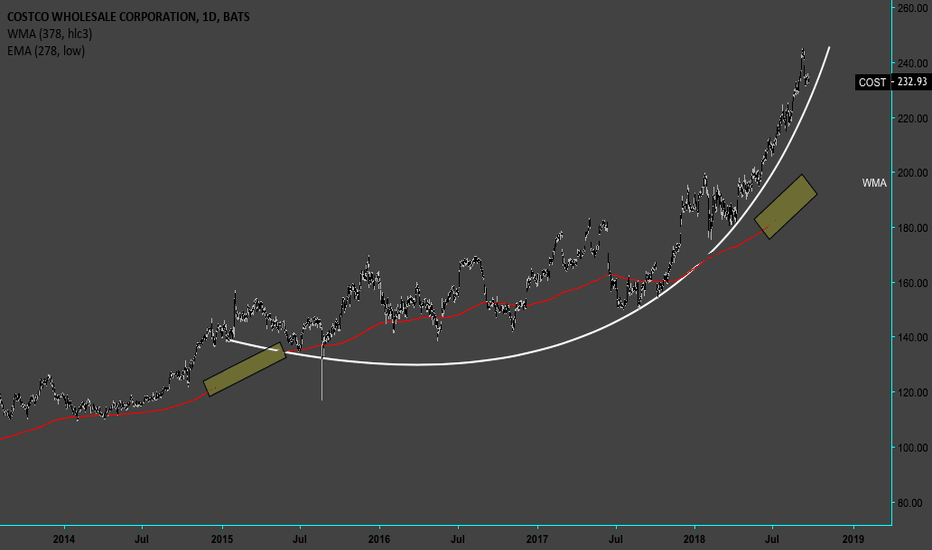

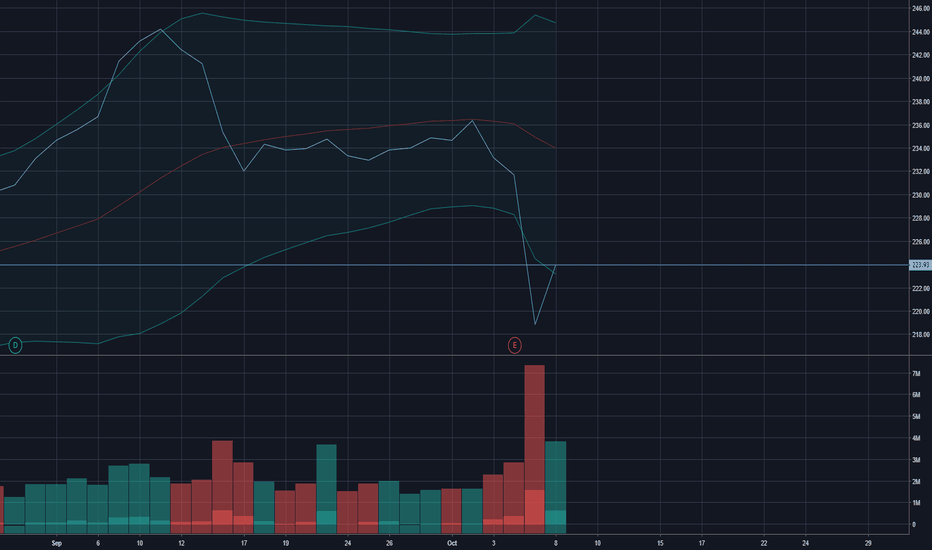

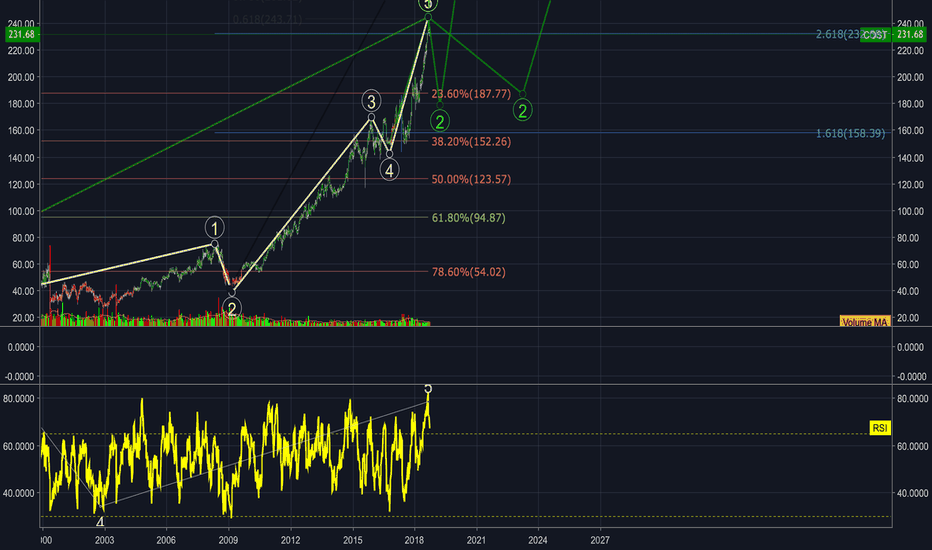

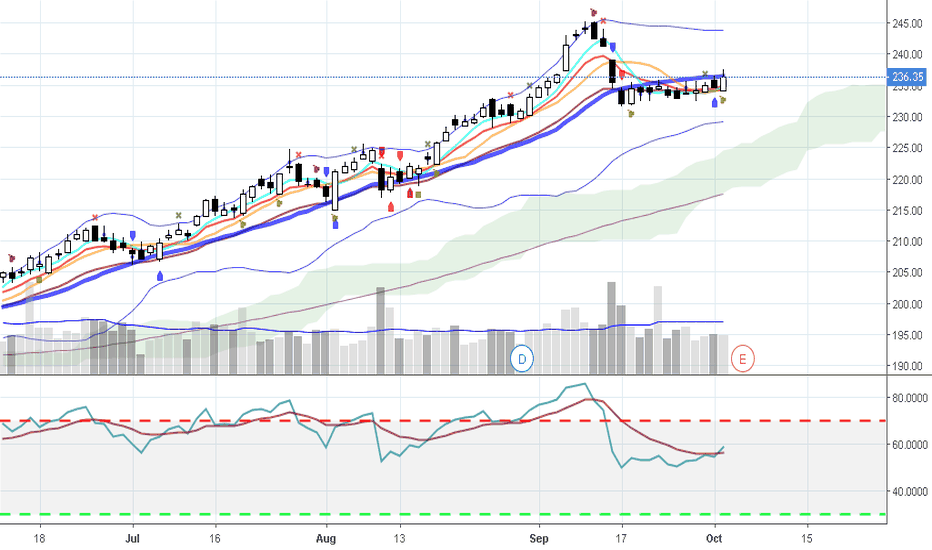

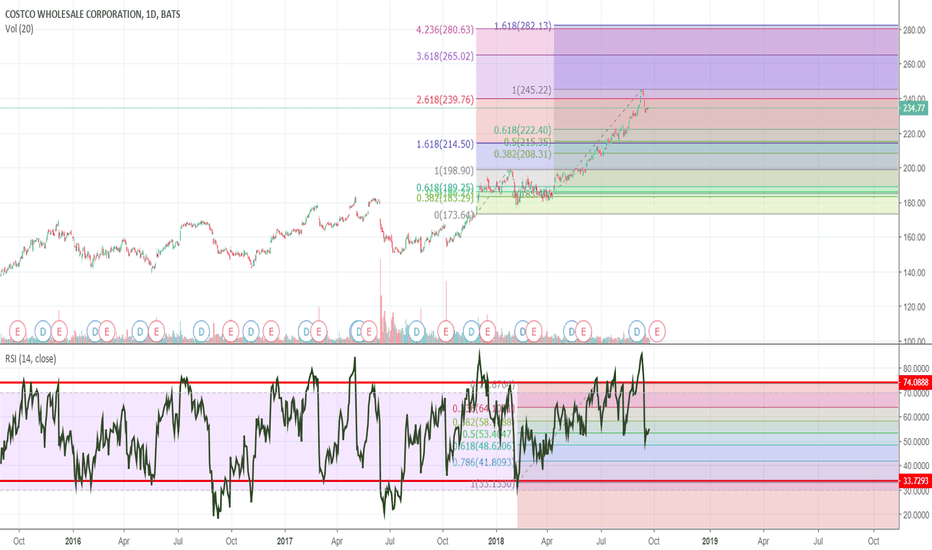

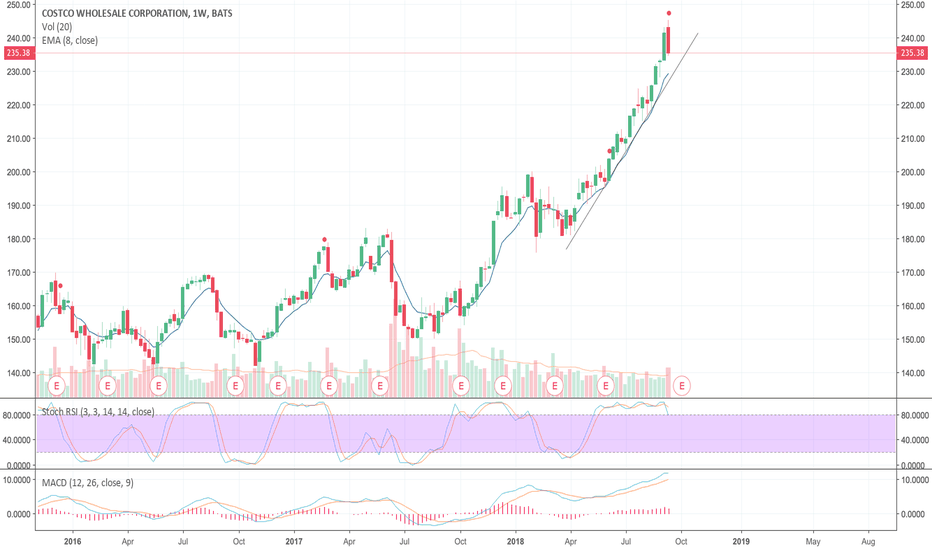

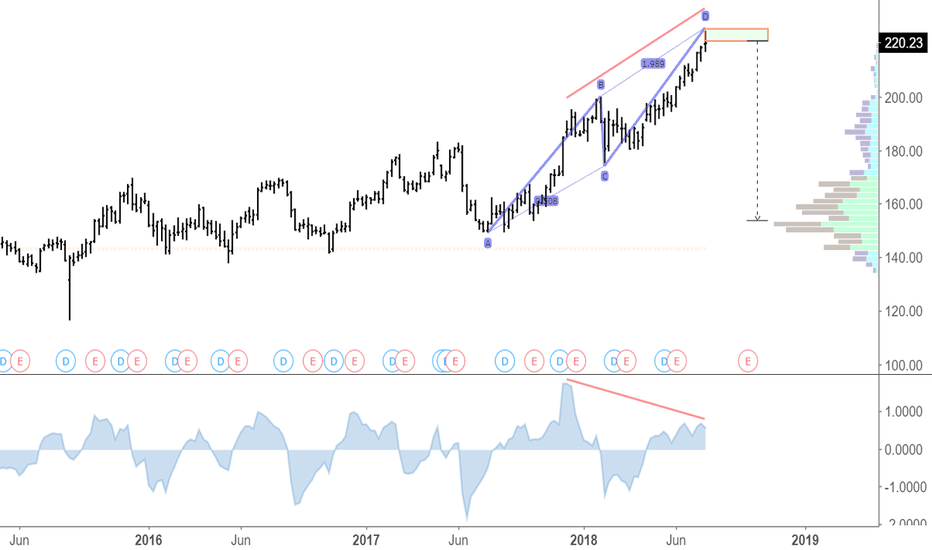

$COST - Lol. Dopest thing you'll read A while back, I remember wanting to get into algorithmic trading. I love math & all, but once one thing led to another & eventually I found myself trying to understand mechanics & quantum physics & computer learning - there was no way lmao. I tried, & it ultimately did help come up with my own strategy that I've gotten accustomed to. But since then, the most helpful & my favorite recollection of all things math & stocks is the bubble report. Chances are if