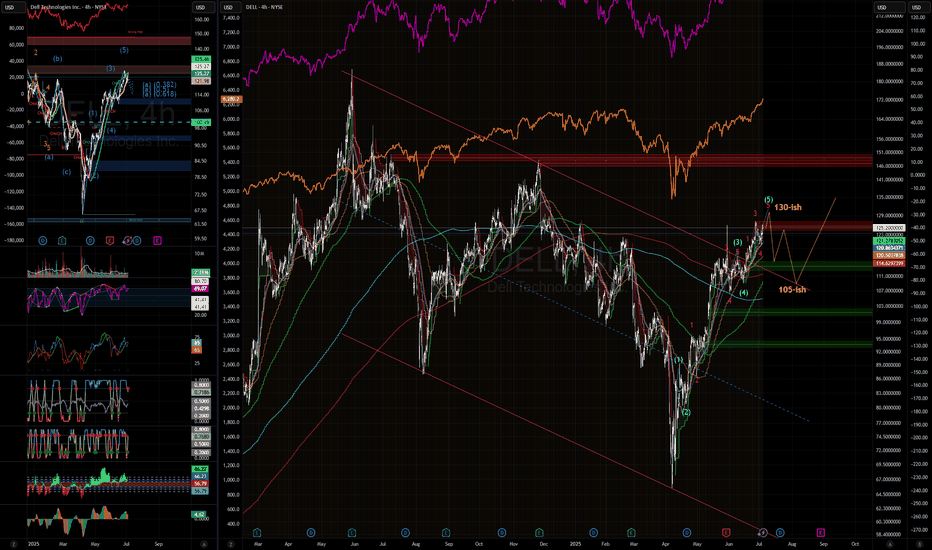

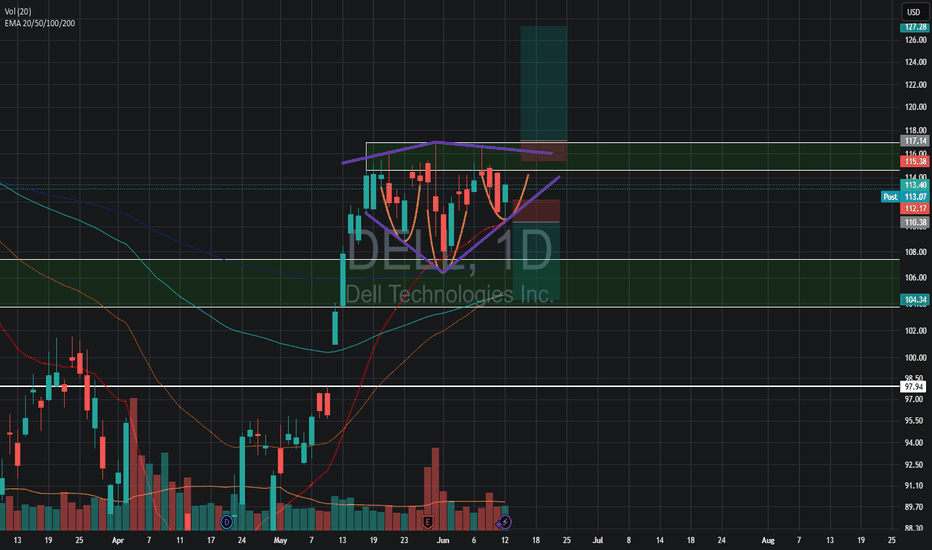

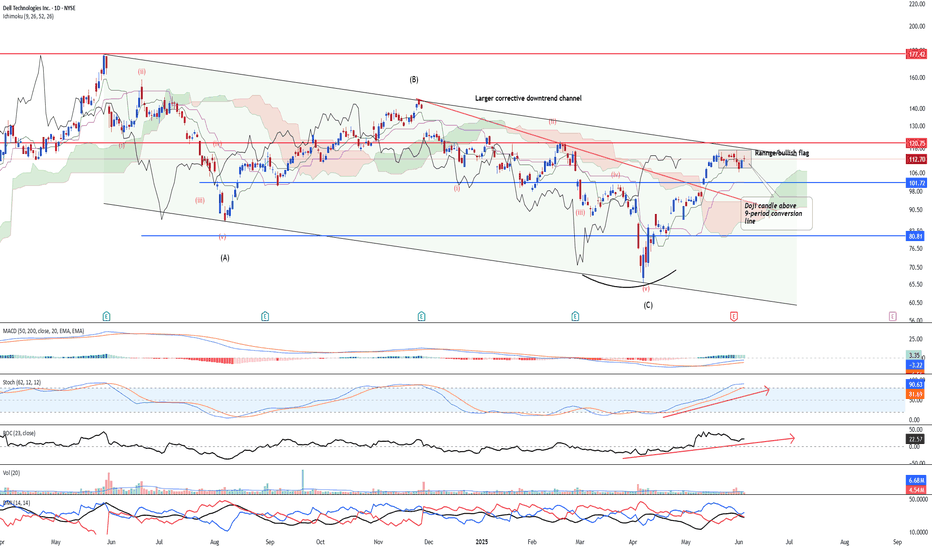

DELL : Bullish after correctionwithin a 1 or so I expect a Pull back correction (1-2 weeks) than a continuation of Dells bullish momentum , May be an opportunity to add to you position. There no telling exactly how far down a larger scale wave -2 correction may go , ( Best case 105/ Worst case 85 ), . Need to wait and analyze th

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

125.63 MXN

95.15 B MXN

1.98 T MXN

309.23 M

About Dell Technologies Inc.

Sector

Industry

CEO

Michael Saul Dell

Website

Headquarters

Round Rock

Founded

1984

FIGI

BBG00MZ7DR58

Dell Technologies, Inc. is a technology company, providing customers with a broad and innovative solution portfolio to help customers modernize their information technology (IT) infrastructure, address workforce transformation, and offer critical solutions that keep people and organizations connected. It operates through the following segments: Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG). The ISG segment includes servers, networking, and storage, as well as services and third-party software and peripherals that are closely tied to the sale of ISG hardware. The CSG segment includes designs for commercial and consumer customers of desktops, thin client products, and notebooks. The company was founded by Michael Saul Dell in 1984 and is headquartered in Round Rock, TX.

