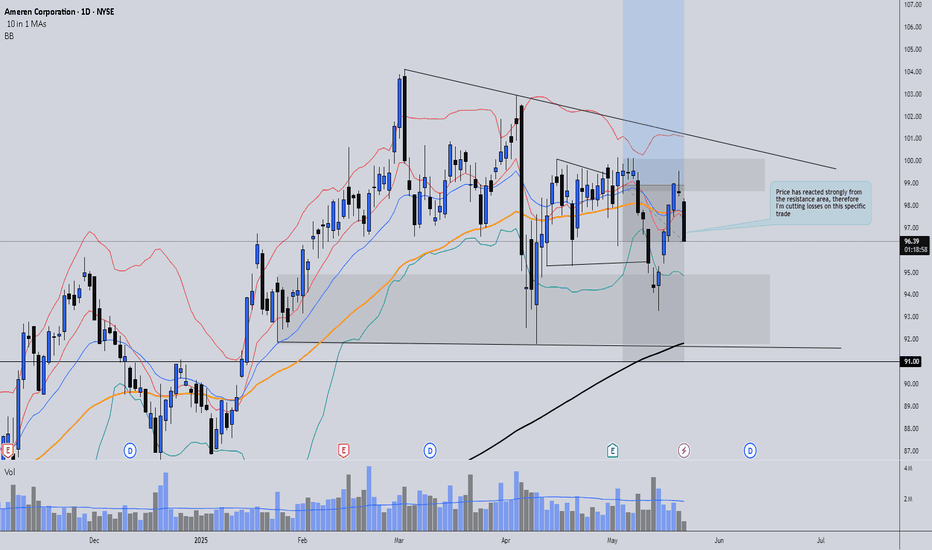

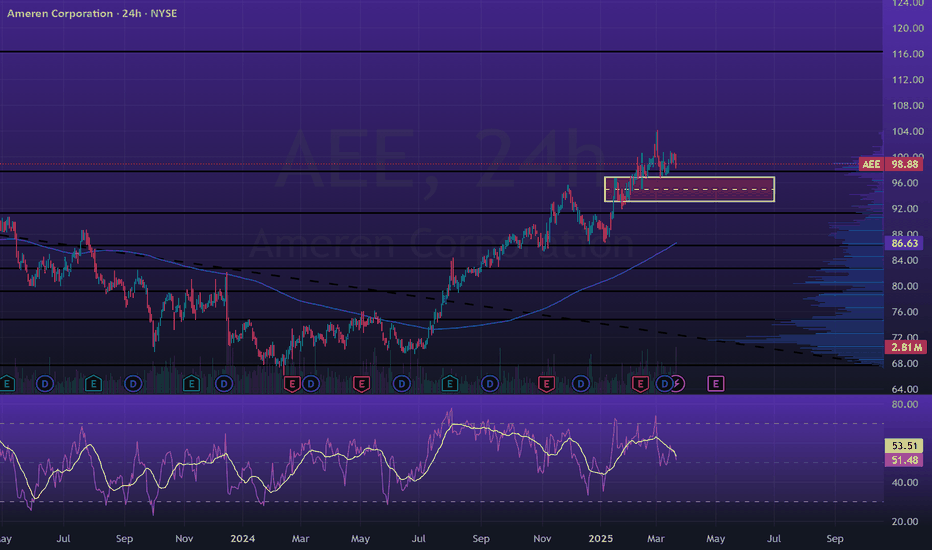

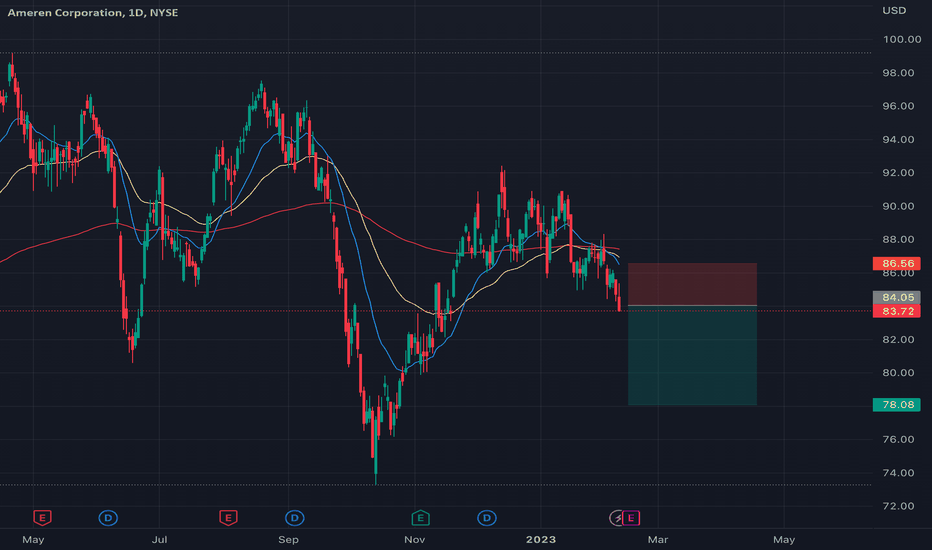

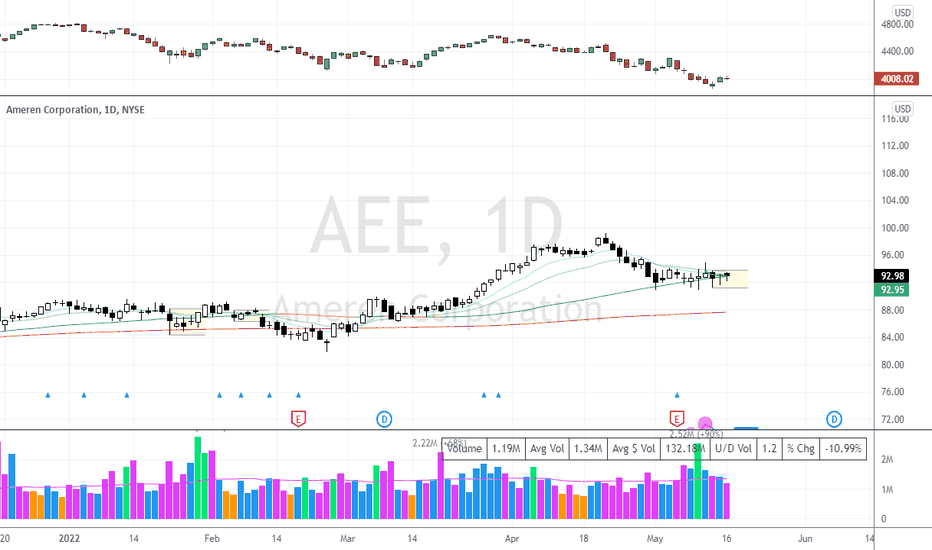

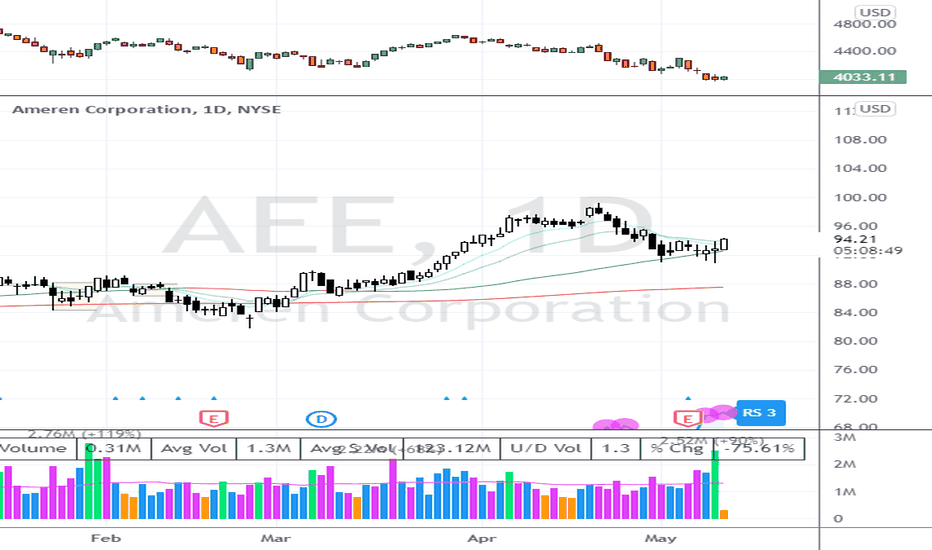

AEE cutting lossAs we can see on this trade, the price reached a key resistance level and reacted strongly to the downside. Given this behavior, along with the fact that the trade nearly hit my stop-loss, I’ve decided to cut the loss short. The stock isn’t behaving as expected, and in situations like this, it's bet

