TSLA34 trade ideas

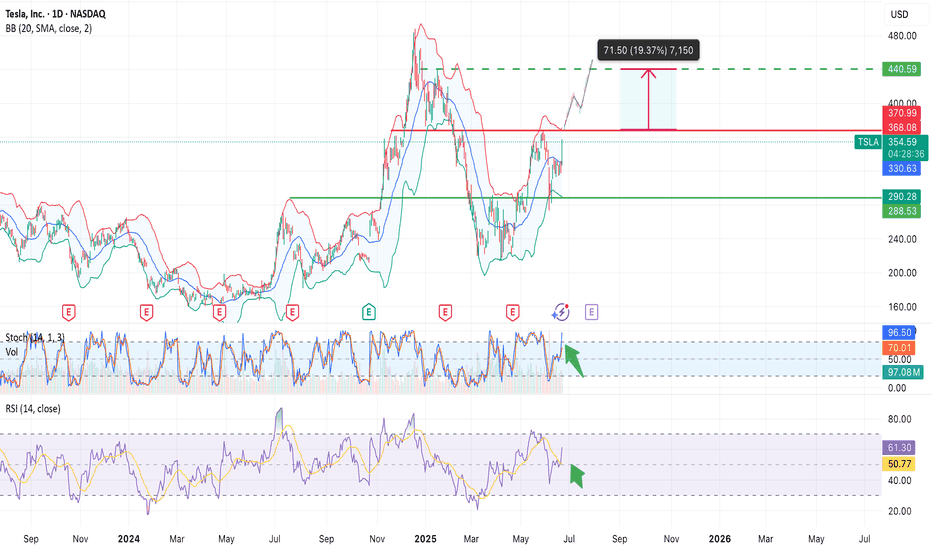

Tesla: Robotaxi Hype and Breakout WatchNASDAQ:TSLA surged nearly +10% today, driven by growing anticipation around the upcoming robotaxi unveiling on August 8.

Investors are positioning early, speculating this innovation could open new revenue streams for Tesla and redefine mobility.

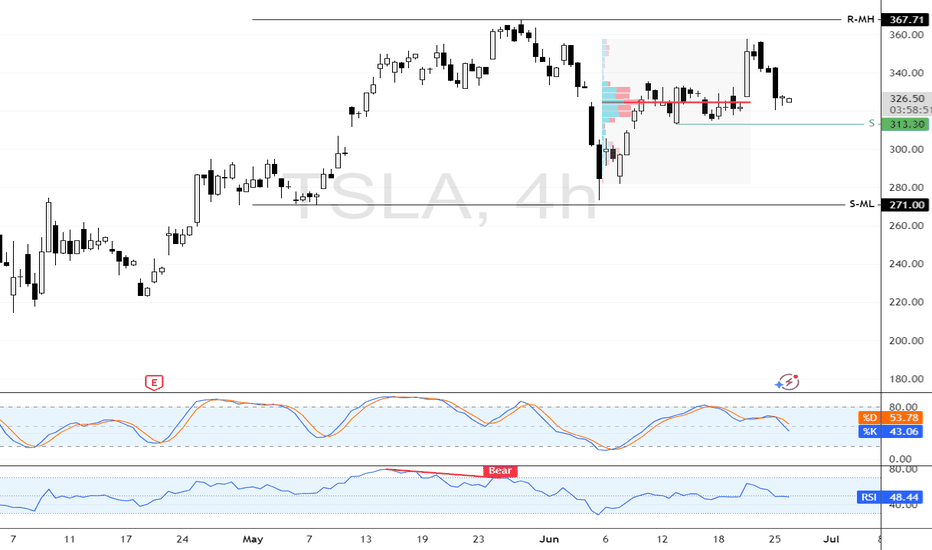

📊 Technical Setup:

• Price broke out of local resistance near $330

• Approaching major resistance at $370–371 (Bollinger Band + prior support)

• If $370 is broken and held, the stock could enter a new trading range: $370–$440

• RSI and Stochastic are heating up, but no signs of reversal yet

⚙️ Robotaxi Catalyst:

• Elon Musk confirmed the Robotaxi event set for August 8

• Analysts speculate this could boost valuation through AI and self-driving revenue potential

• Option volume and retail interest are rising fast

📌 Levels to watch:

• Breakout level: $370

• Target: $440

• Support zone: $330

• Invalidation: Close below $310

👀 Watch for pre-event momentum. A break above $370 could trigger a squeeze.

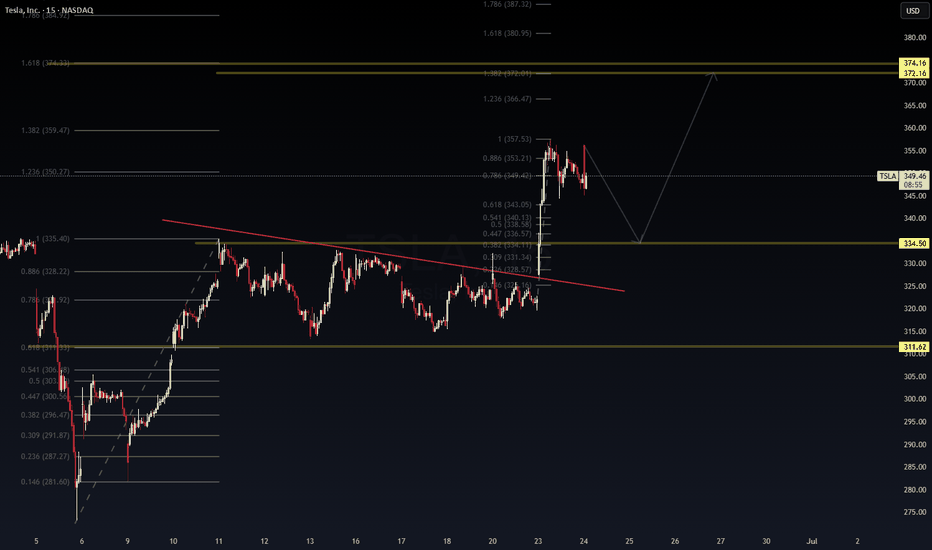

Technical Analysis – TSLAChart Summary:

