THE WEEK AHEAD: CHWY, LULU, PVH EARNINGS; GDXJ, XOP; VIXEARNINGS:

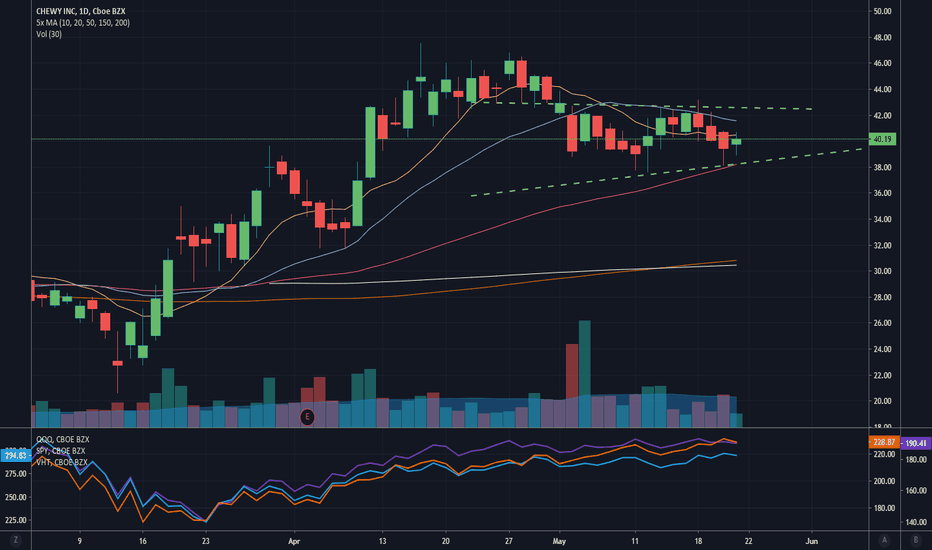

CHWY (71/85/17.34%)* announces Tuesday after the close.

The June 19th 41.5/60 17-delta short strangle pictured here pays 2.55 with break evens wide of the expected move. The similarly delta'd July 17th 39/65 gives you more room to be wrong, but doesn't pay that much more for the wait -- 2.48 at the mid.

LULU (36/57/10.01) and PVH (57/85/14.8) announce Thursday after market close, but have less than ideal volatility contraction play metrics.

SECTOR EXCHANGE-TRADED FUNDS SCREENED FOR >35% 30-DAY WITH JULY SHORT STRADDLE PRICE AS A FUNCTION OF SHARE PRICE:

EWW (37/38), <10%

GDXJ (36/53), 13.74%

GDX (33/43), 11.12%

TQQQ (30/77), 17.7%

XLE (30/39), <10%

EWZ (29/48), 11.75%

XOP (17/49), 12.4%

GDXJ looks to be the most productive from the premium selling standpoint, although we're getting on the short side of duration for July (40 days until expiration).

BROAD MARKET EXCHANGE-TRADED FUNDS WITH JULY SHORT STRADDLE PRICE AS A FUNCTION OF SHARE PRICE:

IWM (39/35), 8.66%

EFA (28/25), 5.50%

QQQ (22/25), 5.93%

SPY (21/24), 5.43%

IRA DIVIDEND EARNING EXCHANGE-TRADED FUNDS SCREENED FOR 30-DAY >35%:

EWZ (29/48)

VIX/VIX DERIVATIVES:

The /VX July contract finished the week at 27.21, with the VIX July 22nd 27/29 short call vertical paying .75 at the mid and the 27/30, nearly a buck at .95. Going out farther in time to take advantage of contangoized term structure here doesn't net you much additional juice, unfortunately. /VX August finished the week at 27.25 -- only .04 above August. September traded at 27.70, but the 27/29 pays only .65, probably due to the fact that the VIX of the VIX (i.e., VIX implied), slopes away, with nearer term implied being higher than those of longer duration.

In "derivative land," the VXX July 29/30 is paying .38, the 29/31, .71, and the 29/32, .99. UVXY is probably also paying 1/3rd the width for similar setups, although options pricing is showing wide in the off hours ... .

* -- The first metric is implied rank; the second, 30-day implied, and the third, the percentage of share price that the nearest monthly at-the-money short straddle is paying (i.e., the LULU June short straddle is paying 10.01% of share price, the PVH June short straddle, 14.8%).

