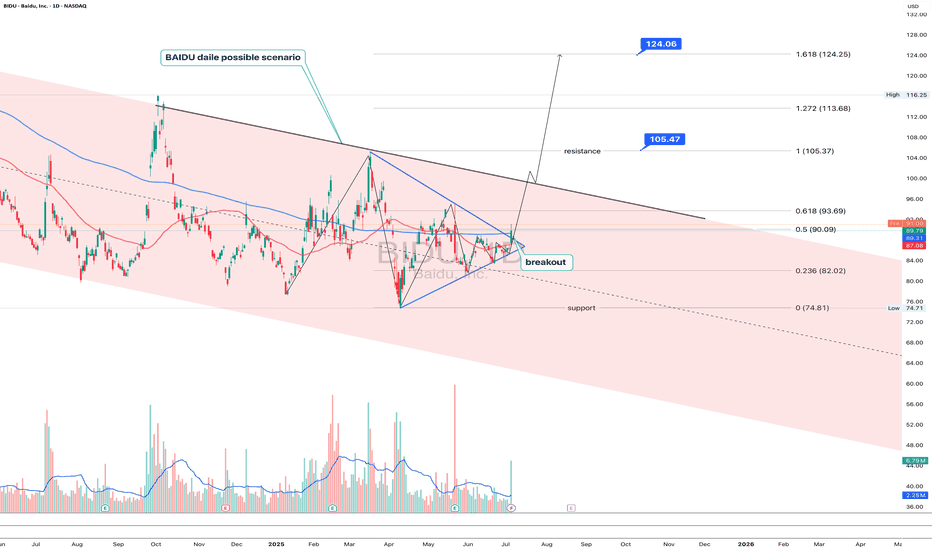

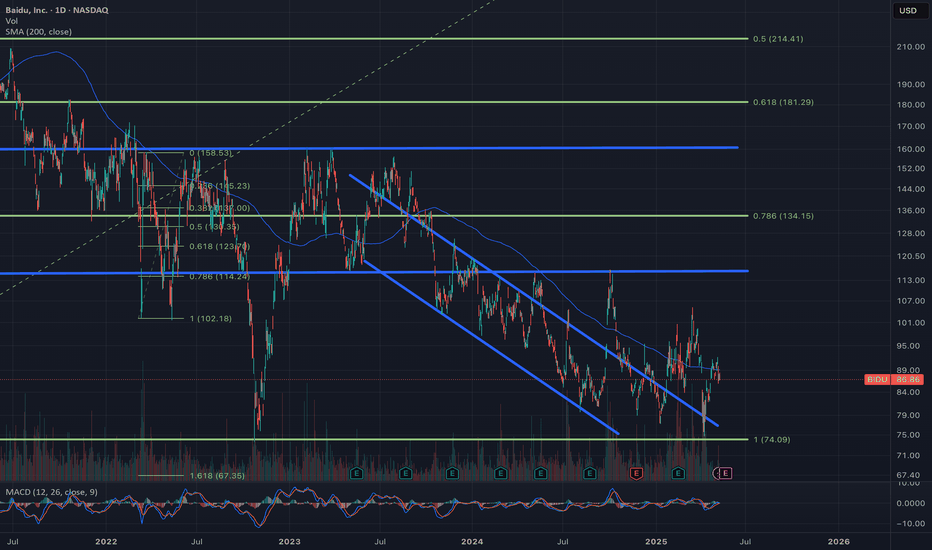

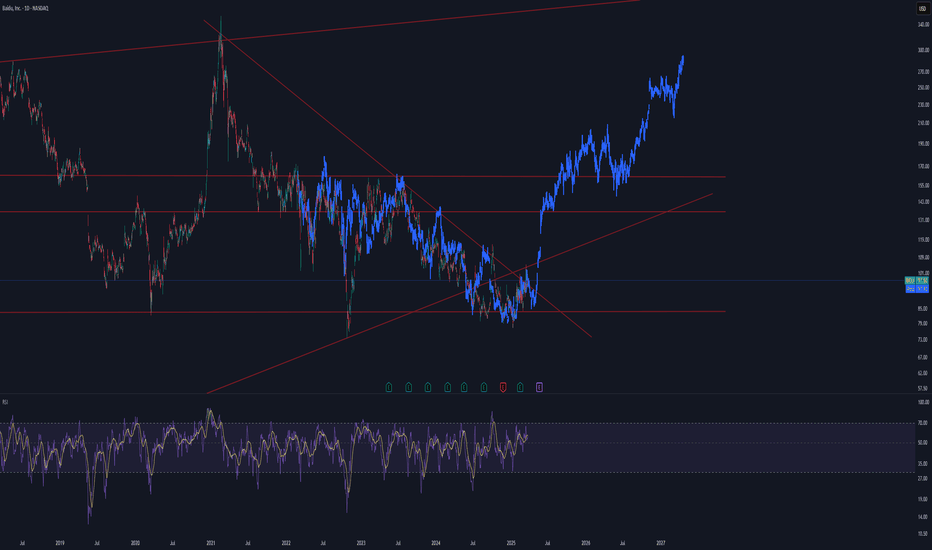

BIDU 1D: triangle breakoutBIDU 1D: triangle breakout + real-world AI deployment boosts bulls

Baidu (BIDU) breaks out of a triangle within a falling channel on the daily chart, with solid volume, reclaim of the 50MA, and approach to the 200MA. $90.09 flips into support. Targets stretch to $105.47 / $113.68 / $124.06 (Fibo l

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

26.05 MXN

67.40 B MXN

387.24 B MXN

2.17 B

About Baidu, Inc.

Sector

Industry

CEO

Yan Hong Li

Website

Headquarters

Beijing

Founded

2000

FIGI

BBG01NLM1Z61

Baidu, Inc. engages in the provision of internet search and online marketing solutions. The firm’s products and services include Baidu App, Baidu Search, Baidu Feed, Haokan, Quanmin, Baidu Post Bar, Baidu Knows, Baidu Encyclopedia, Baidu Input Method Editor or Baidu IME, Baidu AI Cloud and Overseas Products. It operates through the following segments: Baidu Core and iQIYI. The Baidu Core segment provides search-based, feed-based, and other online marketing services. The iQiyi segment is an online entertainment service provider, which offers original, professionally produced and partner-generated content on its platform. The company was founded by Yanhong Li and Xu Yong on January 18, 2000 and is headquartered in Beijing, China.

Related stocks

Baidu Accelerates Robotaxi Expansion and Opens the European DoorBy Ion Jauregui – Analyst at ActivTrades

Baidu (NASDAQ: BIDU), the Chinese tech giant, is doubling down on autonomous vehicles through Apollo Go, its robotaxi platform. According to industry sources, the company is planning to expand into Europe, with Switzerland and Turkey as its first potentia