Current Price: ~$349.21

Local Top: ~$357.53 (100% Fib extension)

Bearish Rejection: Notable wick + retrace from 0.886–1.0 zone

Probable Pullback Zone: 343.00–338.50 (Fibonacci 0.618–0.5 retracement)

Major Support Levels:

$334.50 – Prior key horizontal + Fib confluence

$311.62 – Historical demand zone

Projection:

Intraday double-leg correction toward $338–$343

Possible bounce and continuation toward the golden target zone:

$366.47 (1.236 Fib)

$374.16–$380.95 (1.618 zone)

🌍 Macro Alignment

Bullish backdrop:

Tech sector leading broader rally

Tesla’s robotaxi and AI narrative lifting sentiment

Oil down → margin relief for EV production

Catalysts this week: Powell testimony, PCE inflation

📈 Trading Plan

Type Direction Entry Target(s) Stop Loss Confidence

Intraday Bearish $352–$353 rejection zone $343 → $338.5 Above $357.5 🔶 Medium

Swing (Buy the dip) Bullish $338–$334 zone $366.47 → $374.16 Below $330 🟢 Strong

📌 Suggested Strategy

Scalp short if rejection at $353.2–$357.5 confirms with bearish candle on volume.

Add long exposure if price consolidates or reverses from the $338–$334.5 support area.

Monitor Powell’s remarks – Any dovish tilt could accelerate tech upside.

TSLA sentiment remains strong, but intraday shakeouts are expected.

✍️ Summary Signal

“TSLA remains bullish on a swing basis, but intraday looks set for a Fibonacci pullback to $338–$334. Buy dips if structure holds. Macro backdrop (robotaxi + Fed pause) supports continuation to $366–$374.”

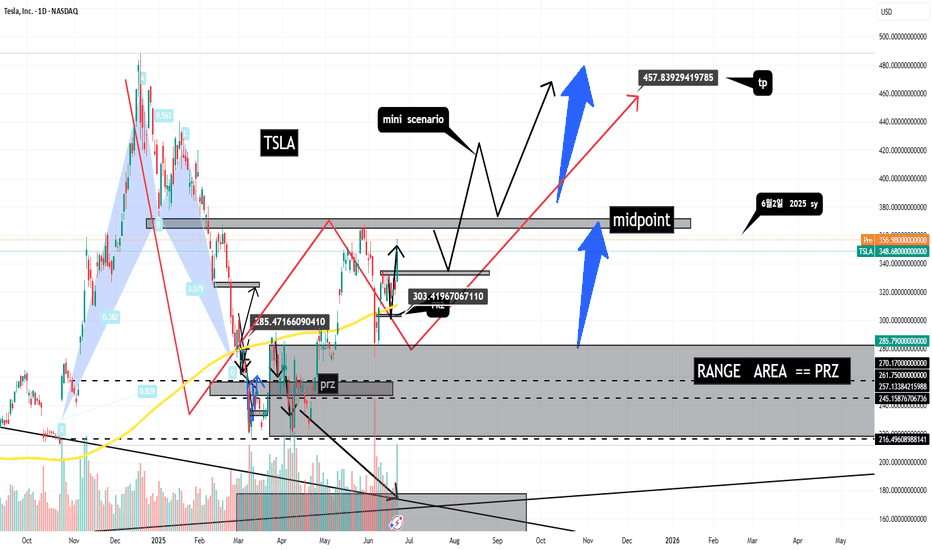

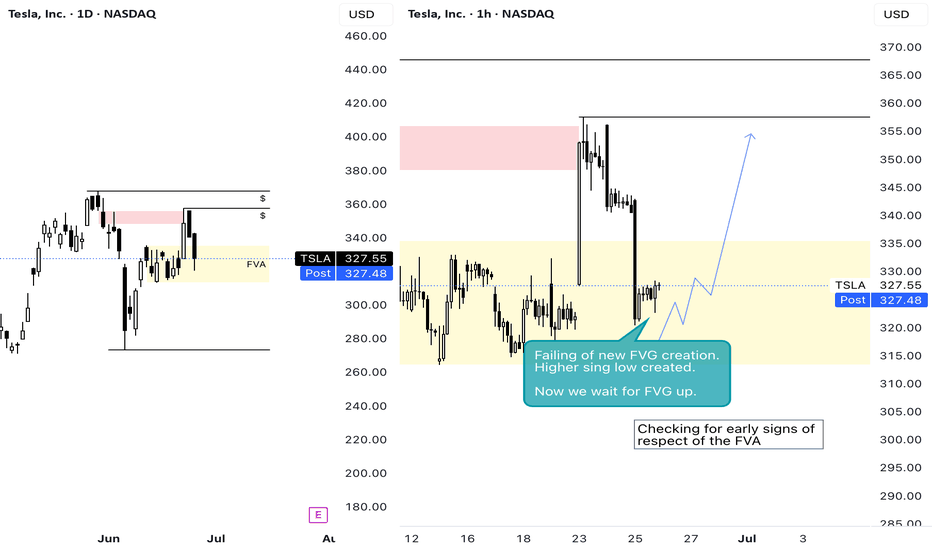

V-Bottom + Apocalypse news => Going UpV bottom was formed.

News are clearly bearish in a conclusive way =>> fool the public to sell shares to the big fish while the market will go up...

Overall market sentiment under the hood is bullish. Public is in huge fear of banks that collapsed and will continue to collapse, so the masses will sell stocks on an up wave fearing it will go down.

How else you will make the mass public sell their stocks? if there is no apocalypse on the way...? think about it...

