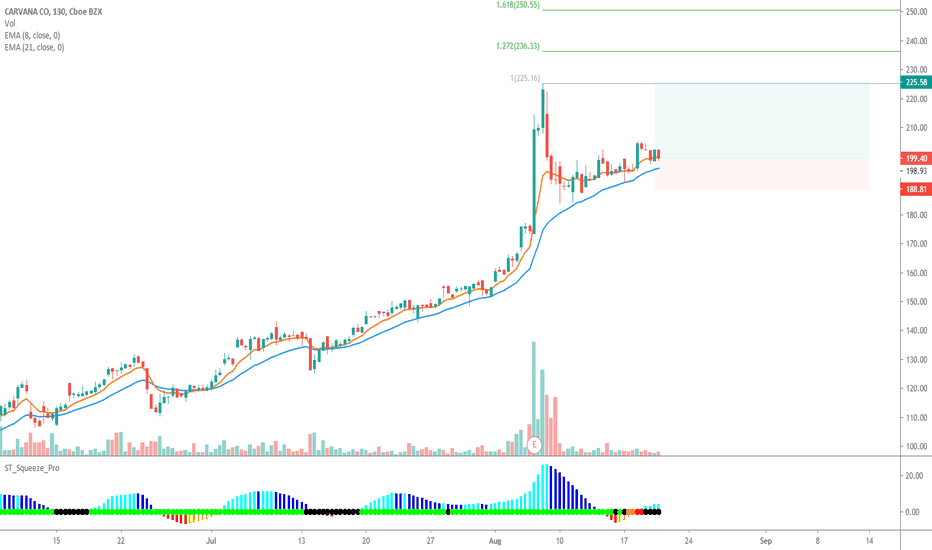

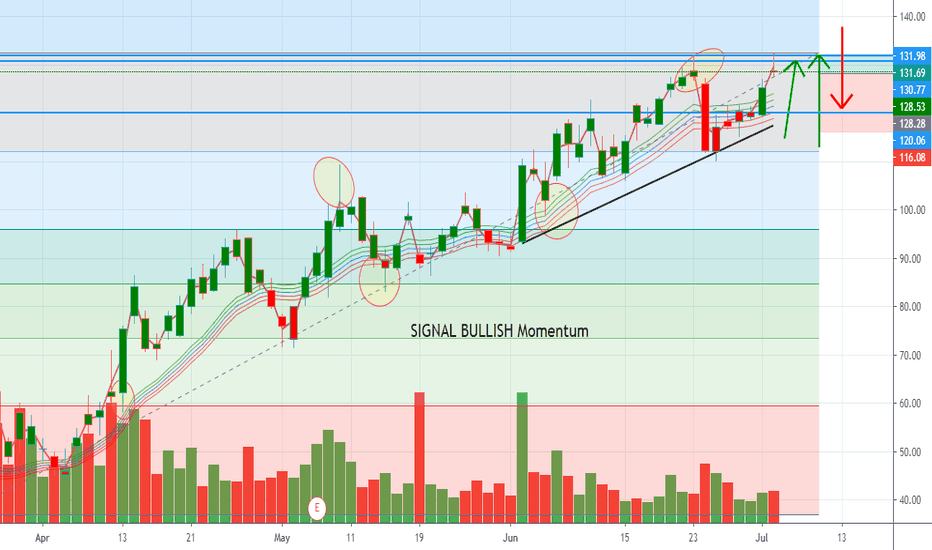

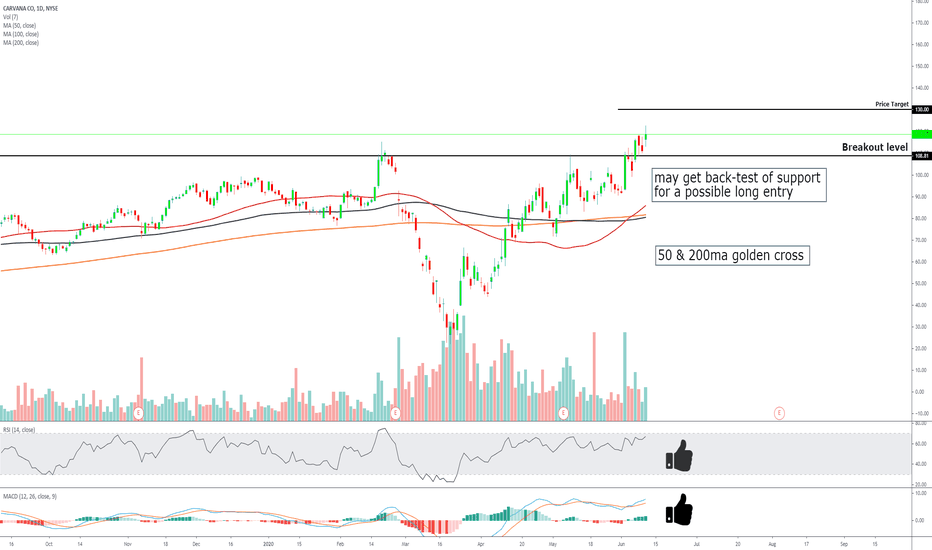

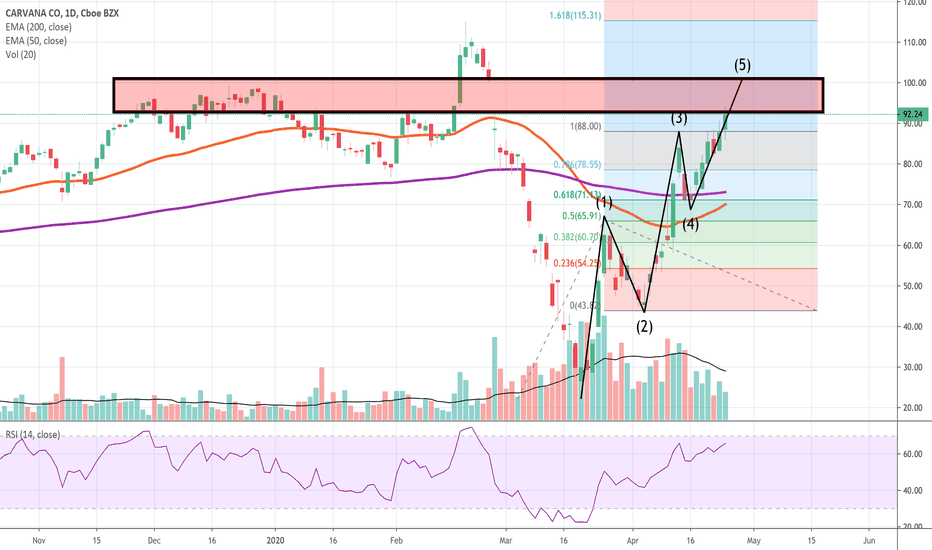

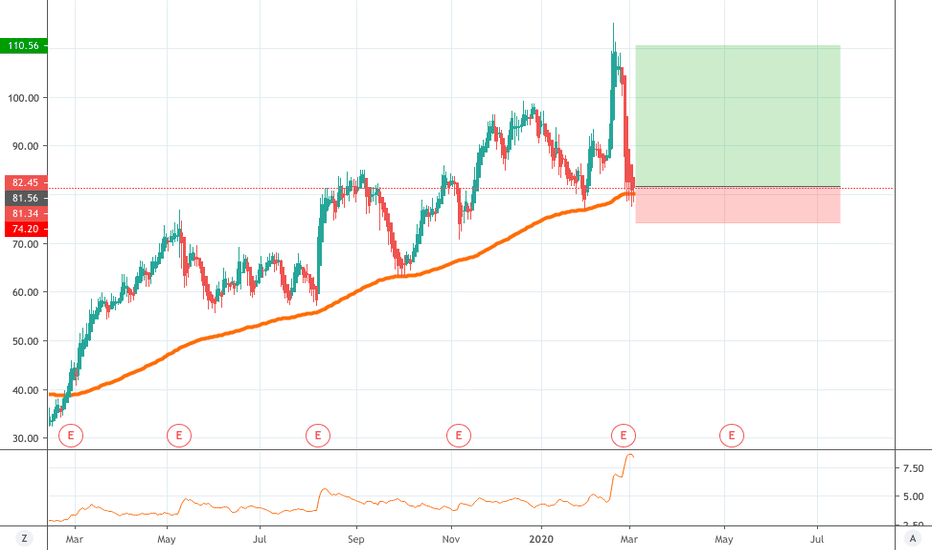

Carvana re-entered the upwards channel Carvana has been on a steady upwards trend since COVID hit and the government started handing out stimulus checks. Not only that but a lot of car manufacturers aren't even making new cars this year, raising the demand for used cars and along with the price. I have personally seen this, this year alone according to kelly blue book my car has gained 4k in value and is almost worth the price I paid for it 2 years ago with 20k fewer miles. One other benefit for this company is that transactions are done entirely online and the car is delivered to your doorstep on a flatbed. For anyone unfamiliar with this company they only sell used cars. Carmax would be their biggest competitor but with COVID having to limit restrictions on people being outside this is the perfect time for Carvana to establish their dominance in this market.

