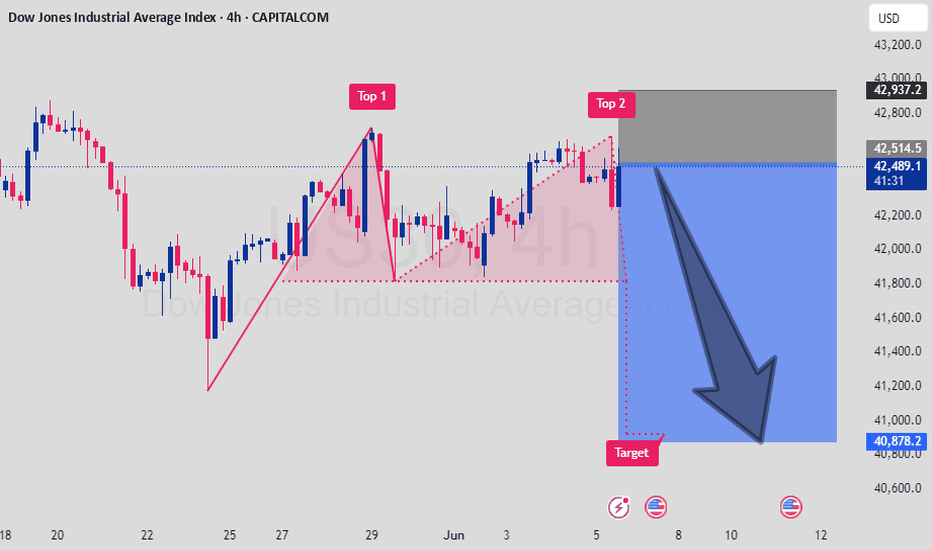

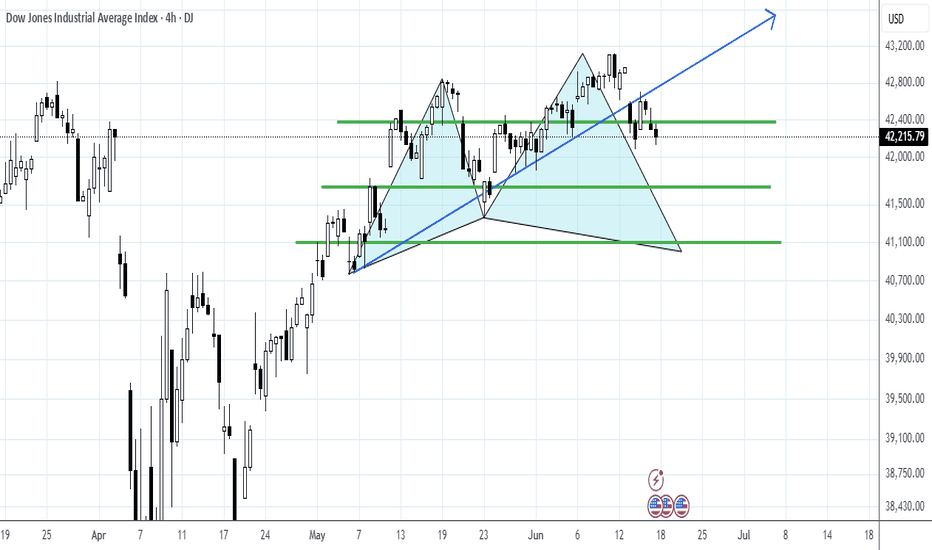

Double Top Pattern Signals Bearish Reversal (Short Trade ActiveThe Dow Jones Industrial Average Index (DJI) on the 4H chart has formed a Double Top pattern, indicating potential trend exhaustion and bearish reversal. The price was rejected near 42,900 twice and has now broken below the neckline, triggering a short trade setup.

🔹 Pattern: Double Top

🔹 Resistance Zone: 42,900 – 43,000

🔹 Neckline Break: ~42,450

🔹 Target Area: 40,878 based on pattern projection

🔹 Fundamental Context: Profit-taking and market uncertainty post recent highs

Bearish momentum active – trade remains valid unless price reclaims and holds above 42,950. Short setup is technically and structurally supported. 📉🧭

Note : If you found this helpful, like and follow for more trade ideas!

Share My Idea With Your Firends Mention Your Feed back Comment Section

This is not financial advice. Please conduct your own research and manage risk accordingly.

