TGT trade ideas

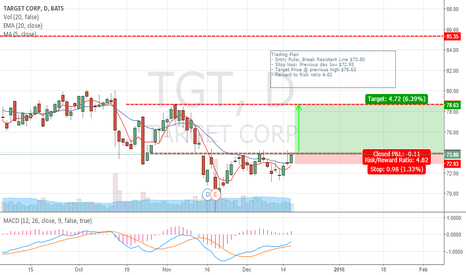

REPUBLISHING Target TGT Daily "CHEAP ENOUGH TO BUY"Note the blue box highlighting the low-risk level to buy TGT shares.

Nice 10% rally in TGT from those levels just two months ago.

This level may be a decent enough area to exit this trade (now that I'm patting myself on the back here)

Tim

12:17AM EST 7/25/2014

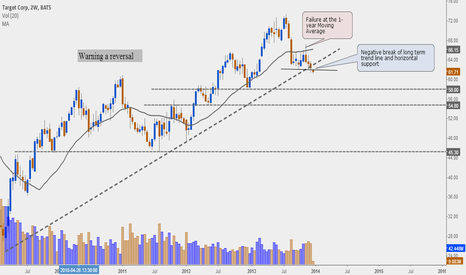

Target Corp TGT Daily -Oversold and CHEAP enough to buy I tallied up the last four quarters of earnings from the last 4 earnings reports and came to this conclusion:

$55.79 last / $4.03 TTM earnings = 14 times trailing earnings = 7.1% earnings YIELD

Given all of the problems TGT has had in the last year and they can still generate a decent profit then I think they can turn this ship around. I know it looks ugly but when you look at the valuation it gives enough margin of safety to generate a decent risk versus reward investment here.

I added some great fundamental data to the bottom of the graph: I added TOTAL REVENUES (in $Billions) and Target's AFTER TAX MARGIN. It shows flat revenues and a sharp drop in their margins. Granted, Wall Street thinks in a straight line many times and assumes that a falling line (after-tax margins) will continue to fall when in fact they already may have reached a bottom and are basing out and poised to rise.

I also have shown many of the earnings reports and how those levels create important support and resistance going forward. I also added the 1-year earnings trend-line (in light red) that connects 2 earnings reports that are 1-year apart. It is also interesting that these "lines" which no one sees, actually are somewhat useful at seeing support and resistance.

I think Target is cheap enough to buy here and I have labeled a box to represent the zone where I think the risk-reward makes sense. I would risk 3 times the average daily range upon entry on the long side of TGT.

Tim 12:35PM EST, Friday, May 23, 2014

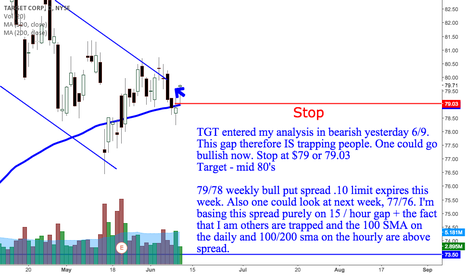

TGT reports before the bell WednesdayTarget reports earnings before the bell Wednesday. Data breach dec 19th, fired ceo, customers lost, effects .70 estimate? Walmart disappoints with their earnings and forward guidance. Have not decided yet what to do, if anything, but if they disappoint, some well placed put options could reward Wednesday, and if the markets slide down this week, which my radar says may happen. $$$

TGT Long WeeklyTarget recently completely redid their company security structure and the

market responded buy heavy buying confirmed with heavy volume and a huge reversal bar on the weekly..

I look for continued buying as the bears over did it.. Target is extremely well

run however like any major company is subject to a gaff in operations. I remember the new Coke in the

1980's and how Coke fought its way back for huge gains after that debacle. Any dips should be bought and

I look for TGT to retest its highs long term Target has a unique nich in how they market products particularly to younger shoppers in their sector

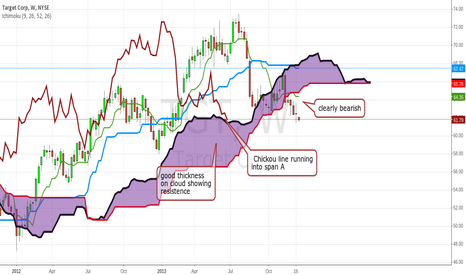

TGT Short weeklyTarget is clearly bearish and I look for support around 59 bucks which is the Kijun on the Monthly Ichimoku.

They guided lower for 2014 and with the credit card mess this target is likely to be hit. Any rally on the daily should be sold. XRT is under performing as well.

This is a good example of a great company making a huge mistake. Like Coke in the 1980's with new Coke which was a utter disaster. They are well managed so I look for buyers to step in at some point though and it will be a great long