TGT trade ideas

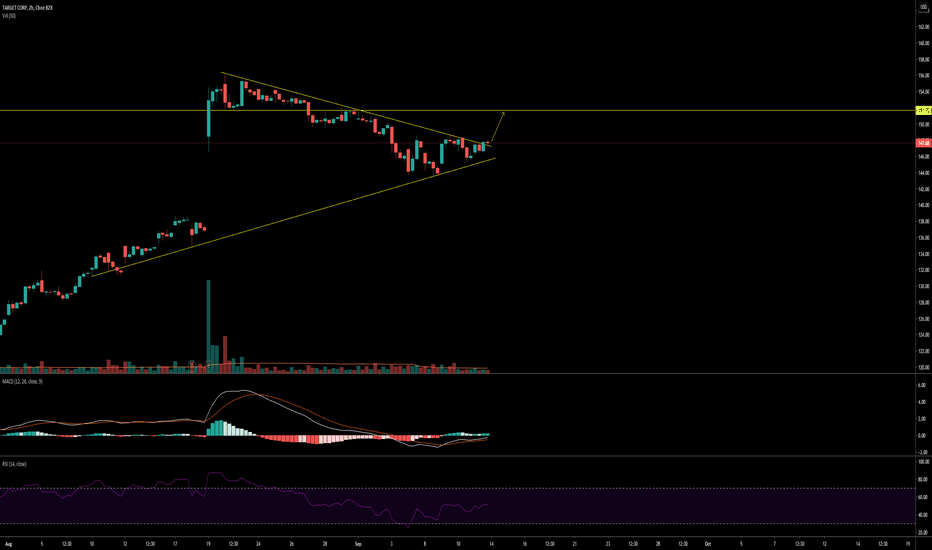

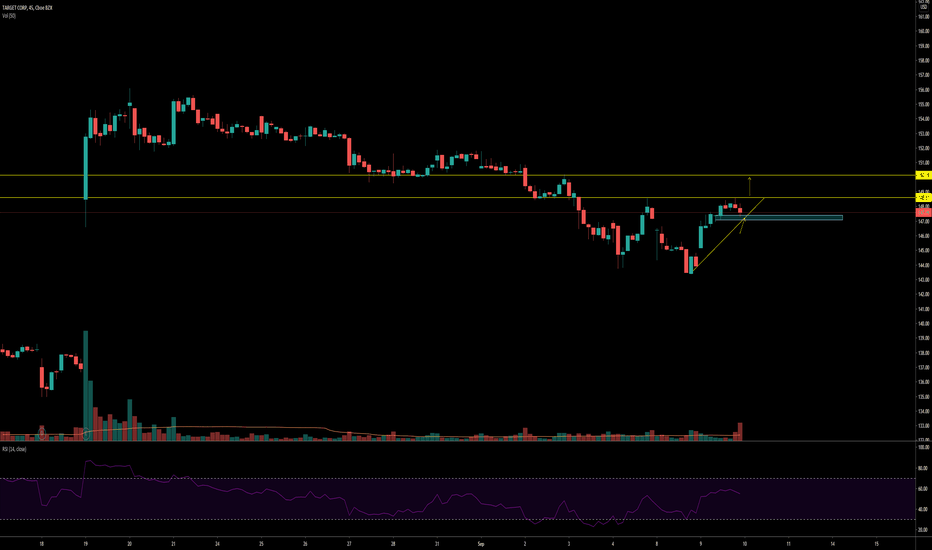

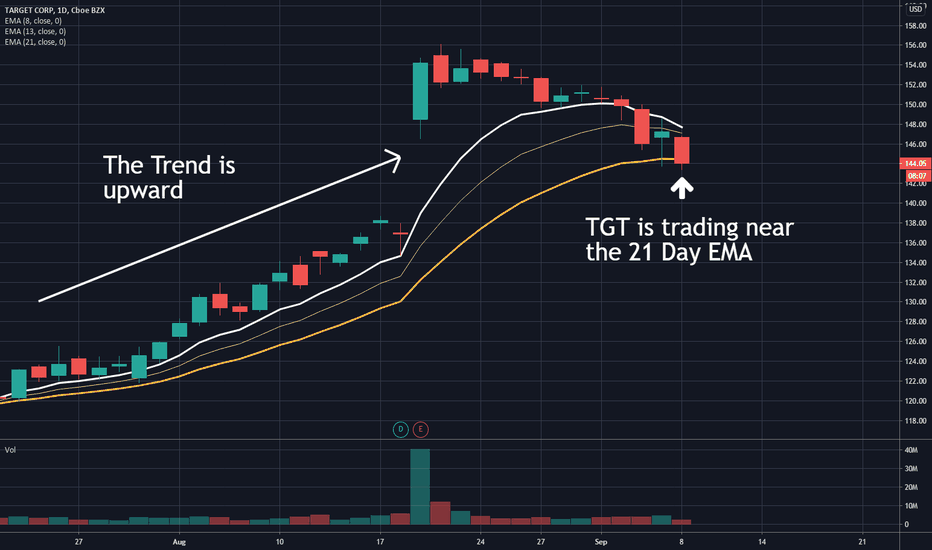

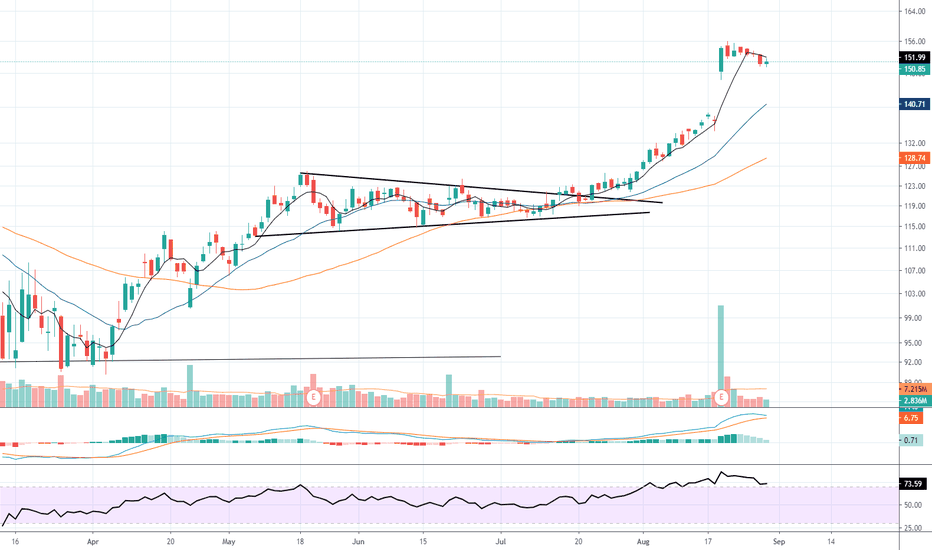

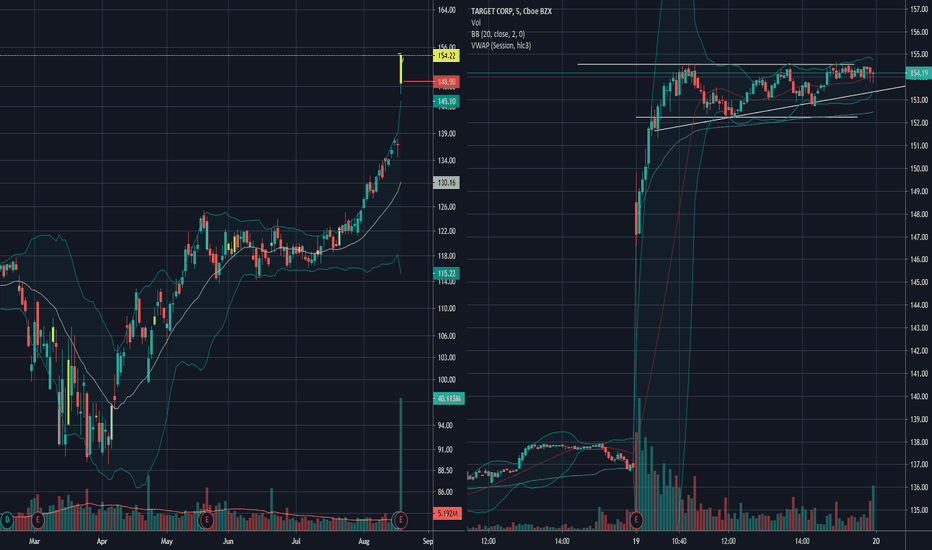

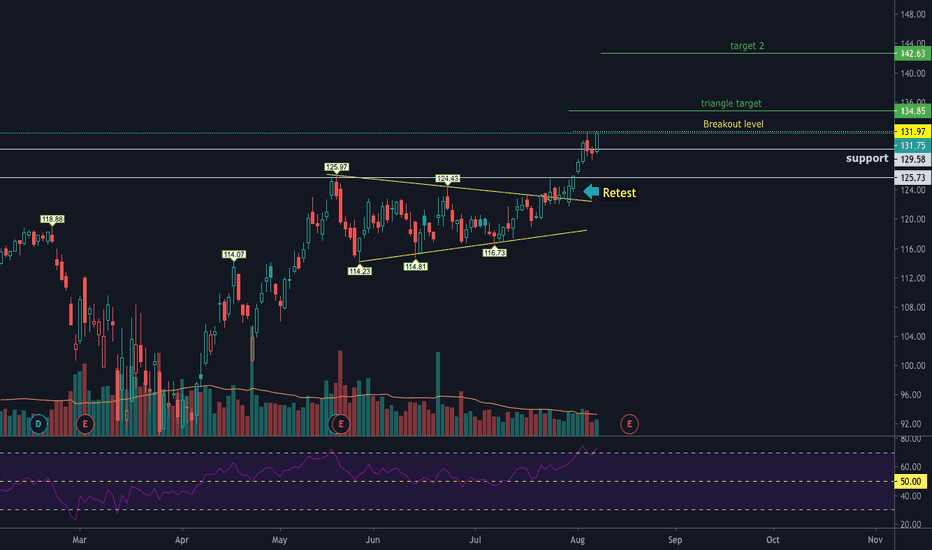

Target - Pullback tradeThe markets have been selling off over the past few days, leaving most of the sectors in the S&P 500 in the red. A stock that caught my eye today was Target. The discount store's stock prices have been trading near it's 21 day exponential moving average only dipping beneath it temporarily throughout intraday trading sessions. Despite the warning signs of what could be another big sell off, I choose to remain bullish on TGT and consider this to be a pullback trade setup. Of course, we might see price dip below the 21 as it has in the past...but that doesn't seem to be more than a day or two. If it does... then consider the possibility that Target is reversing rather than pulling back.

Options speculators should consider the chance of a broad market selloff and at think about using spreads rather than directional plays. If you are trading the stock, plan your trade and trade your plan. Only you know what you can afford.

