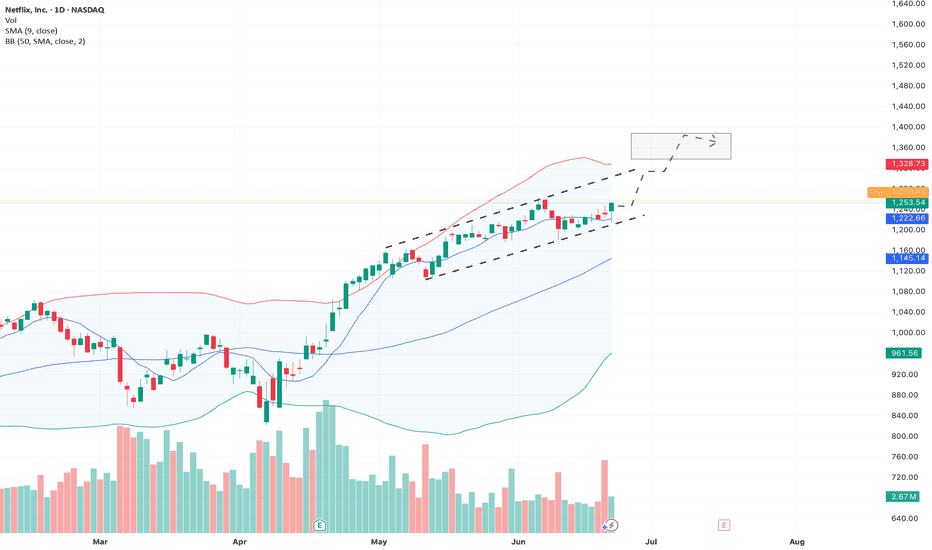

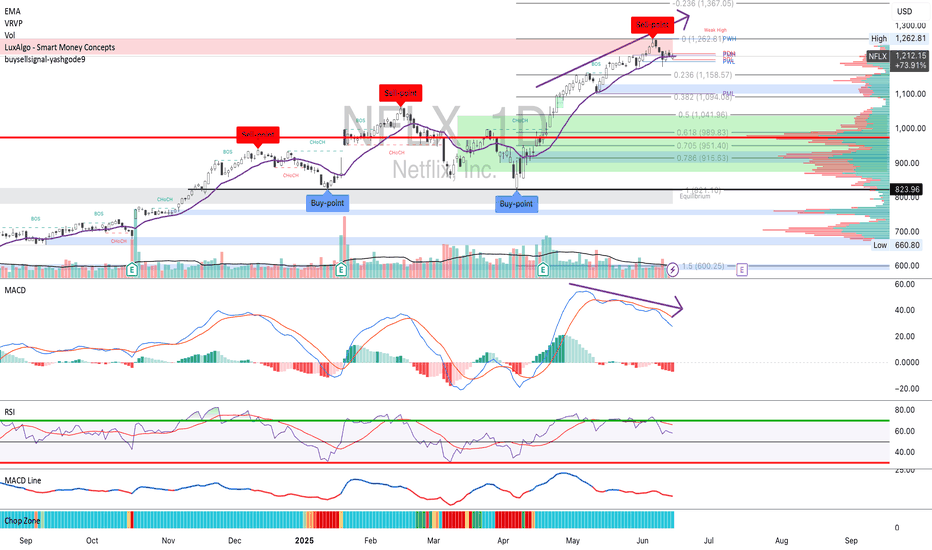

NFLX gains the momentumNFLX is gaining strength.

Fundamentals: Netflix reported a 12.5% year-over-year increase in Q1 revenue, reaching $10.54 billion and surpassing expectations. Adjusted EPS rose by ~25% YoY to $6.61, coming in 16% above consensus estimates.

The company also issued bullish Q2 guidance, forecasting 15.

Key facts today

Netflix ranks No. 9 on Apple's App Store for free downloads, reflecting its competitive position in the streaming market.

In 2025, ODW, a French creative agency, supported Netflix in adapting its messaging for European audiences, focusing on culturally relevant and entertainment-driven campaigns.

60,620.83

0.00 BRL

46.96 B BRL

209.58 B BRL

About Netflix, Inc.

Sector

Industry

Website

Headquarters

Los Gatos

Founded

1997

ISIN

BRNFLXBDR000

FIGI

BBG002H1K8C1

Netflix, Inc. engages in providing entertainment services. It also offers activities for leisure time, entertainment video, video gaming, and other sources of entertainment. It operates through the United States and International geographic segments. The company was founded by Marc Randolph and Wilmot Reed Hastings on August 29, 1997 and is headquartered in Los Gatos, CA.