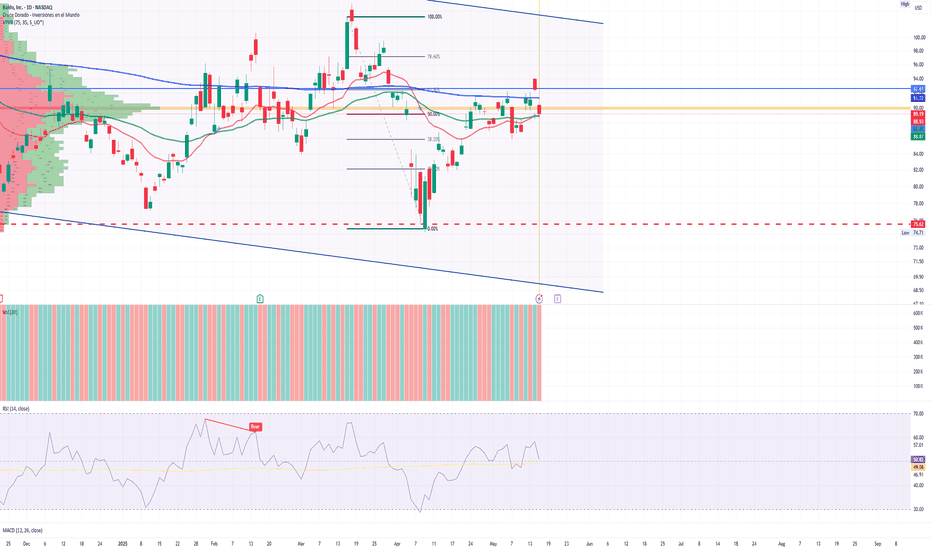

BIDU close watchAs of the latest update, here’s a snapshot of Baidu Inc. (BIDU) stock:

Current Price: $86.86 (as of May 11, 2025, 10:26 AM EDT)

After-Hours Price: $87.29

Day Range: $86.68 – $87.75

52-Week Range: $74.71 – $116.25

Market Cap: $29.86 billion

P/E Ratio: 9.66

Dividend Yield: 0% 1

Analyst Outlook:

Conse

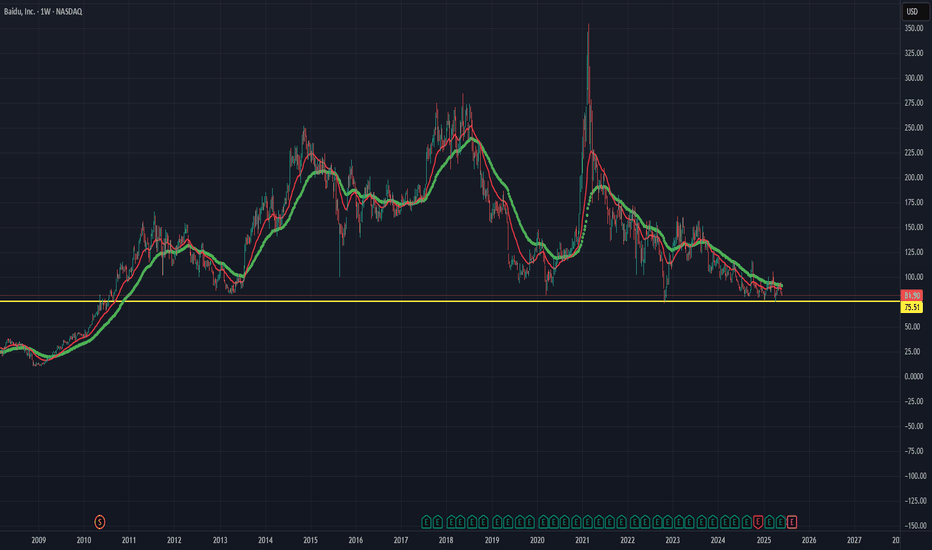

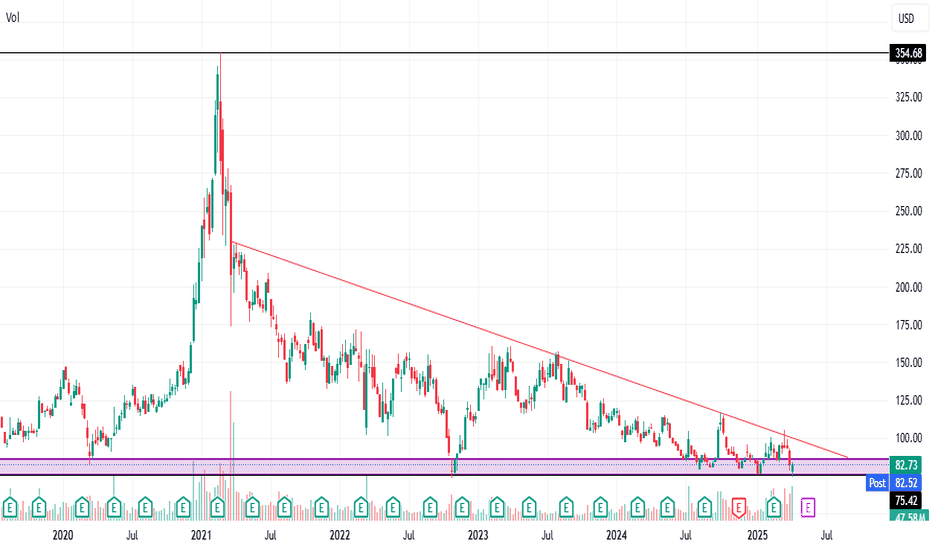

$bidu smash or crashNASDAQ:BIDU continues to get bought up at this demand zone that has held for 12 years between $85-$73. One of the most beautiful charts Ive seen on an individual name in a long time. Not the most exciting name around but $70 cash per share on hand and a PE of 9 with as solid of a defined R/R as yo

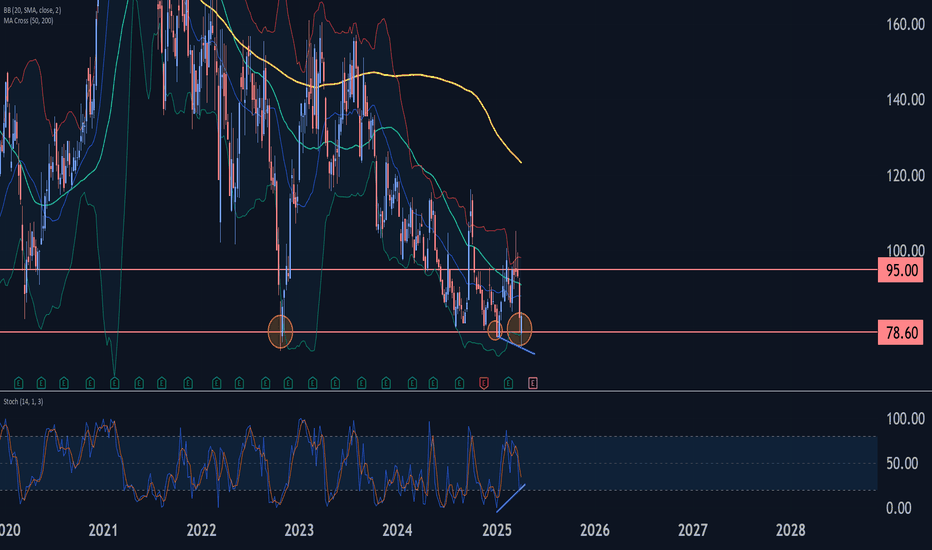

Baidu Wave Analysis – 11 April 2025

- Baidu reversed from support zone

- Likely to rise to resistance level 90.00.

Baidu recently reversed from the support zone between the major long-term support level 78.60 (which has been reversing the price from the end of 2022) and the lower weekly Bollinger Band.