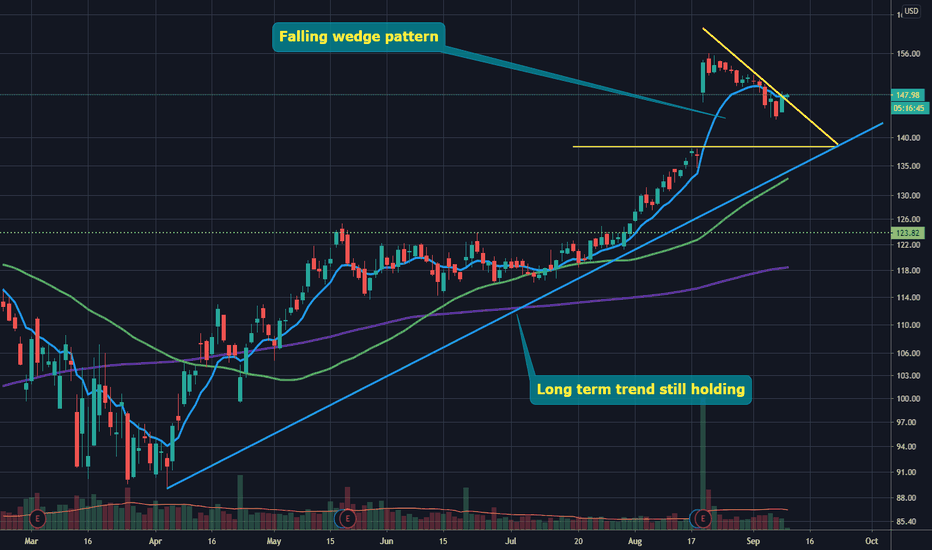

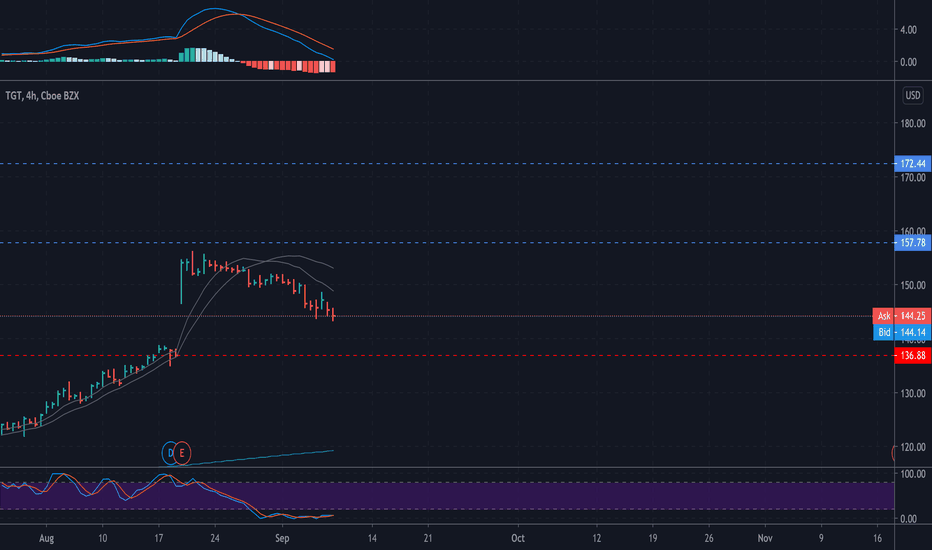

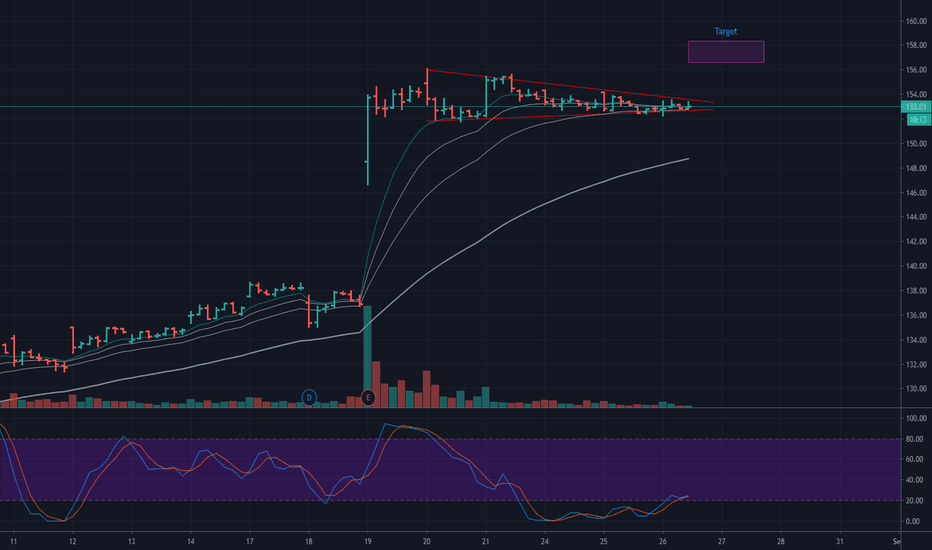

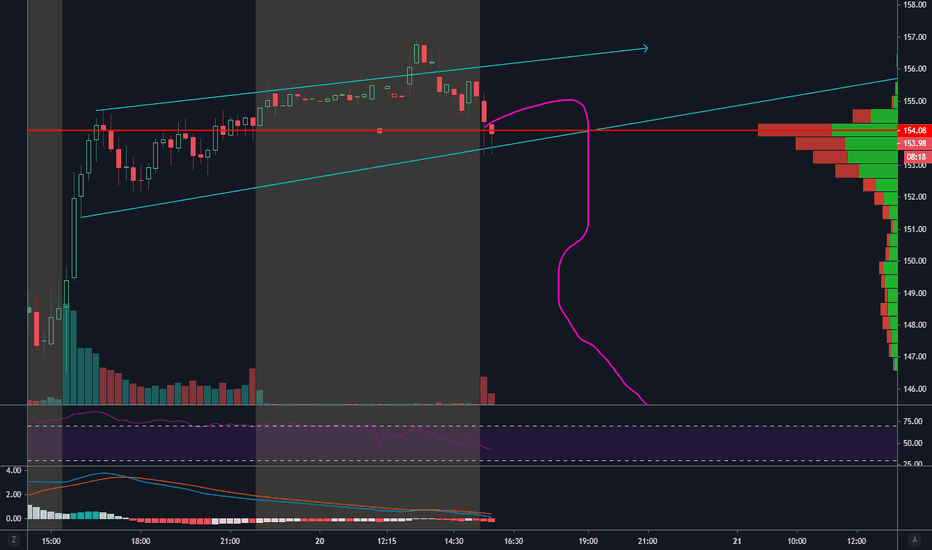

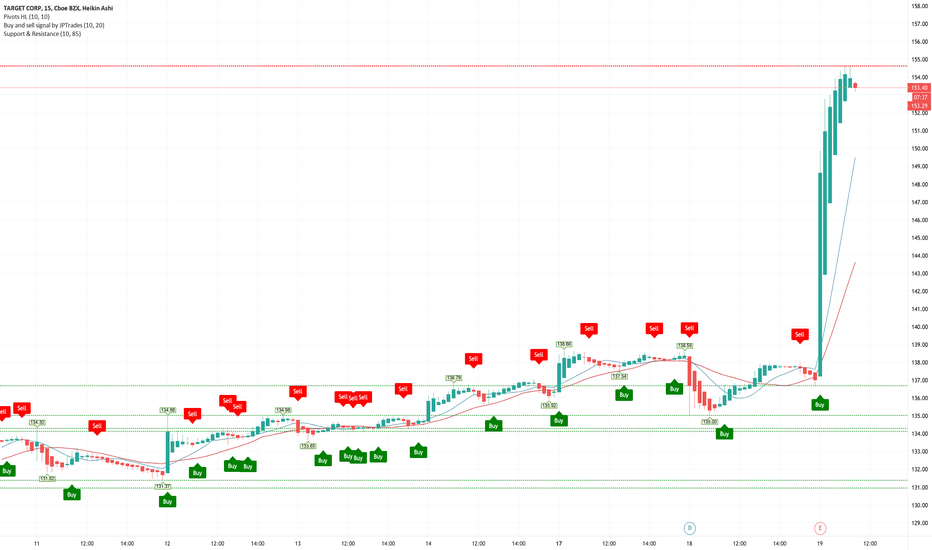

Why are you holding? When rumors are talking about JP going to make a speech.. a correction coming... you may think BUY MORE, too. But I am caution with anything with a GAP. It has to be filled sometime. And when technical indicators are giving some messages... take some profits is not a bad thing to yourself.

GL! NO FOMO, play more next time.

