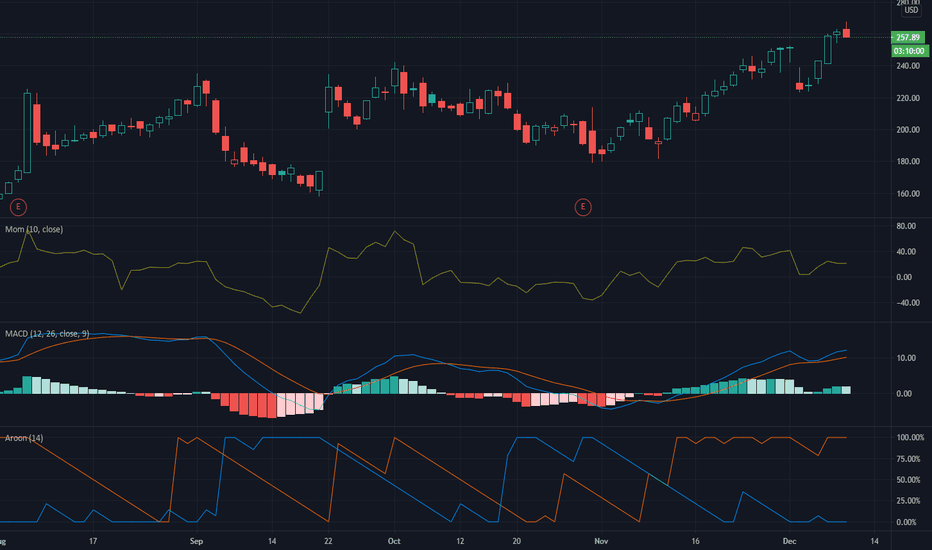

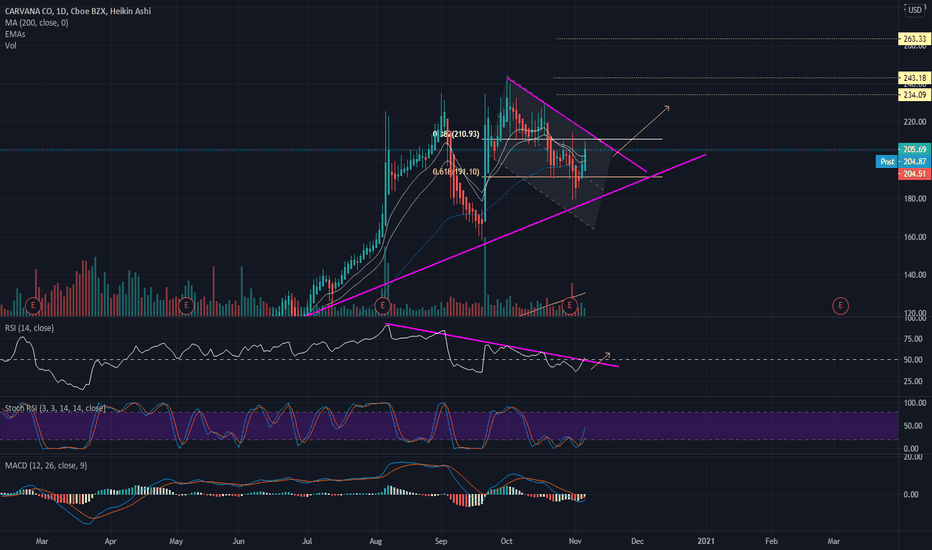

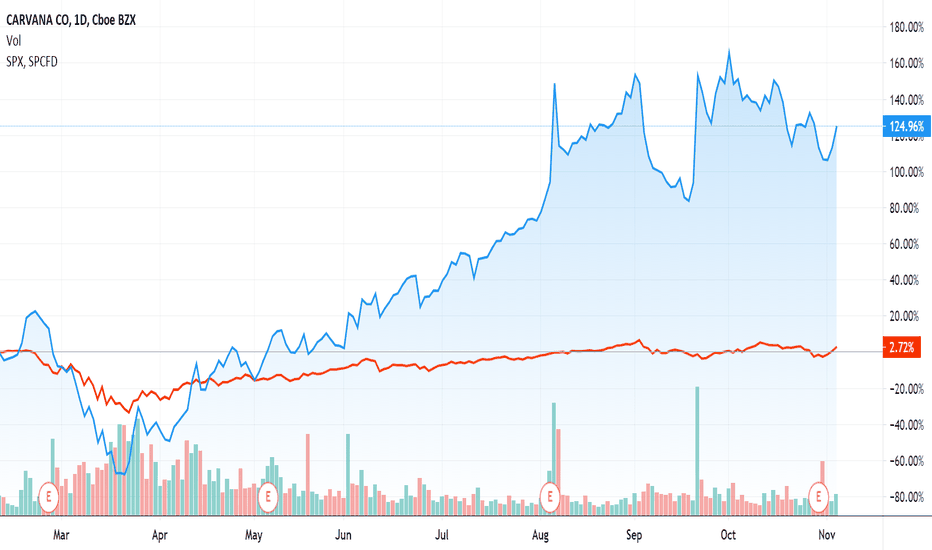

CVNA, Aroon Indicator entered an Uptrend on December 08, 2020.Over the last three days, A.I.dvisor has detected that CVNA's AroonUp green line (see chart) is above 70, while the AroonDown red line is below 30. When the green line goes above 70 while the red line stays below 30, this is an indicator that the stock could be poised for a strong Uptrend. For traders, this could mean going long the stock or exploring call options in the next month. A.I.dvisor backtested this indicator and found 242 similar cases, 210 of which were successful. Based on this data, the odds of success are 87%. Current price $260.38 is above $227.36 the highest resistance line found by A.I. Throughout the month of 11/05/20 - 12/08/20, the price experienced a +28% Uptrend. During the week of 12/01/20 - 12/08/20, the stock enjoyed a +4% Uptrend growth.

