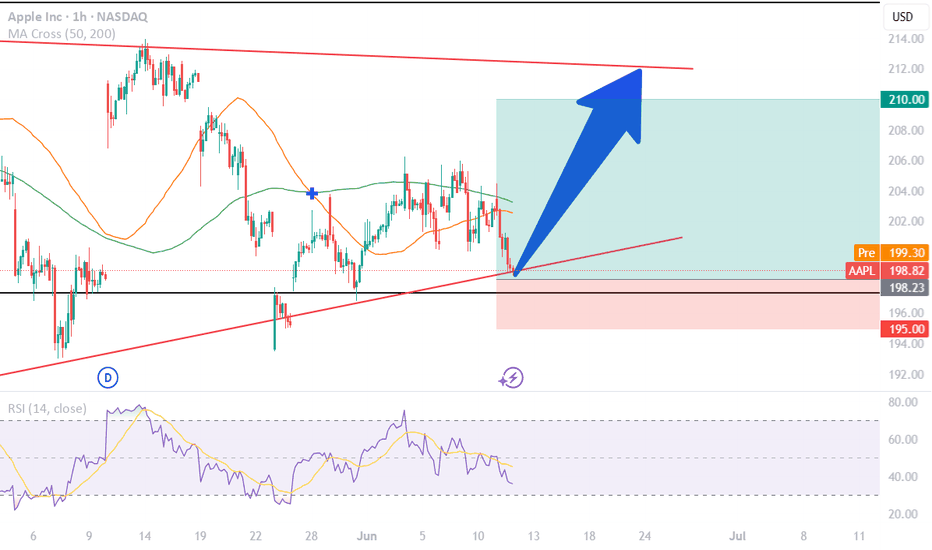

AAPL Breaking Structure! Gamma Says Caution — Is $195 Next? 🍎 AAPL Breaking Structure! Gamma Says Caution — Is $195 Next? 🔻

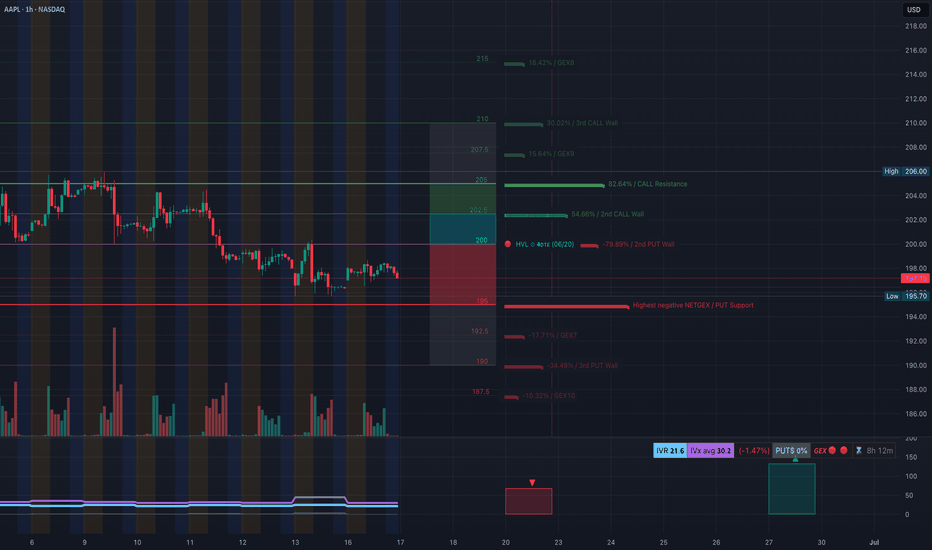

🧬 GEX Options Sentiment Analysis:

* Gamma Key Levels:

* CALL Walls:

* $202.50 (moderate resistance)

* $205 = Gamma Wall / Call Resistance

* $210–215 = Higher walls unlikely to reach short-term without catalyst

* PUT Walls:

* $198 = 2nd PUT Wall and Heavy Volume Level (HVL)

* $195.70 = Highest negative NET GEX / PUT magnet

* Below $195 opens risk to $192.50, $190 (GEX7/10 cluster)

* Options Metrics:

* IVR: 21.6

* IVx avg: 30.2

* PUT Flow: 0% (!!) – no PUT buyers showing up (caution on reversals)

* GEX Sentiment: 🔴🔴🔴🔴 (very bearish tilt)

* Interpretation:

* AAPL is hugging the gamma flip zone at $198–$200. If it breaks and stays under $198, dealers may accelerate hedging, sending it down toward $195/$192.

* Call side is weak; momentum buyers missing.

🧠 15-Minute SMC Structure Breakdown:

* Current Price: $197.18

* Structure:

* CHoCH confirmed just below supply at $198.50 → bearish sign.

* Repeated rejections from the supply zone (pink box).

* Broke ascending wedge/trendline support on rising volume — bearish pattern confirmation.

* Demand box sits near $195.70–$196.50.

* Volume:

* Bearish volume increasing during rejection = potential for trend continuation lower.

⚔️ Trade Scenarios:

🟥 Bearish Breakdown Setup:

* Trigger: Confirmed close below $196.50 with increasing volume.

* Target 1: $195.70 (GEX/SMC demand)

* Target 2: $192.50 (GEX7 magnet)

* Stop-loss: $198.50

Strong confluence with gamma, SMC structure, and volume break = high-probability short.

🟩 Bullish Reversal Setup (Low Probability):

* Trigger: Reclaim of $198.89 with conviction

* Target 1: $200

* Target 2: $202.50 (CALL wall)

* Stop-loss: Below $196.45

Only consider if SPY/QQQ stage reversal bounce and AAPL leads.

💡 My Thoughts:

* AAPL looks weak and vulnerable heading into Tuesday.

* If price loses $196.45, gamma + structure suggests fast flush to $195 and possibly $192.

* This is not the spot to go long blindly — let the level reclaim first.

* PUT flow being 0% despite this setup suggests retail hasn't stepped in — this could change rapidly.

🔚 Conclusion:

AAPL is breaking down from structure and trending toward gamma PUT support. Options sentiment and Smart Money structure are both aligning for bearish continuation — short bounces are sell opportunities unless $199+ is reclaimed with strength.

Disclaimer: This is for educational purposes only. Always manage your risk and follow your plan.

Would you like to format this for a TradingView post next or combine all into one GEX/TA wrap-up?