you've seen bitcoin - you could tell it was a bubble, but probably didn't know when it'd pop, how long it'd take to recover (if ever), & where the top of it would be. Whether it's stocks, forex, bitcoin, commodities, etc., a bubble is a bubble. The best way (might be the only.?) to describe a 'bubble' is when exponential growth exceeds linear growth; historical growth (x) surpasses the equilibrium rate of growth (y) over time, & instead of a linear graph - you need a logarithmic graph just to make fit. A new bubble report is released each month & I remember seeing Costco on it w/ a 98% "bubble" score. Kept it on watch, but seeing as implied volatility is in it's top 25 percentile - better late than never lmao. I made this layout back during my experimenting on producing actual results to use moving averages as a "bubble" finder - bitcoin was my original start & I saved it since then. Although you can only see one (red) moving average, there's two. The 2nd is a weighted moving average for a half a year longer, while the red is a shorter, exponential moving average based off lows. I made the 2nd the same color as the background w/ thicker width that way whenever the (red) crosses over it - both moving averages disappear in an indication of faster exponential growth without an equilibrium. Although you can't see the 2nd moving average - click on any one of the yellow rectangles & you'll get an idea. I was supposed to make a comment about how this chart reminds me of Venezuela's inflation rate but, yeah. Better late than never. If you wana check out that bubble report,

