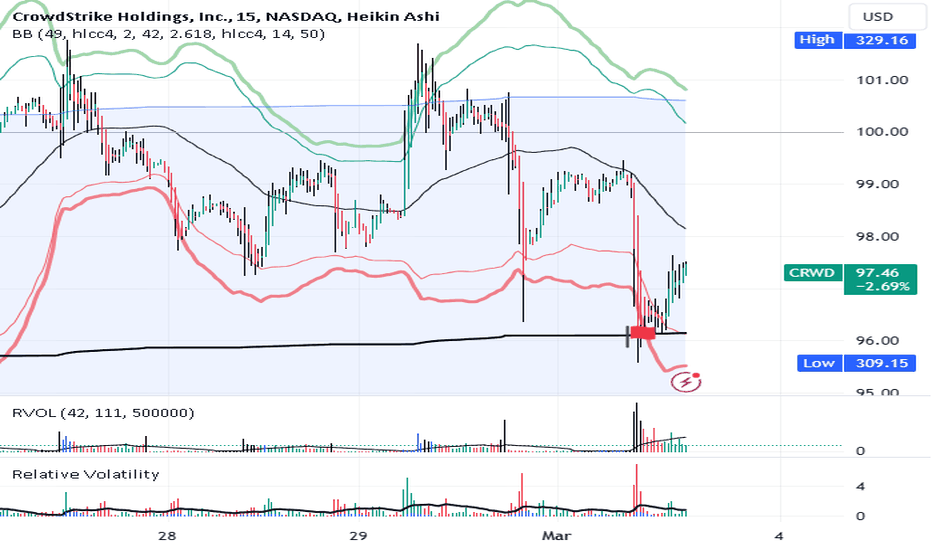

CRWD VWAP bounce earnings coming LONGCRWD reports on March 4th in the meanwhile in it is shown here on a 15 minute chart with

a Bollinger Band overlay. Price has trended from the upper bands down through the middle line

into the lower inner and outer bands where a reversal took place at the level of the mean

anchored VWAP band where the price fall was rejected with good support and wick touches

on the lower time frames. I see this as a set up for a new trend up in the run to earnings.

I will take a long trade of shares and call options. My easy target is the upper BB

bands but expect more than that in the upcoming week.

CRWD trade ideas

CRWD Stock Surges as Cado Security and CrowdStrike Join ForcesCado Security has announced an innovative integration with CrowdStrike (NASDAQ: NASDAQ:CRWD ), unleashing a powerhouse collaboration that promises to revolutionize how organizations combat cyber threats. This groundbreaking partnership not only amplifies the capabilities of both platforms but also sends shockwaves through the cybersecurity sector, particularly buoying the prospects of CrowdStrike ( NASDAQ:CRWD ) stock.

Cado Security, renowned for its pioneering cloud forensics and incident response platform, has seamlessly integrated with CrowdStrike's ( NASDAQ:CRWD ) AI-native Falcon platform, introducing a new era of efficiency and agility in the face of escalating cyber risks. This integration, available through the CrowdStrike ( NASDAQ:CRWD ) Marketplace, signifies a strategic alignment aimed at empowering organizations to respond swiftly and decisively to security incidents, thus fortifying their cyber defenses against evolving threats.

At the heart of this collaboration lies the promise of accelerated incident response, driven by automation and enriched security telemetry. By harnessing the collective strength of Cado Security's advanced forensics capabilities and CrowdStrike ( NASDAQ:CRWD ) Falcon Insight XDR, security teams gain unparalleled agility in identifying, analyzing, and neutralizing threats in real-time. The seamless integration facilitates rapid data collection, processing, and investigation, significantly curtailing response times and bolstering the resilience of organizations in the face of cyber onslaughts.

Key benefits of this integration include:

1. Rapid Response Times

Through automated incident response processes, organizations can swiftly transition from detection to resolution, mitigating the impact of security breaches and minimizing potential damages.

2. Faster Investigations

The fusion of Cado Security and CrowdStrike Falcon equips security teams with immediate access to comprehensive forensic evidence, empowering them to conduct thorough investigations and pinpoint the root cause of incidents with unprecedented speed and precision.

3. Improved Productivity

By automating tedious investigative tasks, the integration liberates security professionals from the shackles of manual processes, enabling them to focus their expertise on strategic initiatives rather than mundane chores.

4. Comprehensive Visibility

With the ability to perform forensics investigations across diverse environments, including on-premises, hybrid, and cloud infrastructures, organizations can achieve holistic visibility into their security posture, thereby fortifying their defenses against emerging threats.

Conclusion

The synergy between Cado Security and CrowdStrike ( NASDAQ:CRWD ) not only elevates the efficacy of incident response but also streamlines the security landscape for organizations, reducing operational costs and simplifying the management of complex security stacks. This seamless integration exemplifies the power of collaboration in combating cyber threats, setting a new standard for speed, efficiency, and effectiveness in cybersecurity operations.

Chris Doman, CTO, and Co-Founder of Cado Security, expressed his enthusiasm for the collaboration, emphasizing its transformative potential in empowering security teams to navigate the intricate labyrinth of cyber threats with unparalleled agility and efficacy. With the CrowdStrike Marketplace serving as a conduit for seamless procurement and deployment of integrated solutions, organizations can embrace this synergy with confidence, knowing that they are equipped with the tools needed to defend against the ever-evolving threat landscape.

As organizations worldwide grapple with the relentless onslaught of cyber threats, the partnership between Cado Security and CrowdStrike emerges as a beacon of hope, heralding a new era of resilience and adaptability in the face of adversity. With NASDAQ:CRWD stock poised to benefit from the ripple effects of this transformative collaboration, investors are eyeing the cybersecurity sector with renewed optimism, recognizing the immense value proposition offered by innovative partnerships that redefine the boundaries of possibility in cybersecurity.