Related stocks

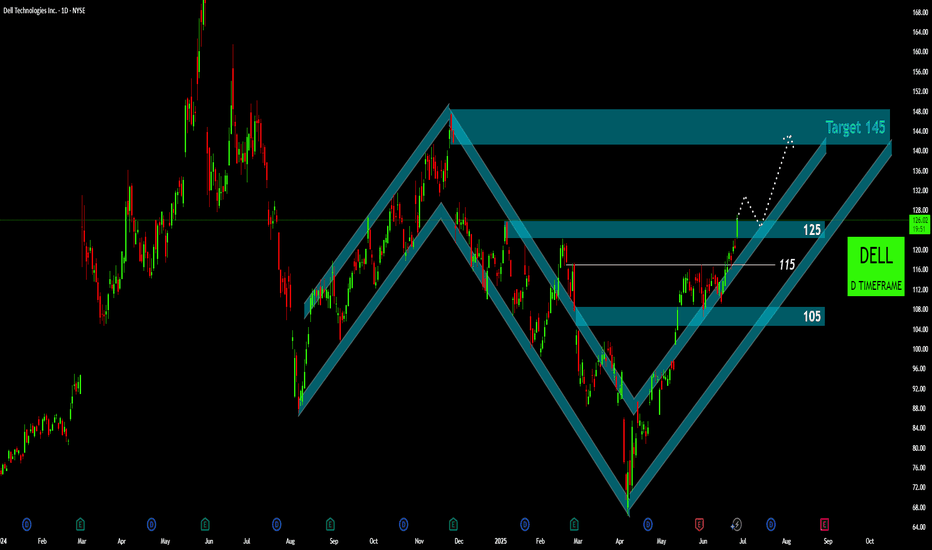

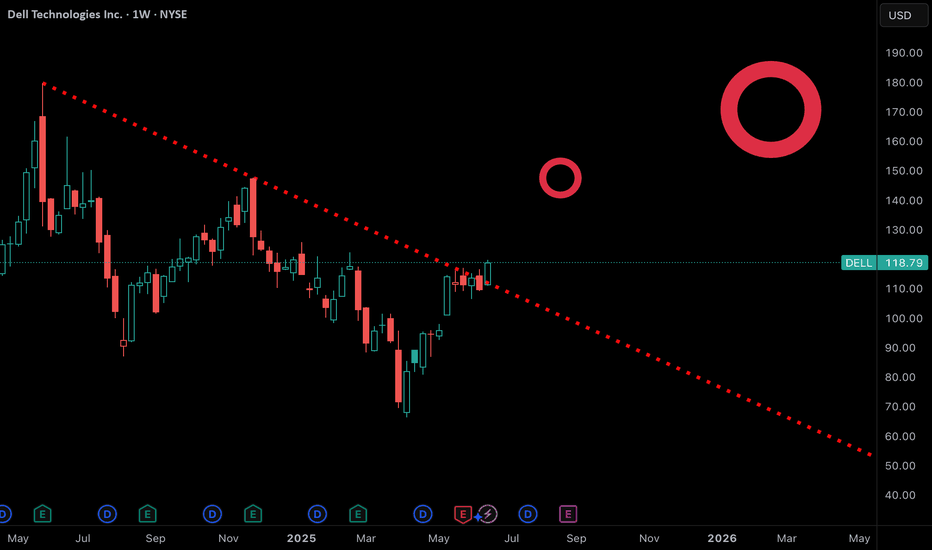

DELL: Bullish Channel Breakout Targeting Prior HighsOverview:

Dell Technologies ( NYSE:DELL ) has exhibited significant price action over the past year. After a strong uptrend culminating in a multi-month high around the Target 145 zone in late 2024, the stock underwent a substantial correction. However, since its April lows, NYSE:DELL has initiat