Related stocks

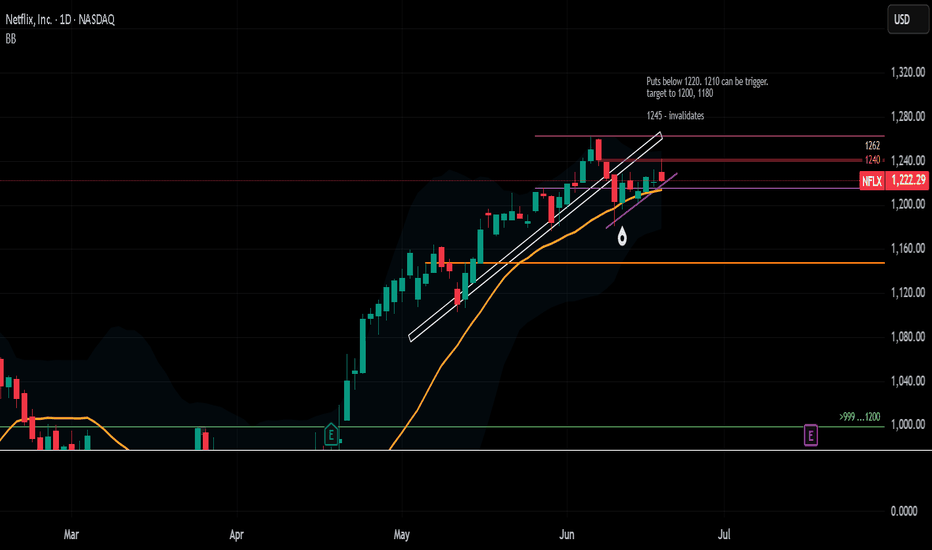

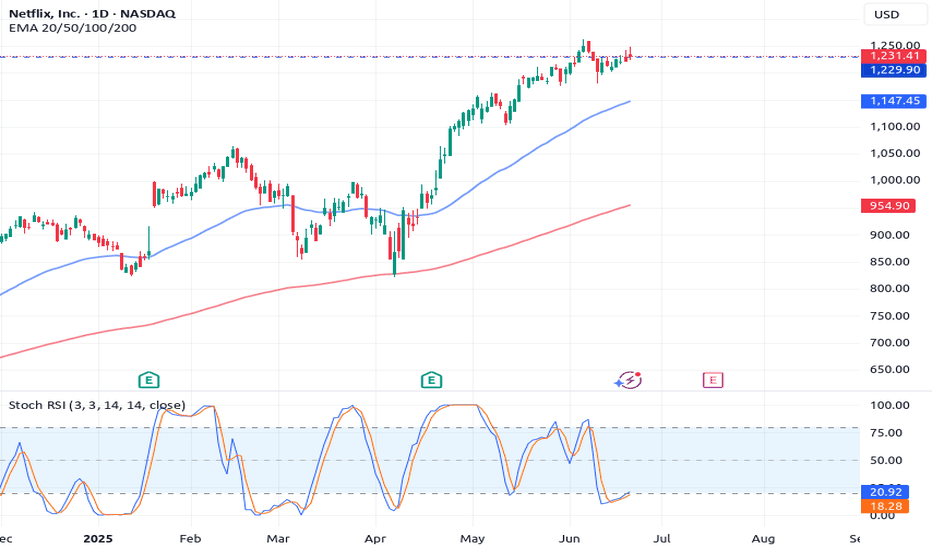

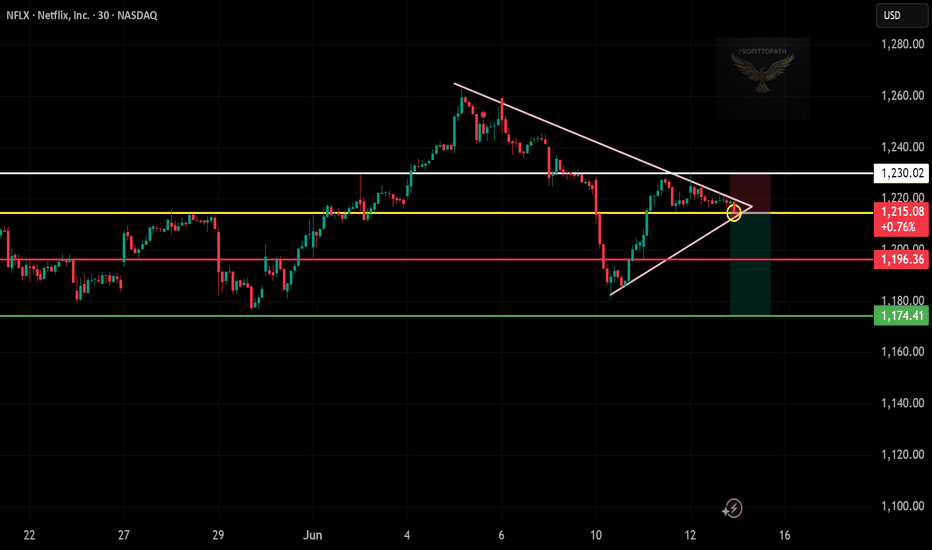

NFLX chop & dropI had a whole video that I created but couldn't manage to post. Nonetheless... I figured it out and will just share my points in this picture.

*below the 21 ema (1220), I believe we can target 1200 down to 1180. I'll be on the lookout for this trade until it happens.

That's it... that's the post.

NFLX She got away #3Ahh yes the 3rd stock/idea/position I sold out of in order to go all in on $TSLA. I will stay the course with