Key facts today

BP (BP.) led the FTSE 100, rising 3.21% after announcing plans to reopen its Tripoli office and signing an agreement with Libya's National Oil Corp for hydrocarbon exploration.

BP will keep its crude-processing unit at the Gelsenkirchen refinery in Germany open for now, influenced by market demand, while still planning to sell the refinery and related assets.

BP's stock increased by 2.6% in recent trading, contributing to the overall positive performance of oil and gas companies in the UK and Ireland.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−9.21 MXN

8.15 B MXN

3.94 T MXN

2.60 B

About BP ORD USD0.25

Sector

Industry

CEO

Murray Auchincloss

Website

Headquarters

London

Founded

1908

FIGI

BBG000HJ8796

BP Plc operates as an integrated oil and gas company providing carbon products and services. It operates through the following segments: Gas and Low Carbon Energy, Oil Production and Operations, and Customers and Products. The Gas and Low Carbon Energy segment includes upstream businesses focused on natural gas production, gas marketing and trading activities, as well as solar, wind, and hydrogen ventures. The Oil Production and Operations segment comprises regions with upstream activities that predominantly produce crude oil. The Customers and Products segment includes customer-focused businesses, including convenience and retail fuels, EV charging, Castrol, aviation, B2B, and midstream, along with refining, oil trading, and bioenergy businesses. The company was founded by William Knox D'Arcy in 1908 and is headquartered in London, the United Kingdom.

Related stocks

$BP’S COMEBACK? ELLIOTT’S STAKE & UNDERVALUATION BUZZBP’S COMEBACK? ELLIOTT’S STAKE & UNDERVALUATION BUZZ

1/7

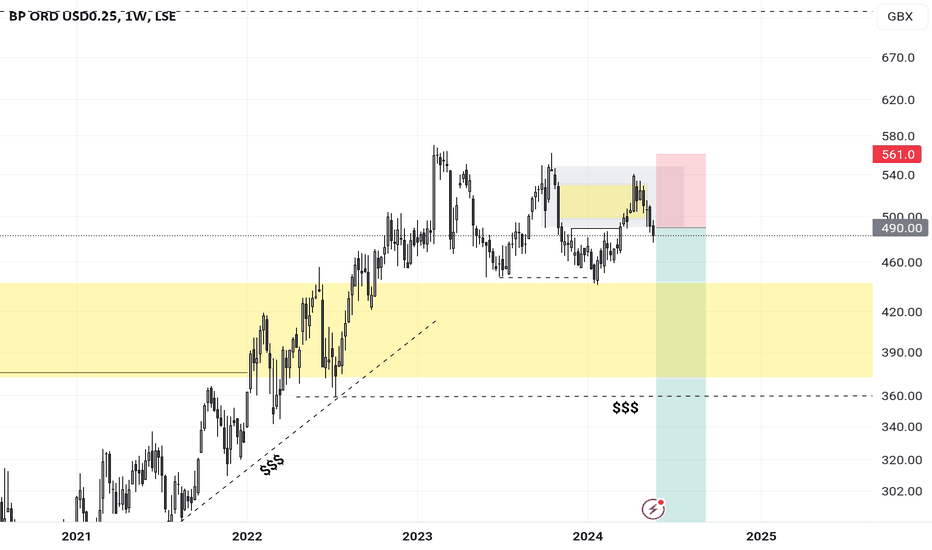

BP ( NYSE:BP ) just got a jolt of activist energy ⚡️ as Elliott Management took a significant stake. Shares surged 7% to 464.75 pence—the highest since August. Are we witnessing the start of a big turnaround? Let’s break down the numbers.

