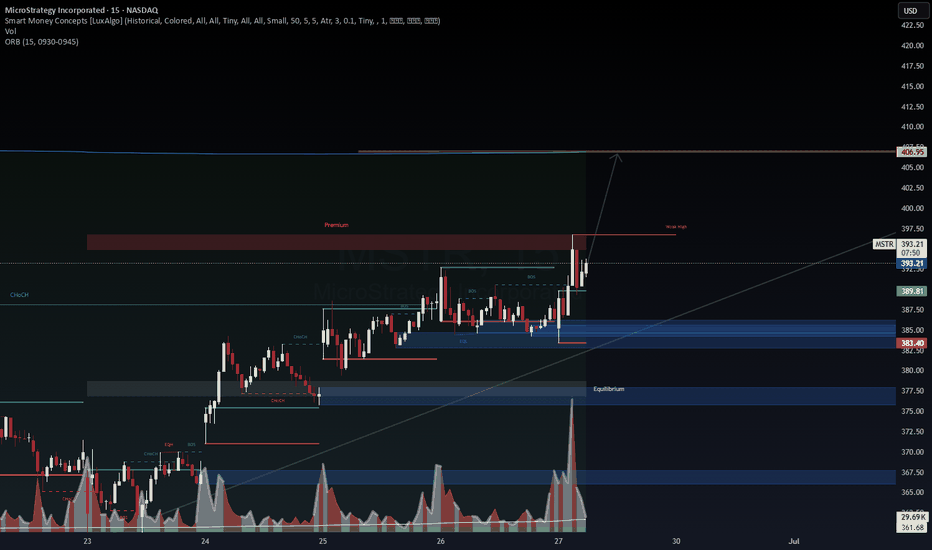

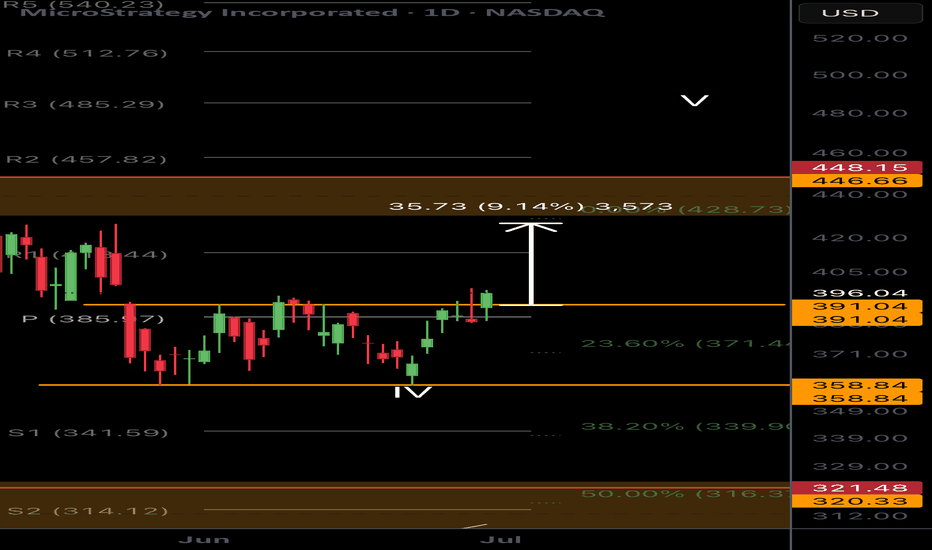

$MSTR Trade Setup – SMC Intraday Structure🕒 Timeframe: 15-Min

📈 Direction: Long

📊 Bias: Intraday Bullish Continuation

🔍 Technical Context

ChoCH to BOS Sequence: Clean change of character followed by two bullish BOS (Break of Structure) signals.

Liquidity Sweep & Reclaim: Price swept the EQH zone and reclaimed above minor liquidity; signal

Key facts today

MicroStrategy (MSTR) expects a Q2 profit of about $14 billion from unrealized gains on its 528,000 Bitcoin holdings, valued at $43.5 billion amid rising prices.