my plan, but when it hits I'm going to Diversify. You should only make mistakes once, if you repeat them you should cut your left nut. IDK, just have a real consequence so you don't F up aga

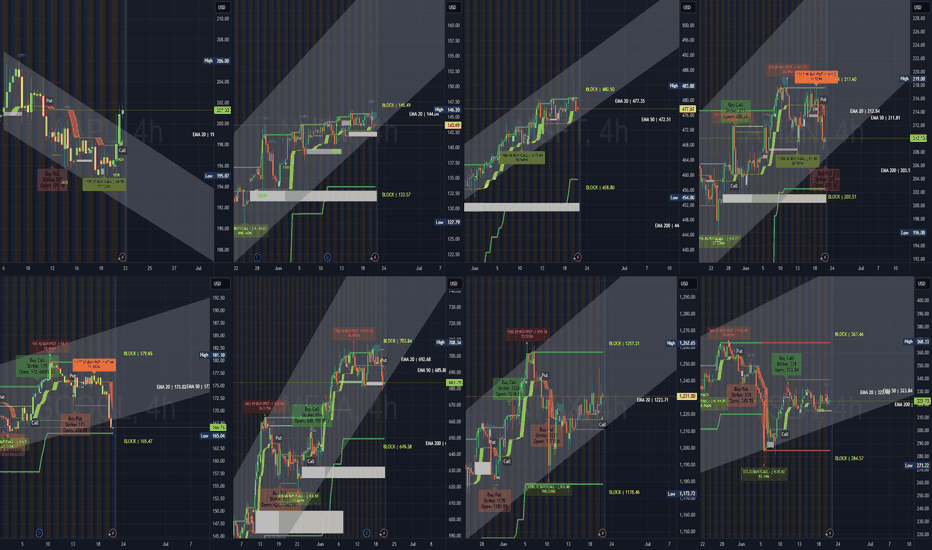

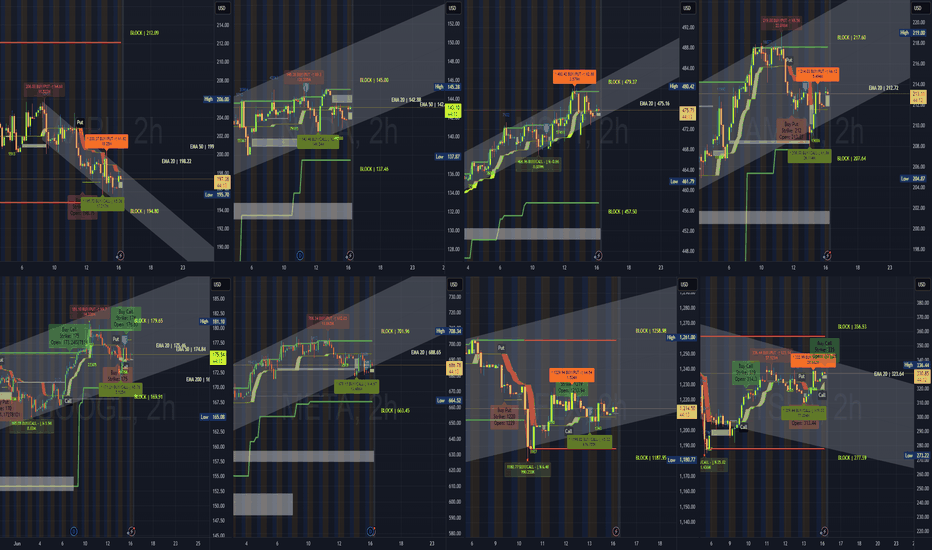

MAG7 - Jun 23, 2025 Institutional Swing Analysis – Jun 21, 2025

📈 AAPL

Trend: Reversal attempt in downtrend

Buy Zones (CALLs): 196 (accumulation)

Sell Zones (PUTs): 199 (distribution)

Support Block: —

Resistance: 201 → 204 → 206

Scenario: Above 200 = continuation to 204–206. Below 198 = back to 195–194.

