TGT trade ideas

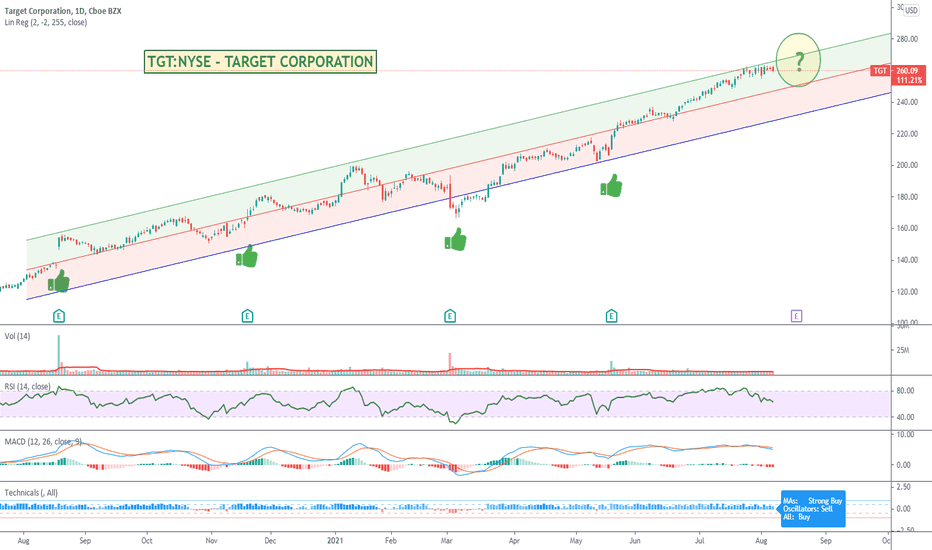

Target: From a loser to a big winnerNYSE:TGT

Target went against the consensus and proved it worthwhile to invest in physical stores

Four years after disappointing investors with its decision to prioritize traditional branches, the retail giant is enjoying a steady rise in revenue, which soared during the pandemic.

At the heart of the strategy: listening to customers and better training employees.

When Target announced its strategy in 2017 to give priority to physical stores to fight Amazon, investors did not try to hide their disappointment.

Apparently, on the day that $7 billion was allocated to promote this strategy, the American retail company’s share fell by 12%.

Four years later, few on Wall Street doubt the justification for investing.

While consumers have abandoned malls and department stores since the plague broke out, they have flocked to Target’s huge, bright, and organized stores.

Last year, revenues jumped 20 percent to $93.6 billion, led by the movement of shoppers in physical stores as well as online commerce.

The company’s stock has soared 170% since Corona’s restrictions began in March 2020, and last week its market capitalization climbed to $130 billion.

Target, which opened its first branch in 1962 in Minnesota, did not always enjoy the sympathy of the public.

In 2013, it went through a difficult period, when the customers’ personal details were revealed in a cyberattack, and at the same time, it began a failed expansion operation in Canada. A year later, Brian Cornell, former CEO of Walmart’s Sam’s Club, was named CEO, with the goal of leading the change.

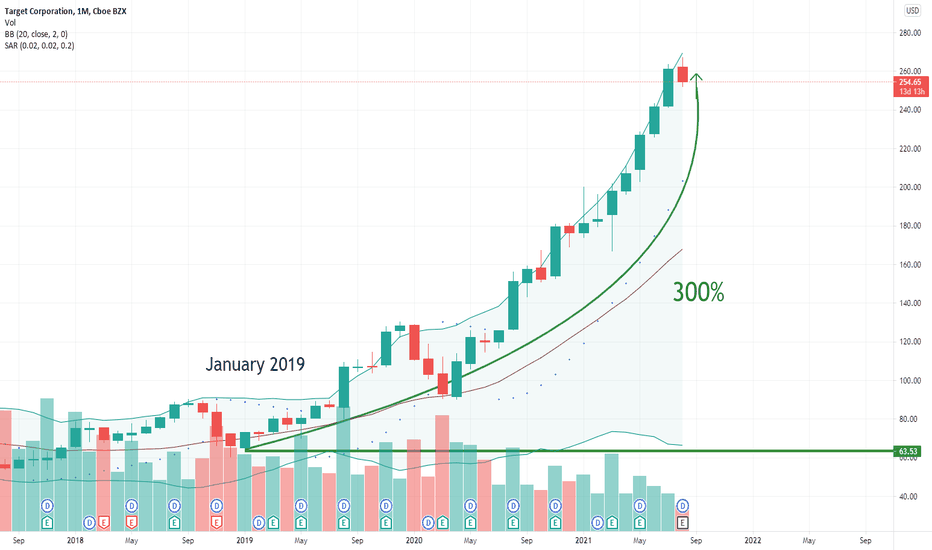

Target Stock Price: 300% within 2 and a half years.