CHWY trade ideas

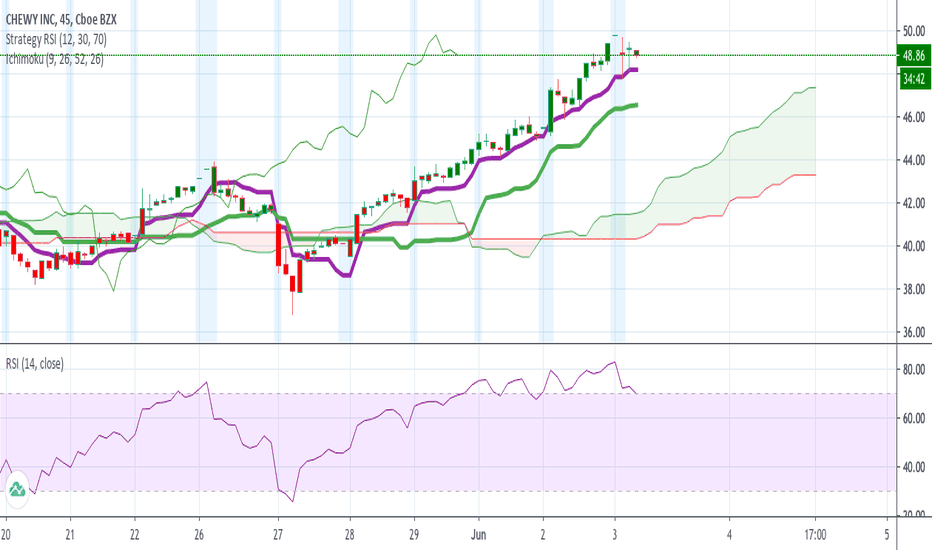

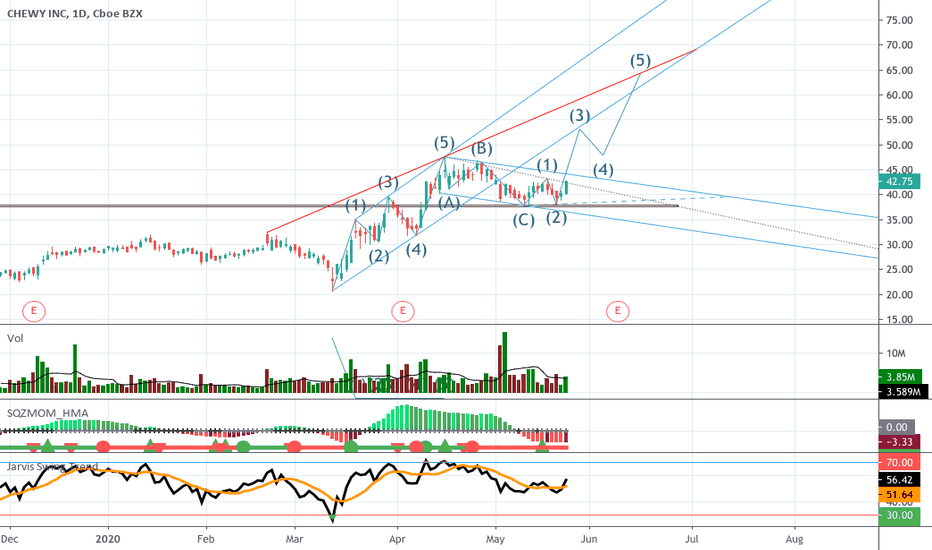

CHWY - 6/3/2020CHWY - Latest ichimoku chart shows a strong momentum, not only both tenkan sen and kijun sen are above cloud, but the thick green cloud ahead interprets more buyers ahead than sellers. RSI shows overbought apparently so this upside could be a s/t move that corresponding with the 6/9 earning release, as well as the sharp increase buying on 6000+ contracts of 7/17 $70 call options this morning.

