B/N trade ideas

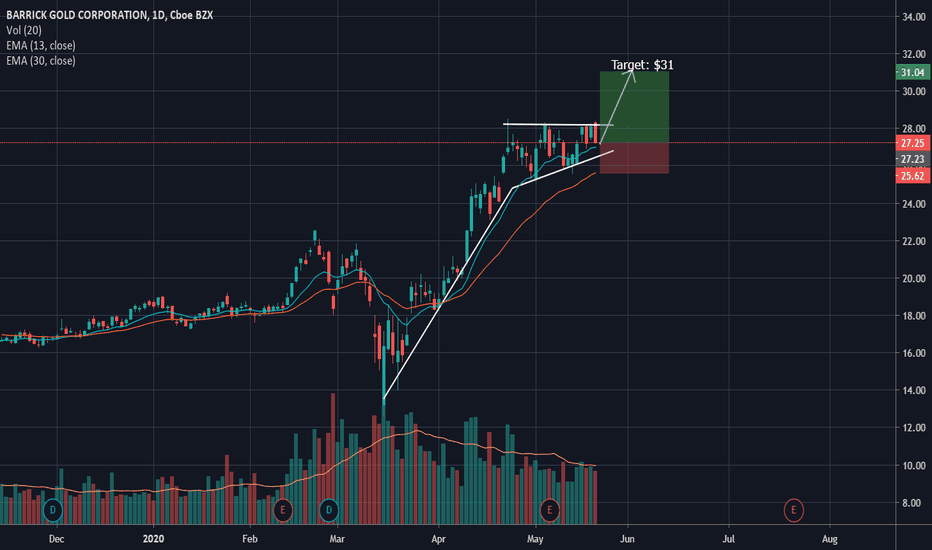

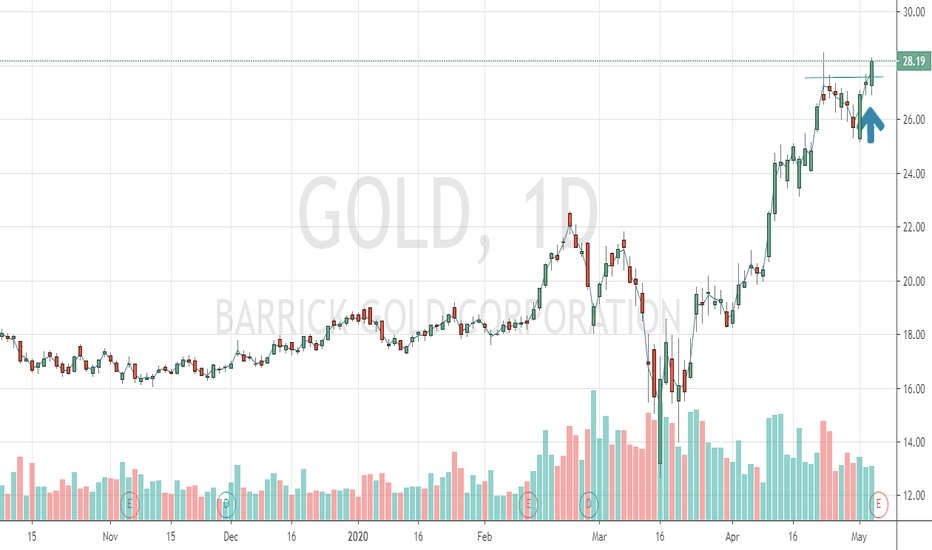

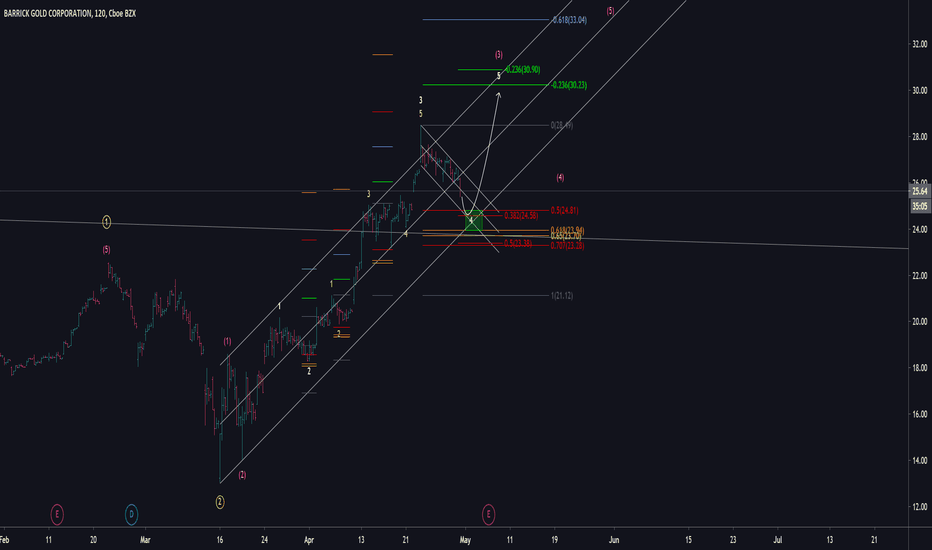

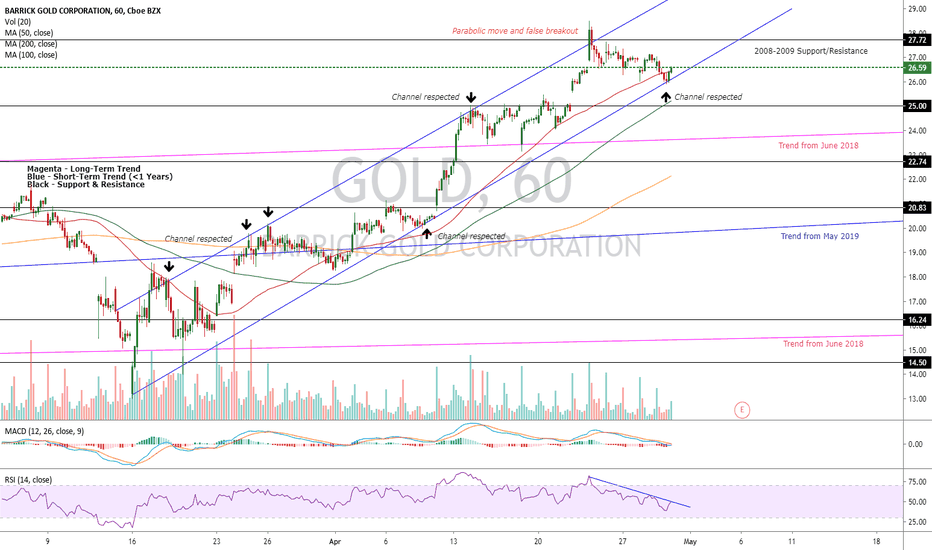

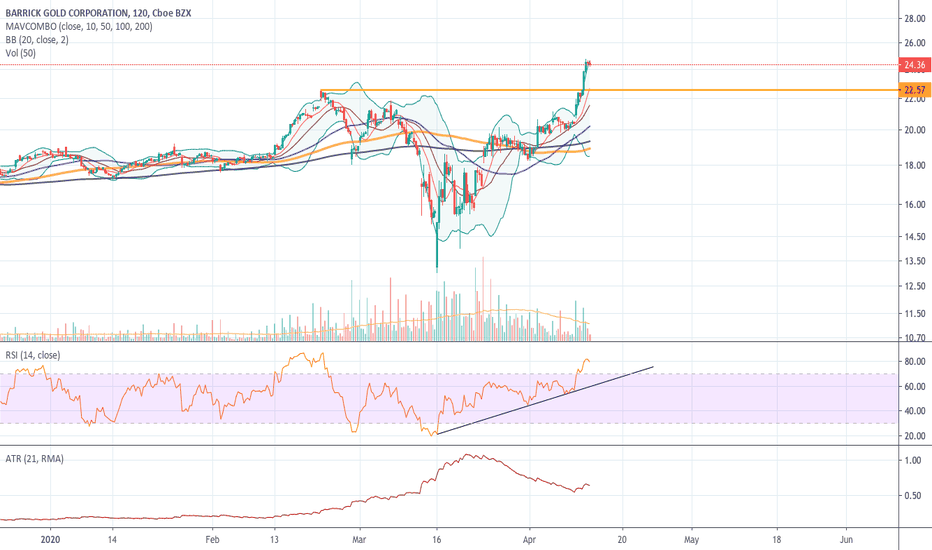

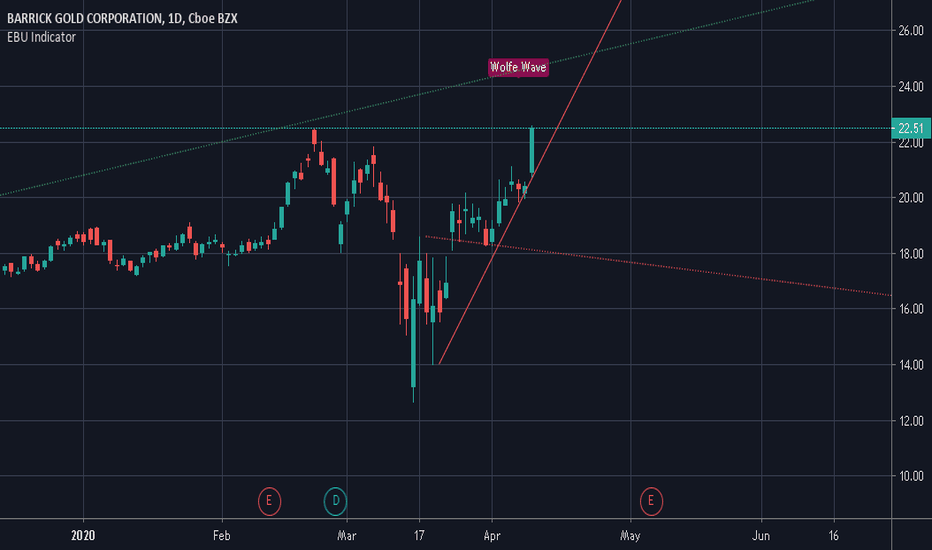

Barrick Gold - Ascending Channel Intact Post-FOMCBarrick has been