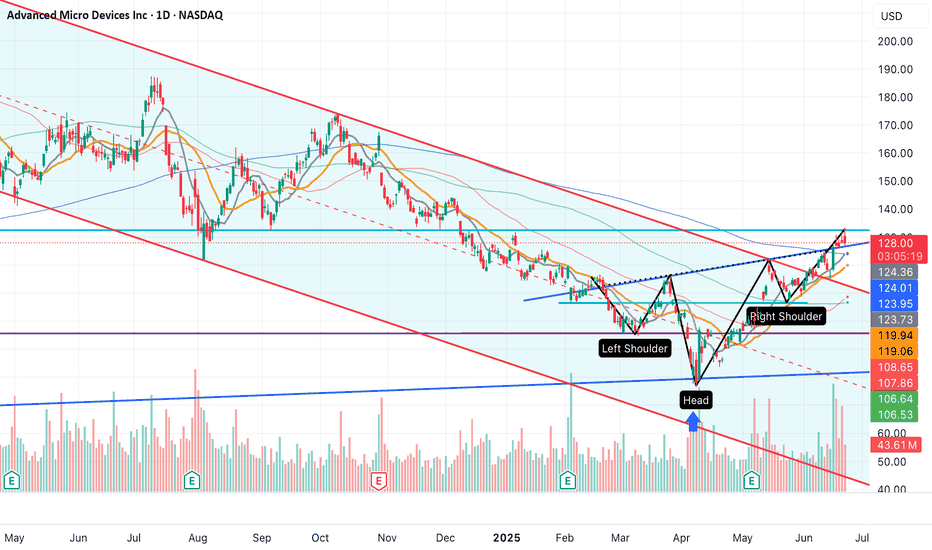

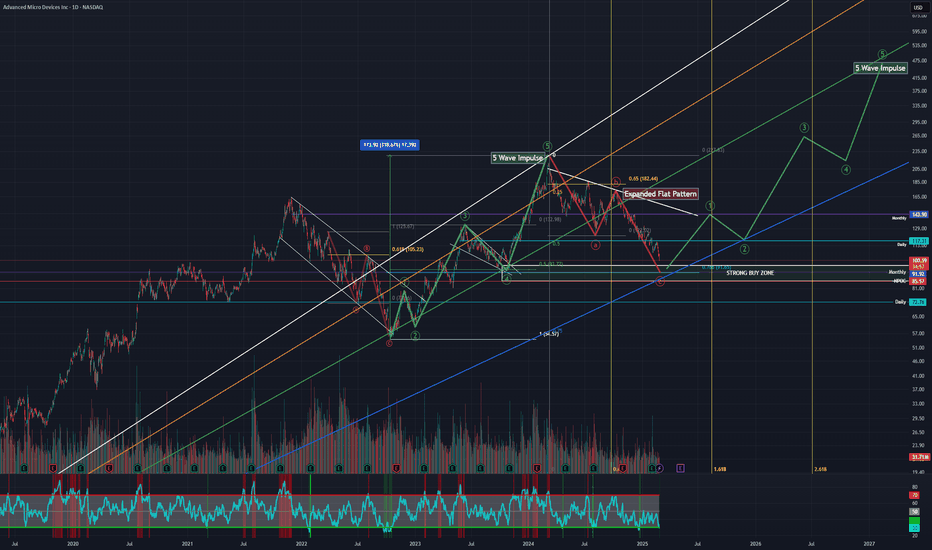

AMD: Looking a bit bearish Sort of taking a break from posting about SPY which never seems to do anything interesting.

So posting about AMD which I have been day trading more frequently recently.