Link - www.ethz.ch

COST trade ideas

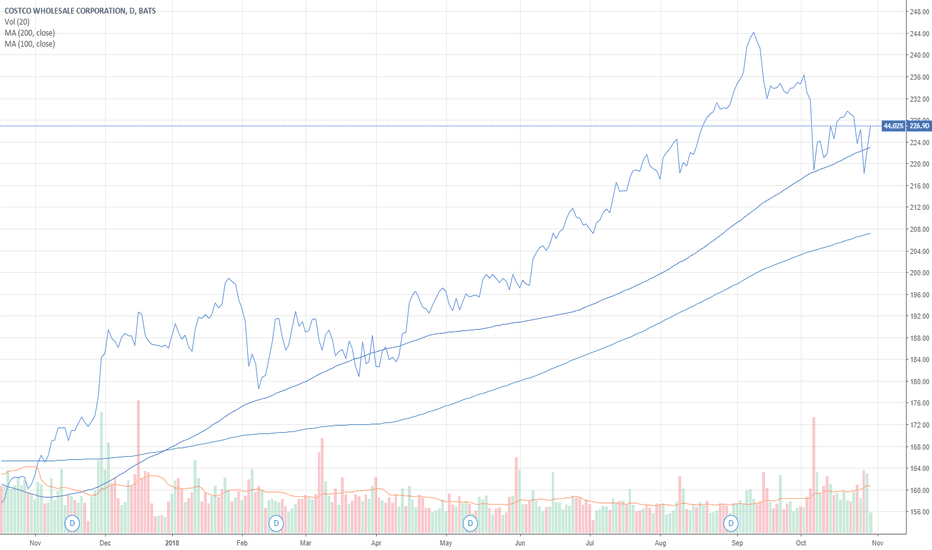

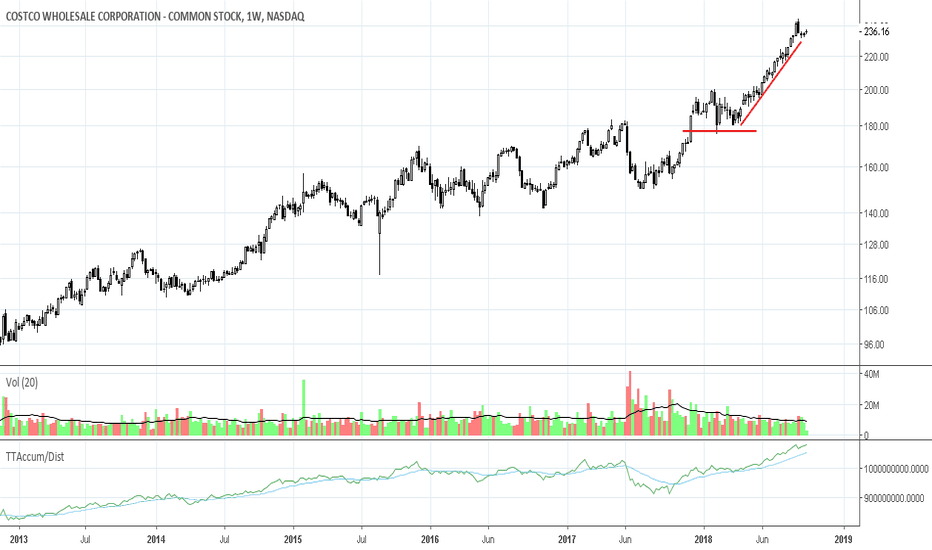

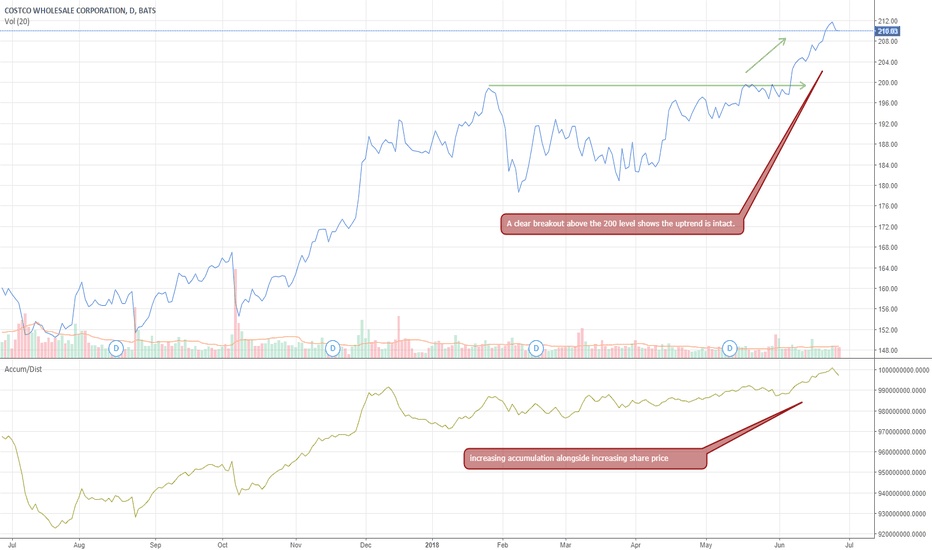

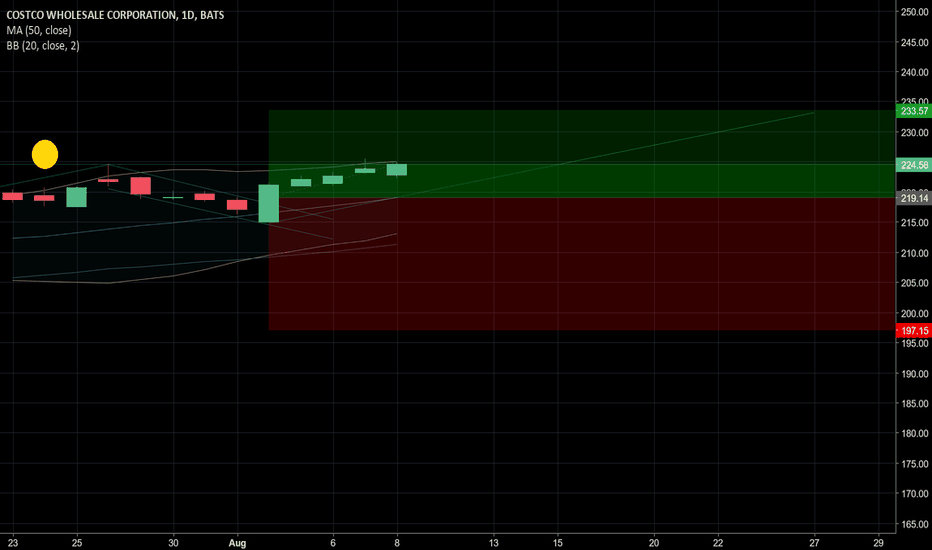

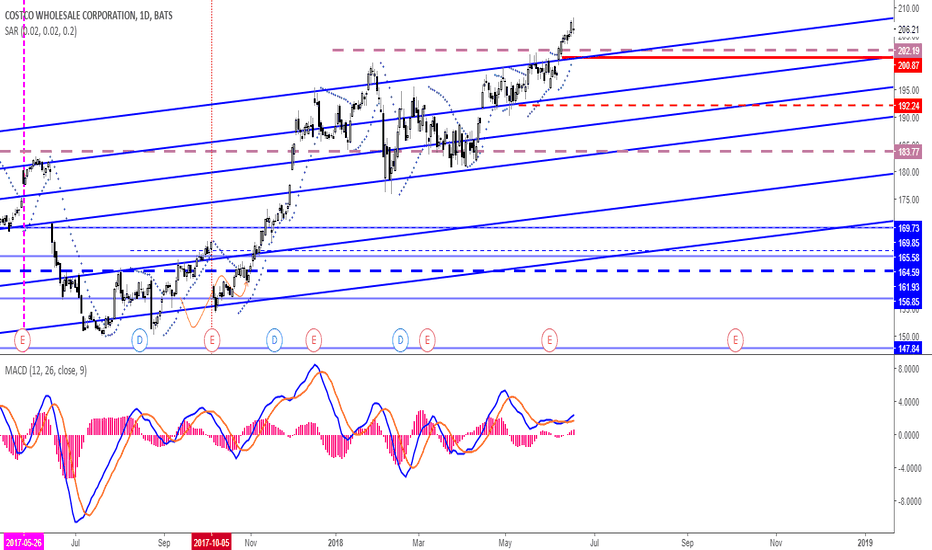

COST: High Risk for Long Term BuyConsidering your risk is something that all investors and traders should do before trading or investing in any stock. Often when a stock displays this much risk on the long- and intermediate-term time frames, it also warns of risk for short-term trading as well. The Weekly Chart provides better perspective of the risk of buying the stock at this new all-time high price. There is no support nearby. See how many points are at risk if a correction occurs?