DJ30.F trade ideas

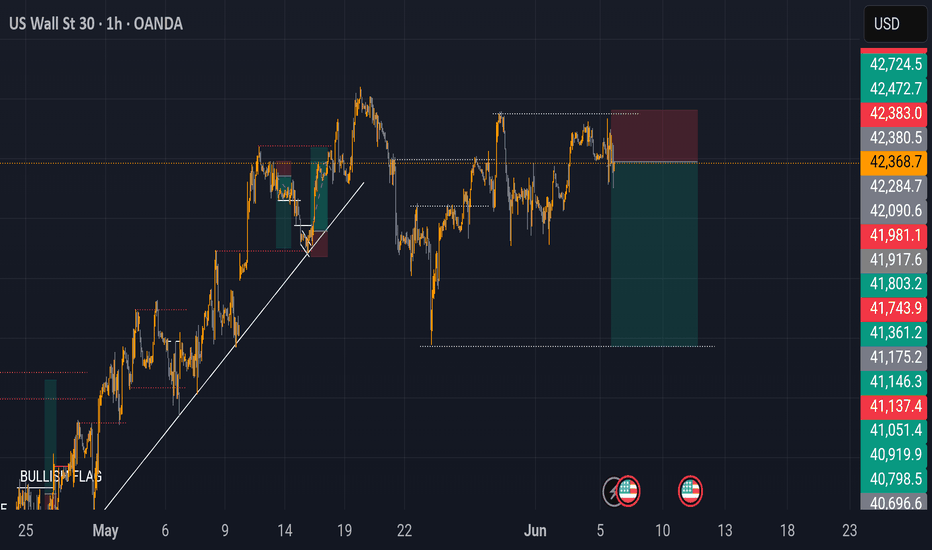

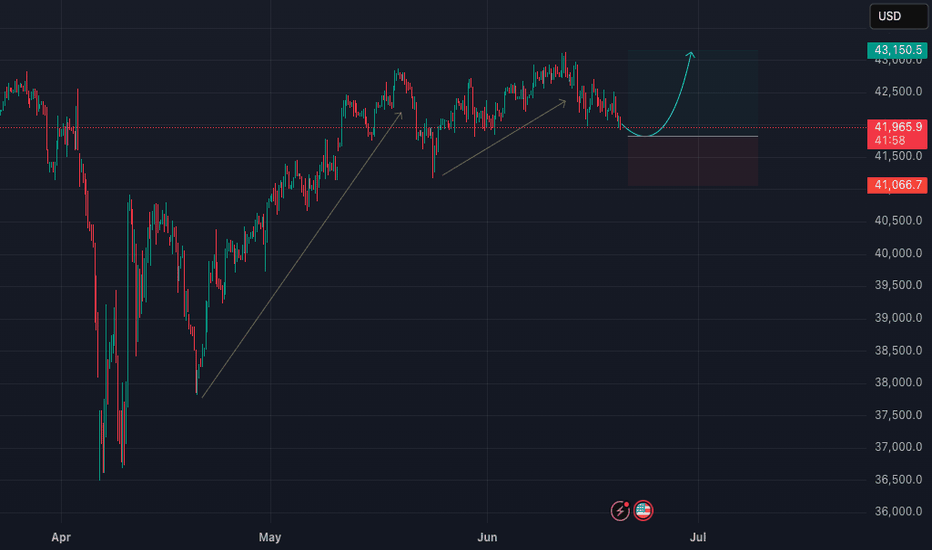

US30 Set to Break Records? Bulls Eyeing 46K–52K US30 Weekly Chart Outlook – Eyes on New Highs

Technical Outlook — June 6, 2025

Current Market Condition:

US30 (Dow Jones Industrial Average) is showing strong bullish momentum on the weekly chart after rebounding from the key 38,000–39,000 support zone. Price is now trading above the 50 EMA and maintaining distance from the 200 MA, indicating sustained strength in trend structure.

Key Technical Highlights:

Price bounced from the strong demand zone around 38,500.

Sustained recovery above EMA 50 (blue) and holding above short-term swing highs.

Weekly stochastic has crossed bullishly from oversold territory, supporting continued upward movement.

Price currently aims for retesting previous highs around 46,000.

If bullish momentum sustains, the next resistance levels are at 48,000 and 52,000.

Possible Scenarios:

🔸 Bullish Case:

If the current weekly structure holds and no major reversal signs appear, US30 could rally toward 46,000 in the coming weeks. A breakout above that could open the way to 48,000 and eventually 52,000.

🔸 Bearish Case:

Any strong rejection around 46,000 paired with a break back below 41,000 could expose the 38,000 support zone again.

Important Note:

NFP and major U.S. inflation data are due in the upcoming week. Watch out for volatility, especially near key resistance zones.

If you found this analysis valuable, kindly consider boosting and following for more updates.

Disclaimer: This content is intended for educational purposes only and does not constitute financial advice.

