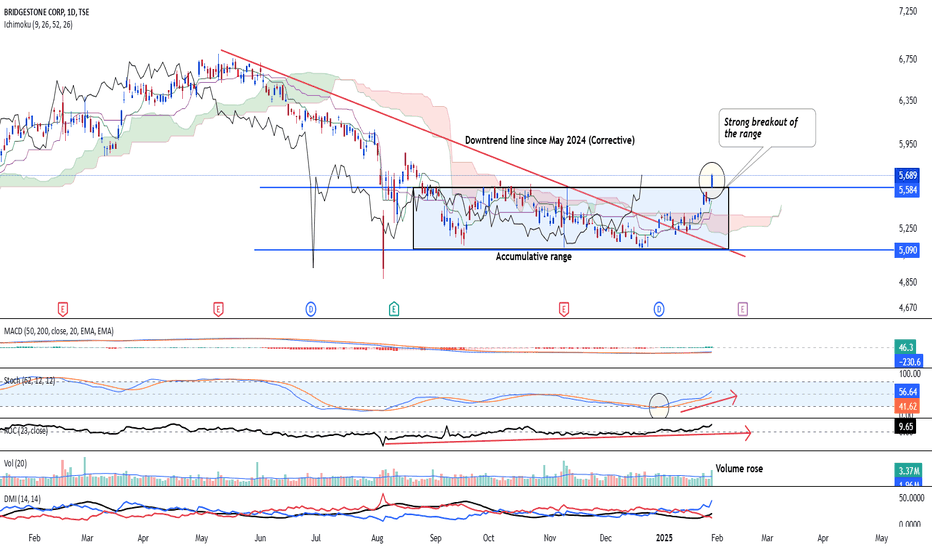

Bridgestone is looking at upside resumption TSE:5108 Bridgestone's major trend of 10 years has always been strong and recent correction which started in May 2024 seems to be finished after the stock has closed above the overhead resistance and downtrend line. Furthermore, the break above the key support turned resistance at 5,584 is strong,

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

54.72 MXN

37.79 B MXN

587.44 B MXN

509.54 M

About BRIDGESTONE CORP

Sector

Industry

CEO

Shuichi Ishibashi

Website

Headquarters

Tokyo

Founded

1931

ISIN

JP3830800003

FIGI

BBG00X0V3D15

Bridgestone Corp. engages in the manufacture and sale of tires and rubber products. It operates through the Tires and Diversified Products segments. The Tires segment manufactures and sells tires, tubes, wheels and accessories. It also offers retread material and services, and auto maintenance. The Diversified Products segment includes chemical and industrial products, sporting goods, bicycles, and financial services. The company was founded by Shojiro Ishibashi on March 1, 1931 and is headquartered in Tokyo, Japan.

