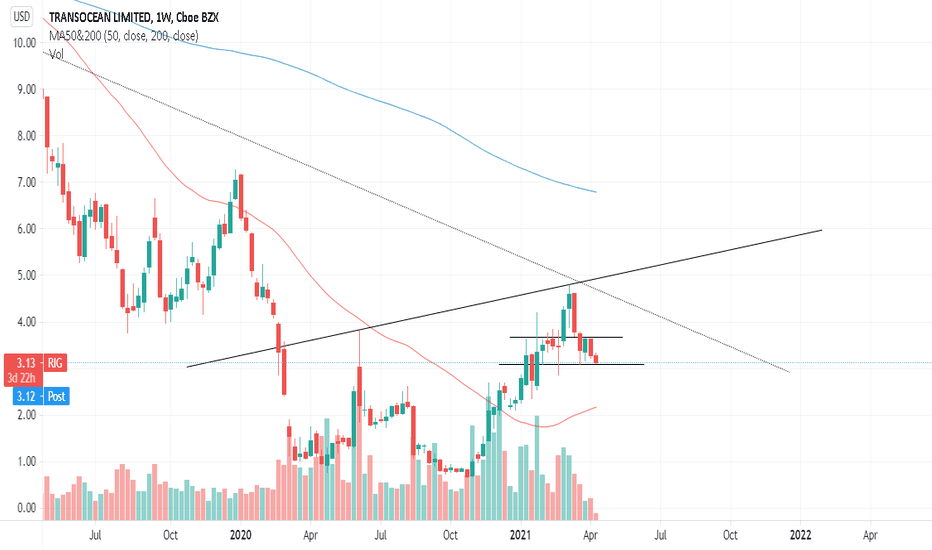

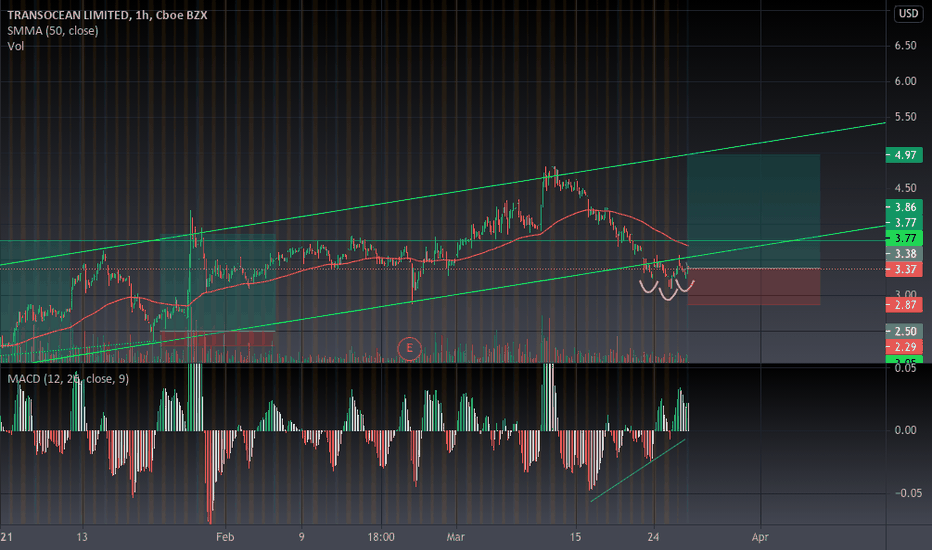

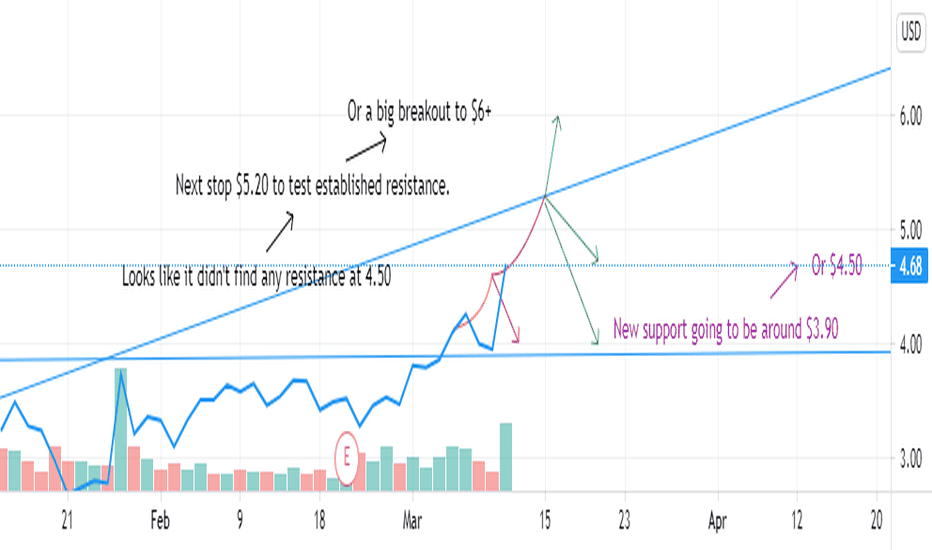

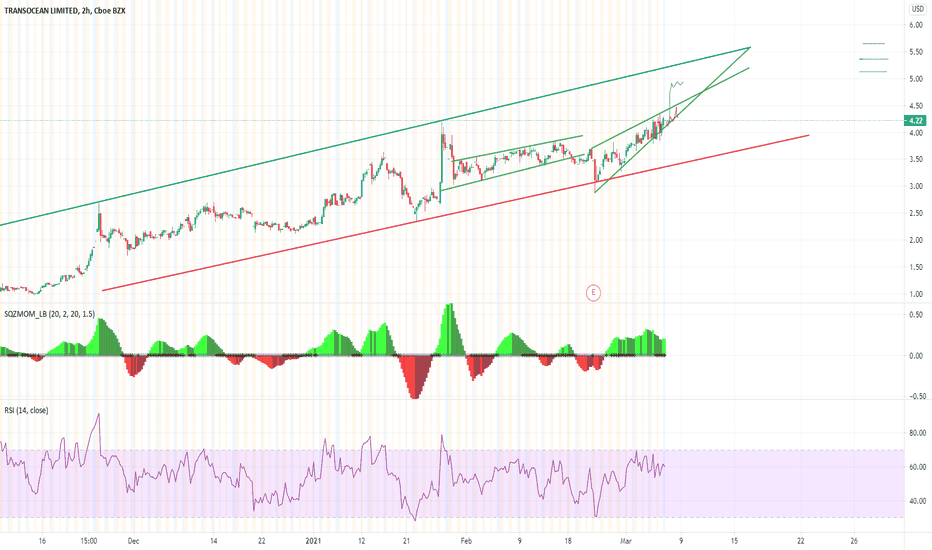

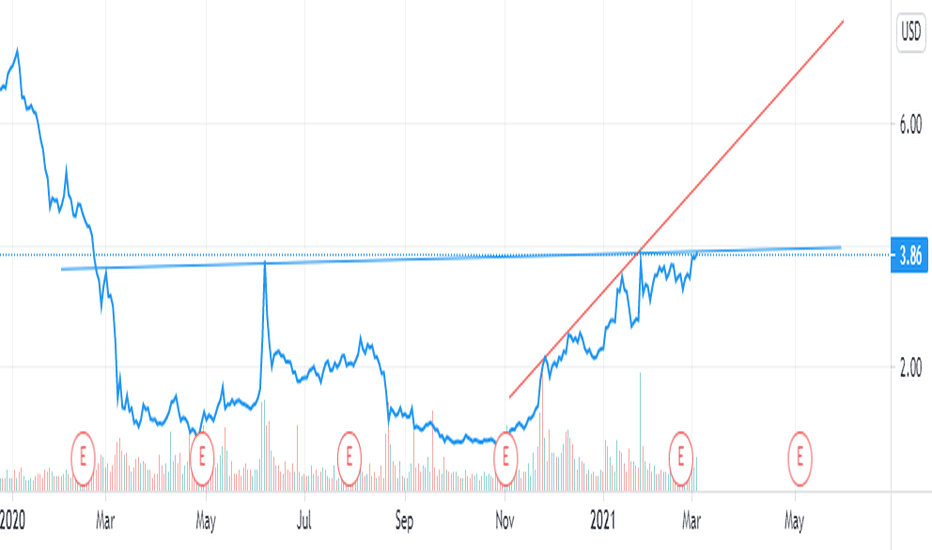

Weakness or a powerfull coilRIG has lagged major oil players such as xom. Xom was able to breakout of the consolidation in the 55 range to be past 60 dollars again. RIG on the other hand has failed to breakout past the 3.71 resistance level.

