TDOC trade ideas

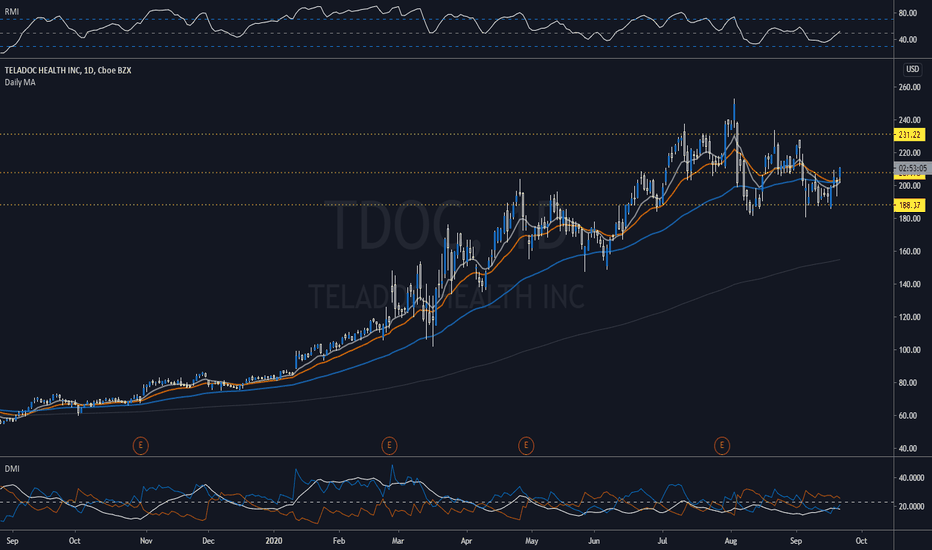

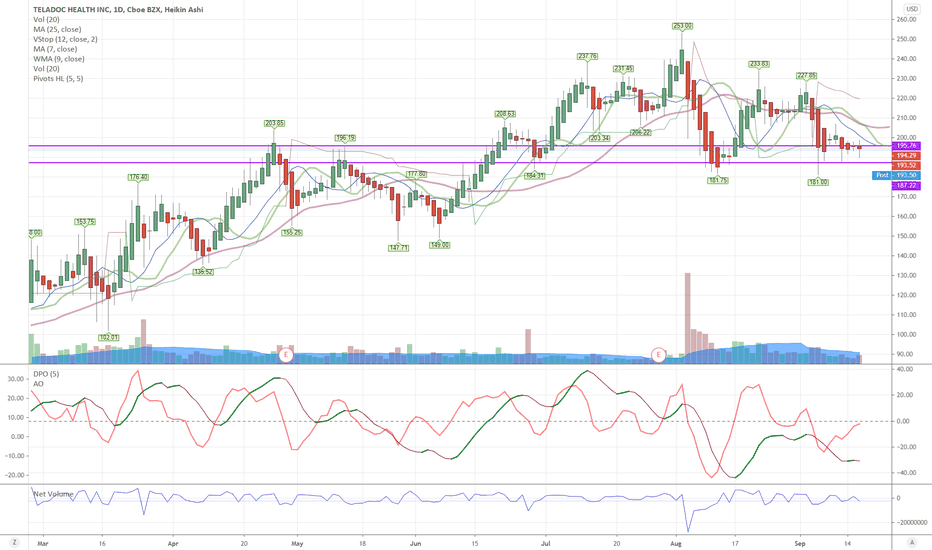

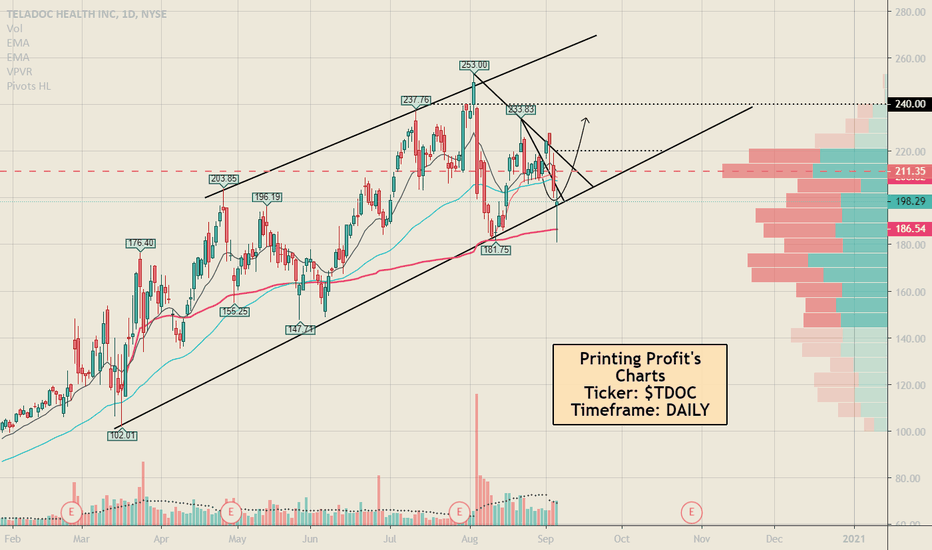

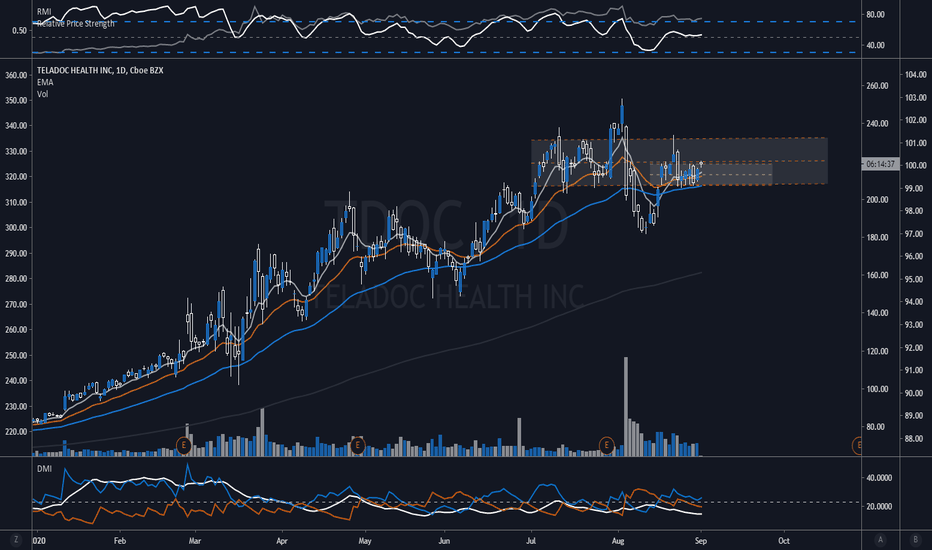

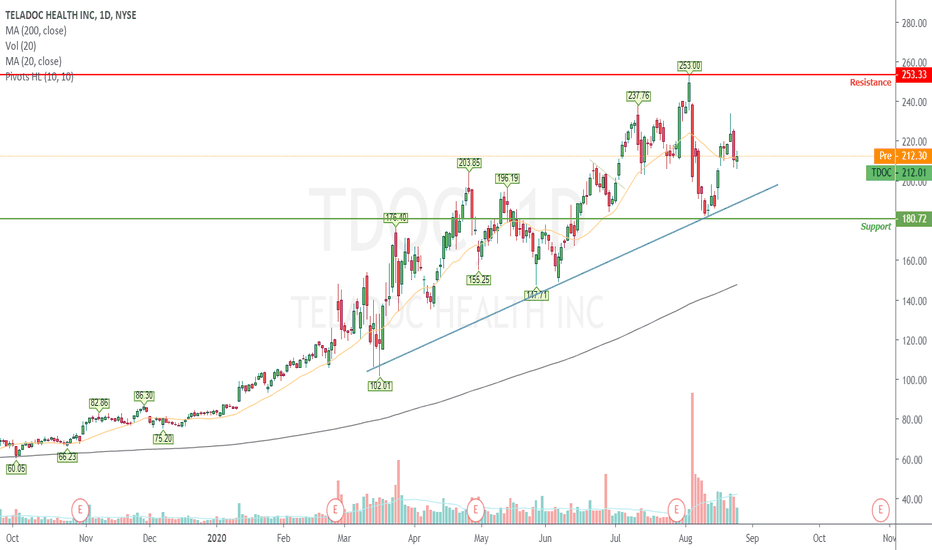

TDOC: Looks primed to go on another runI took a long position in TDOC last Thursday in anticipation of the break of 199 resistance and was able to capitalize on a nice 10 point move on Friday. However, the move was short-lived as TDOC sold off with the rest of the market but it did find support at 199 demand zone. We got a decent close on Friday but still need to break above 212 level which is coincidentally the break of high volume node and 50 DMA to confirm the breakout. $TDOC, $LVGO, and several telemedicine names have seen monstrous accumulation these past few weeks and with the resurgence of COVID cases in Europe, I can see these names moving 15% in the coming weeks and eventually retest all-time highs. I added a small long position on Friday and will add more once the breakout is confirmed. The above ideas are my own and should not be considered as investment advice. Please do your own due diligence before investing.