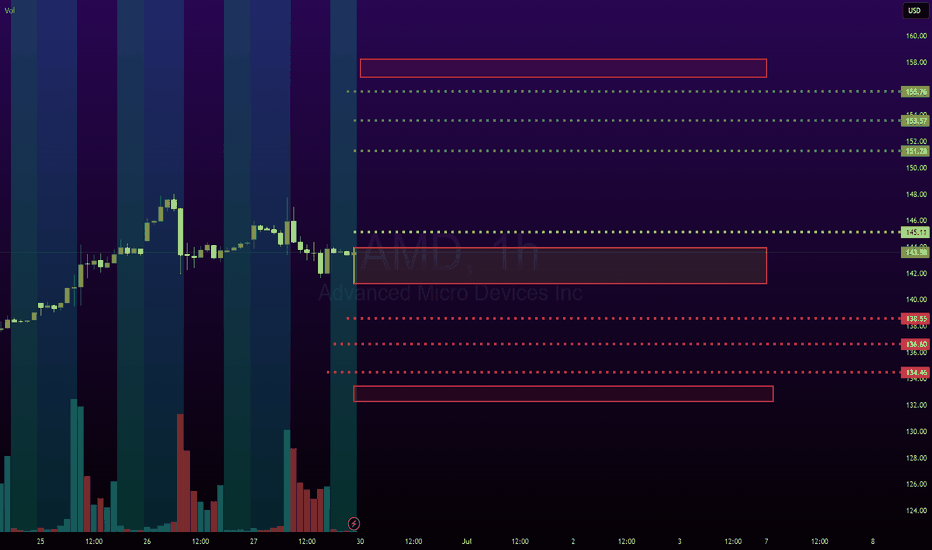

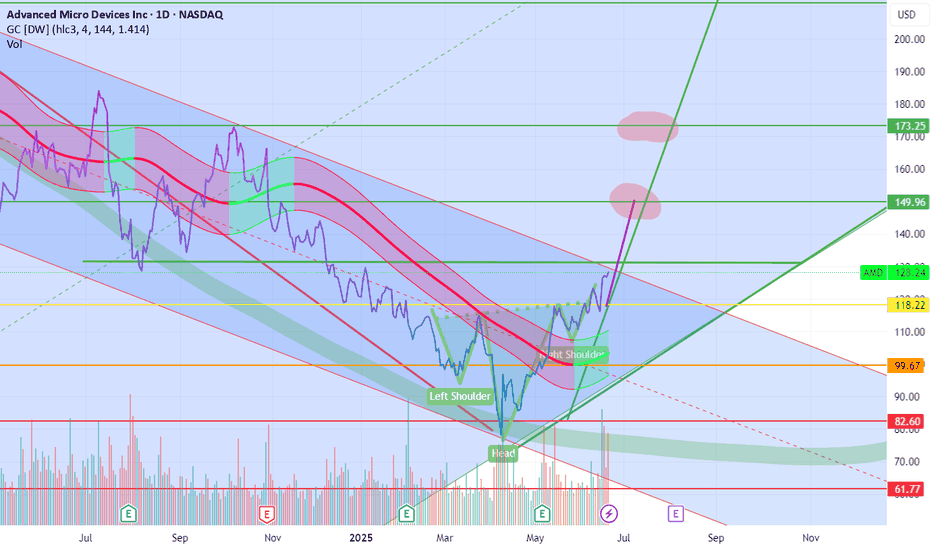

Looking at AMD, expecting some upside initially to 145 region, perhaps a gap up into Monday, but overall, the impression is a pu

Key facts today

Advanced Micro Devices (AMD) is a major player in the AI chip market, driven by rising demand for AI chips. The chip manufacturing equipment market is expected to nearly double by 2028.

OpenAI is using AMD chips alongside Nvidia GPUs to meet rising AI needs, while also testing Google's Tensor Processing Units without plans for large-scale use.

99,000.00

0.00 BRL

8.85 B BRL

139.01 B BRL

About Advanced Micro Devices Inc

Sector

Industry

CEO

Lisa T. Su

Website

Headquarters

Santa Clara

Founded

1969

ISIN

BRA1MDBDR002

FIGI

BBG00R3WWJK7

Advanced Micro Devices, Inc. engages in the provision of semiconductor businesses. It operates through the following segments: Data Center, Client, Gaming, and Embedded. The Data Center segment includes server-class CPUs, GPUs, AI accelerators, DPUs, FPGAs, SmartNICs, and Adaptive SoC products. The Client segment refers to the computing platforms, which are a collection of technologies that are designed to work together to provide a more complete computing solution. The Gaming segment is a fundamental component across many products and can be found in APU, GPU, SoC or a combination of a discrete GPU with another product working in tandem. The Embedded segment focuses on the embedded CPUs, GPUs, APUs, FPGAs, and Adaptive SoC products. The company was founded by W. J. Sanders III on May 1, 1969 and is headquartered in Santa Clara, CA.