CVNA trade ideas

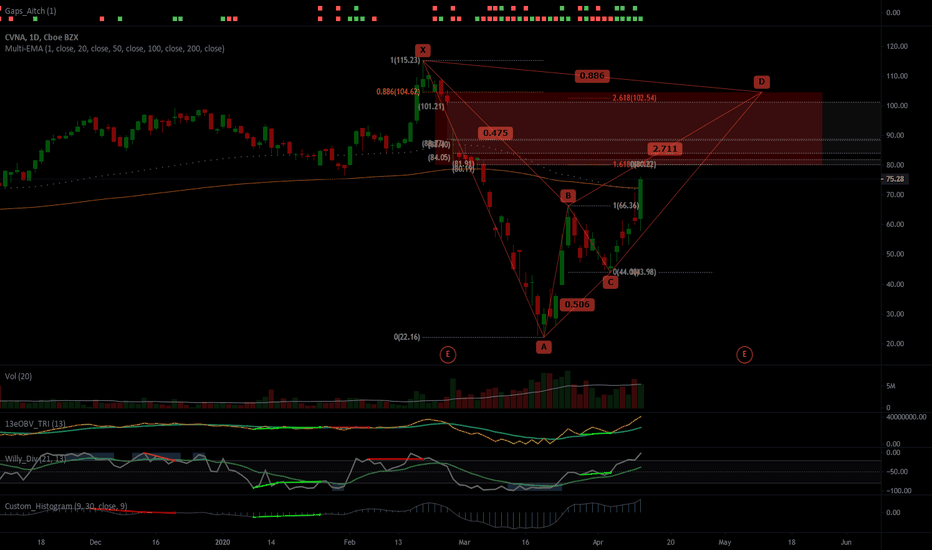

$CVNA May get a better entry for Carvana Stock carries a high short interest at 34%

Company profile

Carvana Co. is a holding company and an eCommerce platform, which engages in the buying of used cars and provision of different and convenient car buying experience. It operates through the following segments: Vehicle Sales; Wholesale Vehicle Sales; and Other Sales and Revenue. The Vehicle Sales segment consists of used vehicle to customers through website. The Wholesale Vehicle Sales segment comprises of the proceeds from vehicles sold to wholesalers. The Other Sales and Revenue segment composes of sales of automotive finance receivable originate and sell to third parties. The company was founded by Ernest Garcia, III, Benjamin Huston and Ryan Keeton in 2012 and is headquartered in Phoenix, AZ.

CVNA IdeasNYSE:CVNA

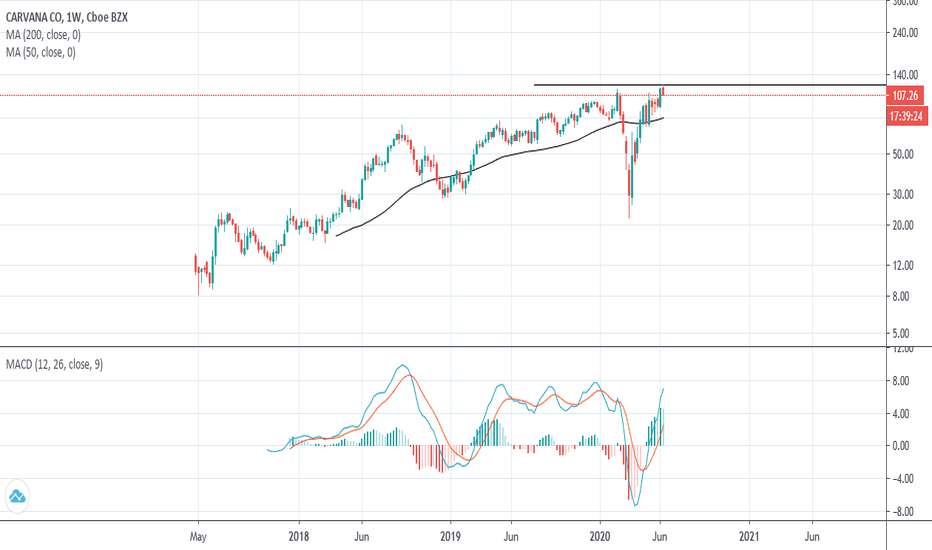

Just my thoughts. I've both made and lost money on this one over the past 24 months.