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

92.62 MXN

24.64 B MXN

158.94 B MXN

275.52 M

About Ameren Corporation

Sector

Industry

CEO

Martin J. Lyons

Website

Headquarters

St. Louis

Founded

1902

FIGI

BBG01HQNP1Q4

Ameren Corp. is a public utility holding company, which engages in the provision of electric and natural gas services. It operates through the following segments: Ameren Missouri, Ameren Illinois Electric Distribution, Ameren Illinois Natural Gas, Ameren Transmission, and Other. The Ameren Transmission segment consists of the aggregated electric transmission businesses of Ameren Illinois and Ameren Transmission Company of Illinois (ATXI). The company was founded in 1902 and is headquartered in St. Louis, MO.

Related stocks

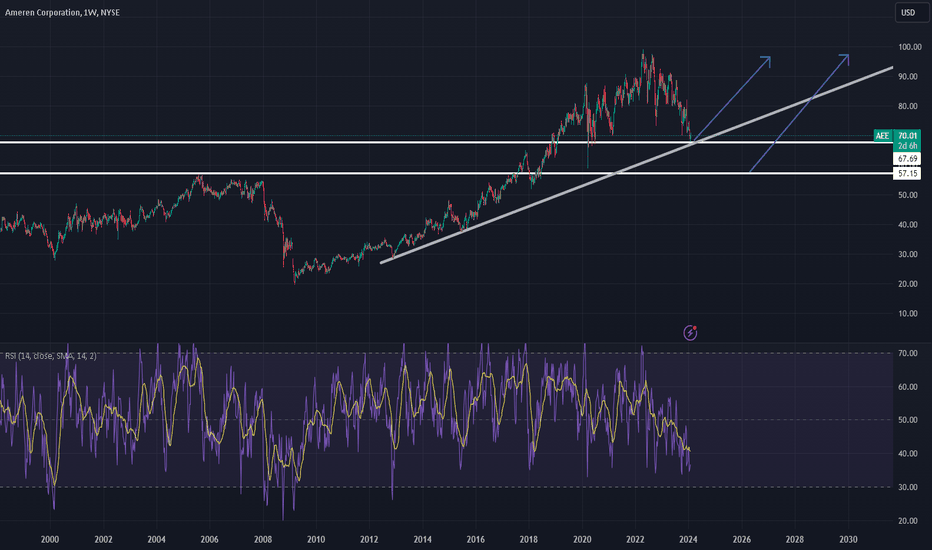

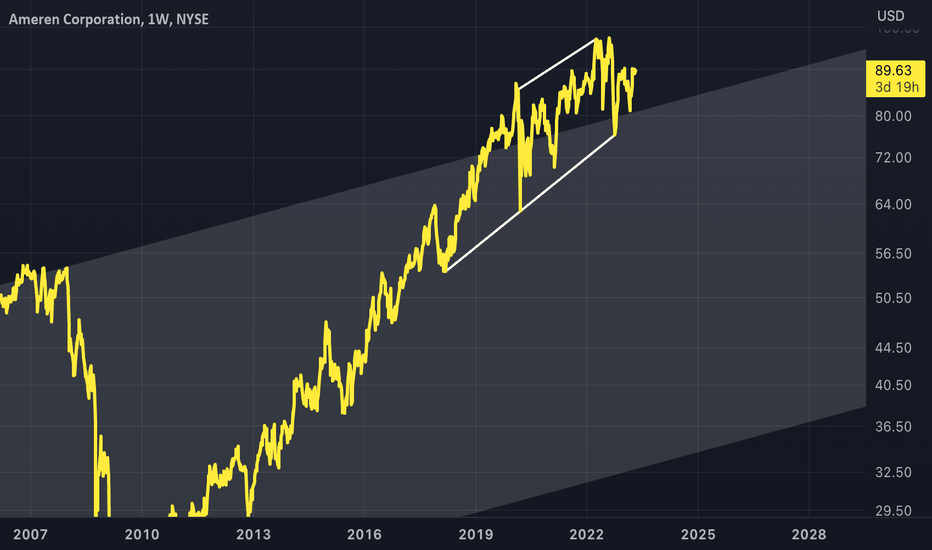

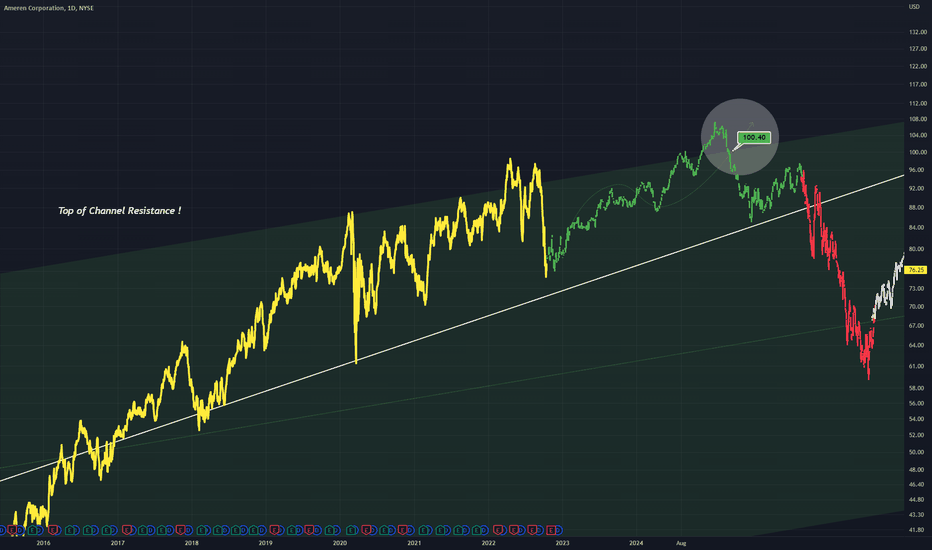

AEE - Top of Channel RejectionPrice has reached the top of a very long term channel

This is shown with the rising white line against the upper channel band

I expect price to return to the middle of this channel

I have shown this return to middle with the bars pattern tool

Rejection will likely be at around 100

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of AEE is 1,789.11 MXN — it has decreased by −7.34% in the past 24 hours. Watch AMEREN CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange AMEREN CORP stocks are traded under the ticker AEE.

AEE stock has fallen by −7.34% compared to the previous week, the month change is a −7.34% fall, over the last year AMEREN CORP has showed a 2.50% increase.

We've gathered analysts' opinions on AMEREN CORP future price: according to them, AEE price has a max estimate of 2,145.52 MXN and a min estimate of 1,865.67 MXN. Watch AEE chart and read a more detailed AMEREN CORP stock forecast: see what analysts think of AMEREN CORP and suggest that you do with its stocks.