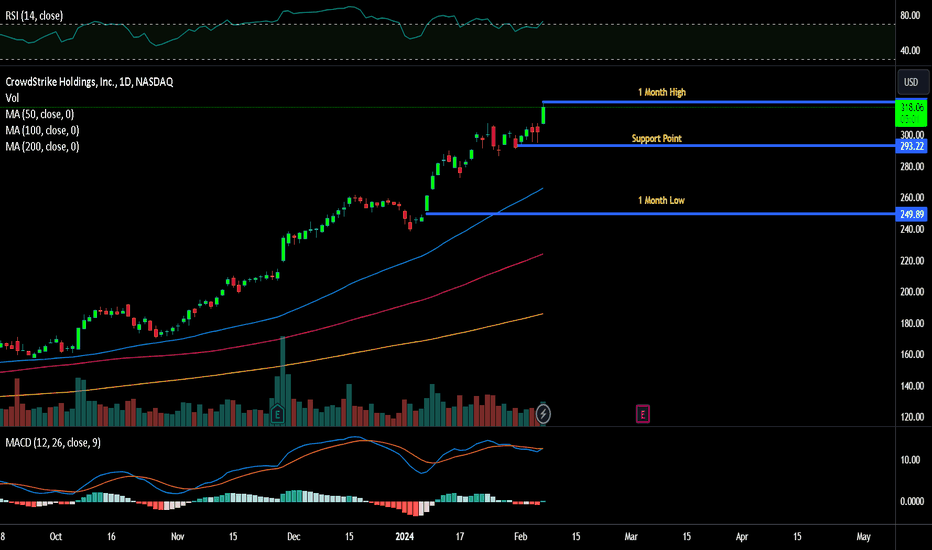

Negative Divergence; targe 200 SMA <$250 (20% correction)We've been forming a negative divergence on the daily for 2-3 months now.

CRWD has been red hot.

Margins are barely positive over the last few quarters (after a long-time being negative). But CRWD is still a $72 billion company trading at 24x revenue.

Now is the time to do the mature thing and to take some profits.

I'd suggest looking at the 200 SMA for re-entry (around $230-250 as a guess).

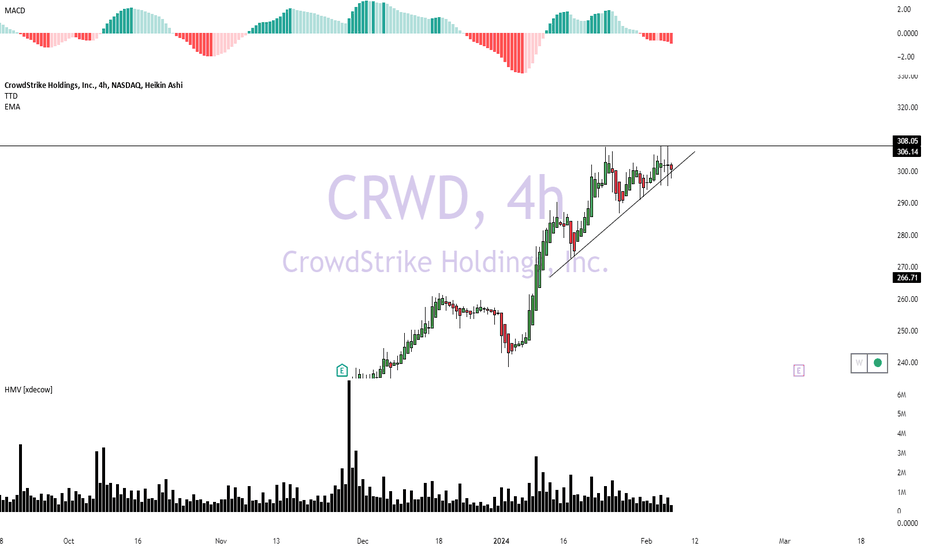

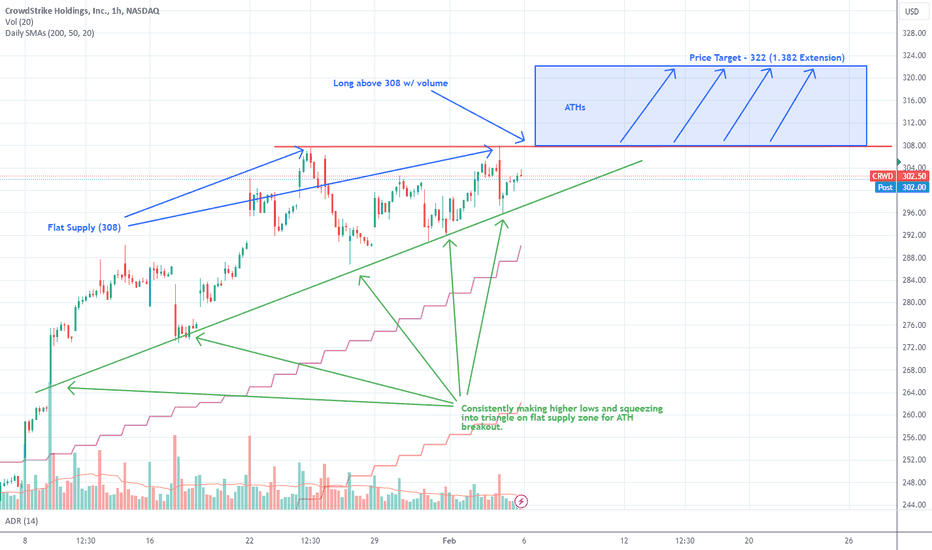

Bullish Setup on CRWD for ATHsKey Takeaways:

+Consistently making higher lows (5 times) and squeezing into triangle on flat supply zone for ATH breakout

+Trending above 20d SMA and 20d SMA > 50d SMA > 200d SMA

+After running up from 260 in early Jan we've found a horizontal supply zone at 308 which we should squeeze into should we continue making higher lows

+Breaking 308 will send us to ATHs and I would expect a ~$15 move topside with breakout for 2 reasons:

1)After 1st 308 rejection we retraced about $15 into 290 area and I'm treating this as the 'consolidation zone' (like triangles and other price patterns)

2)Since forming the uptrend, we've moved up $40 and a 1.382 fib extension of the uptrend lands us at that $15 move as well

Keep an eye on this ticker with a 308 breakout into ATHs!