Bullish Trend Analysis

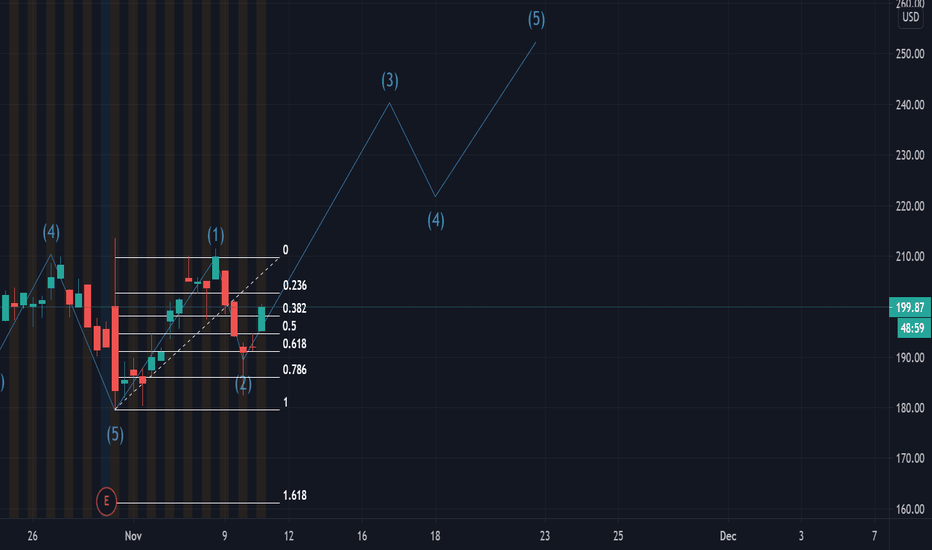

The Momentum Indicator moved above the 0 level on November 11, 2020. You may want to consider a long position or call options on CVNA as a result. In 44 of 51 past instances where the momentum indicator moved above 0, the stock continued to climb. The odds of a continued upward trend are 86%.

The Moving Average Convergence Divergence (MACD) for CVNA just turned positive on November 11, 2020. Looking at past instances where CVNA's MACD turned positive, the stock continued to rise in 26 of 29 cases over the following month. The odds of a continued upward trend are 90%.

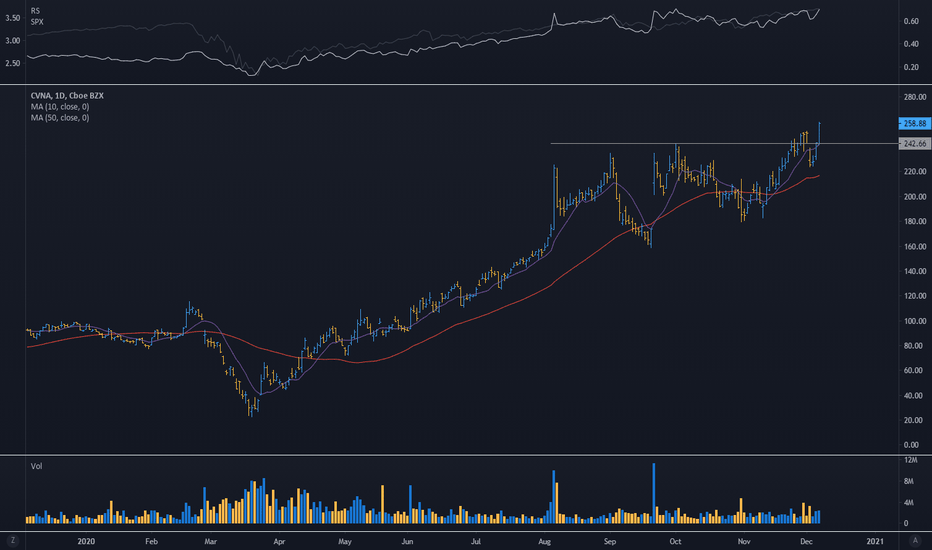

CVNA moved above its 50-day Moving Average on November 11, 2020 date and that indicates a change from a downward trend to an upward trend.

Following a +7.51% 3-day Advance, the price is estimated to grow further. Considering data from situations where CVNA advanced for three days, in 224 of 249 cases, the price rose further within the following month. The odds of a continued upward trend are 90%.

CVNA may jump back above the lower band and head toward the middle band. Traders may consider buying the stock or exploring call options.

The Aroon Indicator entered an Uptrend today. In 210 of 242 cases where CVNA Aroon's Indicator entered an Uptrend, the price rose further within the following month. The odds of a continued Uptrend are 87%.