Related stocks

Amd - This is just the beginning!Amd - NASDAQ:AMD - perfectly plays out:

(click chart above to see the in depth analysis👆🏻)

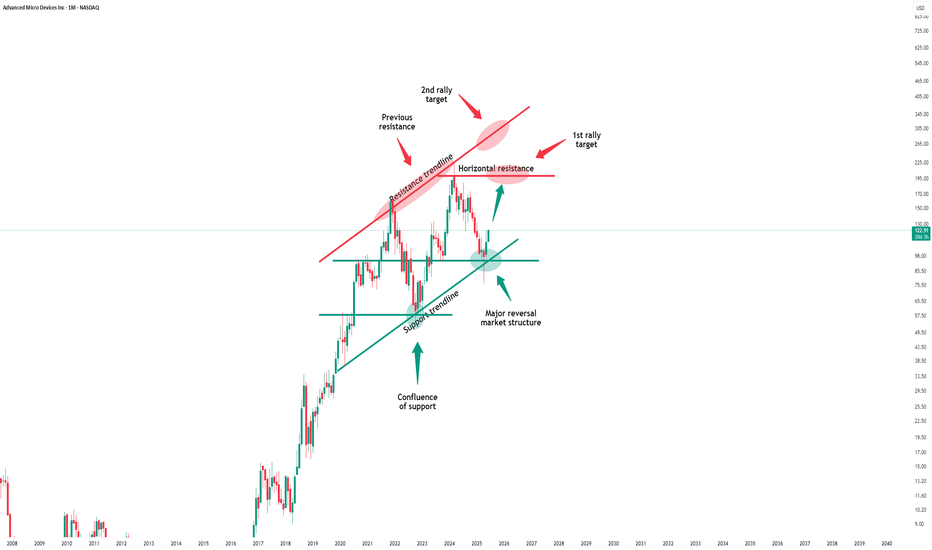

Despite the harsh drop of about -65% which we have been witnessing starting back in 2024, Amd remains bullish. Just three months ago, Amd retested a textbook confluence of support. We saw bullish confirm

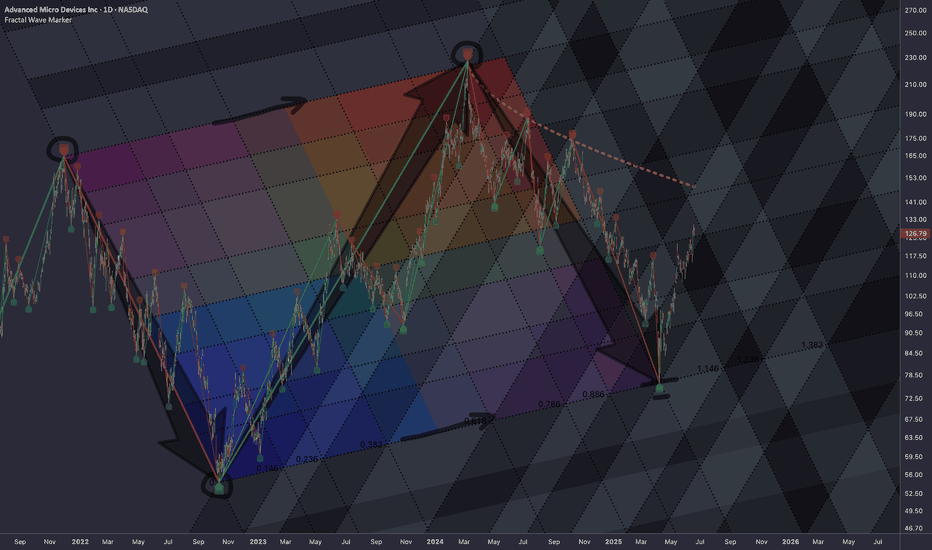

Long 4HR AND Weekly ( Finishing Wave 1)