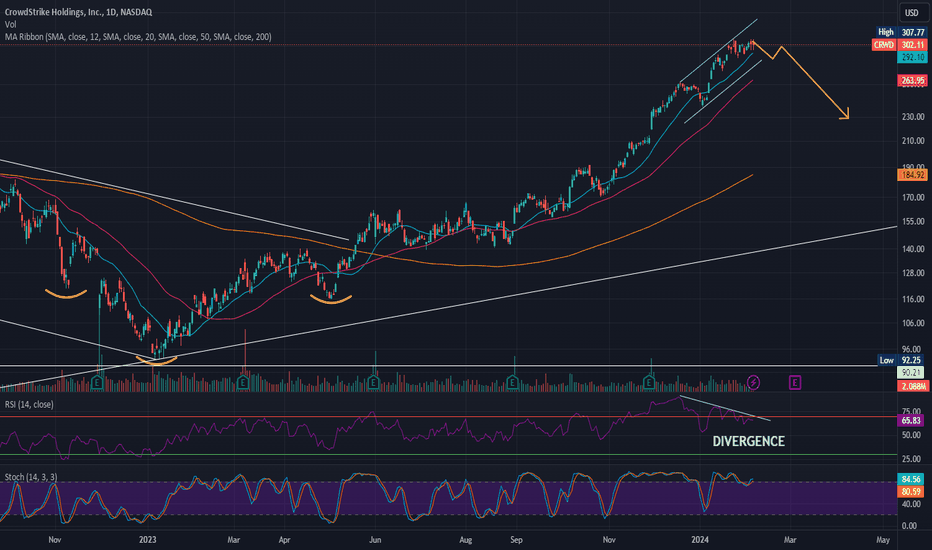

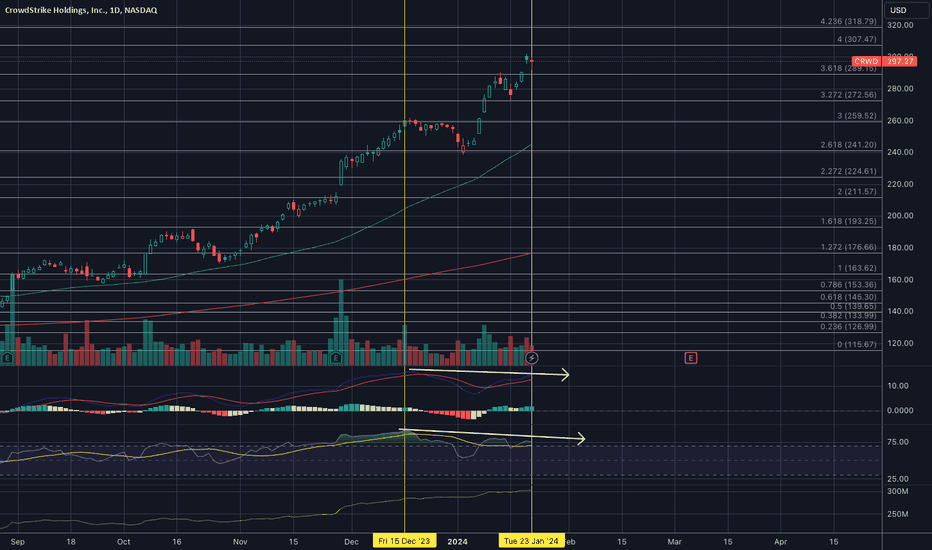

$CRWD - Could be close to a pull backNASDAQ:CRWD CrowdStrike, looks overextended and could be close to a pullback. RSI and MACD are showing bearish divergence.

It may reach $307 before staging a pullback.

I might consider placing a bearish bet around $307.

There is a risk that it could run to $318. Still, risk-reward favors the downside.

Downside targets:

$272

$259

Risk:

$318

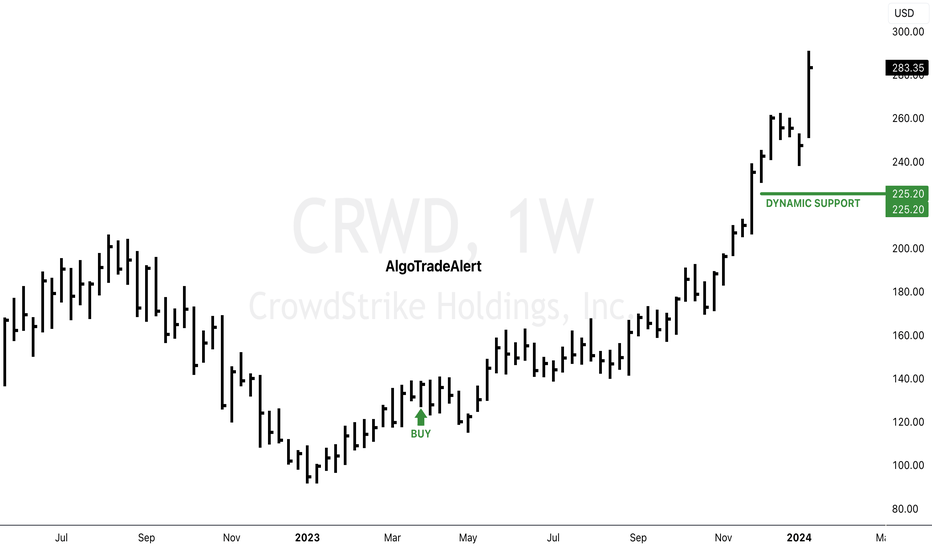

$CRWD Weekly Chart Fundamentals + AlgorithmsFundamentals + Algorithms When you see a green up arrow, it signals an algorithmic buy alert and a new uptrend, allowing you to accumulate the stock for long-term growth

Cloud-delivered security leader: CrowdStrike offers the Falcon® platform, a cloud-based solution protecting endpoints, cloud workloads, identities, and data.

Market leader with industry recognition: Ranked #1 globally by IDC for modern endpoint security, Gartner for managed detection and response, and Frost & Sullivan for AI-powered indicators of attack.

Strong customer base and expansion: 18,000+ subscription customers, including large enterprises and government agencies. Expanding product portfolio through acquisitions and organic development.

Focus on profitability: Though not yet consistently profitable, CrowdStrike demonstrated significant progress with record operating and free cash flow in FY23, and a path towards profitability.