AEE stock is 7.93% volatile and has beta coefficient of 0.31. Track AMEREN CORP stock price on the chart and check out the list of the most volatile stocks — is AMEREN CORP there?

Today AMEREN CORP has the market capitalization of 496.55 B, it has decreased by −0.58% over the last week.

Yes, you can track AMEREN CORP financials in yearly and quarterly reports right on TradingView.

AMEREN CORP is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

AEE earnings for the last quarter are 21.92 MXN per share, whereas the estimation was 21.84 MXN resulting in a 0.39% surprise. The estimated earnings for the next quarter are 18.66 MXN per share. See more details about AMEREN CORP earnings.

AMEREN CORP revenue for the last quarter amounts to 42.96 B MXN, despite the estimated figure of 39.26 B MXN. In the next quarter, revenue is expected to reach 33.56 B MXN.

AEE net income for the last quarter is 5.92 B MXN, while the quarter before that showed 4.32 B MXN of net income which accounts for 37.19% change. Track more AMEREN CORP financial stats to get the full picture.

Yes, AEE dividends are paid quarterly. The last dividend per share was 13.55 MXN. As of today, Dividend Yield (TTM)% is 2.87%. Tracking AMEREN CORP dividends might help you take more informed decisions.

AMEREN CORP dividend yield was 3.01% in 2024, and payout ratio reached 60.63%. The year before the numbers were 3.48% and 57.62% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 14, 2025, the company has 8.98 K employees. See our rating of the largest employees — is AMEREN CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AMEREN CORP EBITDA is 66.77 B MXN, and current EBITDA margin is 40.94%. See more stats in AMEREN CORP financial statements.

Like other stocks, AEE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AMEREN CORP stock right from TradingView charts — choose your broker and connect to your account.