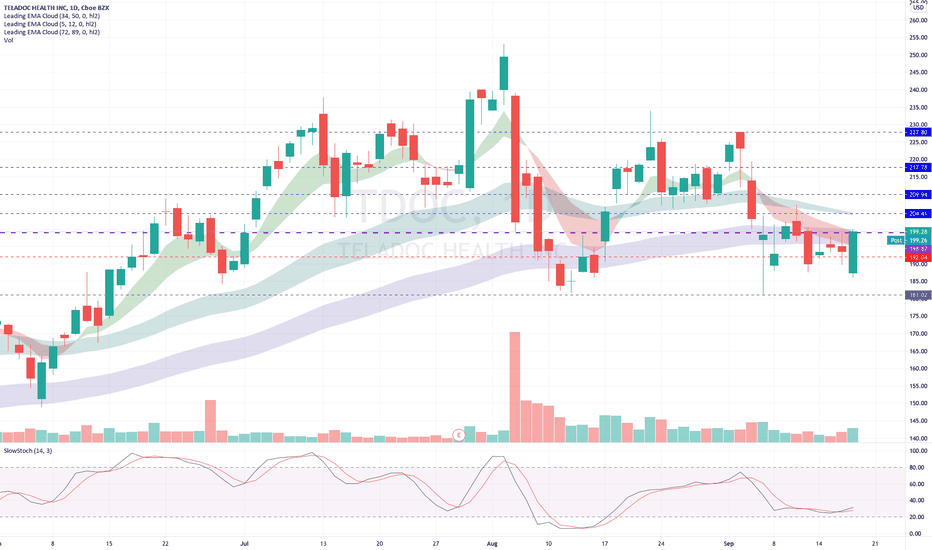

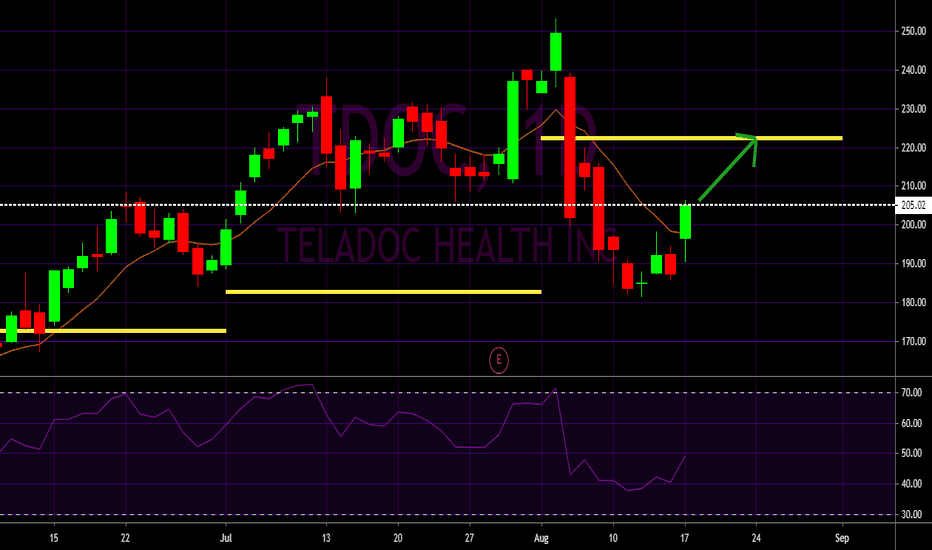

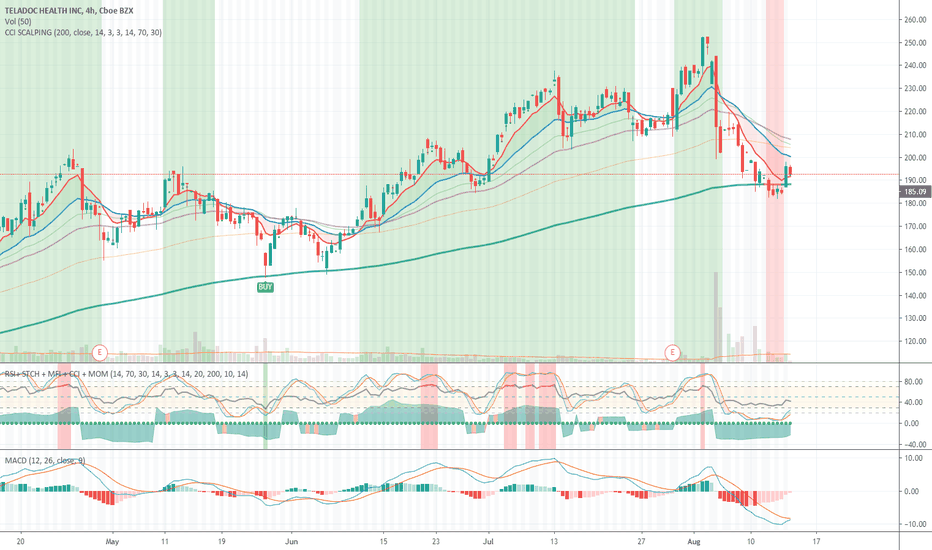

Bullish engulfing and oversoldAfter completing what looks like a head and shoulders pattern, a bullish engulfing on the daily candle may signal a reversal when paired with the SlowStoch indicating an oversold condition. A retest would confirm and make a base for nice entry on good market conditions. Note LVGO follows TDOC.

