COFFEE FUTURE : POTENTIALLY SOMETHING BIG TO COMEENGLISH

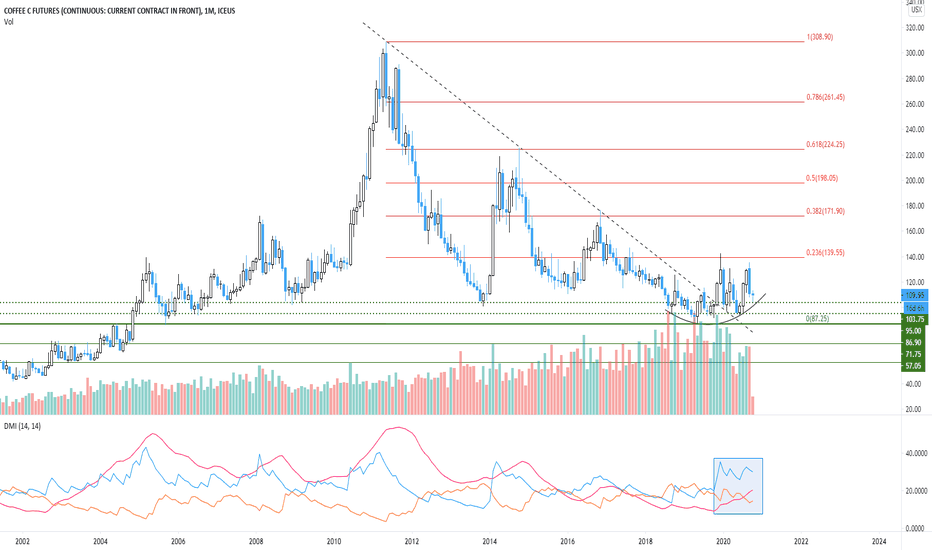

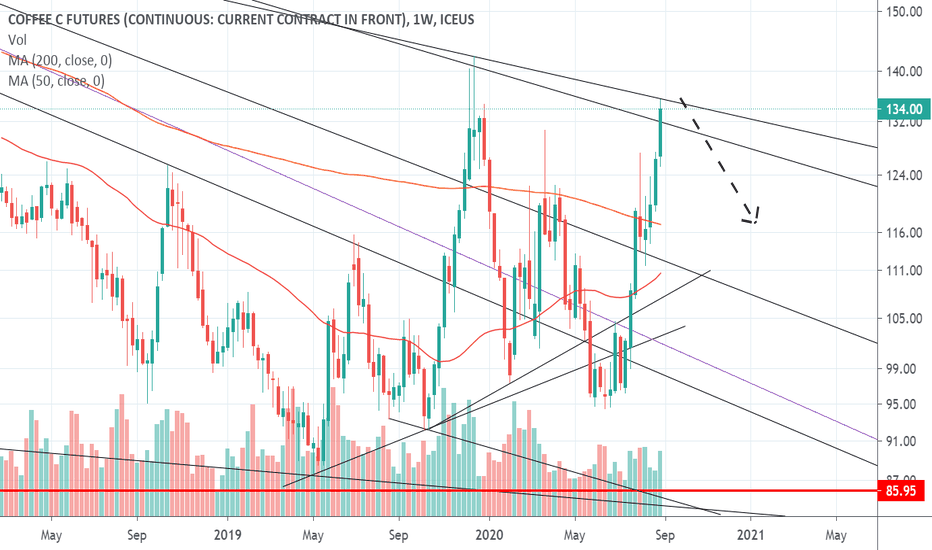

- Prices have been evolving below a bearish trendline, registering lower highs but no significant new market bottoms since May 2011. The long-term trend is then neutral.

- However, even though prices have still been consolidating laterally over the last year, they also managed to clear their bearish trendline by successfully rebounding multiple times over the 87.00/103.75 zone, registering what looks like a reversal rounding bottom pattern . In addition, volumes have been on the rise during all the testing phase of the support zone while the DMI shows an increasing bullish pressure inside a more and more directional movement.

- It is still hard to talk about a strong bullish reversal here as the market hasn’t registered any new highs. However, this year’s bullish breakout tells us the bearish trend is now over while positive signs on technical indicators (transaction volumes and DMI) demonstrate buyers ‘interest for the asset. It seems the slow dance around the strong psychological and technical level of 100.00 has been an opportunity for bull traders to try to regain control of the market. In this configuration, the bullish scenario remains the most likely but a market close below the 103.75/95.00 zone would invalidate or, at least, delay the bullish potential towards 140.00, 172.00, 198.00 and 224.00 by extension.

NB : Coffee has been overperforming the Bloomberg Commodity Index since October 2019

________________________________________________________________________________________________________________________________

FRENCH

- Les prix ont évolué sous une ligne de tendance baissière, enregistrant des sommets de plus en plus bas mais aucun nouveau creux de marché significatif depuis mai 2011. La tendance long-terme est donc neutre.