Tesla update, watch 343 level!boost and follow for more ❤️🔥 tsla broke the trend support mentioned in my last analysis, doesn't surprise me too much I did mention it was likely, now look for a daily close above 343, if we can get that then the rally to and past 400+ will come in the blink of an eye 🎯👁️

that is all, I am done posting for today.. I hope you all have a great weekend! stay safe and see you soon ⚡✌️

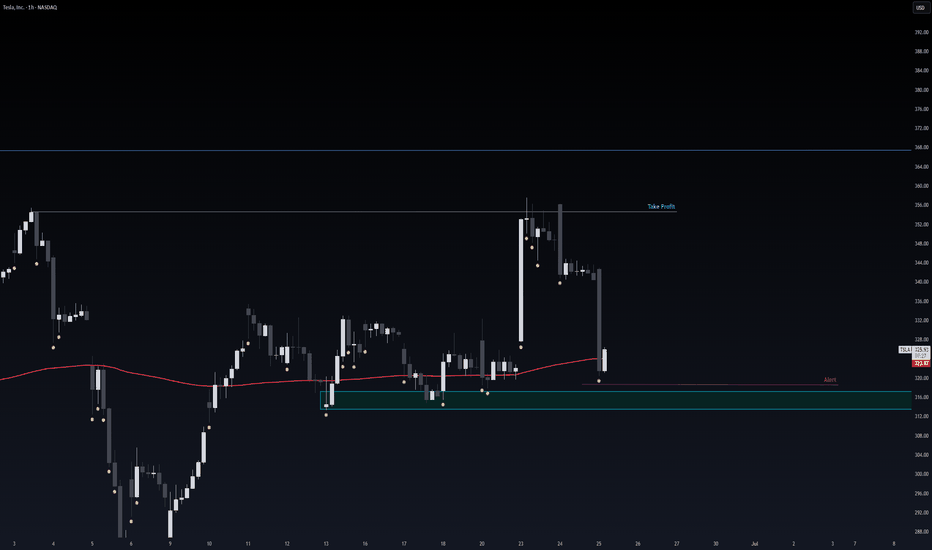

Safe Entry Zone TeslaGreen Zone is Safe Entry Zone.

Target is Take Profit line.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 15M TF when Marubozu Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu Candle, because price will always and always re-test the imbalance.

Will the Robotaxi euphoria continue to push TSLA higher?NASDAQ:TSLA pushing higher the last few days thanks to the start robotaxis. Will this rally continue? the answer is yes until the LIS gets broken.

LIS is at 311, any break below will give a retrace. If you are long, get out and get back in when the next LIS gets broken on the upside. This is efficient investing. Don't waste time doing HODL.

LIS is evolving over time, I will keep you updated on it.

This is really simple trading based on important levels. Keep following my post, so you can see it by yourself.

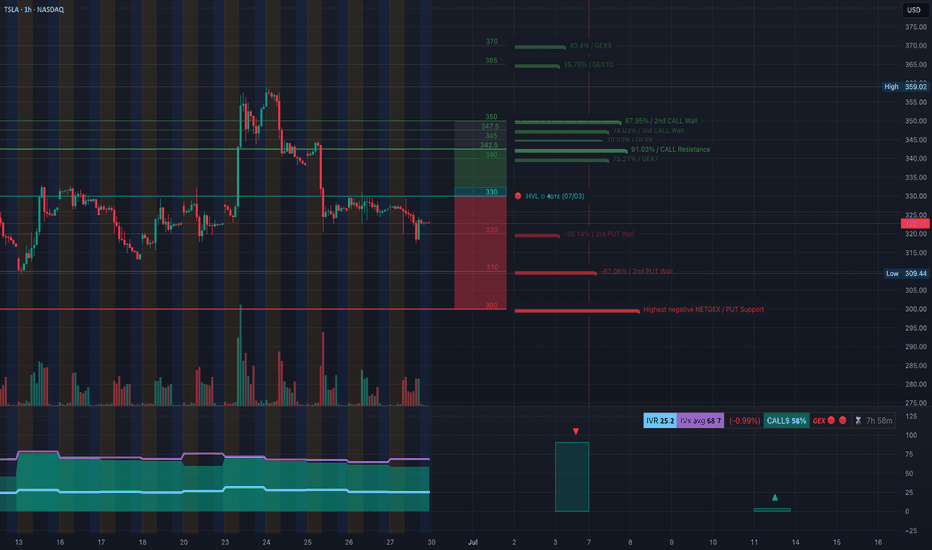

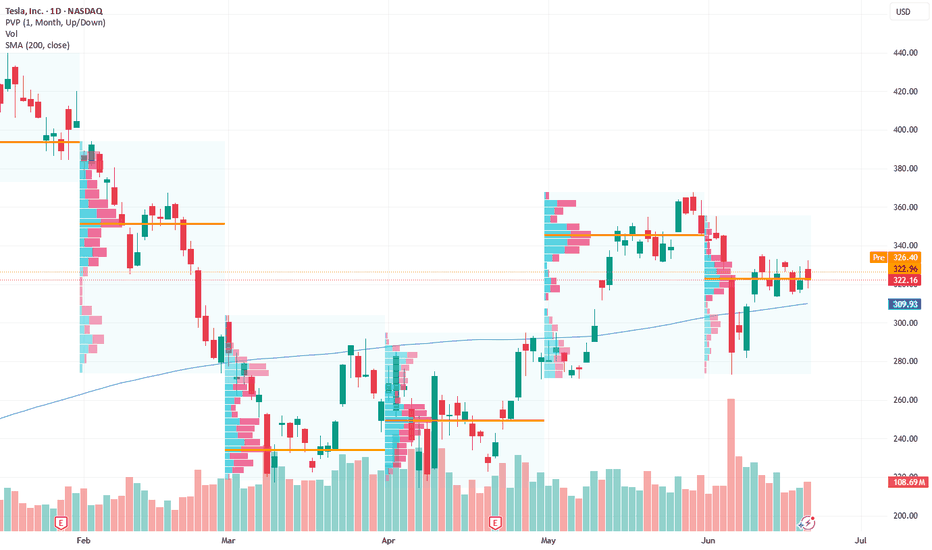

TSLA Bearish Breakdown in Progress – $322 or Bust? TSLA Bearish Breakdown in Progress – $322 or Bust? Monday Puts On Watch 🔻

🧠 GEX-Based Options Sentiment:

Tesla is currently trading right at a critical GEX flip zone. The $330 level used to be gamma support but has now broken, leaving TSLA vulnerable to a drop toward the high-risk gamma pocket between $320–$310.

The Highest positive GEX zone was stacked near $330–$340, but that structure has failed. The gamma walls above—like $347.5 and $350—now serve as resistance, especially with no strong call flow to support a squeeze.