📈 NVDA

T

The Best Trading Strategy For 2025In this video you will see:

-The double top pattern

-The long lower shadow pattern

-The morning star

Now as you watch this video remember

to understand the following:

-The Rocket Booster Strategy

-The Reversal Strategy

-Candle Stick Patterns

Understanding these Top 3 Things

will he

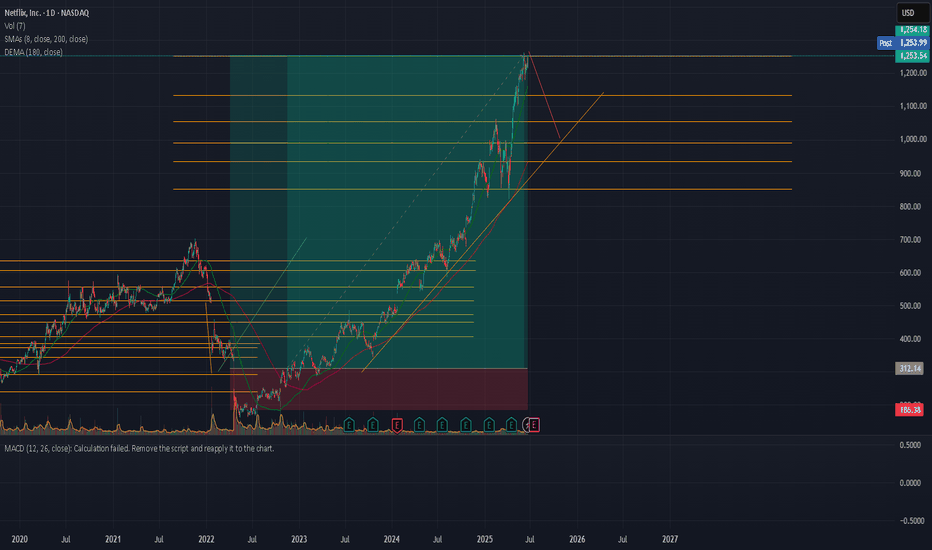

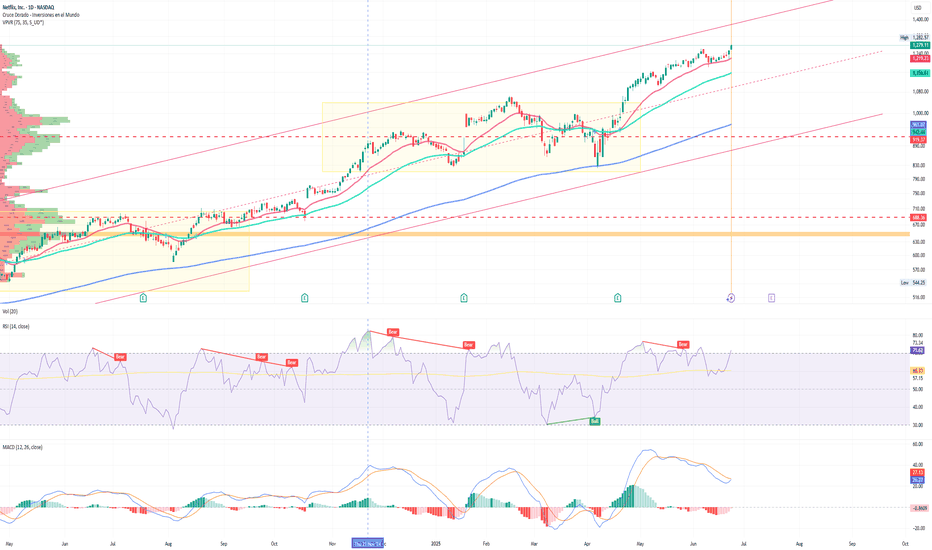

Can Netflix Reach One Trillion Dollars? Can Netflix Reach One Trillion Dollars? The Market Already Bets on It

By Ion Jauregui – Analyst at ActivTrades

Netflix, the giant of digital entertainment, continues to cement its position as the global benchmark in streaming. With a market capitalization exceeding $515 billion, the platform is h