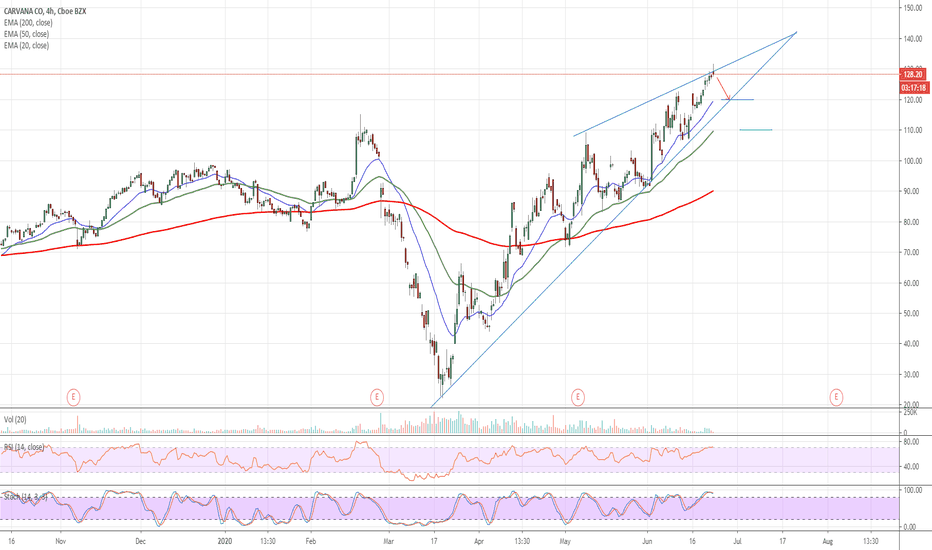

Seems to me, once CVNA establishes a channel, it really likes it, so figuring that out is the key.

This chart is way more helpful 12-24 months ago. If only I had a time machine. LOL