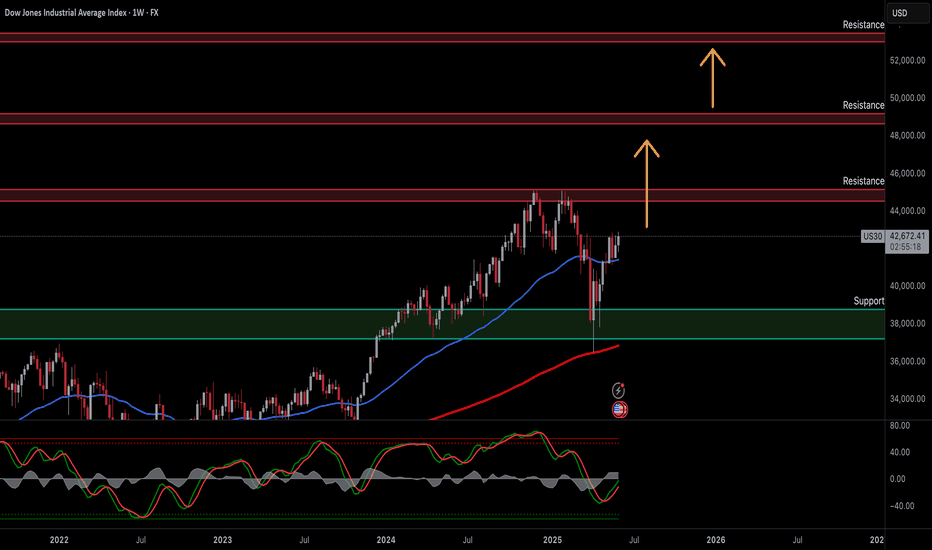

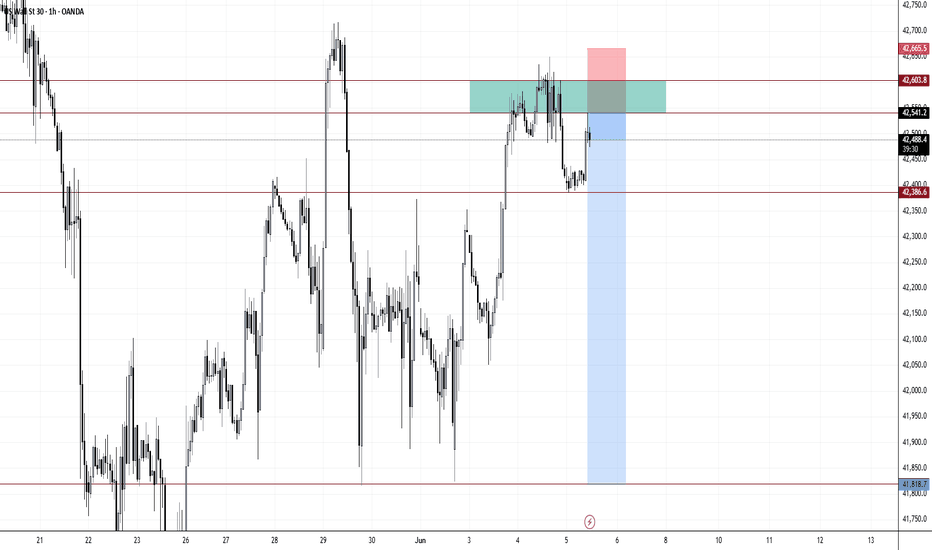

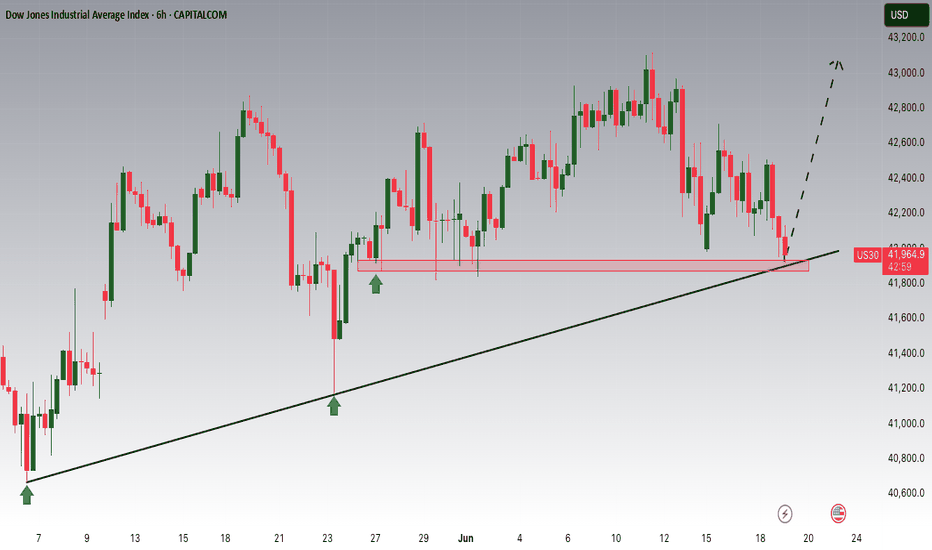

US30 - Potential BuyHi traders,

We are looking to BUY CMCMARKETS:US30

Stay tuned :)

Price Action:

Short-term sell bias toward 41,700 zone based on lower high and projected weakness.

Watch reaction at 41,700—if buyers return strong with a new higher low, it resumes uptrend.

Invalidation: If price breaks above 42,800 with strength and closes above, sellers are overwhelmed—trend continues.

Good Luck :)

Study, Study, Study! Lorenzo Tarati

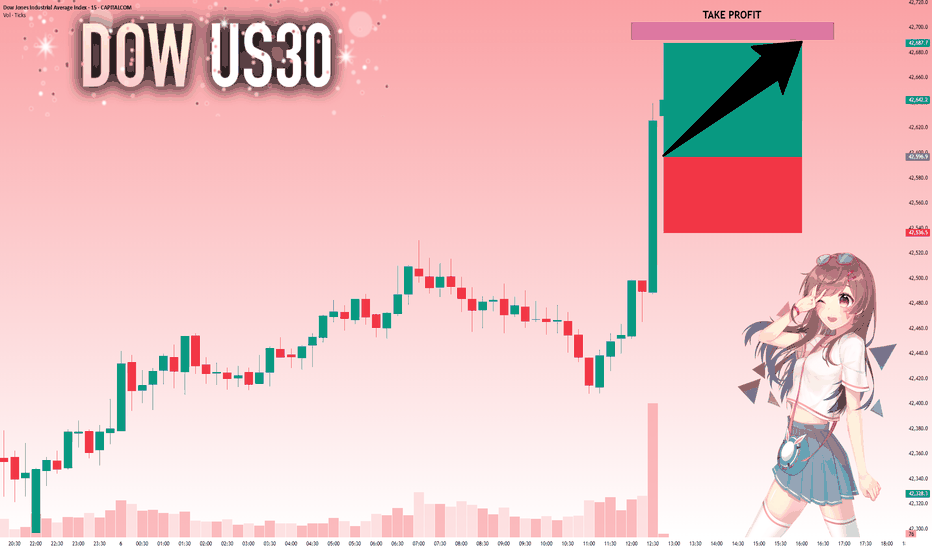

US30: Target Is Up! Long!