−0.021 BRL

−6.29 B BRL

2.50 B BRL

About MicroStrategy

Sector

Industry

CEO

Phong Q. Le

Website

Headquarters

Vienna

Founded

1989

ISIN

BRM2STBDR009

FIGI

BBG014XJY4X0

MicroStrategy, Inc. engages in the provision of enterprise analytics and mobility software. The firm designs, develops, markets, and sells software platforms through licensing arrangements and cloud-based subscriptions and related services. Its product packages include Hyper. The company was founded by Michael J. Saylor and Sanjeev K. Bansal on November 17, 1989, and is headquartered in Vienna, VA.

Related stocks

Is MSTR overvalued?Pros of Investing in MSTR

Massive Bitcoin Reserves

-Owns ~582,000 BTC (~2–3% of total supply), making it a levered proxy to Bitcoin. Any BTC rally strongly benefits MSTR.

Aggressive Treasury Strategy

-The company continuously issues equity, preferreds, and convertible bonds to buy more Bitc

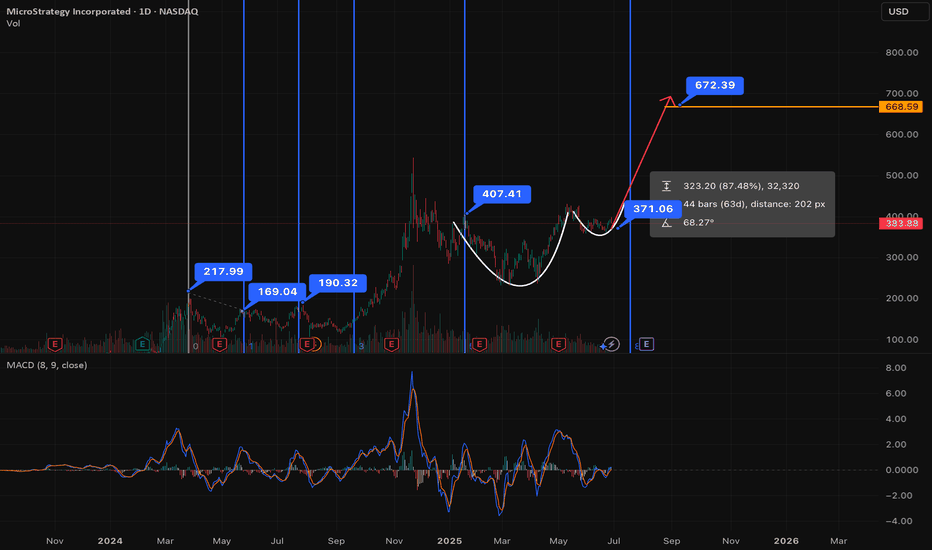

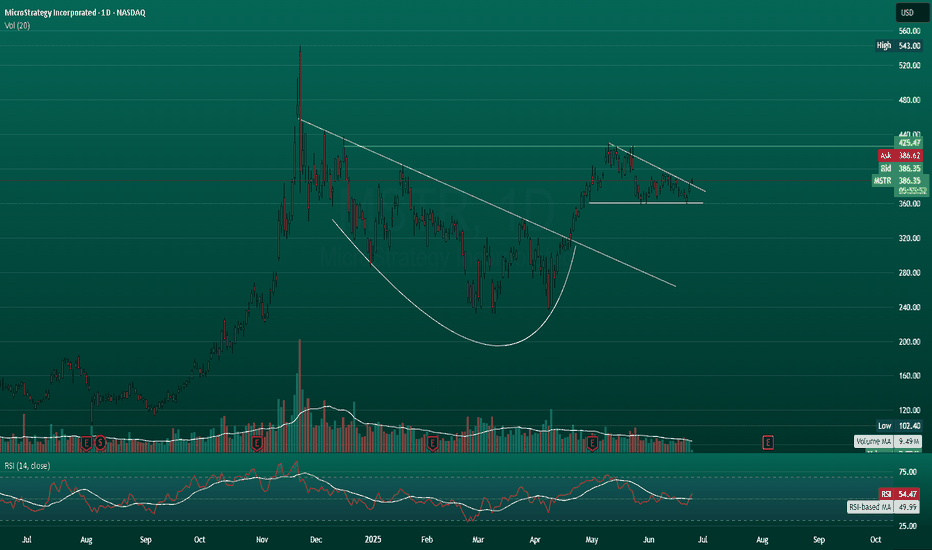

Time to make a move. Microstrategy upside forecast could be 80%Let's perform a technical analysis of MicroStrategy (MSTR) stock, focusing on Time-based Fibonacci analysis, the potential for a Cup and Handle pattern with a 50% upside target, and briefly touching on Williams Alligator strength.

As of Friday, June 27, 2025, at 9:36:57 PM PDT, here's an analysis o

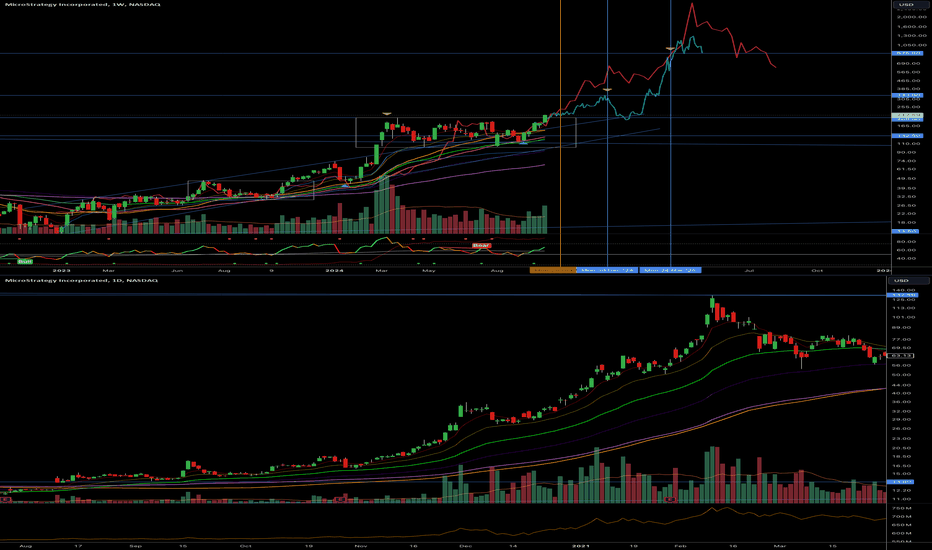

MSTR 10x From HereThis fractal compares the current price action of MSTR to its price action in 2021, during the previous Bitcoin bull market. This time, it is moving slower, so the time interval was adjusted to 1 week instead of 1 day. The next base consolidation target is around December 2024, with a top expected a