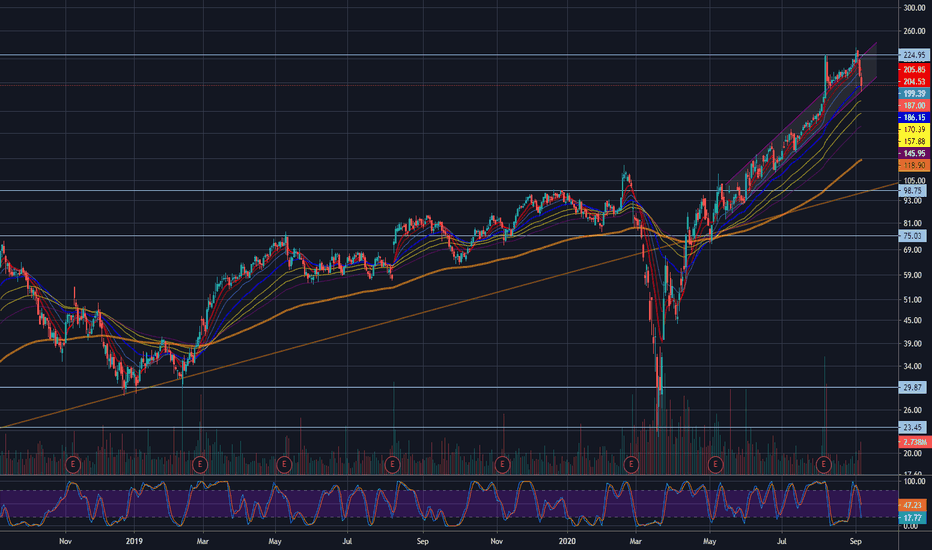

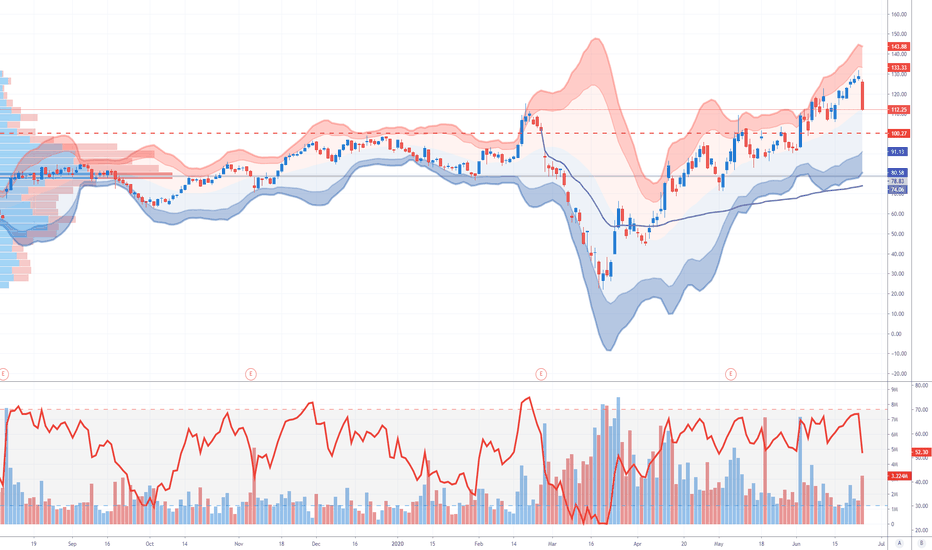

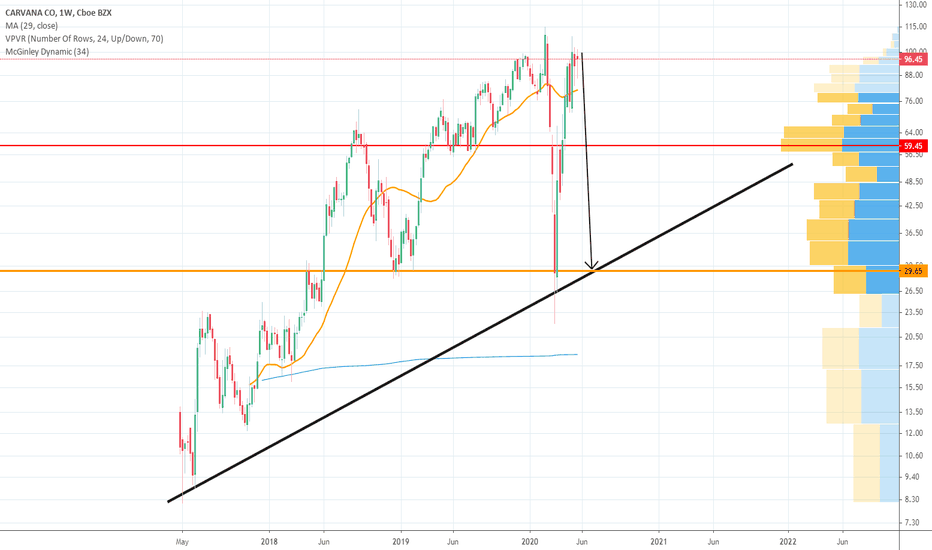

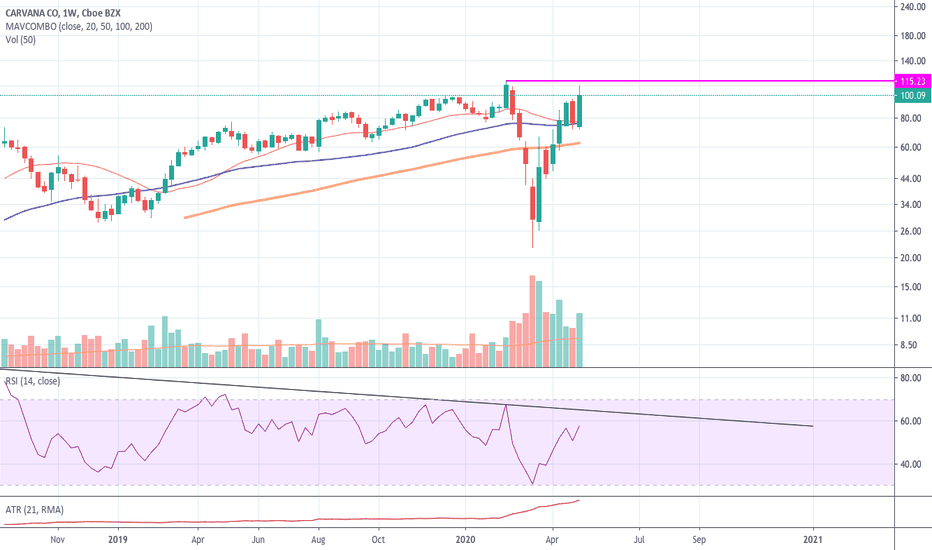

Basically, here we see how CVNA has built up during 2018, 2019 and now into 2020.

My guess is, this will once again peak out above the ranges, only to fall back to the top of the long term trend chart.

Probable catalyst is Aug earnings.