- Cependant, même si les prix ont consolidé latéralement au cours des dernières années, ils ont également réussi à s’affranchir de leur ligne de tendance baissière de long-terme en rebondissant à de multiples reprises au-dessus de la zone 87.00/103.75, en s’inscrivant dans ce qui semble être une figure haussière de creux en soucoupe. De plus, les volumes ont été en hausse durant toute la phase de test de la zone support alors que le DMI affiche une pression acheteuse grandissante au sein d’un mouvement de plus en plus directionnel.

- Il est toujours compliqué de parler d’un fort renversement à la hausse alors que le marché n’a toujours pas effectué de plus haut significatif. Cependant, le franchissement technique de cette année nous confirme que la tendance baissière de long-terme est désormais terminée alors que les signes positifs rapportés par les indicateurs techniques (volumes de transaction et DMI) nous démontrent un regain d’intérêt des acheteurs pour l’actif. Il semblerait que la lente dance des prix autour du niveaux technique et psychologique fort des 100.00 a été une opportunité pour les acheteurs de tenter de reprendre le contrôle du marché. Dans cette configuration, le scénario haussier reste le plus probable mais toute clôture de marché en-dessous de la zone 103.75/95.00 invaliderait ou, du moins, diffèrerait le potentiel haussier vers 140.00, 172.00, 198.00 puis 224.00 par extension.

NB : le café superforme l’indice Bloomberg des matières premières depuis Octobre 2019.