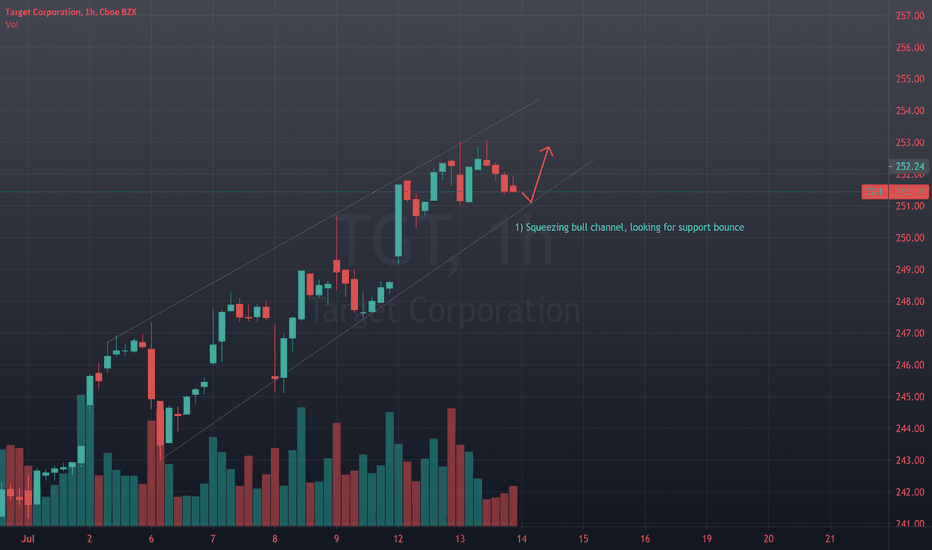

🚀 Target with next Leg up ? 🚀 NYSE:TGT

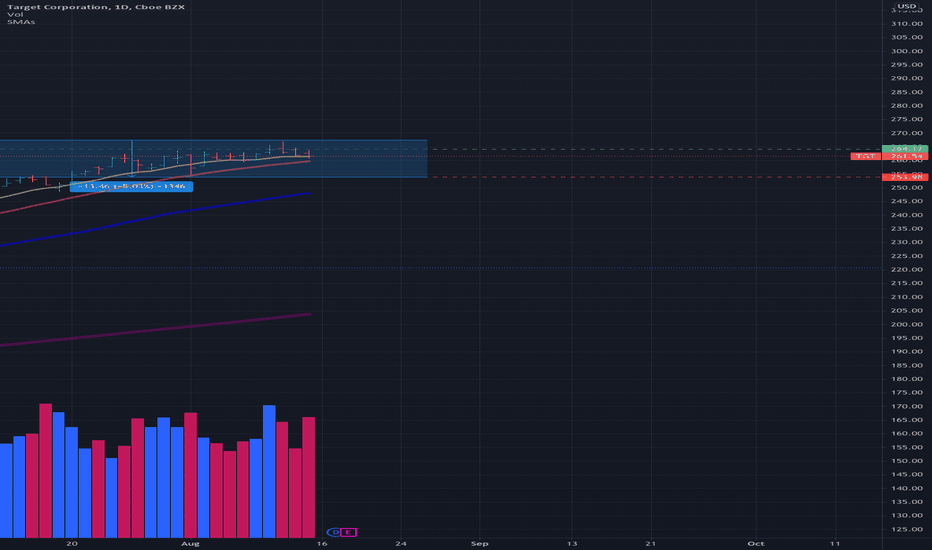

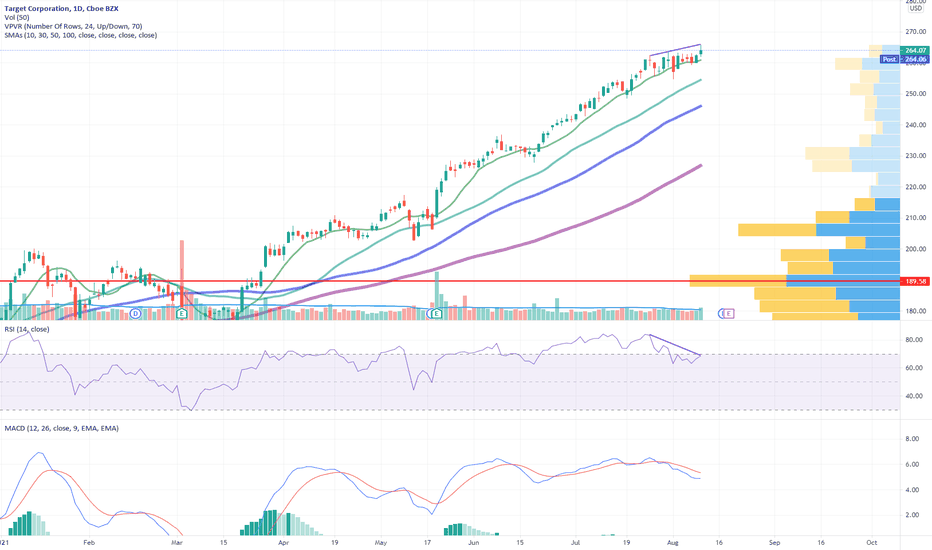

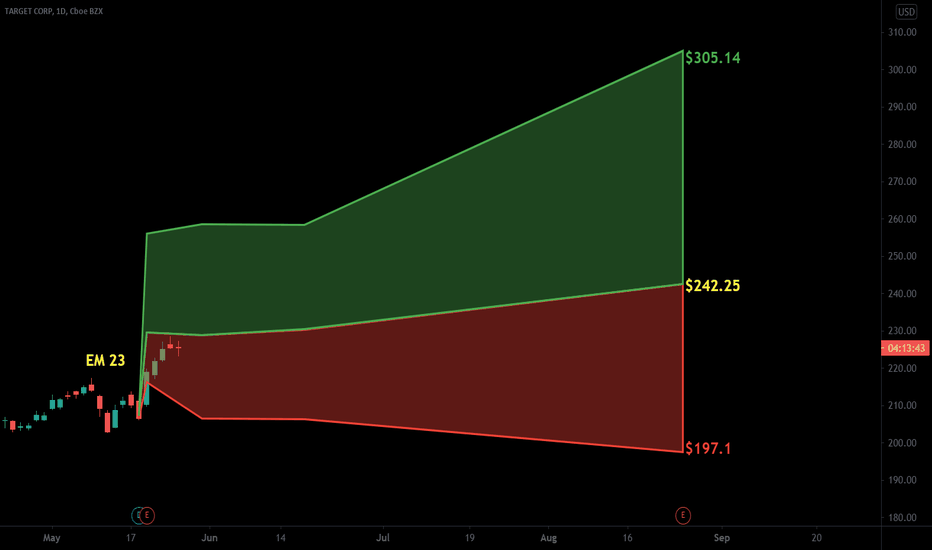

Today I want to talk a little bit about Target. As one can see this stock is in a strong upward moving trend. Since the last 52 weeks high which is around 267,23 the stock corrected by 5% and created a base between 267,23 and 253,98.

Trading Idea:

Long above 264,20 with as Stop Loss below 252,42

Important:

- Pay attention to the earnings and dividends date which are on 17th and 18th of August

Gaming Plan Best Case:

If TGT breaks out above 264,20 one can place first profit target order at 287,76 and self half there. If the first profit target order is hit, one can move the stop to breakeven. My second profit target would be around 300. Of course one can only use one profit target to sell half and use the other half to play for a bigger move.

Gaming Plan Worst Case:

If the stock squats i would prefer to sell half of the position around 258,60 and the second half at 252,42

---

You liked my idea ?

Follow me in TradingView, will try to have interesting Streams once per Week.

You are also very welcome to post your suggestions and topics for my strams.