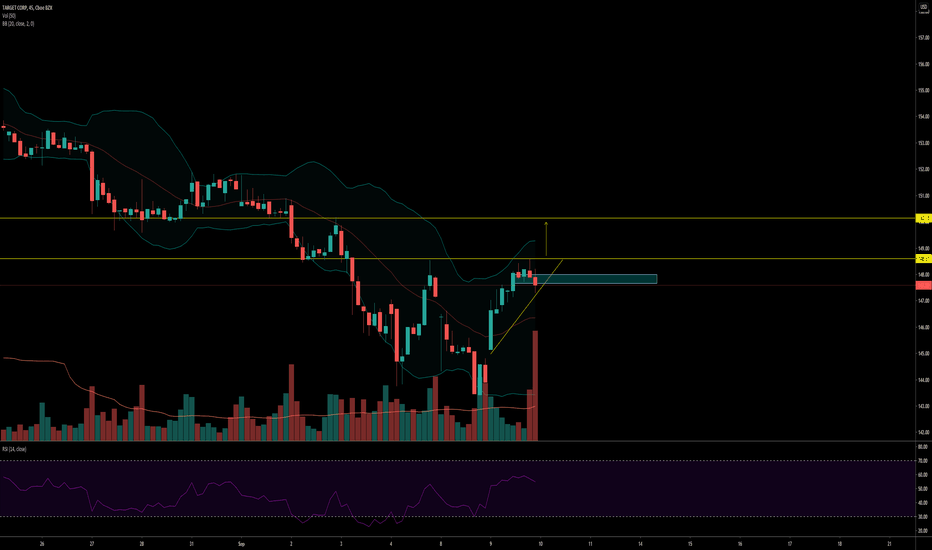

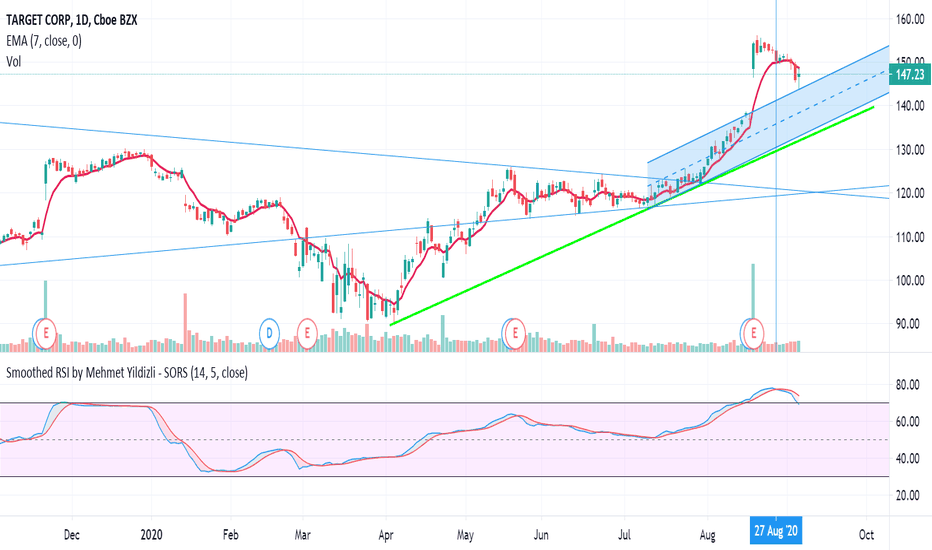

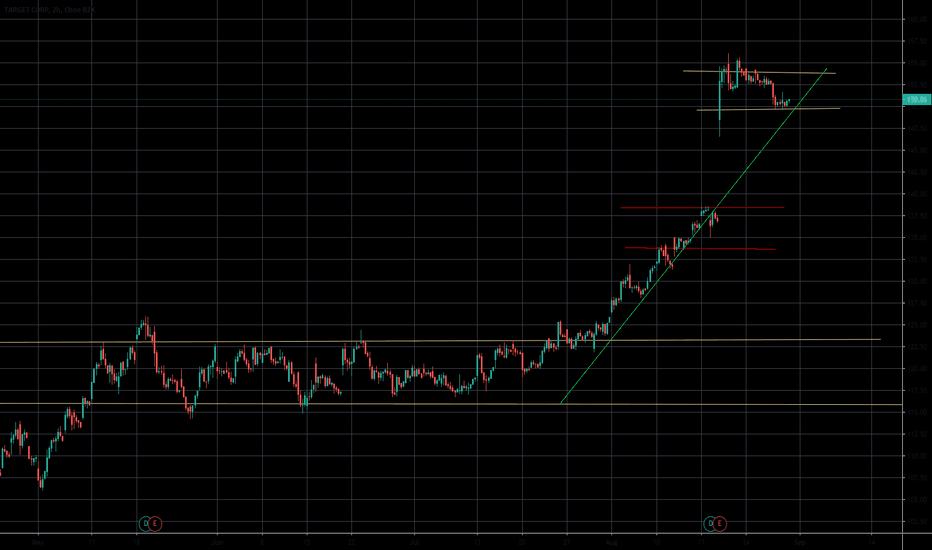

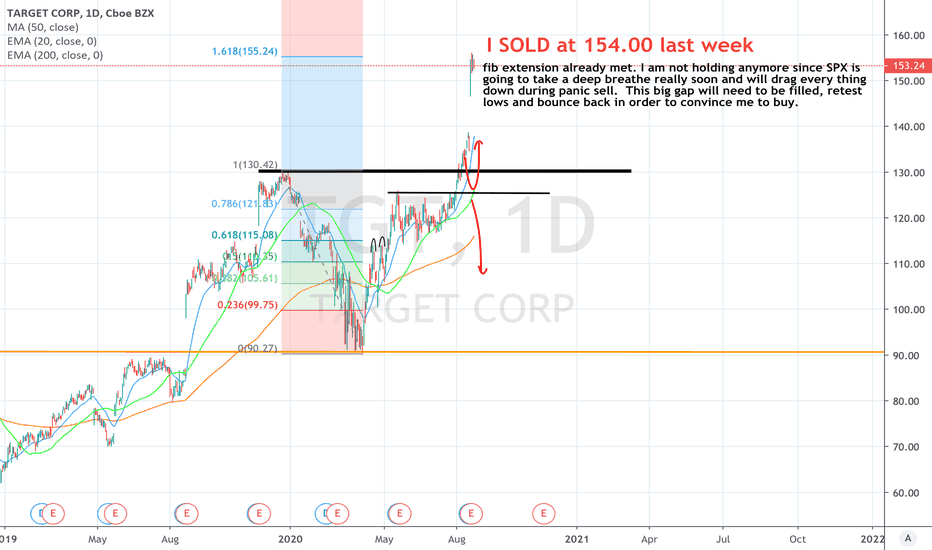

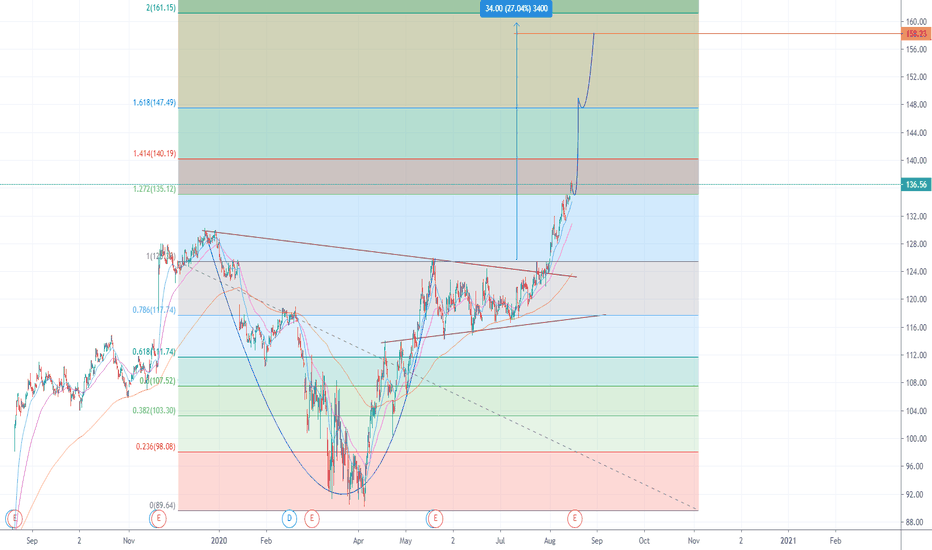

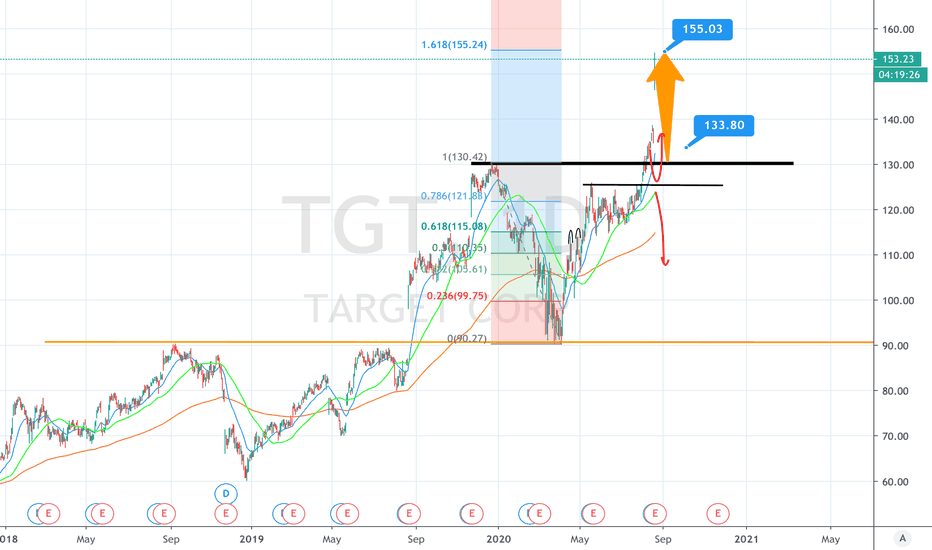

Oops I didn't post this. But worth to read below! This market is insane for retail shoppers. This stock is just playing fib extension. If you don't know what fib extension is, look it up. It has played out well for me.

M I taking profit? yes. I am taking it according to SPX500 :D My enter price is 133.80 (same time when I also bought Walmart $WMT)