The upward reversal

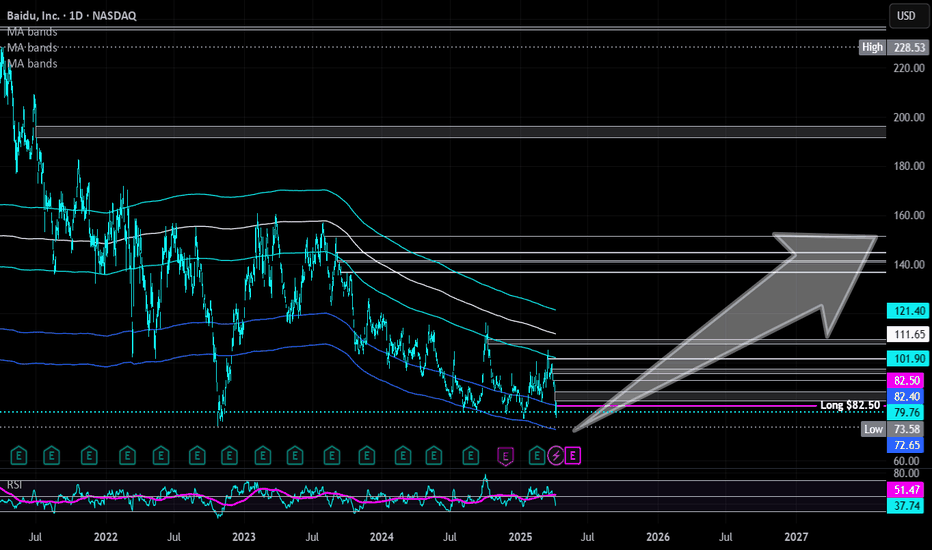

Baidu | BIDU | Long at $82.50Baidu NASDAQ:BIDU - the Google of China. This one is being ignored by AI investors, and may be an opportunity. Maybe... nothing is certain (especially with the "risks" of Chinese investments).