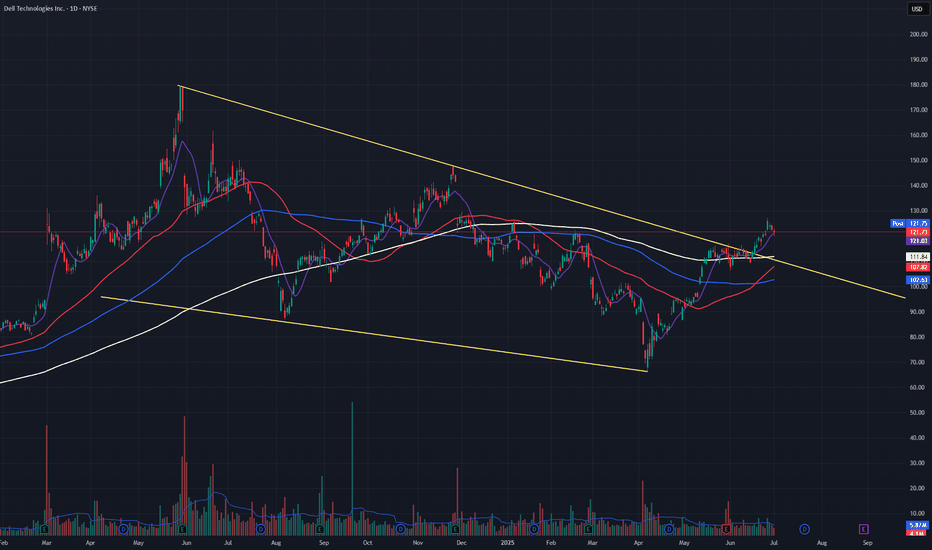

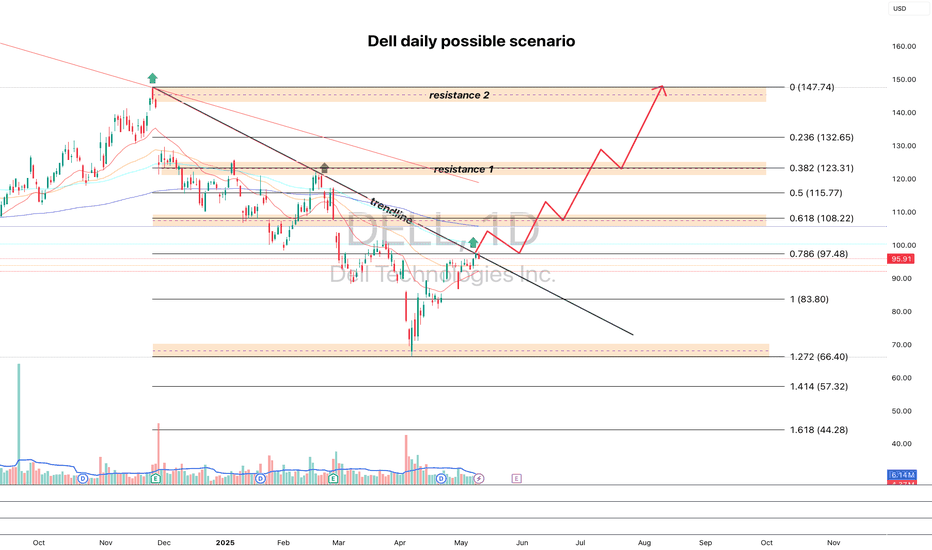

DELL looks good for pump dailyI'm watching DELL for a breakout of the trendline and a cross above the 100 MA — targeting a move toward 108.22, followed by a retest of the breakout and further upside targets at 123.31 and 147.74.

Fundamentally, the company looks strong, and the next earnings report is expected on May 29.