My dear friends,

Today we will analyse US30 together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 42.596.9 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 42.690.5. Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

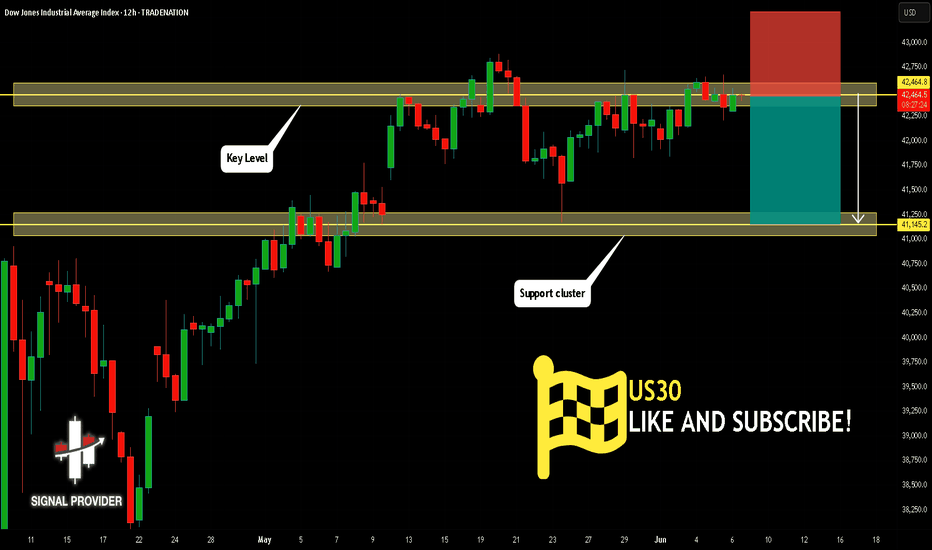

US30 Will Move Lower! Short!

Here is our detailed technical review for US30.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 42,464.8.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 41,145.2 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

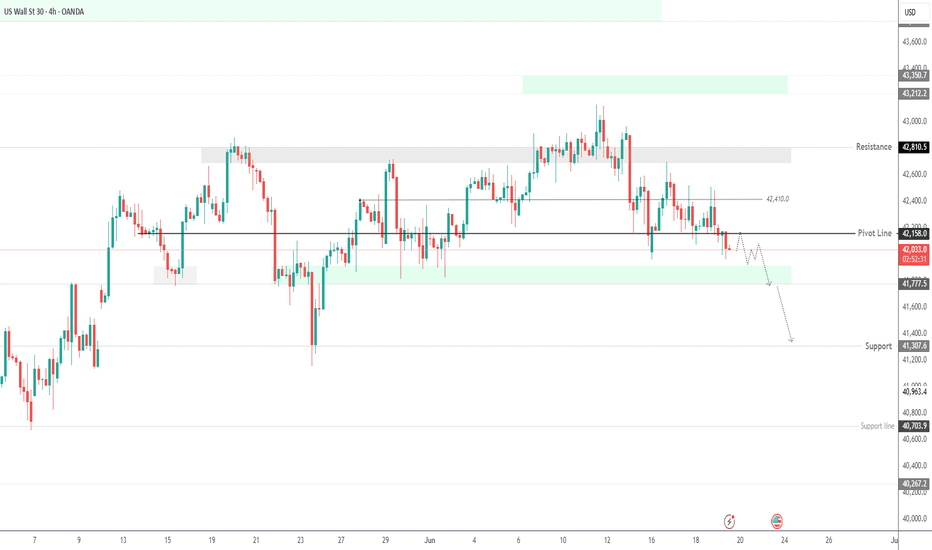

US30 Breaks Key Support as Geopolitical Risk Weighs on SentimentUS30 – Technical Overview

Amid rising Middle East tensions, the indices market remains under bearish pressure, with risk-off sentiment dominating.

US30 dropped to the 42160 level, as previously forecasted, and has now broken below it.

As long as the price trades below 42160, the bearish trend is expected to continue toward 41780, and potentially 41310 if that level fails to hold.

Key Levels:

• Pivot: 42160

• Support: 41900 / 41780 / 41310

• Resistance: 42310 / 42410 / 42580

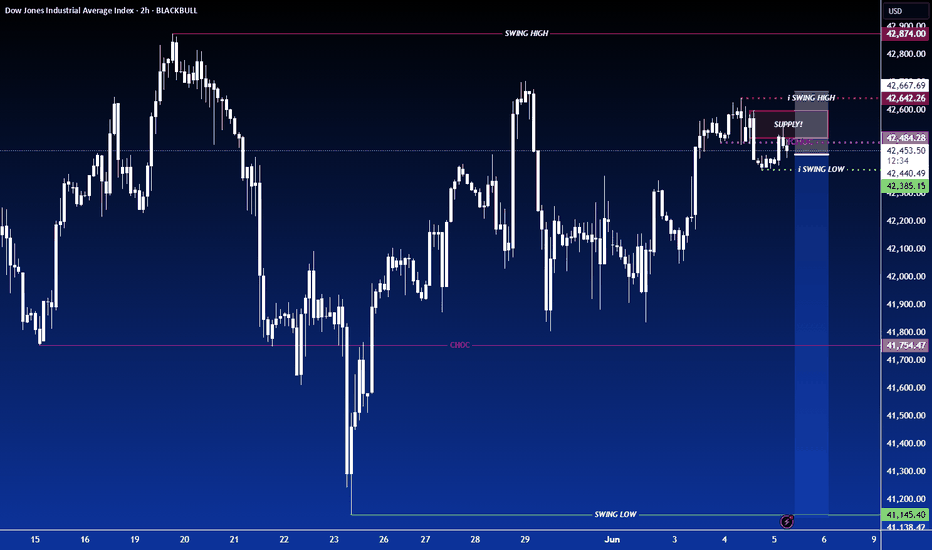

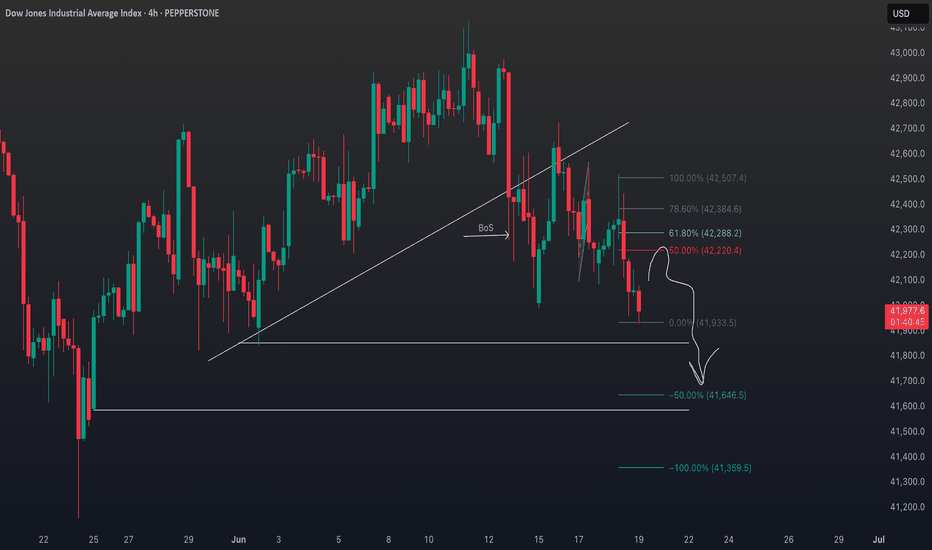

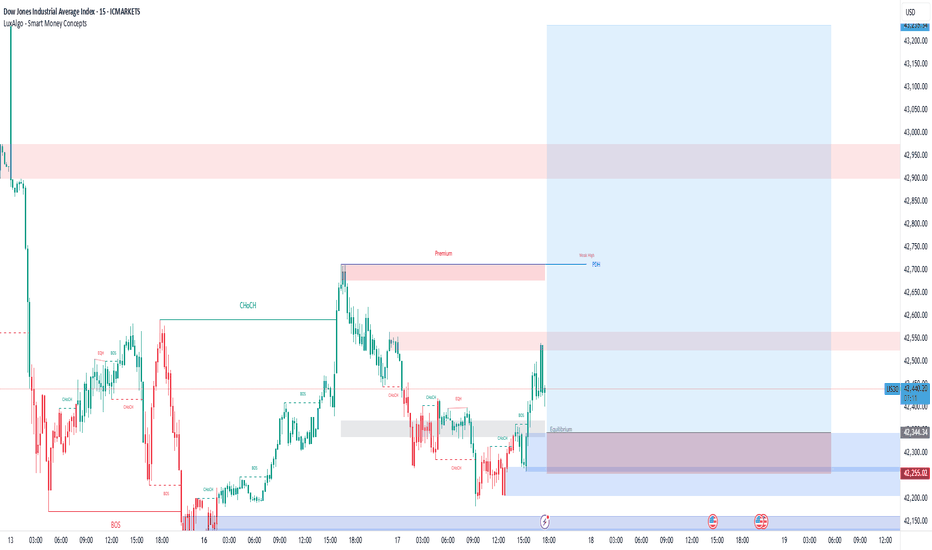

US30 Under Pressure: Possible Short Setup Brewing on the 4HI'm currently eyeing the US30 (Dow Jones Index) for a potential short opportunity based on multi-timeframe structure 📊.

🔍 Weekly Overview:

The weekly chart continues to show sustained pressure, with this week and last week both closing bearish. The sellers are clearly in control at the macro level. 🔻

📆 Daily & 4H Structure:

Drilling down to the daily and 4-hour charts, we can clearly see a break of structure (BOS). The 4H specifically is showing textbook signs of a bearish trend with lower highs and lower lows forming consecutively 🪜🔽.

🎯 Trade Plan:

I'm watching for a pullback into equilibrium, ideally near the 50% level of the recent Fibonacci range. If price revisits that zone, I’ll be looking for short confirmations to ride the momentum back toward the previous lows, as marked on the chart. 🧠💸.

US30 next target releasedNo comment needed. All information is in the chart analysis.

Steps to follow:

Analyze yourself.

Take the position with SL and Take Profits.

Wait, it may take a couple of days, so take a break and step away from the screen from time to time, just like I do :)

Get the result.

I will update the trade every day.

Like, comment with your good mood or viewpoint, share with your circle. It’s together that we get stronger!

Good trades, Traders!