CVNA trade ideas

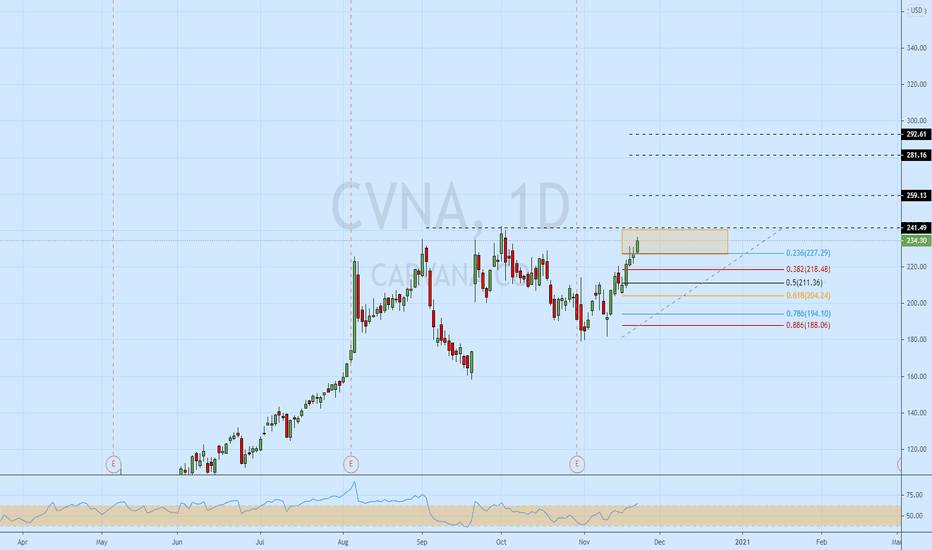

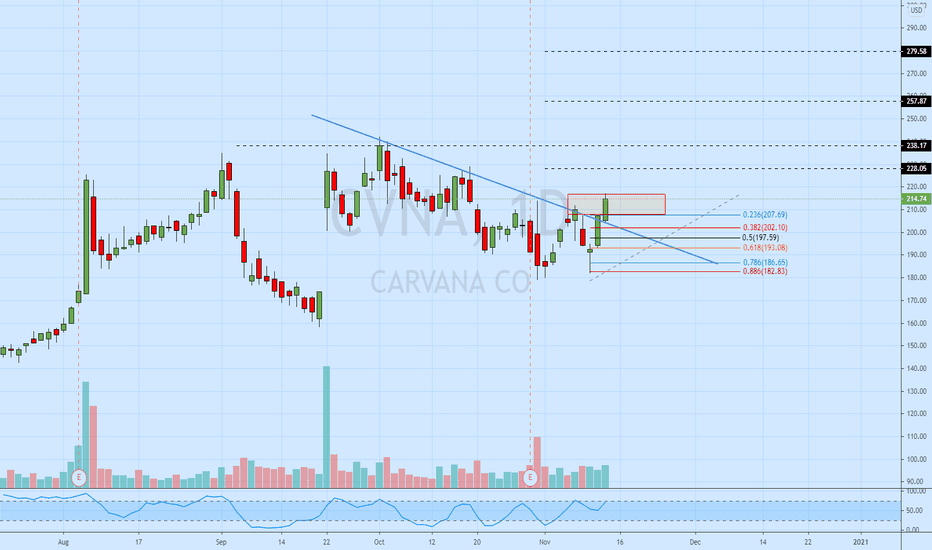

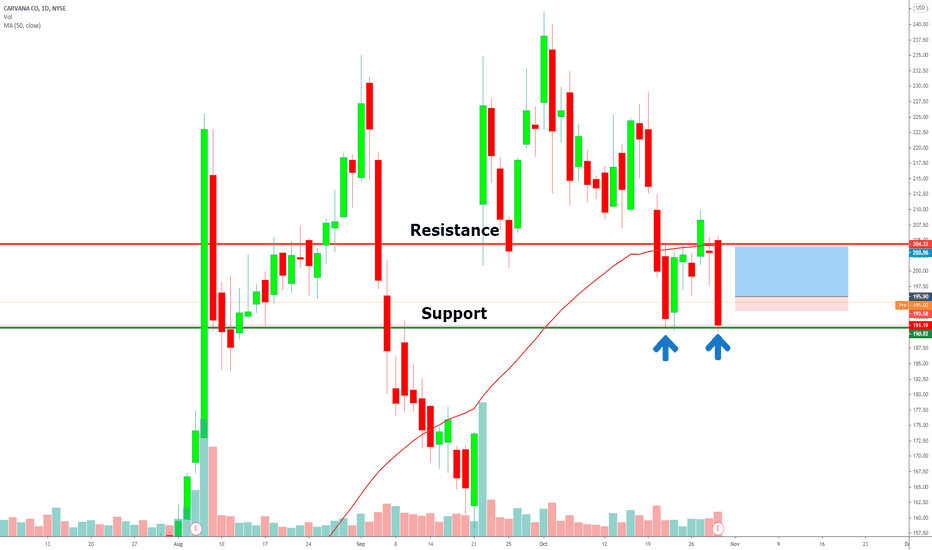

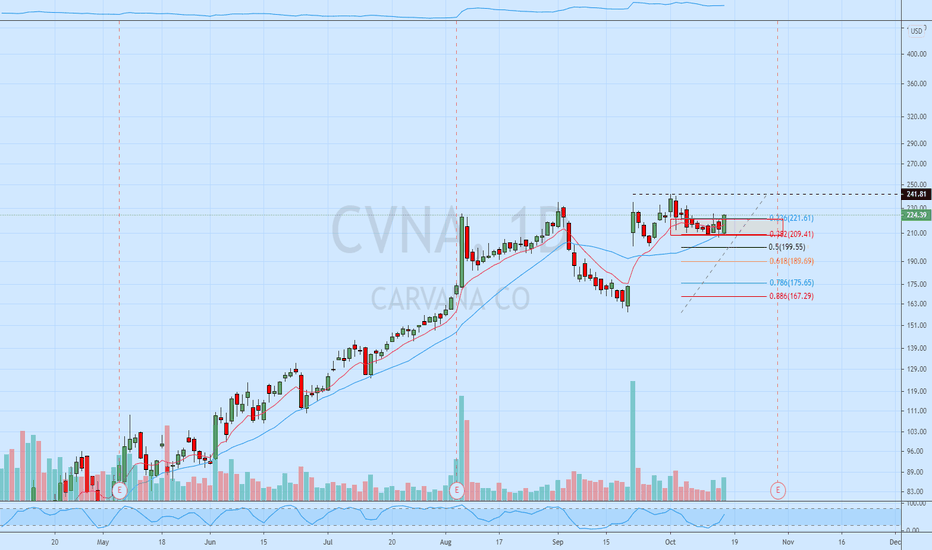

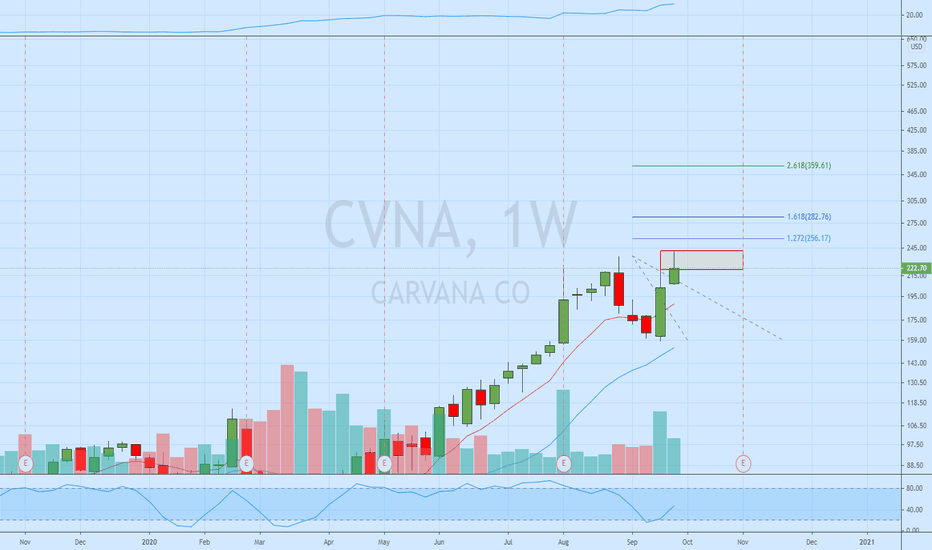

CVNA on watchIf you missed the re-entry on CVNA its setting up again for an ATH breakout. Prefer to see a little consolidations in the box then

a break above the box. The box is my risk and the dotted lines are fib extension targets. I use the dotted lines instead of fibs to

keep my charts clean. Clean charts = clear mind and better trading.