ICF1! trade ideas

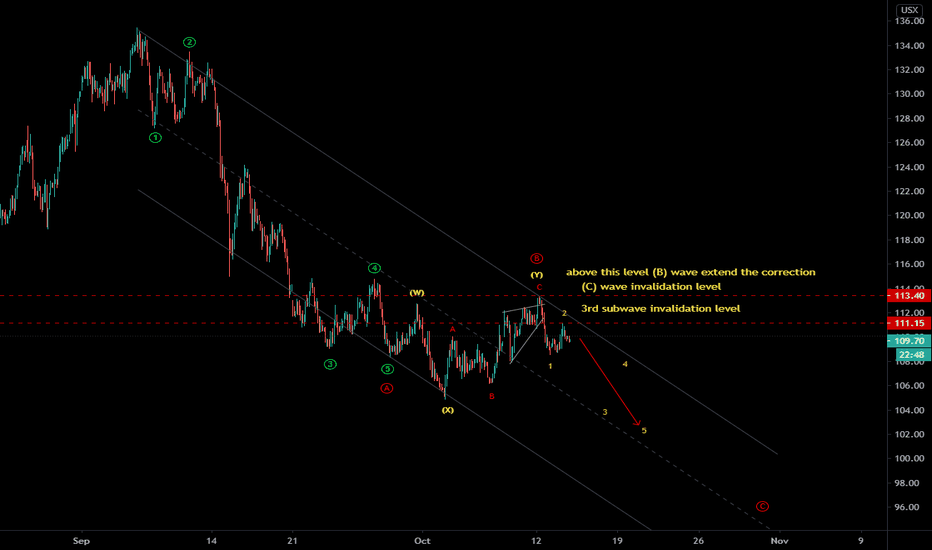

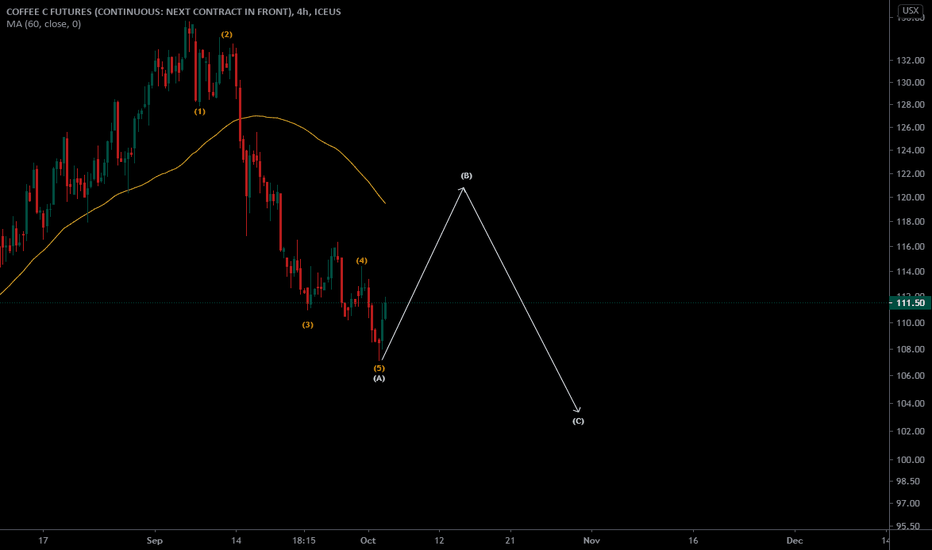

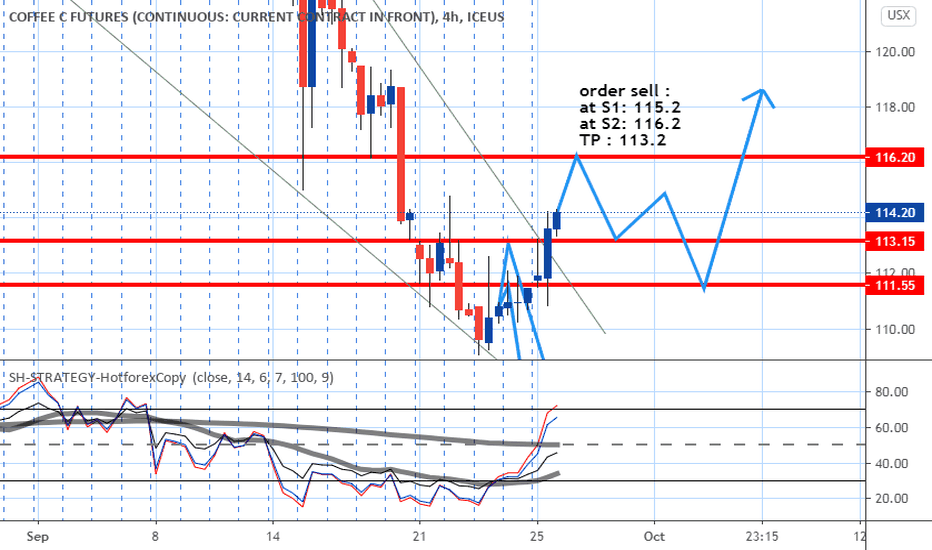

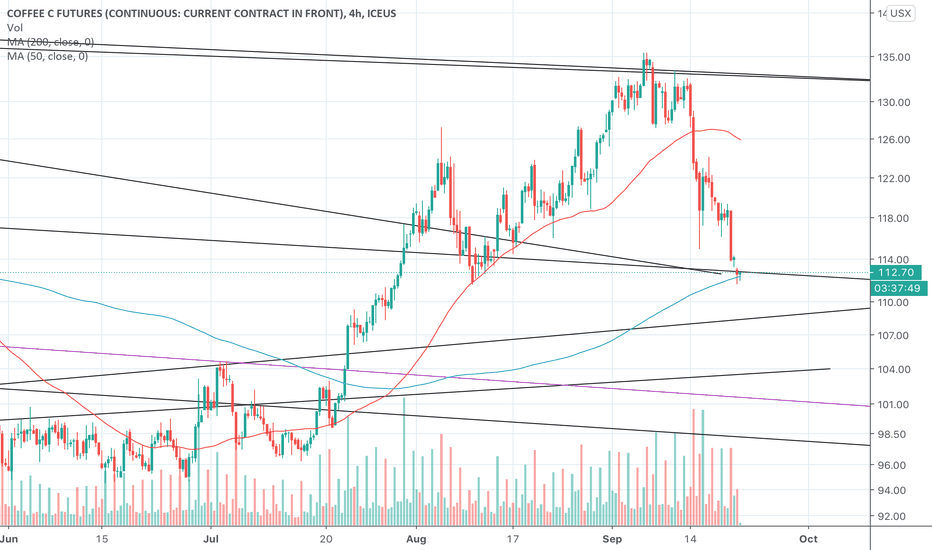

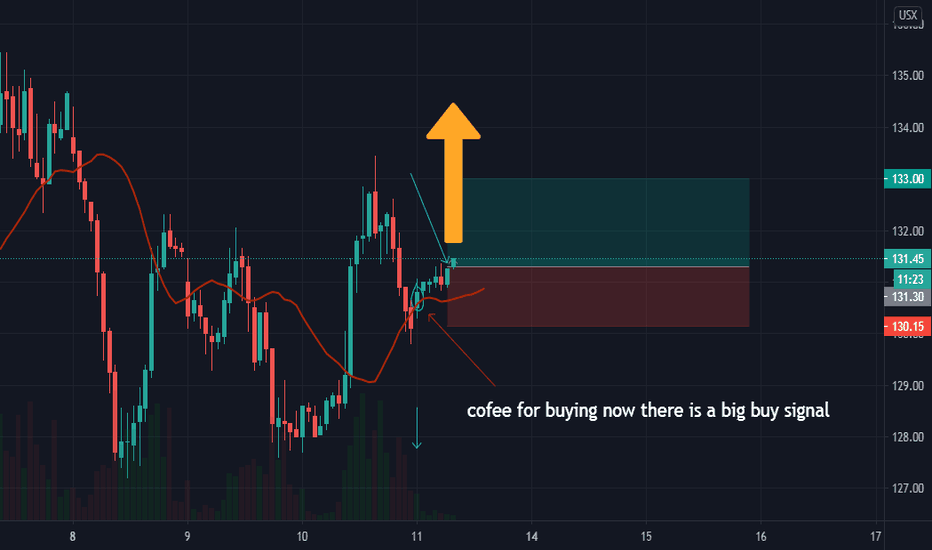

KC - Coffee futures - Sell set up - EW analysis Welcome guys,

CycleWave is the top author sharing trade ideas based on EW analysis since last five months on the global stocks, currency pairs, cryptos, future indices and commodities. You can follow us to get more trade ideas/analysis.

KC Coffee futures - It is within ABC zigzag down move, where B wave was corrected in complex wxy correction in ending diagonal c in y wave. The drop should be expected sharp down. So stay bearish at current level with stop loss above 113.40 for target below 100 level. There is a chance of C wave extension too. But next price action will reveal the how C wave down will reach the target. Dump it down from current level. There is also a chance of B wave extension if price crosses above invalidation level. so stay small in size unless it made a new low.

Give thumbs up if you really like the trade idea.