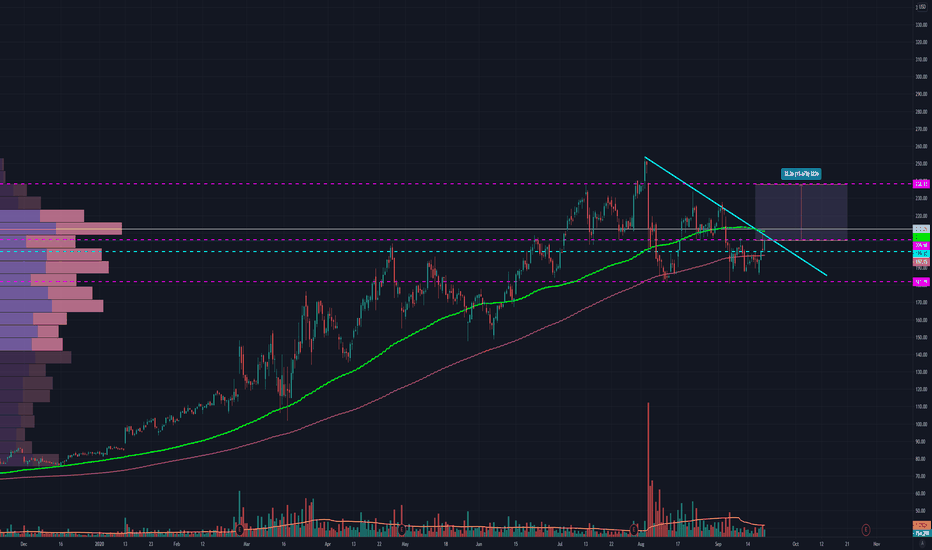

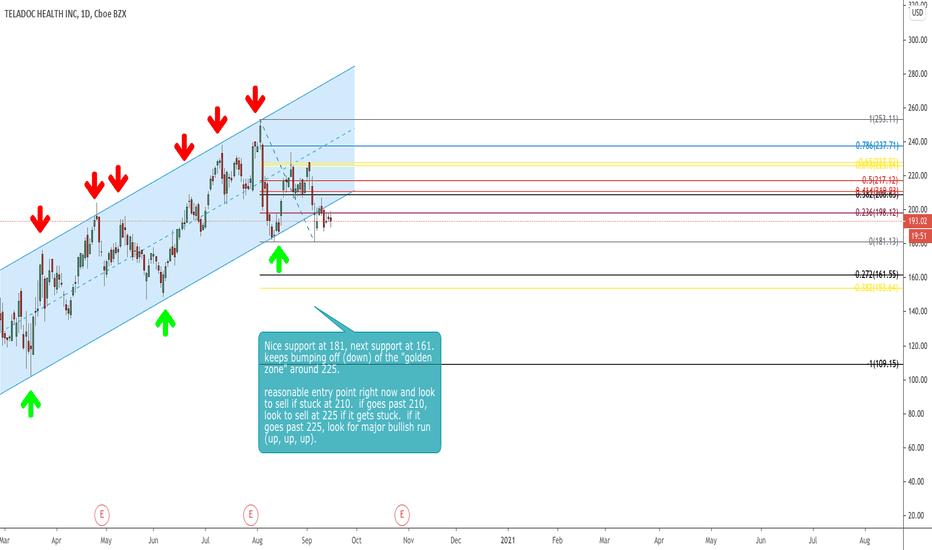

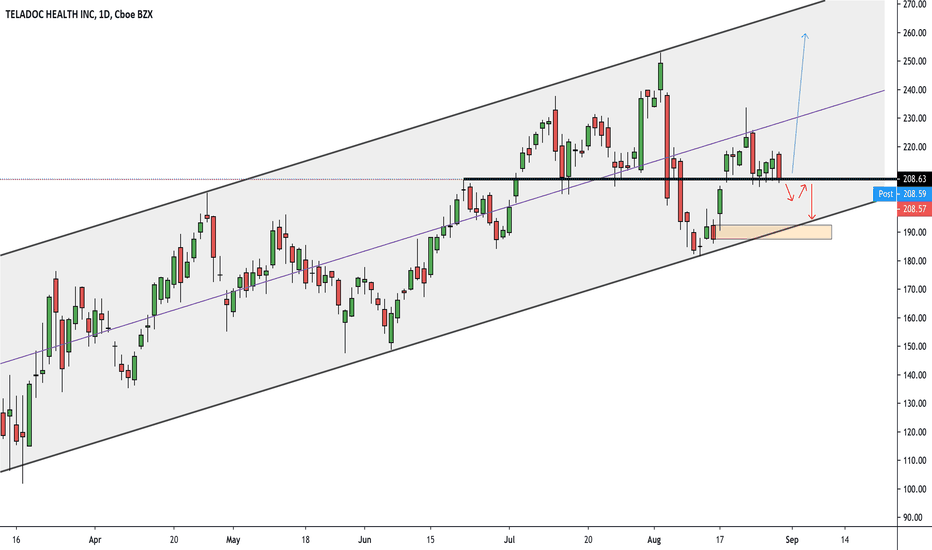

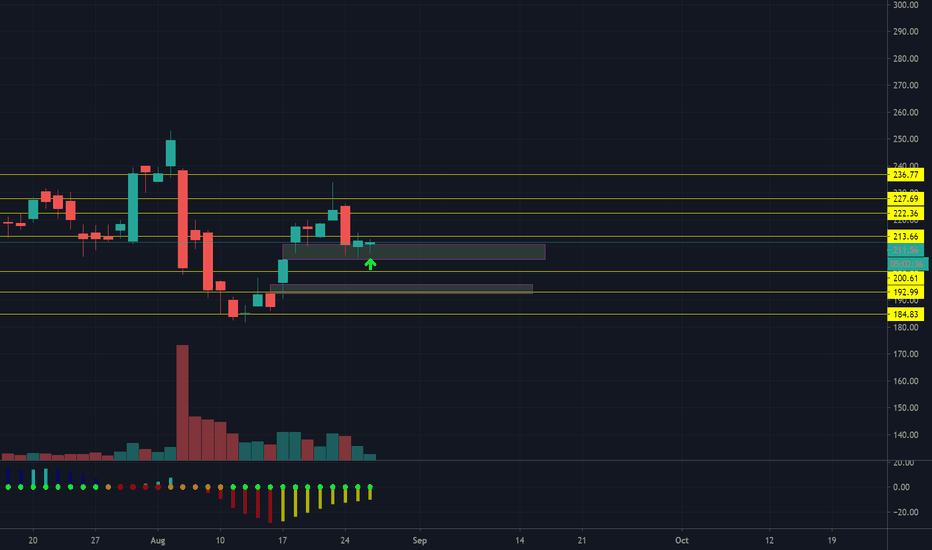

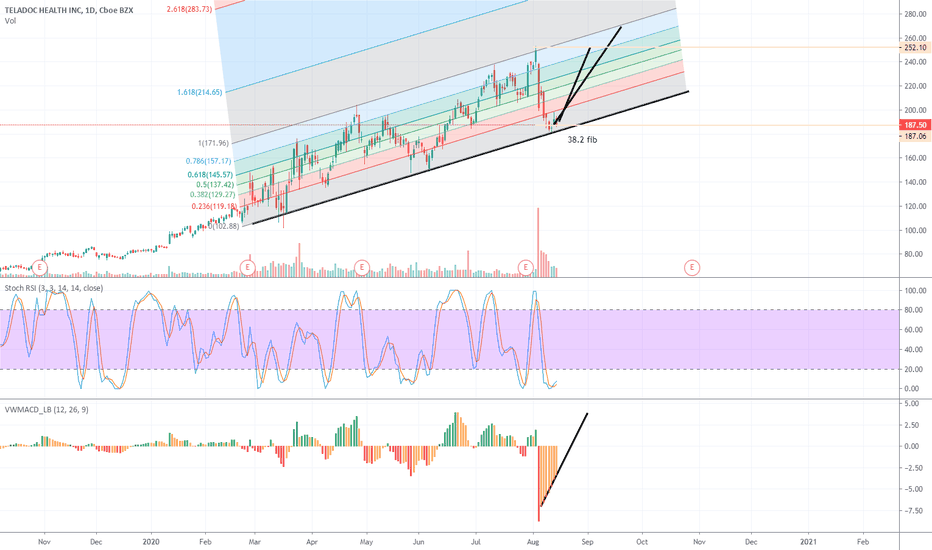

TDOC bullish using fib extension for entry/exits. Nice support at 181, next support at 161. keeps bumping off (down) of the "golden zone" around 225.

reasonable entry point right now and look to sell if stuck at 210. if goes past 210, look to sell at 225 if it gets stuck. if it goes past 225, look for major bullish run (up, up, up).