If you l

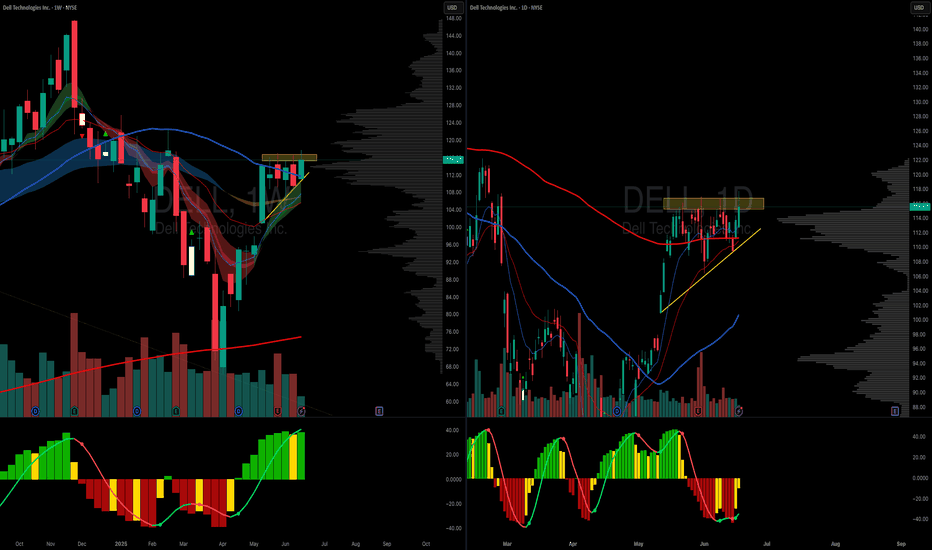

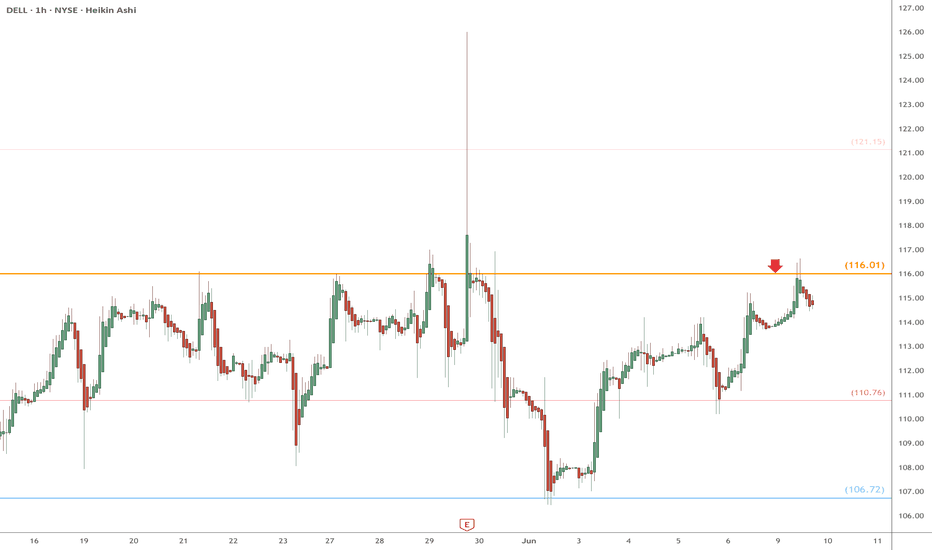

DELL eyes on $116.10: Golden Genesis fib will determine TrendDELL has been a sleepy stock with mixed earnings.

Now testing a proven Golden Genesis at $116.01

Look for a Break-and-Retest to start an Uptrend.

.

See "Related Publications" for other plots ---------------------->>>>>>>

This one in particular is caught the BOTTOM exaclty:

====================

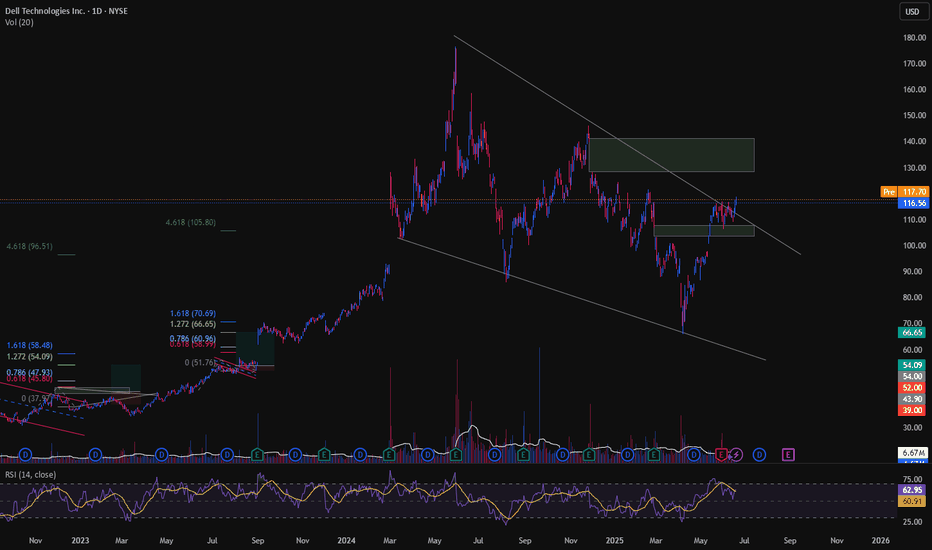

Dell- Upside momentum is backNYSE:DELL . Despite weaker earning expectations, Dell managed to stay afloat and consolidate into a potential bullish flag. We think that there is still short-term upside expectation as the doji candle managed to stay above the 9-period conversion line. Furthermore, based on the Elliott wave theory