The downside gamma structure is open. $310 is a soft magnet, but $300 is where the largest negative GEX sits, along with the 2nd and 3rd Put Walls. If TSLA continues slipping, a drop into the $300 zone could be swift.

Implied Volatility Rank is at 25.2, with IVX above 68 — meaning options are expensive, so spreads are safer than naked calls or puts. Flow is still 8% call-heavy, but that can flip hard if Monday starts red.

🔧 Options Trade Setup (for Monday–Wednesday):

Bearish Scenario (favored setup):

If TSLA opens weak or rejects $325–$327.50 area again, consider buying a PUT debit spread, such as 322p/310p or 320p/300p (July 3 expiry).

Target zone: $312, then $300 gamma flush.

Stop: reclaim of $331 with bullish momentum.

Bullish Scenario (lower probability):

If TSLA reclaims $330 and breaks trendline toward $335, consider a CALL debit spread like 335c/345c (Jul 3).

Target zone: $345–$350.

Cut if it falls back under $327.50.

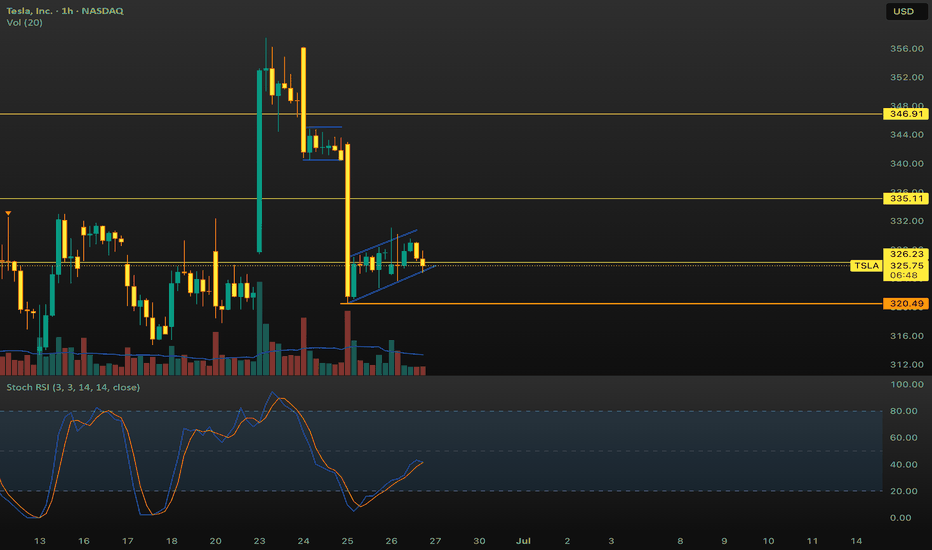

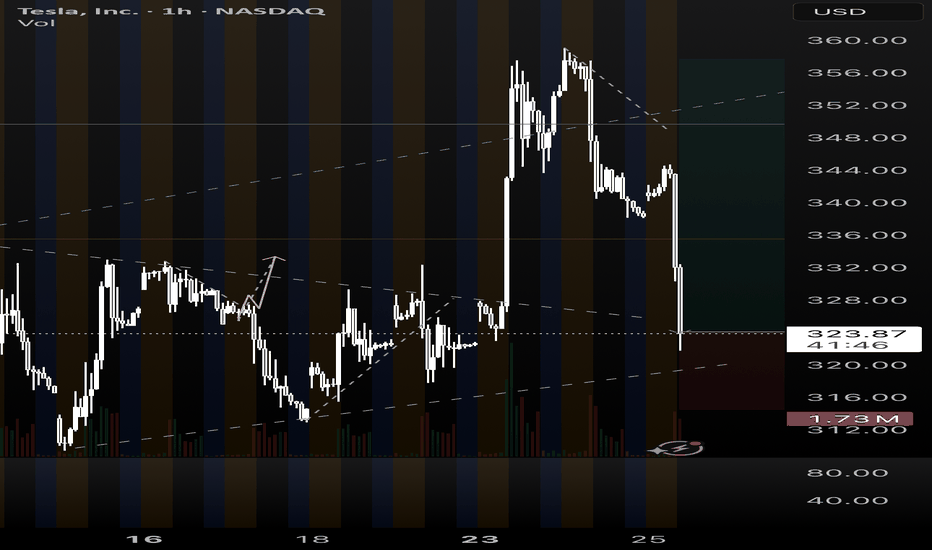

📉 Intraday Technical Breakdown (1H Chart):

The price has confirmed a CHoCH + BOS combo, rejecting from supply and pushing below the rising trendline. Friday’s recovery attempt stalled right under that broken structure, and sellers took over late day.

The 1H chart is forming a bearish descending channel, with price currently trying to bounce off short-term demand, but failing to reclaim the key mid-zone.

This current setup favors continuation lower unless bulls can pull off a breakout early Monday. Otherwise, the path of least resistance is down.

📌 Key Levels to Watch:

$330.00 – Former GEX support, now resistance

$331.10 – Trendline and bearish trigger flip

$322.00 – Key support line (last defended Friday)

$320.00 – Gamma pivot zone

$310.00 – GEX magnet and low-volume shelf

$300.00 – Highest negative GEX and major PUT support zone

$345.25 – Upper trendline + prior supply rejection

✅ Thoughts and Monday Game Plan:

TSLA is sitting on the edge of a breakdown. The gamma structure supports further downside as long as price stays below $330. Watch for early rejection at $325–$327.50 to initiate puts.

If bulls manage to gap and reclaim above $331, reassess for a reversal setup — but for now, structure, volume, and GEX are all pointing down.

This is a reactive trade — wait for early confirmation on Monday and ride the wave, especially if SPY opens weak.

Disclaimer:

This analysis is for educational purposes only and not financial advice. Always trade with proper risk management and do your own due diligence.

