ISP1! trade ideas

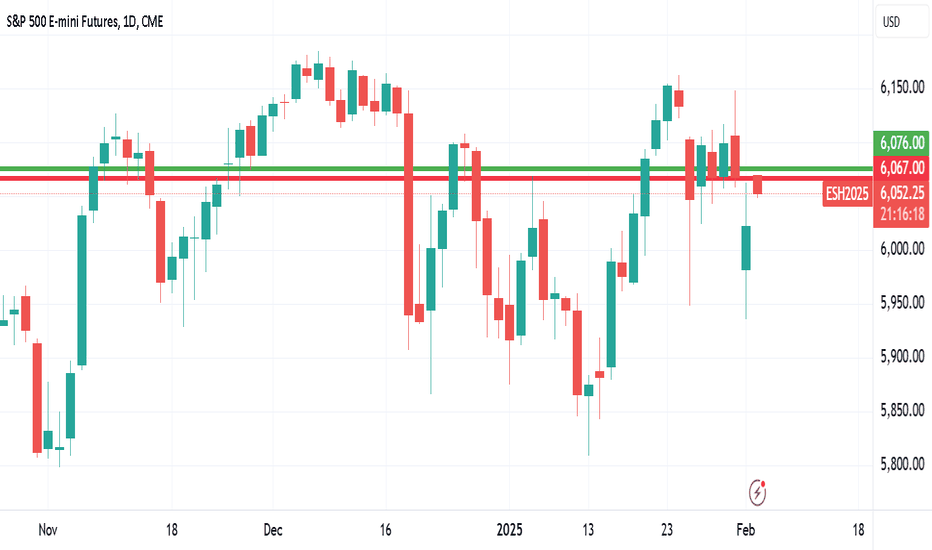

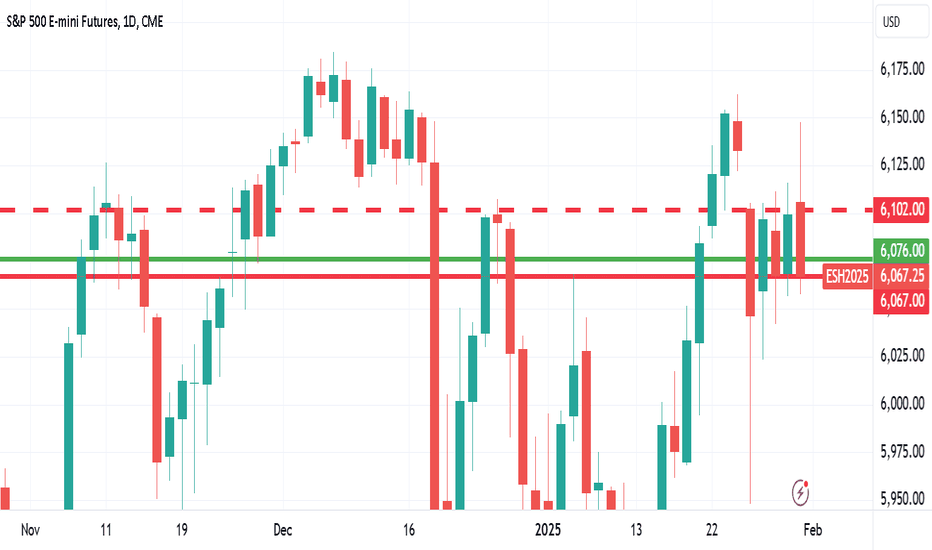

Inside day is expectedAnd inside day in the S&P 500 daily chart is expected for Tuesday. This means that Tuesday's range will be basically inside of Monday's range. I think this type of structure will happen because the market is going to try to absorb what is the total picture so I don't look for a big move up or down without new information.

ES Trade Idea: Key Levels and Strategies Amid Macro UncertaintyCME_MINI:ES1!

ES futures opened with a gap down on Sunday.

With numerous macro headlines, President Donald Trump’s comments on the Fed’s decision last week, and ongoing trade war tariffs, traders may struggle to distinguish what truly matters for the markets from the noise.

In our opinion, do not let macro headlines cloud your judgement. Have a trade plan and be ready to adjust with market conditions and volatility. One way to mitigate risk is by utilizing micro CME contracts , allowing for more precise risk management during volatile market conditions. Additionally, you can participate in the CME and TradingView paper trading competition, giving you the opportunity to test your skills in The Leap without risking real money.