Trade Wisely,

Martha Stokes, CMT

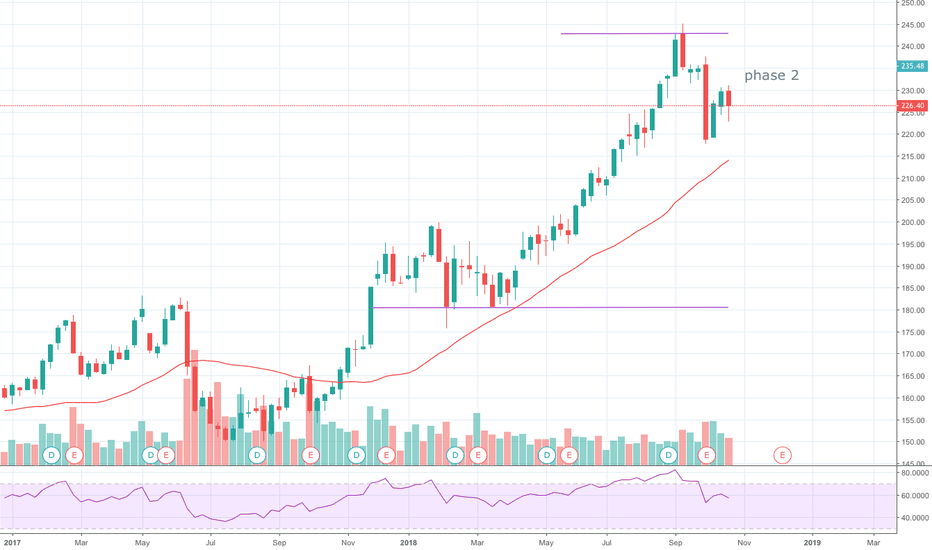

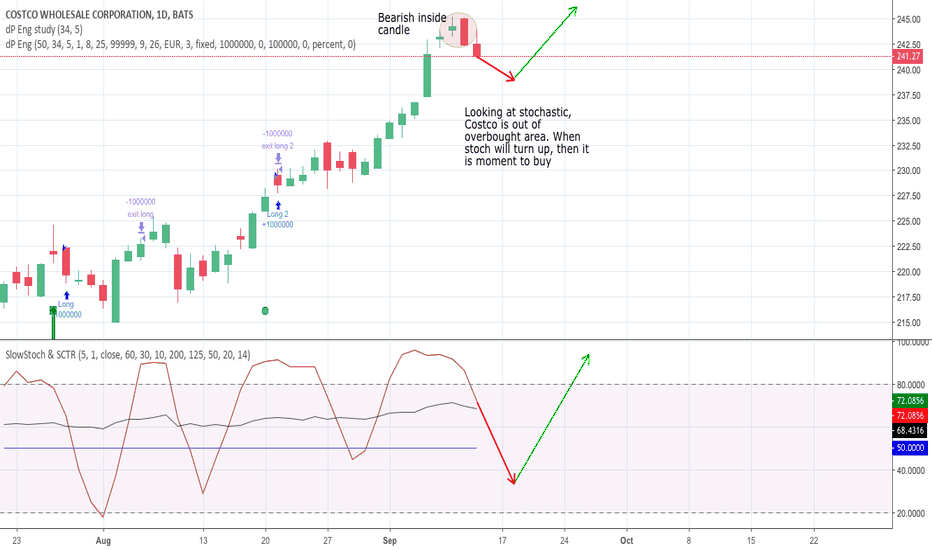

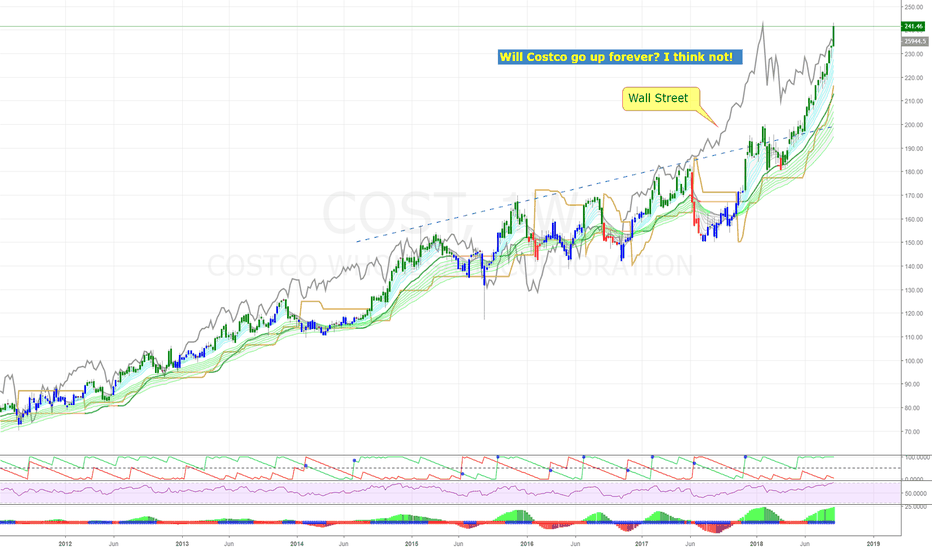

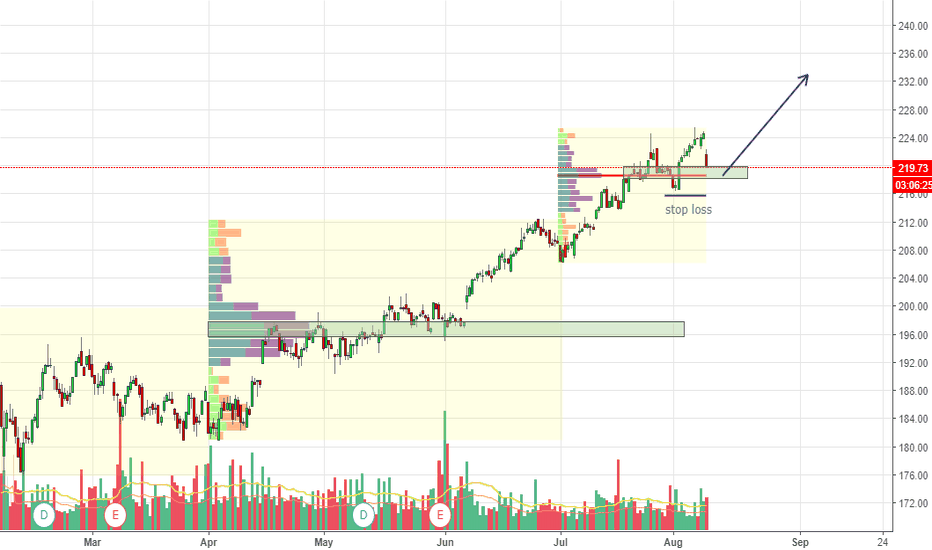

Stalking for a crash. Good traders stalk 90% of the time and trade only 10% of time. Quote me. :) :)

In this screencast I run through several superhot equities on the monthly time frame.

The higher time frames are often the cause of surprises for people' on 15min - 1H time frames.

Then the end of the screencast I look at the VIX on the 2 hour time frame for signs of nervousness.

I suspect - not predict that something big is coming.