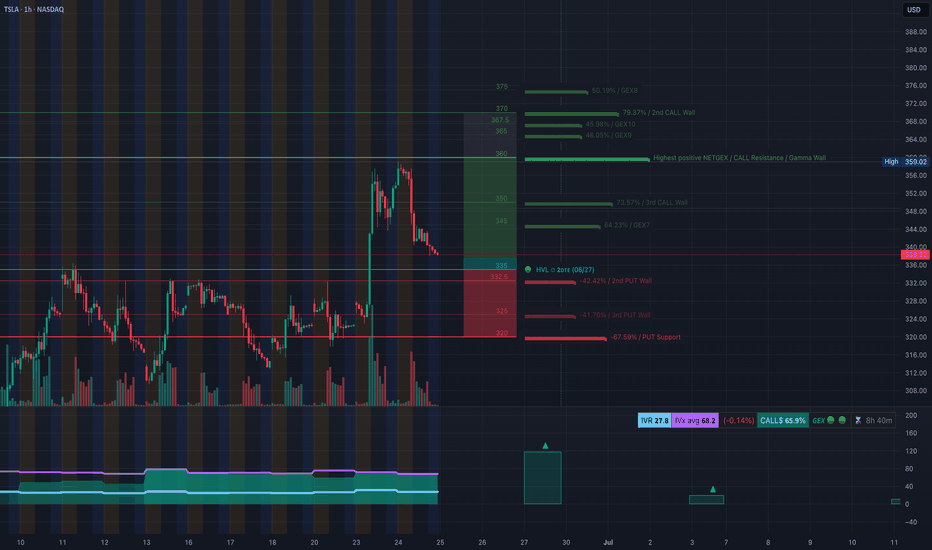

TSLA: GEX Points to Bounce Setup. Is This the Dip to Load Calls?📊 GEX-Based Options Suggestion

Gamma Exposure (GEX) data paints a bullish opportunity if TSLA holds the critical support zones:

* ✅ Key GEX Levels:

* $338: Near current price, minor GEX flip zone.

* $345–$350: Strong upward magnets (3rd Call Wall + GEX build-up).

* $359: Gamma Wall + Highest Net Positive GEX — market makers may pin price near this into end of week if bulls hold.

* 🛡️ Below Support:

* $330: Light PUT defense.

* $320: Major Put Support (-67.5%) — strong bounce zone if downside accelerates.

🔔 Option Trade Idea Based on GEX:

With TSLA near the $338 zone and GEX showing stacked resistance above + positive net exposure, a high-risk/reward call entry is forming.

* Play: Buy 345C or 350C expiring 06/28 or 07/05

* Trigger: Only if price holds $335+ and shows strength with volume bounce

* Target: $345 → $350 → potential pin near $359 (Gamma Wall)

* Stop: Close under $332 invalidates the bounce setup

🧠 Trading Setup – 1H Chart (Second Image)

From the second image, we analyze price action and structure to validate the GEX idea:

📉 Market Structure:

* Price is pulling back into a prior demand zone from $335–$338.

* Trendline support + Fair Value Gap zone + SMC CHoCH aligning at this base.

* Multiple bullish CHoCHs suggest potential reaccumulation if support holds.

🎯 Trading Plan Based on Price Action:

Bullish Case (Base Holds):

* Entry: $335–$338 zone (bounce off trendline and demand zone)

* Target: $345 (GEX level) → $348 → $350

* Stop-Loss: $331

High confluence with GEX option play. Use volume spike for confirmation.

Bearish Breakdown Scenario:

* Trigger: Loss of $331 + trendline break

* Target: $325 → $320 (strong PUT wall support)

* Put Options: 325P or 320P if breakdown triggers with momentum

⚠️ Summary:

TSLA is entering a decision zone — GEX shows bullish opportunity if $335 support holds, with upside targets toward $350–$359. But if price breaks under $330, expect a flush toward PUT support.

Patience is key — let price confirm the bounce or the break.

This setup is for educational purposes only. Trade with discipline and use stops. Always do your own research.

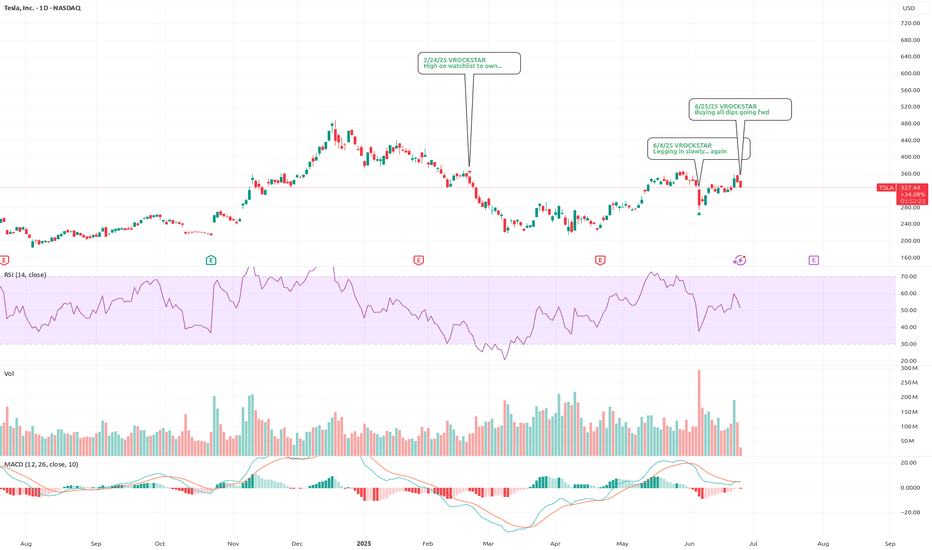

6/25/25 - $tsla - Buying all dips going fwd6/25/25 :: VROCKSTAR :: NASDAQ:TSLA

Buying all dips going fwd

- "successful robotaxi or not successful robotaxi"

- elon's clearly won the vision game

- scaling hardware (cars, infra, optimus, solar) is m-o-a-t

- so is a humanoid and robotaxi robotics company that doesn't burn cash worth a trilly in today's world if the upside is perhaps 5-10 tn in the coming decade (worst case) and your downside here is what? 30... 40... 50%? Is it more? unlikely.

- so "yes" we remain entering consumer recessy. yes "tsla" shares r not cheap. and that's for a reason.

- buy scarce paper.

- buying all dips here.

- i like the dec '27 deep ITM leaps. allows me to wrangle size with a bit more flexibility in the coming months.

- but this rocketship has yet to make any meaningful moves.

- $1,000/shr is the 2Y tgt.