Related stocks

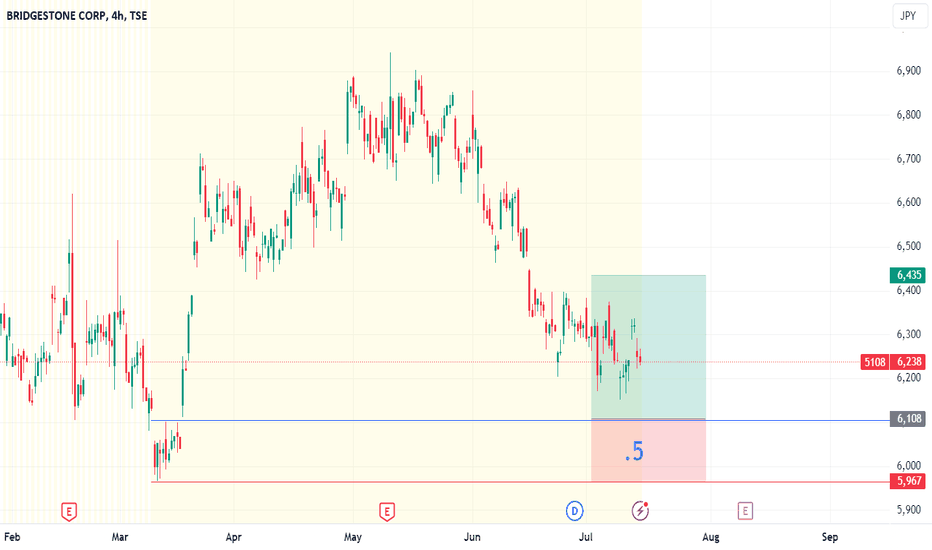

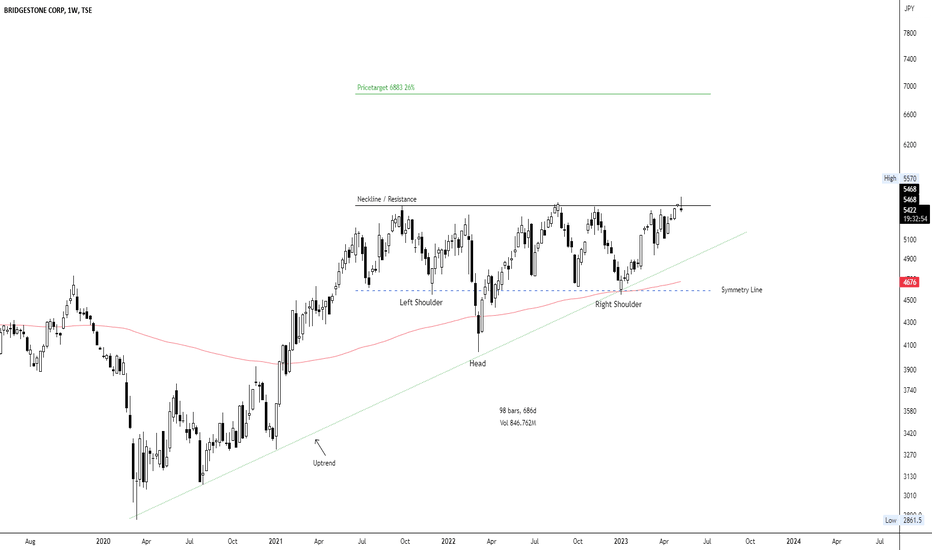

Bridgestone Corp WCA - Inverted head and shouldersCompany: Bridgestone Corporation

Ticker: 5108

Exchange: TSE

Sector: Automotive & Auto Parts

Introduction:

Greetings, and thank you for taking the time to read this analysis. Today, we are examining the weekly chart of Bridgestone Corp on the Tokyo Stock Exchange (TSE). Our focus is on a classic

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of 5108/N is 761.08 MXN — it has increased by 1.70% in the past 24 hours. Watch BRIDGESTONE CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange BRIDGESTONE CORP stocks are traded under the ticker 5108/N.

5108/N stock hasn't changed in a week, the last month showed zero change in price, over the last year BRIDGESTONE CORP has showed a 1.70% increase.

We've gathered analysts' opinions on BRIDGESTONE CORP future price: according to them, 5108/N price has a max estimate of 930.35 MXN and a min estimate of 741.68 MXN. Watch 5108/N chart and read a more detailed BRIDGESTONE CORP stock forecast: see what analysts think of BRIDGESTONE CORP and suggest that you do with its stocks.

5108/N reached its all-time high on Aug 15, 2022 with the price of 820.30 MXN, and its all-time low was 642.29 MXN and was reached on Aug 22, 2023. View more price dynamics on 5108/N chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

5108/N stock is 1.68% volatile and has beta coefficient of 0.79. Track BRIDGESTONE CORP stock price on the chart and check out the list of the most volatile stocks — is BRIDGESTONE CORP there?

Today BRIDGESTONE CORP has the market capitalization of 523.20 B, it has increased by 2.64% over the last week.

Yes, you can track BRIDGESTONE CORP financials in yearly and quarterly reports right on TradingView.

BRIDGESTONE CORP is going to release the next earnings report on Aug 8, 2025. Keep track of upcoming events with our Earnings Calendar.

5108/N earnings for the last quarter are 15.18 MXN per share, whereas the estimation was 12.39 MXN resulting in a 22.49% surprise. The estimated earnings for the next quarter are 11.40 MXN per share. See more details about BRIDGESTONE CORP earnings.

BRIDGESTONE CORP revenue for the last quarter amounts to 144.51 B MXN, despite the estimated figure of 146.04 B MXN. In the next quarter, revenue is expected to reach 140.35 B MXN.

5108/N net income for the last quarter is 10.36 B MXN, while the quarter before that showed 4.28 B MXN of net income which accounts for 142.26% change. Track more BRIDGESTONE CORP financial stats to get the full picture.

BRIDGESTONE CORP dividend yield was 3.93% in 2024, and payout ratio reached 50.46%. The year before the numbers were 3.42% and 41.75% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 2, 2025, the company has 121.46 K employees. See our rating of the largest employees — is BRIDGESTONE CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BRIDGESTONE CORP EBITDA is 111.84 B MXN, and current EBITDA margin is 18.59%. See more stats in BRIDGESTONE CORP financial statements.

Like other stocks, 5108/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BRIDGESTONE CORP stock right from TradingView charts — choose your broker and connect to your account.