AAPL34 trade ideas

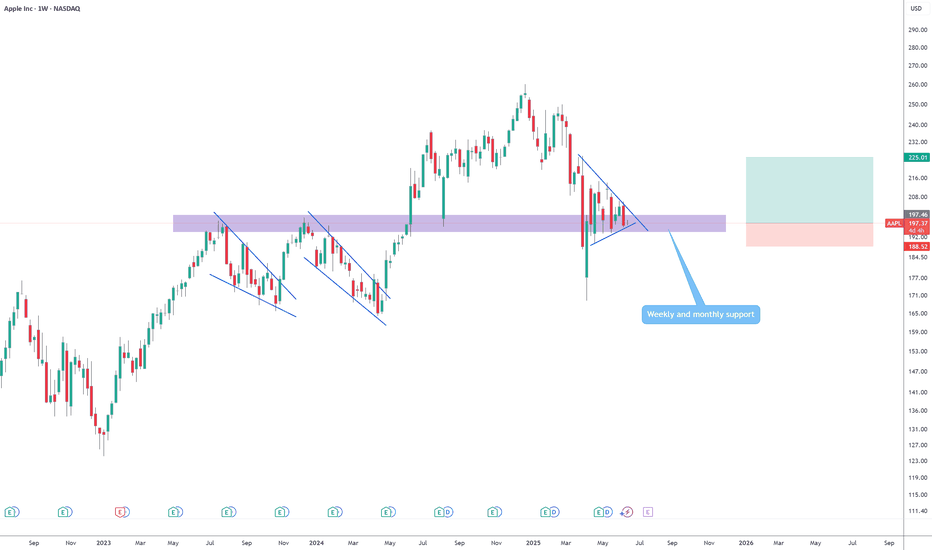

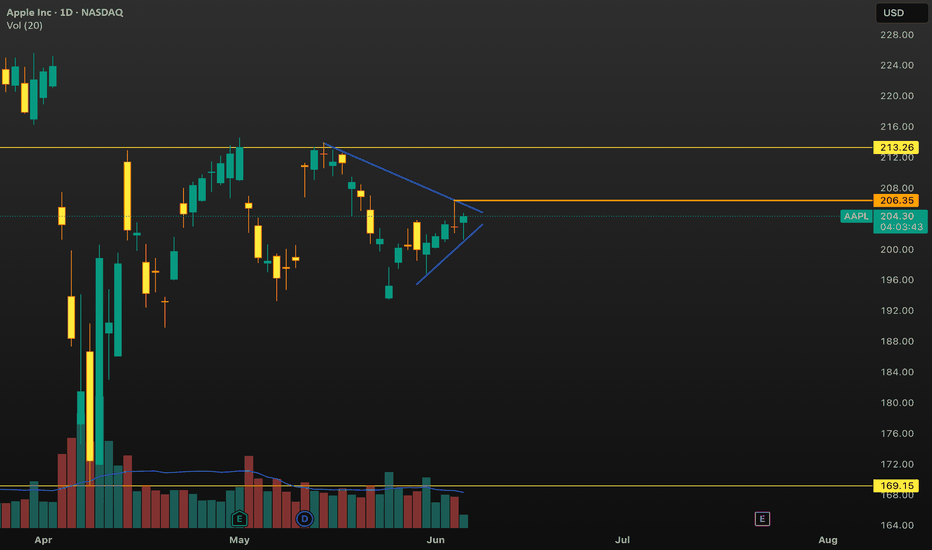

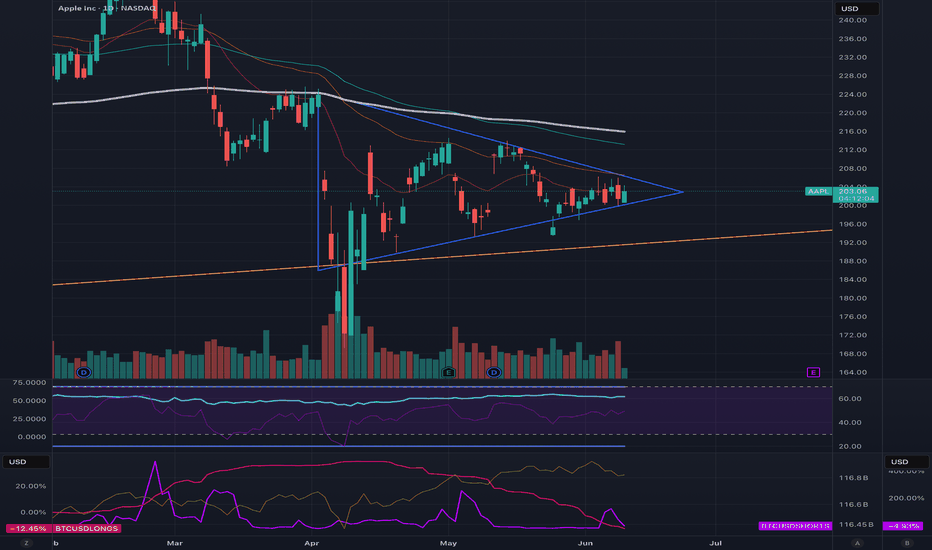

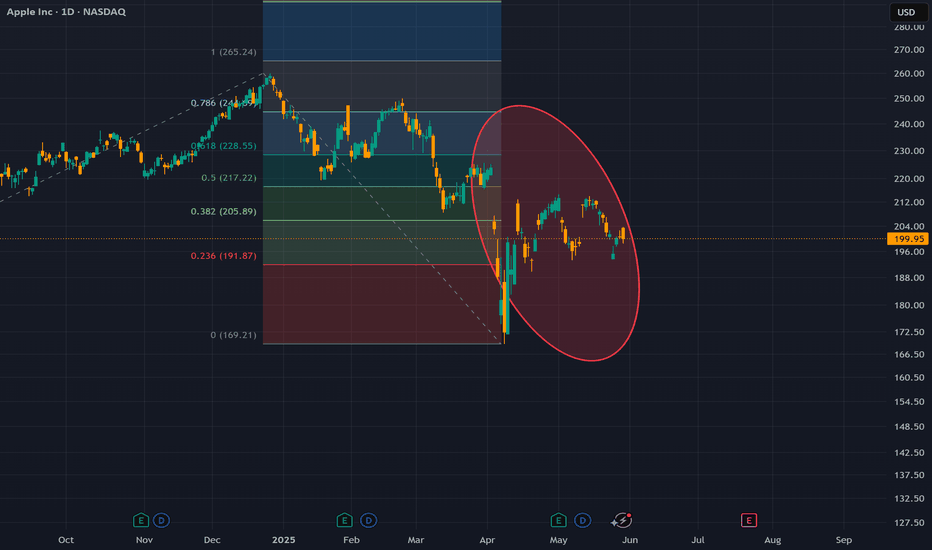

At monthly supportSymmetrical triangle at a monthly support. Breakout is coming soon, could be either way but I think is most likely to go to the upside following the previous two continuation patterns. Price is just over the lower vertex of the triangle, so we have a tight SL, it triggers if a weekly candles breaks down the triangle. I have calls that expire 3 months from now strike 200. Buying the stock is much safer. Good luck.