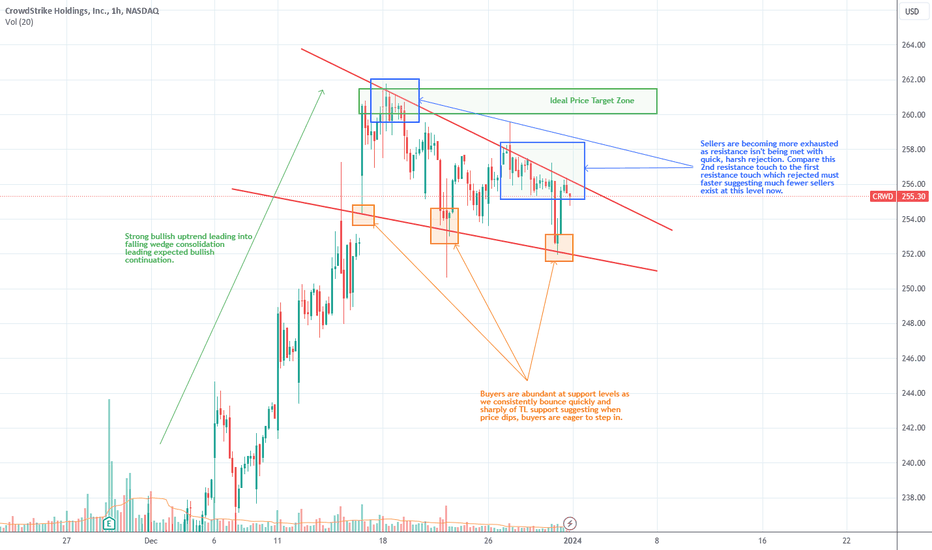

Bullish Falling Wedge on CRWDShort term bullish bias based on falling wedge continuation play. Ideal price target after confirmed breakout ~260. Please see the chart for more details but essentially, we have a nice bullish consolidation pattern here and within the pattern on supply and demand retests we are already seeing buyers showing relative strength vs sellers which bodes well for a breakout and a strong potential move topside.