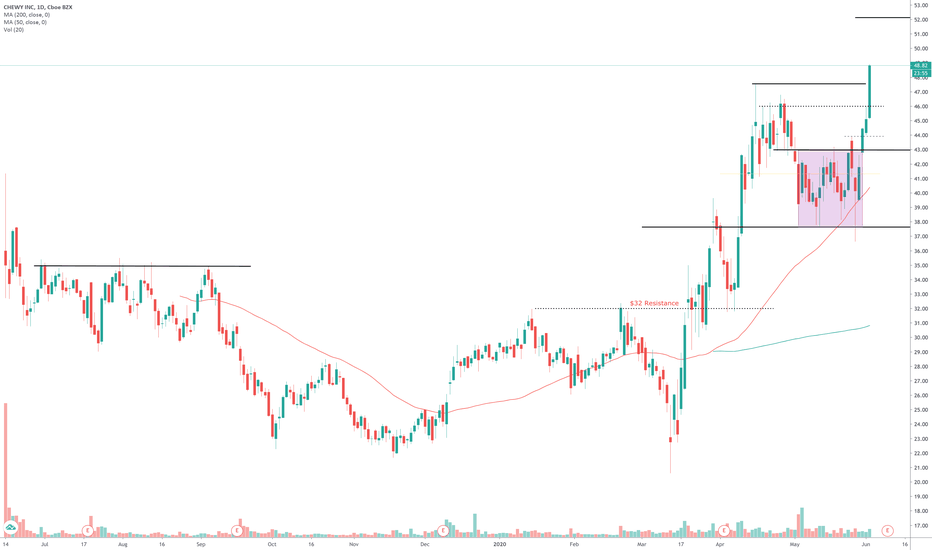

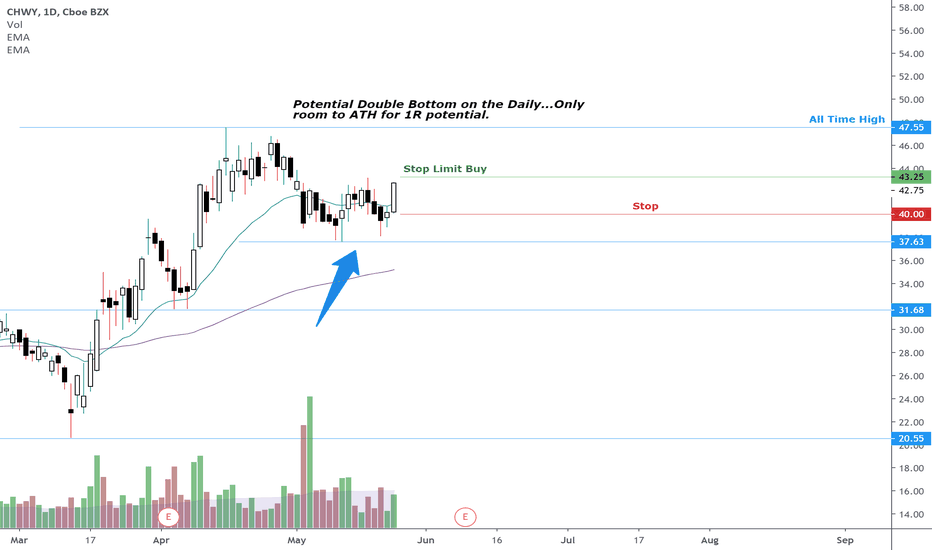

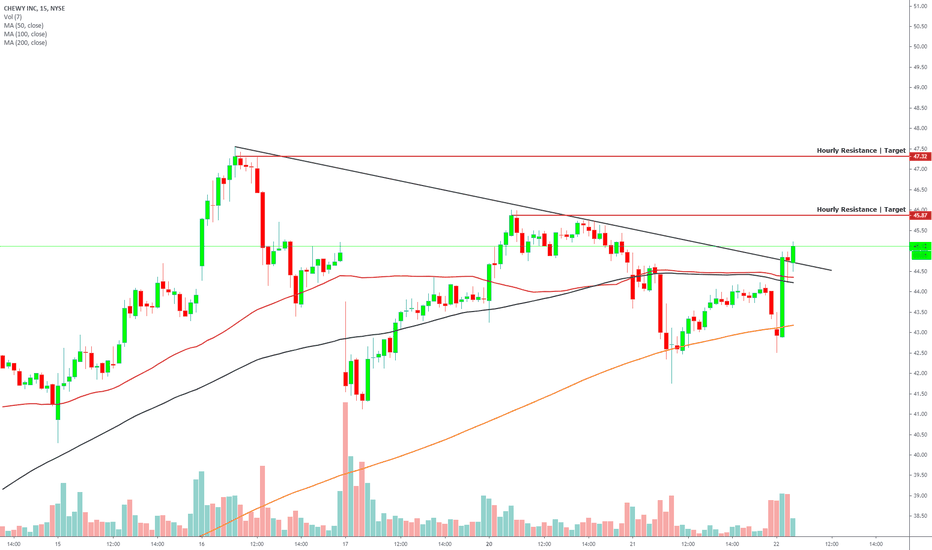

$CHWY - New dogs can learn new tricks$CHWY - Up but still in a channel. Watching for a confirmed breakout over $45 to issue a buy. Given the sentiment of the market it would not surprise me to see this drop back into the $40s as the market ebbs and flows.

This will 100% go higher, but i believe we will see another chance to get a better buy in price.

Reasons I like $CHEWY outside of chart:

1. I should've put down a ton of money on this after the 3rd chewy box came in.

2. They deliver dog food to your door and allow for auto reorders.

3. Animal lovers know that they cannot guarantee the products they buy off amazon inst some Chinese bullshit laced with chemicals that going to kill your dog.