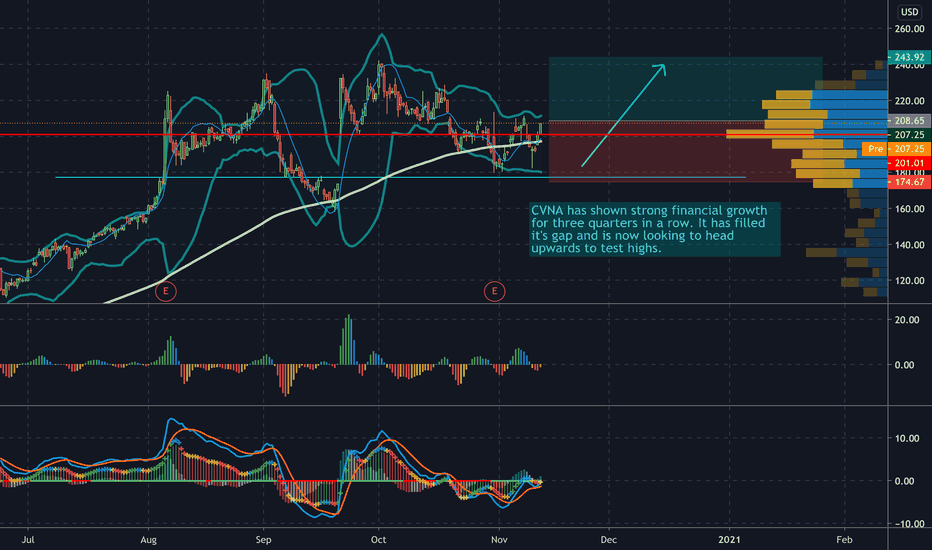

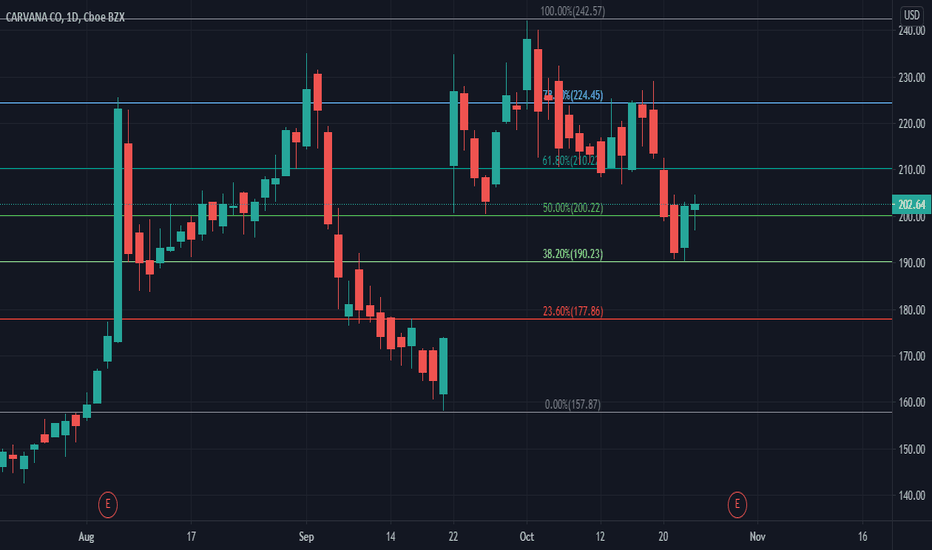

CVNA BullishCVNA is rated a "strong buy" from tradingview. It has shown strong financial growth for three consecutive quarters, it has just completed a gap fill and the bearish move was rejected. In a bullish market setting I would look for CVNA to potentially make new highs or short squeeze further.

It's Time To Have An Opinion On Auto EcommerceAfternoon gang!

This is a real simple idea here that I think over time will be a low n' slow winner. As autobuying, like all other industries, becomes increasingly susceptible to the forces of digitization and ecommerce, we are looking at the potential for one or two companies to own the entire space within the United States. The top two companies right now are VRM and CVNA, and I think it's become clear over the last month or so that CVNA is clearly the superior player in the space. Increased selection, more than triple the gross margins, a stronger balance sheet, and a huge lead in brand awareness make this the name to own.

Instead of owning the company outright with directional risk, short VRM to reduce your beta exposure and take advantage of the likely winner-take-all scenario playing out.

Cheers!