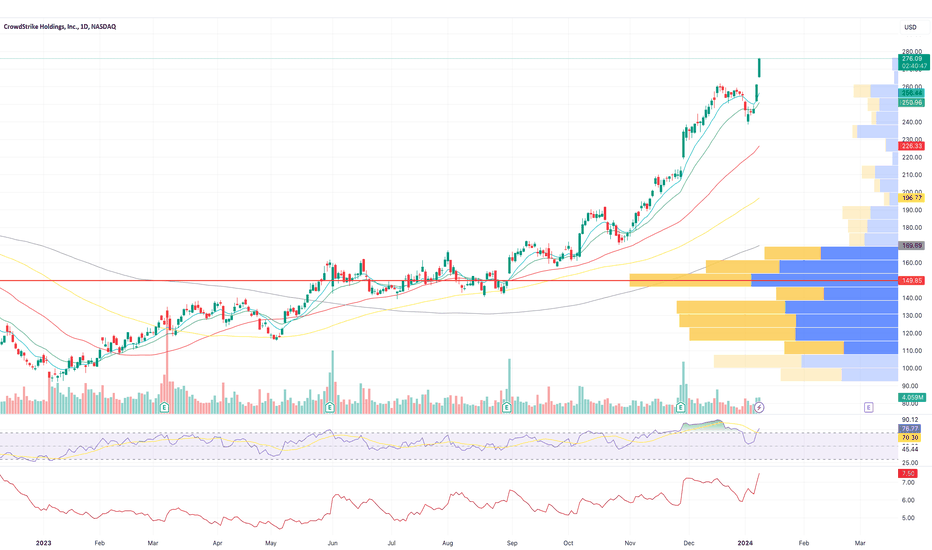

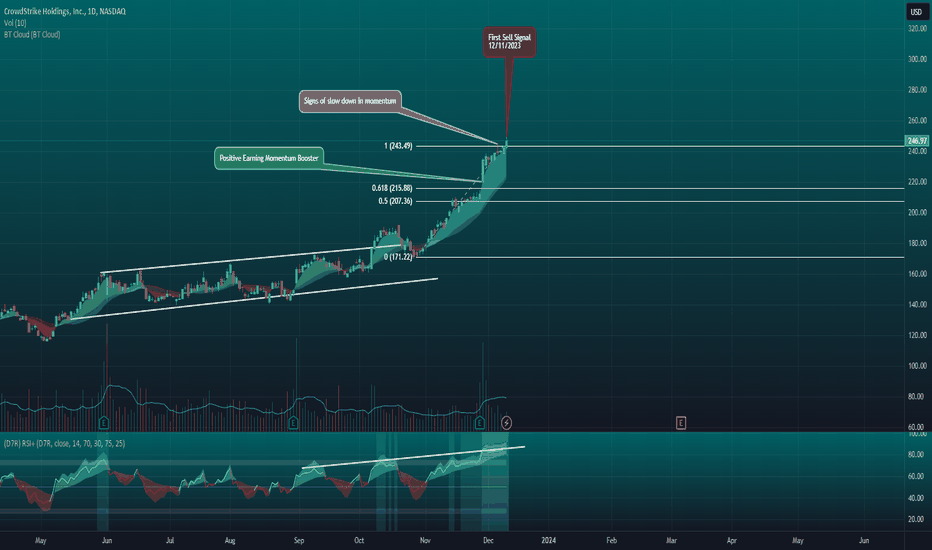

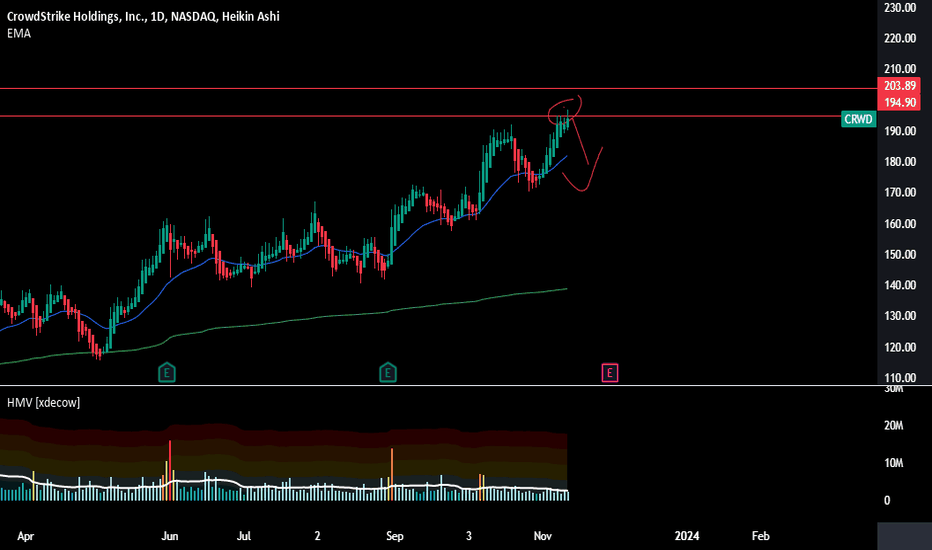

Antares Data: CRDW Buyer Momentum SlowdownAntares Data Lab on CRWD

2024 will continue to be the year for companies to invest in their cybersecurity, with CrowdStrike leading the market in this industry. Following a rise since the low on October 27, CRWD experienced upward momentum until the earnings announcement. A week of consolidation provided buyers with a chance to catch their breath and gather strength for another push higher, buoyed by a strong earnings report. However, the current market appears to be excessively extended, and bullish investors are starting to feel the pressure from the sell side.

The first alert was generated today: Sell.

1st Target: 230.59 - Probability: 40%

2nd Target: 215.88 - Probability: 27%

3rd Target: 207.36 - Probability: > 10%

This sell signal suggests a potential pullback. Achieving any of the targets may recapture the attention of bullish investors

CrowdStrike (NASDAQ: CRWD) Leaps After Solid Q3 EarningsCybersecurity group CrowdStrike says its on target to reach $10 billion in annual recurring revenues over the next five to seven years.

CrowdStrike (NASDAQ: CRWD) - shares jumped higher in early Wednesday trading after the cybersecurity group posted better-than-expected third quarter earnings paired with a solid-near term sales outlook.

CrowdStrike said current quarter revenues would likely range between $836.6 million to $840 million, nudging just ahead of Street forecasts, with annual recurring revenue (ARR), a key performance metric for tech services companies, pegged at $3.15 billion.

Investors were also impressed with the group's potential to grow revenues from small and medium-sized business through new product launches on Amazon (AMZN).

For the three months ending in October, CrowdStrike posted adjusted earnings of 82 cents per share, topping Street forecasts by around 8 cents, on revenues of $786 million, a tally the came in just ahead of estimates. Annual recurring revenue rose 13% from last year to a record $223 million.

CrowdStrike share were marked 6.8% higher in today's trading to change hands at $226.80 each, a move that would extend the stock's six-month gain to around 44% and value the Austin, Texas-based company at around $54.1 billion.

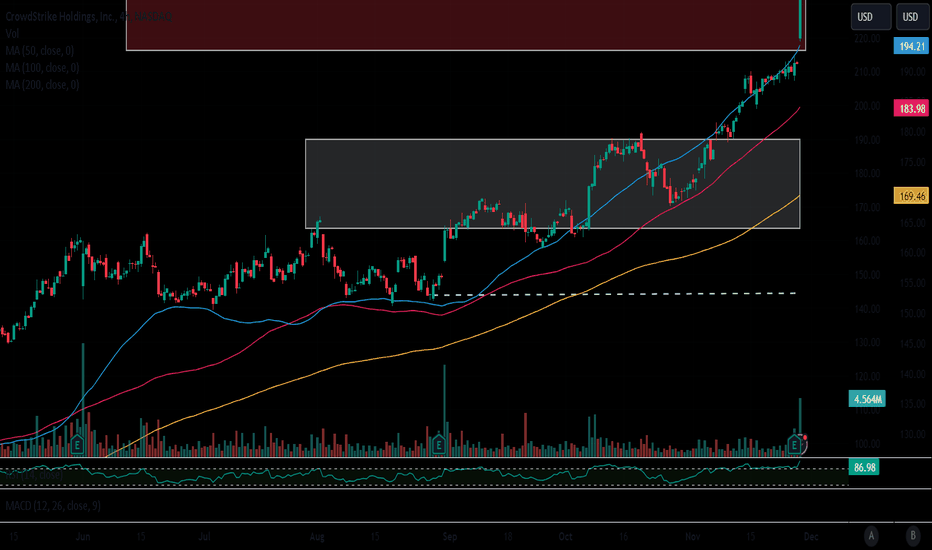

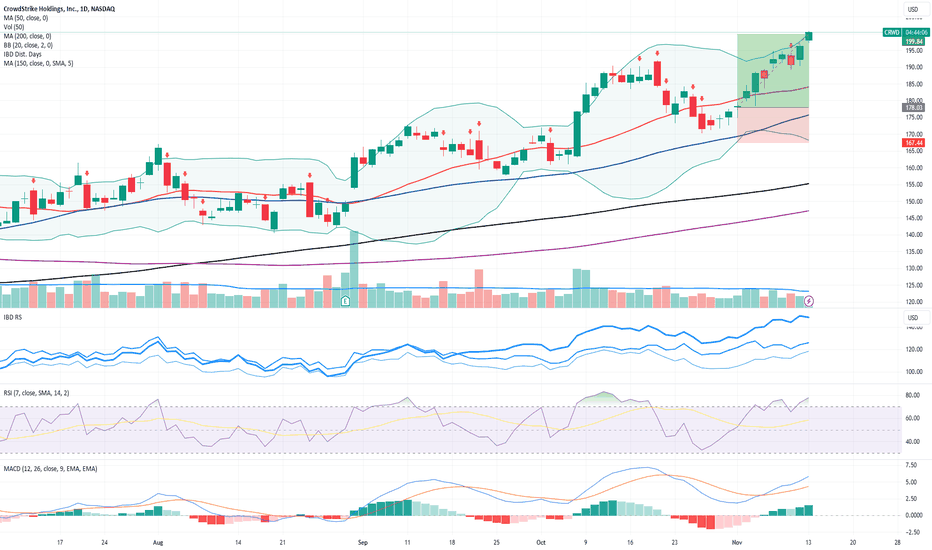

CRWD - US cybersecurity play If this market will find traction and have a follow-through day, I will bet on CRWD being one of the next up-cycle leaders.