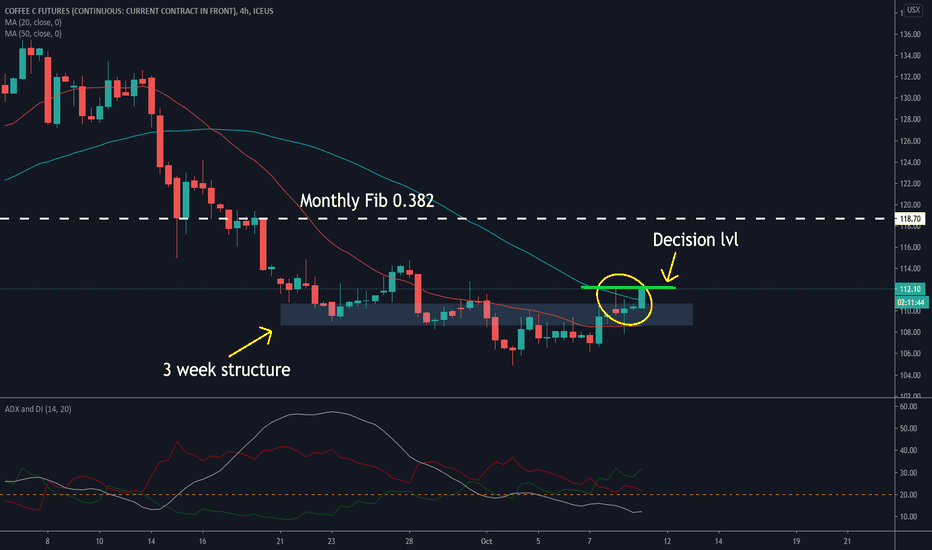

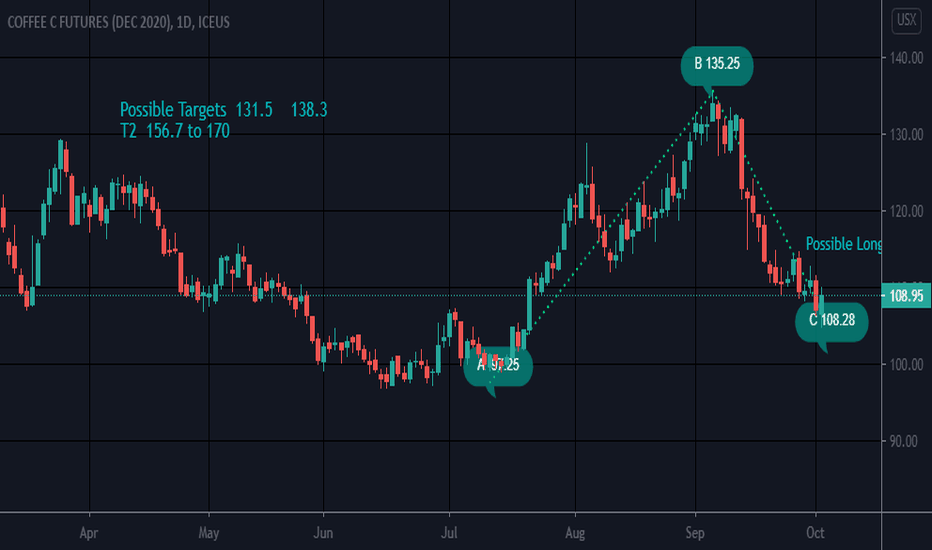

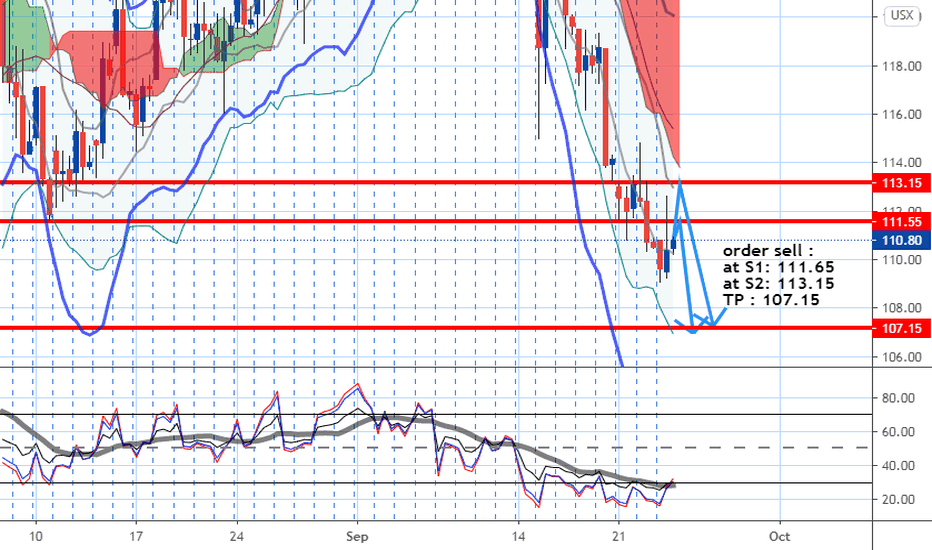

COFFEE - Turning the tide ?Coffee after a 3 week structure and battle seems to be making a break towards the Fib 0.382.

The higher time frames still point down.

The ADX indicator shows uptrend but no strength yet (it usually has a delay on that).

The COT of Sep 29 shows a lot of long orders closed (-3745) and more short open (+3065) with net long positions to 54931 compared to 61741 of the week before that.

So hudge funds expect more to the down.

We might have a turn of tide for coffee if this is not a false breakout, at least up to the Fib 0.382 area.

I will start engaging buy orders just after the decision level (green line) is broken to the upside by solid moves, maybe wait for the day to close.

Good luck traders.

Note: I'm no trading expert nor have the ambition to become one! The above is just an idea that I share with the intention of attracting comments and perhaps become a better trader.