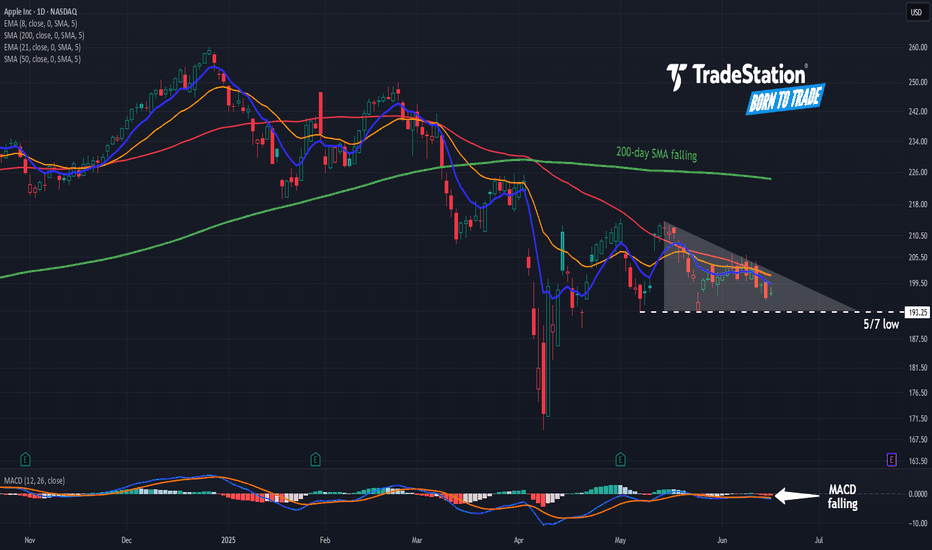

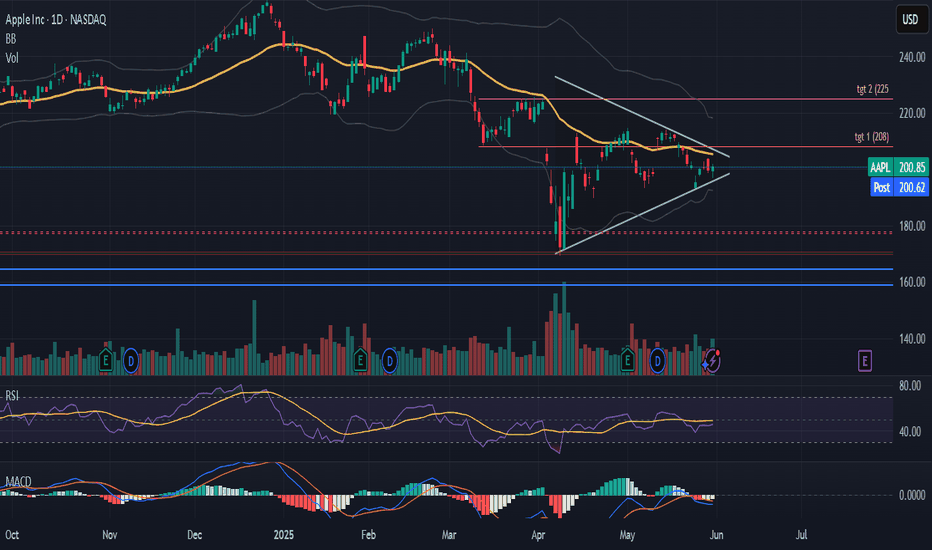

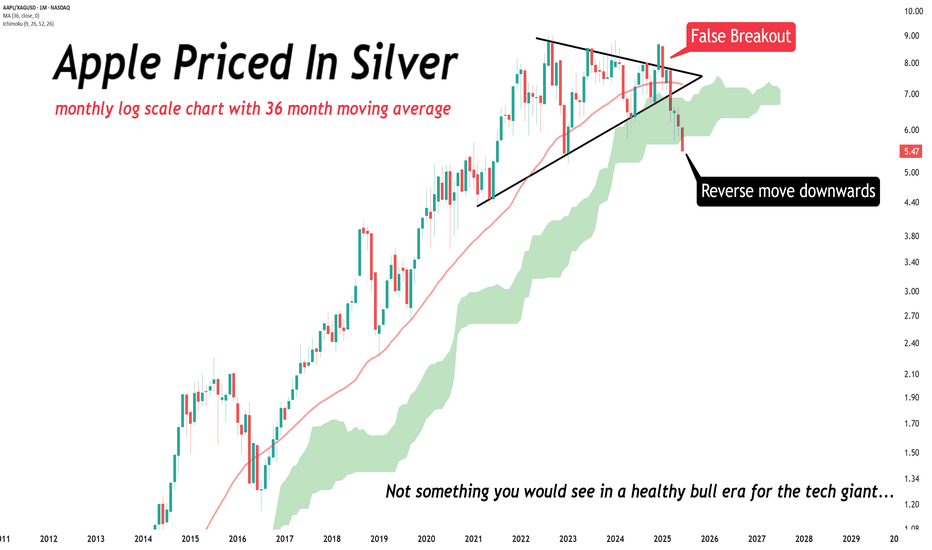

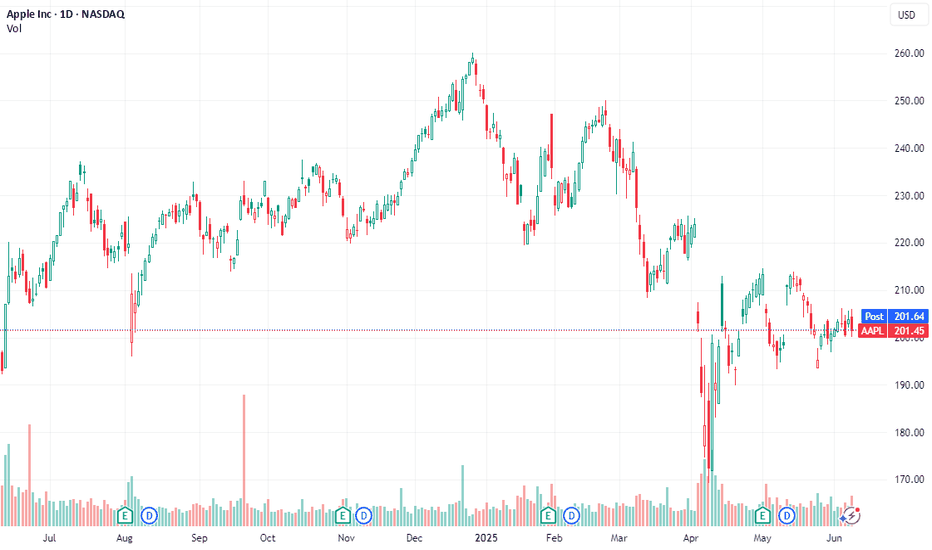

Descending Triangle in Apple?Apple has struggled all year, and evidence of a downtrend may be growing in the tech giant.

The first pattern on today’s chart is this month’s lower high relative to mid-May. Combined with the May 7 low of $193.25, some traders may think a descending triangle is taking shape. That’s a potentially bearish formation.

Second, TradeStation data shows that AAPL is the only trillion-dollar company now trading below its 200-day simple moving average (SMA). The 200-day SMA has also turned lower. Those points may confirm long-term price action is less bullish.

Next, prices remaining below the falling 50-day SMA may signal intermediate-term weakness.

Fourth, short-term trends may be weakening: The 8-day exponential moving average (EMA) is below the 21-day EMA and MACD is falling.

Finally, AAPL is one of the most active underliers in the options market. That could help traders take positions with calls and puts.

Check out TradingView's The Leap competition sponsored by TradeStation.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