in an ascending channel since it bottomed in mid-March with multiple tests of the channel and 1 failed breakout after a parabolic rise. Move appears healthy with a slow grind higher.

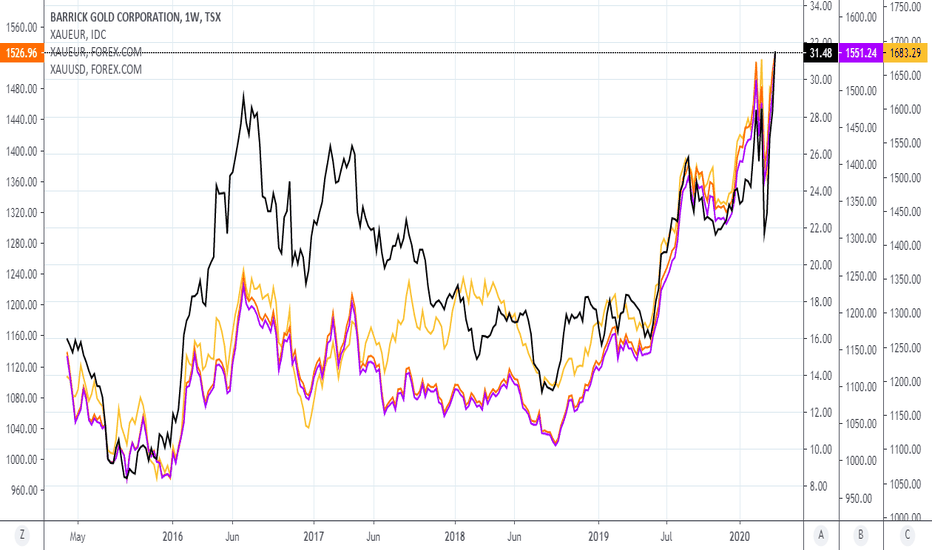

Post-FOMC, gold continues to trade bullishly with dips being bought prior to the meeting and big spike after "whatever it takes" message from Powell. Since gold is trading higher with multiple tailwinds, Barrick appears ready for the next move up because:

- Channel respect today after initial drop from false breakout,

- Above rising 50, 100, 200 MA, and

- Sideways movements the last 2 weeks heading towards the bottom of the channel.