P.S: For educational purposes only, not trading advice

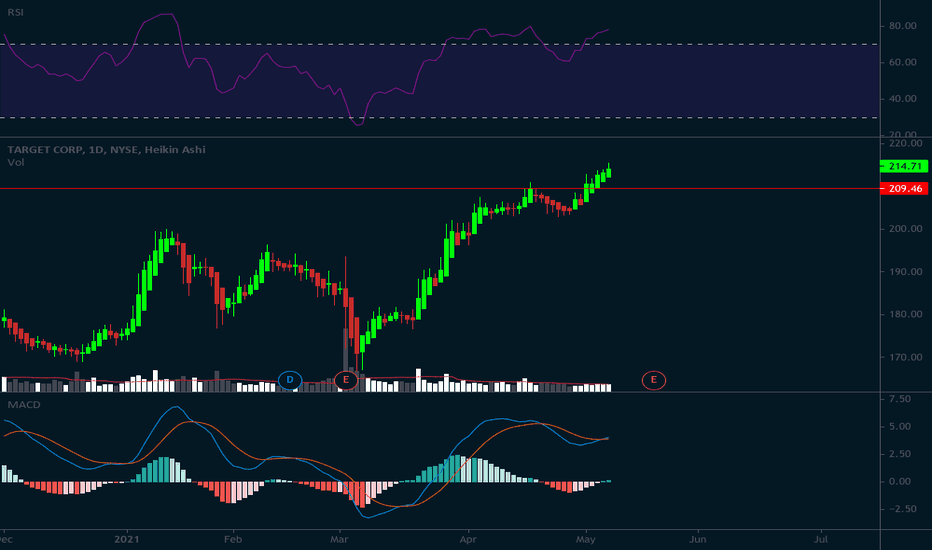

Target Is Approaching Earnings. Boom or Doom ?Target has had a pretty good record recently of continuing its upward move on earnings or shortly after. Its just topped a 100% return for the year.

Will be interesting to see what happens this next earnings period. My vote would be on the boom side. I think it will keep going up regardless of pandemic or not.