Price target of 125-130 between now and early Aug. Or just as easily 1-250. LOL

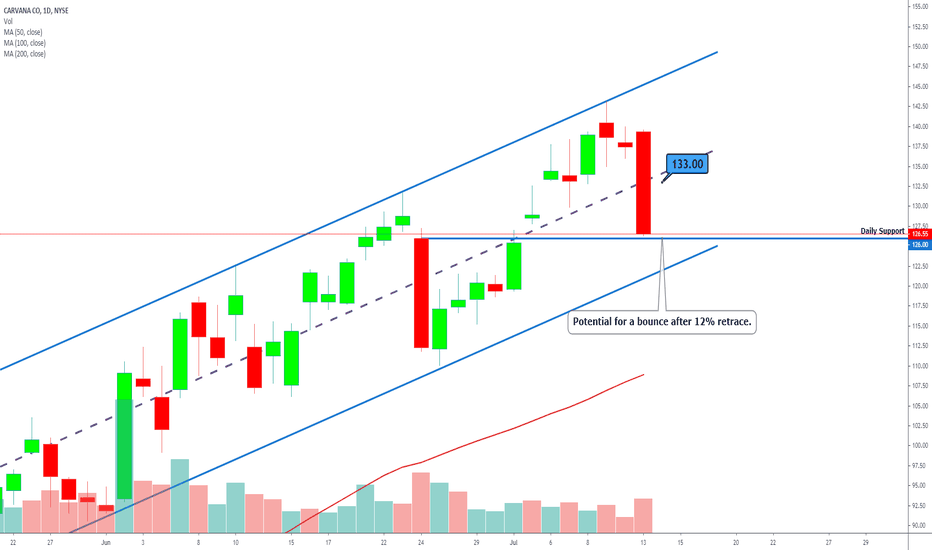

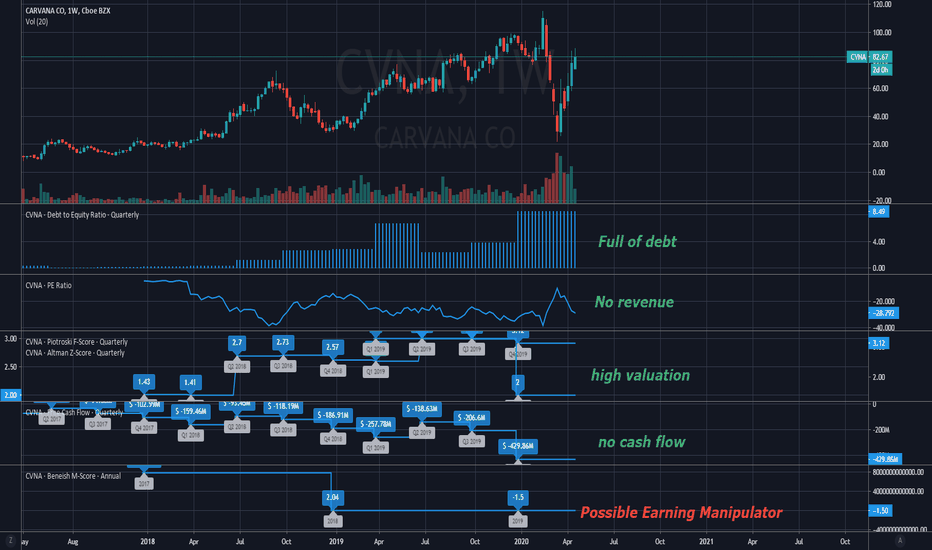

Short CarvanaCarvana offers an online platform to comfortably browse and buy used cars from, with delivery and 7d test drive money back guarantee.

The argument has been made that this form of selling will outperform in person buying from car dealership during COVID.

However, with strong decline in car sales globally and the entire sector suffering heavily in this environment, Carvana has remained relatively unchanged to its pre-COVID levels.

At such high unemployment numbers and bad economic outlook, it is questionable that they can sustain their growth, which seems to be the core pillar of its evaluation.

Additionally, this is not a Tech company, but seems to be traded as such.

Their platform is a digital product, but the core business and stream of revenue is buying and selling of used cars, which has very slim margins.

The core idea is great, but its evaluation way too high in this environment.