P/E = 9x

Debt/Equity = 0.27x

Price/Sales = 1.55x

Price/Book = 0.80x

Price/Cash flow = 7.59x

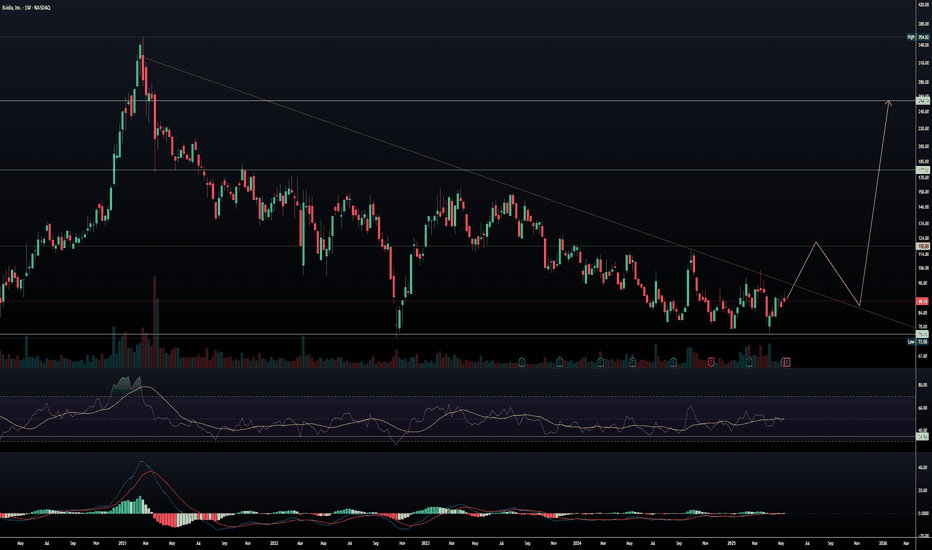

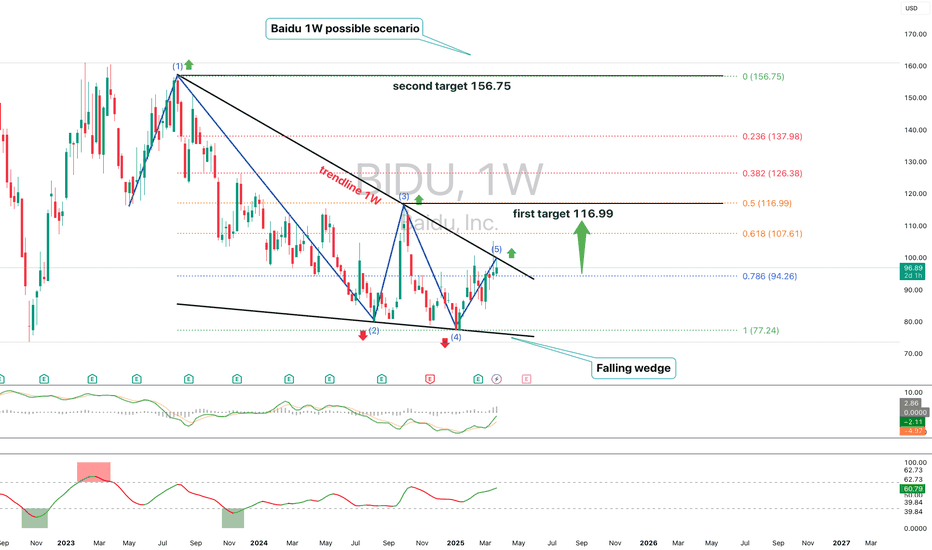

Baidu: Possible move as per previous chart patternNASDAQ:BIDU

Hello,

Just a guess work.

I see similar pattern played out few years ago, I guess it can follow the same pattern, may be the magnitude is different.

Please exercise caution while trading these stocks as they can stay flat for years.

Happy trading

Baidu Inc. (BIDU) 1WTechnical Analysis 1W

A breakout from the "falling wedge" could signal potential upside.

Key levels:

-Support: 94.26 | 77.24

-Resistance: 107.61 | 116.99 | 156.75

Fundamental Analysis

-AI Leadership: Baidu continues expanding in AI, cloud computing, and autonomous driving.

-Financials: Solid

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 9888/N is featured.

Frequently Asked Questions

The current price of 9888/N is 199.99 MXN — it has increased by 2.06% in the past 24 hours. Watch BAIDU INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange BAIDU INC stocks are traded under the ticker 9888/N.

9888/N stock has risen by 2.06% compared to the previous week, the month change is a 2.06% rise, over the last year BAIDU INC has showed a 2.06% increase.

We've gathered analysts' opinions on BAIDU INC future price: according to them, 9888/N price has a max estimate of 374.37 MXN and a min estimate of 196.29 MXN. Watch 9888/N chart and read a more detailed BAIDU INC stock forecast: see what analysts think of BAIDU INC and suggest that you do with its stocks.

9888/N reached its all-time high on Jul 10, 2024 with the price of 195.95 MXN, and its all-time low was 195.95 MXN and was reached on Jul 10, 2024. View more price dynamics on 9888/N chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

9888/N stock is 2.02% volatile and has beta coefficient of 1.24. Track BAIDU INC stock price on the chart and check out the list of the most volatile stocks — is BAIDU INC there?

Today BAIDU INC has the market capitalization of 555.13 B, it has increased by 4.93% over the last week.

Yes, you can track BAIDU INC financials in yearly and quarterly reports right on TradingView.

BAIDU INC is going to release the next earnings report on Aug 20, 2025. Keep track of upcoming events with our Earnings Calendar.

9888/N earnings for the last quarter are 6.63 MXN per share, whereas the estimation was 5.04 MXN resulting in a 31.53% surprise. The estimated earnings for the next quarter are 4.95 MXN per share. See more details about BAIDU INC earnings.

BAIDU INC revenue for the last quarter amounts to 92.84 B MXN, despite the estimated figure of 87.11 B MXN. In the next quarter, revenue is expected to reach 87.26 B MXN.

9888/N net income for the last quarter is 21.72 B MXN, while the quarter before that showed 13.36 B MXN of net income which accounts for 62.60% change. Track more BAIDU INC financial stats to get the full picture.

No, 9888/N doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 15, 2025, the company has 41.3 K employees. See our rating of the largest employees — is BAIDU INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BAIDU INC EBITDA is 78.60 B MXN, and current EBITDA margin is 27.00%. See more stats in BAIDU INC financial statements.

Like other stocks, 9888/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BAIDU INC stock right from TradingView charts — choose your broker and connect to your account.