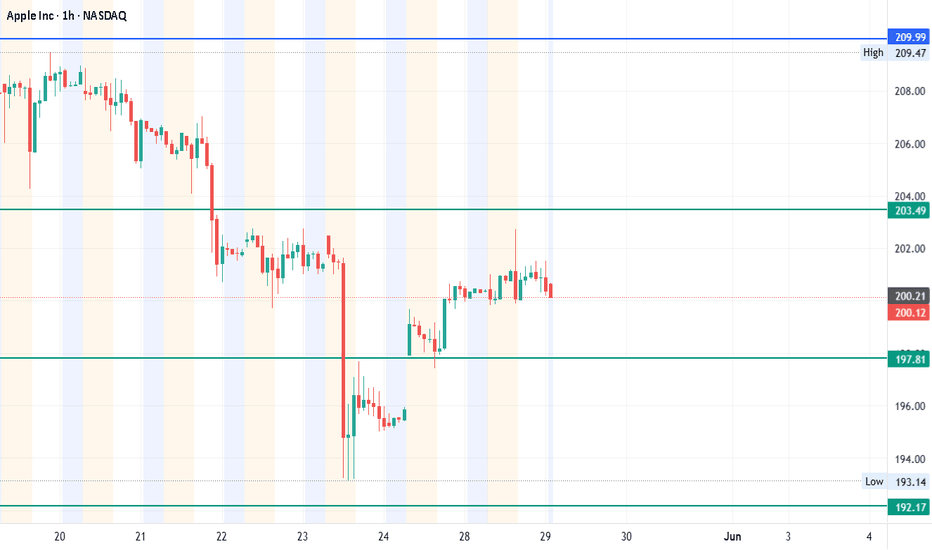

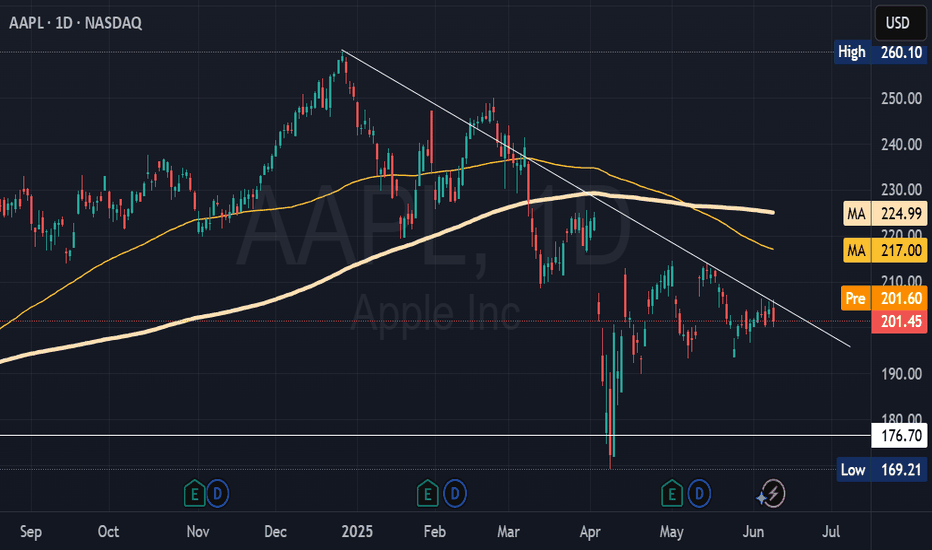

#AAPL - Pivot Point: $197.81#AAPL Trading Update — May 29, 2025

Current Price: $201.36

Pivot Point: $197.81

Upside Targets:

1️⃣ $209.99 — First resistance level to watch for profit booking

2️⃣ $216.49 — Confirmation of bullish momentum if price breaks above

3️⃣ $223.50 — Stronger resistance, potential for trend continuation

4️⃣ $230.50 — Longer-term target signaling significant upside potential

Downside Targets:

1️⃣ $185.65 — Immediate support, key level for bulls to defend

2️⃣ $179.13 — A more significant retracement level, watch for bounce or breakdown

3️⃣ $172.13 — Possible floor if selling pressure intensifies

4️⃣ $165.12 — Strong support zone, critical for trend reversal risk

Support Level: $192.17 — Acts as the first buffer zone; a break below could trigger further downside

Resistance Level: $203.49 — Short-term resistance; a clear breakout above this level would open the door to upside targets

