BBY trade ideas

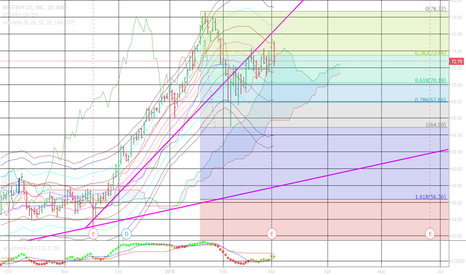

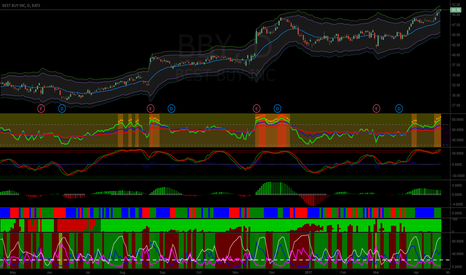

TRADE IDEA OF THE WEEK IN BEST BUY (BBY)Our trade Idea of the week is in Best Buy! It has some nice consolidation and is beginning to fire out of a daily squeeze. We believe that there is a good chance for the price to move to new highs!

We will have a smaller position just to take into account the recent volatility so that we do not get stopped out of a winning trade if we can control it!

Best of luck!

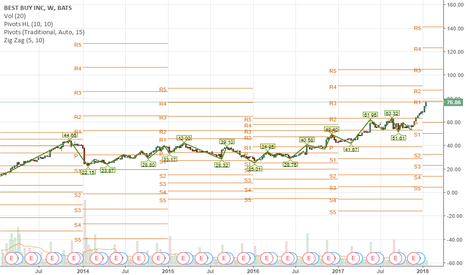

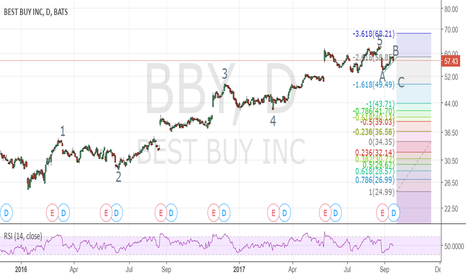

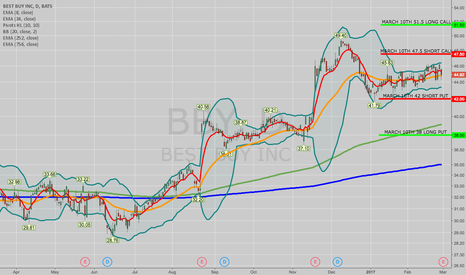

BBY Breakout?BBY does not seem to want to break over that 60 mark. Indicators plus technical analysis showing a short might be appropriate for the long term if the price bounces back from this resistance point or a long if it decides to break over that 60 mark also the bull flag formed starting May might be a good indicator that this thing is ready to break out

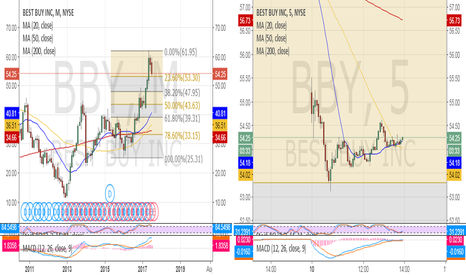

OPENING: BBY MARCH 10TH 38/42/47.5/51.5 IRON CONDORBBY announces earnings tomorrow before market open, so look to put on something today before market close to take advantage of the ensuing volatility contraction. Implied volatility rank is currently at 92 over the preceding six months, with implied volatility just shy of the 50% mark.

I compared and contrasted going with my standard 20-delta iron condor, as well as a full on iron fly. Here, I'm selling the 30-delta shorts as a sort of compromise ... .

Metrics:

Probability of Profit: 57%

Max Profit: $163/contract

Max Loss/Buying Power Effect: $239/contract

Break Evens: 40.39/49.11

Delta: -2.39

Theta: 9.03