4. They send out birthday cards and sympathy cards for pets. (They customer retention and customer service is better than walking into a strip club with 10k in your pocket)

Chewy is the Amazon.com for Pets!** Comments and Likes are appreciated; Subscribers are pet lovers! **

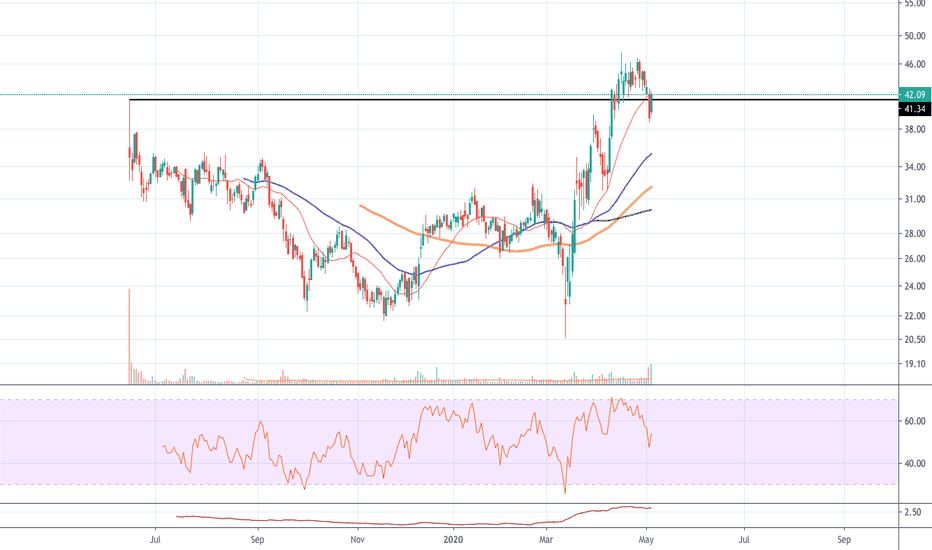

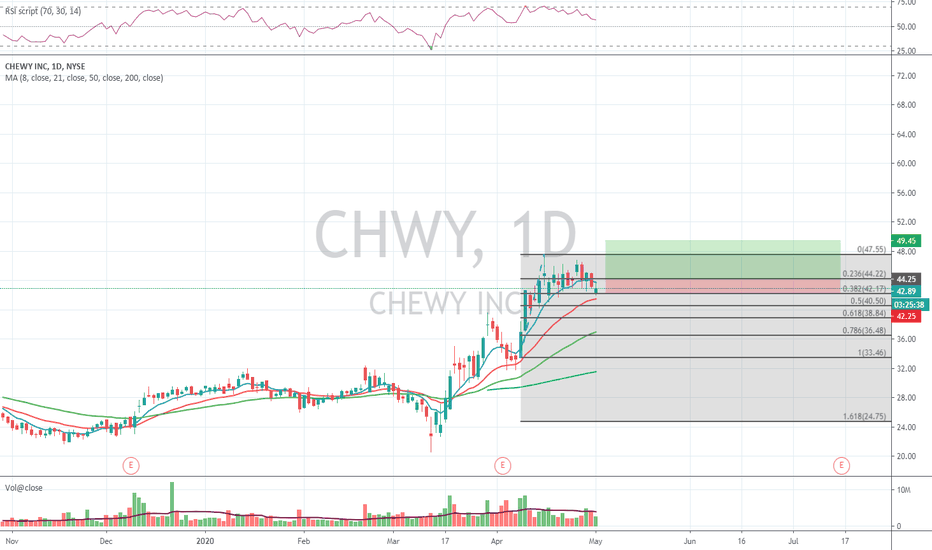

What I see...