4HR

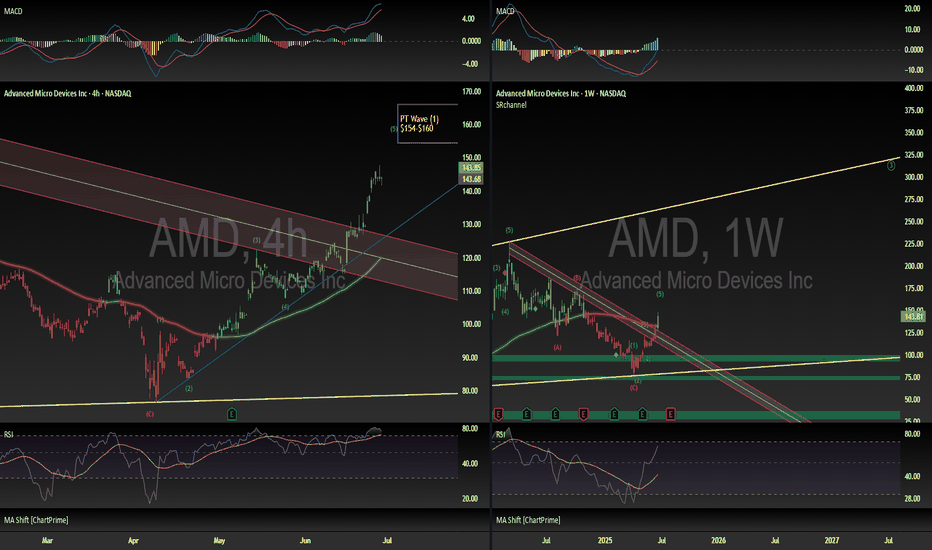

NASDAQ:AMD is close to potentially finishing Wave 5 of a larger degree wave 1.

$154 is the calculate Fib extension of Wave 1+3 for a wave 5 however, there is plenty room for the stock to run with multiple $160+ Analyst upgrades.