BP: Positioned for a Strong 2025**BP: Positioned for a Strong 2025** ⛽📈

With the energy sector set to benefit from a pro-oil environment, BP stands as a solid opportunity for 2025. A potential rise in commodity prices, driven by favorable policies, could support higher margins and shareholder returns. While tariffs remain a ris

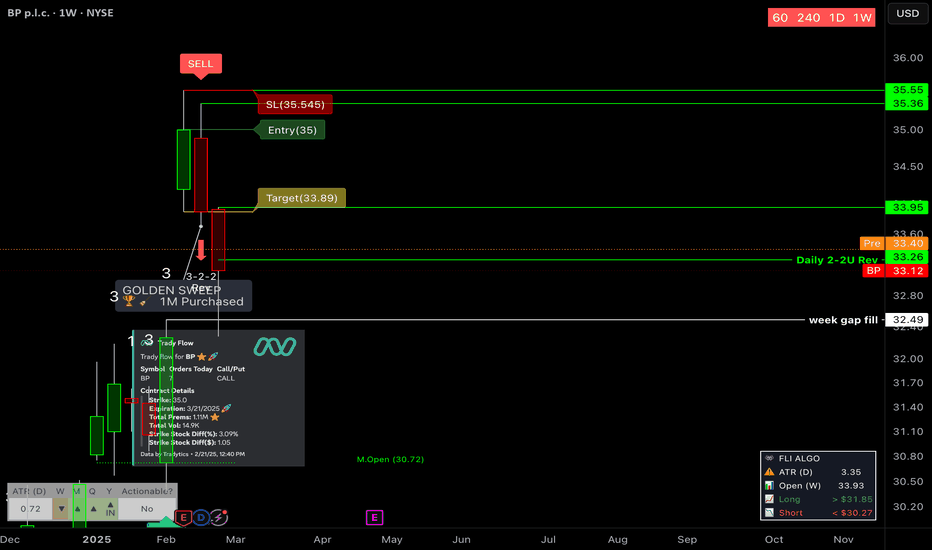

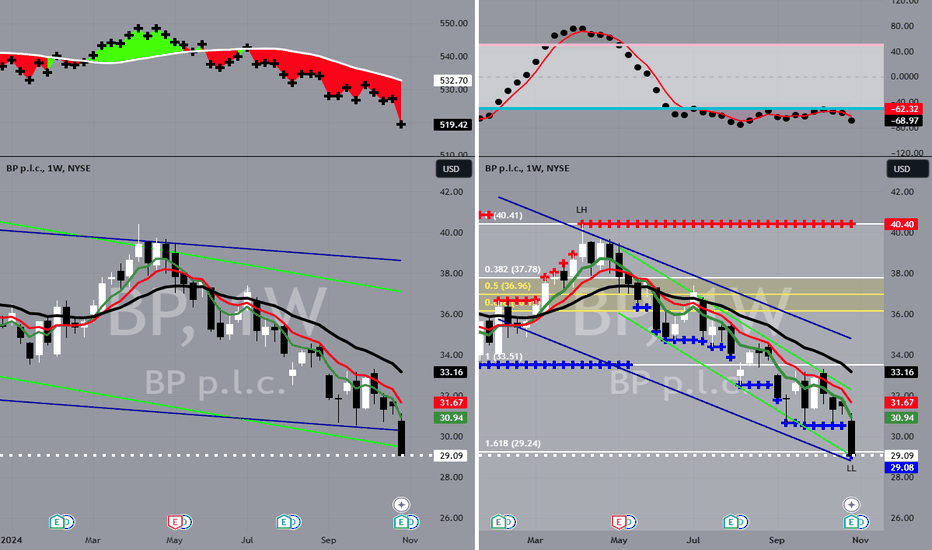

BP to $33.50MODs have suggested that I provide more detail about the picks I make.

Sorry. I'm not as verbose as y'all, and I don't like things to be complicated.

My trading plan is very simple.

I buy or sell at top & bottom of parallel channels.

I confirm when price hits Fibonacci levels.