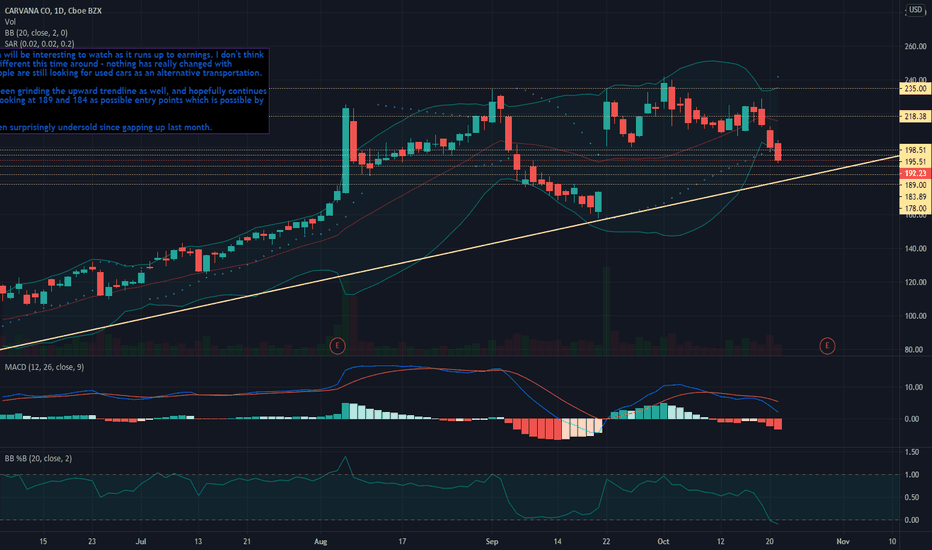

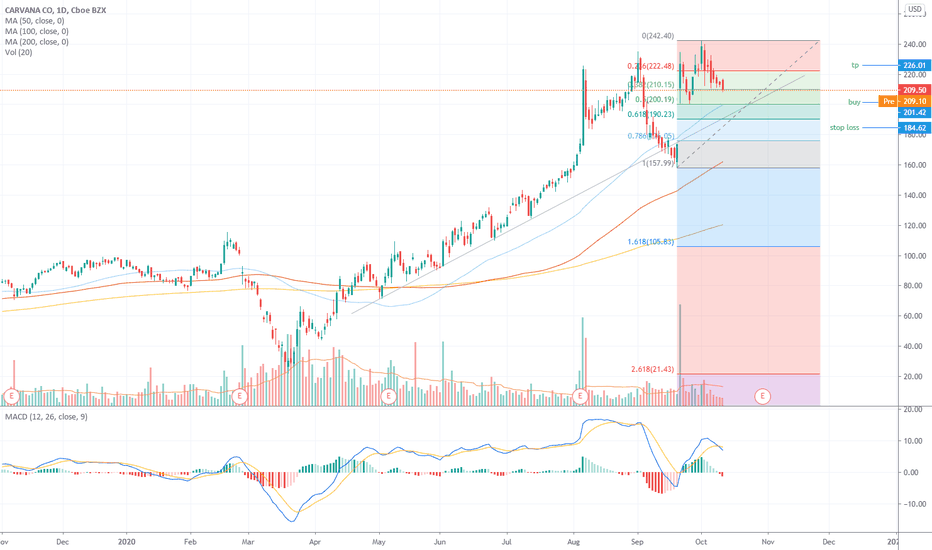

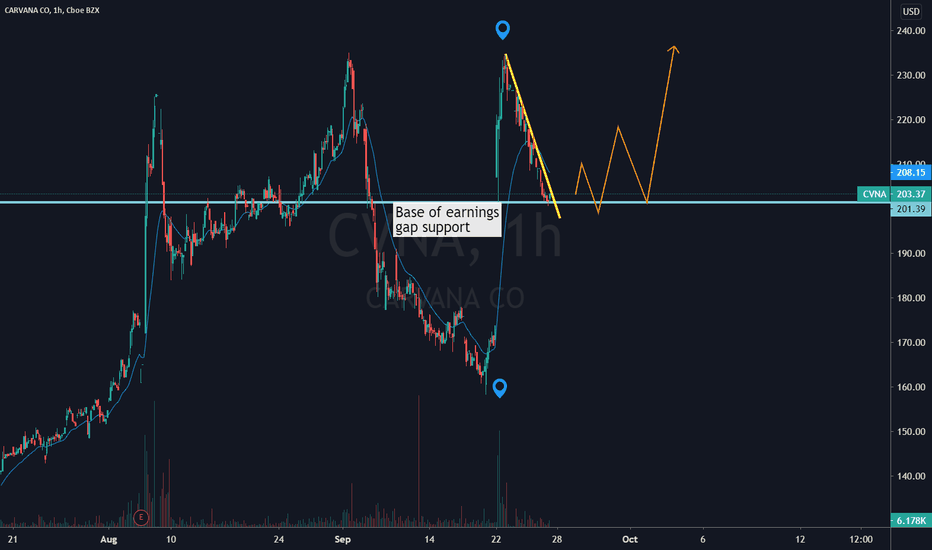

CVNA Earnings IdeaCVNA price action will be interesting to watch as it runs up to earnings. I don't think earnings will be different this time around - nothing has really changed with pandemic and people are still looking for used cars as an alternative transportation.

Price action has been grinding the upward trendline as well, and hopefully continues to do so. Will be looking at 189 and 184 as possible entry points which is possible by Friday 10/23.

CVNA has also been surprisingly undersold since gapping up last month.

CVNAi think this good to buy or start averaging into here, could keep coming down some but i don't think it's a good idea to wait on this one, i think this could easily be the target to autotrader's walmart, once the market gets going again this will see all time highs quickly i think, i think this is a great long term hold too, i think this is one we'll look back on from on high