From the Close Price on 6/27 to $160 there is a potential 11

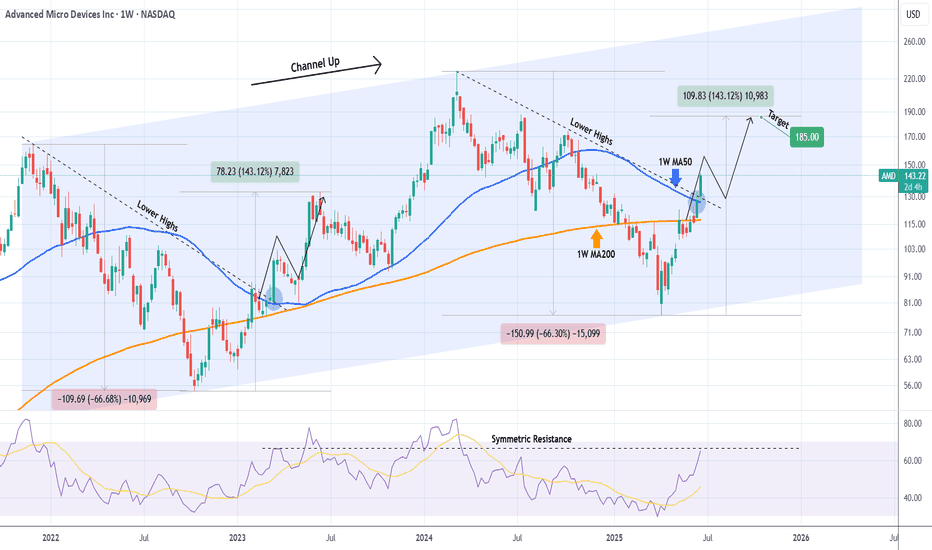

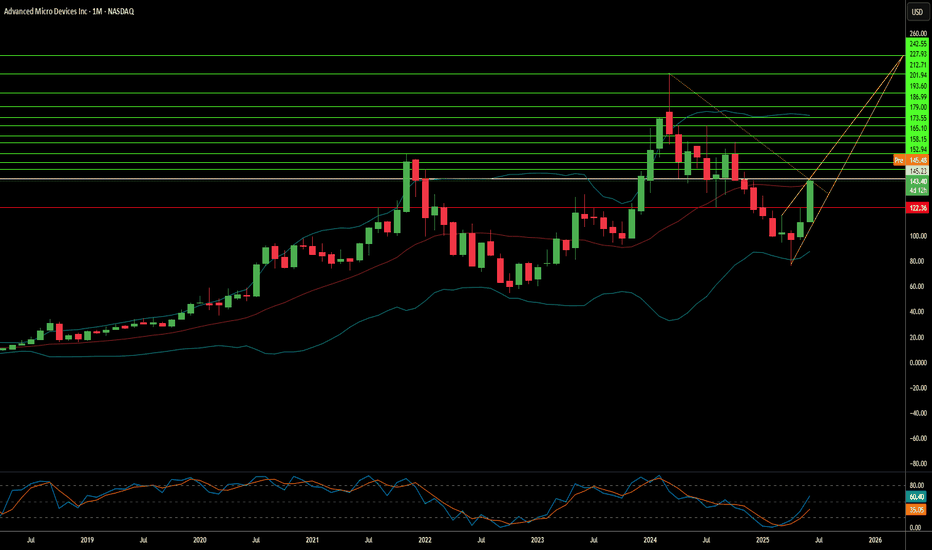

AMD Major Lower Highs/ 1W MA50 break-out.It was only 9 days ago (June 16, see chart below) when we called for a potential bullish break-out on Advanced Micro Devices (AMD) above the 1W MA50 (blue trend-line):

The break-out did happen, this 1W candle is already considerably above its 1W MA50 and based also on the level the 1W RSI is at

Big move for AMD monday inverted H&S greatly confirmed 150USD!!!The pattern have been greatly confirmed for me and i will sell my amd this week at 150 USD and i will wait at july when a drop will occurs to rebuy and i will cumulate more stock or more profits in cash.

The information and publications are not meant to be, and do not constitute, financial, invest

Is AMD Poised to Redefine the Future of AI and Computing?Advanced Micro Devices (AMD) is rapidly transforming its market position, recently converting a Wall Street skeptic, Melius Research, into a bullish advocate. Analyst Ben Reitzes upgraded AMD stock to "buy" from "hold," significantly raising the price target to \$175 from \$110, citing the company's

Breakout Alert: AMD Head & Shoulders Points to $160+Overview

Name: Advanced Micro Devices, Inc.

Ticker Symbol: AMD

Exchange: NASDAQ

Founded: 1969

Headquarters: Santa Clara, California, USA

CEO: Lisa Su (as of 2025)Sector: Technology / Semiconductors

About

AMD is a leading semiconductor company known for its high-performance computing and graphics

The next Intel or the next Nvidia?Neither, AMD has it's own path with destiny. The cyclical nature of semiconductors makes this an interesting stock to analyse through TA. The fundamentals remain strong, whilst they are clearly behind Nvidia and Broadcom, there's also closely following behind and have a far smaller market cap. In a

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

AMD5426832

Advanced Micro Devices, Inc. 4.393% 01-JUN-2052Yield to maturity

5.94%

Maturity date

Jun 1, 2052

AMD5426831

Advanced Micro Devices, Inc. 3.924% 01-JUN-2032Yield to maturity

4.53%

Maturity date

Jun 1, 2032

AMD6026359

Advanced Micro Devices, Inc. 4.212% 24-SEP-2026Yield to maturity

4.03%

Maturity date

Sep 24, 2026

AMD6026360

Advanced Micro Devices, Inc. 4.319% 24-MAR-2028Yield to maturity

3.96%

Maturity date

Mar 24, 2028

See all A1MD34 bonds

Curated watchlists where A1MD34 is featured.