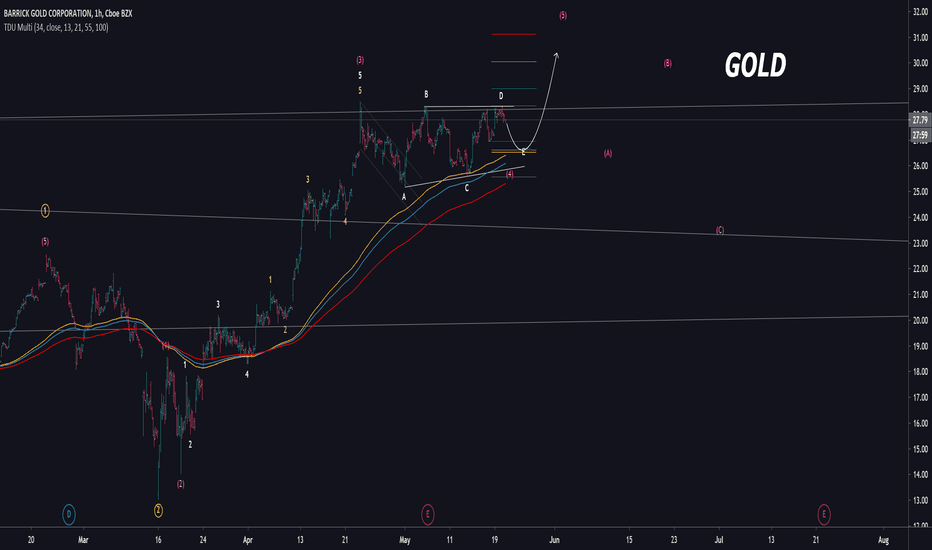

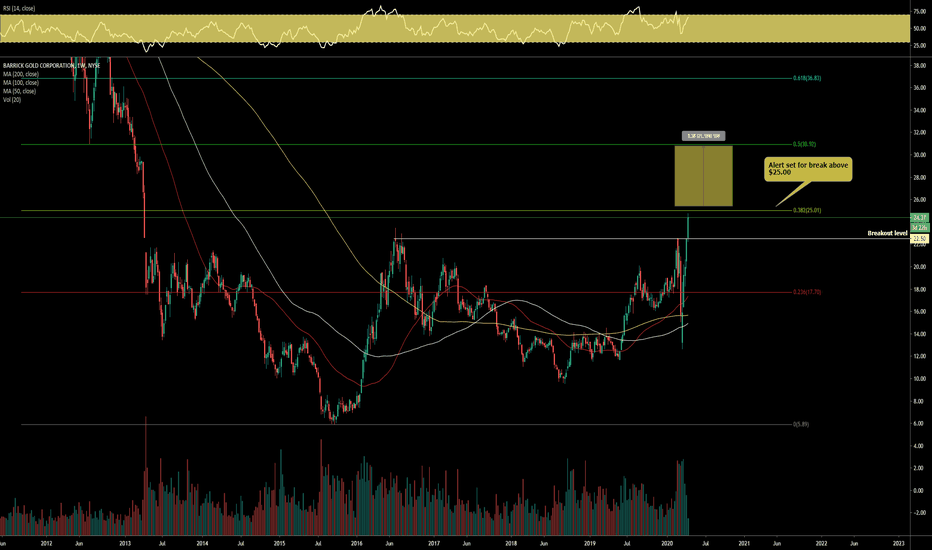

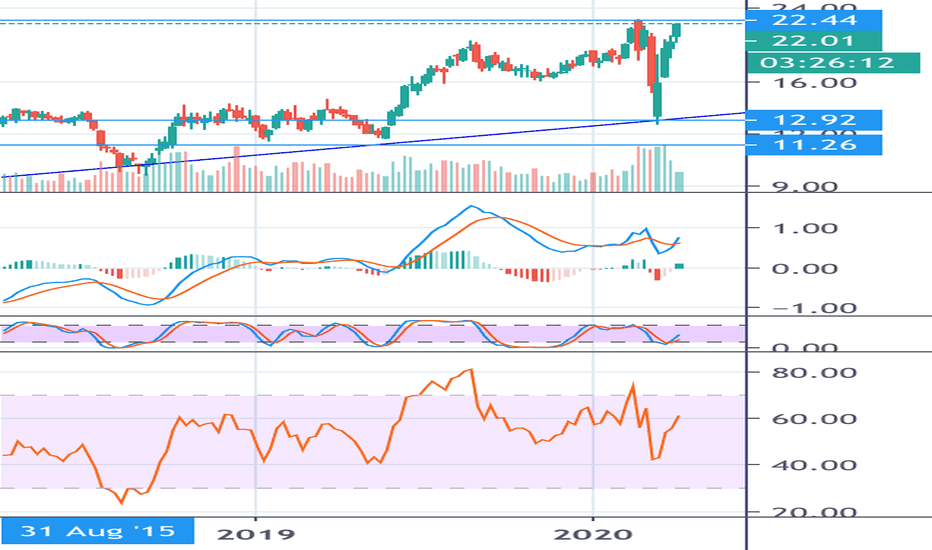

If it breaks the downtrend for the RSI, it should continue to move higher with resistance at $27.72 from 2008 - 2009.

If it fails to break the downtrend for RSI, likely to move lower with minor support at ~$25 from 100MA and resistance and major support at ~$24 from long-term trend from June 2018.