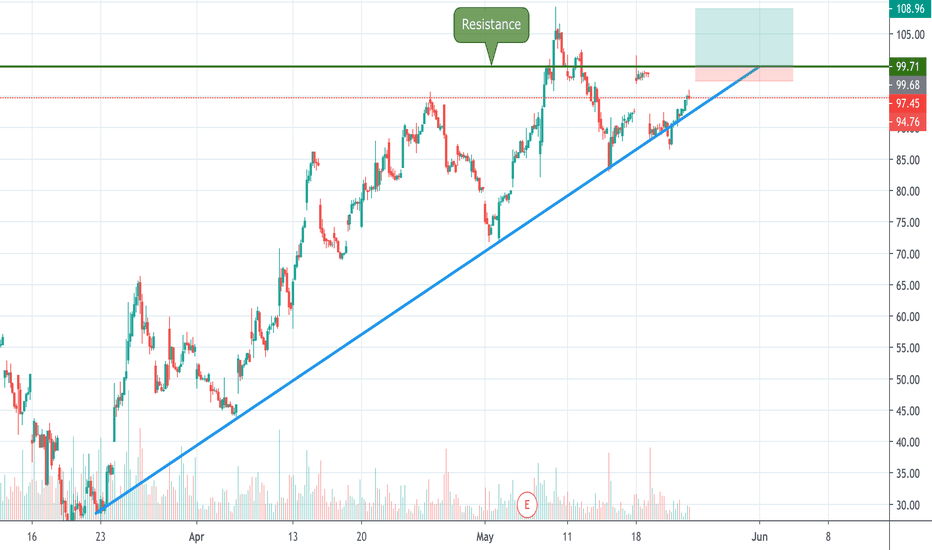

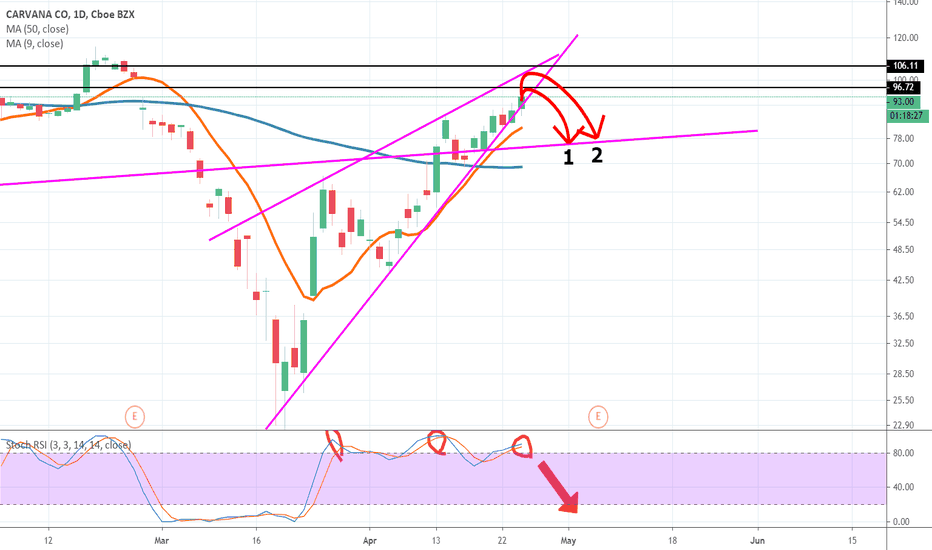

The stock is very volatile. Looking to enter near previous resistance levels at around 99$-100$.

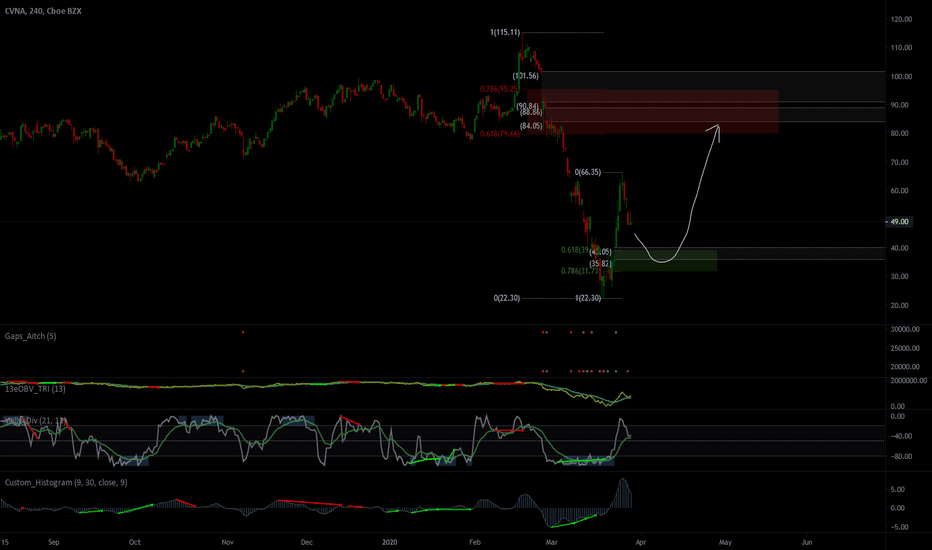

Target 130Looks like it wants to go there and that would be my short target. This is valid as long as it holds the price above that bottom trend line. Closing above that line monthly is critical.

If it closes monthly(on May 29) below that bottom trend line then you can expect lower prices.

Stop loss 92.