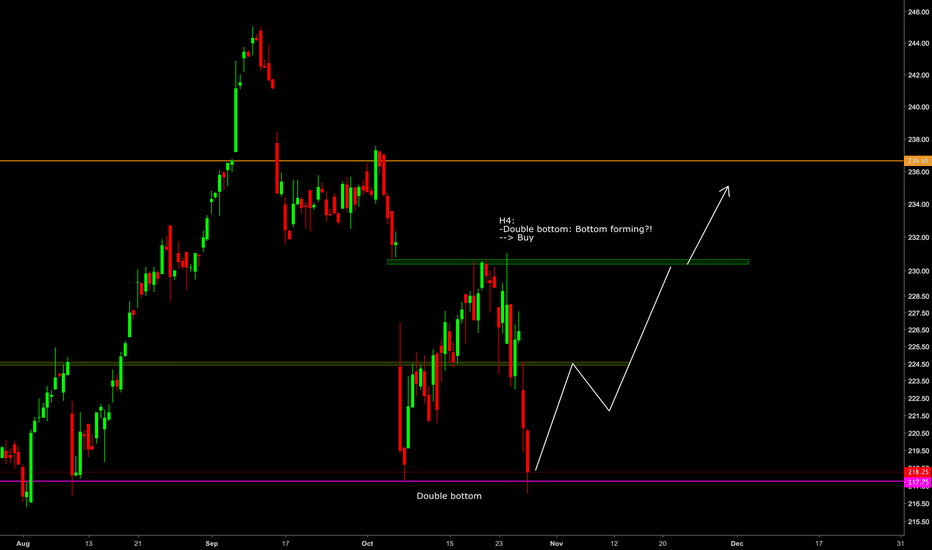

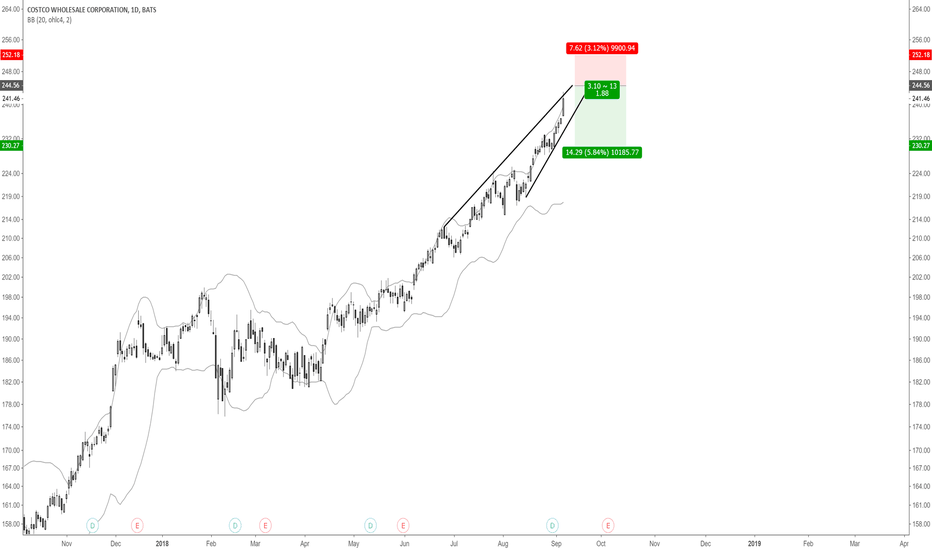

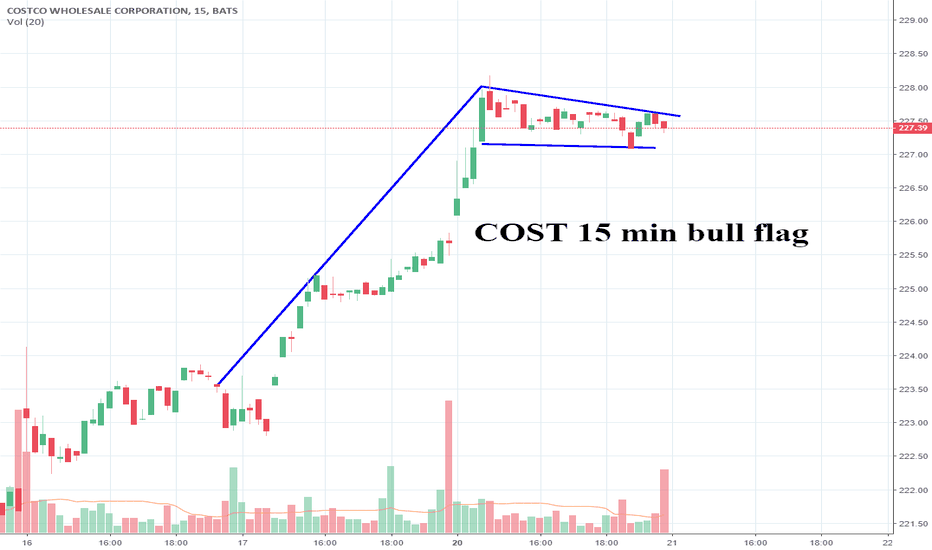

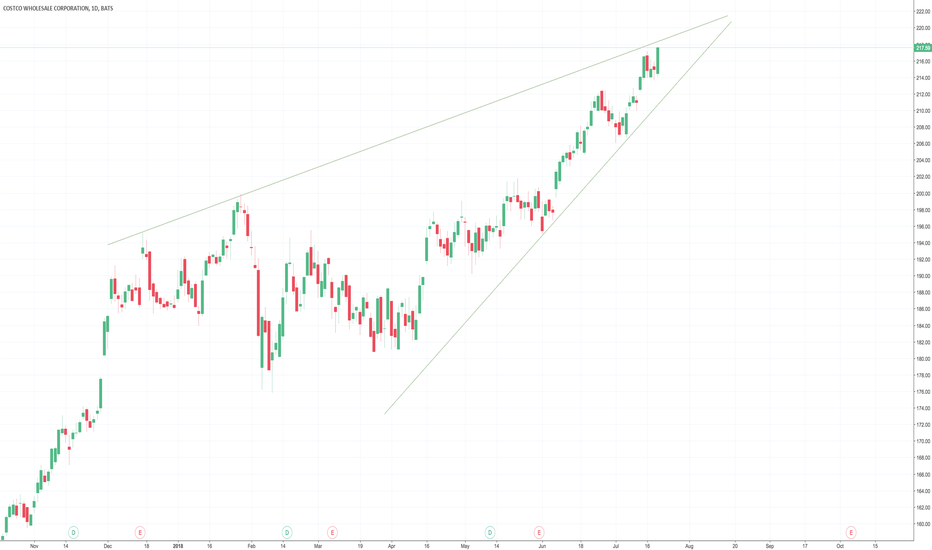

COST Bull FlagNoticed a flag appearing on COSTCO and entered position on bounce and break.

target at around 133-134 are but no current limit. Used more of an entry for long term EPS generally growing and PE is also getting higher but at a much lower pace.

Stop is low due to the nature of getting into the position. If it were to go that low from entry then I expect the market has changed for the position and sentiment would turn more bearish.

Keeping on position for time being to find any blatant exit signals.