LONG KC (Coffee) here to 160 by Dec. (73 days)3 separate (Bearish Bat + Gartley) PRZs line up @160!

With the Real strengthening but also, option volatility rather expensive @ 41%...

... we have bought up the Dec. 2020, 140-160 CALL Spreads for $1095 a pop.

We are expecting Coffee to finish the year >160.00, for a 1:7.3 R/R on this trade - i.e. $7500 / contract.

Good luck out there!

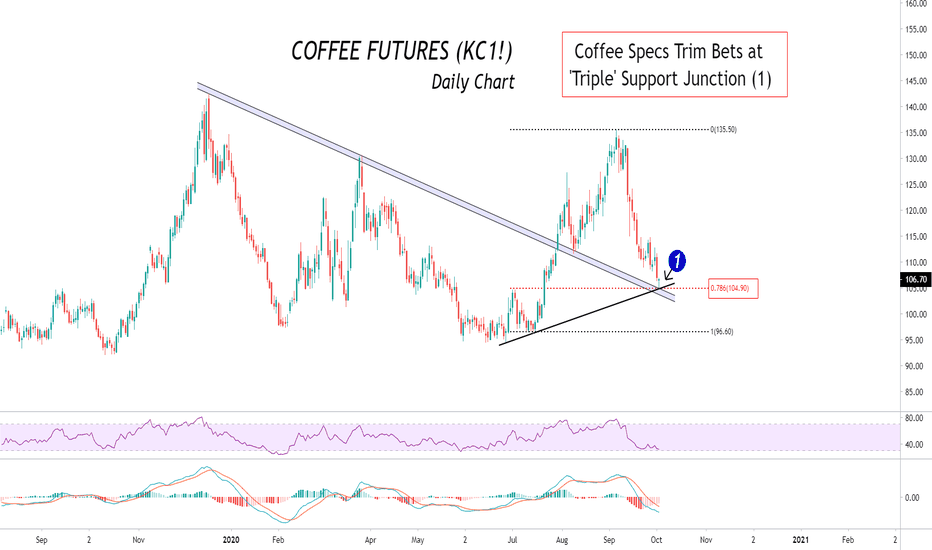

Will the smart money drive coffee prices even lower? According to last weeks Commitment of Traders report (COT) which breaks down the total open interest as of each Tuesday’s settlement for markets held amongst three groups of traders (Commercials, Non-Commercials and Non-Reportables) showed that Commercial Hedgers more commonly known as Smart Money Hedgers are holding near extreme bearish exposure on Coffee which totalled -65,782 contracts (previous week -70,963).