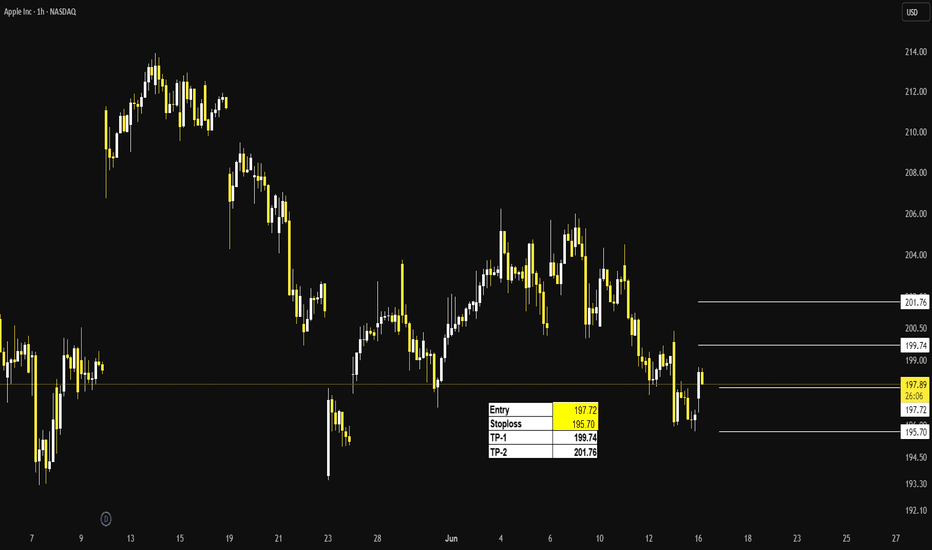

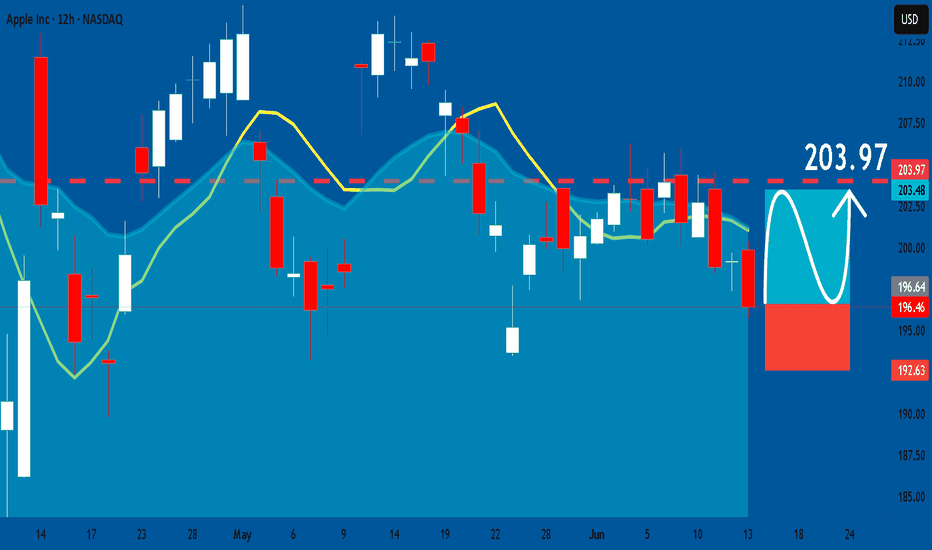

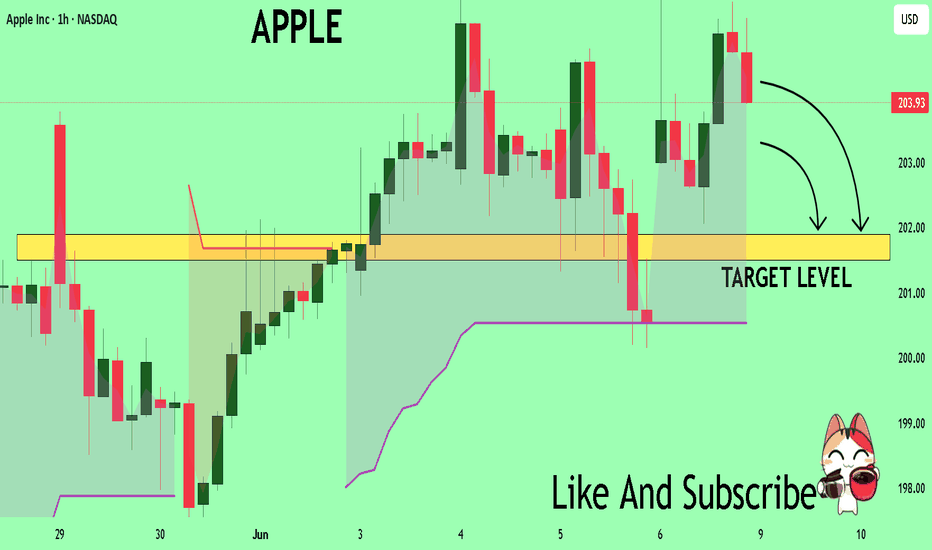

APPLE: Long Signal with Entry/SL/TP

APPLE

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy APPLE

Entry - 196.46

Stop - 192.63

Take - 203.97

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

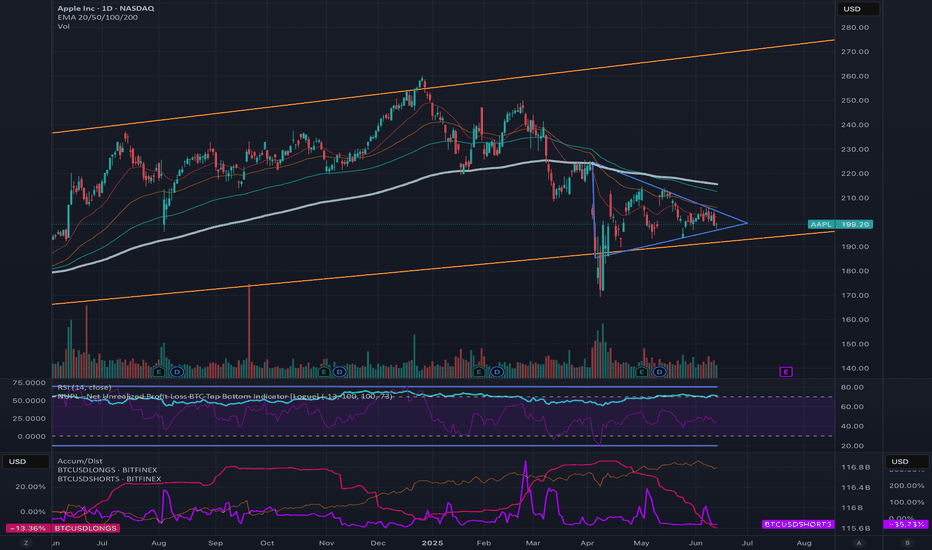

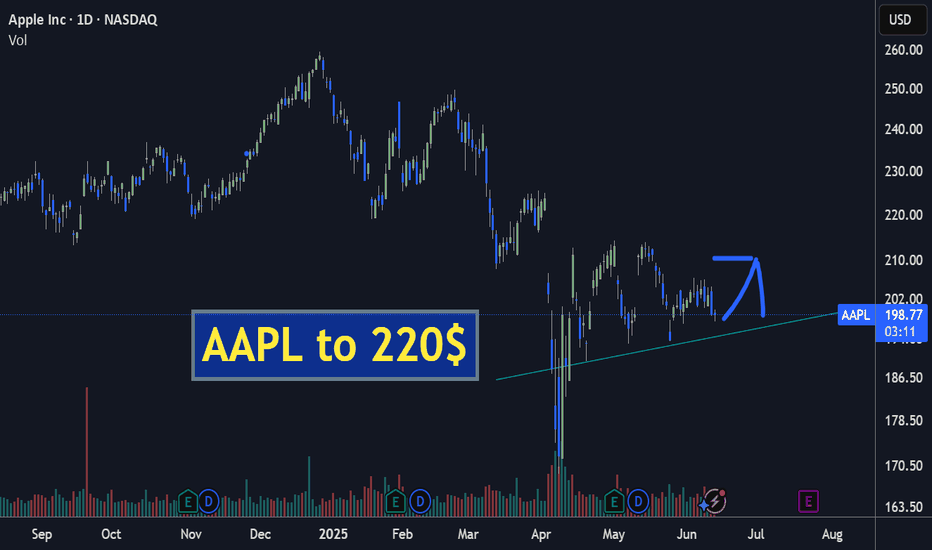

Time to buy? Too much negative press. Buy in Fear- Updated 13/6Apple has faced a significant amount of negative press recently, which has created a lot of fear and critical perceptions. This situation indicates that in times of fear, you should buy, and in times of greed, you should sell. As a result, I have taken a substantial long position on Apple.

The flag pattern is nearly complete, suggesting that a move is imminent. My stop loss is set at $196, with an expected profit from a positive breakout at >$223, indicating potential gains of over 10%. There is further upside potential to exceed >$230.

Apple is a strong long-term hold regardless of current fluctuations. It has an extensive and mature ecosystem, and this is not a company I would bet against. If you already own Apple products, you understand how unlikely it is that you would ever switch to something else.

AAPL breakout coming soonWhich way will it squeeze? I share my thoughts if AAPL can hold above 200.

*technically showing caution signs (bearish, but can flip)

*news is affecting the market greatly (esp AAPL re: tarriffs)

*RSI & MACD need a positive signal

*204, 205, 208 immediate targets to be focused on imo

Have a great weekend!