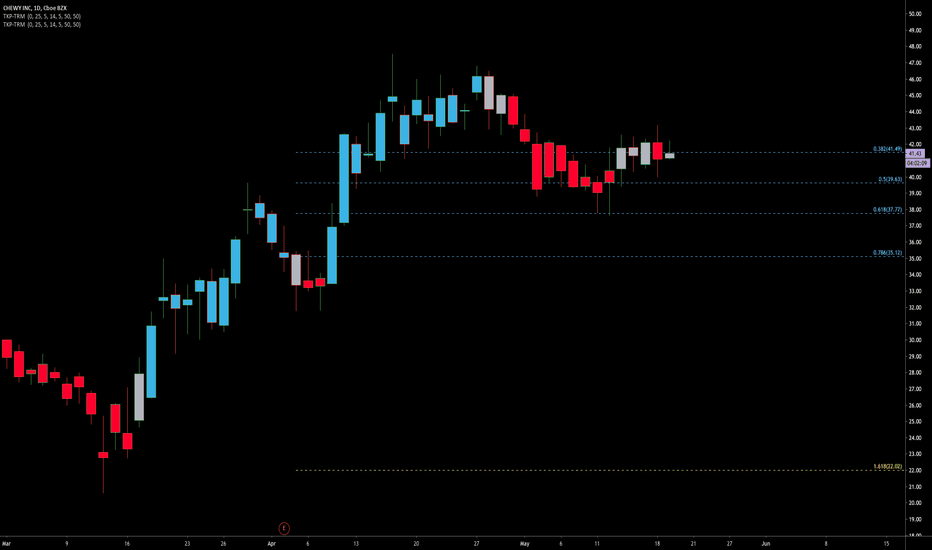

:: Stock went IPO 1 year ago

:: Formed a based for a good 6 months

+ Steady rise within channel since mid-March low

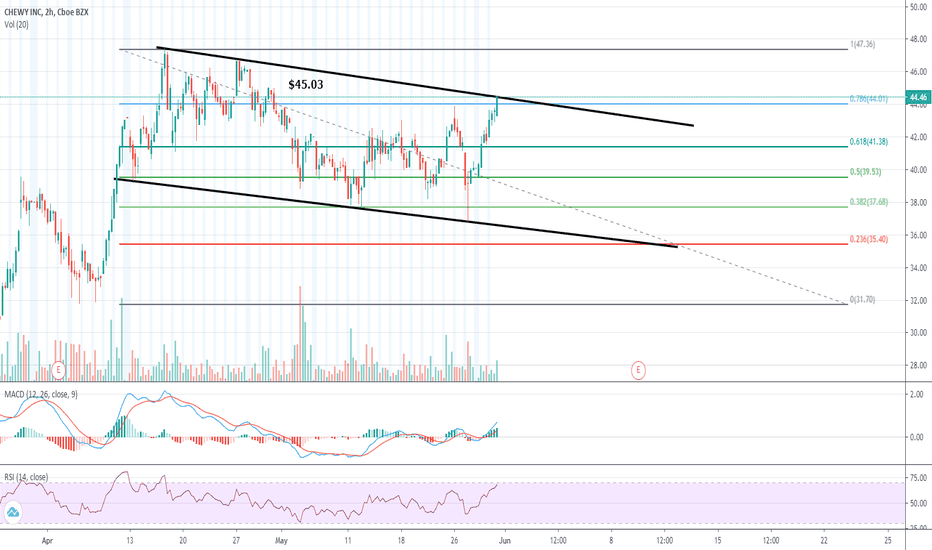

+ Peaked at $48 back in early April and pulled back to 0.618 Fib and has been bouncing in between fib for a month!

+ Last week prices bounced off of 50MA

+ Friday had a strong close above 10MA

+ RSI is at 66

- Fib is below signal bar

- 1st Resistance at high 47

- Vol. is on the low side

- Bollinger is wide

What I setup...