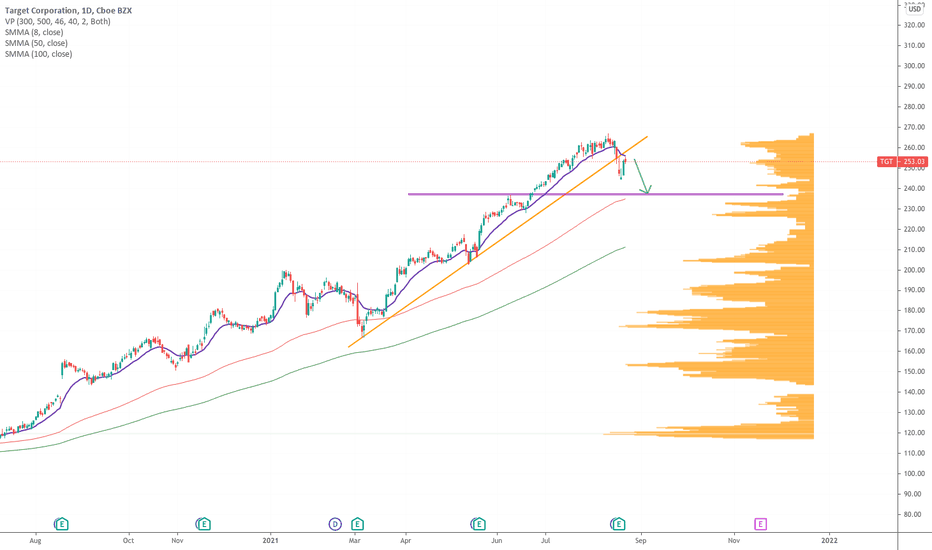

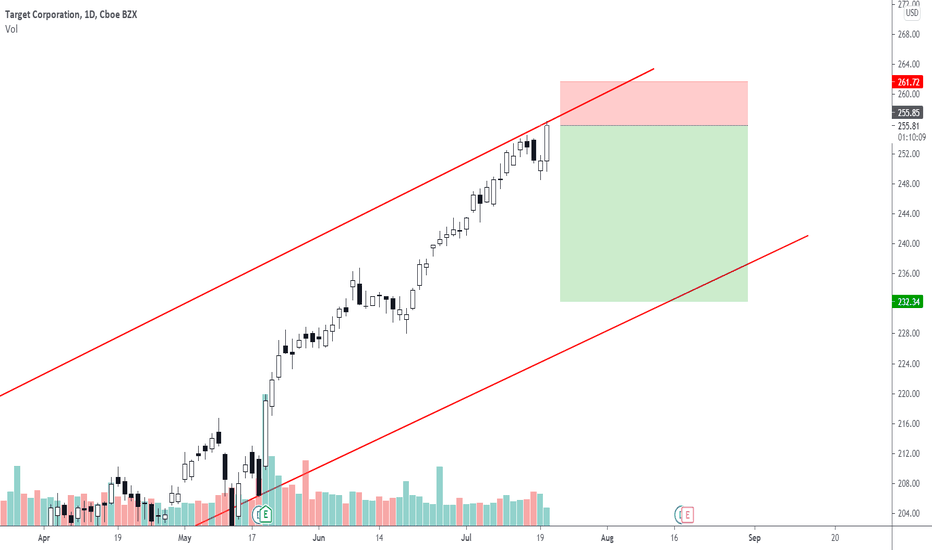

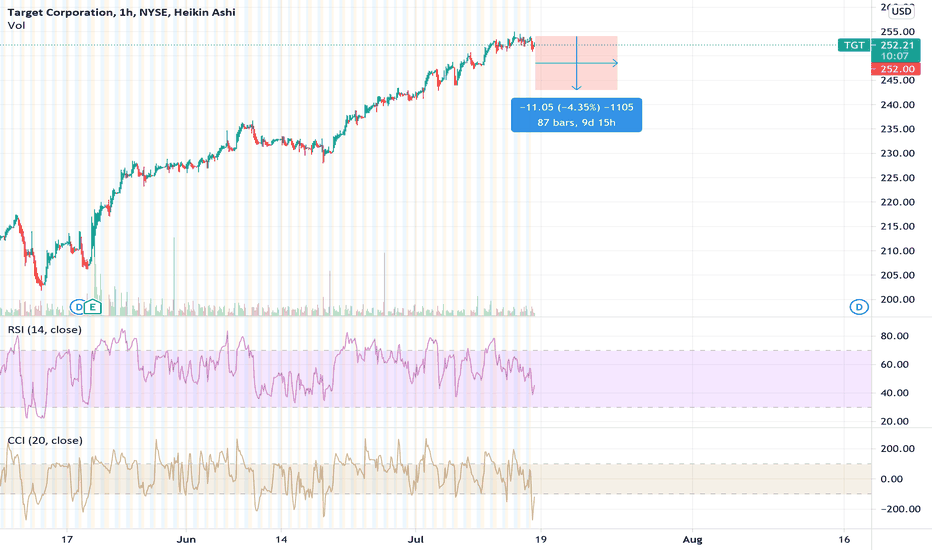

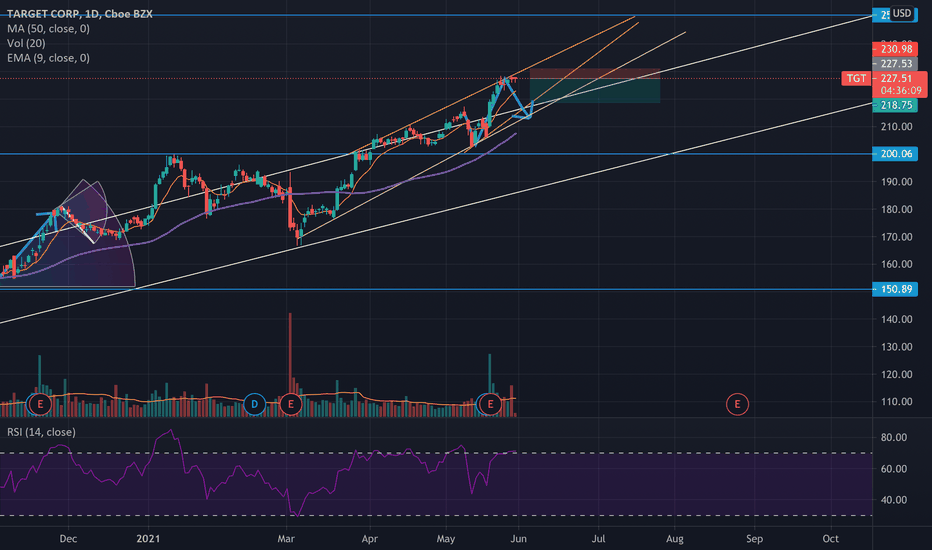

TGT rising wedgeRising wedge on weekly (Yellow line)

Rising wedge on daily (white line)

RSI overbought on weekly and daily.

MFI overbought

If they Rotate out of growth back into value this will tank hard.

First Target is daily wedge support at 247.