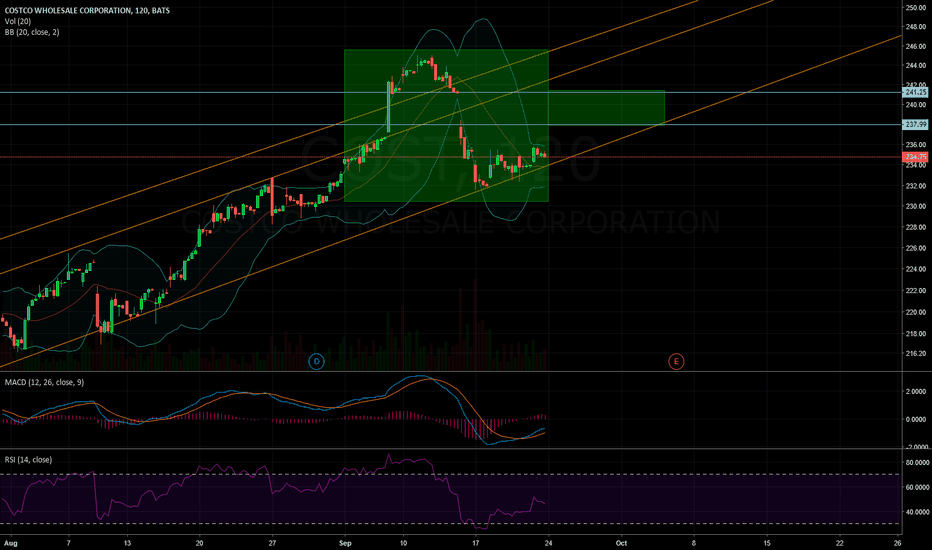

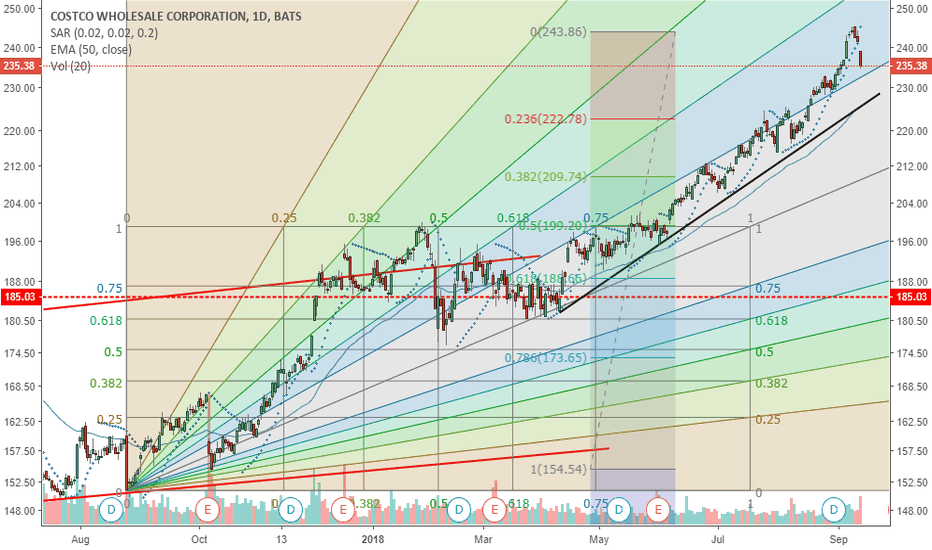

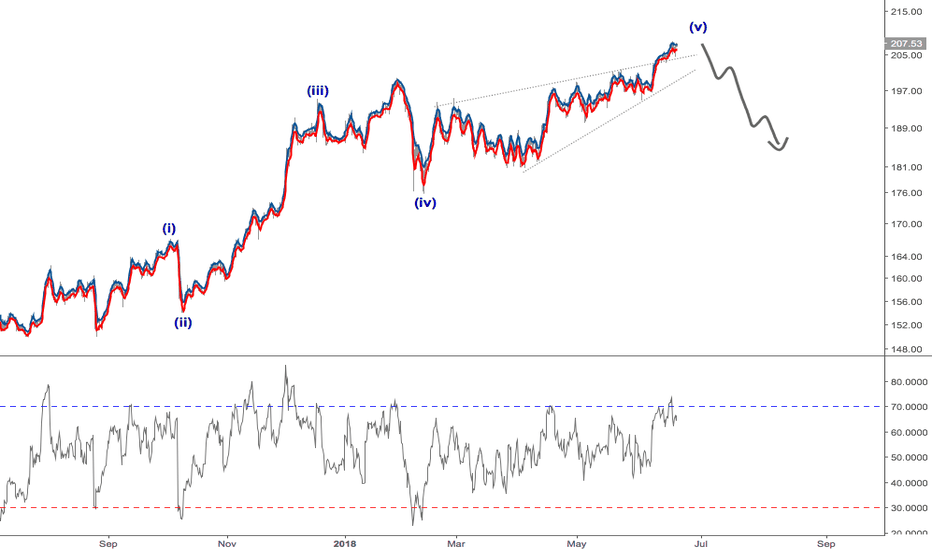

Short COST on throw-overThis 120m chart of COST shows a pattern that I trade frequently - the ending diagonal. It is a setup that, when identified correctly, can result in sharp moves lower as the stock breaks out of its impulsive sequence. I recently placed a similar trade on INTC that is working well.

As COST grinds higher in a converging wedge, it looks to have "thrown-over" trendline resistance. This is common in ending diagonals as price makes one final push before breaking lower through the bottom of the channel. Initiating a short position at 207.50 for a move back toward 180. A sustained rally through 215 will cause me to reevaluate the trade.