+ Long entry above channel high

- Stop under Friday's low

+ Target at 1.618 Fib

:: Duration - 2 to 3 weeks

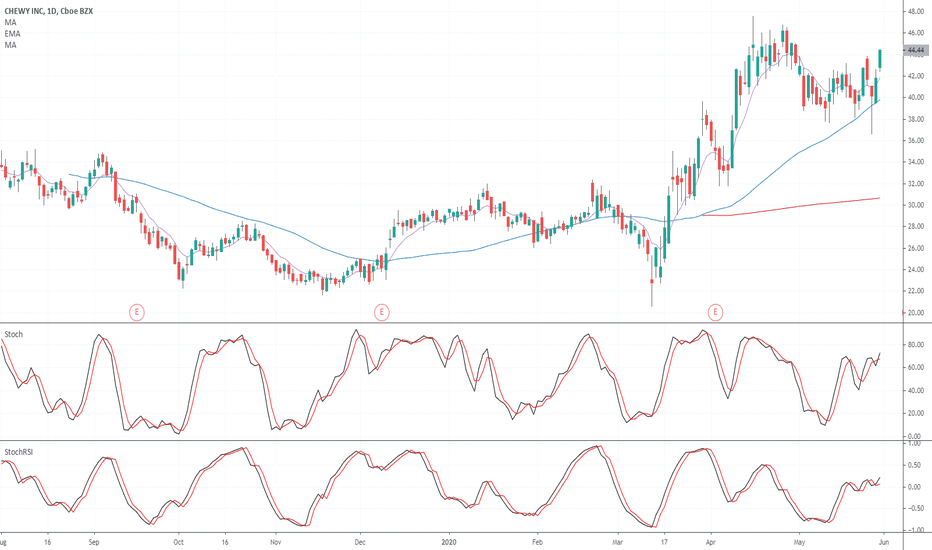

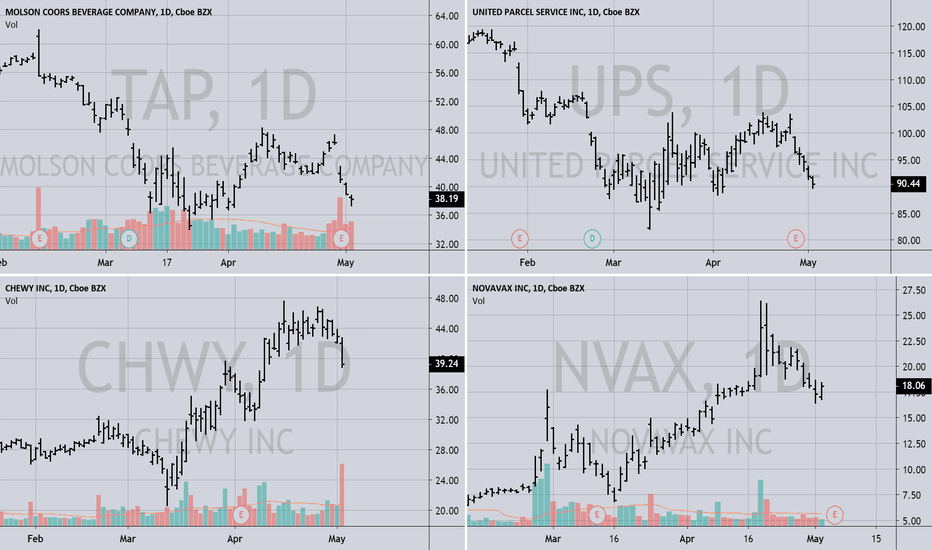

$TAP $UPS $CHWY $NVAX - 4 More Early Long SetupsThis is another set of early long setup scan results from my pullback strategies.

Remember - A good trade is - Definable, Manageable and then Profitable. So, Define your Risk, Manage your Risk and eventually you will be profitable.

Good Luck.

If trading options - The Vol Skew can be your best friend. Choice of Strike defines your Profitable Trades.