The golden bear

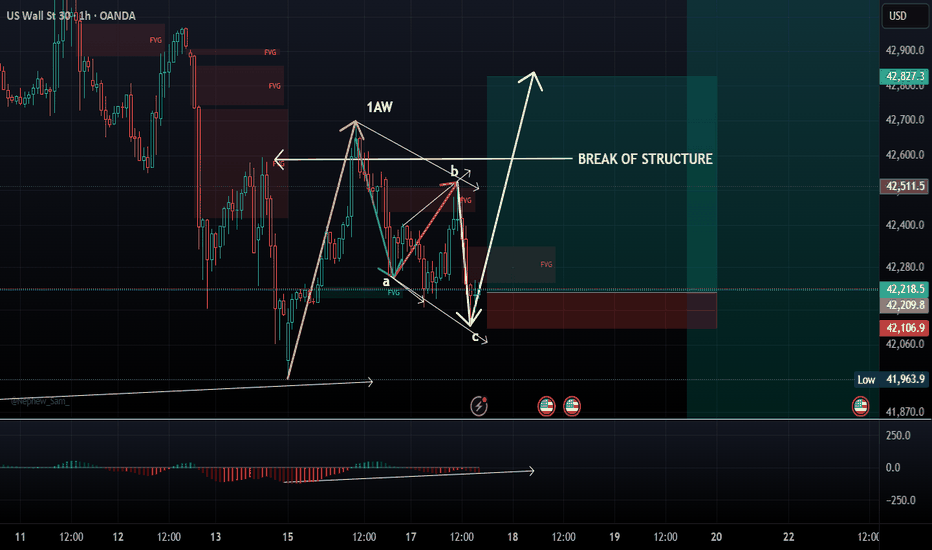

US30/DJ30 Long/buy 1:6Reason for buy:

VERY SIMILAR STRUCTURE TO GOLD!!!!!

1. Break of structure

2. Regular flat in play with a complete corrective structure (a,b,c)

3. NO MACD divergence shows strong moment upwards

4. Impulsive move (1AW) indicates a strong move upwards will continue

5. Liquidity at the top (TP area)

Entry: CMP (Current market price)

Stop loss :42086

Take Profit: At own discretion...OPEN!

Strategy/ies: Engulfing candle on 15/1HR TF

Losses are part of the game...don't be too hard on yourself!