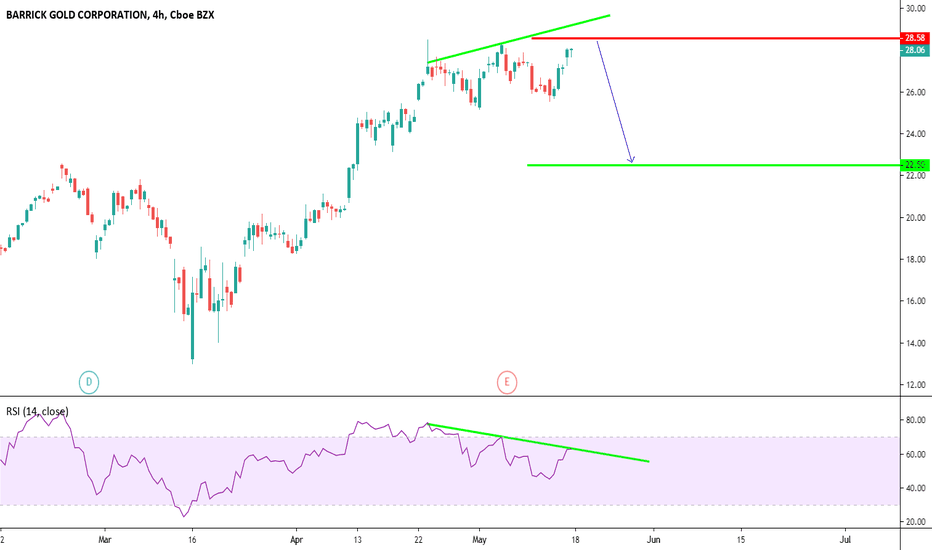

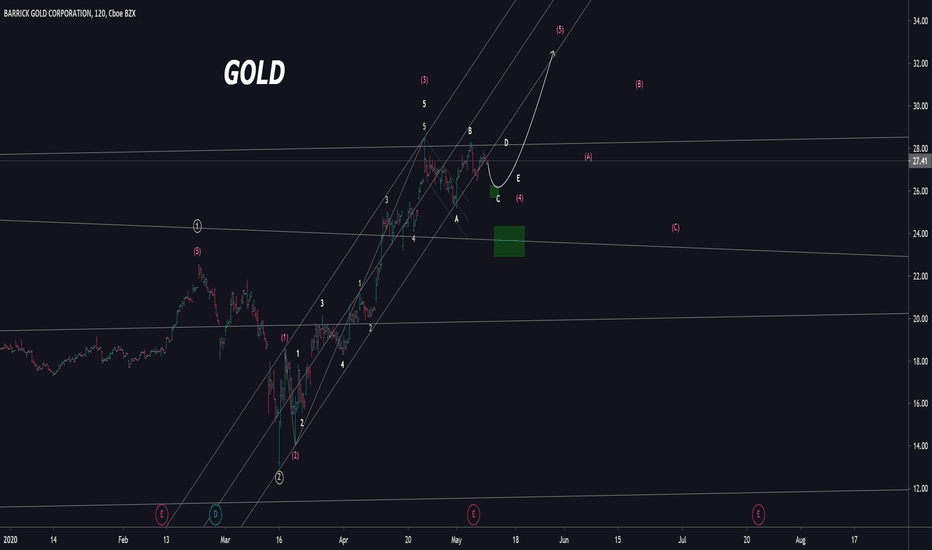

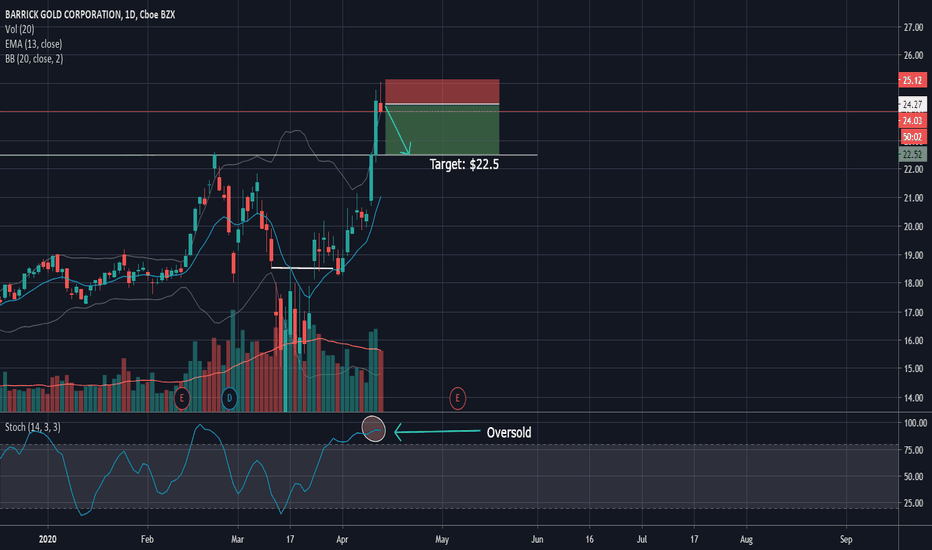

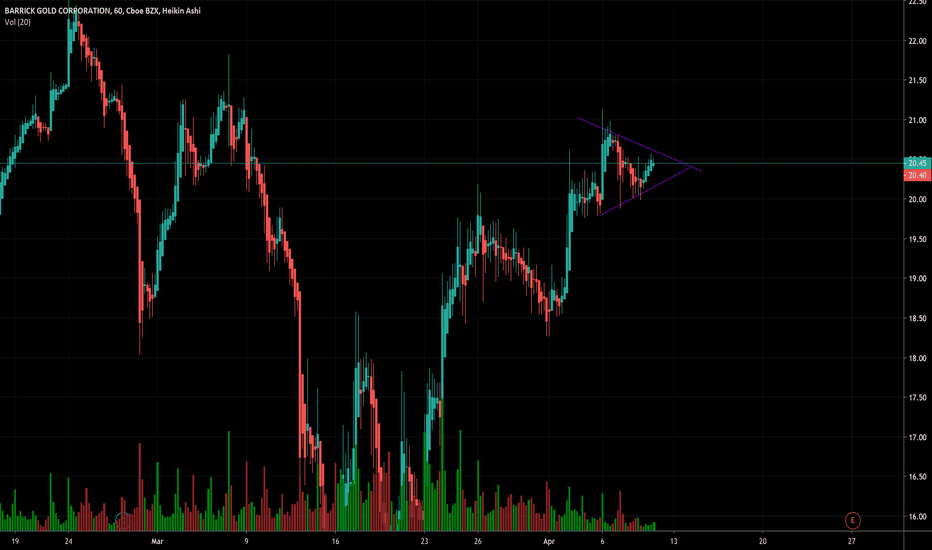

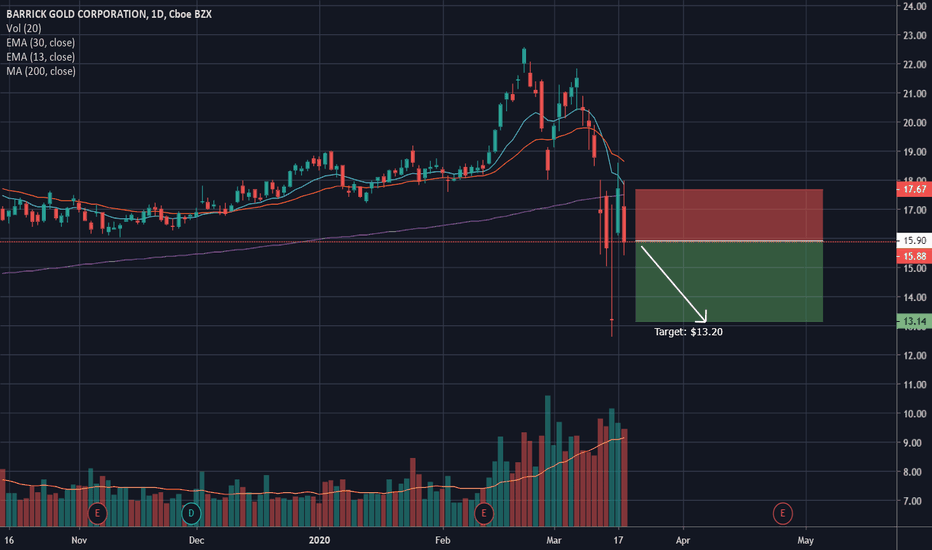

GOLD Rubberband SnapbackLooks like GOLD has rallied to far to fast, extending beyond the bollinger band and ranking over 90 on stochastics. Being that its on its 3-4 consecutive up day, these are all pointing to selloff for people to start taking profits. This can run down to 22 range, before it can rebase and run higher.