Remember, it's NFP week, and several other key economic data releases are also on the calendar.

In our view, it is important to zoom out and reduce key levels on your charts to ones that are significant.

Key Levels:

Key levels represent areas of interest and zones of active market participation. The more significant a key level, the closer we monitor it for potential reactions and trade setups in alignment with our trading plan.

(mcVAH) micro composite value area high: 6,134.25

Key LIS/Yearly Open: 5,949.25

(mcVAL) micro composite value area low: 5,914.25

(CVAH) Composite Value Area High: 5,924

Scenario 1: Long above Key LIS

Our key LIS is still Yearly open as it was discussed in last week’s idea. We are looking for long trade setups at this level.

Scenario 2: Short below Key LIS

If the price moves lower and holds below a key level, we will look for short trade setups targeting our green support zones on the chart from mcVAL and CVAH confluence.

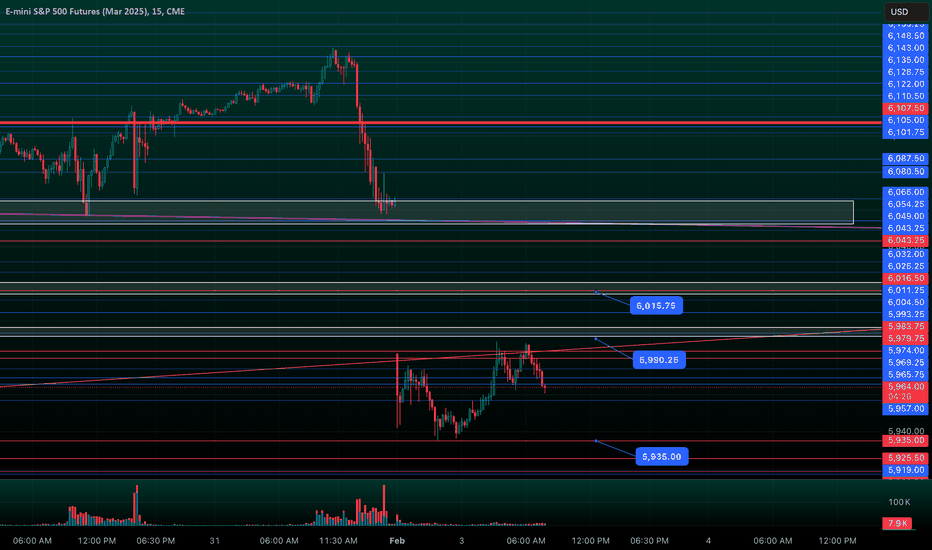

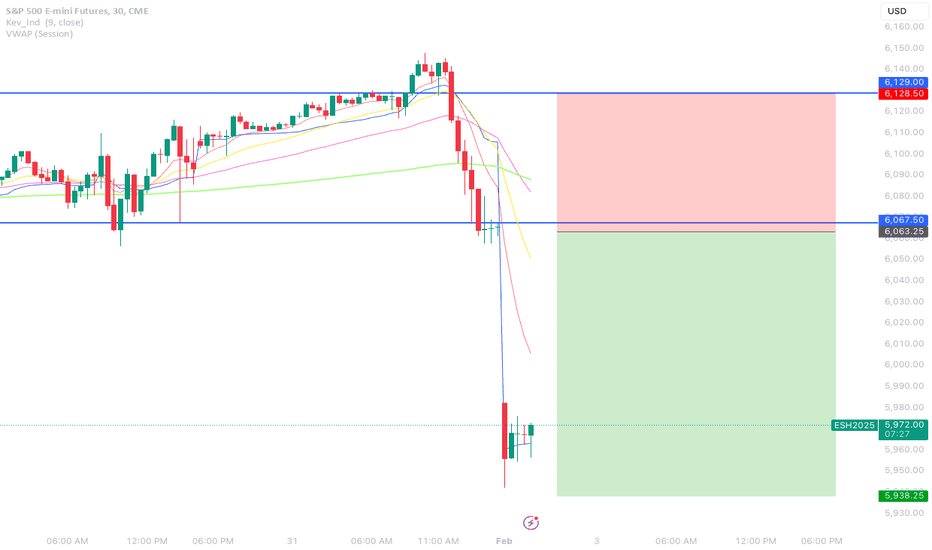

ES Morning UpdateLast night, ES experienced its largest gap down in over a decade. Despite the steep drop, key levels held precisely—5934 was marked as support and the overnight low of 5935.50 was tested multiple times and held.