Bonus if a TTM Sq

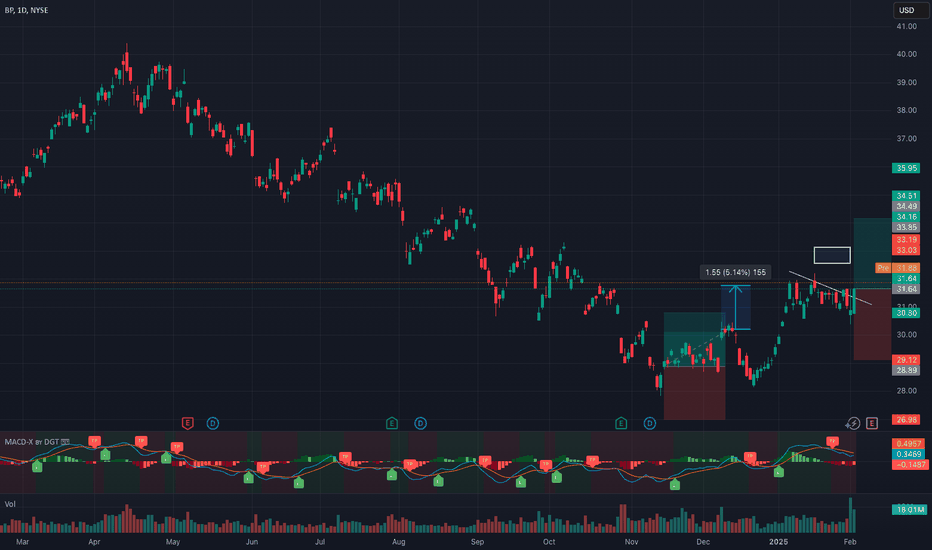

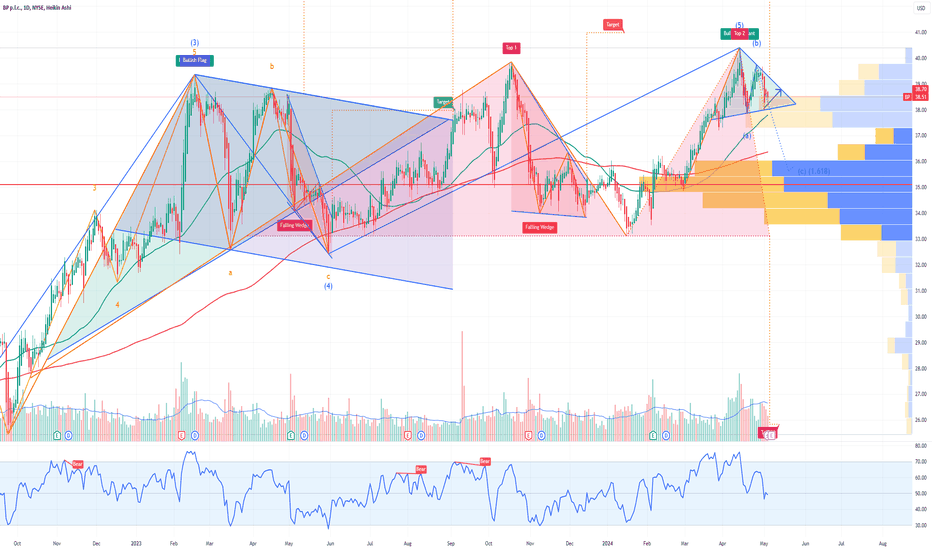

BP Slides on Profit Warning due to Impairments & Refinin IssuesBP plc (BP) investors are jittery after the company's stock price dropped 3% on news of potential asset impairments and weaker-than-expected refining margins. This announcement follows similar cautions from Exxon Mobil, pointing to industry-wide issues within the energy sector.