At these extreme levels, commercials are important to watch as they have proven themselves over time to be correct at crucial turning points.

What’s interesting with this particular soft commodity is that the current turning point illustrated in the chart, where inside trendline support, 78.6 fib and ascending trendline junction at (1) contradicts the Smart Moneys near extreme bearish positioning. However, it’s our opinion that any downside relief at this triple support cluster will only provide better selling opportunities for the next leg down.

Non-Commercial traders trimmed their bullish net positions last week from the previous week by -4,598 contracts which now total 61,741 contracts. These large speculators are trend followers by definition and usually get it wrong at turning points, along with small speculators (Non-Reportables) which totalled a net position of 4,041 contracts, down -583 contracts reported the previous week (4,624 contracts).

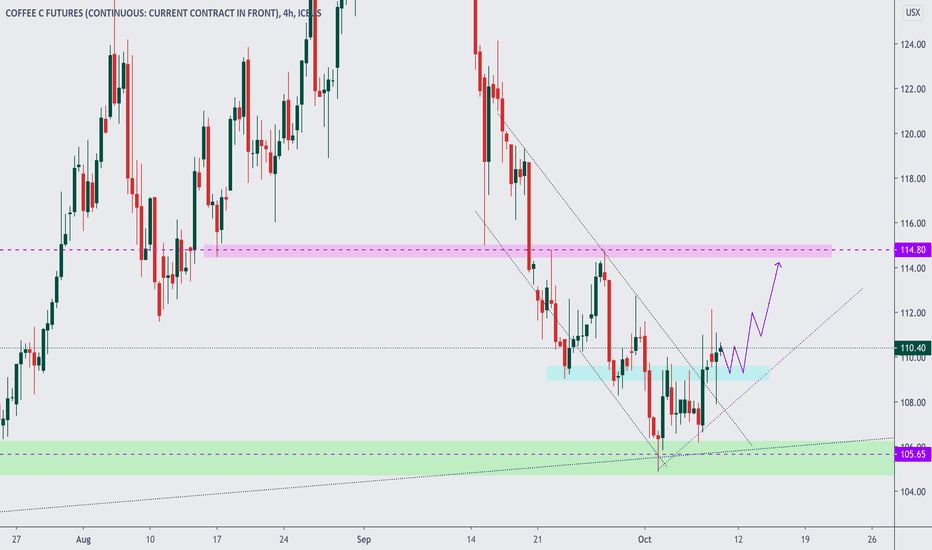

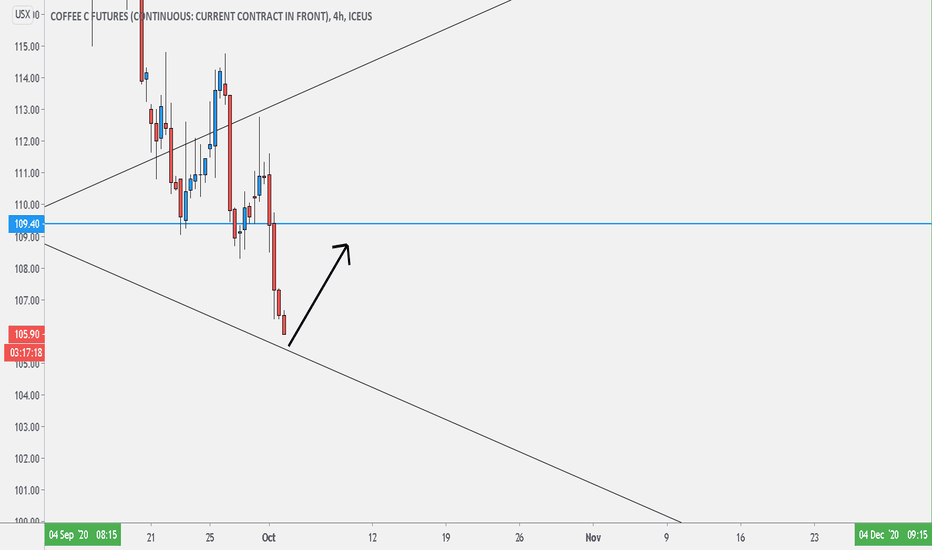

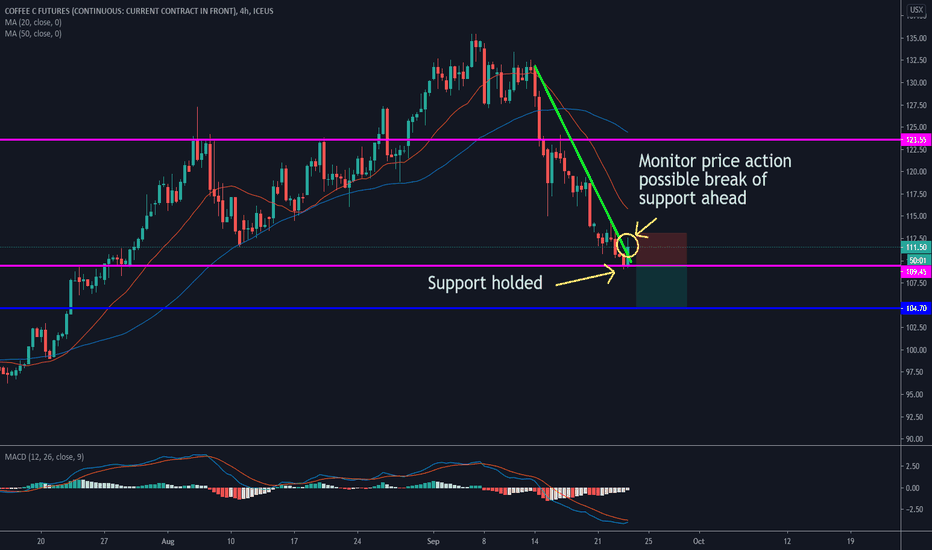

COFFEE FUTURES - Wake up and smell the coffeeCOFFEE holded the support area of ~109.20-109.50 and made a pullback breaking the trendline (marked green on chart).

However the bulls seem to be sleepy so I believe the trend continues to be bearish and we have to monitor how price will react to make our decision.

Personally I'm considering a short position around the area marked on the chart.

Potential profit to blue line which is the next support area.

So as mentioned on the chart we monitor price and have our finger on the trigger.

Good luck traders.

Note: I'm no trading expert nor have the ambition to become one! The above is just an idea that I share with the intention of attracting comments and perhaps become better at trading commodities.