As of now:

• 5951-49 and 5934 are acting as support (with 5934 showing some weakness)

• Holding these levels keeps 5990, 6008, and 6016-20 in play

• If 5934 fails, sell down to 5907

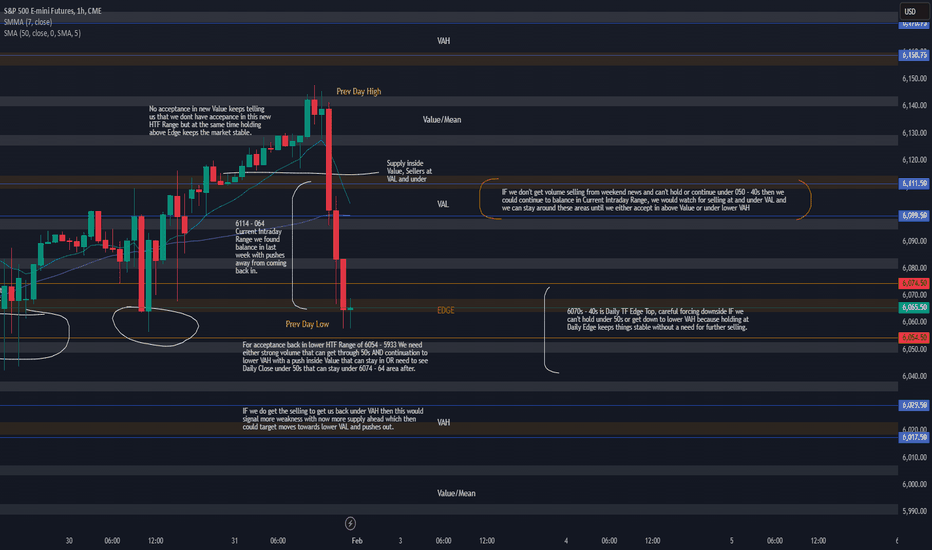

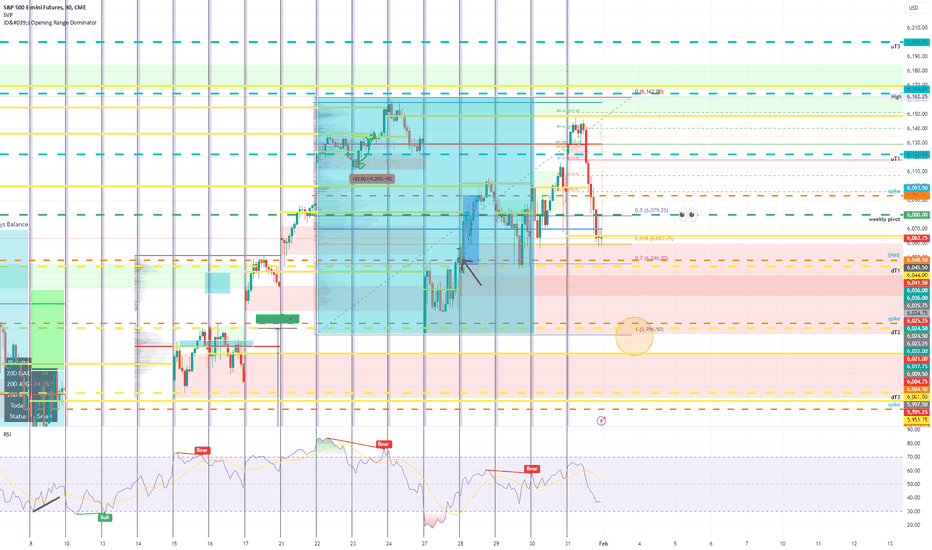

#ES_F Day Trading Prep Week 2.02 - 2.07.2025Last Week :