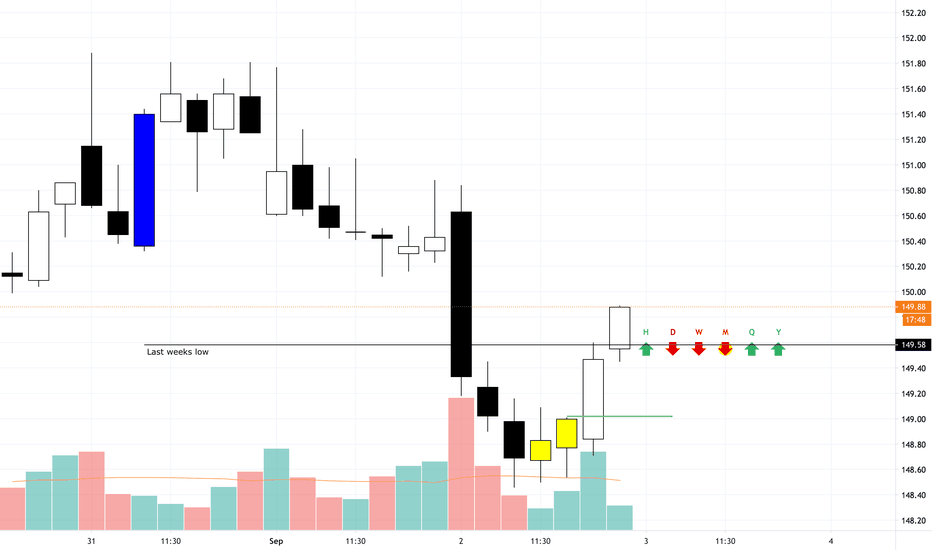

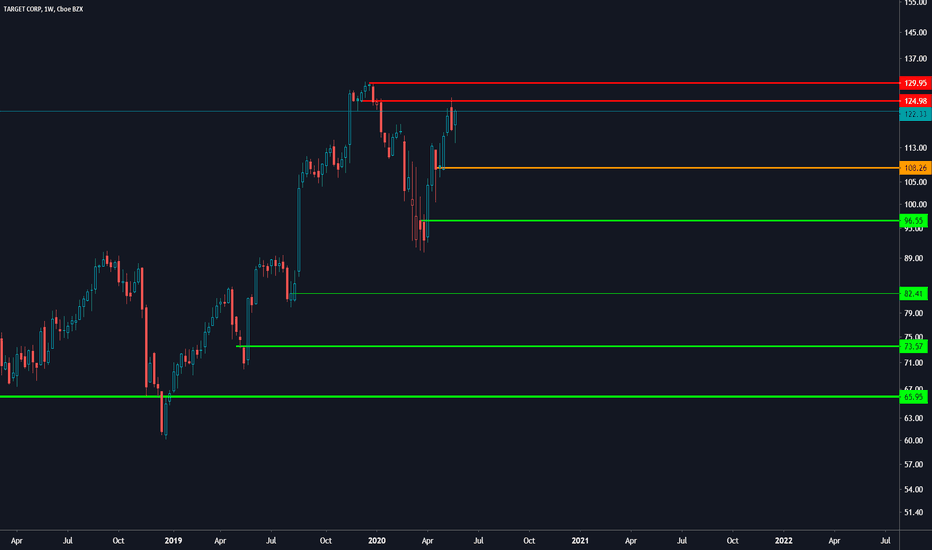

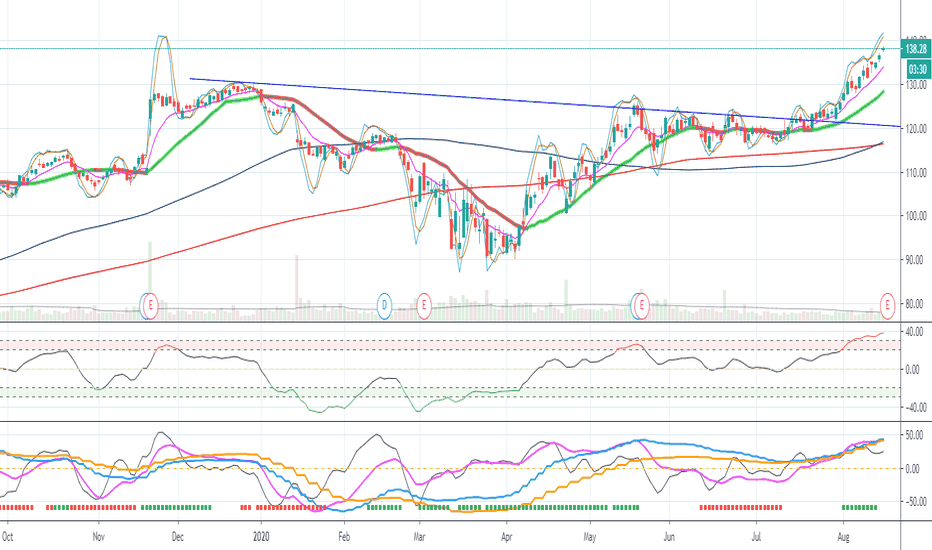

I did not have time to share this stock since I am back to my full-time job (Speech therapist)... I miss the market!

However, it's time to sit the money and play as smart as I could!