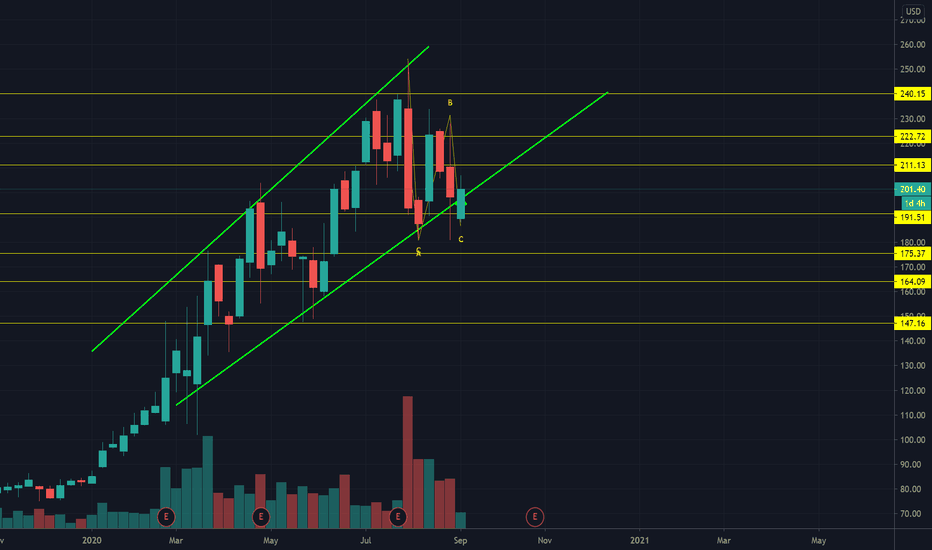

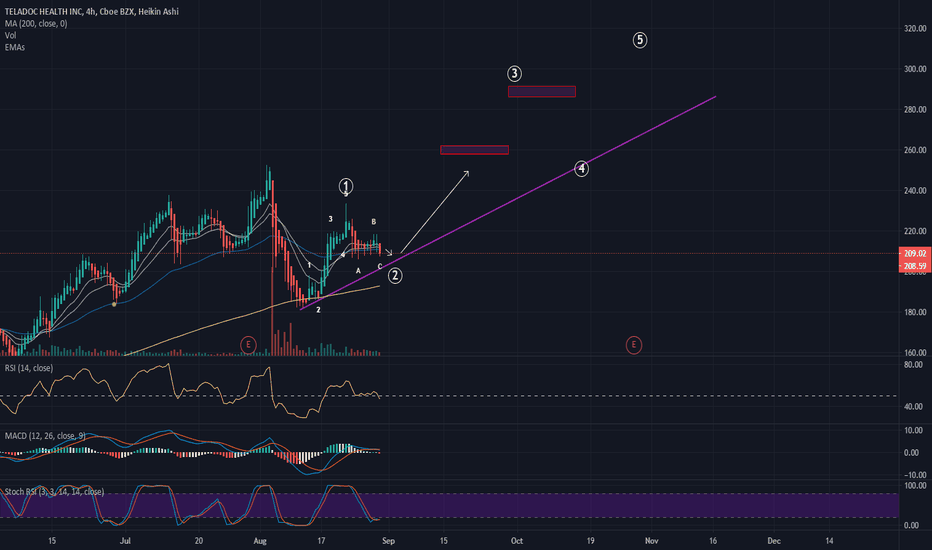

TDOC target 275Moving along the upward trend channel. Having spent Aug consolidating in megaphone, TDOC looks ready to breakout to the upside. Measured move to 275-285.

Position: Long

Disclaimer: These should be seen as the commentator's Notes to Self. Hopefully educational but aiming for entertaining. No legal or financial liabilities should be pursued from these materials.

TDOC - LONG Idea- After a recent pullback (news of merger with LIVONGO), price has closed above the 20ma again and looking attractive to jump on the trend or add to existing positions ( LINK BELOW of intial trade)

-- MANAGE YOUR RISK - -

Disclaimer: All ideas are my opinion and should not be taken as financial advice.