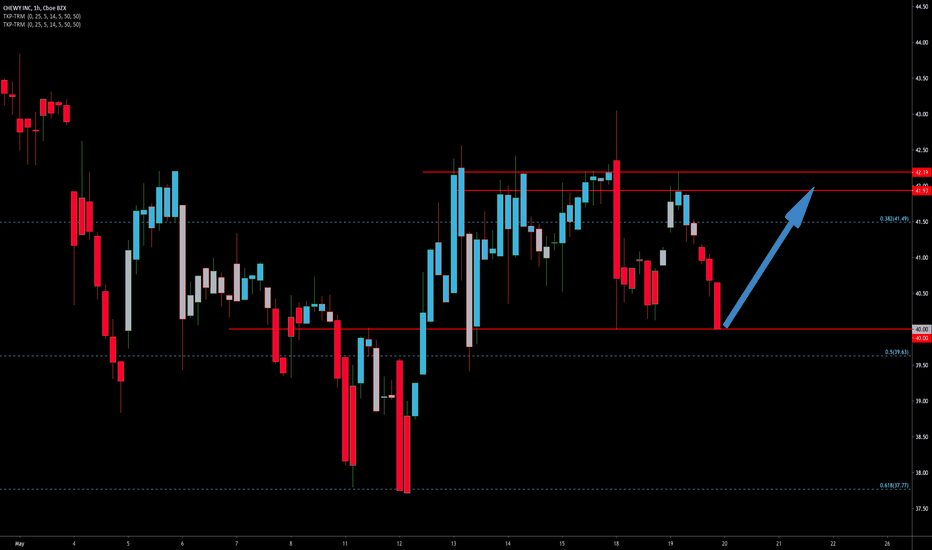

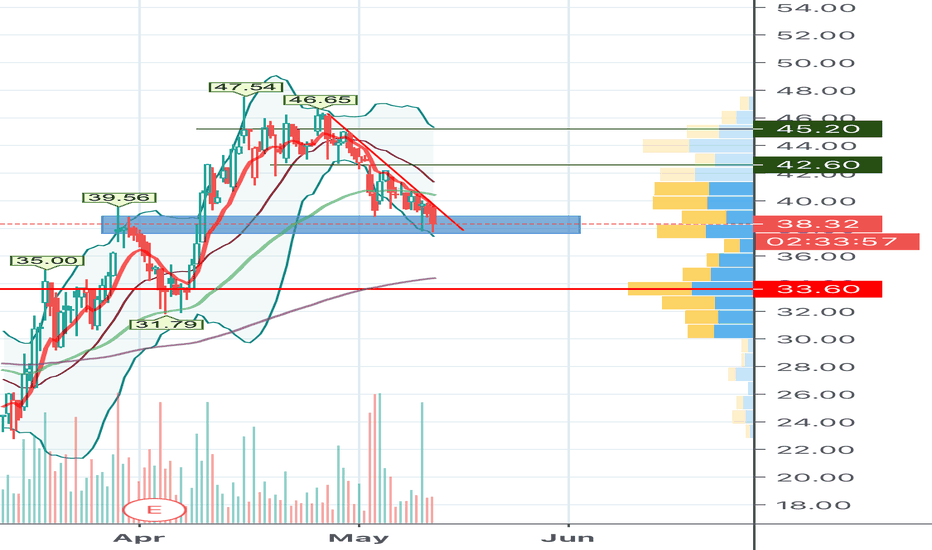

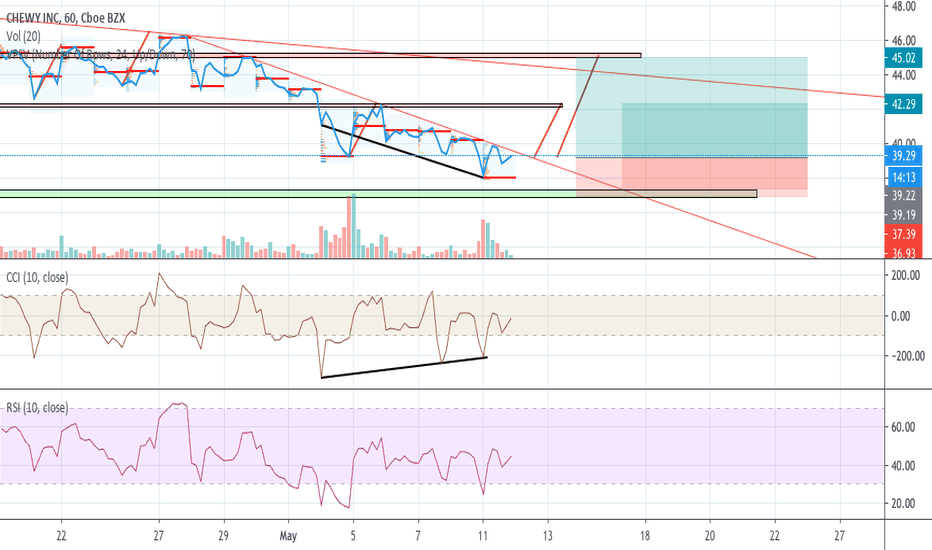

Strong Stock With Retracement, Support, and Bullish DivergenceCHWY is a strong stock at a level of horizontal support. It is breaking its counter trendline resistance. It has bullish divergence between price action and the CSI(10) oscillator on the hourly chart. I am using the next level of support as a stop loss and measured moves from my take profit, which are congruent with historical resistance price levels.