V

Bullish Setup Suggests Rally Towards $350 Zone

- T1 = $340.00

- T2 = $350.00

Stop Levels:

- S1 = $315.00

- S2 = $310.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Tesla.

**Key Insights:**

Tesla continues to receive robust interest as macroeconomic conditions favor growth-oriented companies, particularly in the electric vehicle sector. The recent earnings showed signs of stabilization in gross margins, thanks to operational efficiency and cost reductions. Similarly, the company's megapack energy storage segment is gaining traction, which provides an ancillary growth avenue outside its core vehicle business. Technical indicators suggest strong momentum, with Tesla's Relative Strength Index (RSI) approaching bullish levels while trading volume supports the ongoing price recovery.

Furthermore, global EV adoption continues to rise, with increased government support for sustainable energy initiatives securing Tesla's place as a leading player. Supply chain constrictions, previously a concern, are relaxing, providing tailwinds for smoother production cycles.

**Recent Performance:**

Tesla's stock has gained over 8% in the past two weeks, recovering from its support levels around $305. The recent breakout above $320 signals renewed buying interest, accompanied by increased institutional participation. Short-term volatility has brought manageable dips, but overall momentum indicates bullish consolidation towards higher highs in its near-term trading range.

**Expert Analysis:**

Market strategists highlight Tesla’s ability to outperform its competitors due to vertical integration, advanced battery technologies, and scaling of operational efficiencies. Technical analysts note Tesla hovering near an ascending triangle formation with breakout potential above $330. Analysts also observe robust support around $310, which acts as a safety net for downside risks. Moving averages, especially the 50-day and 200-day lines, are converging as they indicate sustained bullish sentiment.

**News Impact:**

Recent news regarding expanded production facilities in Europe and positive developments in autonomous driving technology have fueled optimism among investors. Further bolstering sentiment is CEO Elon Musk’s strategic focus on prioritizing volumes over short-term profit metrics—a move widely seen as prudent given the current competitive landscape in EV markets.

**Trading Recommendation:**

Tesla is primed for upside momentum and presents an attractive long opportunity for traders targeting $340 and $350 next price zones. Its technical and fundamental outlook support the bullish case as macroeconomic tailwinds and company-specific factors align for higher valuations. Focus on maintaining risk discipline by exiting trades if stops at $315 or $310 are breached. For patient investors, Tesla is likely to remain a candidate for continued capital appreciation.