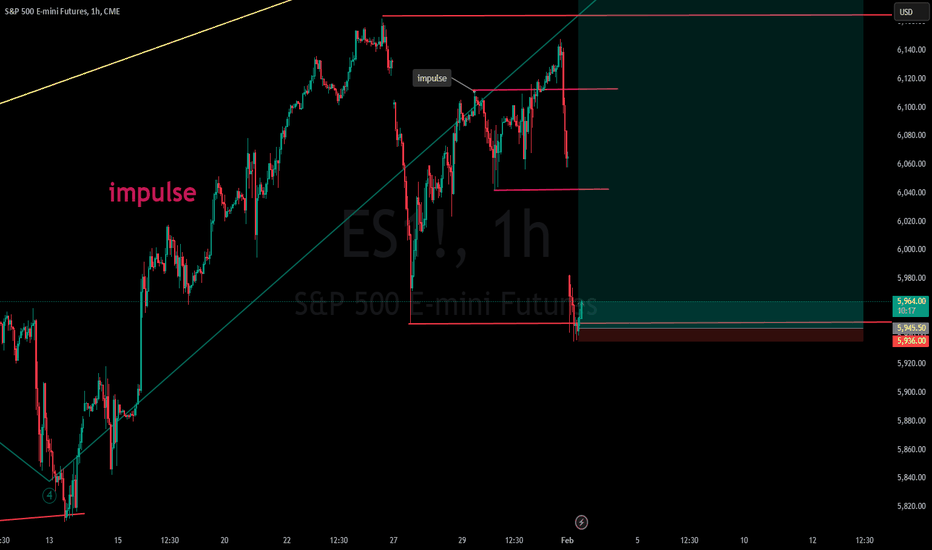

Globex opened inside VAL under the Weak stops from previous sessions that we have market off which signaled weakness, under 6100 market started taking out lower stops and key areas which gave a big flush into lower Value during ON hours to start the week but we ran out of selling after looking below lower VAL and rotated out of Value from there. RTH Session did not bring anymore size selling, instead we were able to hold above Value take in all the Supply and move back into/above upper Edge which brough stability and pushed us into 6114 - 064 Intraday Range where we found balance. End of week price made a push into upper Value again but the move was done during ON lower Volume hours and once we hit the bigger area of supply/where we previously found bigger sellers over 6144 the whole push came apart and gave us another move under VAL into the Edge where we closed right at a big area without really breaking under.

This Week :

This week is really tricky to try and call because we have new month starting, we had some news over the weekend which has made a lot of people bearish or at least think that we should be bearish and either open on gap down or continue lower, we have seen strong selling from above areas which probably trapped buyers to give us more weakness BUT as much as I like to cheer for the downside and a good correction most of the time as I am a short seller, we have to be careful here because we are at important HTF areas which if we don't get the needed volume to stay under could bring stability and continue to give us balancing action over them.

We will have to see what we do on the open tonight and during ON sessions to really get a better picture but we can have a plan and keep things in mind that IF they start happening then we can be ready. Daily TF for now is still in uptrend after a failed correction in mid January and we are just grinding over smaller Daily MA with buying interest running out over 6100s which is giving us this sideways/selling action, weekly TF also grinding over its smaller MA and has closed right around weekly balance mid area after failing to hold under its low which is in 940s this could mean that we may potentially continue holding and grinding/sideways with weakness until we see some bigger change.

Daily Edge top is around 6070 - 40s we would need to either see a push that can close under 50s to signal acceptance back in lower HTF Range or a push under with continuation to/through lower VAH which can then bring in more sellers and give us continuation towards lower targets at VAL/Edge and if things get really ugly to push us through 933 - 913 Edge from where we need to watch out for further continuation towards our Previous Distribution Balance.

On the other hand we need to be careful forcing the short side under 6060-50s unless market can clearly show us that it wants to be under, if it does not then we can watch for us to stay inside Current Intraday Range where we could balance and maybe tighten up the ranges as things have been pretty wild, if this will be the case then we could see stronger sells coming from areas closer to above VAL and from inside/above it, weakness from VAL can continue until we can push into Value and start balancing around the Mean area without getting back under 6114.