NYSE:TDOC

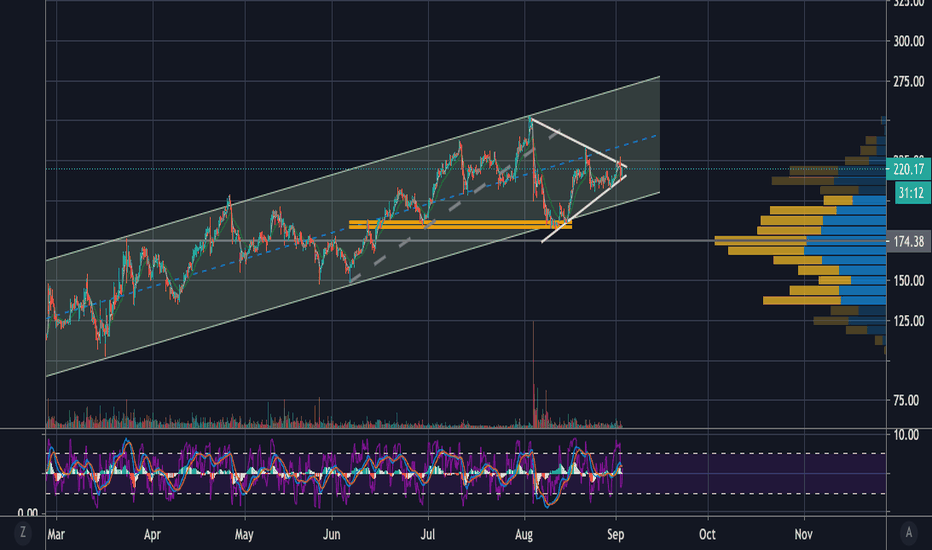

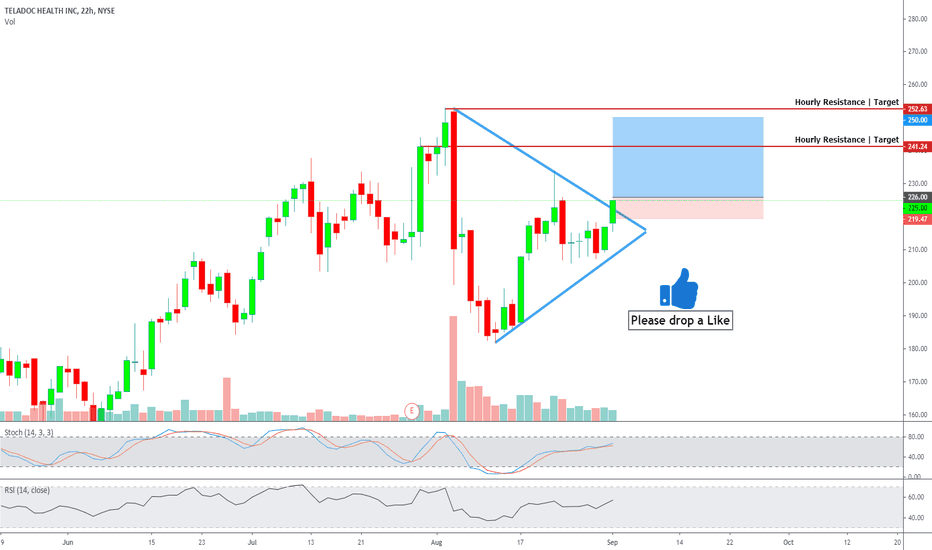

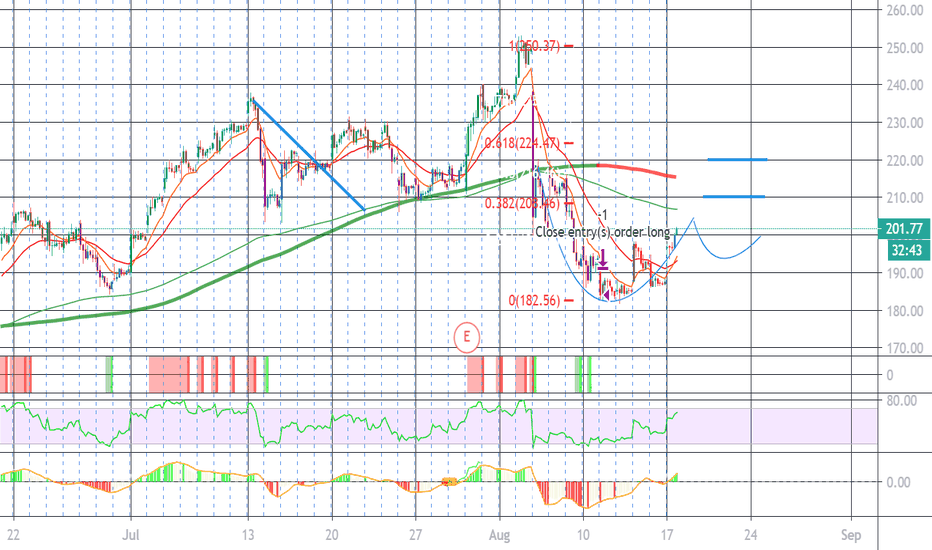

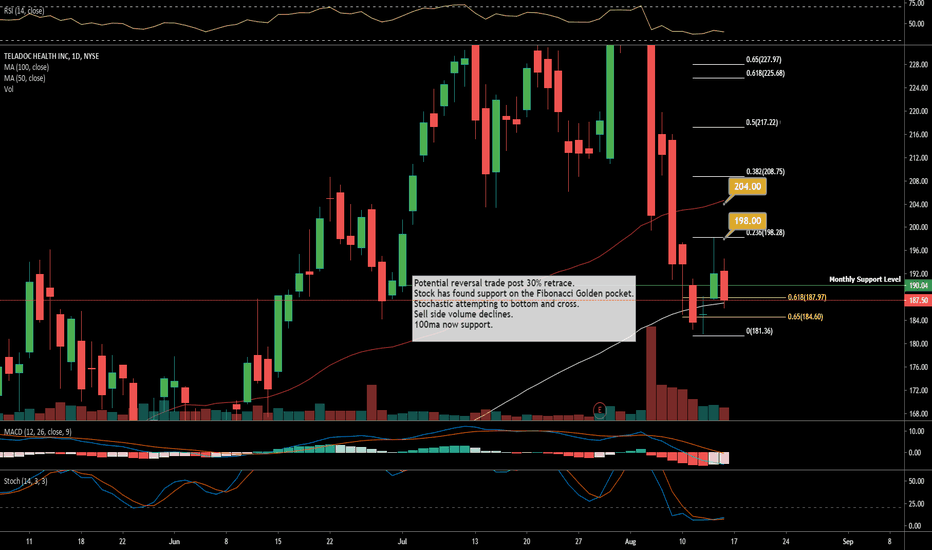

$TDOC Teladoc Reversal Targets

Potential reversal trade post 30% retrace.