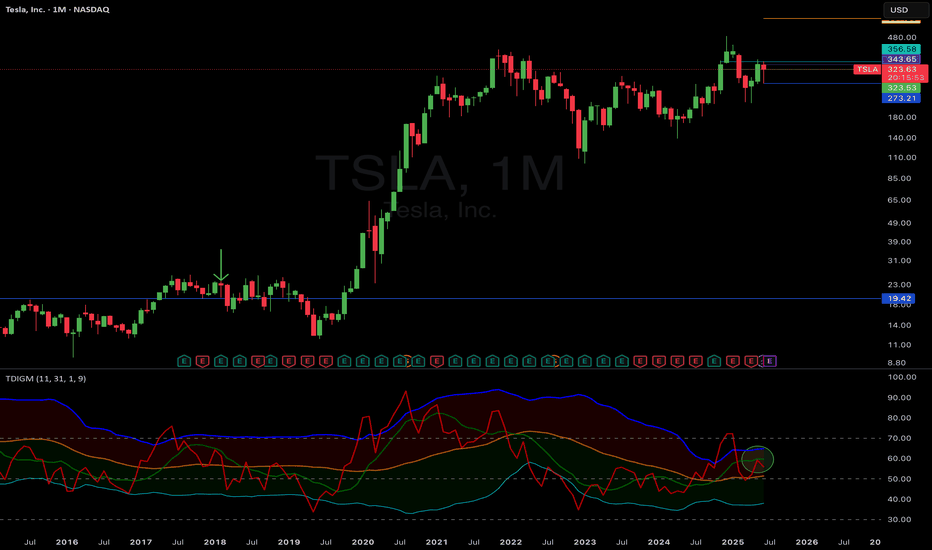

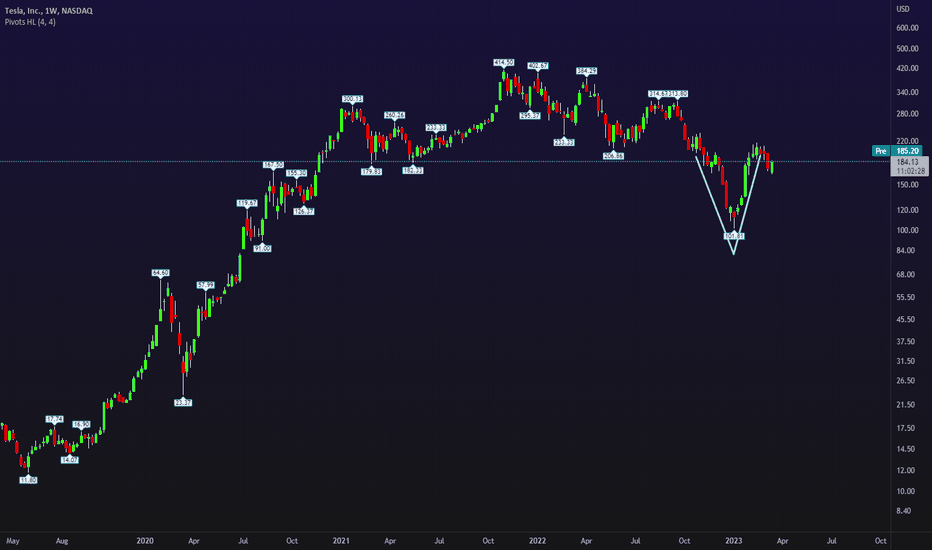

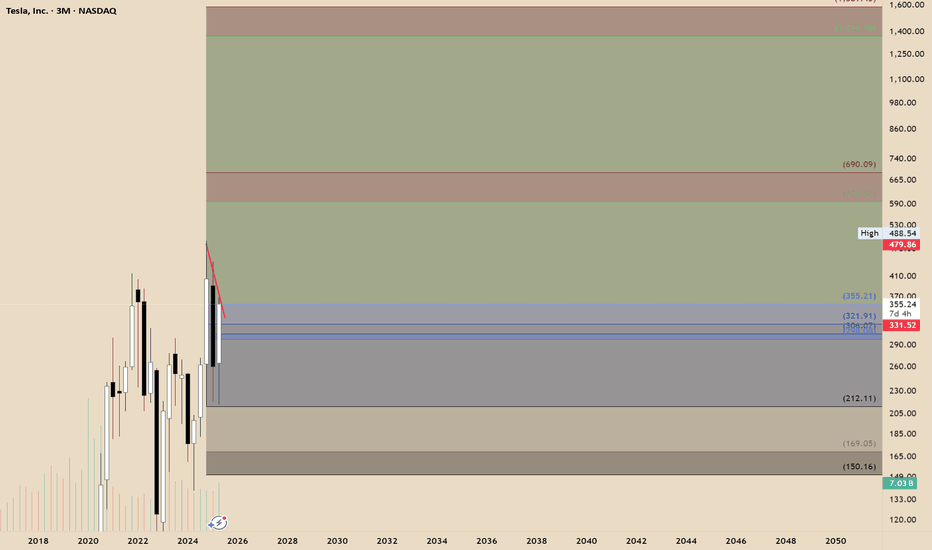

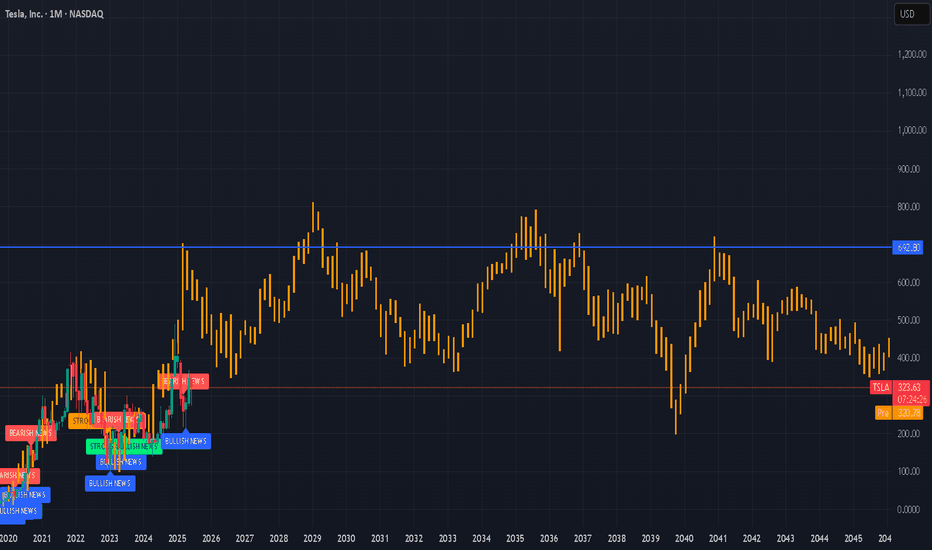

A Bullish Long-Term Outlook Tesla continues to present a compelling case for long-term investors, underpinned by its innovation-led growth trajectory and emerging dominance in autonomous mobility. Technically, recent market structure reveals an imbalance within a quarterly bullish breaker, suggesting further price expansion. If macroeconomic conditions remain favorable, the next algorithmic target zones fall between $594 and $690, signaling potential upside.

On the fundamental front, Tesla’s recent moves—particularly its rollout of the robotaxi network—have ignited fresh investor optimism. Analysts now estimate that autonomous driving could account for a substantial portion of Tesla’s future valuation, with some long-range forecasts placing the stock above $2,000 within the next several years.

While short-term pressures such as softening EV demand and regulatory barriers persist, Tesla’s consistent execution on AI-driven mobility may unlock new valuation territory.