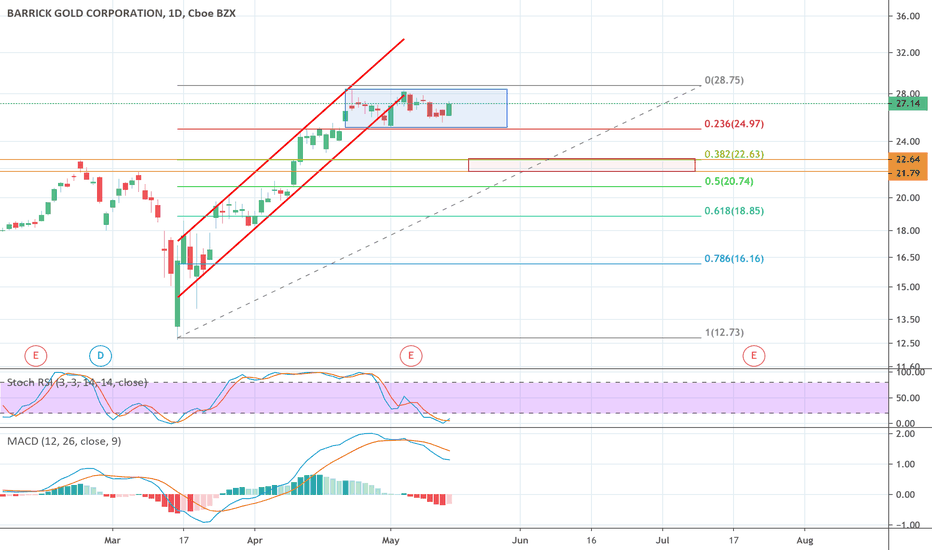

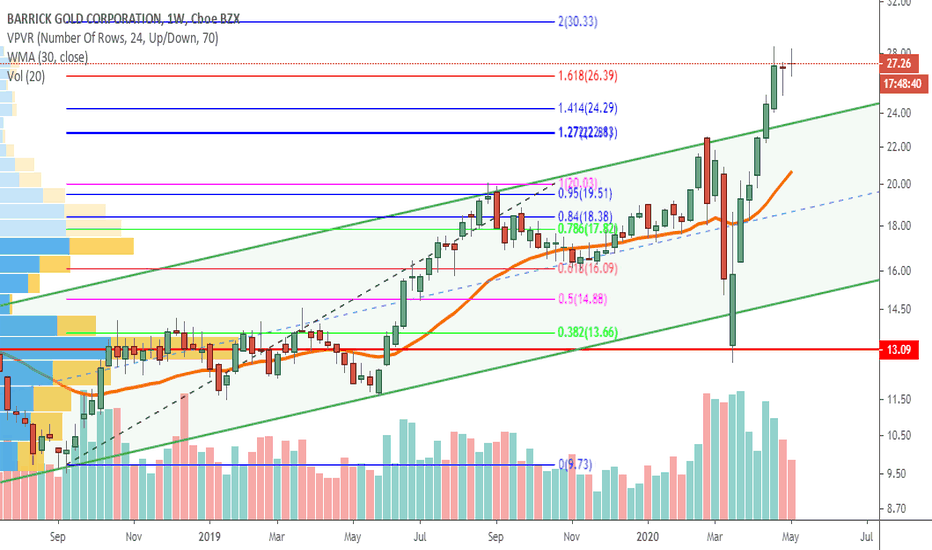

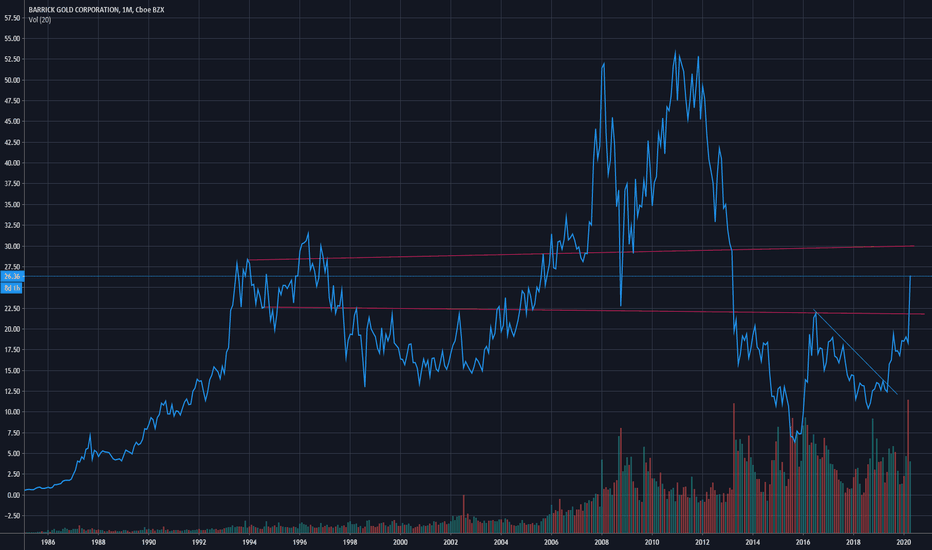

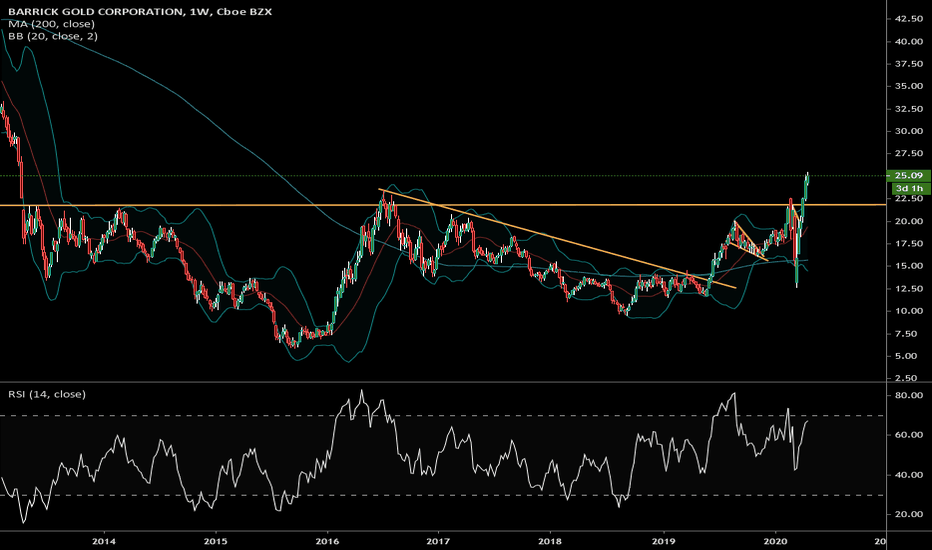

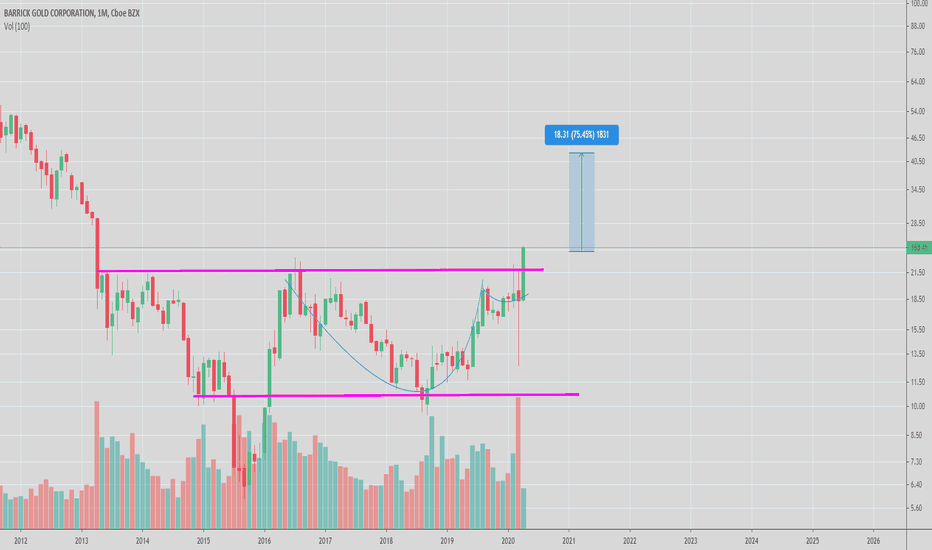

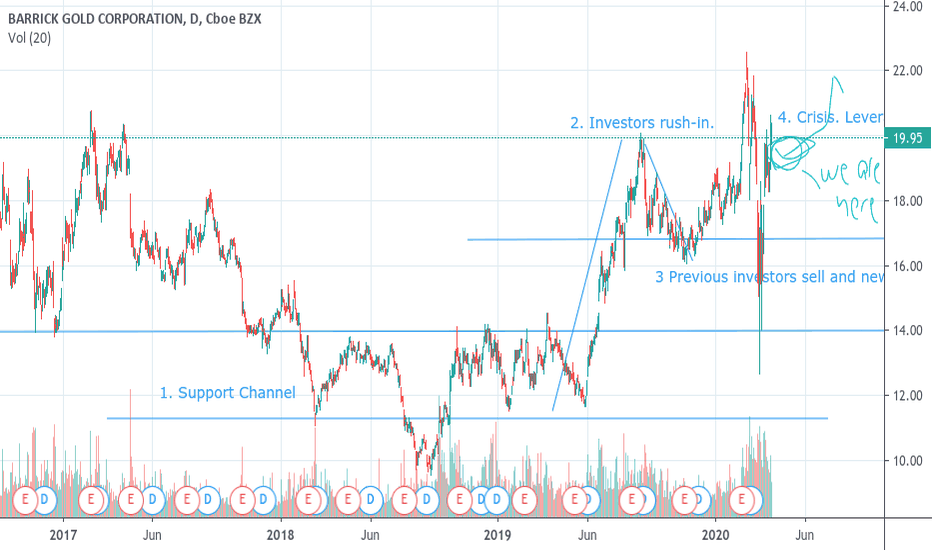

Barrick Gold reaching resistance.Barrick Gold bounced almost perfectly off of the rising support line of the monthly ascending triangle. Price is approaching the horizontal resistance, and a pull back to support is likely here. A close with breakout on volume above the resistance line would be an extremely bullish signal.