Second target is weekly wedge at 244

final target -25%

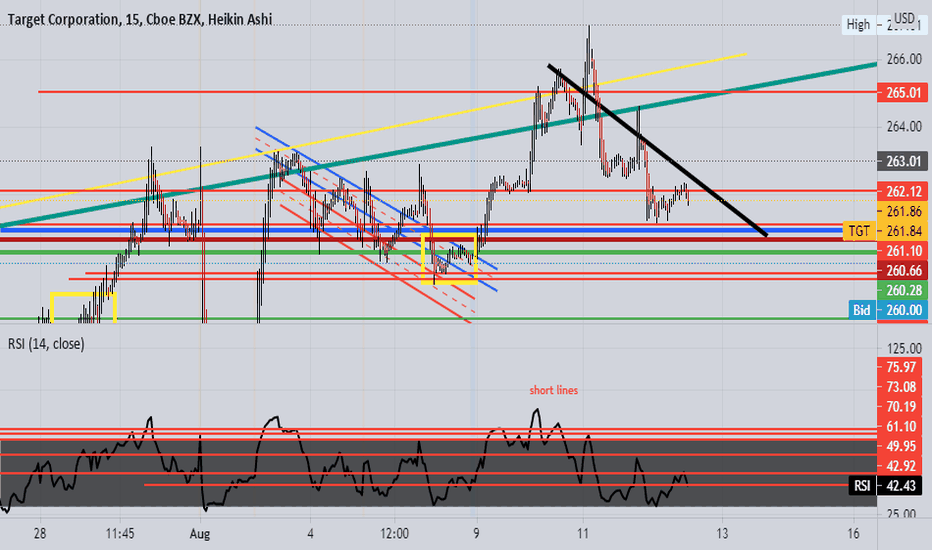

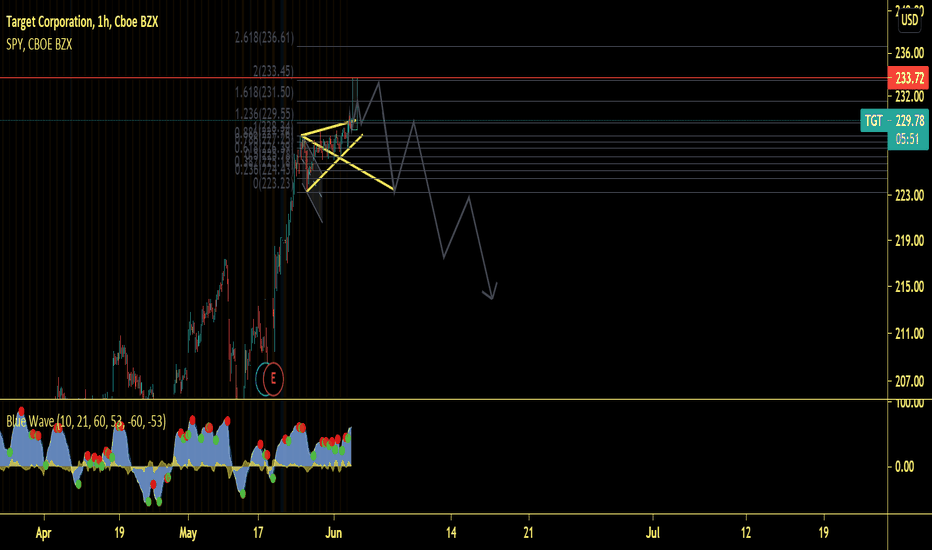

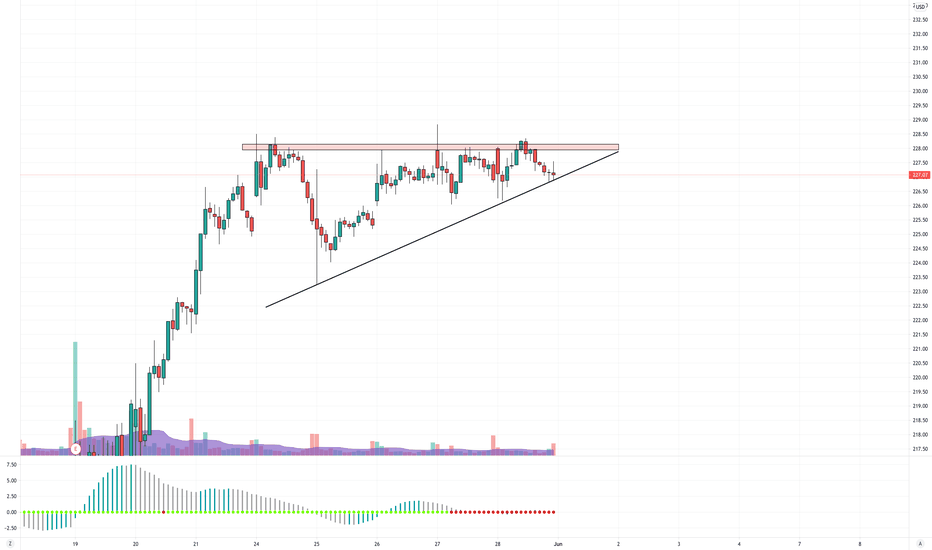

TGT Day Trade IdeaTGT seems to be forming an ascending triangle on the 30MIN TimeFrame. I like playing squeeze plays and that's exactly what TGT is doing on the 30MIN. Using the TTM Squeeze indicator you can see that it is in a moment of consolidation and looking to breakout. I'm betting that breakout to be to the upside and break TGT's current ATH. Wait for confirmation before entering which means high volume and momentum on your side. Watch what TGT does above $228.