IBD 94 Relative strength and 99 Composite and EPS ratings are markers of a superb company. The industry group is 35 out of 197. High double and triple quarter earnings growth and stable 40+ sales growth for 3 qrts in a row; with stable 35+ ROE; Up/Down volume of 1.5; double digits analyst estimates of 24/25 EPS growth and increasing number of institution last qrt... all these make me call this stock a perspective leader.

From the technical perspective, notice how well the stock price holds and builds the high-handle close to 2023 highs, while general index (line above) is in a downward momentum being almost 10% of the highs. Unfilled gap-up on 31Aug (green circle) is also a sign of strength to me.

I want the price to subside more in volatility to the right side of the handle, creating a tight 3-4% risk pivot and maybe an inside day before breaking out above 172 pivot. That would signal and ideal entry point for my strategy with very tight risk. Although if price decides not to wait and will proceed with definite move above 172 pivot with supportive volume and will be hesitant to buy/add to the position, expecting the price to move to next resistance 194-206 target area.

Trading thesis is wrong if price moves bellow: 157 area

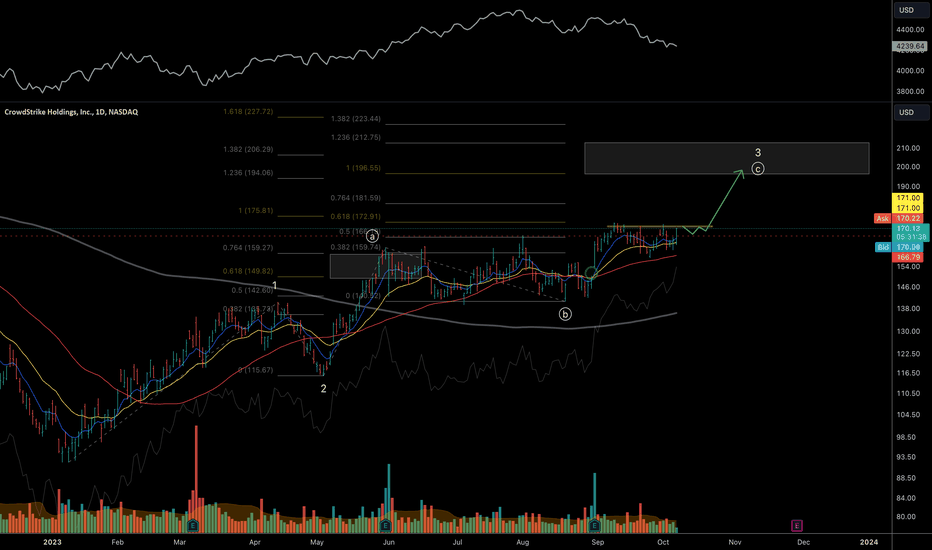

CRWD LONG to $230CRWD | CrowdStrike Holdings, Inc.

CrowdStrike've just finished it's correction and is now above the MA 200.

Short term target: $230

Long term target: $492

Revenue grows steadily, yearly net income soon will become positive, cash grows, geographically diversified by operating revenue.

Closed CRWD trade at a profit of 12.5%We have closed our CRWD trade at a profit of 12.5%. The profit target has been reached and the stock if short-term overbought (RSI) which increases the risk for a short-term pullback.

When the stock is at the target profit, you have several options: a) close the full trade, b) close half of the trade and move the SL for the remaining half up to e.g. breakeven, c) move the SL up to e.g. breakeven and hold the stock for a larger move.

Here is the link to our updated portfolio:

tradingview.sweetlogin.com

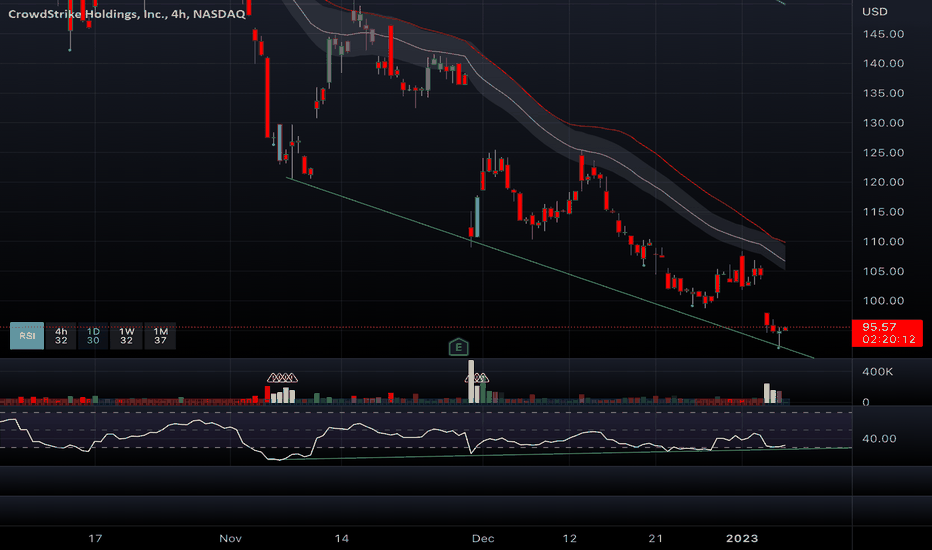

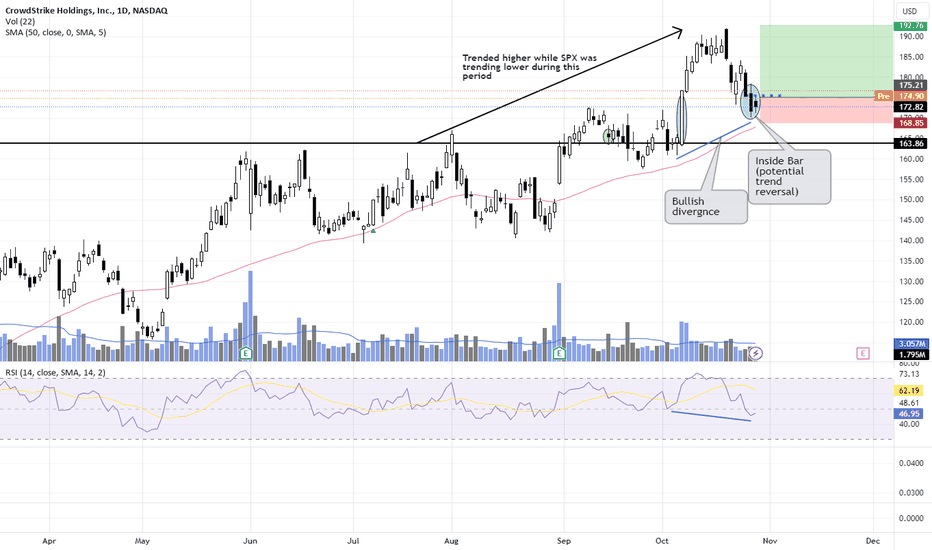

CRWD - Ready to bounce?CRWD - Ready to bounce?

Despite the steep decline in the general market that started in mid July, CRWD was actually trending higher, showing good relative strength. In fact,it is still trading above its 50 day MA while both SPX and NQ is now well below this MA.

There are a few signs that CRWD could be ready to bounce from it's recent correction that started on 19th Oct:

1. Bullish divergence between price and RSI on its daily chart

2. An Inside bar last Friday that could signal the near term correction could be ending

I will long as soon as it crosses above last Friday's candle (inside bar) high @ 175.70 with an initial stop loss about $1 below its recent low @ $170.

Disclaimer:

This is just my own analysis and opinion for discussion and is NOT a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance and don't forget that money management (ie trailing stop loss and position sizing) is (probably the most) important!

Take care and Good Luck!

CrowdStrike Pulls BackCrowdStrike has been making new 52-week highs as the broader market languishes. Now after a quick pullback, some traders may look for the cybersecurity stock to continue higher.

The first pattern on today’s chart is the bullish gap on August 31 after results and guidance beat estimates. A series of higher highs and higher lows followed, which may suggest a new uptrend is taking shape.

Second, the stock could now be trying to bounce slightly above the September 11 high. Is old resistance becoming new support?

Third, the lower study includes our 2 MA Ratio custom script with the default settings of the 8- and 21-day exponential moving averages (EMAs). It’s been positive since early last month, meaning the fast EMA has remained above the slower EMA. That could also reflect prices climbing in the short term.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

Important Information

TradeStation Securities, Inc., TradeStation Crypto, Inc., and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., all operating, and providing products and services, under the TradeStation brand and trademark. TradeStation Crypto, Inc. offers to self-directed investors and traders cryptocurrency brokerage services. It is neither licensed with the SEC or the CFTC nor is it a Member of NFA. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Please click here for further important information explaining what this means.

This content is for informational and educational purposes only. This is not a recommendation regarding any investment or investment strategy. Any opinions expressed herein are those of the author and do not represent the views or opinions of TradeStation or any of its affiliates.

Investing involves risks. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures, or digital assets); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on the Important Documents page, found here: www.tradestation.com .