BP expects to incur

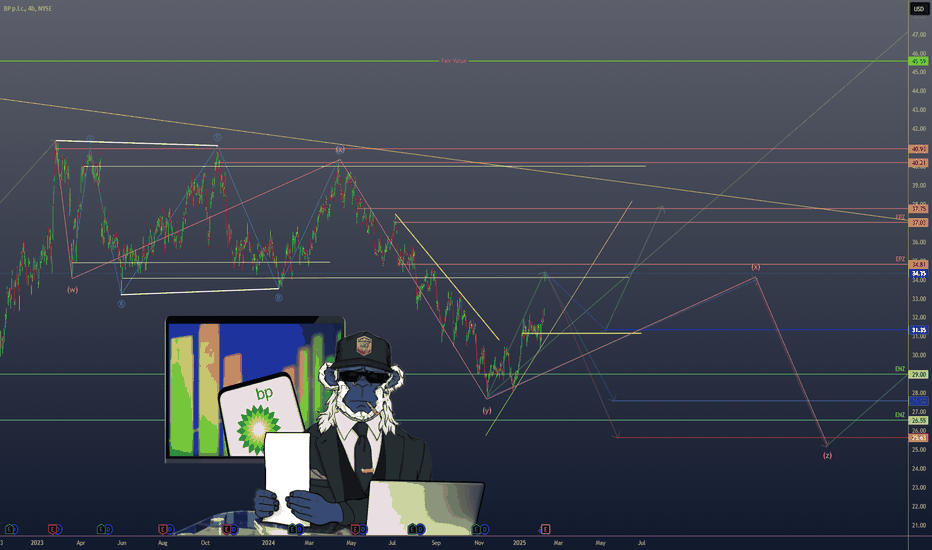

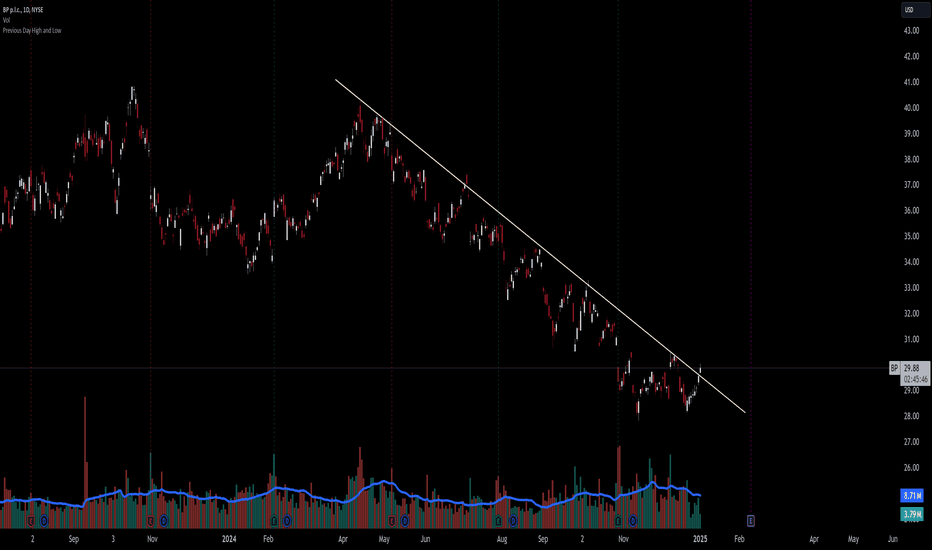

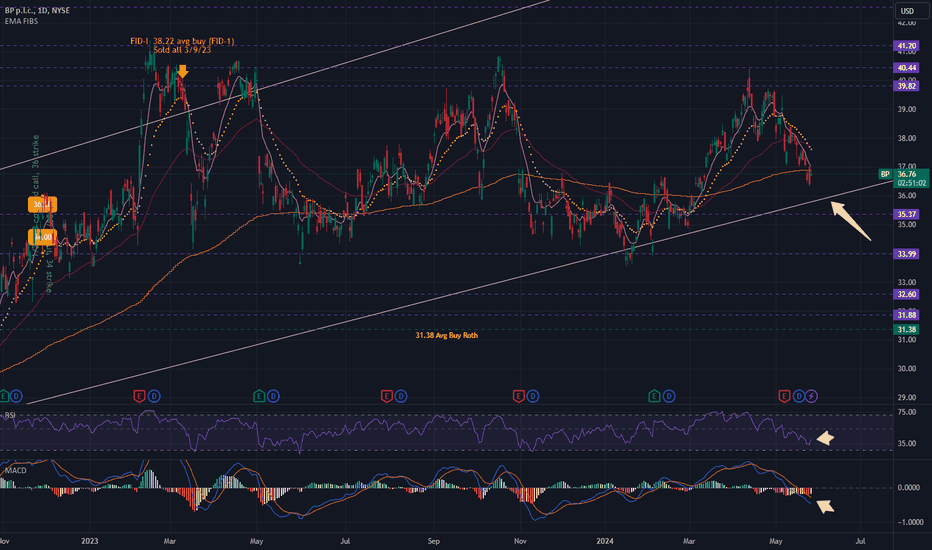

BP about to Bounce?BP is coming close to a long term trend line. If it touches this line the probability of it bouncing upwards shortly after touching or crossing is good based on historical interactions. Also, the RSI and MACD appear to be in the first stages of reversing direction. Probabilities would be higher o

BP Options Ahead of EarningsAnalyzing the options chain and the chart patterns of BP p.l.c. prior to the earnings report this week,

I would consider purchasing the 38.50usd strike price Calls with

an expiration date of 2024-5-17,

for a premium of approximately $1.05.