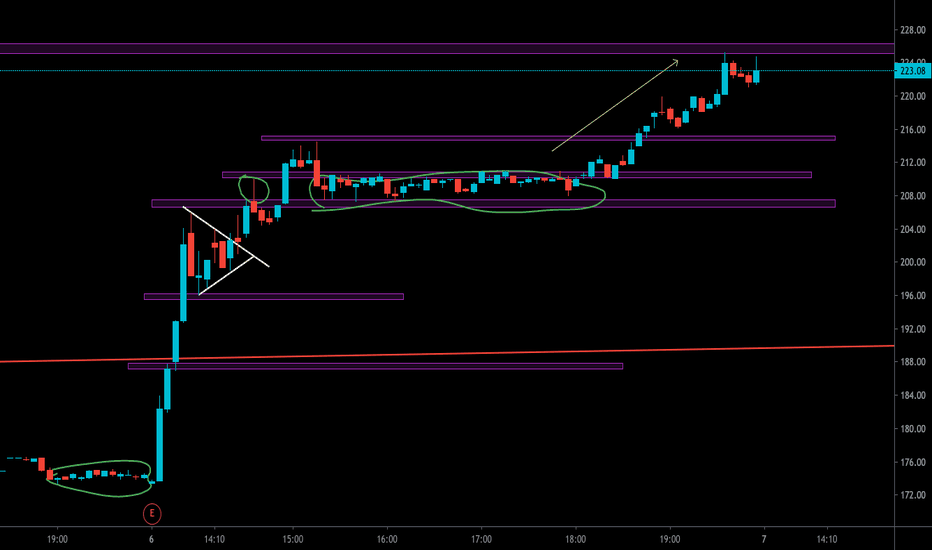

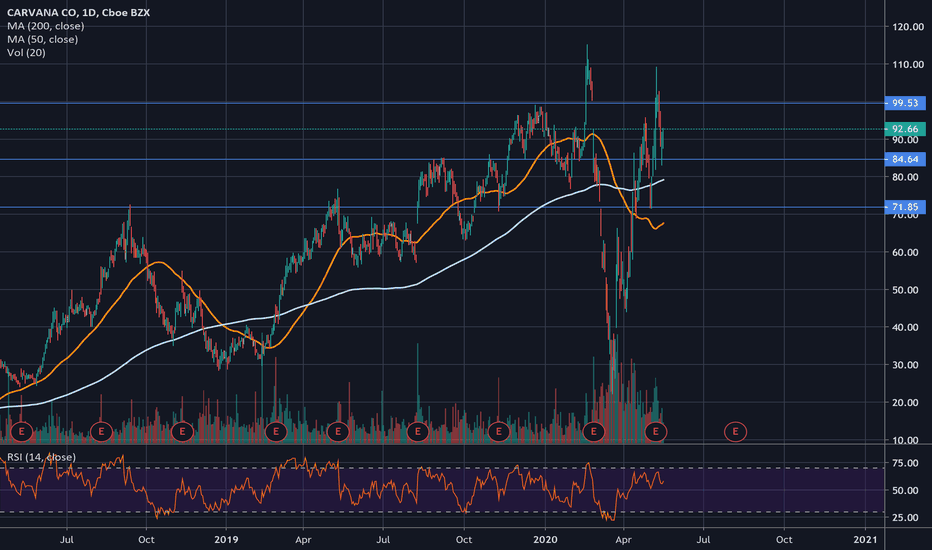

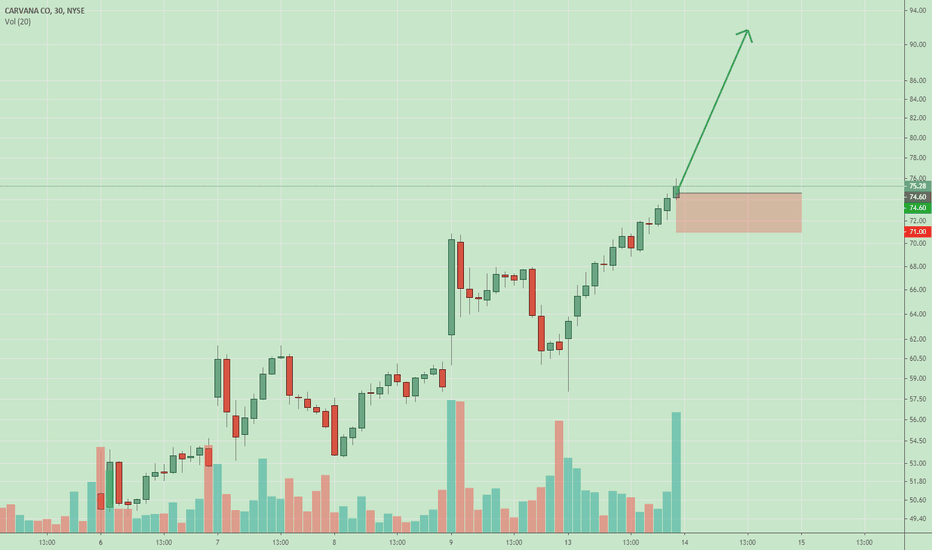

$CVNA can rise in the next daysContextual immersion trading strategy idea.

Carvana Co. operates an e-commerce platform for buying and selling used cars in the United States.

The demand for shares of the company looks higher than the supply.

This and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $74,60;

stop-loss — $71,00.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!