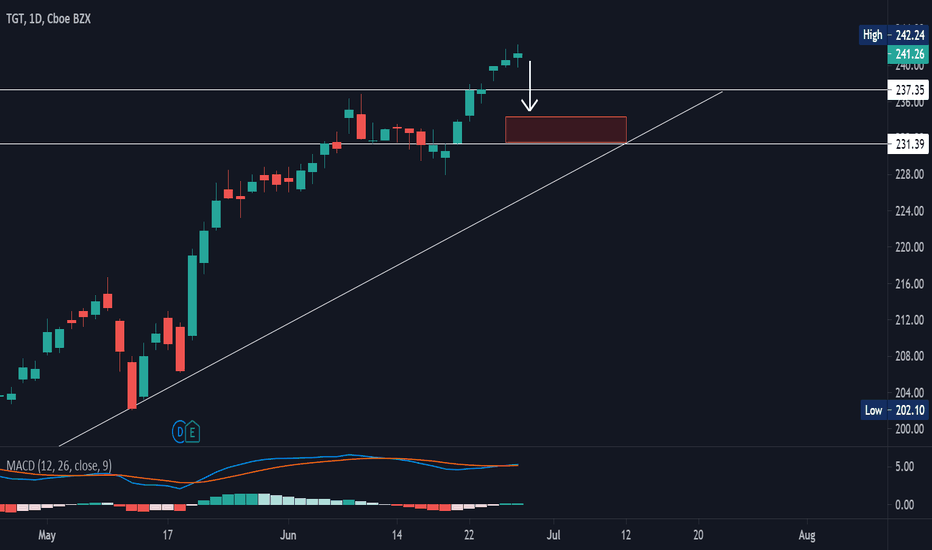

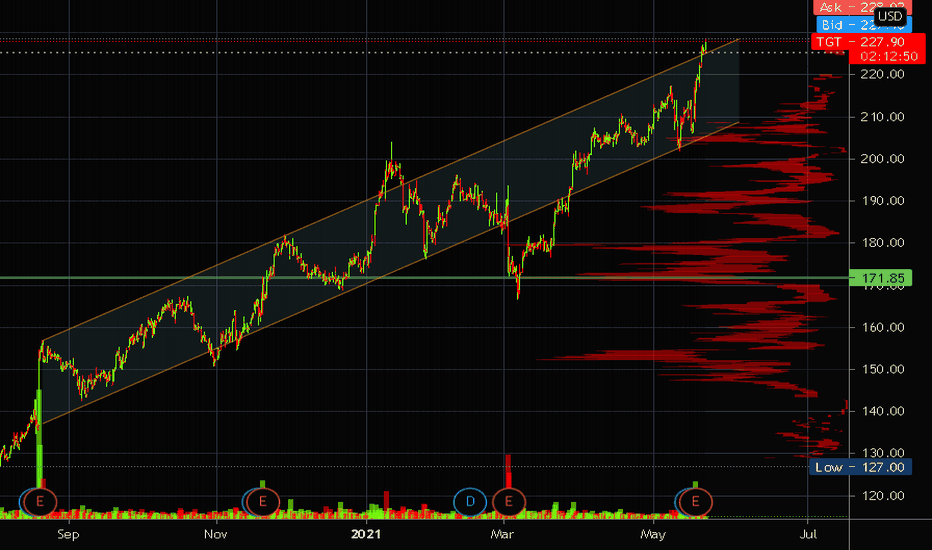

TGT bearish back down into channelTarget has been a consistent winner for a while now

Can't see it being chased too much higher...though it's of course possible

That's why I'm gonna scale into some June puts and average in while waiting for a turn back down into the makeshift channel we broke above today

I've had some success recently on these type of plays, looking to keep it going with TGT

$TGT with a Bullish outlook following its earnings #Stocks The PEAD projected a Bullish outlook for $TGT after a Positive under reaction following its earnings release placing the stock in drift A