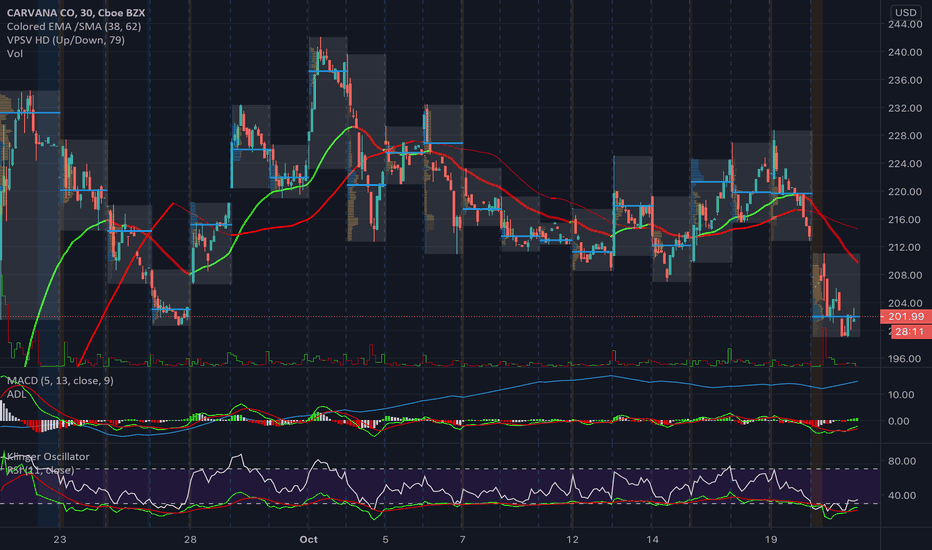

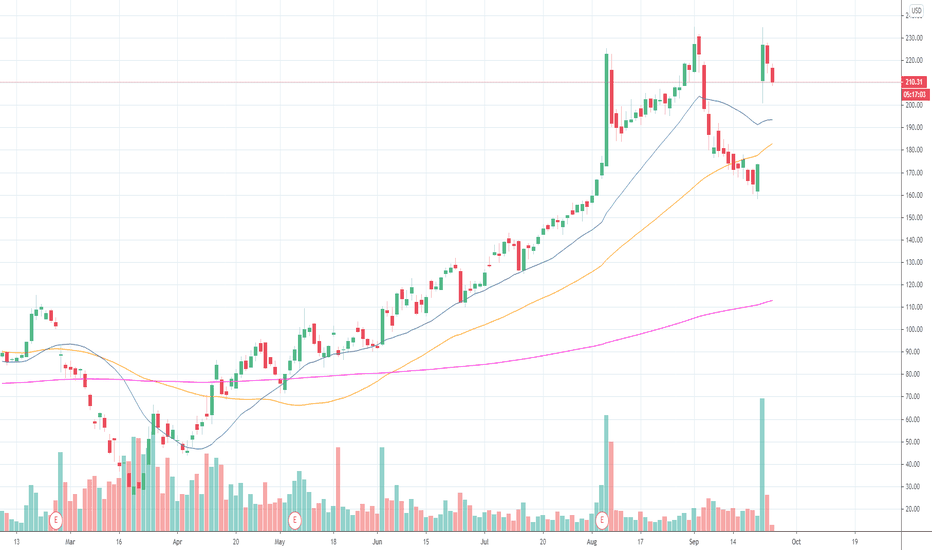

CVNA 6 month trendline bounceCarvana, CVNA bounced off it's 6 month trend-line exactly to the T today at 2:15pm for $213.28. Despite the volatile market and current events, CVNA predictably held it's long term rising value. Even with it's close of $222.70 this is still a great entry point because today's pullback closed lower $15. I wouldn't wait long to get long on CVNA if you missed September 21st pop, there's more positive gains still to come in the future.