This is on the back of a major move in oil prices up. When oil was at 64 a few weeks ago RIG reached 4.5, but now that oil is at 65 its trading at 3.5. This might be a major sign of weakness, especially on the back of earnings, which generally came in as expected. However, This if it does break past 3.5, i see a massive catch up move past 4.5 into the 5-6 range.

Economic: The API released inventory levels, and it came in extremely bullish. The draw was -7 compared to -2 expected. Oil did move down lower, although I expect OIL to move past the $70 range. This will be a major multi year resistance level. In the past Donald J. Trump will start tweeting any time oil hit these levels. I expect RIG to move dramatically up, as we approach those multi year resistance levels in crude oil.

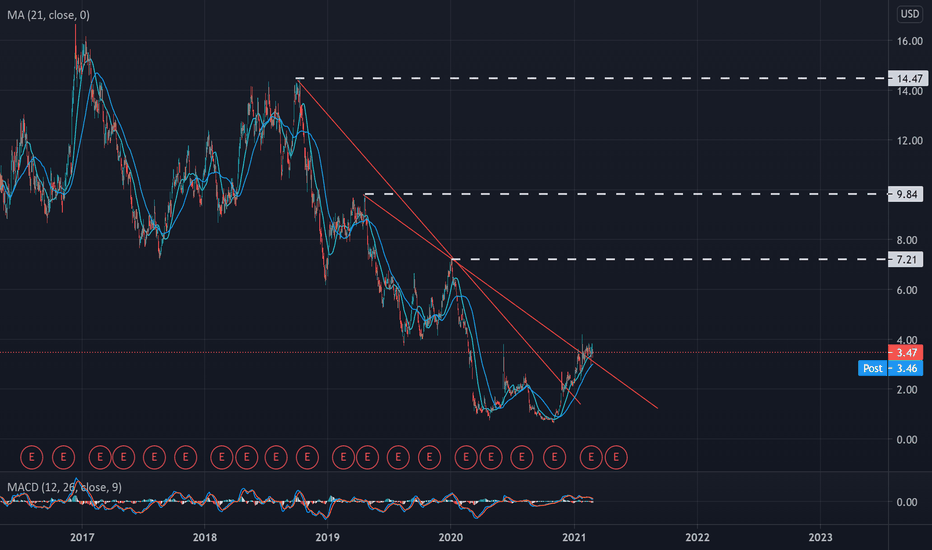

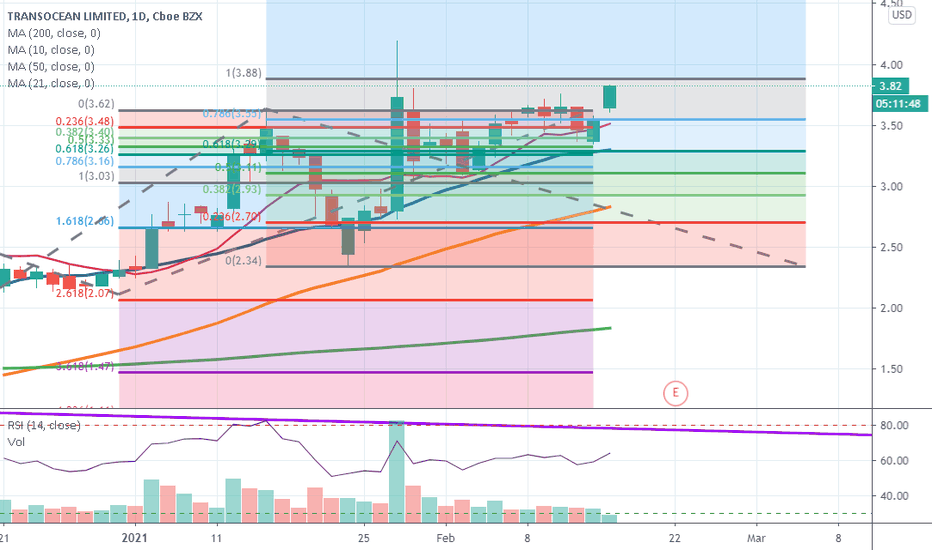

Trade set Up:

For this trade i recommend buying in at 3.8, with a stop loss at 3.2, and a price target of 5. At 5 I would add to the position and move the stop loss up to 4.5.

From this point I would not add to the position until the 7.2 resistance level is broken up.

For trailing stops i recommend the low of the trailing 5 day bar.

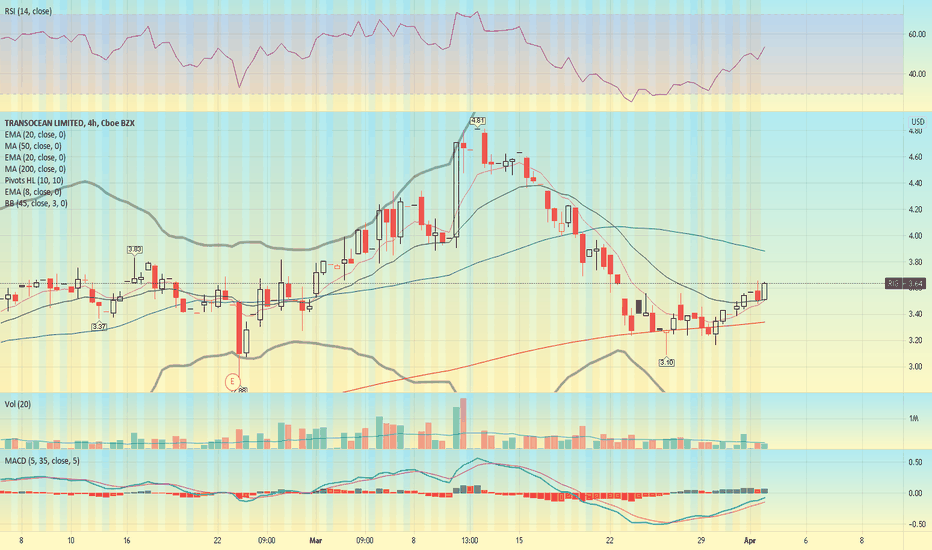

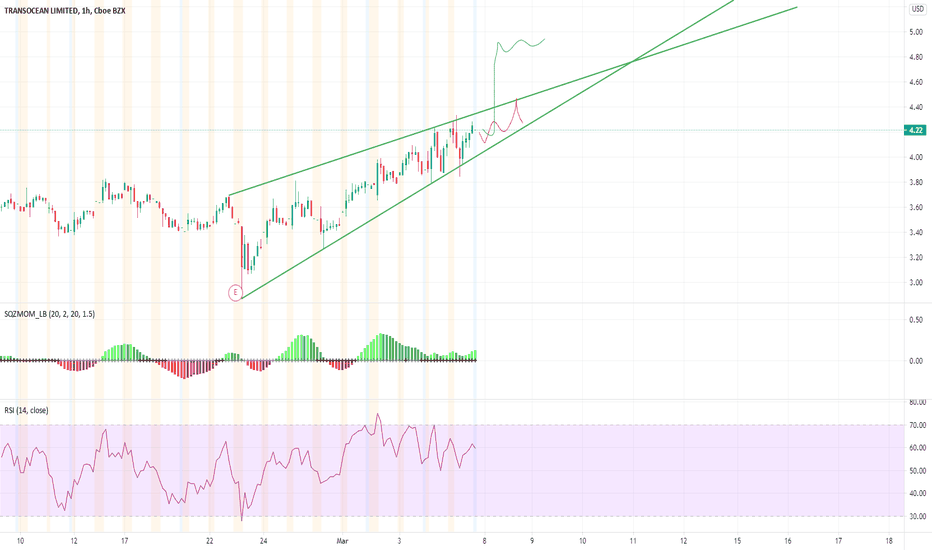

Breaking 3.70 Resistance soon ?It appears that RIg is attempting to get out of the 3.70 resistace. Its made multiple attempts now, with the last one quickly being rejected. It appears the stock is moving slowly towards resistance, which should be enoug energy to smash through. Now it needs a catalyst.