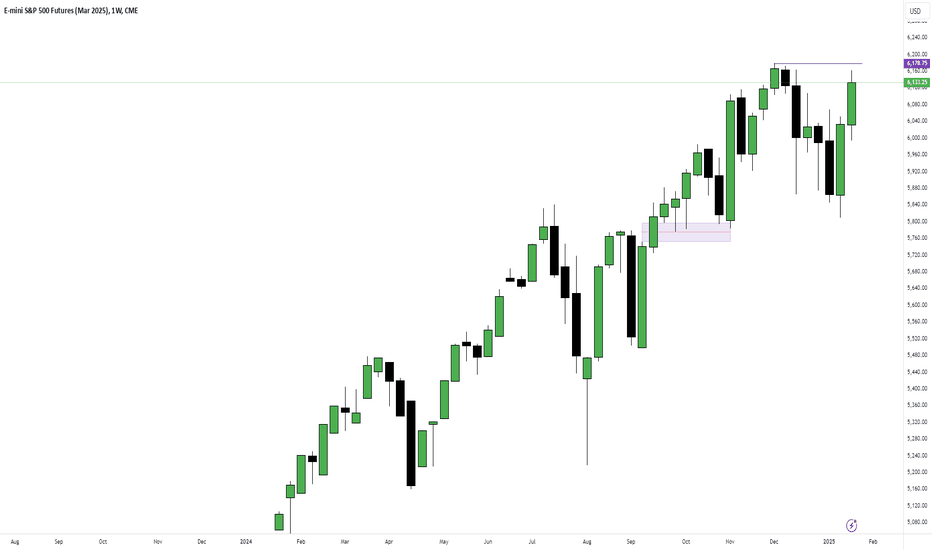

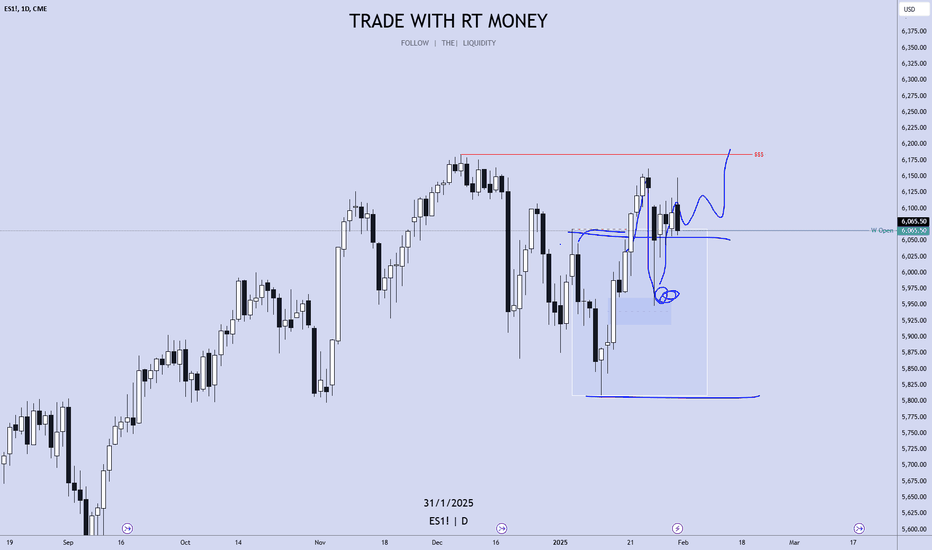

S&P 500 (March 2025) - Expecting Resistance At All-Time HighsA rally to ATH is always a good sight to see but what I don't want to see is a fake out, especially in the higher timeframes like the weekly or daily.

Candlesticks like doji's, shooting stars just above ATH can increase the likelihood of a retracement back down into previous inefficiencies.

For the next two weeks, we all are going to be on a wild ride!