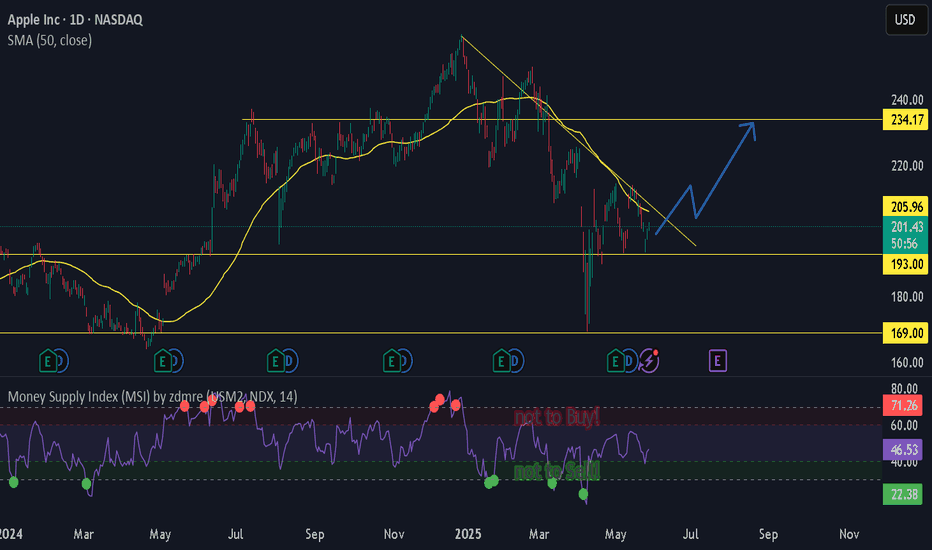

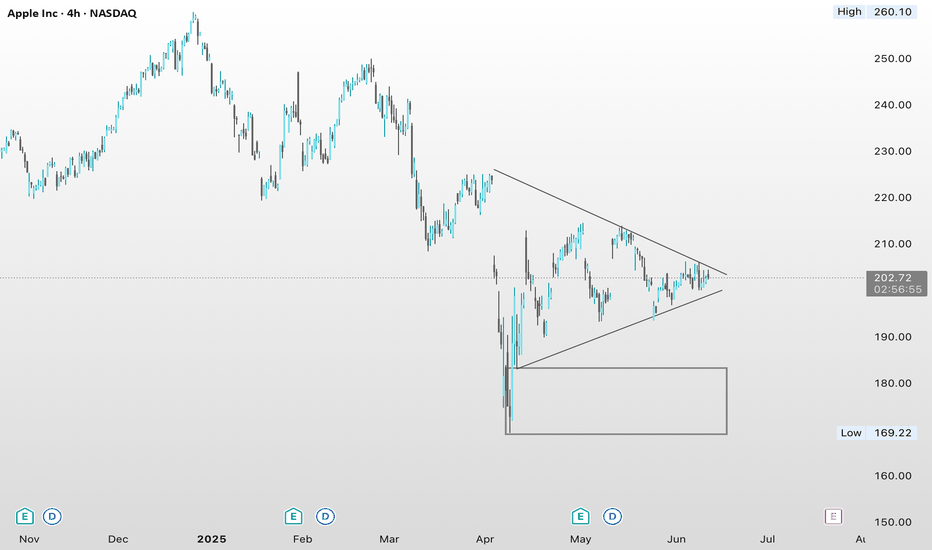

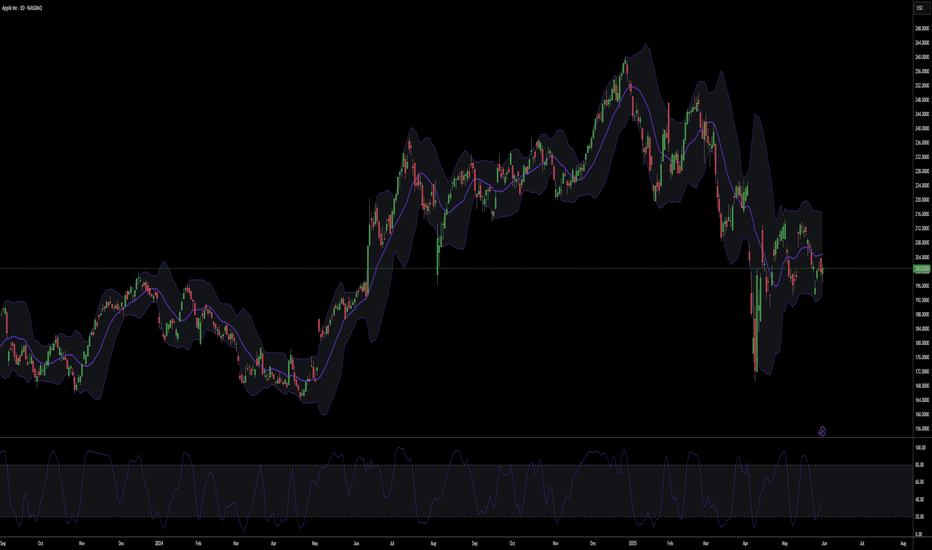

Apple (AAPL) Stock Analysis Apple's stock (AAPL) is currently trading at $201.15, reflecting a modest uptick of 0.47% today. Despite this slight gain, the stock has experienced a 22% decline year-to-date, underperforming its tech peers.

Technical Overview

The stock is navigating a descending broadening pattern, indicating ongoing bearish momentum. Notably, a "death cross" formation occurred in April, where the 50-day moving average crossed below the 200-day moving average, signalling potential further declines.

Support Levels: $193 and $169

Resistance Levels: $215 and $237

A break above the $215 resistance could pave the way for a rally towards $237. Conversely, a drop below the $193 support might lead to a decline towards $169.

Macroeconomic Factors

Recent political developments have introduced volatility. President Trump's proposal of a 25% tariff on iPhones not manufactured in the U.S. has raised concerns. In response, Apple is reportedly shifting a significant portion of its production to India to mitigate potential tariff impacts.

Fundamental Metrics

Market Capitalization: Approximately $3.28 trillion.

Price-to-Earnings (P/E) Ratio: 33.72.

Earnings Per Share (EPS): $6.42.

While Apple's P/E ratio is above its 10-year average, indicating a premium valuation, the company's robust earnings and strategic initiatives continue to attract investor interest.

Conclusion

Apple's stock is at a critical juncture, influenced by technical patterns and macroeconomic factors. Investors should monitor the $215 resistance and $193 support levels closely. A break in either direction could signal the stock's next significant move.

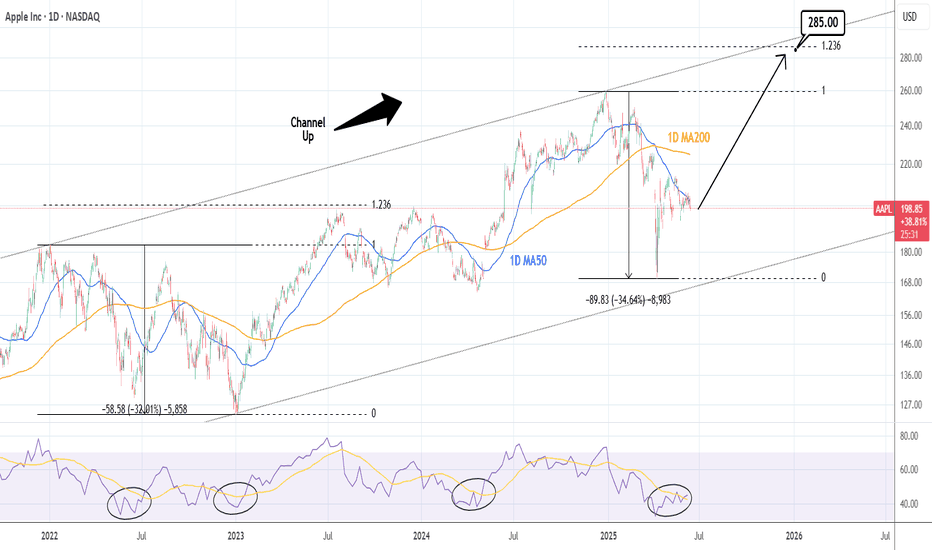

APPLE: 3 year Channel Up targets $285.Apple is marginally bearish on its 1D technical outlook (RSI = 43.788, MACD = -0.260, ADX = 30.978) as the recent weakness impeded the price from making the decisive bullish break-out above it. The 1W RSI structure though indicates that this is a bottom formation and it is evident on the Channel Up that the April 7th low has been the start of the new bullish wave. The first bullish wave which also started after a -32% correction, made a first peak on the 1.236 Fibonacci extension. We are bullish on Apple long term, TP = 285.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

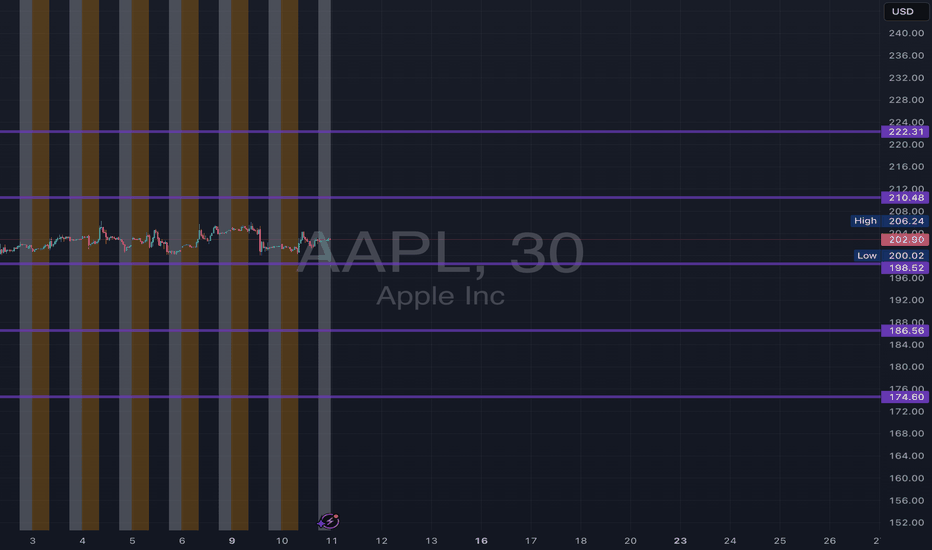

AAPL Monthly Support and Resistance Lines for June 2025AAPL Monthly Support and Resistance Lines for June 2025, valid only until the end of June.