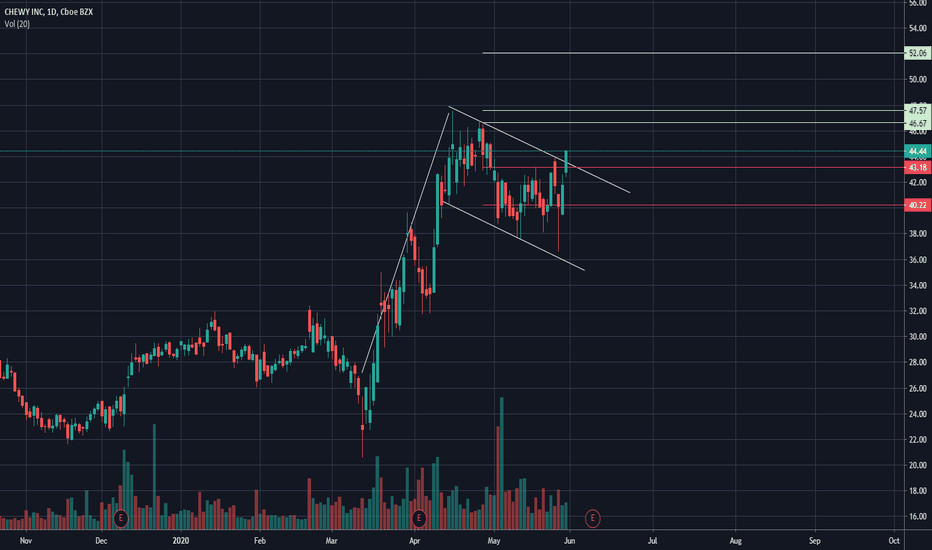

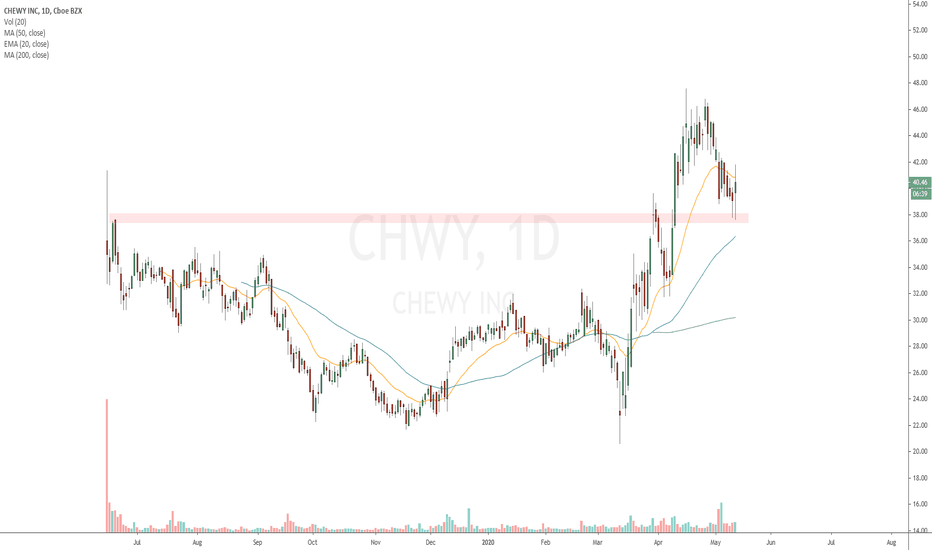

$CHWY can fall in the next daysContextual immersion trading strategy idea.

Chewy, Inc., together with its subsidiaries, engages in the pure-play e-commerce business in the United States.

The demand for shares of the company looks lower than the supply.

This and other conditions can cause a fall in the share price in the next days.

So I opened a short position from $39,09;

stop-loss — $42,02.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

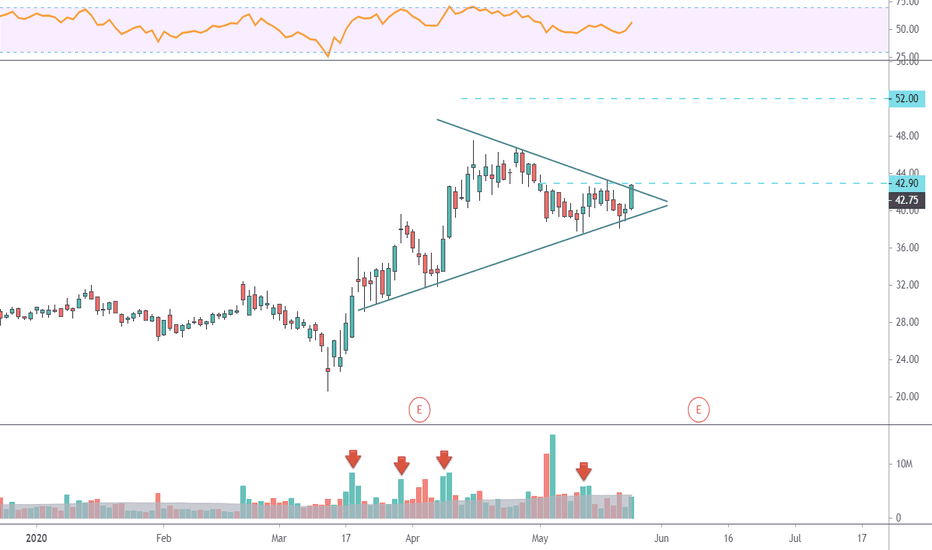

CHWY: Ready to head into next swing. Awaiting confirmation01/05. After a good swing we are now already in pullback phase testing the fib_0.382 level as support. Still awaiting confirmation by crossing ema_8d and/or oscillators (RSI bounce of 50).

Plan:

Take Profit: < $50

Entry: latest on $44.22 (fib_0.236).

Stop loss: fib_0.382