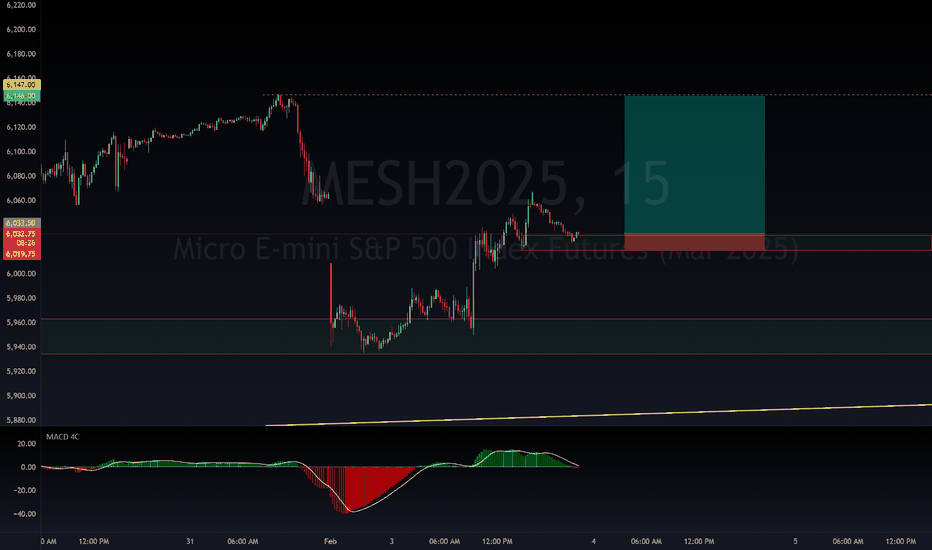

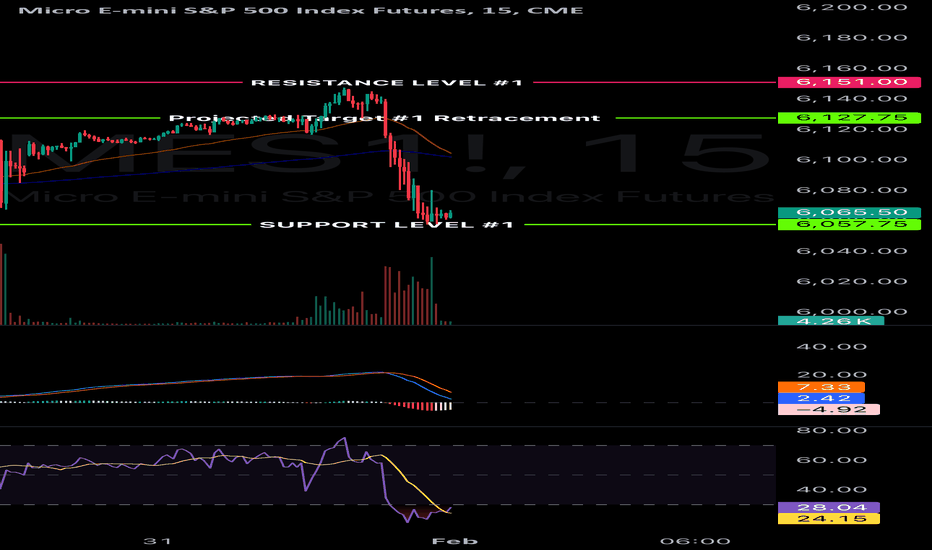

15min - 1 hour short term Day trade Idea for MES15min - 1hr trading idea for short term gain. Thoughts.

After reviewing and studying the chart I found myself pondering on a short term gain for the upcoming trading session. Thoughts and critique welcome.

The use of FVG that has not been mitigated is in play

Oversold on an RSI

Momentum on slowing down on a bear trend

As always. Not offering financial advice. Just food for thought.

Weekly Plan $ES and $NQ FuturesHey traders!

Welcome to this week's market outlook for NYSE:ES and $NQ. In this video, I’ll break down key levels, trends, and setups to watch, helping you stay ahead of the moves. We’ll cover key zones, potential trade scenarios, and what to expect based on volume and price action.

Let’s dive in! 🚀

Weekly Market Forecast Feb 2-7thThis is an outlook for the week of Feb 2-7th.

In this video, we will analyze the following FX markets:

ES \ S&P 500

NQ | NASDAQ 100

YM | Dow Jones 30

GC |Gold

SiI | Silver

PL | Platinum

HG | Copper

The indices were not easy to trade last week, as there were plenty of fundamentals at play. However, they are relatively still strong, and I am looking for further gains next week.