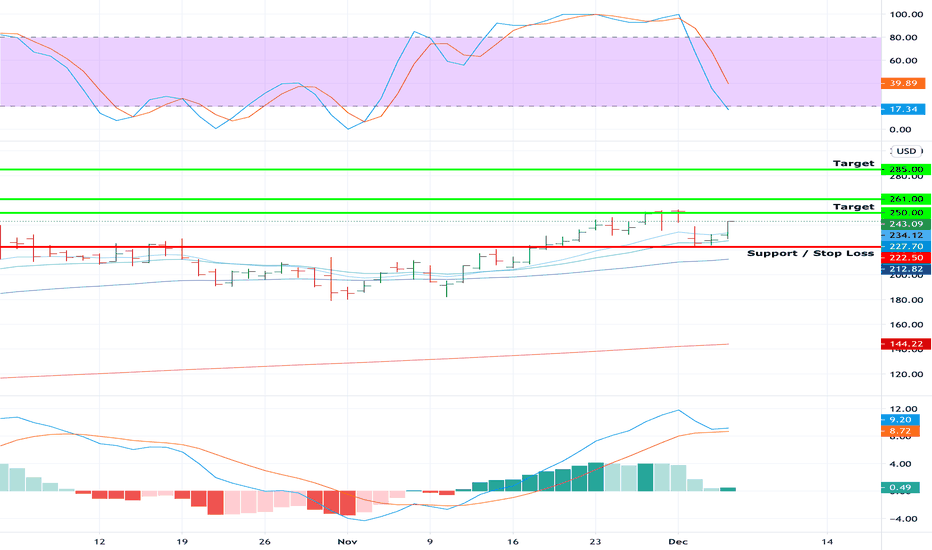

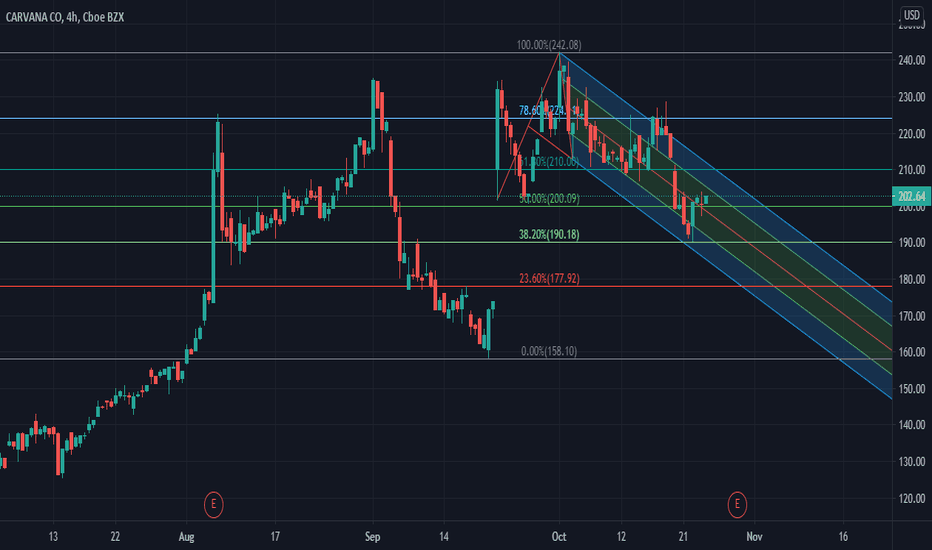

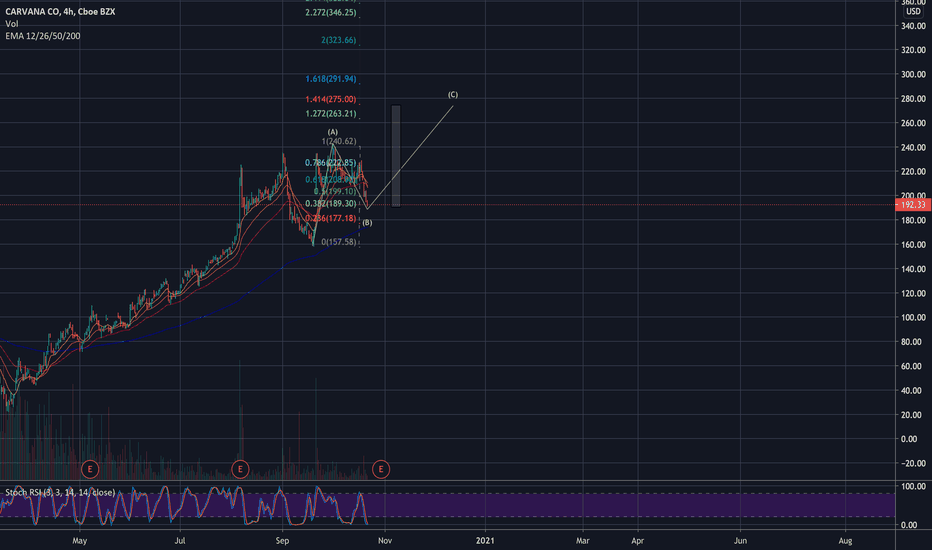

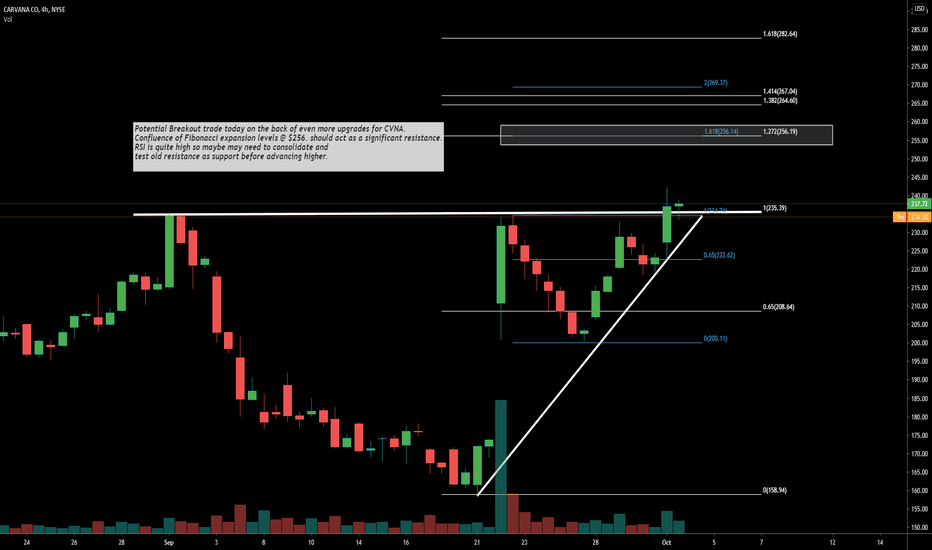

$CVNA Carvana Breakout Trade Targets

Potential Breakout trade today on the back of even more upgrades for CVNA.

Confluence of Fibonacci expansion levels @ $256. should act as a significant resistance.

RSI is quite high so maybe may need to consolidate and