Oil was pushed down after europoors decided to go on lock down again. There was hope the opec + meeting would push oil past (WTI) past 62, but that failed, as seen by todays (4%) down day in XLE. There is no more major catalyst, whcih could send the stock higher. SO what will push the stock higher?

1. Higher Demands is seen coming this summer.

2. 90% of American should be vaccinated this month ( have the option to get vaccinated)

3. European lock downs should end this month, whcih should bring some excitement to the oil market.

Downsides?

The major downside that I see is OPEC+ increasing supply faster than demand rises. They decided to raise supply in anticipation of higher demand, but if they supply and demand is matched or undermatched we would soon see supplies and inventories rise

above the 5 year average. While not a sure trade I think it offers a handsome return to anyone who dares trade this.

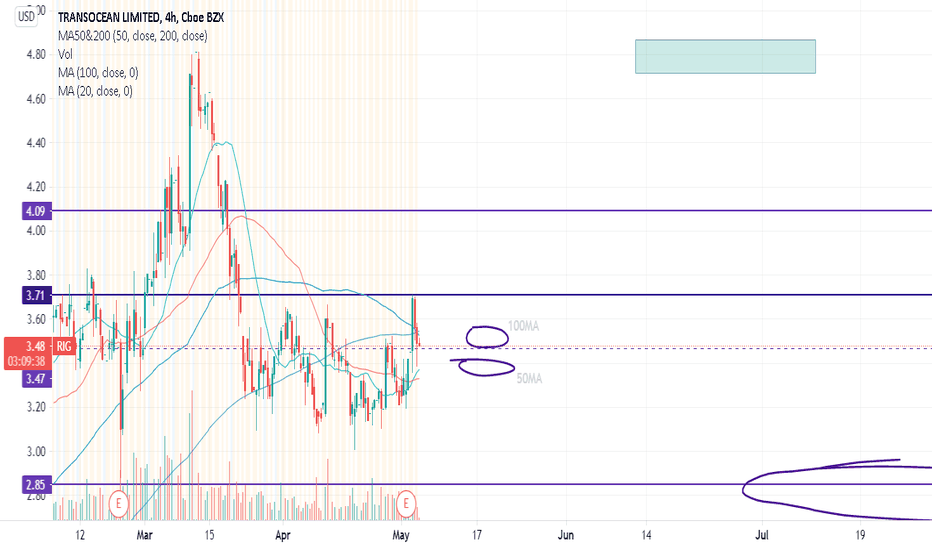

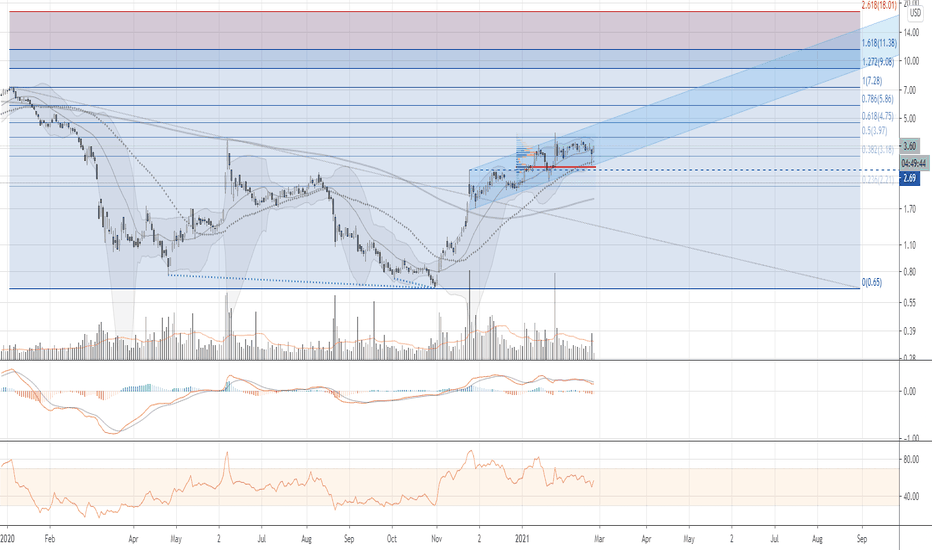

RIGOpened a position on Tuesday after that second bounce off the 200 period moving average. Price action has held above the 8 EMA after an anticipated pullback and bounce. Today we see 8 EMA and 20 MA x-over. If you're looking for an entry, consider the 8 EMA (pink line) or first pullback to the 20 MA. Cheers!