If these options prove to be profitable prior to the earning

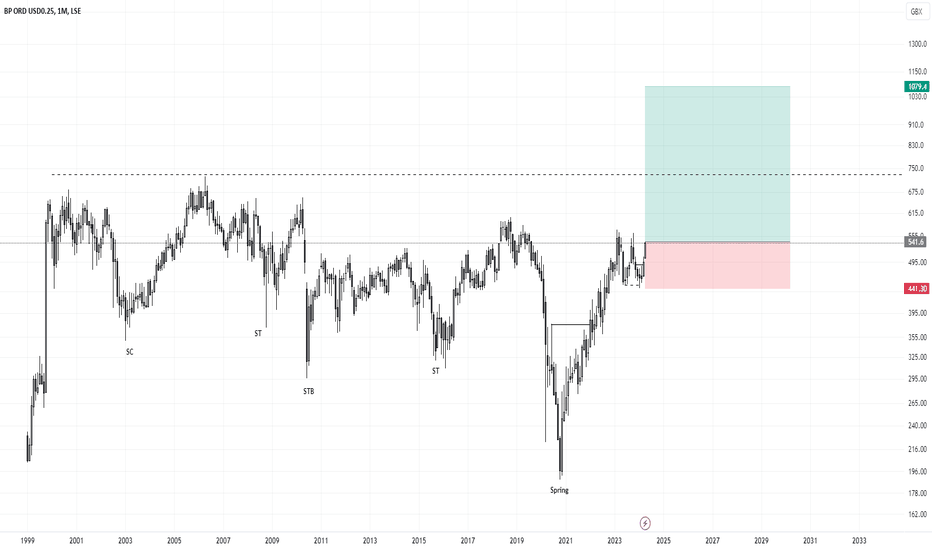

Investment Opportunity BPI share this analysis because it's really interesting how the price moved.

We can see a Vertical Accumulation of orders.:

SC

ST

STB

ST

SPRING

in a long periode, due to this, we can really expect the price to have a bullish move upside, potentially not now but for me it's worth taking a trade even

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

B

BP4923682

BP Capital Markets America, Inc. 3.067% 30-MAR-2050Yield to maturity

8.61%

Maturity date

Mar 30, 2050

B

BP5026513

BP Capital Markets America, Inc. 2.772% 10-NOV-2050Yield to maturity

7.32%

Maturity date

Nov 10, 2050

B

BP5089834

BP Capital Markets America, Inc. 2.939% 04-JUN-2051Yield to maturity

7.21%

Maturity date

Jun 4, 2051

BP4954257

BP Capital Markets America, Inc. 3.0% 24-FEB-2050Yield to maturity

7.14%

Maturity date

Feb 24, 2050

B

BP5258951

BP Capital Markets America, Inc. 3.001% 17-MAR-2052Yield to maturity

7.12%

Maturity date

Mar 17, 2052

B

BP5125397

BP Capital Markets America, Inc. 3.379% 08-FEB-2061Yield to maturity

6.94%

Maturity date

Feb 8, 2061

B

BP5203198

BP Capital Markets America, Inc. 3.06% 17-JUN-2041Yield to maturity

6.51%

Maturity date

Jun 17, 2041

B

BP5813017

BP Capital Markets America, Inc. 5.227% 17-NOV-2034Yield to maturity

5.16%

Maturity date

Nov 17, 2034

See all BP/N bonds

Curated watchlists where BP/N is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

Oil stocks: Liquid black gold

6 No. of Symbols

Political stocks: The corridors of power

15 No. of Symbols

UK stocks: Best of British

28 No. of Symbols

See all sparks