NFP week, imo, is best traded Mon-Wed. Thurs will likely see consolidation until the NFP news announcement Friday morning. I will look to fade the news release on Friday for NY Session.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

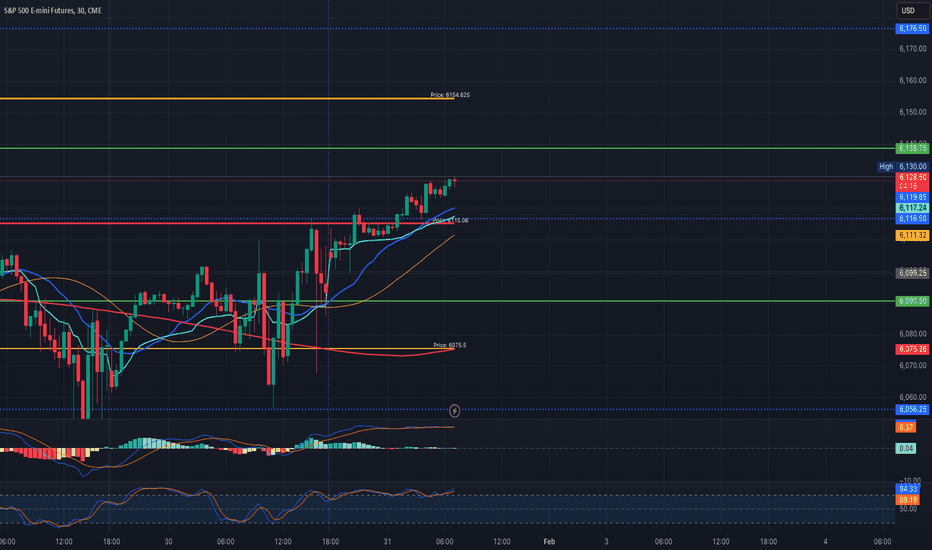

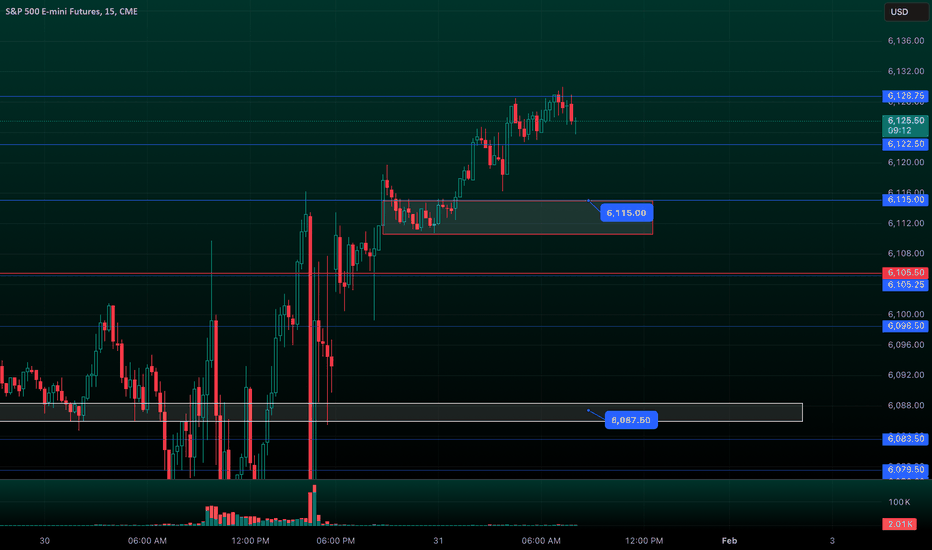

MES!/ES1! Day Trade Plan for 01/31/25MES!/ES1! Day Trade Plan for 01/31/25

📈 6138.80, 6154.60

📉 6115.25, 6090.50

Like and share for more daily ES/NQ levels 🤓📈📉🎯💰

(💎: IF THERE IS NOT MUCH VOLATILITY; FOCUS ON ZONES VERSES INDIVIDUAL PRICE LEVELS)

*These levels are derived from comprehensive backtesting and research, demonstrating over 90% accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

ES Morning Update Yesterday’s game plan was all about the 6070 area staying above, which set up longs targeting 6105, 6115, and 6127 to fill Sunday’s gap starting point. We’ve now hit 6127—let the runner go, anything more is a bonus for today

As of now:

• 6109-6115 = key support zone; bulls need to hold above to set up 6136, 6154

• Lose 6109, and we dip toward 6086