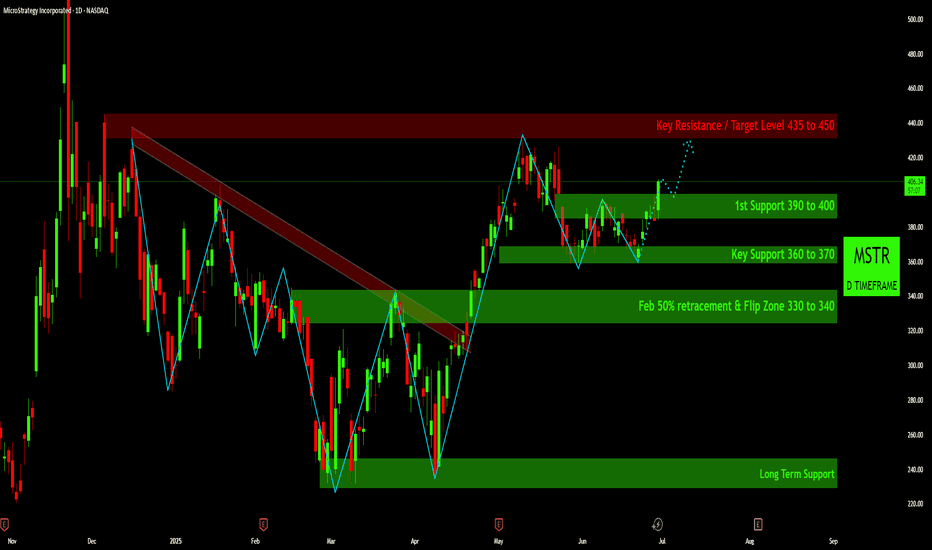

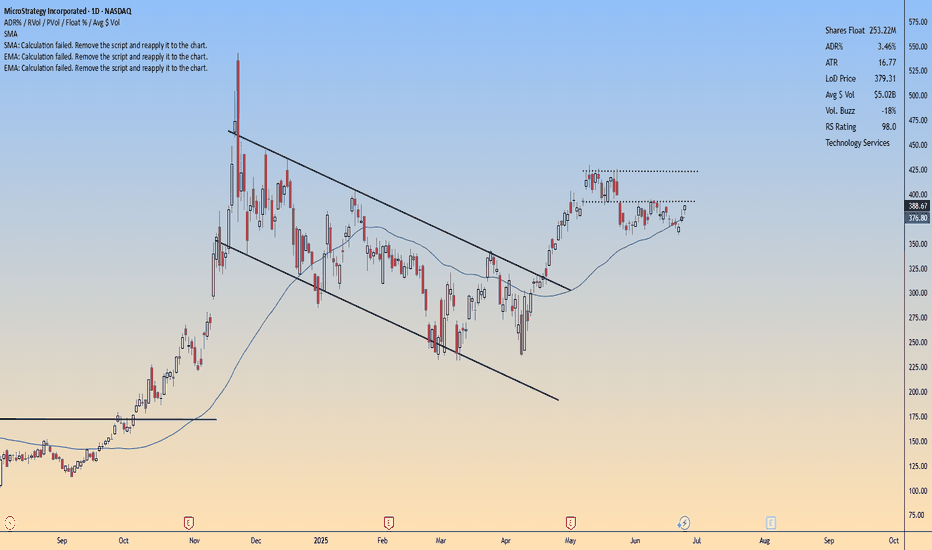

MSTR Daily Chart Analysis: Key Price LevelsThis analysis focuses on the daily chart of MicroStrategy (MSTR), highlighting significant price action, identified patterns, and predefined support and resistance levels.

Price Action Overview:

Starting from late 2024/early 2025, MSTR experienced a notable downtrend, characterized by a series