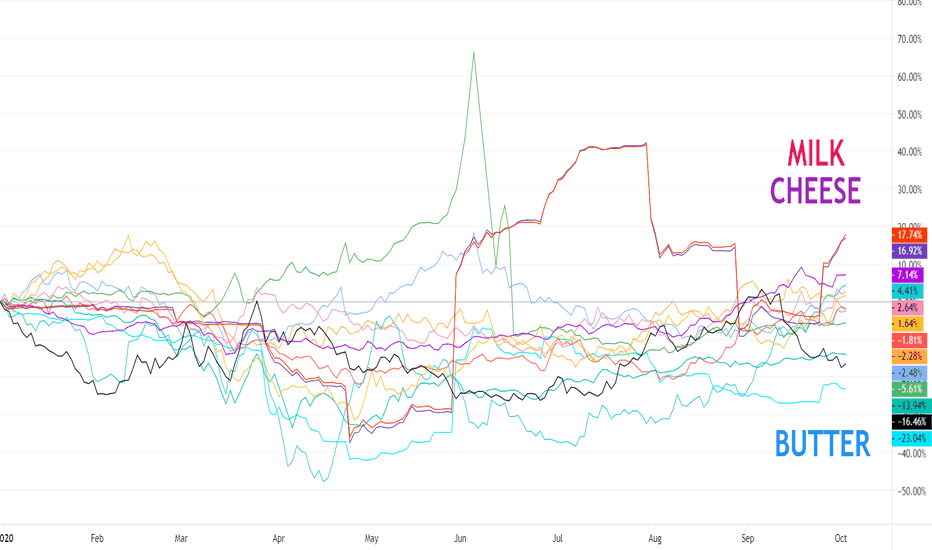

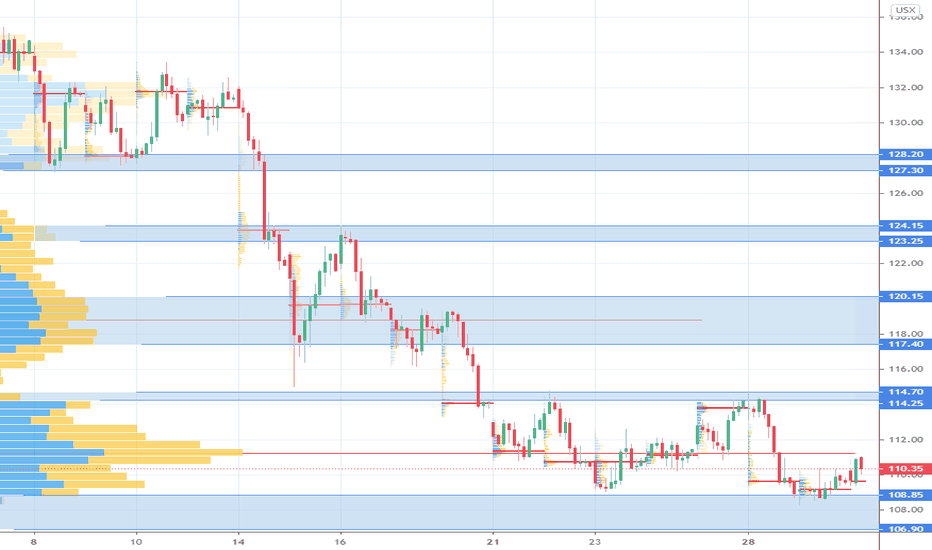

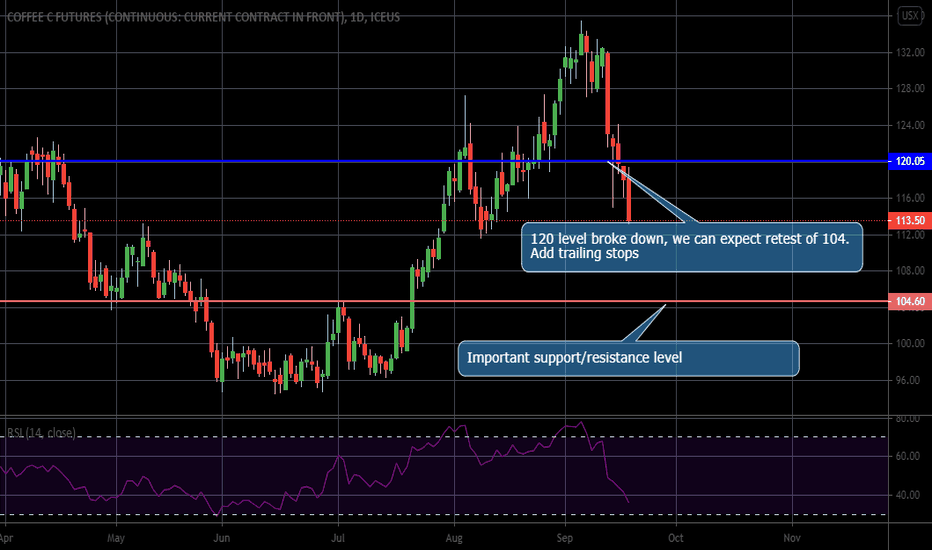

The decline is not done yet. ExplainedCoffee reached our target at 120. However, there is still no signal the decline is done and we want to follow the trend. The support is broken and it makes me believe there is a big chance we can see a retest of important support/resistance near 104. So, if you still hold your shorts, consider adding trailing stops and let the good time roll.

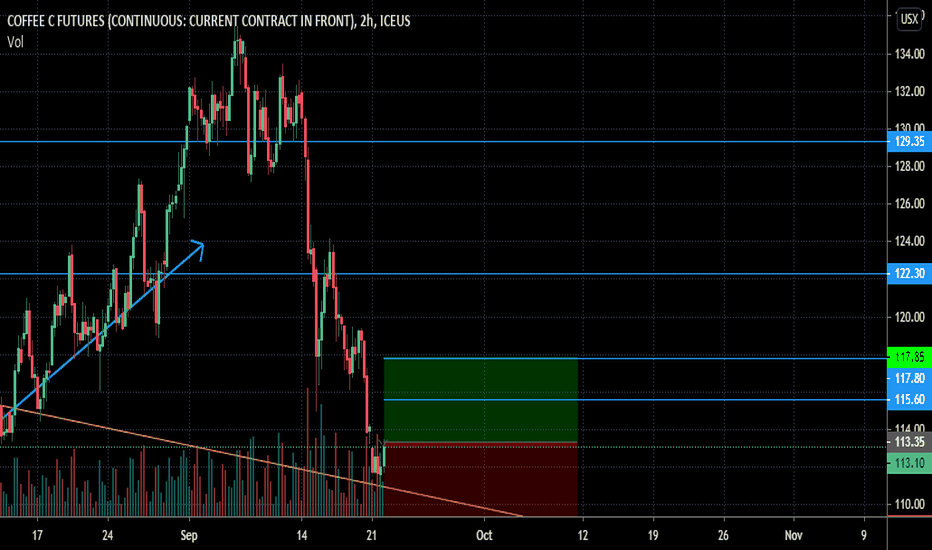

Trend change is coming. Potential entries and targetsThe COT report is bearish, the seasonal tendency is to the downside. We have a divergence in the 4h chart. So, where do we sell? I think breaking below Thursday's low or formation of lower high would be good entries. 120 has been an important level for Coffee. It has to be tested again and it is our swing target.