test old resistance as support before advancing higher.

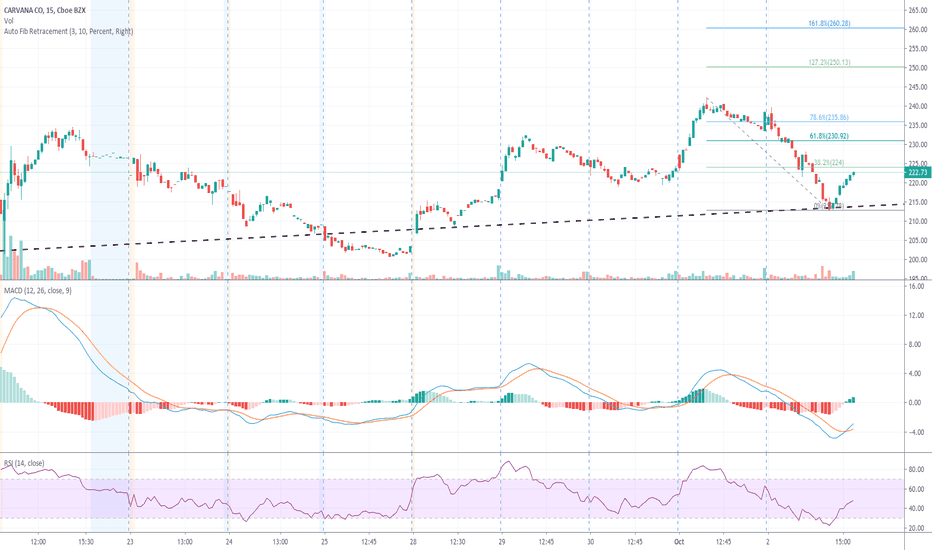

$CVNA Massive Earnings Movement$CVNA had a ripper of a day on the back of earnings. This propelled prices right back up to the major range highs. The difference this time around is that the volume is backing the move up now and earnings being the catalyst shows immense longer term strength (potentially weeks to months).