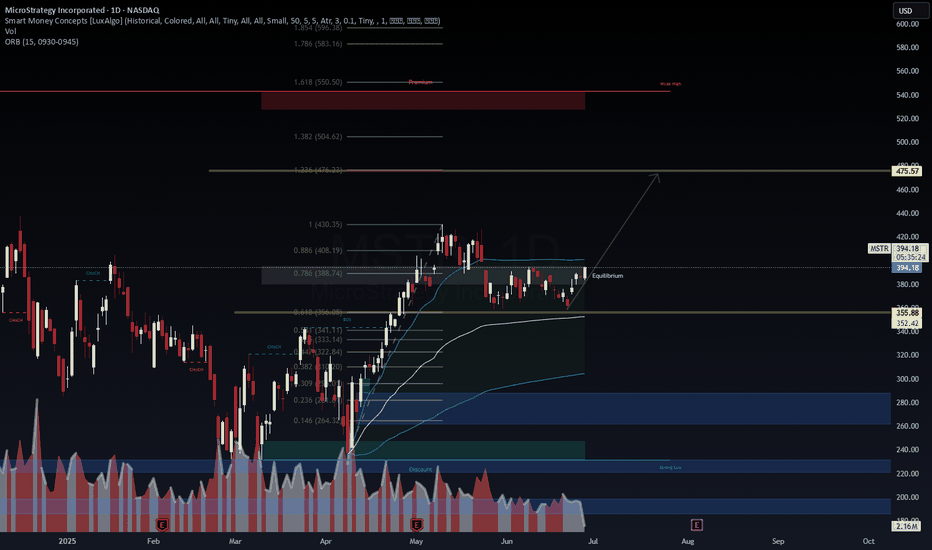

MicroStrategy (MSTR) – Bullish Price Reaccumulation Above EquiliAfter consolidating above the 0.618–0.786 retracement zone, NASDAQ:MSTR shows signs of institutional reaccumulation. The daily chart highlights a breakout from equilibrium with bullish intent, supported by increasing volume and smart money concepts.

📐 Technical Breakdown:

Price reclaimed the 0.7

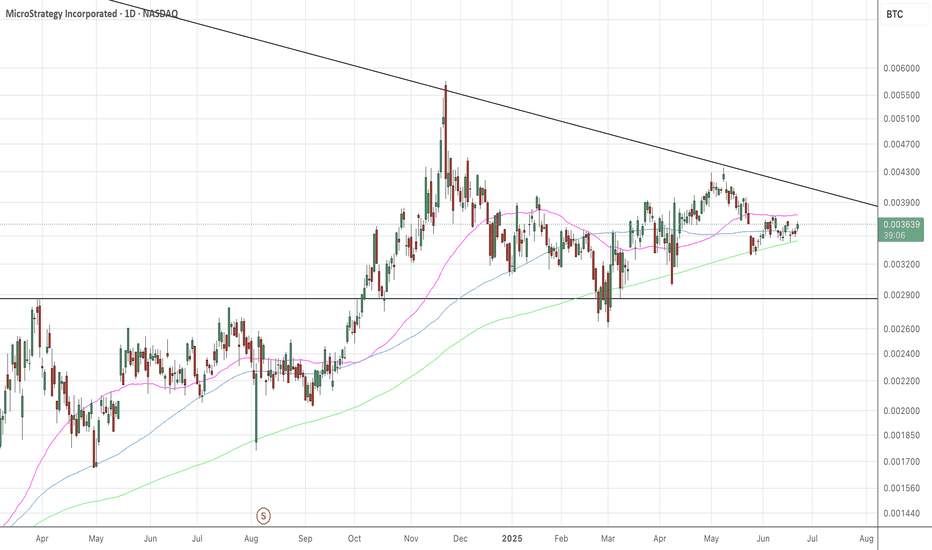

Strategy in SatoshiLooks like MSTR/BTC is being supported by the moving averages, as volatility drops under the all-time descending overhead. What this means is that once the overhead is breached, then MSTR starts to move more than BTC. You start to get days where MSTR moves 3x BTC, and 4x. What MSTU does, only th

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MSTR5946535

MicroStrategy Incorporated 0.0% 01-DEC-2029Yield to maturity

5.77%

Maturity date

Dec 1, 2029

US594972AR2

MICROSTRAT. 24/29 CV ZOYield to maturity

1.43%

Maturity date

Dec 1, 2029

US594972AT8

MICROSTRAT. 25/30 CV ZOYield to maturity

−3.08%

Maturity date

Mar 1, 2030

US594972AN1

MICROSTRAT. 25/32 CVYield to maturity

−6.61%

Maturity date

Jun 15, 2032

MSTR6034213

MicroStrategy Incorporated 0.875% 15-MAR-2031Yield to maturity

−7.20%

Maturity date

Mar 15, 2031

MSTR6032672

MicroStrategy Incorporated 0.625% 15-MAR-2030Yield to maturity

−13.33%

Maturity date

Mar 15, 2030

US594972AP6

MICROSTRAT. 24/28 CV 144AYield to maturity

−17.55%

Maturity date

Sep 15, 2028

See all M2ST34 bonds

Curated watchlists where M2ST34 is featured.