Stock has found support on the Fibonacci Golden pocket.

Stochastic attempting to bottom and cross.

Sell side volume declines.

100ma now support.

$198-$204 potential target range short term

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

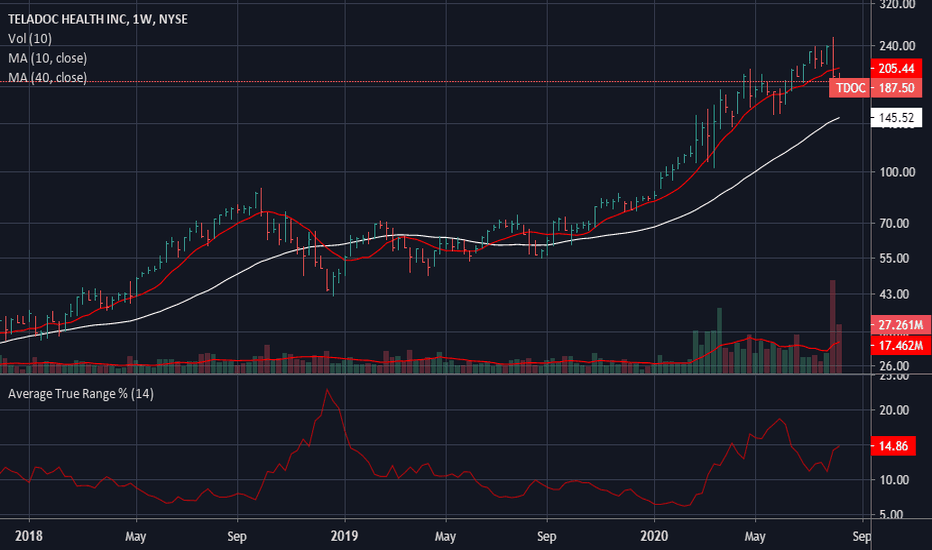

Downside Risk: TDOC Broke 10 WMA in 225% VolumeTDOC, which is a darling in the Covid pandemic has downside ride because of the break of the 10 week moving average. This is highly risky because they are currently in negative cash flow with a yearly estimated EPS of -$1.36/share. If the bull trend continues would not be surprise of a quick recovery in about 3 week by hitting the 40WMA of about $150 then bouncing back.

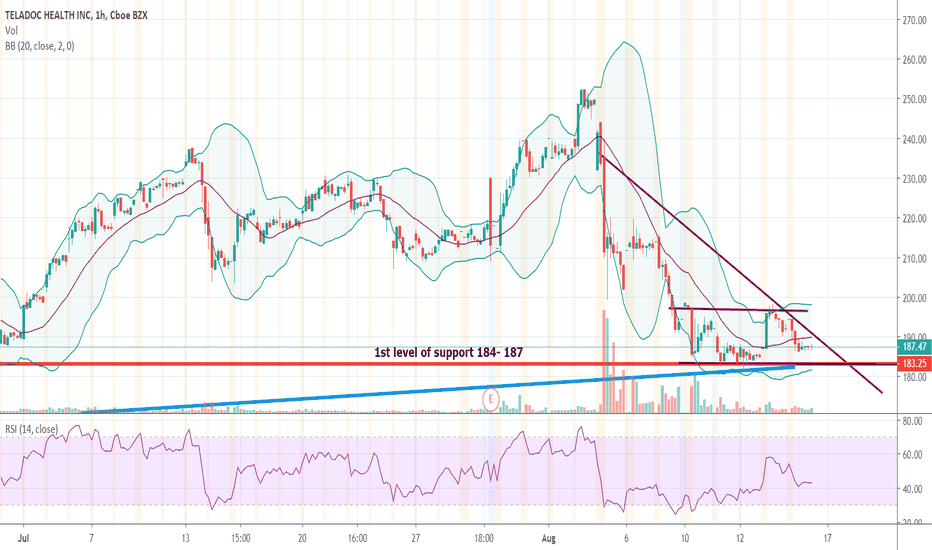

Bullish moving to 200 this weekTested support 3 times at low 180s failed to break, shorts gave us a head fake last week with a big bullish candle and are trying to bring the price back down, however, the selling pressure is not there anymore. Waiting for it to break over the top Bollinger band and this will pop over 200 and stay there.