Overview:

These purple lines serve as support and resistance levels when the price approaches these lines from either the bottom or top direction. Depending on the price movement direction, traders can enter long or short positions.

Trading Timeframes

I typically utilize 30-minute candlesticks for swing trading options, with a holding period of up to 2-3 days. Additionally, 3-hour or 4-hour timeframes can also be used for swing trades lasting up to 2 weeks to capture significant upward or downward movements.

I post these at the beginning of each month, and they remain valid until the end of that month.

AAPL BUYScenario 1

BUY AAPL at 202.00, riding it back up to 258.00 to 270.00 for Profit Targets, Stop Loss is at 196.00!

Scenario 2

BUY AAPL by setting a BUY LIMIT at 194.00, riding it back up to 258.00 to 270.00 for Profit Targets, Stop Loss is at 189.00!

WARNING: This is only a journal of my opinion of the market and only for my journaling purpose. This information and publication are NOT meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations. Trading any market instrument is a risky business, so do your own due diligence, and trade at your own risk. You can loose all of your money and much more.

Time to buy? Too much negative press. Buy in Fear. Apple has faced a significant amount of negative press recently, which has created a lot of fear and critical perceptions. This situation indicates that in times of fear, you should buy, and in times of greed, you should sell. As a result, I have taken a substantial long position on Apple.

The flag pattern is nearly complete, suggesting that a move is imminent. My stop loss is set at $196, with an expected profit from a positive breakout at $223, indicating potential gains of over 10%. There is further upside potential to exceed >$230.

Apple is a strong long-term hold regardless of current fluctuations. It has an extensive and mature ecosystem, and this is not a company I would bet against. If you already own Apple products, you understand how unlikely it is that you would ever switch to something else.

APPLE The Target Is DOWN! SELL!

My dear subscribers,

This is my opinion on the APPLE next move:

The instrument tests an important psychological level 203.93

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 201.90

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

A Apple Stock On the Head And Shoulder MotionAAPL Daily Chart: Head and Shoulders Pattern Confirmed

Apple Inc. (AAPL) has formed a classic head and shoulders pattern on the daily timeframe, signaling a potential reversal from its recent uptrend.

🔍 Key Observations:

Left Shoulder: A peak followed by a pullback.

Head: A higher peak compared to the left shoulder.

Right Shoulder: A peak similar in height to the left shoulder.

Neckline: The support level connecting the troughs between the shoulders and head.

The pattern was confirmed when AAPL closed below the neckline, located around the $220 level. This breakdown suggests a bearish outlook, with a potential downside target of approximately $180, calculated by measuring the vertical distance from the head to the neckline and projecting it downward from the breakout point .

verifiedinvesting.com

📊 Trading Strategy:

Entry: Consider entering a short position upon a confirmed breakdown below the neckline.

Stop Loss: Place a stop loss above the right shoulder to manage risk.

Target: Set a profit target near the $180 level, adjusting based on market conditions.

verifiedinvesting.com

+4

tradingview.com

+4

tradingview.com

+4

⚠️ Risk Management:

Monitor for any bullish reversal patterns or a close above the neckline, as these could invalidate the bearish setup.

Note: This analysis is for informational purposes only and does not constitute trading advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

$AAPL – Long Setup Brewing: Fib Break + Gamma Unwind?Not financial advice

Apple has been the last laggard among the Magnificent 7. While others have already reclaimed their weekly 20 MA, NASDAQ:AAPL has spent over seven weeks consolidating just below major resistance, potentially building fuel for a breakout.

The $205 level is the key battleground. It lines up with the .382 Fibonacci retracement from the previous high and acts as a psychological level and gamma pin. Today’s rejection at $205 reinforces its importance. If broken with volume, it could trigger a strong directional move as delta hedging unwinds into upside momentum.

🔍 Technical Outlook:

.382 Fib retracement = $205 → major inflection level

Weekly 20 MA sits just above; price compressing underneath

Bollinger Bands tightening → volatility expansion expected

MACD (weekly) flattening near a bullish cross

CMO rising, showing improving momentum under the surface

📊 Options Flow – 14-Day Snapshot:

Call Volume: $7.87M

Put Volume: $5.37M

→ Volume favors calls

Call Premium: $2.34B

Put Premium: $5.11B

→ Premium skewed toward puts, suggesting larger capital flows hedging downside or playing defense

Open Interest Cluster: Dense between $195–$300, particularly on the call side

Despite the put premium dominance, the consistent call volume and broad OI range suggest accumulation and potential bullish positioning under the surface.

🧭 Trade Thesis:

Apple is coiling at a critical intersection — Fib level, gamma wall, and major moving average resistance. If it breaks $205 with strength, we could see a swift rally toward $215–$225, where the next Fib levels and gamma zones align.

Right now, the setup is compression under pressure. Watching for a clean breakout with confirmation.

Apple Stock Drops: Is Slow AI Development to Blame?The tech world was abuzz on Monday as Apple, a titan of industry and a beacon of innovation, experienced a sudden and significant dip in its stock value, shedding approximately $75 billion in market capitalization. This abrupt decline sent ripples through the investment community, prompting a closer examination of the underlying factors contributing to what many perceive as a rare moment of vulnerability for the Cupertino giant. While market fluctuations are a normal part of the financial landscape, this particular downturn has been widely attributed to growing investor apprehension regarding Apple's perceived slow progress in the burgeoning field of generative artificial intelligence (AI). In an era where competitors are aggressively pushing the boundaries of AI capabilities, Apple's more measured approach appears to be raising questions about its future competitive edge and its ability to maintain its unparalleled ecosystem.

The $75 Billion Question: Unpacking Apple's Stock Drop

Apple's stock drop on Monday was not an isolated incident but rather a culmination of mounting concerns among investors. While the immediate trigger for such a sharp decline can often be a specific news event or analyst downgrade, the broader context points to a deeper anxiety: the pace and direction of Apple's generative AI development. For a company that has historically set the pace in consumer technology, a perception of lagging in a critical emerging technology like generative AI is a significant red flag for the market.

The $75 billion loss in market value represents a substantial sum, even for a company of Apple's immense size. It signifies that a considerable portion of investor confidence, particularly concerning future growth prospects, has been eroded. This erosion stems from the understanding that generative AI is not just another feature; it is poised to revolutionize how users interact with technology, from personal assistants to content creation and productivity tools. Companies that fail to innovate rapidly and effectively in this space risk being left behind, potentially losing market share and, more importantly, mindshare among consumers.

Investors are keenly aware that the tech landscape is unforgiving. Past leaders, even those with seemingly unassailable positions, have faltered when they failed to adapt to paradigm shifts. The market's reaction to Apple's AI progress, or lack thereof, is a testament to the perceived urgency and transformative potential of generative AI. It suggests that the market is valuing future AI capabilities heavily, and any perceived deficit in this area translates directly into a discounted valuation. The stock drop, therefore, serves as a stark reminder that even for Apple, continued dominance is not guaranteed without aggressive innovation in key technological frontiers.