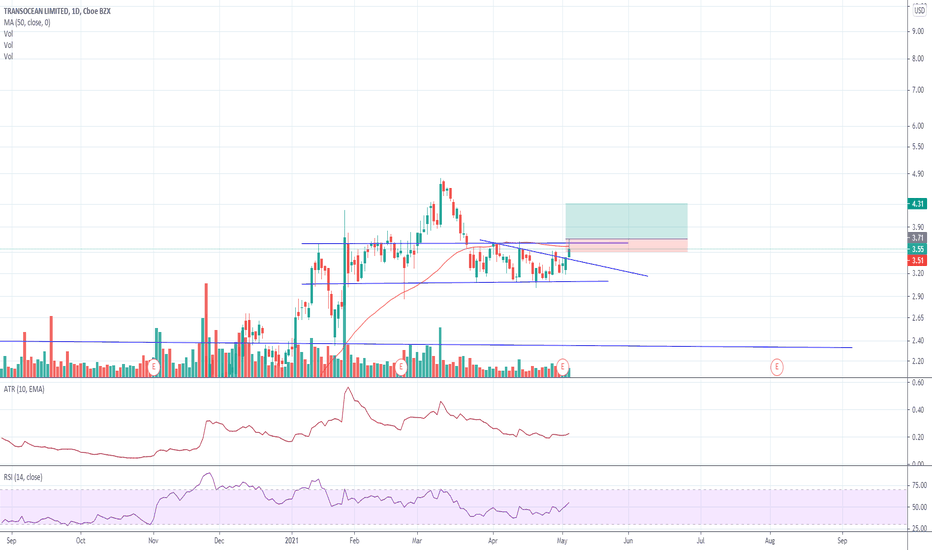

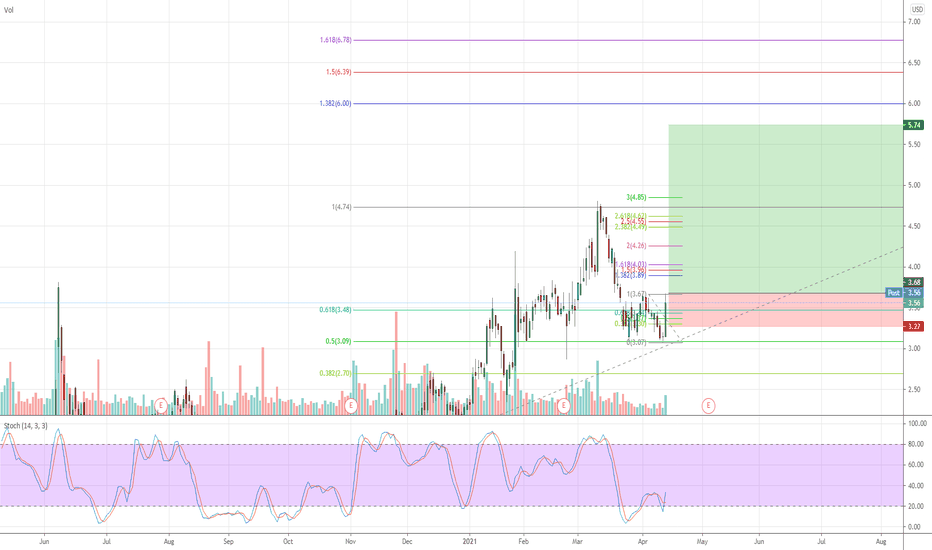

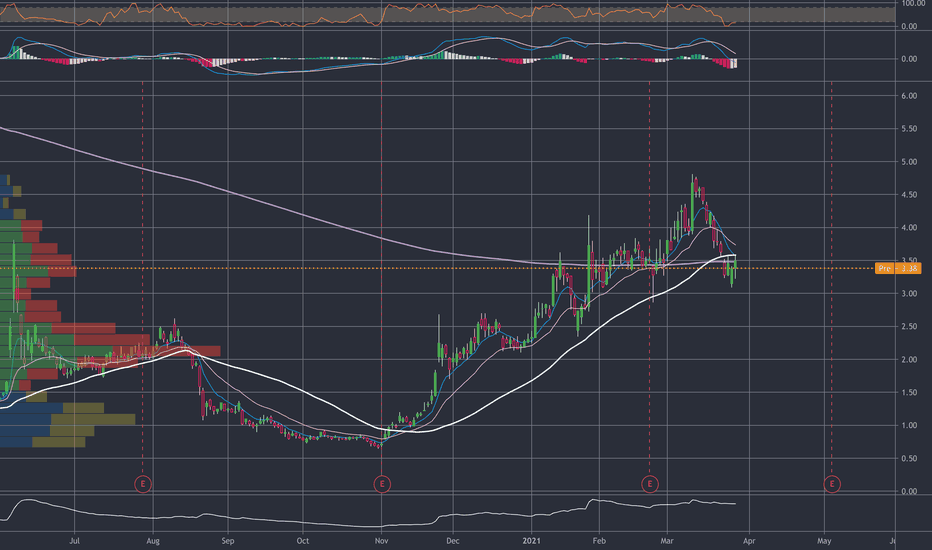

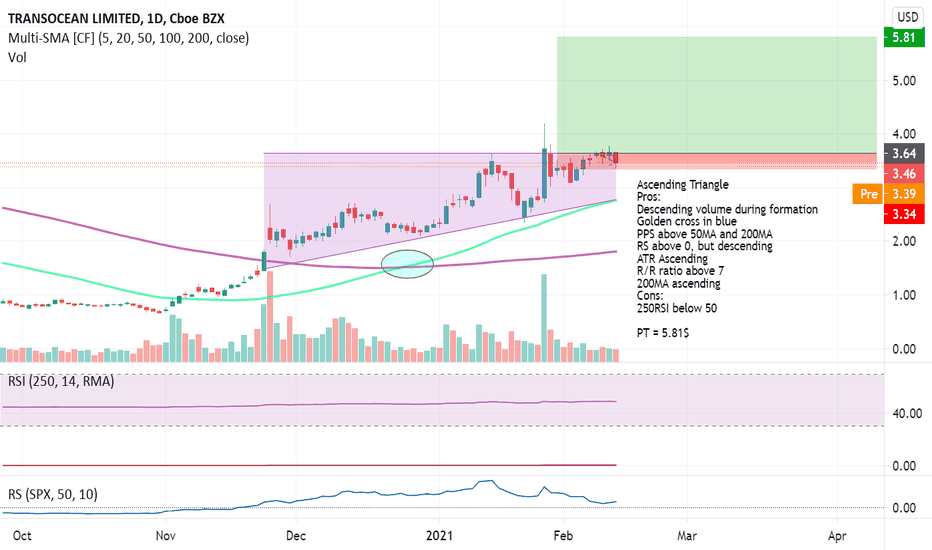

Breakout from cup without handle? Testing major resistance.Currently testing resistance at $3.88, if it breaks out I see it hitting $5.35 in the next two weeks and $5.80 by the end of March. If it breaks through the red resistance trend line, it'll already be too late to buy. This is a $6 stock mid-April at the latest.

I believe we saw a cup without handle from August to November, huge volume on breakout. Could be looking at big gains from here on.

Now looks like a good time to buy. I don't see it getting back down to these prices any time soon.