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

DLTL5317615

Dell International LLC 3.45% 15-DEC-2051Yield to maturity

7.27%

Maturity date

Dec 15, 2051

DLTL5317223

Dell International LLC 3.375% 15-DEC-2041Yield to maturity

7.20%

Maturity date

Dec 15, 2041

DMFP4364659

Diamond 1 Finance Corp. 8.1% 15-JUL-2036Yield to maturity

6.91%

Maturity date

Jul 15, 2036

DELL5663346

Dell International LLC 3.45% 15-DEC-2051Yield to maturity

6.78%

Maturity date

Dec 15, 2051

DELL5317222

Dell International LLC 3.375% 15-DEC-2041Yield to maturity

6.58%

Maturity date

Dec 15, 2041

DMFP4364662

Diamond 1 Finance Corp. 8.35% 15-JUL-2046Yield to maturity

6.53%

Maturity date

Jul 15, 2046

DMFP4364655

Diamond 1 Finance Corp. 6.02% 15-JUN-2026Yield to maturity

6.14%

Maturity date

Jun 15, 2026

DELL.GN

Dell Inc. 5.4% 10-SEP-2040Yield to maturity

5.82%

Maturity date

Sep 10, 2040

US24702RAF8

DELL INC. 2038Yield to maturity

5.66%

Maturity date

Apr 15, 2038

DELL5208606

EMC Corporation 8.35% 15-JUL-2046Yield to maturity

5.52%

Maturity date

Jul 15, 2046

DELL5908308

Dell International LLC 4.85% 01-FEB-2035Yield to maturity

5.42%

Maturity date

Feb 1, 2035

See all DELLC bonds

Curated watchlists where DELLC is featured.

Frequently Asked Questions

The current price of DELLC is 2,341.00 MXN — it hasn't changed in the past 24 hours. Watch DELL TECHNOLOGIES INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange DELL TECHNOLOGIES INC stocks are traded under the ticker DELLC.

DELLC stock has fallen by −0.38% compared to the previous week, the month change is a 8.63% rise, over the last year DELL TECHNOLOGIES INC has showed a −13.30% decrease.

We've gathered analysts' opinions on DELL TECHNOLOGIES INC future price: according to them, DELLC price has a max estimate of 2,908.23 MXN and a min estimate of 1,970.09 MXN. Watch DELLC chart and read a more detailed DELL TECHNOLOGIES INC stock forecast: see what analysts think of DELL TECHNOLOGIES INC and suggest that you do with its stocks.

DELLC reached its all-time high on May 30, 2024 with the price of 3,048.00 MXN, and its all-time low was 706.00 MXN and was reached on Sep 27, 2022. View more price dynamics on DELLC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

DELLC stock is 0.00% volatile and has beta coefficient of 2.24. Track DELL TECHNOLOGIES INC stock price on the chart and check out the list of the most volatile stocks — is DELL TECHNOLOGIES INC there?

Today DELL TECHNOLOGIES INC has the market capitalization of 1.59 T, it has increased by 5.86% over the last week.

Yes, you can track DELL TECHNOLOGIES INC financials in yearly and quarterly reports right on TradingView.

DELL TECHNOLOGIES INC is going to release the next earnings report on Aug 28, 2025. Keep track of upcoming events with our Earnings Calendar.

DELLC earnings for the last quarter are 30.41 MXN per share, whereas the estimation was 33.44 MXN resulting in a −9.06% surprise. The estimated earnings for the next quarter are 42.48 MXN per share. See more details about DELL TECHNOLOGIES INC earnings.

DELL TECHNOLOGIES INC revenue for the last quarter amounts to 458.72 B MXN, despite the estimated figure of 454.84 B MXN. In the next quarter, revenue is expected to reach 538.54 B MXN.

DELLC net income for the last quarter is 18.94 B MXN, while the quarter before that showed 31.76 B MXN of net income which accounts for −40.39% change. Track more DELL TECHNOLOGIES INC financial stats to get the full picture.

Yes, DELLC dividends are paid quarterly. The last dividend per share was 10.31 MXN. As of today, Dividend Yield (TTM)% is 1.49%. Tracking DELL TECHNOLOGIES INC dividends might help you take more informed decisions.

DELL TECHNOLOGIES INC dividend yield was 1.72% in 2024, and payout ratio reached 27.91%. The year before the numbers were 1.71% and 32.15% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 7, 2025, the company has 108 K employees. See our rating of the largest employees — is DELL TECHNOLOGIES INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. DELL TECHNOLOGIES INC EBITDA is 197.10 B MXN, and current EBITDA margin is 10.41%. See more stats in DELL TECHNOLOGIES INC financial statements.

Like other stocks, DELLC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade DELL TECHNOLOGIES INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So DELL TECHNOLOGIES INC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating DELL TECHNOLOGIES INC stock shows the buy signal. See more of DELL TECHNOLOGIES INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.