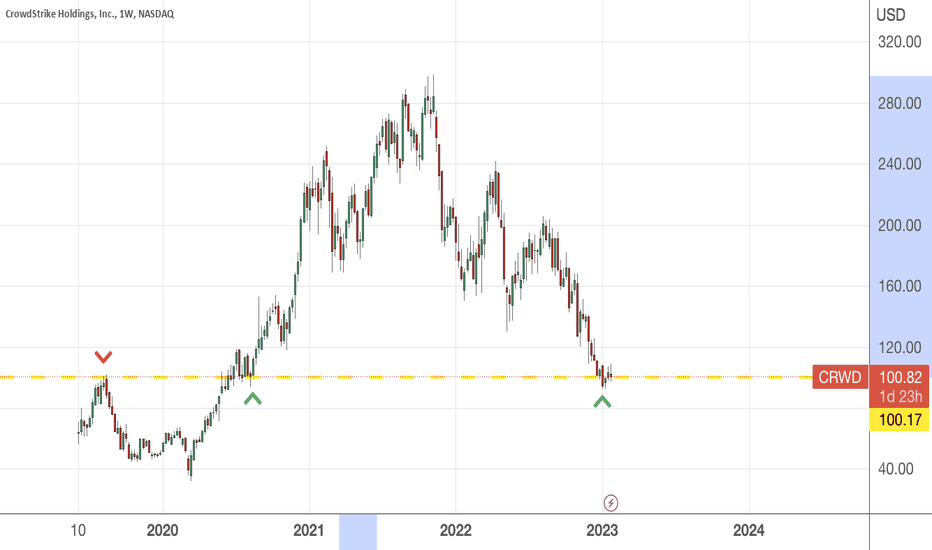

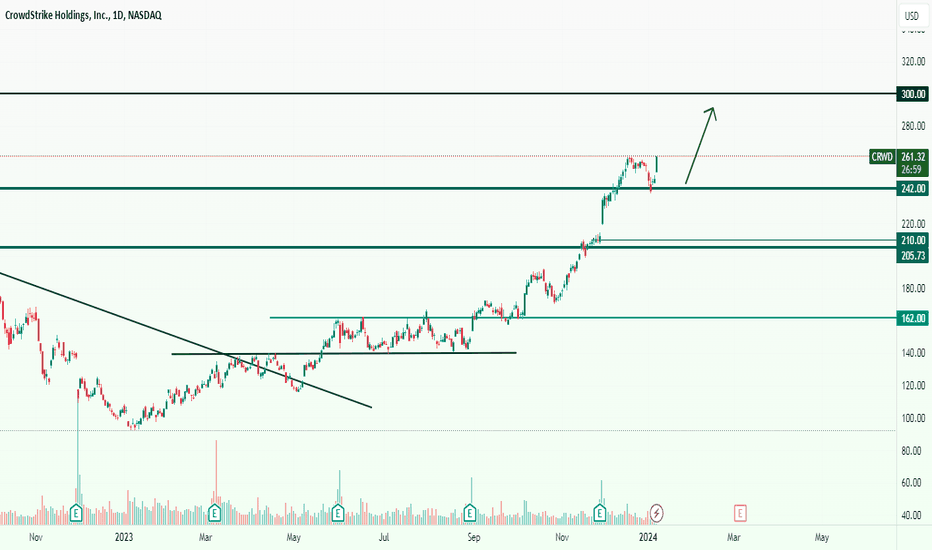

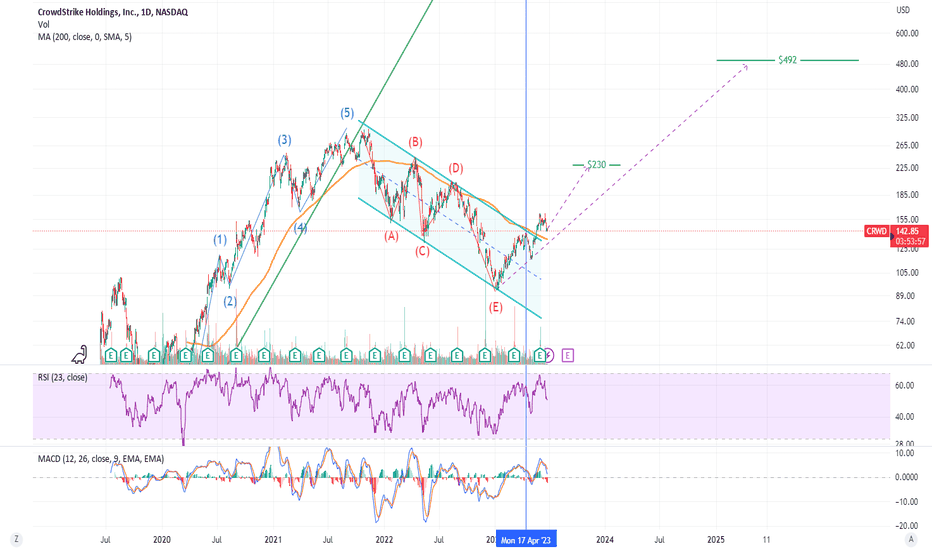

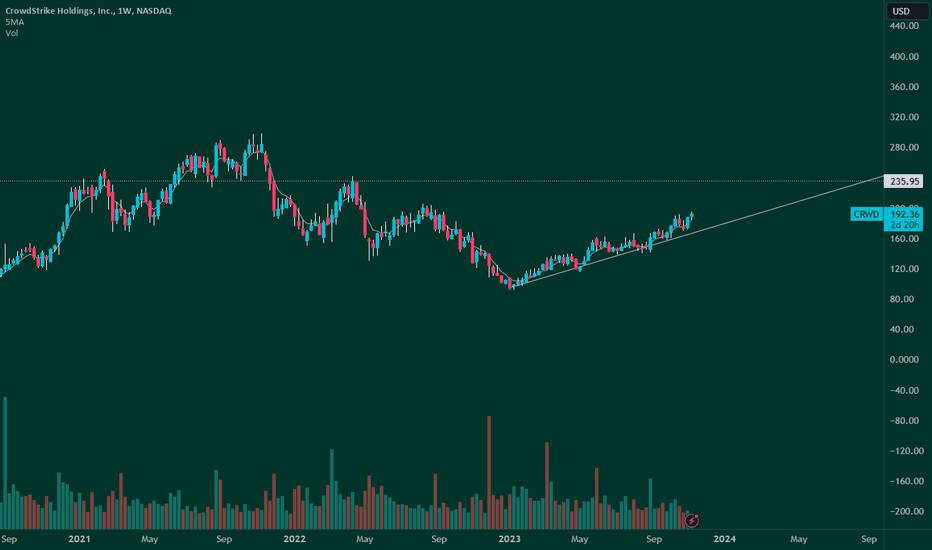

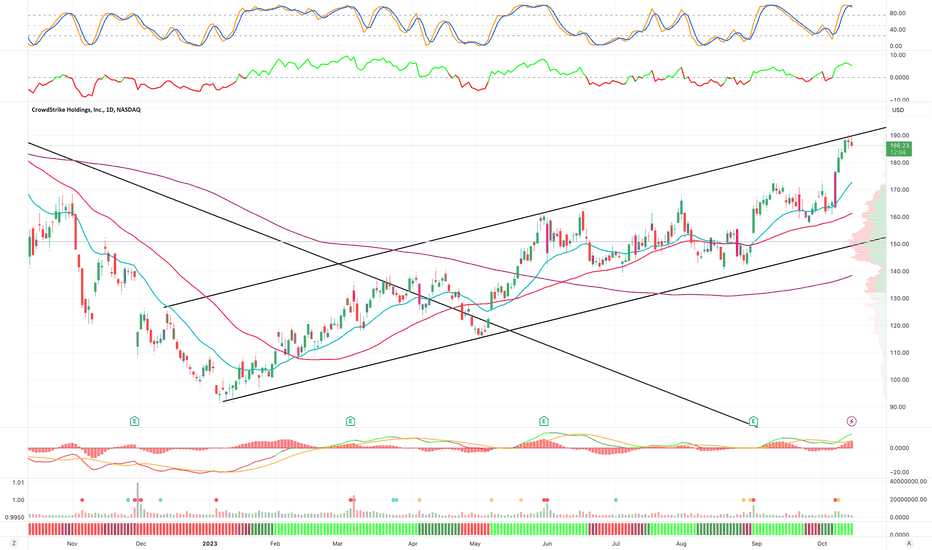

CRWD presently testing significant long-term resistanceCrowdStrike Holdings Inc. (CRWD) presently testing significant long-term resistance, able to absorb monthly buying pressures.

From here, (CRWD) can fall lower to channel support, eliciting losses of 15% over the following 2 - 3 months.

A settlement below channel support would lead to a long-term sell signal in (CRWD) into 2024.

Inversely, a weekly settlement above shown resistance would place (CRWD) into a buy signal where gains of 20% is likely over the following 2 - 5 months.