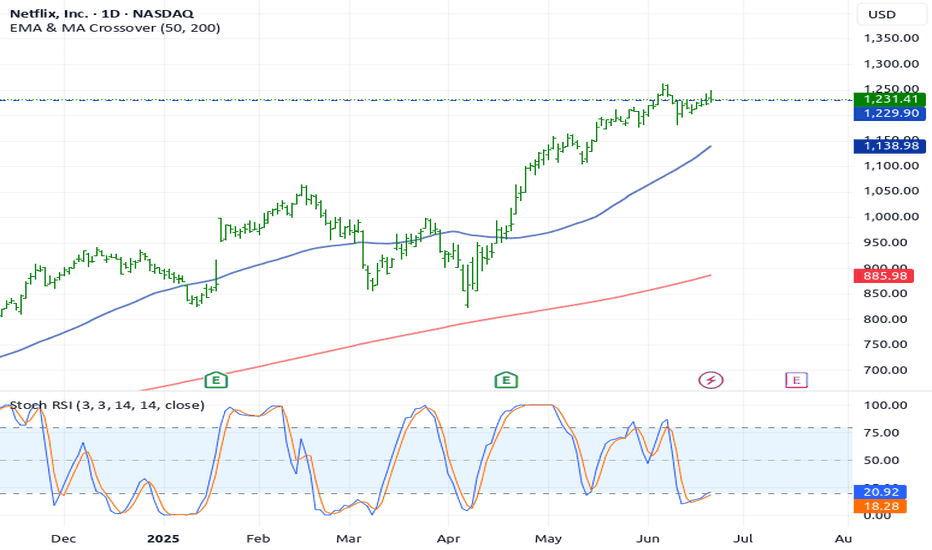

The Classic 3 Step Rocket Booster StrategyThe rocket booster strategy is a classic.

This time around Netflix is on hot fire.

Netflix has outperformed Nvidia, Meta, And Apple.

-

No one is talking about Netflix and how its dominating

the stock market.

-

Am guessing that the reason being online entertainment

is on the rise.I remember about a y

WEEK 16 - 20 JUN WAR, VIX OPTIONS, SPY MONTHLY OPTIONS ******** AAPL

Block High: 212.09

Block Low: 194.80

PUT Active: Strike 200.17

CALL Active: Strike 196

Open Gap: 198.22 → 195.70 (likely support retest or fill)

Channel: Bearish

Scenario:

Holding 195.70 = chance to fill gap to 198.

If 194.80 breaks = risk drops to 190–186.

******** NVDA

Blo

Profit taking on Netflix for the summer, only to buy in lowerNASDAQ:NFLX is still in a strong high time frame uptrend, I'm not saying the stock has turned bearish overall, however profits need to be taken when trading and this is one of those times.

I'd prefer to buy back in closer to $1,000 if possible though either way I'll keep 33% of my stack.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NFLX5862368

Netflix, Inc. 5.4% 15-AUG-2054Yield to maturity

5.47%

Maturity date

Aug 15, 2054

NFLX5862367

Netflix, Inc. 4.9% 15-AUG-2034Yield to maturity

4.54%

Maturity date

Aug 15, 2034

NFLX4901374

Netflix, Inc. 4.875% 15-JUN-2030Yield to maturity

4.38%

Maturity date

Jun 15, 2030

USU74079AN1

NETFLIX 19/29 REGSYield to maturity

4.32%

Maturity date

Nov 15, 2029

NFLX4826528

Netflix, Inc. 5.875% 15-NOV-2028Yield to maturity

4.12%

Maturity date

Nov 15, 2028

NFLX4908613

Netflix, Inc. 6.375% 15-MAY-2029Yield to maturity

4.11%

Maturity date

May 15, 2029

NFLX4764899

Netflix, Inc. 4.875% 15-APR-2028Yield to maturity

4.10%

Maturity date

Apr 15, 2028

US64110LAN64

NETFLIX 4.375% CALL 15NV26Yield to maturity

3.94%

Maturity date

Nov 15, 2026

XS198938050

NETFLIX 19/29 144AYield to maturity

3.48%

Maturity date

Nov 15, 2029

XS207282979

NETFLIX INC. 19/30 REGSYield to maturity

2.82%

Maturity date

Jun 15, 2030

XS198938017

NETFLIX 19/29 REGSYield to maturity

2.77%

Maturity date

Nov 15, 2029

See all NFLX34 bonds

Curated watchlists where NFLX34 is featured.