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

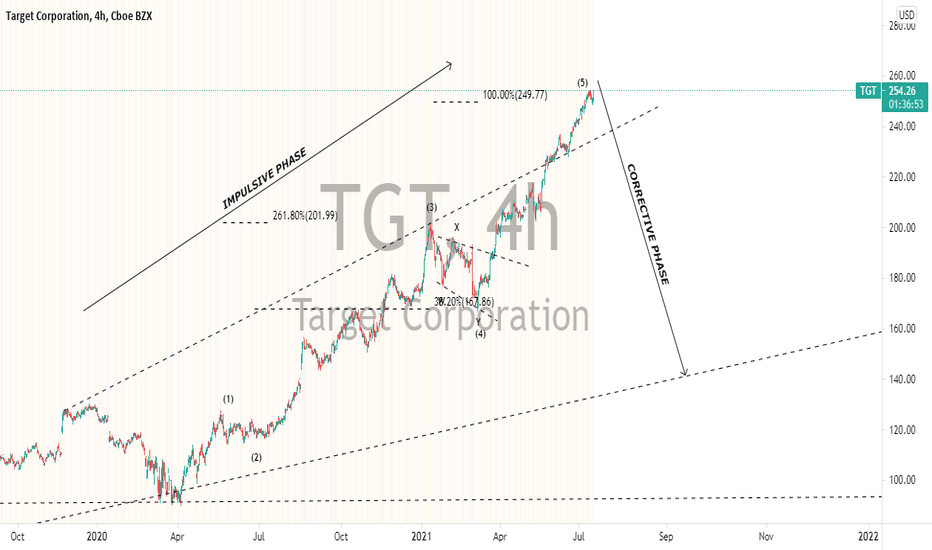

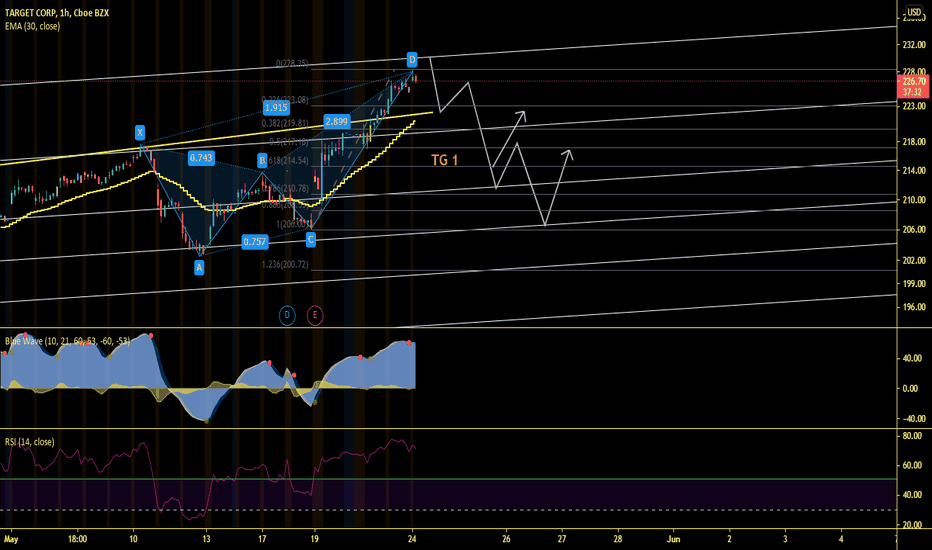

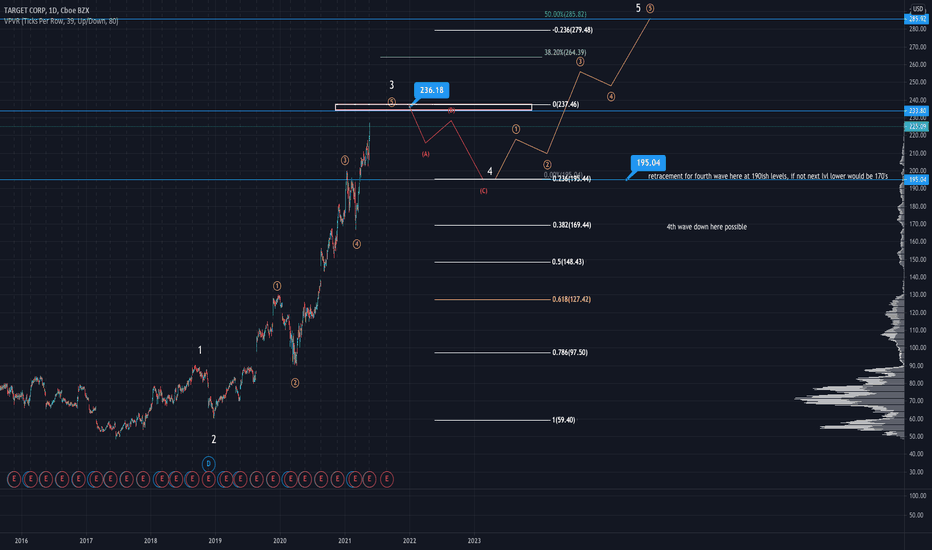

$TGT TARGET ELLIOTT WAVE ANALYSISHeres my thoughts on $TGT, we could be in a nice extended three wave which I believe might be topping sometime soon near the 230's-240's . Im still very bullish longtern. Everything else is on the chart, If anyone has questions or wants me to look at something feel free to reach out.