DowJones resistance retest at 42880Key Support and Resistance Levels

Resistance Level 1: 42880

Resistance Level 2: 43540

Resistance Level 3: 42940

Support Level 1: 41800

Support Level 2: 41400

Support Level 3: 41100

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

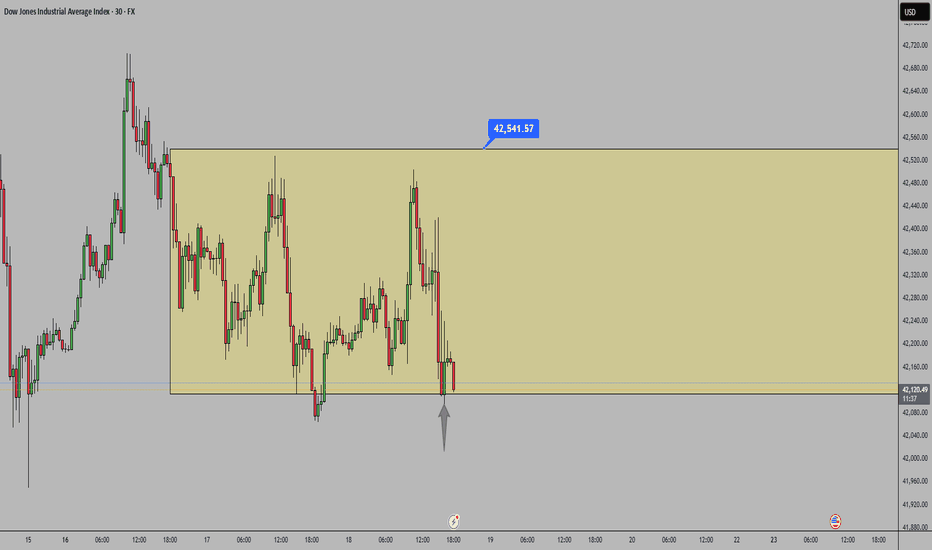

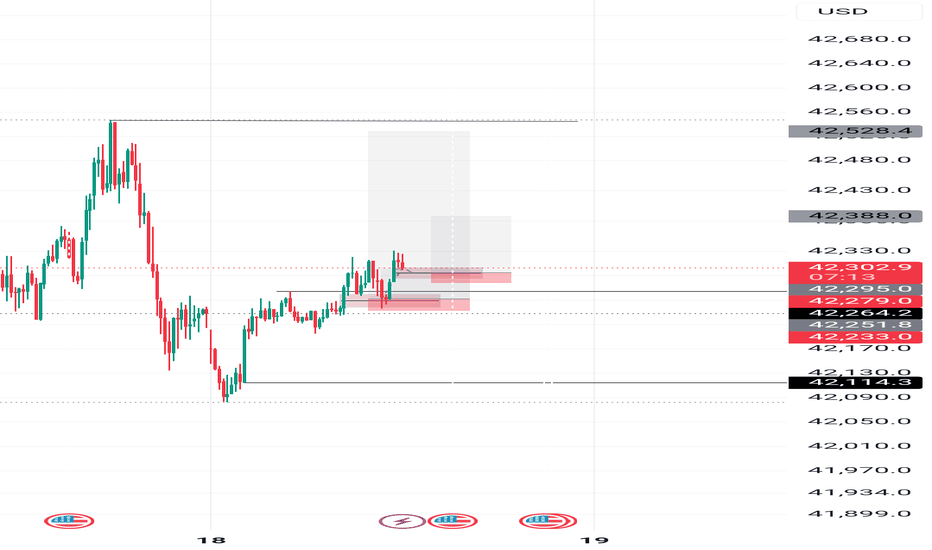

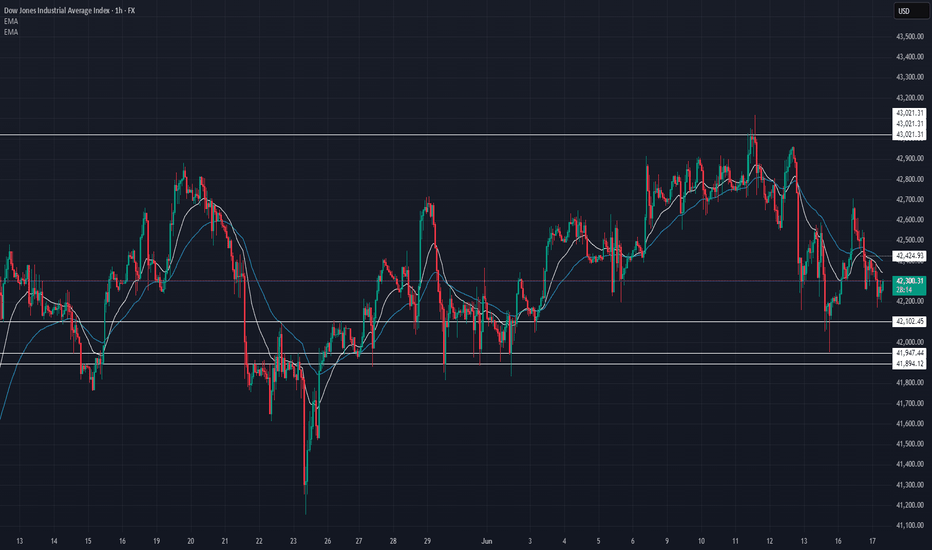

US30 Technical Overview – 06/17/2025📍 US30 Technical Overview – 06/17/2025

The Dow is consolidating below resistance after failing to reclaim the 42,424 EMA zone. Sellers are defending this level, while 42,102 remains a key support.

🧠 Key Observations:

EMA rejection near 42,424 🔄

Lower highs forming = short-term bearish bias

Demand still holding at 42,102

📊 Price Zones:

🔼 Resistance: 42,424 → 42,605

🔽 Support: 42,102 → 41,947

📈 Trade Setup Ideas:

🔹 Long Bias:

Break and hold above 42,424

→ Target: 42,605 → 42,793

🔻 Short Bias:

Break below 42,102

→ Target: 41,947 → 41,894

🎯 Price is currently between key levels—wait for a breakout before committing to direction!

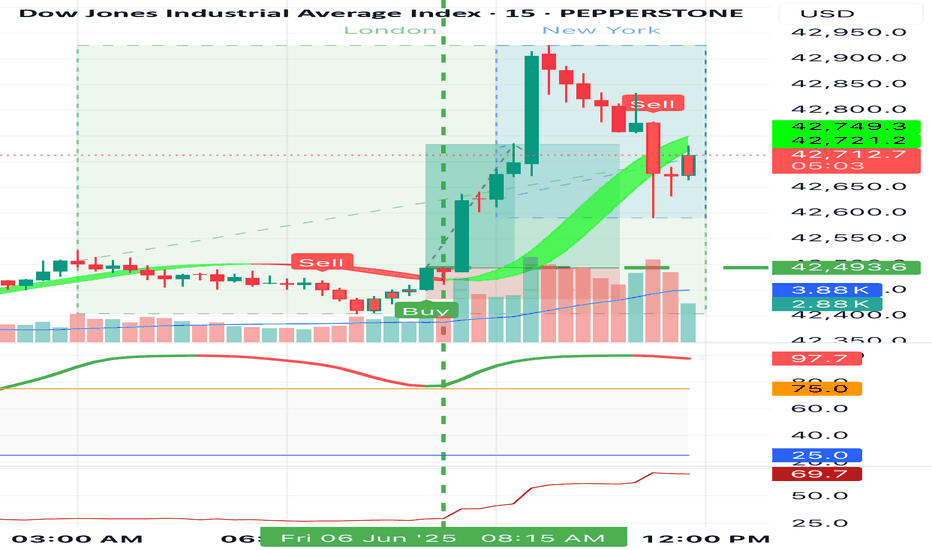

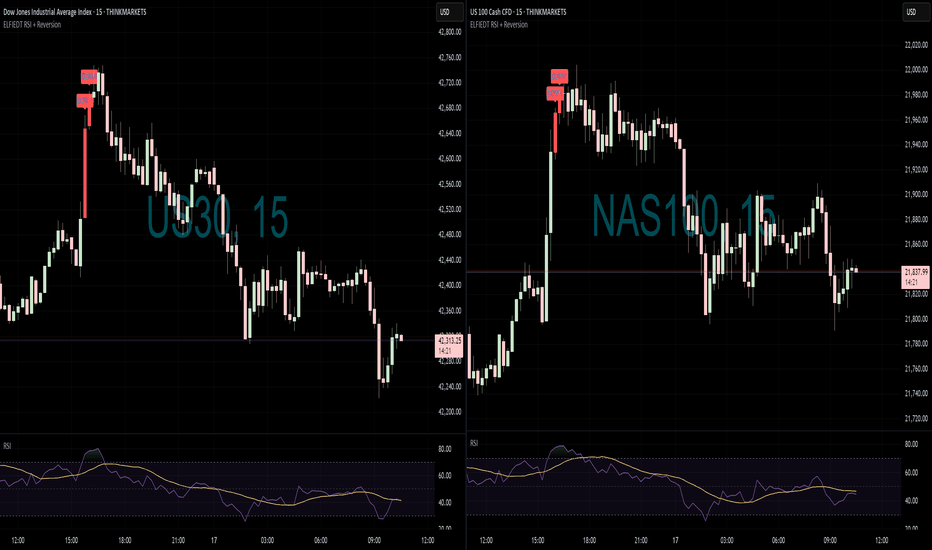

SHORTS - GOTTA LOVE IT!📊 Multi-Market Signal Alignment: US30 & NAS100 (15-Min)

📍 Both indices triggered clean SELL signals at their highs using the ELFIEDT – X-REVERSION indicator.