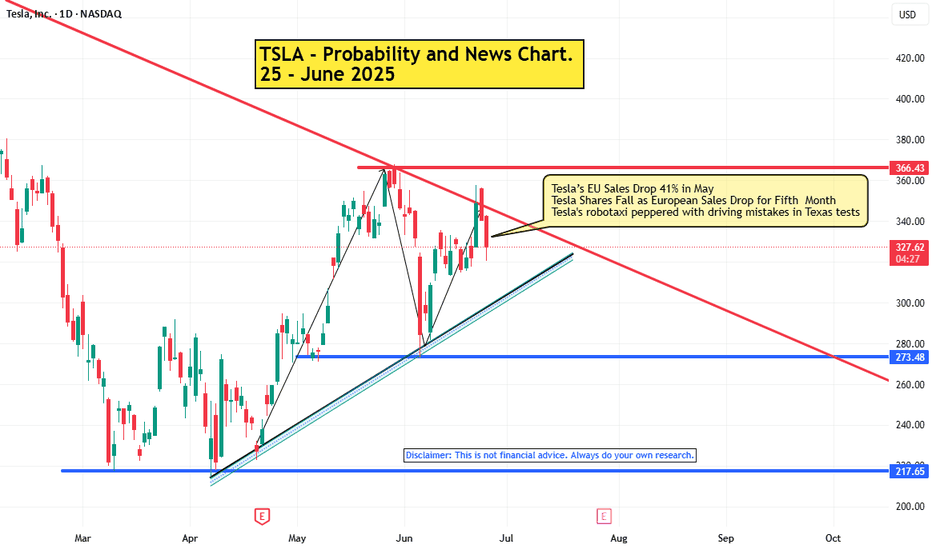

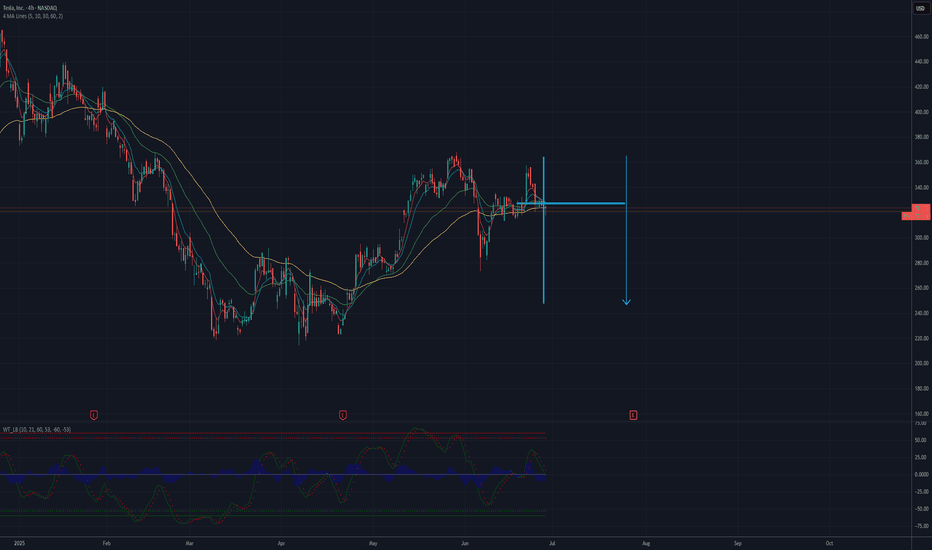

TESLA falling down to 250 USD?Tesla is consolidating in a tight range, showing bearish pressure near the lower boundary of the formation. Moving averages (MA 5/10/30/60) are flattening, indicating a loss of bullish momentum, while the Wavetrend oscillator has issued a sell signal (bearish crossover below the zero line). A downside breakout from this range projects a potential move toward the $250 level, as illustrated by the measured move. This bearish scenario gains validity if price breaks below the $315 support level.

Possible TP: 250 USD

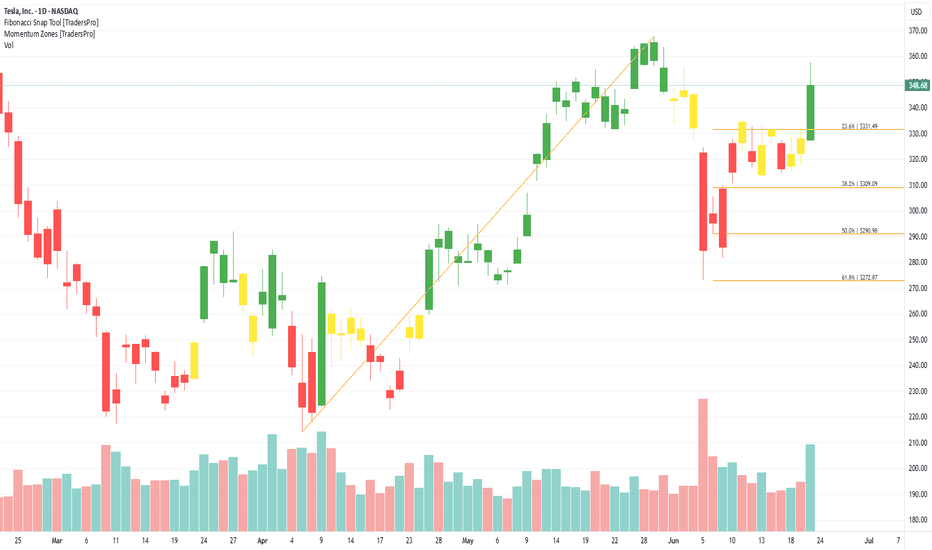

Tesla, Inc. (TSLA) Boosted by Energy StorageTesla, Inc. (TSLA) is a global leader in electric vehicles, clean energy solutions, and battery technology. The company designs and manufactures EVs, solar products, and energy storage systems that help drive the transition to sustainable energy. Tesla’s growth is fueled by rising EV adoption, battery innovations, and expansion into new markets with its cutting-edge technologies.

On the chart, a confirmation bar with increasing volume signals strong buying interest. The price has moved into the momentum zone by breaking above the .236 Fibonacci level. A trailing stop can be set just below this level using the Fibonacci snap tool to protect gains as momentum continues.

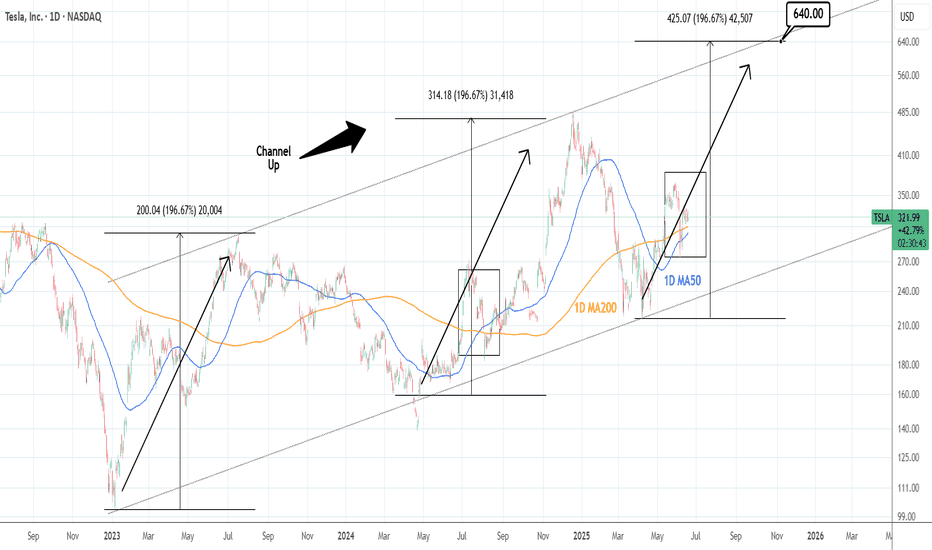

TESLA: Can double its price ($640) by the end of the year.Tesla is neutral on its 1D technical outlook (RSI = 51.064, MACD = 4.910, ADX = 24.971), consolidating for the past week, but remains over its 1D MA50 and 1D MA200 nonetheless. Since the major market bottom on January 6th 2023, it's been trading inside a Channel Up and this is its 3rd bullish wave. The 2 prior rose by +196.67% from the bottom of the pattern (despite the 2nd breaking marginally under it). Consequently, this suggests that Tesla can rise by +100% from the current $320 level, before the Channel Up tops (HH) again. We are bullish, TP = 640.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##