Apple's Generative AI Journey: A Work in Progress

Apple's approach to AI has historically been characterized by a focus on integration, privacy, and user experience. Features like Siri, Face ID, and computational photography are all powered by sophisticated AI algorithms, seamlessly woven into the Apple ecosystem. However, these applications typically fall under the umbrella of discriminative AI, which is designed to make predictions or classifications based on input data. Generative AI, on the other hand, is about creating new content—text, images, audio, video—that is often indistinguishable from human-created output. This is where Apple's "work in progress" status becomes a point of contention.

For years, Apple has been quietly investing in AI research, acquiring smaller AI companies, and hiring top talent. Its chips, particularly the A-series and M-series, are designed with powerful Neural Engines specifically optimized for on-device AI processing. This emphasis on on-device AI aligns with Apple's core philosophy of privacy, allowing many AI computations to occur directly on the device without sending user data to the cloud. While this approach offers significant privacy benefits and can lead to faster, more responsive experiences, it may also present challenges in scaling the massive computational power required for large language models (LLMs) and other complex generative AI applications that often rely on vast cloud infrastructures.

The challenge for Apple lies in translating its existing AI prowess and privacy-centric philosophy into compelling generative AI experiences that can compete with the rapid advancements seen elsewhere. While there have been reports and rumors of Apple developing its own LLMs and generative AI tools, concrete product announcements or widespread public demonstrations have been notably absent. This silence, coupled with the aggressive public releases from competitors, has fueled the narrative that Apple is behind the curve. The market is looking for tangible evidence of Apple's generative AI capabilities, not just promises of future integration. The "work in progress" status, while a natural part of any complex technological development, is being scrutinized under a microscope, especially given the high stakes of the generative AI race.

The AI Race: Contrasting Apple with OpenAI, Google, and Microsoft

The generative AI landscape is currently dominated by a few key players who have made significant strides, setting a high bar for innovation and public perception. The contrast between these leaders and Apple's perceived pace is stark and forms the crux of investor concerns.

OpenAI, with its groundbreaking ChatGPT, DALL-E, and Sora models, has arguably ignited the current generative AI boom. Its strategy has been one of rapid iteration, public release, and collaborative development, often prioritizing innovation and accessibility over immediate commercialization. This approach has allowed OpenAI to capture significant public attention and demonstrate the immense potential of generative AI, effectively becoming the face of the movement.

Google, a long-standing leader in AI research, has been quick to integrate generative AI into its vast ecosystem. Its Gemini models are designed to be multimodal and highly capable, powering features across Google Search, Workspace, and Android. Google's advantage lies in its immense data reserves, vast computational infrastructure, and decades of AI expertise. While it initially faced criticism for being slow to respond to ChatGPT, Google has since demonstrated its commitment to integrating generative AI deeply into its core products and services, showcasing a comprehensive and aggressive strategy.

Microsoft, through its strategic partnership and substantial investment in OpenAI, has positioned itself as a formidable force in the generative AI space. By integrating OpenAI's models into its Azure cloud services, Microsoft 365 suite (Copilot), and Bing search engine, Microsoft has rapidly brought generative AI capabilities to millions of enterprise and consumer users. This partnership has allowed Microsoft to leverage cutting-edge AI research without having to build every component from scratch, accelerating its time to market and providing a significant competitive advantage.

In contrast, Apple has historically preferred to develop its core technologies in-house, maintaining tight control over its hardware and software integration. While this approach has resulted in highly optimized and secure products, it may be a slower path when it comes to rapidly evolving, data-intensive fields like generative AI. The lack of a public-facing, widely accessible generative AI product from Apple, akin to ChatGPT or Gemini, creates a perception that it is not participating in the same league as its rivals. This perception, whether entirely accurate or not, is what is currently impacting investor confidence and contributing to the stock's recent performance. The market is looking for Apple to demonstrate its unique value proposition in generative AI, beyond its traditional strengths.

Challenges and Implications for Apple

Apple's perceived lag in generative AI development presents several significant challenges and implications for its future.

Firstly, there's the risk of falling behind in core product experiences. As generative AI becomes increasingly integrated into operating systems, productivity suites, and creative tools, devices and platforms that lack these capabilities may appear less competitive. Imagine a future where intelligent agents seamlessly manage tasks, generate content, and provide hyper-personalized experiences. If Apple's ecosystem doesn't offer comparable features, it could erode its premium appeal and lead users to platforms that do.

Secondly, developer mindshare is crucial. The most innovative applications and services often gravitate towards platforms that offer the best tools and capabilities. If generative AI developers perceive Apple's platform as less capable or slower to adopt cutting-edge AI models, they might prioritize other ecosystems, potentially leading to a stagnation in the breadth and quality of third-party applications within the Apple App Store.

Thirdly, ecosystem lock-in, a traditional Apple strength, could be challenged. While Apple's integrated hardware and software create a powerful ecosystem, the allure of superior AI capabilities on other platforms could tempt users to switch. For instance, if Google's AI-powered features on Android become significantly more advanced and useful than what Apple offers on iOS, even loyal Apple users might consider alternatives.

Finally, there's the impact on brand perception and innovation narrative. Apple has built its brand on innovation and pushing technological boundaries. A perception of being a follower rather than a leader in a transformative technology like generative AI could tarnish this image, potentially affecting consumer loyalty and its ability to attract top talent in the long run. The $75 billion stock drop is a clear signal that the market is taking these implications seriously.

The Path Forward: Apple's Strategy to Reclaim AI Leadership

Despite the current concerns, it would be premature to count Apple out of the generative AI race. The company possesses immense resources, a vast user base, unparalleled brand loyalty, and a proven track record of entering established markets and redefining them. Apple's path forward in generative AI will likely involve several strategic moves.

One approach could be to leverage its existing hardware advantage. Apple's custom silicon, particularly the Neural Engine in its A-series and M-series chips, provides a powerful foundation for on-device AI. The company could double down on developing highly efficient, privacy-preserving generative AI models that run directly on its devices, offering unique capabilities that cloud-based solutions cannot match. This would align with its privacy-first philosophy and differentiate its offerings.

Secondly, strategic acquisitions and partnerships could accelerate its progress. While Apple prefers in-house development, the rapid pace of generative AI might necessitate acquiring specialized AI startups or forming partnerships with leading AI research labs to quickly integrate cutting-edge models and talent. This would allow Apple to bridge any perceived gaps more rapidly.

Thirdly, Apple might focus on integrating generative AI subtly and seamlessly into its existing products and services, rather than launching standalone, attention-grabbing AI models. This "Apple way" of introducing technology often involves refining and perfecting features before a public rollout, ensuring they are intuitive and enhance the user experience without being overtly complex. This could involve AI-powered enhancements to Siri, improved content creation tools in its creative suite, or more intelligent automation within iOS and macOS.

Finally, developer engagement will be crucial. Apple needs to provide robust tools and frameworks that empower developers to integrate generative AI capabilities into their apps, leveraging Apple's on-device AI power. This would foster a vibrant ecosystem of AI-powered applications that further enhance the value proposition of Apple devices.

In conclusion, Apple's recent stock drop serves as a potent reminder of the market's high expectations and the transformative power of generative AI. While the company's deliberate and privacy-focused approach to AI has its merits, the rapid advancements by competitors like OpenAI, Google, and Microsoft have created a perception of lag. The challenge for Apple is to demonstrate how its unique strengths—integrated hardware and software, a focus on user experience, and a commitment to privacy—can translate into a compelling and competitive generative AI strategy. The coming months will be critical as Apple navigates this pivotal technological shift, aiming to reassure investors and consumers that it remains at the forefront of innovation, ready to define the next era of personal computing with its own distinct AI vision.