The signal printed at the close of the strongest bullish bar, which often marks exhaustion — and price quickly rejected from that level.

✅ US30 printed two stacked 'DOWN' signals — the first entry bar was perfect.

✅ NAS100 printed a nearly identical signal at the same time — showing excellent intermarket confluence.

🧠 Why this setup worked:

Price extended far above mean structure

RSI was stretched and reversed immediately after

Signal printed on a bullish candle before reversal — allowing you to catch the high

Both assets signaled at the same time — strengthening the conviction

📌 Pro Tip: When multiple correlated instruments print reversal signals at the same time (especially indices or FX pairs), it often confirms institutional rotation. These trades offer great risk-reward if you stick to the plan.

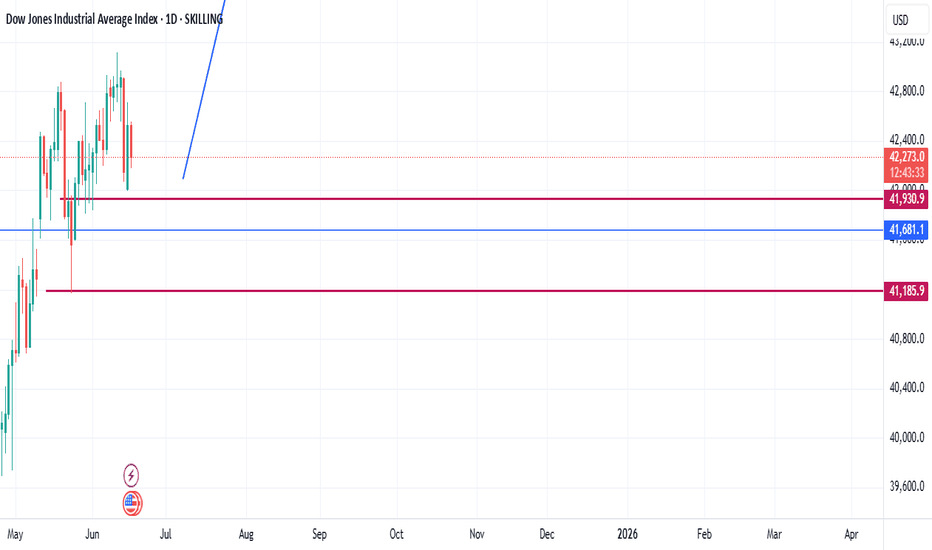

US30 17 JUNE 2025 TRADE IDEA Based on the current US30 (Dow Jones Industrial Average Index) chart, the price action shows a strong bullish trend within a well-defined ascending channel that spans from mid-2023 through 2025. The index recently bounced off the mid-range zone near the 41,185 – 41,940 support levels and is now approaching a potential continuation move toward the upper resistance zone between 44,472 and 44,620. This area represents a key supply zone where price previously rejected, suggesting potential hesitation or reversal upon retest. The recent higher lows and breakout from a corrective phase indicate strong bullish structure, supported by institutional order flow—possibly driven by buy-side liquidity targeting previous highs. If the price maintains above 41,681 and creates a successful retest (break and retest confirmation), it offers a compelling opportunity for long positions aiming toward the channel top or key resistance.

From a Smart Money Concept (SMC) perspective, the market structure shifted bullish after sweeping liquidity below April's low followed by a clear Change of Character (ChoCH) and Break of Structure (BOS) to the upside. This shows strong accumulation by institutions. The demand zone formed around 41,185 – 41,681 can be considered a reaccumulation block and a potential entry point for buys on retracement.

Fundamental Context:

This week's movement must also be interpreted in light of broader geopolitical tensions, particularly the ongoing conflict between Iran and Israel, which has implications on investor sentiment and global market volatility. Heightened tensions in the Middle East typically cause oil prices to spike and introduce risk-off sentiment. However, the Dow’s resilience suggests that U.S. investors may currently be pricing in confidence in the U.S. economy, strong corporate earnings, or the expectation that the Fed will maintain or cut interest rates if geopolitical shocks affect global demand. If tensions escalate further into military confrontation or affect major oil supply chains, we could see a temporary pullback or risk aversion across equities—including US30.

Trade Idea:

Bias: Bullish continuation (if current structure holds).

Entry Zone: Around 41,940–42,100 on a retest with bullish confirmation.

Stop Loss: Below 41,185 (structure invalidation).

Take Profit: First TP at 44,472; extended TP at 44,620 or channel top.

Invalidation: Break below 41,185 with a daily close.

In conclusion, unless the conflict between Iran and Israel leads to a sharp risk-off move, US30 appears poised for bullish continuation driven by technical momentum, strong market structure, and medium-term economic optimism. However, traders should monitor headlines closely, as escalation in the Middle East could introduce significant volatility.